Welcome to Skin in the Game where we take transparency to the next level!

As a Research Firm, our goal is to provide you with actionable insights and exceptional tools to guide your crypto journey. We outperformed the market by +10% during the 2022 bear market with Alpha-DAO, now we’re once again upping the ante.

Skin in the Game will be a monthly report dropping on the 25th of every month and we will be sharing exactly how we’re investing $10,000-$100,000 (each month).

Through the reports you will access:

- Our investments with on-chain proof.

- The information and insights that guide our investment decisions.

- View of the market from our eyes.

- Be able to learn from our strategies and mistakes.

We’re not just sharing information, we are sharing our skin in the game.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making.

Cryptonary’s Investment Approach

Before diving into investments, it is important to define our investment approach and objectives.

We are focused on long-term returns, this means that we target high value investments that we believe deliver outstanding performances over a multi-year timeline. This is the reason we are investing every single month regardless of market conditions. You will seldom see us investing in short-term hype opportunities (not never though).

You will also notice that we develop deep conviction in our investments, meaning we aren’t afraid to double down if price falls. However, with this deep conviction comes absolute freedom to dump assets whose teams are failing to deliver on their plans.

Our objective is simple: O U T P E R F O R M T H E M A R K E T

Investment #1 | Bitcoin ($2,500)

Conviction Level: 60%

No crypto portfolio is complete without some BTC. Afterall, it is the asset that birthed this market. Given our beliefs in the digitisation of capital and that the dollar will fail, Bitcoin is a perfect bet that we will continuously take (monthly DCA).

Thesis

BTC is Gold 2.0.

For the past 2,500+ years, Gold has been the go-to asset for humans. We all consider it an indestructible Store-of-Value (SoV). Times are changing though, most of our lives are now online. The upcoming generations cannot understand how we do not have a digital alternative.

Enter Bitcoin: an easy-to-store, trade, and travel with, alternative for the future of mankind.

Institutional investors have already adopted this view and we’re betting Central Banks (CBs) adopt it next. Meaning we will see CBs announcing BTC holdings sometime this decade. Later on, we’re betting new fiat currencies emerge with BTC backing similar to how Gold was used before 1971.

So yes, given all of these factors, we always want to be BTC owners.

Target ($650,000) | 2030+

Given our thesis on “BTC = Gold 2.0”, it would be fair to assume a similar market capitalisation. We believe the world sees a day where their market caps trade 1:1.

At the moment, Gold has a $12.5T market cap and we bet it rises towards $15T+ given the upcoming de-dollarisation of the world. But for the sake of simplicity, we will work off the $12.5T market cap.

At $12.5T, Bitcoin would be trading at $650,000+ a piece and that is our target.

Of course, there’s the argument that if the world is being de-dollarised, how can we set a target with it? Well that’s the most commonly used method today but a fairer one would be denominating in Gold ounces, in which case our target would be 1 BTC = 345 Gold Ounces (currently 11.8).

Invalidation

Only certain tail-risks can invalidate our thesis, and price going down (even to $10,000) isn’t one of them because our BTC time horizon is for 2030+.

The only three elements that can invalidate our investment and cause us to sell are:

- Satoshi wallets start moving funds indicating a cash out (even if partial) as that would cause mass exodus and panic.

- Regulatory scrutiny incoming from all developed countries in the world announcing an outright ban on Bitcoin.

- Miners starting to shut down their rigs, causing the hash rate to drammatically fall due to decreased profitability.

All three scenarios are highly unlikely, but they aren’t impossible.

Investment #2 | Ether ($2,500)

Conviction Level: 60%

The second asset that should be included in every single crypto portfolio is ETH. The DeFi motherboard and the first network to upgrade Bitcoin’s vision to allow for decentralised applications to exist. To this day, Ethereum maintains majority ownership of the capital invested in DeFi (60%), so yes it is a success.

Thesis

We believe Ethereum is the new Wall Street where all banks, exchanges and lenders move. They’re already seeing their new competitors building hard (you can read more here).

Buying & Staking ETH makes you the new Wall Street landlord.

We’re certainly not going to bet against the financial internet and even less so now that ETH has an improved investment attraction and physique. After the merge and multiple upgrades, ETH has become much more attractive to institutional investors due to an improved economic model and being eco-friendly (you can read more here).

Target ($115,000) | 2030+

When we say Wall Street, we’re kind of lying to you because truth is Ethereum replaces Wall Street, The City of London and every other financial district in the world. However, their real values are unknown which means we have to adopt another methodology for price targeting.

As you know, we believe ETH flips BTC in market cap and takes the top spot. The minimum viable ratio required for that to happen is 1 ETH = 0.175 BTC. Now given, our above BTC target of $650,000, that translates into an ETH price of $115,000 (rounded up).

Invalidation

There are multiple elements that can cause us to sell our ETH, and again price going down isn’t one of them as we have a 2030+ vision. The various elements are:

- Financial Applications migrating towards other base layers, such as Solana, en masse and causing major TVL transfers (50%+ of the network).

- Regulatory scrutiny causing a global ban on ETH. The US calling it a security is less of a problem as it is a single country, while it could have massive short-term effects it wouldn’t be detrimental.

- Consistent network outages after years of uptime.

- Inability to improve the user experience by lowering fees.

Investment #3 | DYDX ($2,500)

Conviction Level: 50%

There isn’t a more successful product in crypto than perpetual futures. While FTX failed, how did it rise to the top of the crypto exchanges list in under a year? What was a major contributor to Binance taking the top spot on the crypto exchanges list?

The answer is: Perpetual Futures.

This product was innovated in crypto (futures with no expiration date) and it invited millions of gamblers to come and trade with cheap 100x leverage.

Thesis

After the collapse of FTX, people are starting to look for decentralised alternatives. Everyone still loves gambling, the users will not go away.

We believe dYdX is at the forefront and the winner of the decentralised futures market.

The below section was written two days before dYdX announced the unlocks delay from Feb 2023 until Dec 2023 👇🏼 ___

Everyone is screaming at the top of their lungs that you should be shorting DYDX because a big unlock is coming on February 2nd which doubles the circulating supply from ~150M to ~300M tokens. We are running the other way and believe the shorters’ blood will be used for a rally.

People are discounting two things:

- The market has already priced in the upcoming unlocks. How can we be sure? GMX is a competitor that does 20% of dYdX’s volumes and is priced at 1.5x DYDX. This means, once the unlock takes place (where DYDX’s MCap will jump by 2x overnight) DYDX will be priced in a ‘reasonable” range at 1.1x GMX.

- The market is underestimating the power of marketing. Every single project in crypto has big announcements up their sleeves that they’ve kept on hold until better market conditions arise. Look at Shiba Inu announcing their own L2 as soon as the market started rallying.

Target

Short-Term ($12.5)

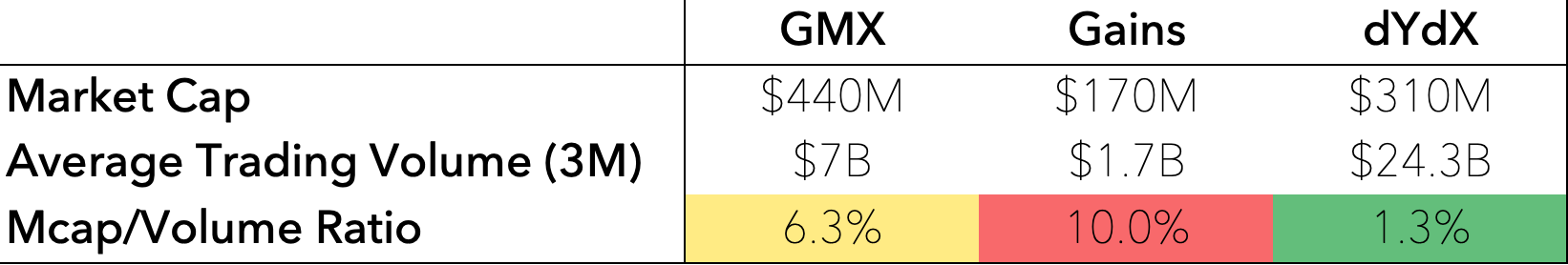

Today, the two largest competitors to dYdX are GMX & Gains. How is the market pricing each of these three protocols?

The market is pricing both GMX and GNS at an average of 8% Trading Volume and only pricing in DYDX at 1.3%. This means DYDX should do a 6X, only to catch up to this market valuation.

This methodology does not even take into consideration the fact that dYdX has a superior product; the reason behind the larger volumes.

6 x $310M = $1.85B

$1.85B / 150M Tokens = $12.3 per token (round up to $12.5)

This correlates with the charts 👇🏼

We believe the market is mispricing DYDX and it should be trading at $12.5 as of today.

Note: Prior to dYdX’s unlock delay announcement, our price target was $7. Given the fact that supply will not increase, our price target has to meet the same MCap target of $1.85B by increasing to $12.5.

Long-Term ($65)

In the future, we believe dYdX can have 62X more volume (~in line with Binance Futures) which will price it at $65 through the above methodology.

Note: We have taken into consideration how much supply will be unlocked by then.

Invalidation

As of now, we consider price our invalidation and our line in the sand is $1 on the weekly timeframe. Should a breakdown happen, we will exit our position and await new opportunities to re-enter.

Investment #4 | LDO ($1,500)

Conviction Level: 30%

Lido is the undisputed king of liquid staking - a massive industry.

If you wanted to earn yield on your ETH, would you buy in batches of 32ETH, lock it up and go through the technicalities of staking? Or would you opt for a plug and play solution to earn the juicy yield?

Exactly, unless you’re a rich computer expert who’s ready to lock up his ETH for a long time, you’ll use liquid staking.

Thesis

People talk about the centralisation risk of Ethereum but misinterpret the meaning. They believe they have to sell their ETH... meaning they are blind to the fact that this creates a spectacular investment opportunity.

By staking through Lido, the Lido DAO (governed by LDO token holders) gets to make decisions on Ethereum through the staked ETH - makes sense? If not read 2-3 times.

A Proof-of-Stake network is more secure the more its token goes up in price. This way a 51% attack becomes impossible because no one in the world has enough money to buy half the network.

This means, in theory, the liquid staking tokens must have a value proportional to that of the ETH staked in them (MCap = TVL).

Target

Short-Term ($10)

Currently, 5M ETH are staked through Lido which make up 4% of the total Ether supply. This means, LDO must have an MCap equating to the 4% of ETH in order for the staked ETH to be secure enough.

4% ETH MCap = $7.8B

LDO currently trades at a $2.2B MCap, it needs to go up by 3.5x to a price of $9.80 (rounded up to $10).

Long-Term ($275)

The future fair price of LDO is tough to predict because it will depend on where ETH is trading and how much of ETH’s supply is staked through Lido. Now, if we take our assumption of $115,000 per ETH and reduce the percentage down from 4% to 2% (very conservative), then we deduce a fair future price of $275.

Invalidation

Our invalidation for this investment is a mixture of technicals and fundamentals:

- Price of LDO dropping under $0.50

- Lido DAO performing an action that hurts the Ethereum network

- Lido having technical faults and being unable to fix it (at least partially) over a 3-months period

Investment #5 | HEGIC ($1,000)

Conviction Level: 10%

We believe DeFi Options are the most assymetric, highest yielding bet there exists in crypto as of today. BUT, we also think it takes a LOT of time before these returns materialise.

Thesis

On average, Robinhood has its highest single-source revenue coming from Options trading. This means the degen gamblers love it. We also know that institutional investors love this derivative as the split between Options & Futures volumes is 50/50 on average.

In crypto, the options market is non-popular yet and the split is around 95/5 in favour of futures. This ratio alone explains how much growth options have ahead of them in crypto.

There are multiple competitors in this space, with the largest being Ribbon, Dopex, Hegic, Premia and Lyra.

Each one of these has pros and cons, picking an absolute winner isn’t the play. Getting exposure to DeFi Options is. The reason we’ve decided to do that through HEGIC is because their user experience is superior to the others and their founder has often underpromised and overdelivered.

Target

Short-Term ($0.15)

This target is purely derived from technicals as we are seeing the trend shift from bearish to bullish for the first time in 500 days.

Given the recent creation of higher highs and higher lows (bullish market structure) and the overall state of the market. We believe HEGIC is able to pull a good performance leading it towards $0.15. The two levels that it will have to overtake first are $0.036 and $0.08.

Long-Term ($27)

Our conviction in HEGIC is the lowest out of the other four investments above, yet we remain positive on it as the R:R is VERY attractive.

Given the lack of options data, we will be using a “pricing by relativity” methodology, comparing it to futures’ valuations given the close relationship between Futures & Options.

If successful, we believe a fair valuation for HEGIC is at the very least equal to half of dYdX’s projected one which would be $30B+ ($27 per HEGIC).

This valuation is dependent on many factors, it will require long years and unparalleled effort by their team before materialising.

Invalidation

Once again, our invalidation is a mixture of technicals and fundamentals:

- Price dropping under $0.005

- Inability for Hegic to attract users while competitors successfully do so

- Inability to fix options pricing on the platform

Summary

- Bitcoin: We are investing on a monthly basis, patiently awaiting our 2030+ target.

- Ether: Also DCAing on a monthly basis, patiently awaiting our 2030+ target.

- DYDX: Buying in here, selling half our position at $7 and letting the rest run.

- LDO: Buying here, selling half our position at $10 and letting the rest run.

- HEGIC: Buying in here, selling half our position at $0.15 and letting the rest run.

In all cases, we would sell our holdings if one of our invalidations is met.

Below you will find on-chain proof of our investments ⛓️

BTC: $2,500 invested for 0.1075BTC - Proof

ETH: $2,500 invested for 1.55 ETH - Proof

DYDX: $2,500 invested for 1,194 DYDX - Proof

LDO: $1,500 invested for 612 LDO - Proof

HEGIC: $1,000 invested for 37,320 HEGIC - Proof

Skin in the Game Addresses

- Bitcoin: bc1qzpppmek8wh2vqymq06petmfwmhjj9k8vdxl389

- Ethereum: 0x8Be9987d18a10F770cADC94635CeDB2eF33B0f17

Looking forward to seeing you again on 25 Feb 23.