Small Price, Big Mistake: How Unit Bias Tricks Retail Investors

‘Unit bias’ is a psychological flaw that could seriously damage your crypto portfolio. Buying ‘cheap coins’ because they seem affordable? You’re setting yourself up for failure. Influencer hype won’t save you—this cycle, unit bias is a losing game. Here’s how to spot the trap and protect your portfolio.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Unit Bias?

Unit Bias is a cognitive bias that affects how investors perceive the value of given assets. It refers to the tendency for individuals to prefer owning whole units or a large number of units of an asset rather than fractions or few units, even if both have the same value in absolute terms.Simply speaking, it is a psychological trap that makes inexperienced investors equate a low unit price with affordability or higher growth potential, ignoring metrics like market capitalisation or circulating supply, which better reflect the true price of an asset.

Some inexperienced investors might feel more psychologically satisfied owning 1,000,000 units of a low-priced asset (e.g., priced at $0.01) rather than owning 0.0001 units of more expensive crypto like Bitcoin (e.g., priced at $90,000). This is a mistake that can really hurt your portfolio.

Market cap is what really matters

Let’s get one thing straight: unit price doesn’t mean anything without context. A token’s value is determined by market cap, not its unit price. Market cap is the total value of an asset and is calculated by multiplying the price per unit by the circulating supply.Here’s an example:

- BONK is a memecoin with over 75 trillion tokens in circulation, priced at $0.00005164 per coin. If you multiply the circulating supply by the price, you get a market cap of around $3.8 billion. For BONK to reach $1 per coin, its market cap would need to be $74.5 trillion. Do you really think that’s possible? Probably not.

- WIF, on the other hand, has a supply of 1 billion tokens, priced at $3.51, with a market cap of $3.5 billion. Unit-wise, BONK seems much cheaper than WIF. For $1, you can buy 19,204 BONK tokens, but only 0.28 WIF tokens. However, this can trick inexperienced investors. It's much more likely for WIF to be 10x than for BONK to reach a huge market cap like that.

Thus, unit bias is one of the oldest tricks in the book that has worked pretty well in previous market cycles and is still used by bad actors to lure retail investors into selling them a dream. However, markets are dynamic, and what was absolutely essential in previous cycles might have only a marginal effect on this cycle. We believe unit bias is one of these things.

Why are low unit memecoins pushed?

When it comes to memecoins, this psychological manipulation is often used to exploit a common cognitive bias among retail investors: the allure of low unit price coins and the false perception that they are "cheaper" or offer more potential for profit. Here's how this dirty trick plays out and why it's so effective:- Promoters of these coins prey on get-rich-quick fantasies by selling scenarios where a small investment in these "cheap" tokens could turn into massive wealth if the price ever reaches X dollars.

- The story often goes, “Hey, look, you can buy millions of this coin for $10, and when the price of a coin hits $1, you will be a multi-millionaire”. The problem? For most of these coins to hit $1, the market cap would need to exceed global GDP, which is completely unrealistic.

- Meanwhile, influencers and insiders dump their coins while promising the coin is the next big thing, still very cheap and can easily reach $X price.

- The price never reaches the promised round numbers because it is simply not feasible and realistic. Those who sold those fantasies got rich and retail got hurt.

Why unit bias doesn’t matter anymore

Even though we see repeated pushes towards low unit memecoins, we believe the market has evolved and moved past it for the following reasons:Mindshare: One of the most important counterarguments against unit bias is virality. When it comes to memes, the performance is more a function of mindshare and narrative rather than the price tag. People buy what is hot and going up. Virality beats the unit bias every day of the week.

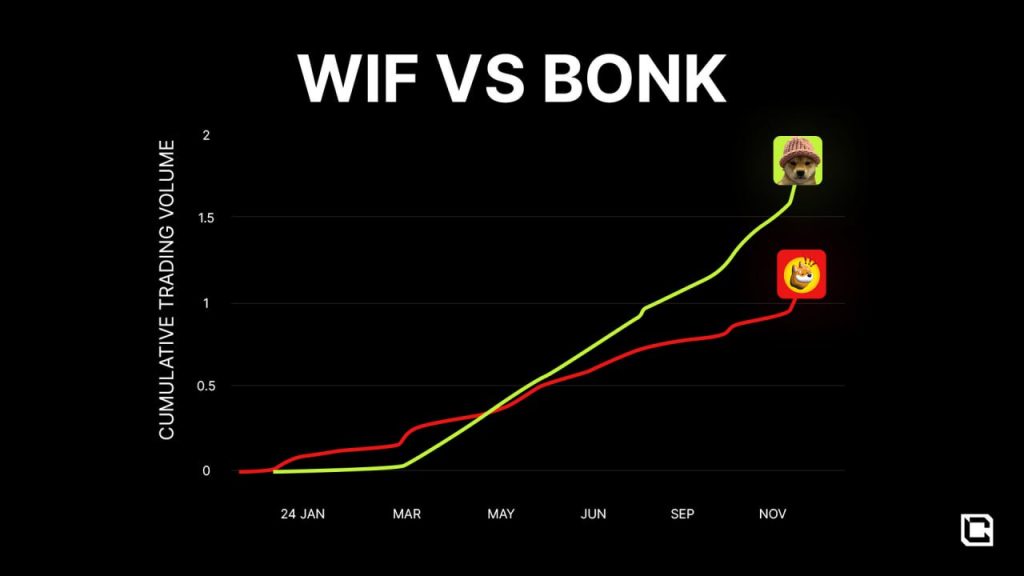

Here is an example: the chart below shows the cumulative trading volume for WIF (virality) and BONK (unit bias) over time, and it’s clear that WIF is crushing it.

Around May 2024, WIF’s volume starts pulling ahead, and by November 2024, it’s way higher than BONK’s. While WIF trading volume reached $183.88 billion, BONK trading volume was only $122.68 billion (Data from CoinGecko for the last 365 days). This just goes to show that when something goes viral and gets people excited, it can easily beat out other factors like unit bias—WIF is what’s hot, and the numbers prove it.

Thus, the memes that pump the hardest aren’t the cheapest—they’re the ones with the strongest memetics, community traction, and mindshare. It’s not about decimals or price tags; it’s about what’s capturing attention and driving action in the market.

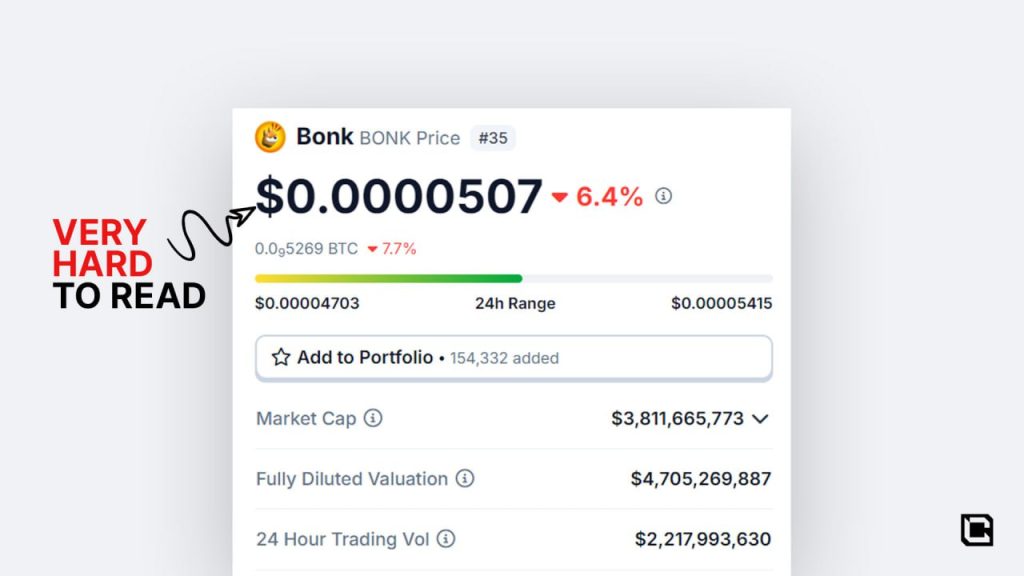

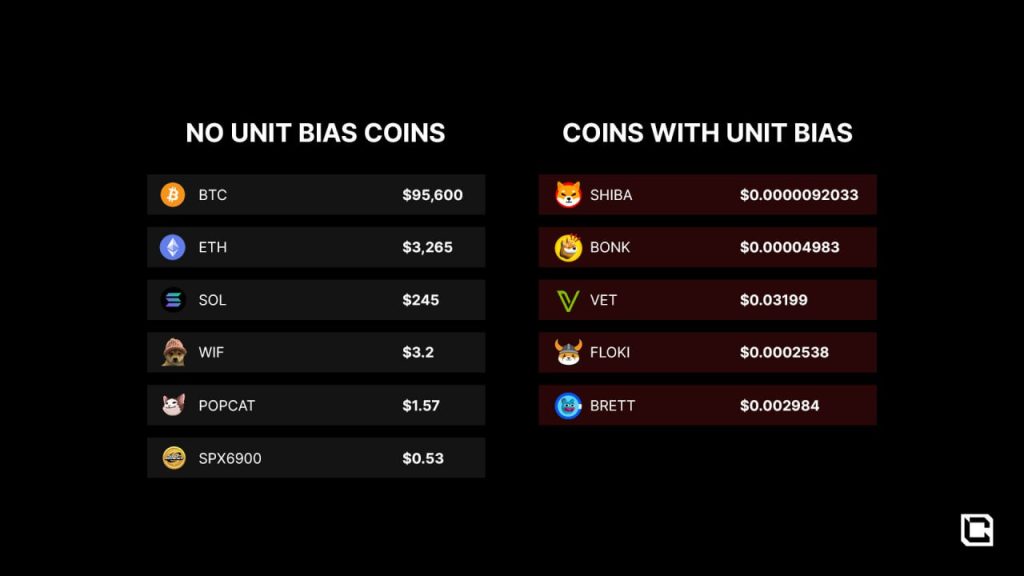

Readability: Many argue that coins like SPX, WIF, and POPCAT have unattractive potential unit prices ($1-$100), and they won’t attract retail investors. However, we argue the complete opposite; try reading the price of $0.0000000018654 instead of simple $1, $20, $50. These units read so much easier, and they are not as expensive as Bitcoin ($90,000) or Ethereum ($3,000). Smaller units are confusing and put retail investors off.

Here is another real-world example…

Education: Unit bias is less likely to be an important factor compared to last cycles because, first of all, the availability of AI can explain price vs market cap so much faster. Second, crypto has become more legitimate with more experienced and professional participants. Therefore, the average investor is likely to be more informed than in previous cycles.

High unit price assets: Despite the arguments, high unit prices empirically haven’t been a problem for major successes in crypto.

- Bitcoin costs over $90k but still dominates because of its narrative as digital gold, scarcity and decentralisation.

- Solana costs over $200 but still dominates in terms of a fast and cheap alternative to Ethereum, which also has a very high unit cost (over $3k)

- XRP and ADA pumped hard last cycle even though they had over $1 unit price.

- All organic trench memecoins from this cycle don’t have low unit cost. However, they are still going viral with the potential to reach a range between $1-$100 per coin. This range is a perfect balance between being cheap and being readable.

- PumpFUN, a platform that promotes the fair launch of memecoins, does not rely on the unit bias technique. This statement from the biggest memecoin launch platform validates our view further and discourages manipulative practices in the market.

How do you protect yourself?

As we keep saying, the crypto market rewards traction, narratives, and value over unit price. The market mostly doesn’t care about price—it cares about momentum and narrative. Therefore:- Look at the market cap and circulating supply instead of a unit price.

- Ensure that the meme is fully circulating and there is no allocation to teams and insiders. If the meme has any allocation to the team, it is not a meme in the first place. It is a corporate coin, and you should treat it as such.

- “Cheap coins” are likely to be engineered rugs because the only reason to make them look cheap is to lure retail into the trap.

- Therefore, don’t chase cheap coins—chase the coins that are moving, with strength and like we have been preaching all of this time. That's what matters, not how much each unit costs. Here are a few examples of low unit memecoins that prove our point: unit bias has negligible impact on the success of a meme.

Cryptonary’s take

If you’re still basing your investments on unit price alone, you’re setting yourself up for failure. Don’t fall into the trap—be smarter. Unit bias might have swayed past market cycles, but this cycle is different.The game has evolved, and success now belongs to assets with strong communities, compelling narratives, and unmatched memeability—not arbitrary price tags. The market rewards momentum, narrative and strong cults, not psychological tricks.

Ditch the outdated mindset, focus on what truly drives performance, and don’t let “cheap tags” cloud your judgment. We are likely to see 2-3 memecoins reach $100 price tags and many more in a range between $1-$100 this cycle. No more unreadable $0.000000000231874 prices.

Unit bias is dead!

- The Memecoin Battleground: Organic vs. Corporate Cabal

- Corporate vs. Organic Memecoins: Don’t Become Exit Liquidity for VCs

Cryptonary, OUT!