Smart Money bet $21M on two exciting coins: What's your move?

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

As we approach the dawn of 2024, two intriguing gems have emerged that are capturing the attention of Smart Money investors.

Our latest Smart Money analysis shows that whales have demonstrated a pronounced interest in both projects.

And what’s more, the recent transactions from these whales provide insights into what to expect in 2024.

In this edition of Smart Money, we delve into the strategic moves of significant whales in the Rollbit (RLB) and Polygon (formerly MATIC, now POL) ecosystems.

We also explore the underlying reasons behind these strategic transactions.

But beyond telling what crypto’s Smart Money is doing with Rollbit and Polygon, we offer you two strategies on what to do to gain a strong start in 2024.

TLDR

- Whales are boldly buying the dip on RLB and MATIC.

- Fundamentals are improving with revenue-driven burns (RLB) and upgrades (Polygon).

- Buy RLB on BTC dips near $35.6K, monitor closely, and target gains from the breakout.

- Hold for Polygon 2.0 hype gains in January/February.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Whales continue to buy the dip on RLB

Over the week, we have observed sustained interest from whales seeking exposure to Rollbit (RLB), as the price experienced a 29.84% dip from its all-time high of $0.26 on November 11th.

We found transactions showing that some whales saw the decline as an opportunity to gain exposure to Rollbit. Let’s dive into the transactions.

Whale 1 spends $1M on Rollbit

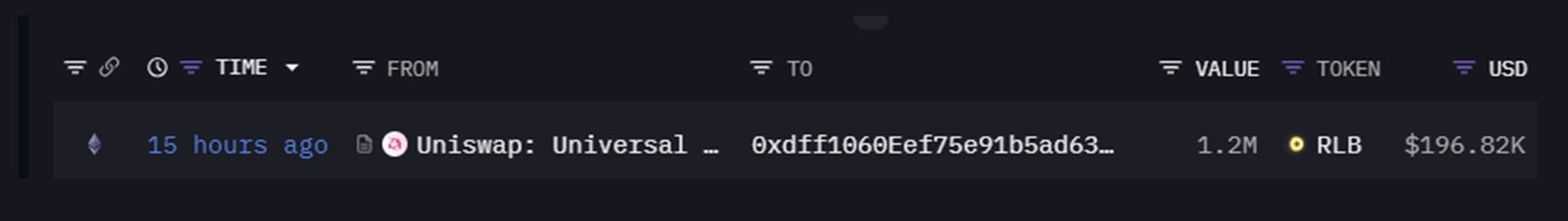

We identified one whale who purchased $659.77K worth of RLB over the past week. Their largest transaction occurred on November 22, 2023, at 20:39:59 UTC, acquiring $197.35K worth of RLB at an average price of 0.17.

The remaining transactions were executed in smaller batches, ranging from $68.70K to as low as $4.97K per buy order over the past seven days.

Adding all the transactions, this whale has strategically amassed a $1M position in RLB distributed across two wallets in RLB.

It doesn’t take rocket science to know that this whale didn’t waste time to seize the opportunity presented by the recent dip in RLB to build up this substantial position.Whale 2 bets $3.5 on Rollbit

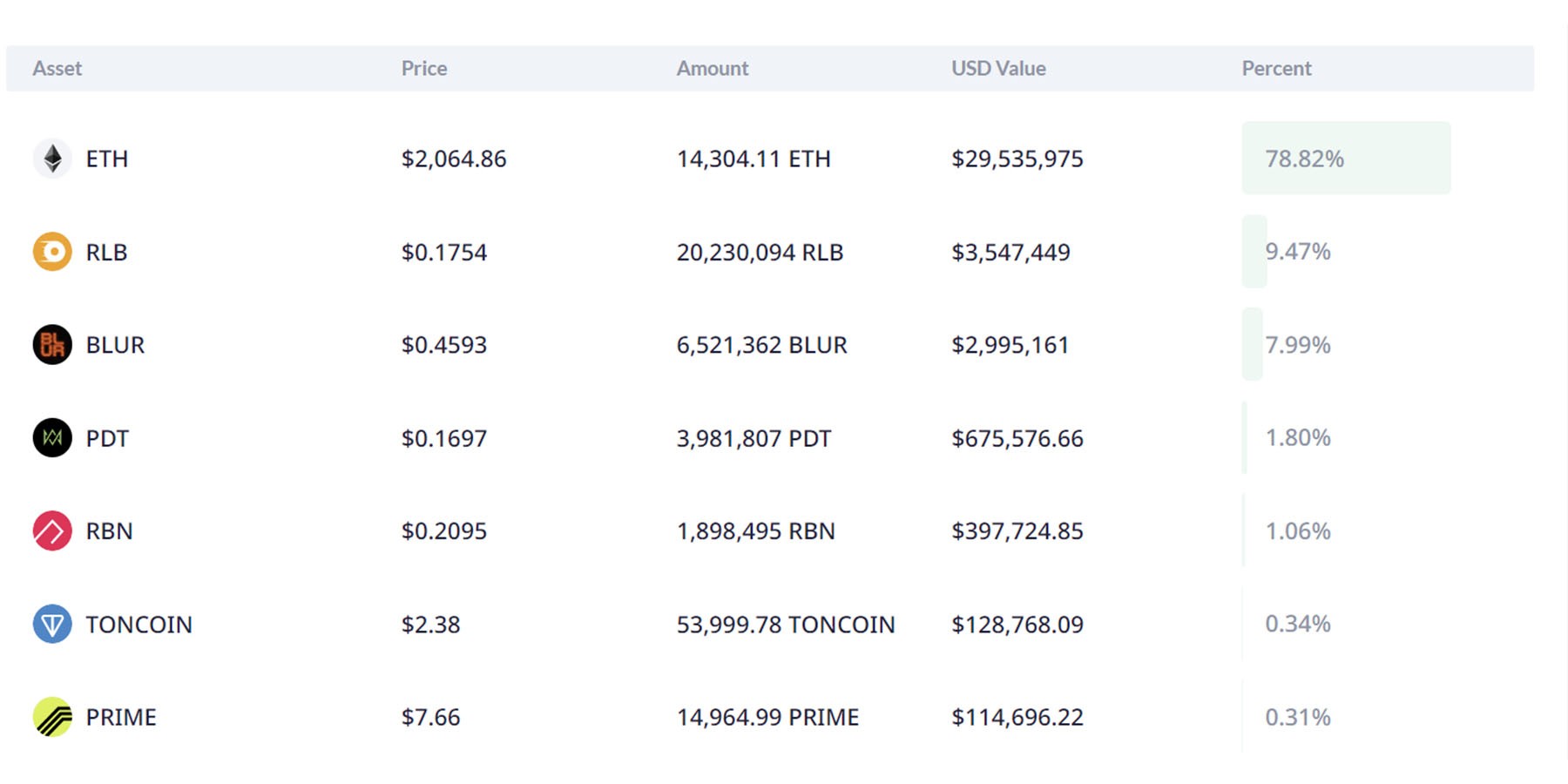

If you thought a $1M position in Rollbit is substantial, you haven’t met whale number 2.This player bet almost 10% of their $37M portfolio to RLB – more than $3.5M in Rollbit.

While this whale has been gradually building up their position, they added another $318K worth of RLB at an average price of 0.18 on November 23, 2023, at 00:44:11 UTC across two transactions.

Why are whales buying up RLB?

Rollbit offers a compelling long-term opportunity. Check our detailed alpha report, which lays out the thesis on why RLB is massively undervalued over the long term.Therefore, it is no surprise that whales are getting in on the action. However, in the short term and near term, there are also some interesting things to highlight.

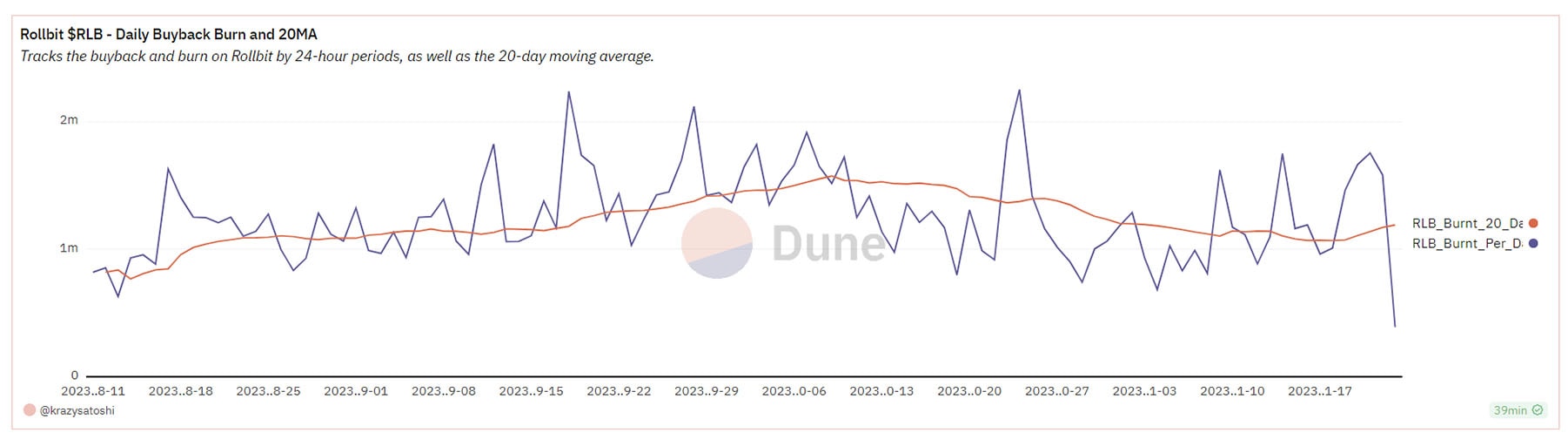

First, Rollbit uses 10% of the revenue generated by casino games to buy back and burn RLB. Secondly, 20% of the revenue generated by the Sportsbook is used for the same purpose. And 30% of the revenue generated by crypto futures trading is allocated to buy back and burn RLB. The buyback and burn mechanism is one of the key factors contributing to setting the value of RLB.

Since Rollbit reached an all-time high (ATH) on November 11, the amount of RLB that Rollbit has burned has increased. This is evident as the 20-day moving average (represented by the red line) moved up during the past 2 weeks, indicating that, while RLB is cheaper, it is able to generate more revenue

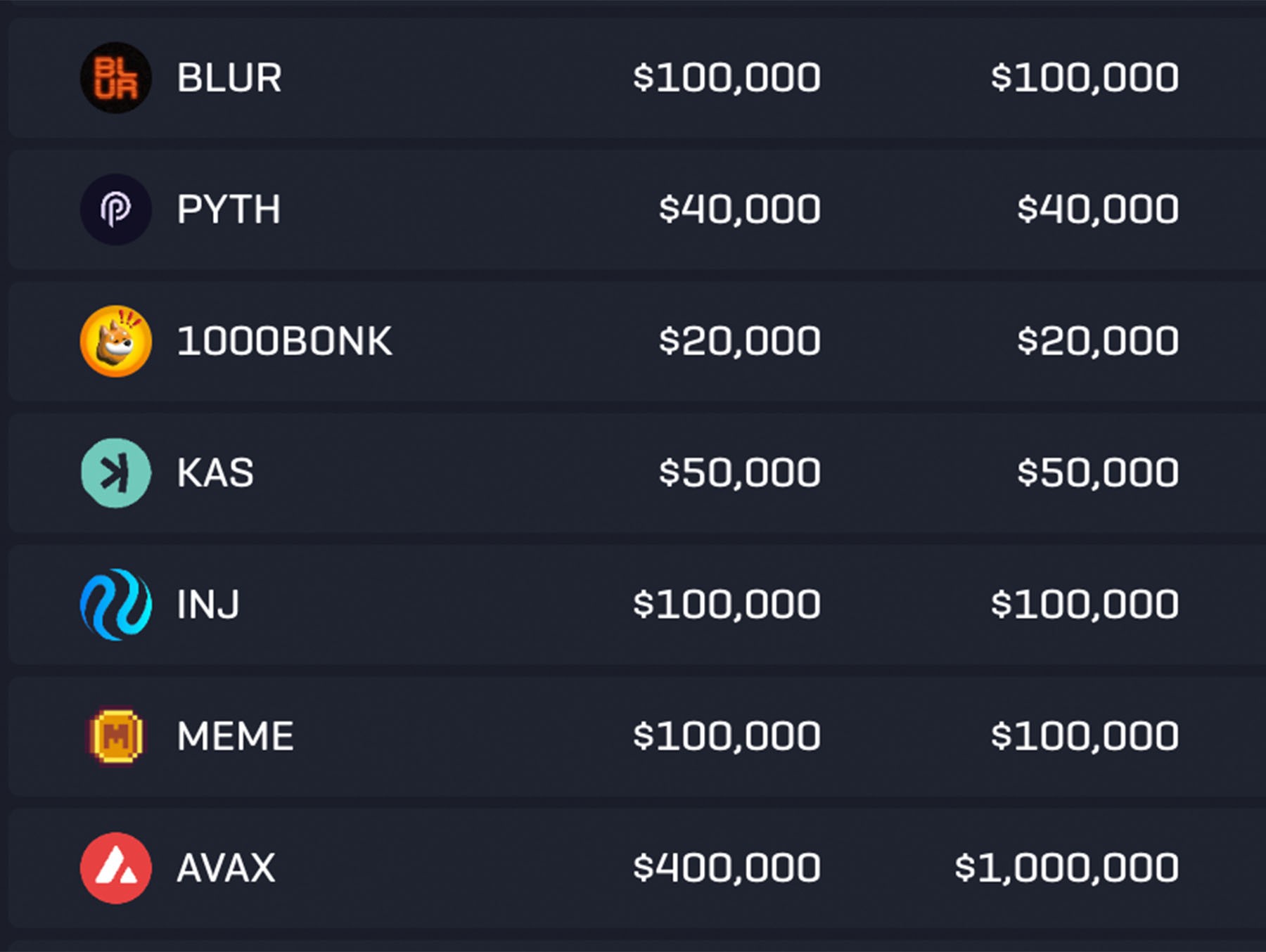

In addition to that, one crucial factor for Rollbit to maintain high revenues is active trading on its exchange. On November 23, Rollbit listed seven new assets, including widely popular names such as $AVAX, $BONK, $KAS, $BLUR, and $INJ.

These new asset listings are anticipated to increase trading volume, given that they include trending assets currently favoured by traders.

Overall, suppose the market continues to exhibit volatility. In that case, this should enable Rollbit to generate even higher revenues and, consequently, burn more RLB, especially considering its current lower price compared to its all-time high (ATH).

Potential RLB trade idea

Given BTC's current consolidation within the $35,600 to $38,000 range, a strategic investment move involves taking a spot position in RLB as BTC approaches the lower end of this range, specifically within the $35,600 to $36,000 zone.The execution of this trade should be closely monitored, and it is imperative to reassess the position if BTC breaks below its support level of $35,600 on a weekly timeframe.

This position can be held in anticipation of BTC breaking out of the $35,600 to $38,000 range, especially with the imminent launches of BTC Spot Bitcoin ETFs expected on January 10, 2024.

Alternatively, it could serve as a long-term investment, aligning with the price targets and validations outlined in our investment thesis for 2024-2026.

Whales have started accumulating MATIC

MATIC, now known as POL, has declined from its local high of $0.95 on November 14, marking an 18.94% decrease and currently resting at $0.77.

Much of this decline can be attributed to sustained selling pressure from the FTX Estate as they continue to sell their MATIC tokens. This is also coupled with a general downturn across the market.

However, there are indications that the situation might be taking a positive turn MATIC.

Whale 1 hoards $2.647M worth of MATIC

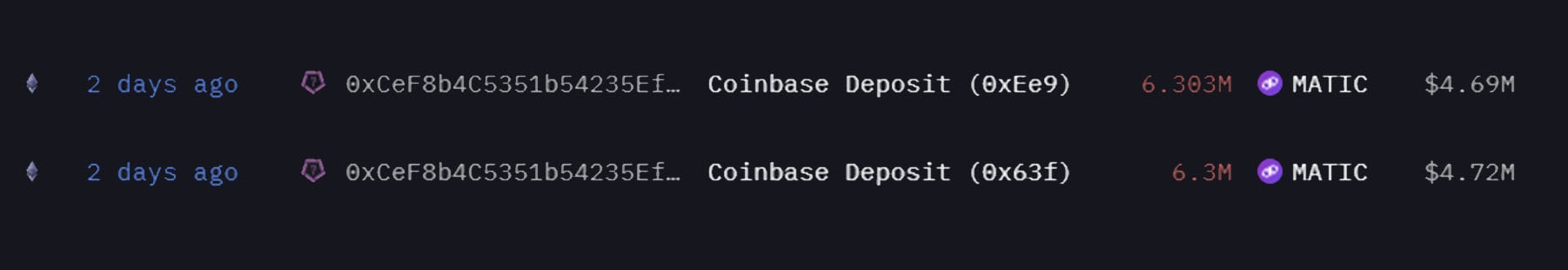

We identified one whale wallet that, over the last 2 days, withdrew $2.647 million worth of MATIC from Coinbase into a new wallet. This likely indicates an accumulation of MATIC, suggesting an intention to build a mid/long-term position.

Whale 2 accumulates $14M worth of MATIC

We found five wallets accumulating MATIC. Each of those wallets withdrew between $2.87M and $2.79M, from Coinbase over the last week. And now, they’ve collectively withdraw $14.09M worth of MATIC.

Now, whales sometimes try to cloak their activities. They often use multiple wallets to accumulate coins to obscure their investment and avoid detection by whale trackers.

While assessing the nature of these transactions is challenging, there's a chance these wallets belong to the same entity.

However, proving this is difficult, as these wallets have yet to have any apparent connection with each other. Nevertheless, it indicates that entities are actively withdrawing MATIC from exchanges.

What do the whales know that the rest of us aren't paying attention to?

Why are whales buying MATIC?

One of the main factors suppressing the price of MATIC/POL is the significant offloading of MATIC by the FTX estate over the last week.On November 14, the FTX estate sold 8.27M $MATIC (equivalent to $7.41M), and on November 22, they sold an additional 22.6M $MATIC (amounting to $17.2M), which was then transferred to Coinbase and Falcon X.

While these amounts may not be catastrophic, the fact that there was already less demand for MATIC compared to, for example, SOL made MATIC less attractive to traders.

However, the FTX Estate only has 15M MATIC tokens left after its previous sales, which amounts to about $12M worth of MATIC. This suggests that just after one or two more transactions by the FTX estate, the selling pressure on MATIC from the FTX estate will be over.

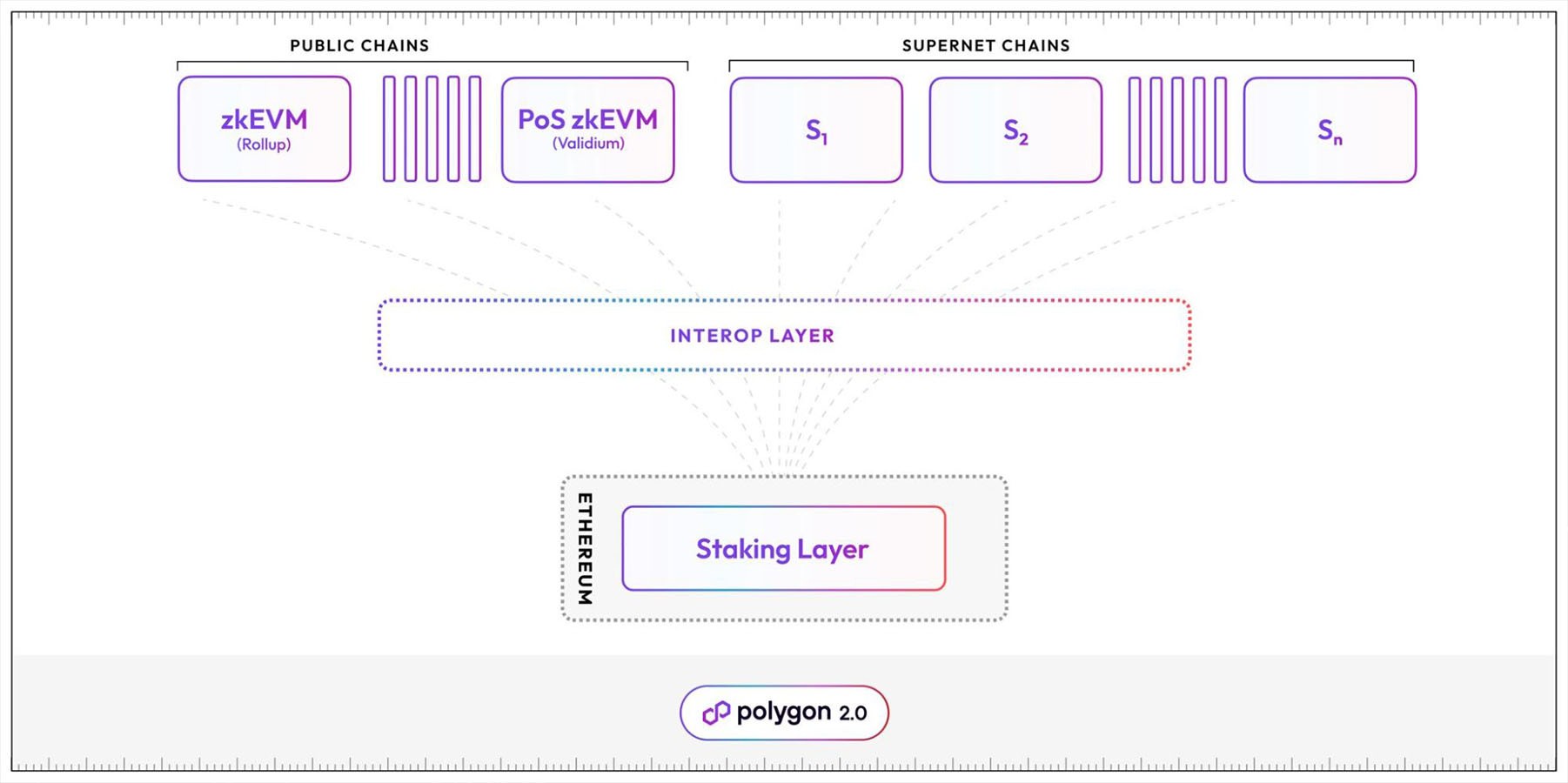

In the meantime, however, the Polygon team is working hard. They are actively engaged in delivering the Polygon 2.0 rollout. This initiative aims to create a unified layer of multiple layer 2s that are all interoperable with each other and secured by Ethereum. The technical upgrades on Polygon might deliver great value-add to investors in the medium- to long-term. Let’s get technical.

Polygon is getting a makeover

The first major upgrade for the Polygon 2.0 vision was the transition from $MATIC to a new $POL token, designed to enhance Polygon's ecosystem.

One of the key innovations is that with $POL, validators will be able to secure multiple chains through the staking layer. This enables $POL to secure multiple chains, similar to how Polkadot validators can secure different parachains. This contrasts with each chain needing its own token and set of validators.

However, this marks just the initial phase of Polygon 2.0. The transition from the original Polygon Proof of Stake chain to a Polygon zkEVM Validium is anticipated as the next significant upgrade.

This shift aims to enhance the security of the original Polygon chain beyond its current design and to establish a more scalable and cost-effective alternative to the existing Polygon zkEVM chain.

A Validium doesn't send transaction data back to Ethereum, unlike Polygon zkEVM. Only the proof of verified transactions is transmitted.

While more centralised than a zk-rollup, Validium is highly scalable and suitable for applications like gaming and microtransactions that prioritise efficiency over maximum security.

This shift will be a significant milestone for Polygon as it signals the official commencement of Polygon 2.0. Beyond the transition to Validium, there are still undisclosed announcements on the Polygon website related to Polygon 2.0, suggesting that this is merely the initial step.

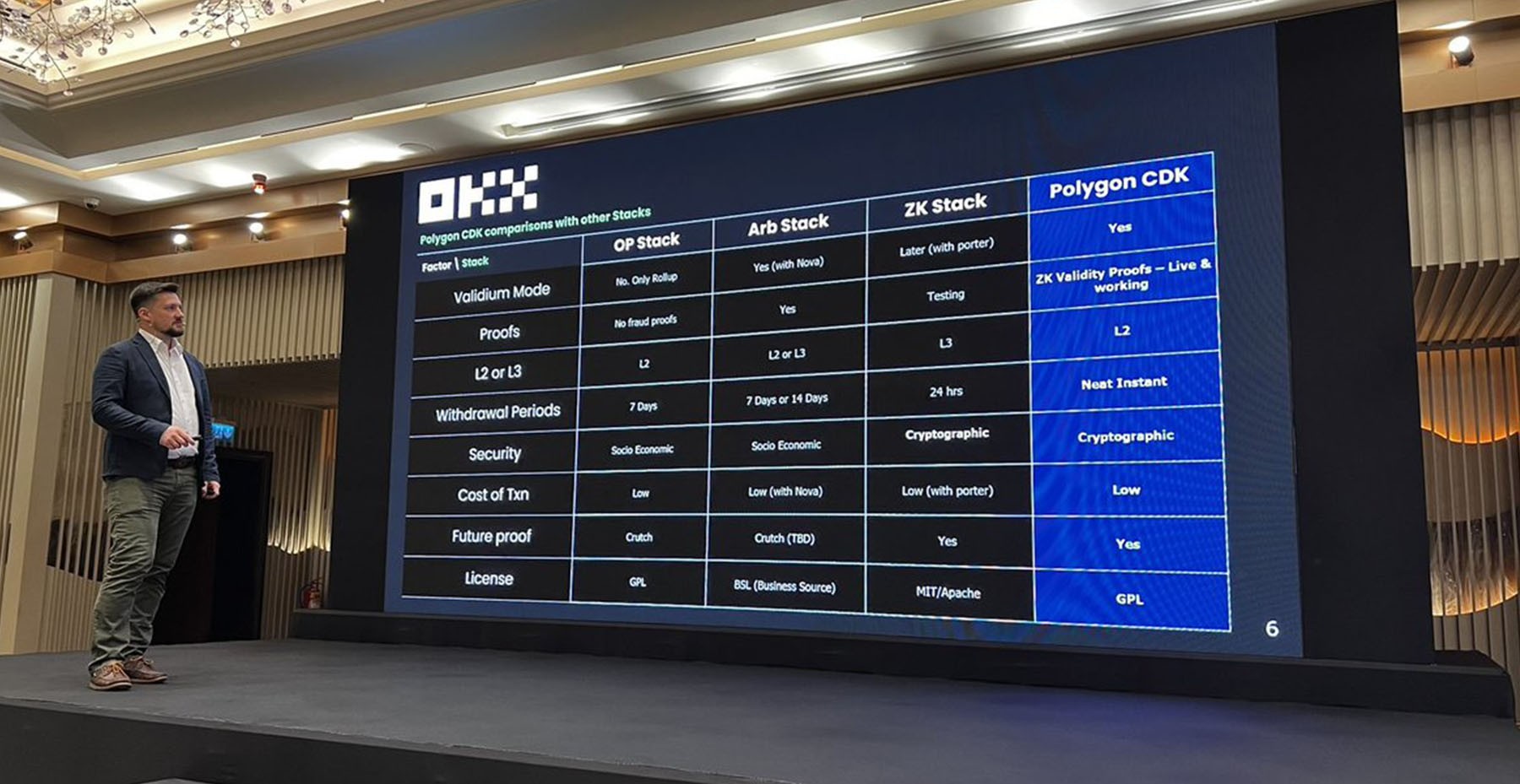

Furthermore, it's essential to highlight that major players in the crypto industry are adopting Polygon's technology to develop their own Layer 2 solutions, integrating seamlessly into the expansive Polygon ecosystem.

The gaming chain Immutable is a prime example, actively deploying the Polygon-powered Immutable zkEVM. Shifting our focus to the cryptocurrency exchange arena, reports indicate that Kraken is exploring incorporating Polygon's technology. At the same time, OKX has recently unveiled plans to embrace a layer 2 solution using Polygon’s CDK.

Why does all this technical stuff matter?

The answer is simple. They’ll make Polygon more competitive and attract more users to the network. They'll also increase the total economic value that Polygon generates.Long story short, whales see these technical upgrades as positive signals for where Polygon is going. And now they’ve started positioning themselves for that MATIC/POL future.

And since the selling pressure from FTX appears to be diminishing, the full acceleration and attention of the market towards the Polygon 2.0 rollout are yet to be realised.

Potential trade idea on MATIC

Once again, with BTC consolidating in the $35,600 to $38,000 range, it's prudent to strategically position in MATIC as BTC approaches the lower end ($35,600 to $36,000).Monitor the trade closely, reassessing if BTC breaks $35,600 on a weekly timeframe.

Once invested in MATIC, hold through the anticipated Polygon 2.0 announcements. Look to sell as significant news events unfold. We expect late buyers in January or February 2024. That's when Polygon's announcements regarding new phases of its Polygon 2.0 roadmap will happen.

Cryptonary’s take

A nuanced picture emerges as we conclude our exploration into the actions of crypto whales and their strategic moves in Rollbit (RLB) and Polygon (MATIC/POL).The activities of these influential players are not merely speculative; they are grounded in the unique dynamics of each asset.

Rollbit's buyback and burn mechanism and recent strategic listings present a compelling case for long-term value.

Meanwhile, the imminent completion of the FTX Estate's selling pressure on Polygon, alongside the promising developments of Polygon 2.0, offers a glimpse into a potential resurgence.

For investors seeking a strong start in 2024, aligning with the Smart Money on RLB and MATIC/POL may be one of the keys to positioning your portfolio for profit in 2024.

As always, thanks for reading.

Cryptonary, OUT!