And as you know, we are bullish on RUNE – it is one of the assets in Cryptonary’s Picks.

But in today’s edition of Smart Money, our sights are on Chainflip (FLIP), a new entrant in the cross-chain swap space.

Chainflip is on a mission to “become a network of networks, supporting increasingly specialised cross-chain liquidity networks supporting classes of blockchains never previously integrated into the DeFi ecosystem”.

It sounds like a lofty mission, but some Smart Money investors think Chainflip is on to something and are now accumulating the tokens of this three-month-old project.

Now, does this token deserve a spot in your portfolio?

Let’s dive in!

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

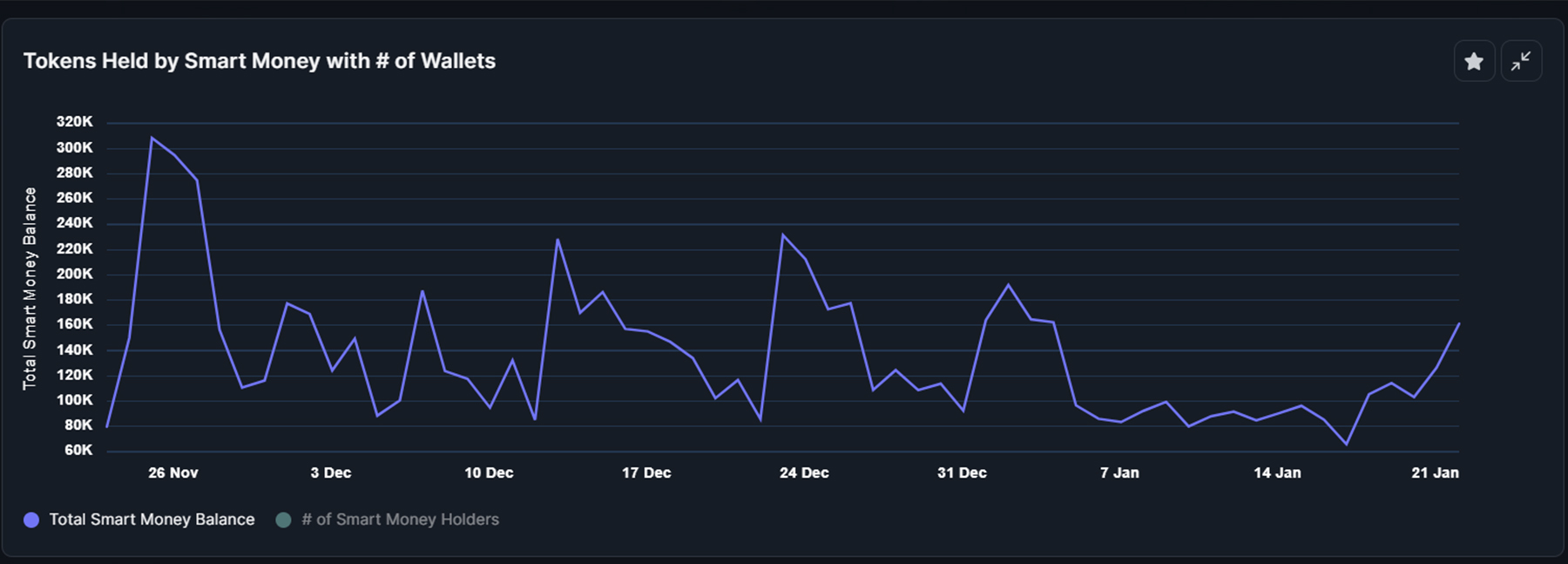

Smart Money buys into FLIP

We have noticed an uptick in activity from Smart Money wallets accumulating the FLIP token over the past week.This growing interest positions Chainflip as a new player to watch in cross-chain swaps.

Yesterday, Jan 22, Auros Global bought FLIP tokens worth $252,578 to expand its portfolio. This purchase increased its total FLIP holdings to 72,637, valued at approximately $337.04K.

In the last seven days alone, another whale has invested $258,688 in FLIP, bringing their total holdings to 53,978.7139 FLIP. This is a high-profile millionaire with a portfolio worth $46,625,094.

In another significant move, a different wallet acquired a substantial 31,899.5778 FLIP on January 19th, amounting to $157,123.47. The total FLIP holdings in this wallet have now reached an impressive 566k FLIP, valued at around $2,634,641. By the way, this particular whale has staked all their FLIP tokens.

The case for holding FLIP alongside RUNE

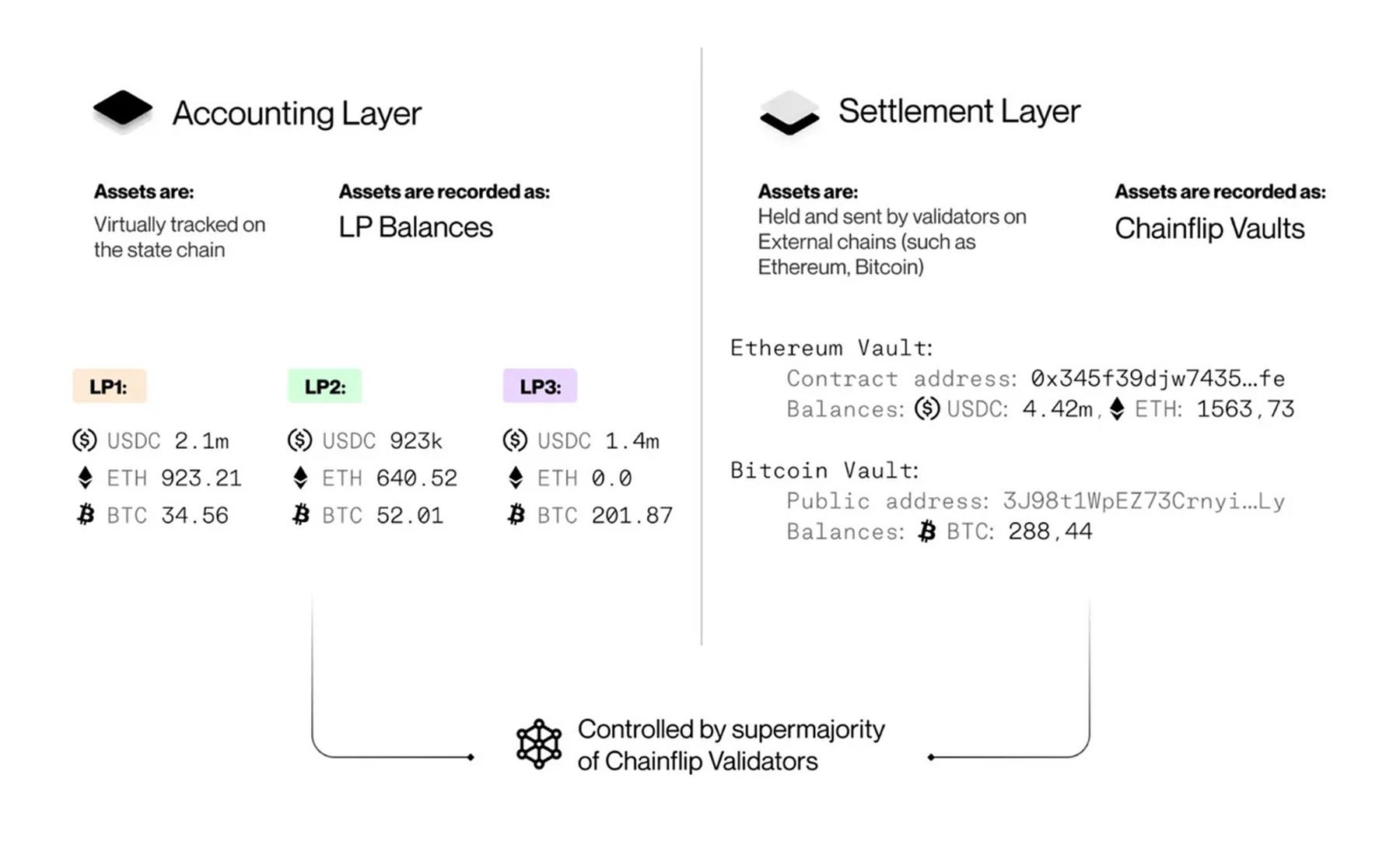

Chainflip's market positioning closely resembles that of Thorchain, with a focus on enabling native cross-chain swaps.This approach allows it to create native liquidity pools on each chain it supports.

The native multi-chain support makes Chainflip a versatile cross-chain settlement layer that caters to the growing demand for asset transfers across different blockchains.

Chainflip offers several notable advantages:

- Chain and wallet agnosticism: Chainflip supports value transfers across any blockchain using ordinary wallets, making it a versatile and user-friendly option for asset swaps.

- Direct asset swaps: The platform facilitates direct asset swaps without requiring wrapped or synthetic assets, reducing the risks associated with post-swap asset handling.

- Minimal on-chain footprint: Unlike some platforms that require additional protocols or executions on specific chains, Chainflip aims for higher compatibility and versatility. It focuses on off-chain computations to minimise users' gas consumption.

- Enhanced user experience: By simplifying the cross-chain value transfer process, Chainflip lowers barriers, reduces risk exposure, and provides a more seamless and efficient user experience.

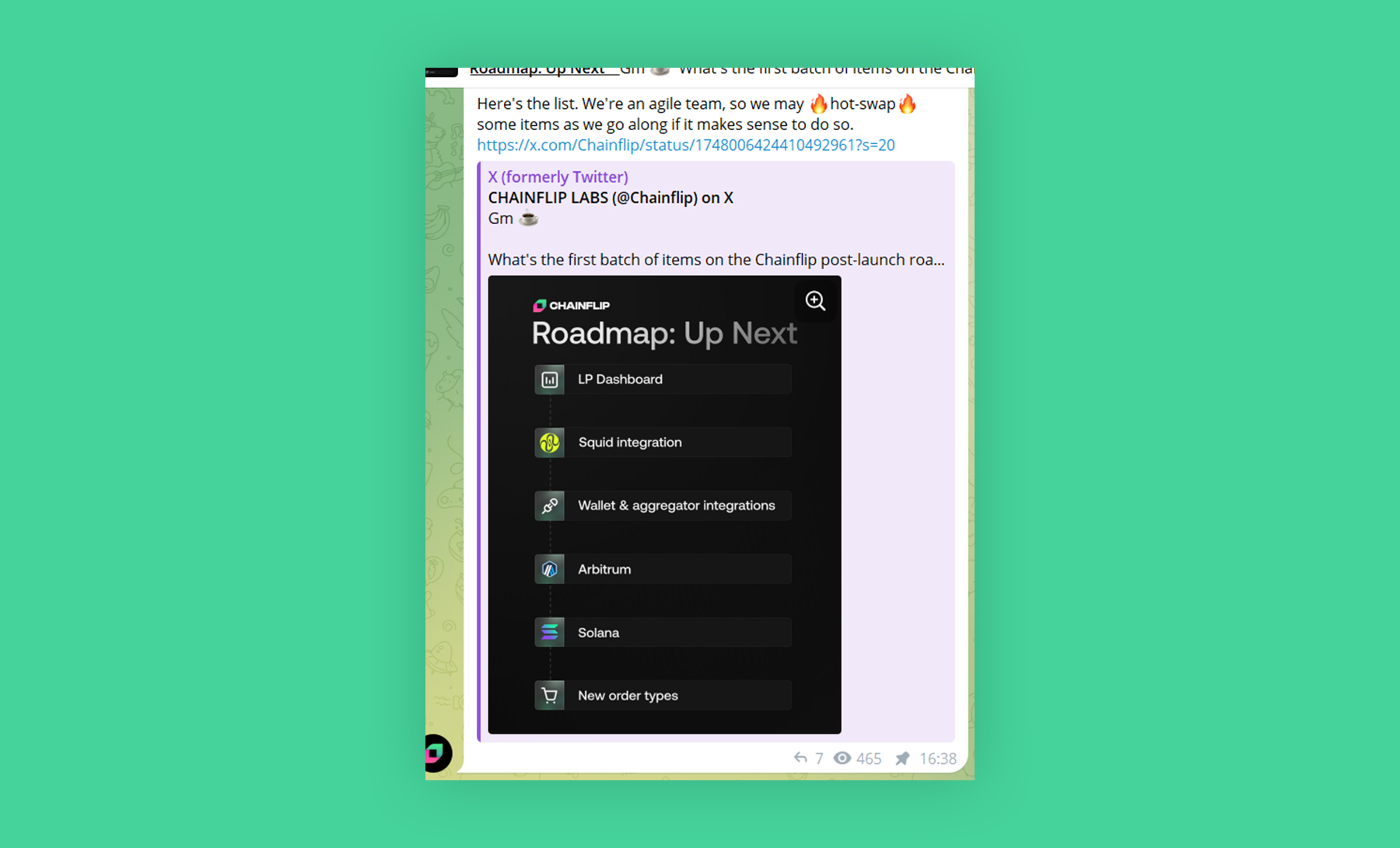

Chainflip’s roadmap for 2024

How will you know if Chainflip is on track to live up to expectations?The project roadmap provides some guidance.

In 2024, we will pay attention to how Chainflip executes its integrations and expansion plans to other chains.

There are plans to integrate both Solana and Arbitrum into Chainflip. Both blockchains have very high trading volumes and Total Value Locked (TVL), so these integrations could help Chainflip acquire new customers relatively quickly.

Interestingly, Thorchain also aims to integrate Solana. It will be interesting to see who manages to complete the integration first.

Should you consider taking a position in FLIP?

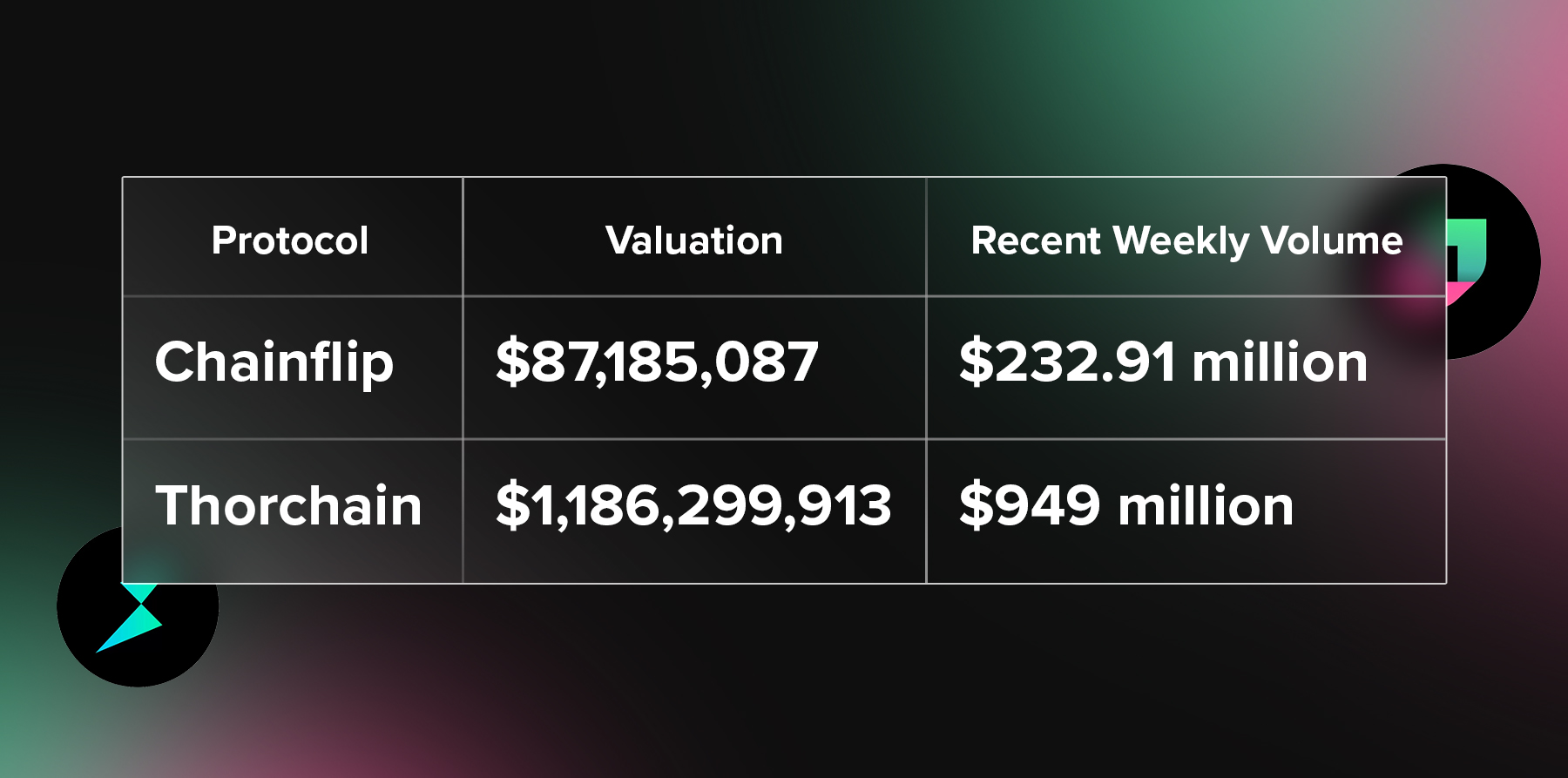

We remain very bullish on RUNE. And we aren’t arguing that Chainflip is superior to Thorchain.However, we see FLIP as a strategic diversification play for RUNE holders.

While Thorchain remains the dominant player, Chainflip can help you diversify your exposure assets in the cross-chain sector. Chainflip is a budding competitor, taking an alternative technical approach.

In a sense, FLIP can serve as a hedge, mitigating risks specific to Thorchain while providing an upside if Chainflip gains traction.

As you can see in the table above, Chainflip is much smaller than Thorchain in terms of both valuation and recent volume.

This means the "insurance" you gain by holding FLIP is cost-effective relative to Thorchain's scale. Although there's a significant difference, it is reflected in the valuations, indicating that the hedge is inexpensive.

What makes Chainflip attractive is its focus on cross-chain swaps, which we consider superior to bridging.

While this approach doesn't diverge into a different area, Chainflip has made different tradeoffs compared to Thorchain in working toward the same goals.

- Chainflip is not exposed to certain Thorchain risks like the use of synthetic assets.

- Unlike Thorchain, which relies on $RUNE as an intermediary asset for pool formation and swaps, Chainflip does not depend on any specific token.

- However, Chainflip's architecture may be more centralised than Thorchain's, which is highly decentralised.

The FLIP token also has utility, featuring a buy-back and burn mechanism. For every token swap conducted through Chainflip, a 0.1% fee is charged, collected in USDC. This fee is then used to purchase and burn FLIP tokens.

Therefore, if Chainflip succeeds, token holders will benefit directly.

If we were buying into FLIP, we would consider light buys at the bottom border of the $4.31 price point.

We would look to add heavier orders if price falls below that level.

Cryptonary's take

When investing in crypto, you don't have to bet on just one team to win the race - spreading bets can improve returns and mitigate risks.FLIP provides an interesting diversification opportunity for RUNE holders.

Rather than thinking of getting exposure to cross-chain swaps through either RUNE or FLIP, we think a better approach will be to get exposure to this sector through RUNE and FLIP.

This analysis on FLIP should not be seen as reduced conviction in RUNE. We remain very bullish on Thorchain long-term and will have a detailed update article on RUNE developments later this week.

However, we saw the notable activity in FLIP and felt a small position could help RUNE holders diversify. If RUNE underperforms, FLIP would likely benefit as the main alternative.

Importantly, this is not a zero-sum game - the cross-chain swaps ecosystem could grow large enough to support multiple winners.

So, how big of a FLIP bag should you get?

We think the ideal allocation depends on your existing RUNE exposure:

- If RUNE is up to 30% of your portfolio, consider allocating 2-5% to FLIP. This provides material exposure to hedge Thorchain risks without overly diluting your RUNE holdings.

- If RUNE is less than 10% of your portfolio, a 1-3% FLIP position may be sufficient as a hedge.