The big news is that this DEX is taking a big bite out of the market share of likes of dYdX, GMX, and Vertex, purely based on the quality of its product and without extra incentives to traders. Unsurprisingly, it has rapidly risen to the top spot among DEXs.

Could this be the next big thing among DEXs?

Here’s what the Smart Money thinks.

Meet RabbitX

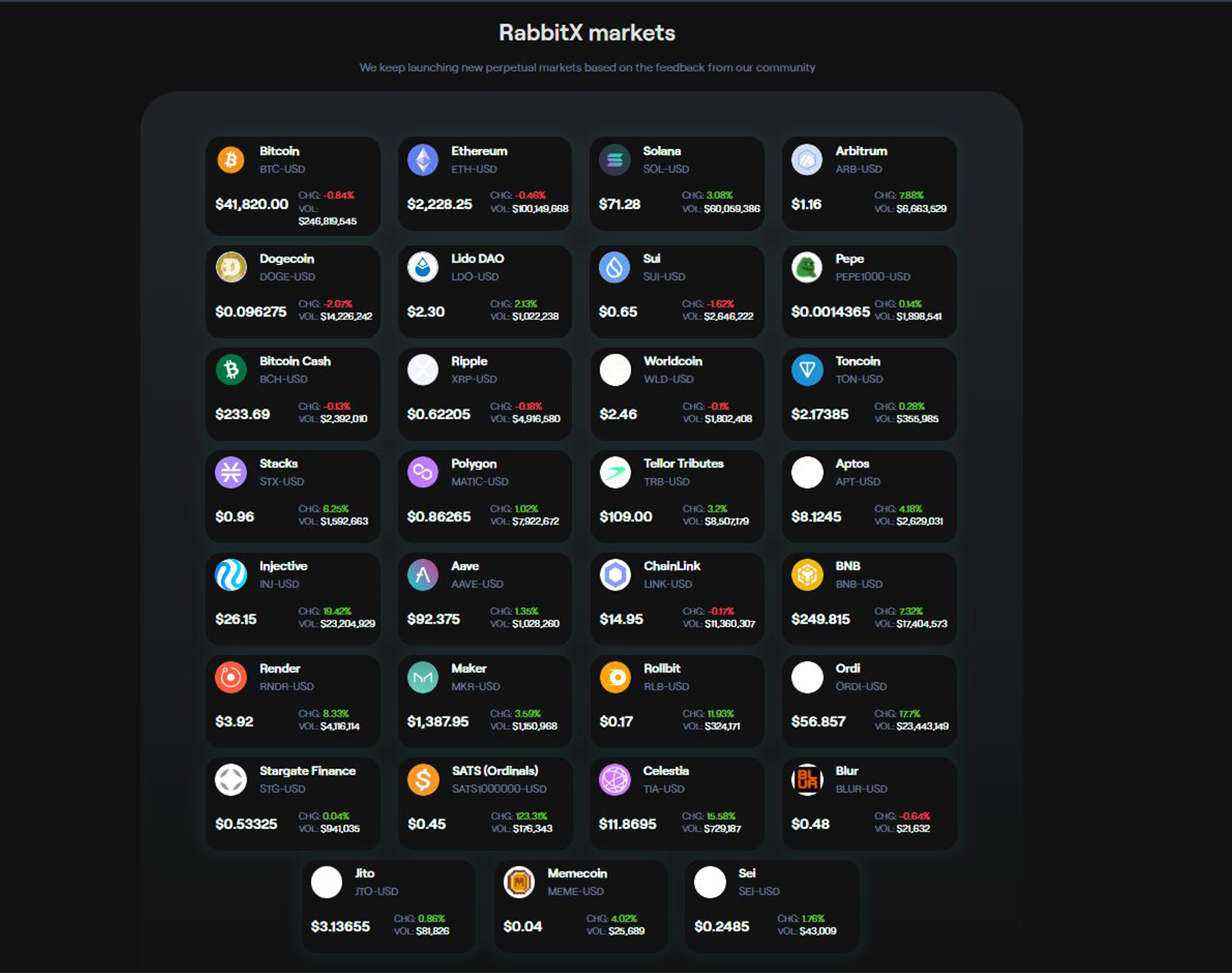

Perpetual exchanges have been among the most exciting crypto products with a clear product-market fit. They are also one of the products that will see significant growth in DeFi.RabbitX is a decentralised perpetual exchange built on StarkNet, a Layer 2 scaling solution for Ethereum. It aims to provide fast trade execution for perpetual contracts with low fees and be a serious competitor to dYdX.

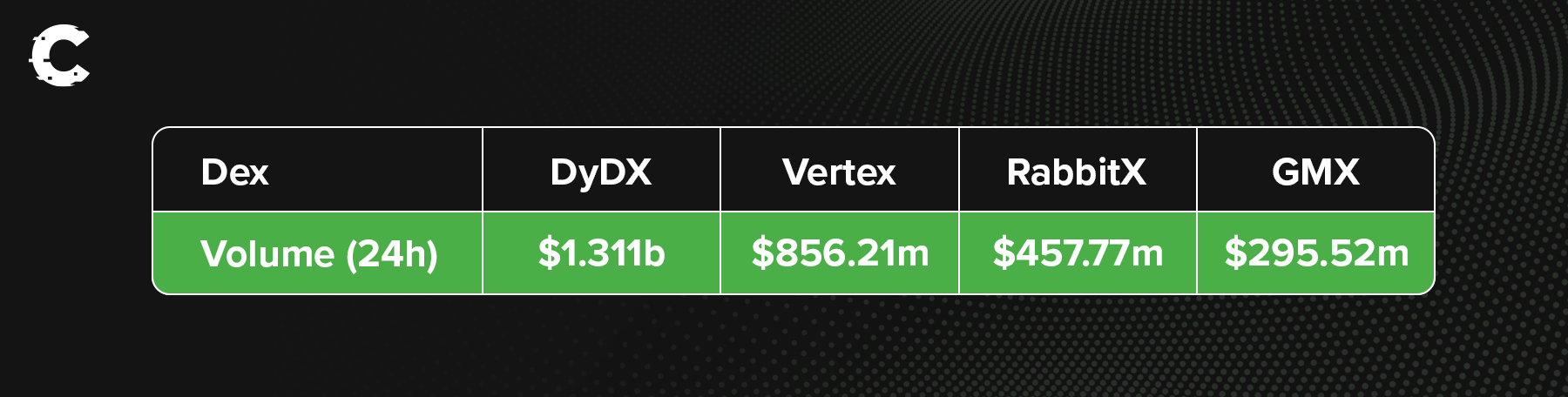

So far, this aim at DyDX has been going reasonably well for RabbitX, as it has consistently been ranked in the top 5 DEXs since November. In the last 24 hours, it was sitting in the top 3.

With this rapid growth, we’ve seen crypto’s Smart Money showing a keen interest in RabbitX.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

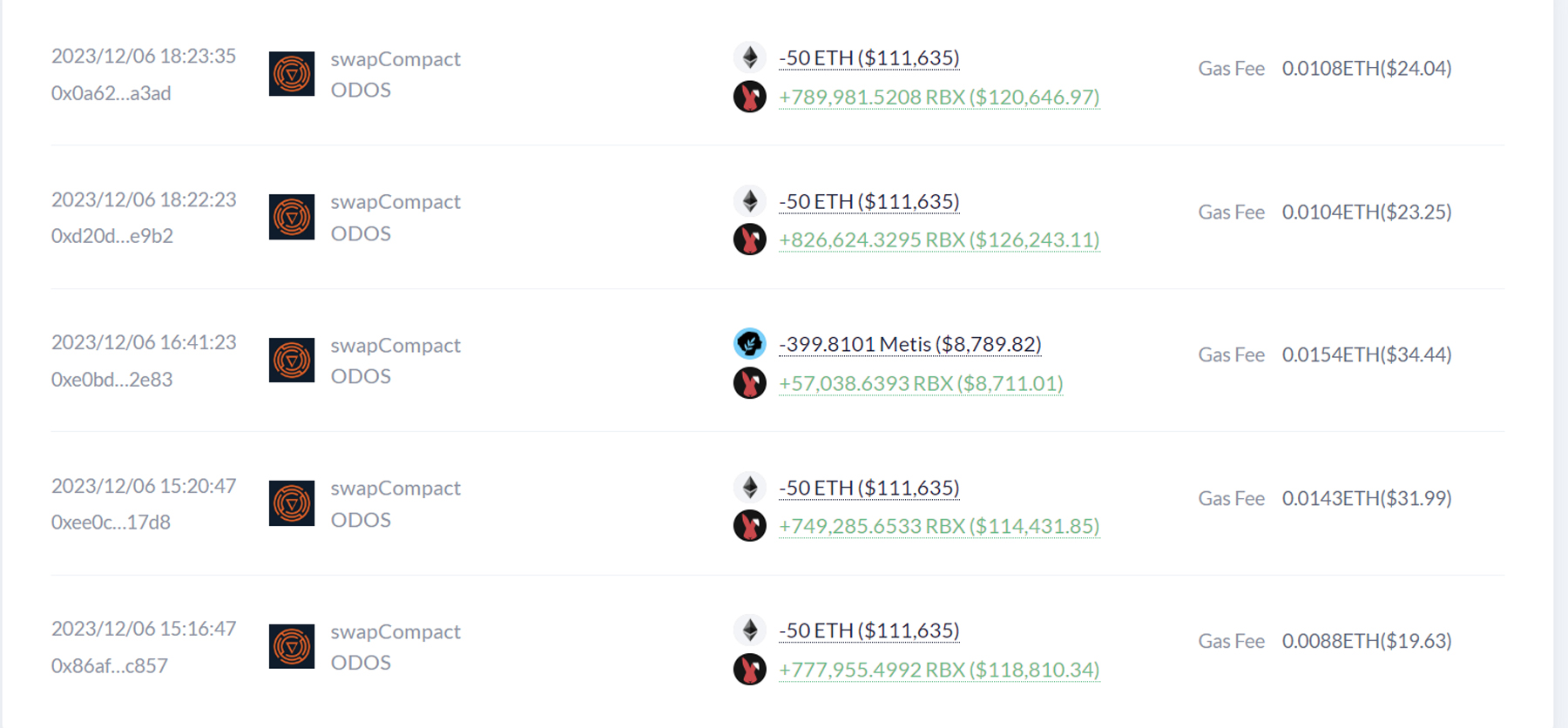

A $13M whale bought a big position in RBX

The whale wallet 0x9cbf099ff424979439dfba03f00b5961784c06ce accumulated a huge position in RBX on December 6, buying a total of 3,200,886 RBX currently worth $676,944.11. This is now one of their most prominent positions outside of ETH.

This move is particularly interesting because the rest of the whale's assets are quite conservative and more 'old school.'

So, the fact that this DeFi OG is betting on this new perpetual DEX says a lot and clearly shows conviction.

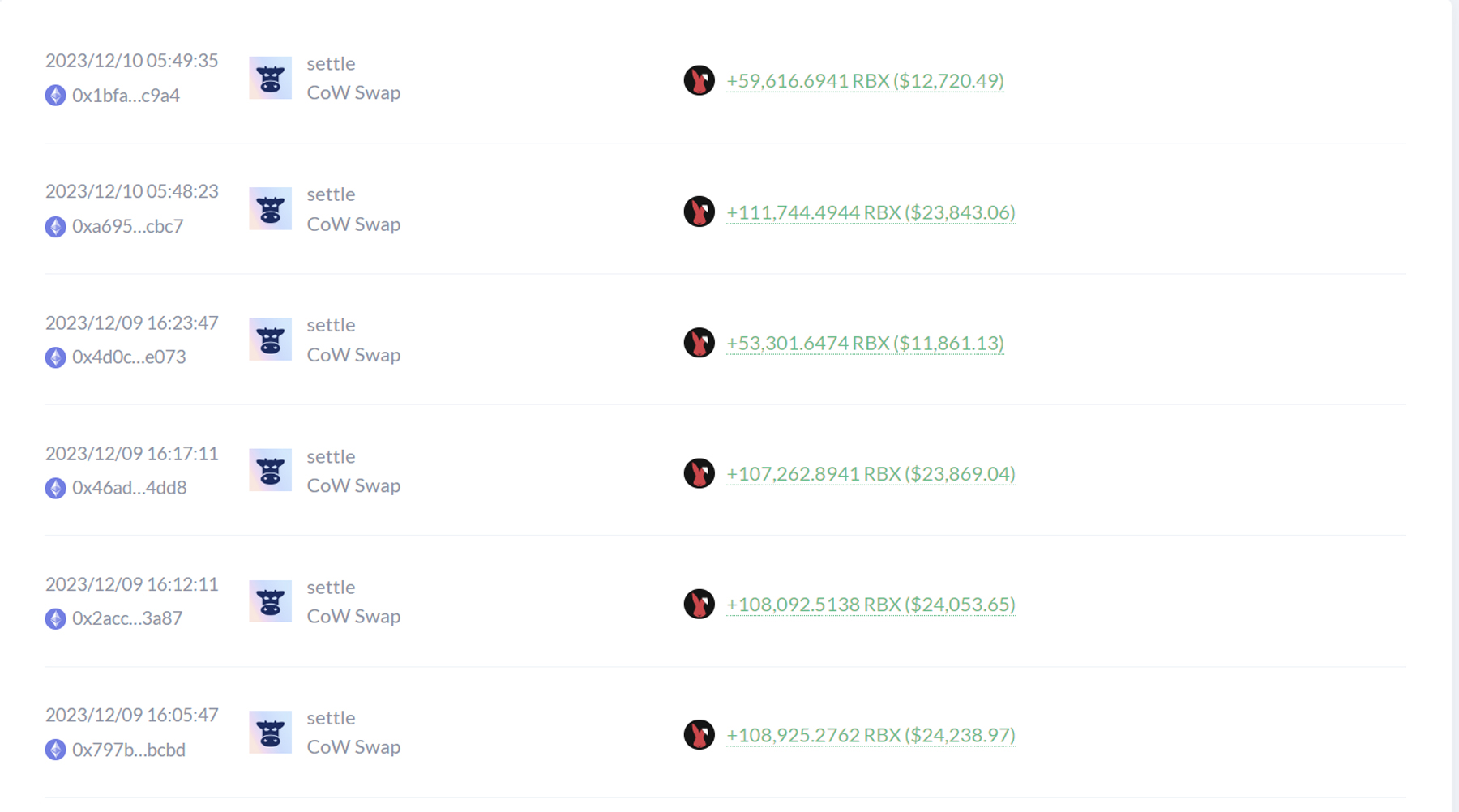

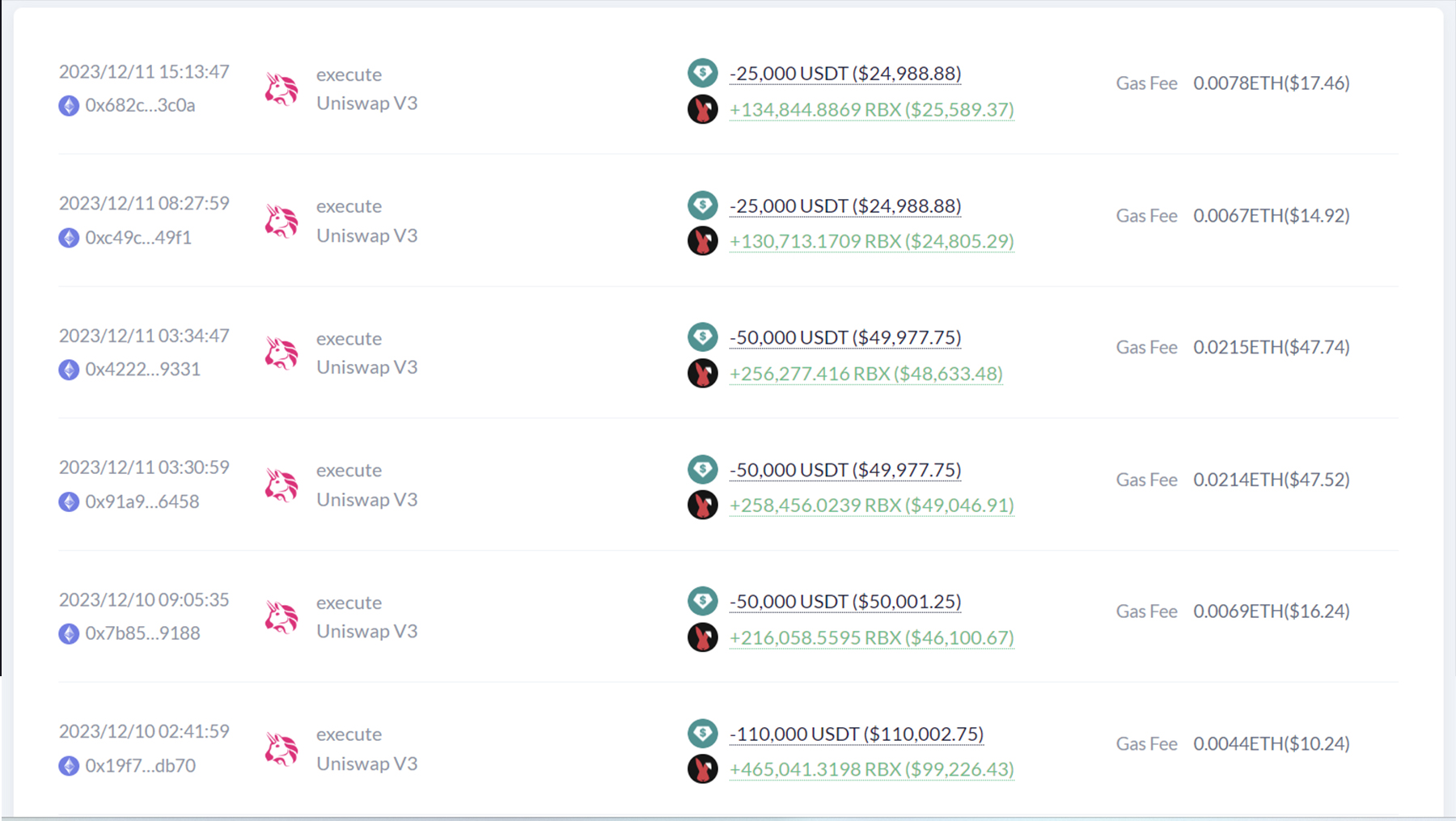

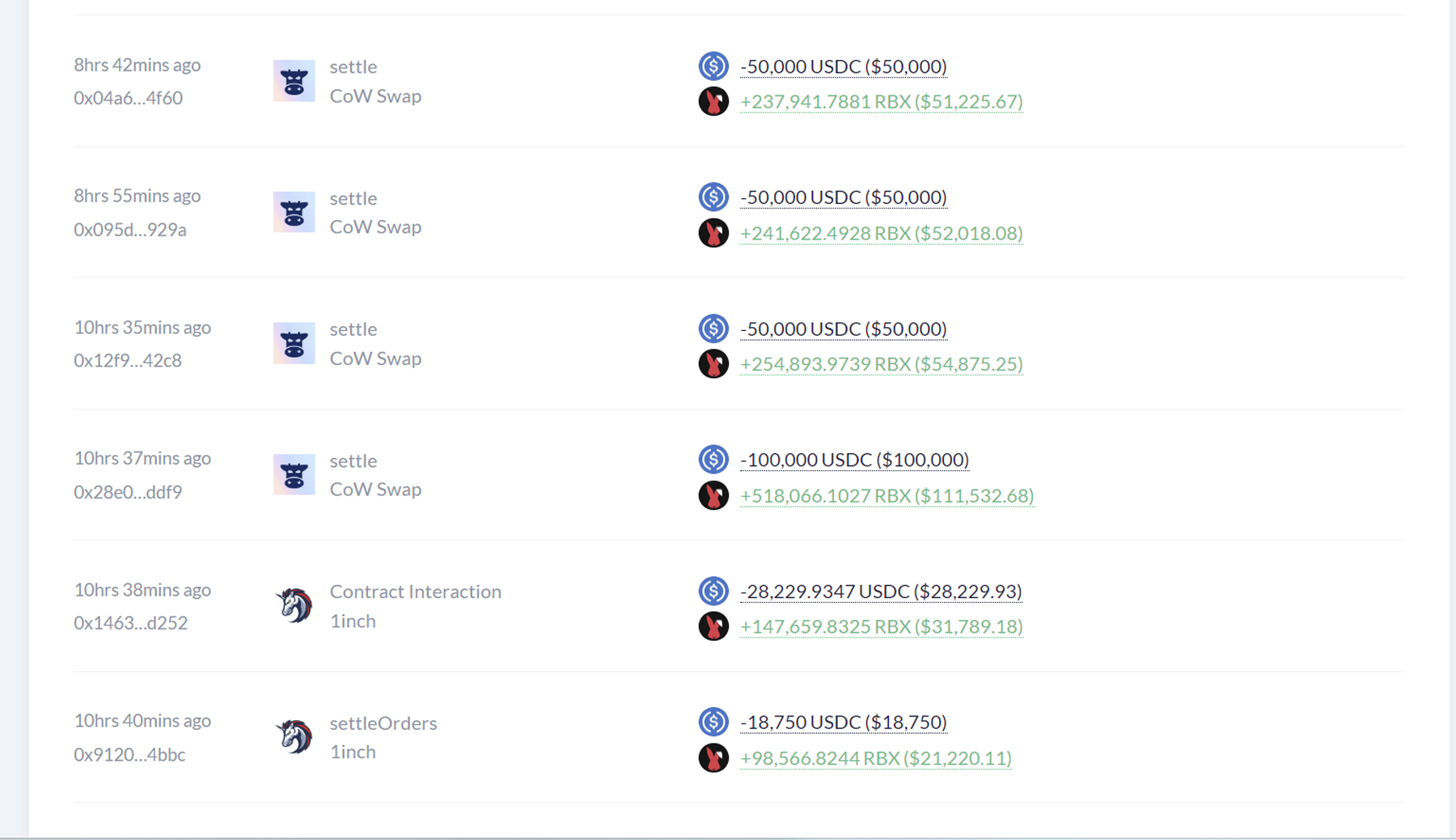

We have also noticed other large transactions recently

However, this whale is not the only one accumulating RBX, as we have noticed three other notable wallets also taking positions in the last few days.Wallet 0x049de45c6750cf0a0b65e820ba045ec57c0620aa bought 1,859,227 worth of RBX, currently valued at $393,201.31, between a price of $0.12 and, more recently, a price of $0.21 from November 28th to December 10th, dollar-cost averaging into the project.

Wallet 0x3ce54b0401bb17c3f88d1cc5b0c53c013c93912c bought 2,344,915 RBX, currently valued at $495,447.05, at prices of $0.19 and $0.21 between December 10th and December 12th.

On December 13th, wallet 0xfb75781f96b2b589a1d40c659c3b3c522b5d4876 purchased 1,630,900 RBX, which is currently valued at $345,694.17. The acquisition was made at $0.22 through multiple transactions.

This indicates that smart money favours RabbitX's direction and considers RBX a promising opportunity heading into 2024.

So far, we've discussed what Smart Money is doing with RBX.

And now, to the more important question, "What should you do?"

Read our thoughts below.

Cryptonary’s take

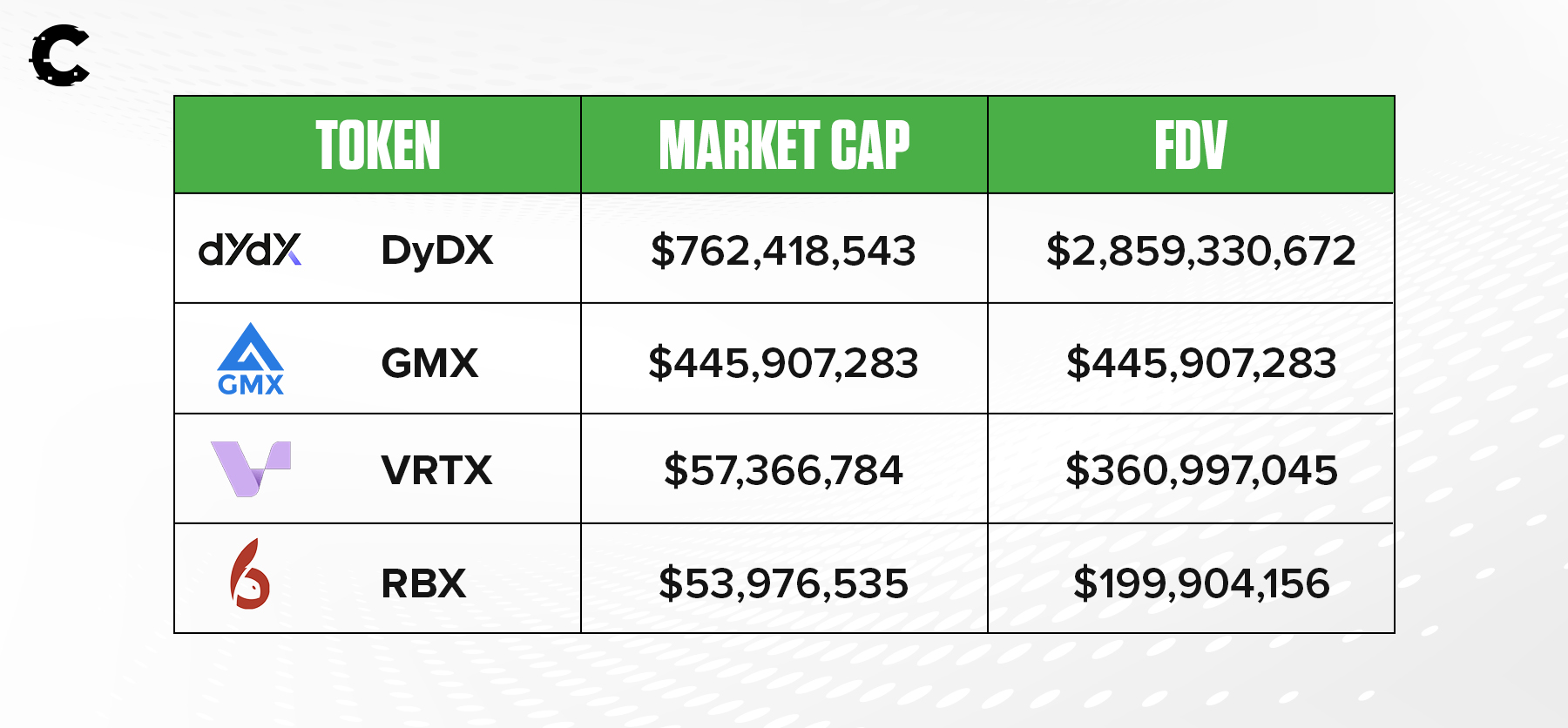

Starting with the fundamentals.Looking at the full picture, RBX stands out as a promising opportunity going into 2024. The fact that it has generated significant volumes with no incentive programs makes RabbitX unique as a top 5 perpetual DEX. Competitors like Vertex, dYdX, and GMX currently operate incentive programs that grant rewards or rebates to traders.

For example, Vertex combines a “trade & earn” model with ARB rewards. This helps explain Vertex’s $856 million in trading activity recently. dYdX and GMX have similar incentives.

In contrast, RabbitX has no comparable programs, yet it maintains volumes alongside those other top 5 players. This puts RBX in a fairly distinct position – traders seem to use the platform based on the merits of the exchange itself without the allure of additional perks.

Comparing RBX’s valuation relative to its competitors suggests it is significantly undervalued despite that traction.

Going into 2024, the launch of staking towards the end of Q1 represents an upcoming catalyst for RBX.

Staking will initiate a revenue-sharing arrangement, providing intrinsic value to the token as stakers participate in proceeds. This should generate more utility and value accrual.

All told, crypto’s Smart Money is making a calculated bet on RBX into 2024. If you already hold a perpetual DEX token, RBX could be a higher-upside complement to balance existing positions. With the sector growing and RabbitX seemingly undervalued, upside potential exists.

The data reveals that RBX may be the most asymmetrical upside opportunity among perpetual DEXs. It uniquely maintains strong volumes absent any incentives programs - yet posts figures rivalling leading exchanges spending heavily on rewards. This suggests genuine organic demand.

Combine that traction with RBX's stark valuation discount, and the risk-reward is compelling.

If execution continues, swift upside potential exists as the market matures. Of course, we must still complete our full deep dive where new facts could emerge, so watch out for our deep dive on RBX.However, based purely on current information, the opportunity was convincing enough that one of our researchers already took an RBX position at $0.19

And if you want to jump into it based on what we know today, below is the technical analysis on how/when to enter.

Moving on to the technical analysis

RBX has been on a rampage, setting its all-time highs at 0.263235.

This establishes a ceiling, and from a technical standpoint, we can anticipate with a high probability that the price will challenge and potentially surpass these highs in the near term.

Since establishing the new resistance level, the price has initiated a retracement and is approaching a significant level for this asset at 0.143700.

This zone presents an excellent opportunity for accumulation. Not only does it align with a robust Fibonacci retracement level, considering the Fibonacci from the 'Scene of the crime' to the all-time high, but it has also been a tested support and resistance level on multiple occasions.

Recent price action, even showing a wick into this level on the daily timeframe, signifies demand at this level. If the price revisits this zone, it could potentially form a compelling double-bottom formation.

If the price trades lower to the scene of the crime at 0.111445, we still have an upside promise. Until that level breaks from a technical standpoint, we're looking for more upside momentum.

This analysis suggests a strategic entry point for investors, considering both Fibonacci retracement levels and historical price action at the 0.143700 level.

Action points!

- Wait for price to reclaim $0.143700 to ensure a high probability of moving higher.

- If price breaks lower than $0.143700, allow price to retrace to the ‘scene of the crime ‘ at $0.111445.

- If price breaks lower than $0.111445, we may have to reposition completely, but until then, we are looking for an upside move from the given levels.