To start with, MKR underperformed compared to other top coins during the recent rally; in fact, it had a 6.7% decline in the top 100 cryptocurrencies.

But more importantly, while MakerDAO's treasury strategy has fueled impressive performance in current market conditions, the tide may soon turn.

Let’s dive into the details.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

MakerDAO whales deposit millions in MKR into Coinbase

MakerDAO whales have deposited millions in MKR to Coinbase as the price declines, indicating a potential intention to sell holdings.

- 0xd8BA64E693D355378eB2781271DCC89BCB61b234 deposited 1.841K MKR worth $2.65M.

- 0x954fBF0CF110d3D79100562C2d2424A58081E900 deposited 2.132K MKR worth $3.09M.

- 0x37ABd173E5b02BA9Fd6d321996F003608dEDe096 deposited 1.836K MKR worth $2.64M.

- 0x3cc257b9dA90e6fC6ab41f59a6781575A86466FD deposited 1.986K MKR worth $2.86M.

- 0x19361aeb40d218e66245CBAF68960f3a317Bc91d deposited 1.9K MKR worth $2.74M.

Since all these transactions occurred within the same timeframe, there is a chance these wallets belong to the same entity. However, we were unable to find a direct connection between the wallets. In total, $13.98 million worth of MKR was deposited into Coinbase.

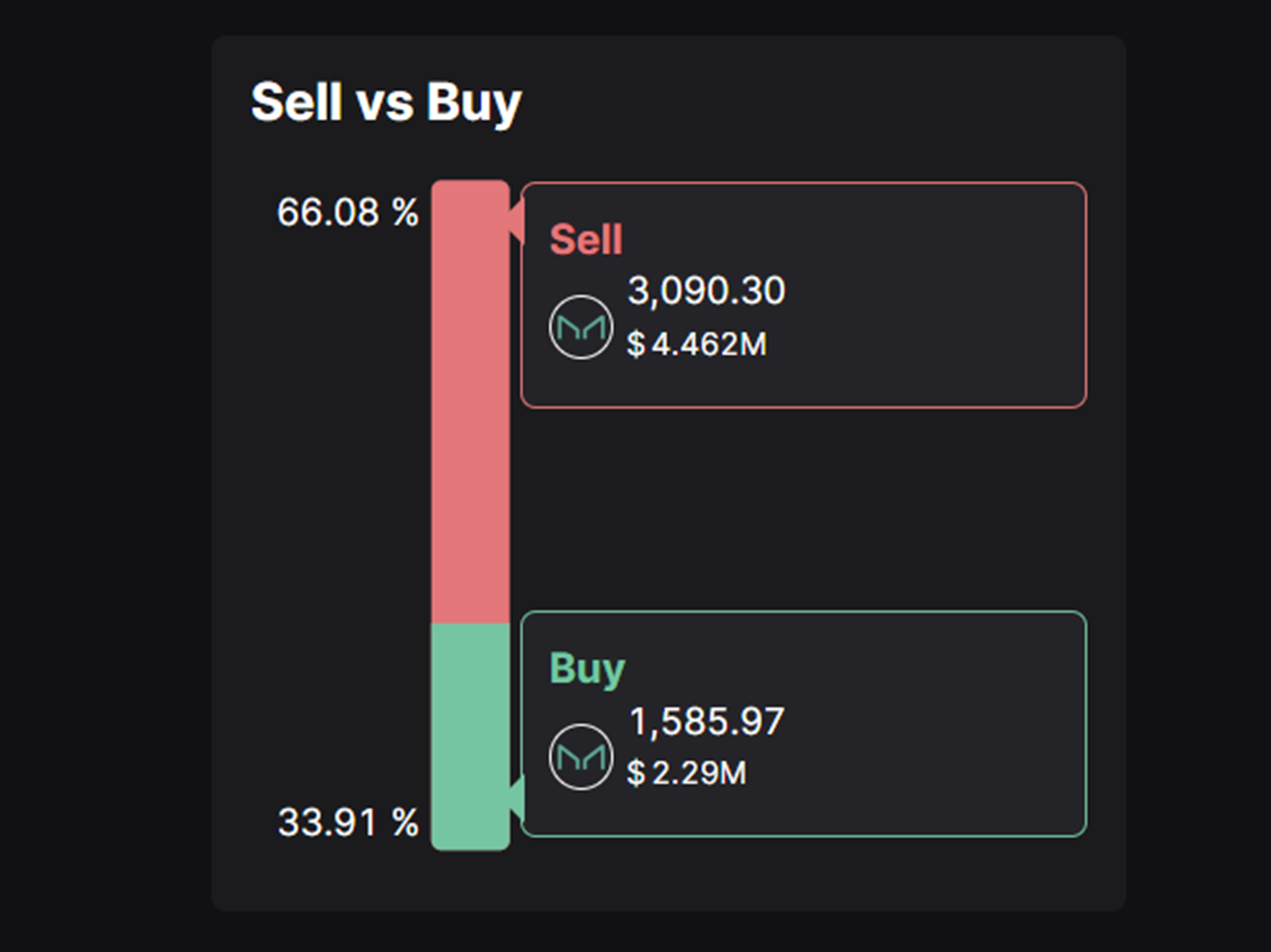

We have yet to observe a significant influx of buyers for MKR to capitalise on this dip, as on-chain data indicates more sellers than buyers in the last 24 hours.

Why would this whale want to sell their MKR, and why didn't MKR perform as one of the top coins during this rally, despite its impressive performance earlier this year?

Well, we have some ideas.

Two reasons indicate that MakerDAO's successful strategy is coming to an end, leading to a shift in the trend.

Interest rates are expected to decline in mid-2024

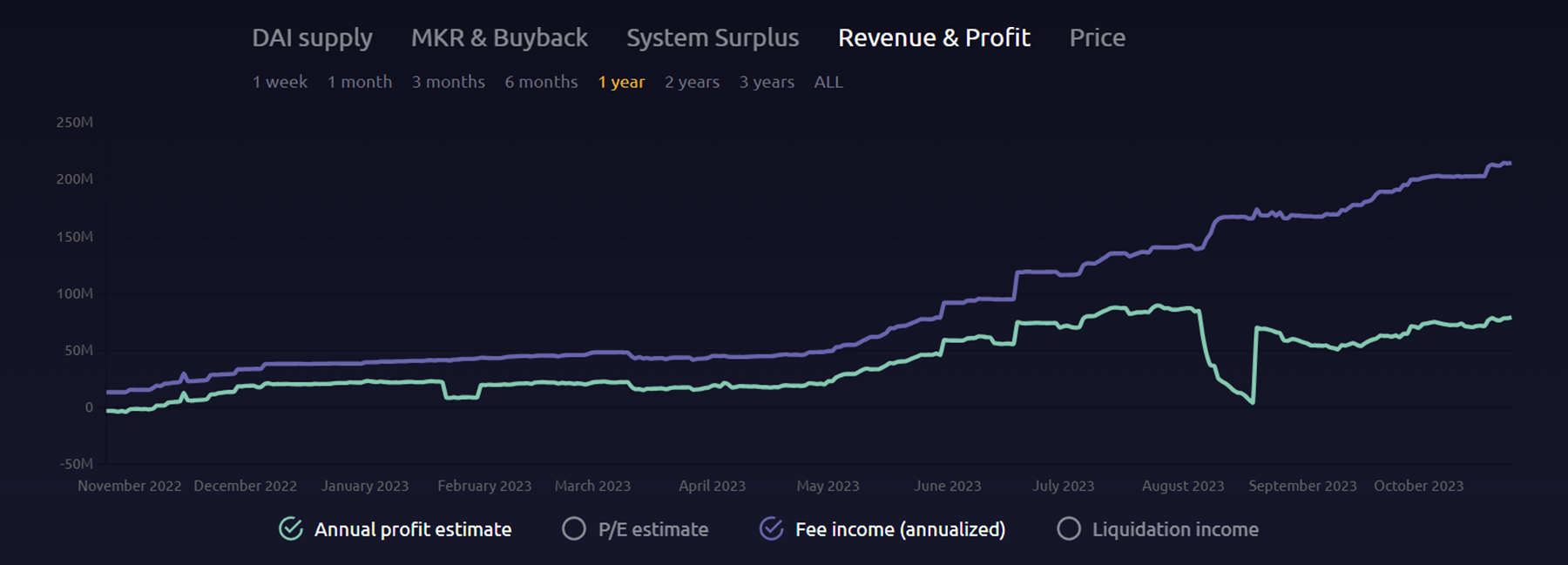

Over the past year, MakerDAO has strategically diversified its portfolio by allocating funds to U.S. Treasury bonds, resulting in a significant increase in revenue.This strategy involves efficiently minting DAI at the prevailing cost of capital and subsequently lending it to the US government at a higher rate.

This enables MakerDAO to profit from the spread, leading to a significant increase in revenue that surpasses estimates.

Currently, MakerDAO is in a promising position, thanks to the Federal Reserve (Fed), which is expected to maintain stable interest rates, allowing MakerDAO to continue profiting from the spread.

An interest rate reduction isn't on the horizon until at least mid-2024. Nevertheless, the absence of hints of potential rate hikes in November and December signals that we are nearing the conclusion of the high interest rate cycle.

The shift in market sentiment changes the question from 'How much will the Fed hike?' to 'When will they begin rate cuts?' While MakerDAO currently holds a favourable position, there's a clear signal that the trend benefiting MakerDAO is ending.

As interest rates begin to decline, MakerDAO's yield will decrease accordingly. This means they will provide lower yields to DAI holders and generate less revenue.

Stablecoin demand will decrease as we enter a bull market

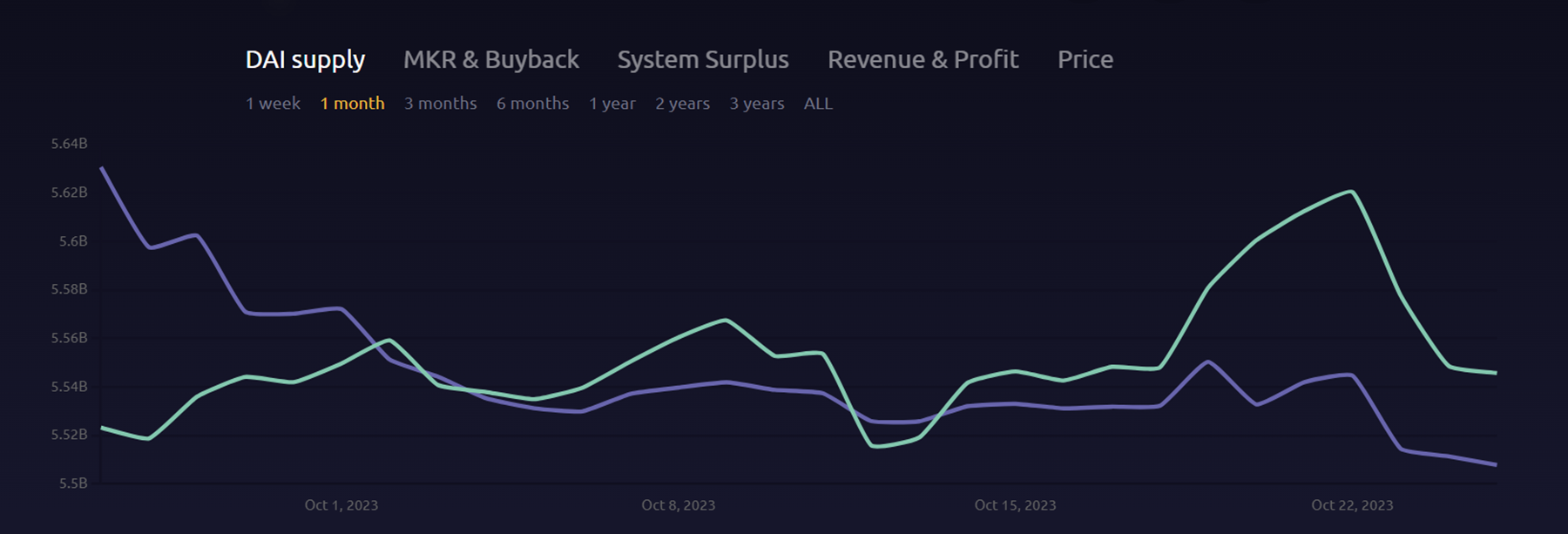

The second reason MakerDAO might soon run into troubled water is that the demand for stablecoin will start declining.The viability of MakerDAO's collateralization-based revenue model depends heavily on sustained demand for its DAI stablecoin. While DAI’s demand may rise in absolute terms as money flows into crypto during a bull market, its share of total crypto market capitalisation will likely decline.

This is because, in bull markets, investors tend to favour higher-risk, higher-return assets over stablecoins like DAI. Even with a 5% yield on DAI, speculative upside in major cryptocurrencies and altcoins becomes more attractive to investors in bullish environments.

As a result, the percentage of funds allocated to DAI versus other crypto assets decreases. We saw initial signs of this shift as DAI supply dipped when Bitcoin and Ethereum began rallying earlier this week.

Furthermore, rising DeFi lending yields in bull markets provide crypto investors more options to earn a yield on their capital. This, too, could incentivise a rotation out of DAI into higher-yielding assets.

Overall, while MakerDAO should see rising DAI demand in absolute terms as new money enters crypto during bull markets, DAI's share of total crypto asset allocation will probably decline.

New crypto entrants will focus on speculative returns from major cryptocurrencies and altcoins rather than allocating a large portion to stablecoins. Similarly, existing crypto investors will shift funds out of DAI into higher-risk, higher-return assets like BTC, ETH, and speculative DeFi yields.

Cryptonary’s take

MakerDAO seized its opportunity this year, generating yields that made it an outlier. However, as macro conditions evolve, other protocols explicitly designed to thrive in bull markets will likely outpace MakerDAO. Declining interest rates will render its Real World Asset approach less competitive than other DeFi yield options.Therefore, MakerDAO has already largely realised its upside potential compared to other assets that were suppressed during the bear market.

It may generate additional gains in early 2024 if rates remain elevated. Still, it will likely underperform later as the bull market gains momentum, which we expect to occur in the second half of 2024.

However, we do not recommend shorting MKR currently. The core purpose of this report is to warn that we view it as an unsuitable long-term holding. Between now and early 2024, investors should consider reallocating toward other assets poised to benefit from the coming bull trend.