We're here to catch you up on who's up, who's down, and who's worthy of a refreshed outlook in 2024.

Skip the boring re-reads - we've done the homework for you. Just sit back for a riveting ride through the essential asset updates you need today.

But more importantly, what does the smart money think about these three projects?

Let’s dive in.

TLDR

- RabbitX, with its slight dip, mirrors the resilience of a rabbit in a hat, always ready to surprise, and it did surprise us with its recent strategic collaboration.

- Rollbit rides a wave of optimism, but this uptrend is not just a number; it's a narrative of growing confidence and a community rallying behind RLB.

- Chainflip flips the script with its resilience and strategic manoeuvres. Amid the market's tumult, FLIP stands out with its gains attributed to new partnerships and integrations.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

RabbitX holds steady despite minor stumbles

First up, a hop over to RabbitX (RBX), where playing it safe seems to be the name of the game.RBX has seen a slight dip of 3.4% from our entry point, and it is now sitting around $0.1388.

But don't let this minor setback fool you - RBX has admirably held its ground amidst broader market turbulence. And more importantly, its major catalysts, like staking are on track for later this quarter.

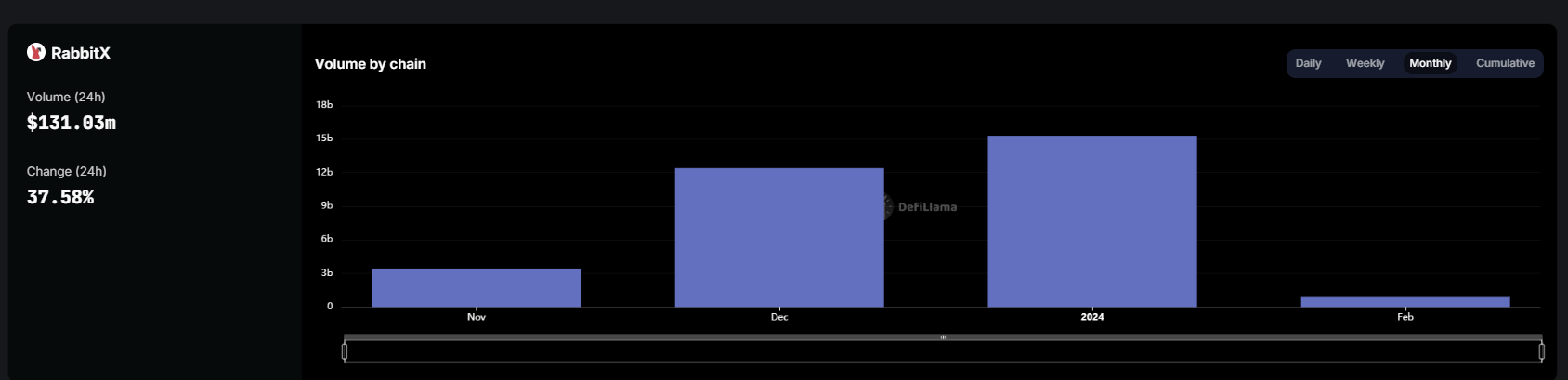

January also marked a new all-time high for RBX in monthly volume at $15.2B, with 1,311 unique traders interacting with the platform - a 62.86% increase. This underscores RBX's growing popularity and expanding user base.

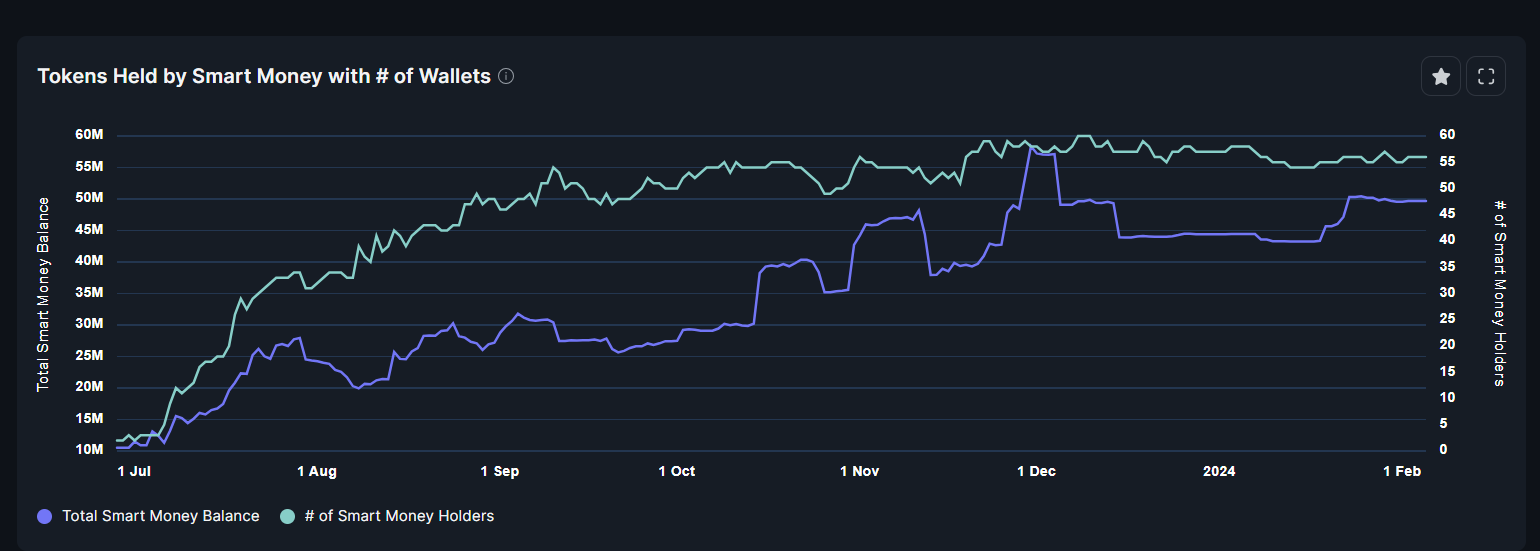

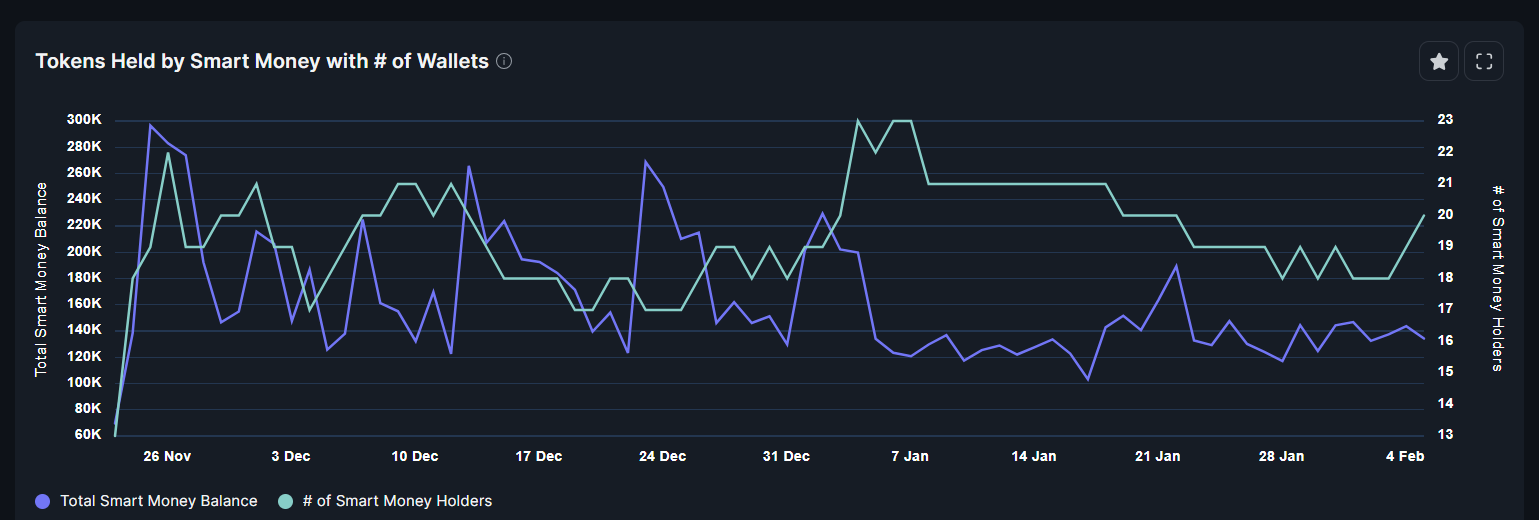

What is the Smart Money doing with RBX?

RBX has held up fairly well despite the recent market downturn, and a closer look at whale activity reveals deep conviction in RBX’s prospect despite the generally stagnant market conditions.- One whale owns 3,200,886 RBX worth $444,436

- Another holds 2,659,516 RBX worth $368,865

- A third maintains 2,959,808 RBX, valued at $410,594

Latest update: RabbitX is coming to Blast!

RBX is also hopping into new partnerships. The most recent is a strategic collaboration with derivatives exchange Blast Futures. RBX will provide liquidity and infrastructure to power trading on Blast's platform.This collaboration not only expands RBX's reach across chains but also allows RabbitX to benefit from increased volume and shared trading fees once Blast goes live. We believe integrations like these will likely boost RabbitX's volumes and revenue when staking launches, generating more revenue for stakers.

Crypontary’s take

Overall, we are encouraged by RabbitX's progress, especially its Blast Futures integration. This collaboration enhances operational scope and cements RBX's role as a vital infrastructure provider for DEXs, potentially increasing trading volumes and incentives.Despite competition from Hyperliquid's points program, strong volumes and user engagement signal an exciting Q1 for RBX as staking launches.

We remain bullish on RBX's prospects.

Rollbit is rolling in gains

Moving on to Rollbit (RLB), we find a nice 17% gain since our last report. RLB is now standing tall around $0.14.

The main reason behind the gains in RLB is that the market is reacting positively to recent partnerships and upgrades. So, it is safe that investors more becoming more comfortable to hold RLB again.

What is the Smart Money doing with RLB?

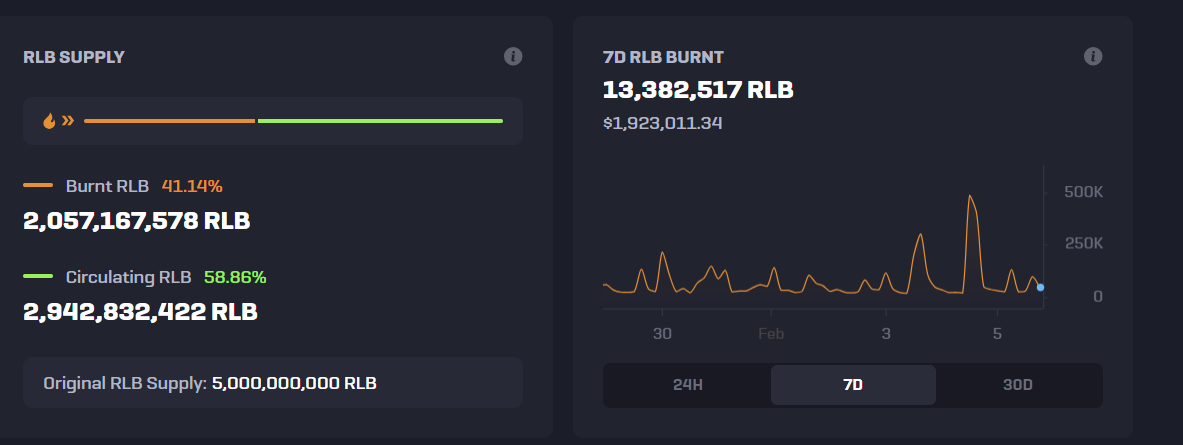

Our RLB whale continues to hold.The smart money featured in our last report has continued clutching a hefty 17,888,083 RLB worth $2.5 million. We’ve also see increasing token accumulation from other smart money wallets. Both actions are positive signs for RLB.

Latest update: Revenue is growing

A deeper look at revenue numbers also explains the growing confidence in RLB. In the last 7 days alone, $1.9M worth of RLB has been burned thanks to growing platform volumes.

Big sports events like the Super Bowl significantly increased sports revenue to $5,326,959.75 over the past week, contributing to the substantial burn. As sports volumes pick up, we can expect to see more records broken.

Crypontary’s take

As you may have noticed, the update on Rollbit is quite short because we have already done a deep dive into RLB in our latest article.Upcoming catalysts include the outcome of community discussions around revenue-sharing, which could have a major impact on RLB valuation. The launch of Rollbit's internal sportsbook is another event that should drive positive price action over the coming months.

Overall, recent developments have us feeling bullish on Rollbit. The numbers paint an optimistic picture of growth, burns, and engagement.

Chainflip is flipping the script

Last but not least, Chainflip (FLIP) has survived and thrived, with a 6.41% gain to $4.81.Amid the tumultuous market, FLIP remains a beacon of resilience.

What is the Smart Money doing with FLIP?

Smart money wallets continue to hold substantial amounts of Flip, with one maintaining $620K of FLIP and another clutching $2.75 million worth.Looking at the smart money data, we see that more wallets now hold FLIP, even as the total amount of FLIP has remained relatively stable. This indicates new accumulation is occurring, as while one whale may have taken profits, others have stepped in and compensated

Latest update: Chainflip lands new partnerships & integrations

FLIP's impressive performance can be attributed to recent strategic partnerships and integrations, most notably with HoudiniSwap and ElDorado.HoudiniSwap is a privacy-focused DEX that routes transactions through ChainFlip. They've self-reported a weekly volume of $7,437,244. As a routing partner, ChainFlip benefits from these volumes.

ElDorado, a DEX aggregator, has also newly integrated ChainFlip after previously only supporting Maya Protocol. ElDorado has already facilitated over $12.4 million in trading volume and $600K in just the last 24 hours. Increased adoption of ElDorado translates to benefits for ChainFlip.

In more positive news, ChainFlip has raised its swap limits to $25K, slowly ramping up as the protocol develops. Cautious increases signal ChainFlip is avoiding exploits as integrations expand.

Cryptonary’s take

Looking ahead, we eagerly await dips to accumulate more FLIP before major catalysts like Solana and Arbitrum integrations. These could significantly impact prices if volumes are strong.Overall, FLIP's developments are highly encouraging. While we'd love to buy around $4.30, strong price action may continue. We'll look to buy any dips but anticipate positive momentum as FLIP keeps flipping the script.