Smart yield strategies to beat the market

The market's slow, but your returns don't have to be. With the right yield strategies, your capital can keep working even when the charts are quiet. From stablecoins to DeFi vaults, we'll show you how to maximize your yield, outpace traditional returns, and make the most of every stage of the cycle. Let's dive in…

So you took profit, now what?

As we all know once we make a profit, the market can get quite dry, no need to be constantly hawking charts, no need to be managing positions, it gets boring. But we, here at Cryptonary, always have something up our sleeves even when the market is slow. So today we want to talk about the best yield farming strategies we have found in the market.In this article we are going to dig into the best yield farming strategies for your stables like USDC and USDT, we will have a mix of approaches from simpler to harder but overall we will hit on effective ways to put some of your money positions to work while it's not being deployed.

We will cover the following:

- What is yield farming and why is it important

- The best ways to get yield on your stables

- & The risks involved with yield farming

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is yield farming and why is it important?

The easiest way to wrap your head around yield farming is to think of it like putting your money to work to get back then a stable % of the money put to work. A good analogy is like a bank. When people take loans out they typically have a % of APR (annual percentage rate) that the borrower must pay. In yield farming, you become the bank. With DeFi in the mix you, the user, are now able to get back yield from staking or lending your capital.There are other TradFi ways people can get % returns on their stables, in this sense currency, like money market funds which return on average 5%, Government Bonds which return 4% on average, or T-Bills which again give about 4-5%. What if we told you that we could beat those numbers by a long shot, what if we told you we could double that and in special cases maybe even triple it?

Sounds interesting right? Well stay tuned, and we will lead you down the yield farming road, welcome to the amazing world of DeFi.

Yield on stablecoins

Today we will start with stables, as given the market conditions, it is something we all have in our portfolios. Since we typically don't do much with them, it is very key to know how we can put our money to work.When it comes to this section we will have 2 easy, one safer, one risker, options and end with a lucrative but difficult final one. But don't be afraid because we have all the info you will need along with videos to guide you along the way.

Hyperliquid

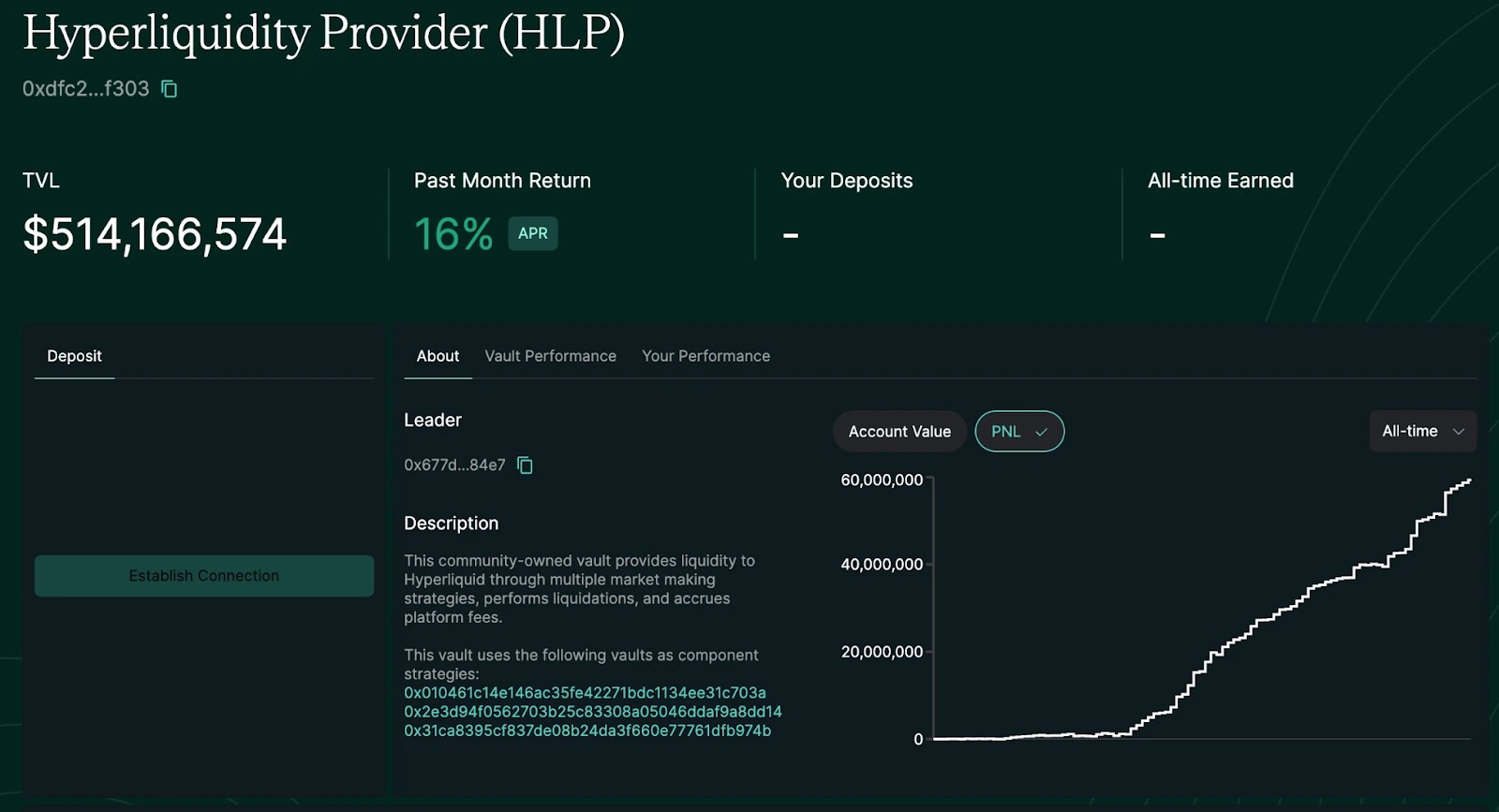

When it comes to Hyperliquid almost all of us think about their DEX, which is okay as it is the highest DEX in market cap in the crypto space. However today we want to take a peek at something that is less talked about. Their HLP vault.

For some context, the HLP Vault is an automated liquidity pool that allows us to passively earn a yield based on the liquidity we provide. HLP also benefits from other things like fees paid by traders on Hyperliquid and from liquidations as well.

We think that with the ability to earn income from fees, liquidations, and funding rates we think the HLP Vault is a good pick especially when markets are volatile as it further increases the APY we can attain from the vault. However, one thing to note is that there is a 4-day lockup when depositing tokens into the vault.

Benefits

- Simple to use

- Exposure to Perp Market Fees

- USDC-Denominated Returns - around 16% yearly

Risks

- In the short-term, the yield isn't stable and sometimes you might lose 1%-2% depending on how traders are performing. If traders win a lot, you are the counterparty to their trades.

- But generally, the loss is very short-term, and the majority of traders lose money most of the time. Therefore, the overall performance is trend is up only, which makes it a very interesting place to park some stables

Action plan:

- Bridge your USDC to Hyperliquid through Mayan Swap

- Deposit the bridged USDC into the Hyperliquid Platform (if from Arbitrum)

- Go to the Vaults Section

- Select the Hyperliquidity Provider

- Deposit your USDC (16% APY)

Kamino

This one is quite an interesting and slightly difficult play. Kamino is a lending and borrowing platform on Solana that is in the top ranks in terms of TVL on the Solana chain.

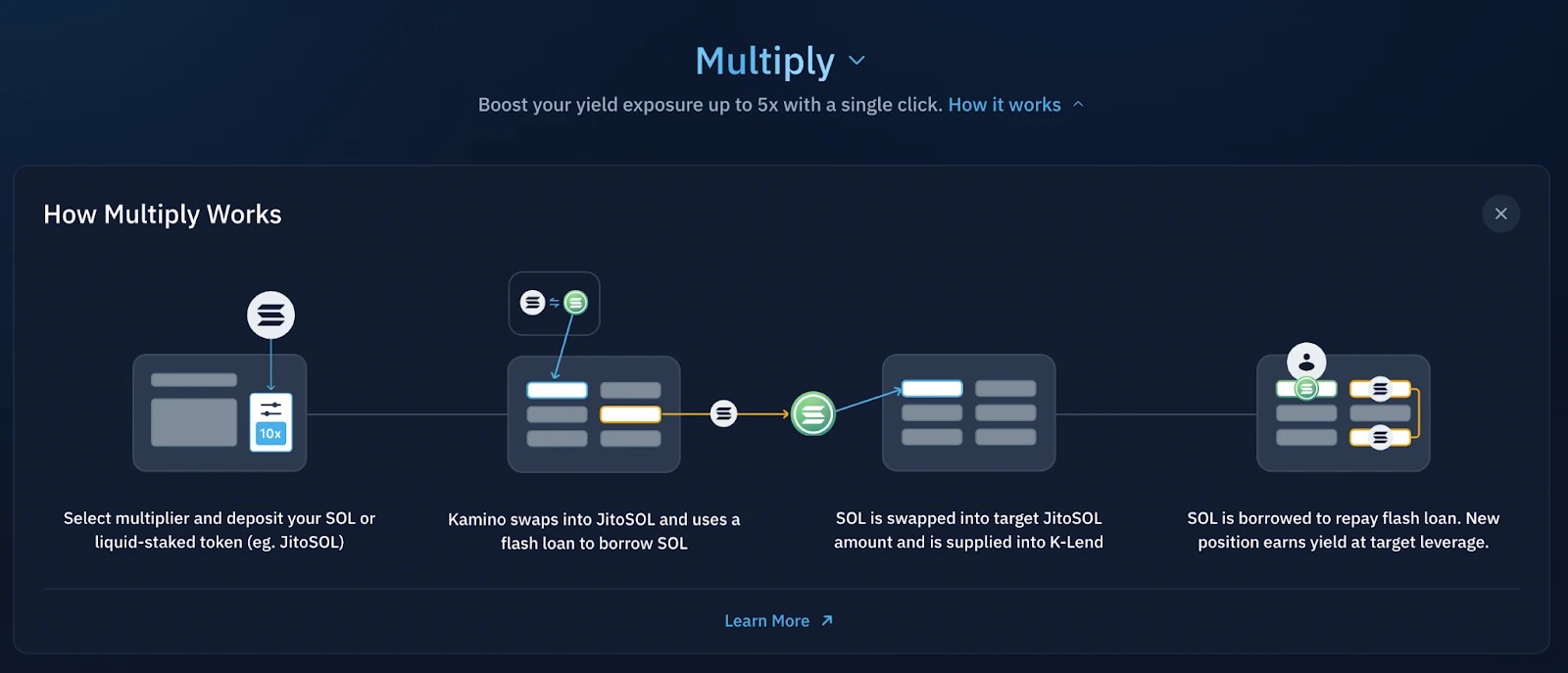

To us, Kamino stands out for a few reasons: its automation, its beautiful and simple UI, and its advanced product that we will look at today to bring you more yield on your stables altogether. The product we will be focusing on today is called Multiply.

As we can see from the explainer below Multiply is a way to boost your yield exposure by multiples in a simple way. This is done through a method called looping which essentially means you stake an asset, borrow from your stake, and stake it again to gain more yield. With the strategy you essentially stake more money than your original stake allowing for you to get more rewards.

While it may seem confusing initially, Kamino makes it incredibly easy to do. They automate the whole process allowing you to do it in just a few clicks. On top of that it also automatically rebalances, watches your loans, and compounds as you gain from the APY.

Benefits

- Deep liquidity

- Low Risk of liquidation

- Easy to use

- Ways to increase our returns

Action plan:

- Supply USDC to Kamino (6%-7% APY)

- Borrow SOL (for 7-9% APY)

- Stake SOL with Jupiter jupSol (~13% APY)

- "Multiply" SOL with Kamino (20%-30% APY).

- Pocket the difference and the yield from stables

Risks:

- Complexity: it involves multiple transactions and if the borrowing rate exceeds staking APY, you will slowly start losing money. However, historically it hasn't been an issue and cases of Borrow rate > Staking APY have been limited to days

- Since it involves multiple transactions, sometimes there is a very small price impact (slippage)

- Smart contract risks

Ethereum

We believe not everyone is fully out to stables, and some readers might have derisked into majors instead. Let's go through the yield available on majors through DeFi, starting with Ethereum.When it comes to Ethereum, it is typically really hard to achieve yields over 3%. However, with further digging, we found more lucrative yield options. This has let us find a yield for our $ETH on Beefy that actually outperforms the typical 3%.In this section, we will cover two vaults that both earn over 5% APY which in our opinion is a decent enough return for just a few more clicks on your end.

Beefy (Stargate vault)

Beefy is a multi-chain yield optimizer that allows us to get higher returns while doing the work for us, such as auto compounding.

Beefy does all this through Vaults which are basically places where the user can deposit your tokens and Beefy will then use those tokens to achieve the yield. This is typically done through interacting with liquidity pools, farms, and or lending protocols across EVM chains.

This means it searches for the best yield strategies across the large DeFi ecosystem looking through chains like Avalanche, Arbitrum, Ethereum, Binance Smart Chain, and more.

Benefits

- Automated

- Multi-chain

- Noncustodial and decentralized

This vault takes the WETH you deposit and deposits it into Stargate. And as you earn more WETH on your deposit it will automatically use that to increase your deposit.

For this vault, the steps are super simple and only require 3 main actions.

Action plan:

- Launch app.beefy.finance

- Select the WETH Stargate Vault

- Deposit your ETH/WETH

Risks

- Smart contract risk (on the Beefy side)

- Smart contract risk (on Stargate side)

Beefy (ETH-WETH Pool)

The next Vault we want to look at is the cbETH-WETH liquidity pool. This vault at the time of writing has a 6% APY beating the last vault by about a %.

This vault is a bit more complex as it is a liquidity pool. This would typically mean that you need to create a liquidity pool position on Alienbase first and then come back to the Beefy platform to deposit it through them. However, you can simply input your WETH or ETH onto the platform and Beefy does the rest.

Action plan:

- Launch app.beefy.finance

- Select the cbETH-WETH LP Vault

- Deposit your ETH/WETH

Risks:

- The biggest risk here is IL (impermanent loss) however since both sides are ETH (one is wrapped) this risk is very low.

- There is also a slippage risk. When you are entering into a position with size there could be a price impact. To minimize this risk, start small and break down your transaction into multiple smaller transactions

Solana

Welcome to our final yield section, here we will be taking a look at two approaches, one is similar to our stable approach and the other is a quite simple and easy-to-use strategy. Solana, unlike Ethereum, has a much better selection when it comes to higher APY and has platforms that help take those returns to the next level.Marinade

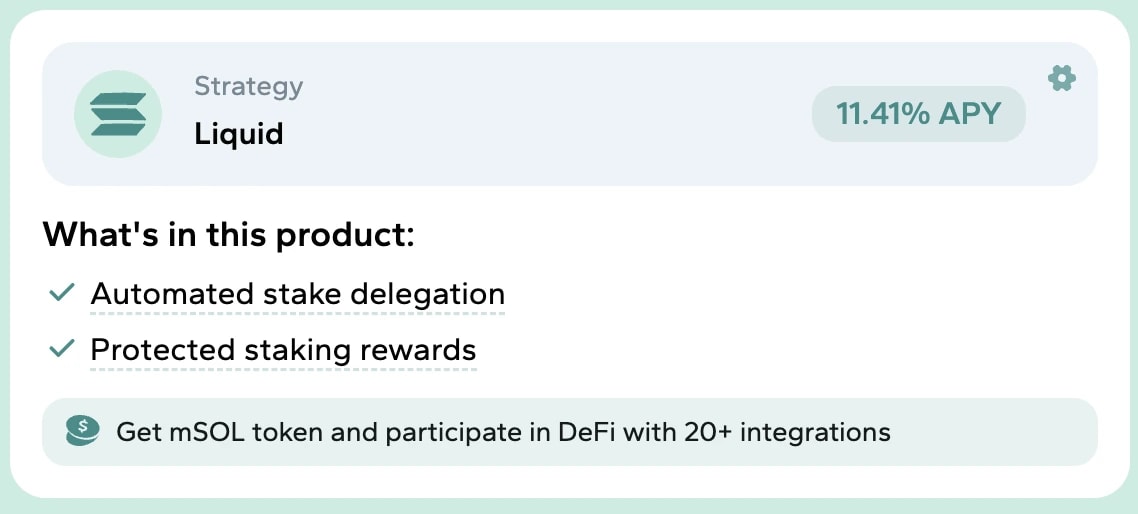

Marinade is a liquid staking platform built on Solana. This means that once users stake they can continue using their Solana through the staked token called mSol which you can use in DeFi, it is also tradable as well.

Marinade currently boasts an 11% APY, combining inflation rewards, Jito Tips, and Priority Fees. The inflation rewards come from Solana validators as it is the base staking reward, the Jito Tips are MEV rewards which essentially are tips from helping transactions get verified on Solana, and lastly profit from Priority Fees which are what people pay when they push transactions through faster or the Solana network gets used at a higher usage rate. As far as we can see this is among the highest APY available through platforms

Benefits

- Liquid Staking

- Instant Unstaking

- Automatic Delegation

Action plan:

- Launch app.marinade.finance

- Select the Liquid Staking Strategy

- Stake your Solana (~11.4% APY)

Kamino

As we already covered what Kamino is and its related benefits we will dive straight into the strategy for this part. In this one, we will take our Solana and once again convert it and then put it inside the multiplier for the lucrative 20%+ APY on our tokens.Action plan:

- Launch jup.ag

- Swap your $SOL for jupSOL (~12% APY)

- Multiply your jupSOL on Kamino (~17% APY)

Risks

- Complexity

- Smart contract risks

- Similar to what we described on the stablecoin

Cryptonary's take

At the end of the day, we can see even though things might be slow and you may even have de-risked there is still quite a large amount of opportunity in the general crypto space. Whether you hold, stables, Solana, or even Ethereum, DeFi platforms have the ability to provide solid yield on your tokens that beats the TradFi returns.And while for some it only beats it by a couple of percentages, for others it beats them by double or even triple the amount. While risks definitely do exist, as we can see making safe and informed decisions can open the door to very solid APY while we sit on our hands.

That's all from us,

Cryptonary OUT!!