Traditional Web 2 companies like Facebook have been found to sell user data, censor voices and sometimes facilitate misleading statements.

Once again, blockchain is stepping in to present the world with solutions to another shortcoming of Web 2; this time, with decentralised social (DeSoc) media platforms.

However, the question is whether they are good enough to replace well-established Web 2 platforms.

The more important question for Crypronary members is whether there is an investment opportunity in DeSoc.

In this report, we analysed 6 SocialFi platforms for (1) their ability to replace traditional social media companies and (2) their investment potential.

Here's what we found

Let's get started…

TLDR

- The rise of SocialFi - blockchain-based social platforms aiming to solve the issues plaguing Web2 giants

- We present an analysis of 6 promising SocialFi contenders vying to replace Facebook, Twitter, and their ilk.

- We explore the investment potential and opportunity to get in early on this emerging crypto narrative.

- One project stands out with impressive user metrics, revenue growth, and a whopping $1B valuation after raising $150M.

- We also dive deep into another project's tokenomics and provide price targets under different scenarios.

- This is a glimpse into several other SocialFi platforms slowly making waves and worth keeping on the radar.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The current state of SocialFi

SocialFi is an innovation that combines the concept of social media networks such as Twitter/Facebook with DeFi.

SocialFi represents Web3's answer to the problems that Web2 social media platforms face. It offers users more control over their content and allows them to monetise it directly. In SocialFi, users have more freedom to create and control their content and data.

With over 50 SocialFi platforms available now, the industry is clearly experimenting heavily and aiming to disrupt the social media landscape.

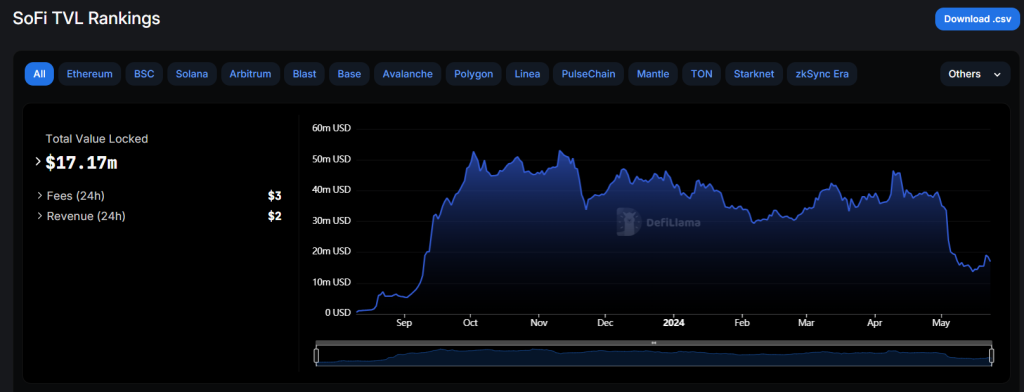

However, despite the promising developments, the collective Total Value Locked (TVL) of SocialFi platforms remains relatively low at $17m.

This raises questions about whether these platforms can achieve the network effect necessary to compete with established Web 2 alternatives like Twitter or Instagram.

Let's be real here! SocialFi is very early, and it might take some time before any of them can take off and compete with centralised alternatives.

That said, SocialFi cuts across multiple narratives, and when the timing is right, the narrative will take off in ways we can't begin to imagine.

Below are the top 6 SocialFi platforms on our SocialFi watchlist.

Farcaster

Farcaster is a decentralised protocol for creating and connecting social apps. It aims to give users control over their data and audience and uses a hybrid architecture of on-chain and off-chain systems to offer a consistent and efficient environment. Farcaster is designed to be censorship-resistant and allows for a seamless onboarding process. It provides developers with a broad and versatile user base to engage with. We have covered Farcaster extensively; you can refer to the details here.

Compared to other SocialFi platforms, Farcaster is the one that stands out the most.

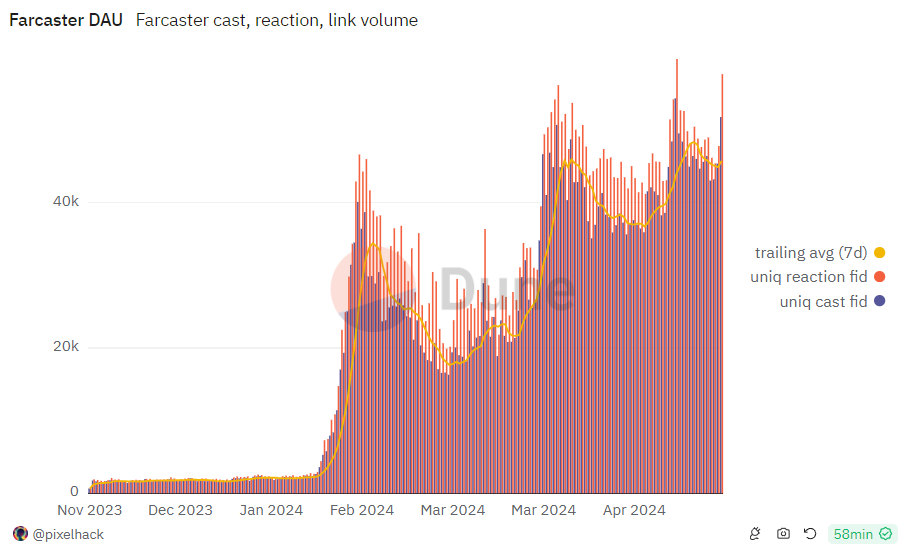

Just looking at the numbers, you can see that Farcaster has quite a solid user base.

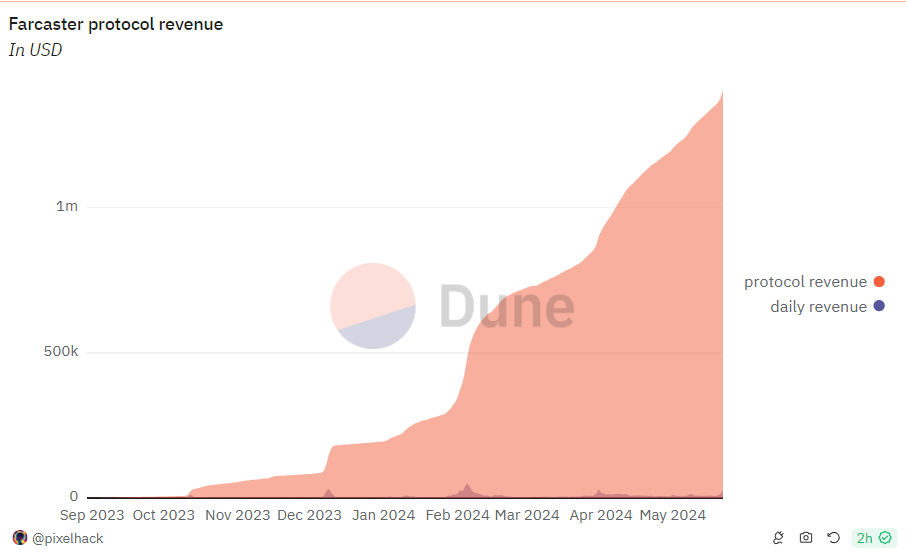

Similarly, revenue generated by Farcaster has been consistently going up.

In addition to impressive metrics, Farcaster recently raised $150m in funding at a whopping $1b valuation.

From a product perspective, Farcasater is great. However, from an investing perspective, there's no opportunity yet because Farcaster has yet to have a token.

So, how do we position ourselves?

Through potential airdrop!

We have previously covered how to position for a potential Farcaster airdrop here.

Long story short, we should use Farcaster ecosystem dApps such as Warpcast.

Warpcast is a decentralised social media application built on top of the Farcaster protocol. It allows users to create and share content, engage with the community, and showcase digital assets, including NFTs.

It also introduced Frames, which enable developers to build interactive experiences directly into Warpcast posts, enhancing user engagement and interactivity.

By leaving a footprint on Warpcast, you might qualify for a potential Farcaster airdrop.

Verdict

Farcaster looks like the most promising platform within the SocialFi sector. But again, getting exposure to Farcaster is tricky because it doesn't have a token yet.We recommend constantly using the Warpcast app to leave a digital footprint for the potential airdrop.

Friend.Tech

FriendTech is a new crypto-native social media platform similar to Twitter and Facebook. However, it is built on blockchain technology to offer numerous unique features.

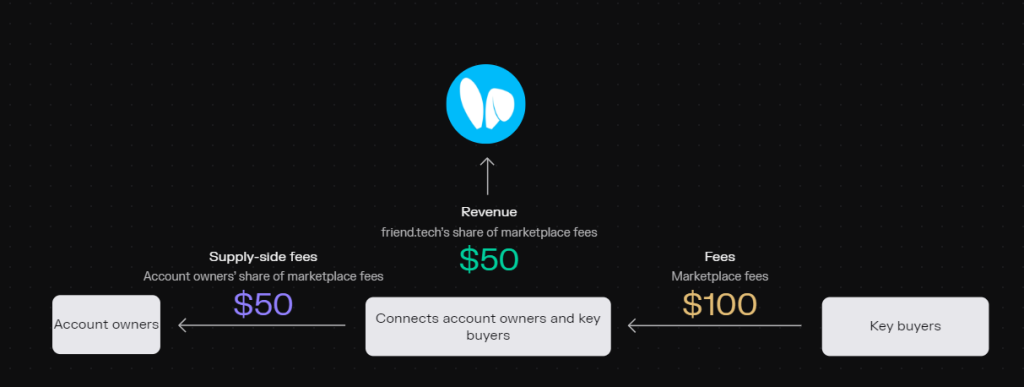

It introduced a unique monetisation model for creators, where they can earn a share of the platform's fees. Every user account on FriendTech has keys, and the value of these keys is tied to the owner's influence and how much they are sought after.

How does FriendTech work?

Users can buy "keys" to other users' accounts. By owning a "key," the user gets access to a private chat with the person whose "key" one owns. When a "key" of a user's account is traded, the user earns commissions.

Sounds interesting? We think it does!

However, since FriendTech is a social platform, to be adopted it needs to achieve critical mass and network effects.

So the main question is: is FriendTech getting adopted by users?

We can see that FriendTech has had three waves of adoption. The first was fueled by novelty and innovation; the second was driven by significant investment from VC firm Paradigm; and the last wave was fueled by airdrop speculation.

What worries us is that FriendTech struggles to retain users after each wave. However, the recent launch of v2 has found some fans. Therefore, we should not dismiss FriendTech prematurely; instead, we should give it more time to develop and improve.

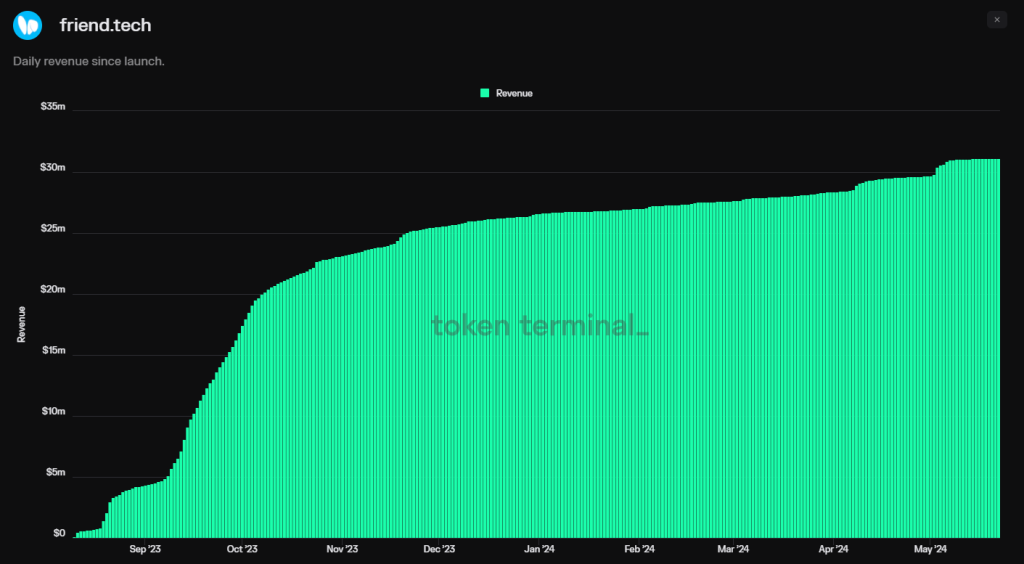

Apart from the positive sentiment around v2, revenue stats look impressive as well. In only nine months, FriendTech generated over $30m in revenue, which is quite impressive for such a young and experimental platform.

FriendTech doesn't seem obvious; however, we believe it is a high-risk, high-reward play worth a punt.

So, how can you capitalise on it?

Recently, after long anticipation, FriendTech has finally launched a token. It generated a lot of hype but saw a significant sell-off from the airdrop farmers.

Let's take a look at tokenomics for a better picture

Tokenomics

FriendTech announced the launch of its native token in early May 2024. New features like clubs, pinned chat rooms, and varied price curves accompanied this launch.FriendTech airdropped 100% of the supply, which is very investment-friendly. Thus, there are no VCs, advisors, or insiders, and all of the supply has been distributed to the community.

Now, let's look at the basics.

- Ticker: $FRIEND

- Circulating supply: 100%

- Mcap (fully diluted): $153m

- Utility: $FRIEND is a utility token with the FriendTech ecosystem used to buy and sell "keys". It would be interesting to see whether the team will develop further tweaks to improve the value accrual of $FRIEND.

Price targets

Base scenario: Based on revenue generated, at a 10x price-to-earnings ratio, $FRIEND should be trading at around $300m (2x from current prices). Therefore, in the base scenario, $FRIEND could deliver 2x from current prices.Bull scenario: In the bull scenario, a 10x multiplier might be low for crypto markets. Crypto is still young, and with the right narratives, assets can be traded much higher than fees generated.

In this scenario, we believe $FRIEND can reach $1b mcap (roughly 7x). Since $FRIEND is fully circulating, that should be relatively easy compared to VC coins, where assets suffer from constant selling pressure from insiders.

Best case scenario: In the best case scenario, we expect $FRIEND to reach levels we might not justify at this point. However, since it is the "best" scenario, we can expect some groundbreaking features from the team or improved tokenomics.

For example, potential revenue share with token-holders could quickly send this asset much higher than it is trading right now.

It may not be accurate at this point because there are many unknowns. However, we could expect $FRIEND to be trading at around $2b mcap, which would result in a 13x increase from current prices.

Verdict

FriendTech has potential, but it still needs some more time to secure its position and ride the waves of a bullish thesis.However, it is still a good asset, and if you want high-risk exposure to the SocialFi narrative, $FRIEND is the best choice at the moment. You'll get a 2x in the base case, at the very least. However, 13x is on the table as a best-case scenario if things develop better than expected.

Zora

Zora Network is a decentralised, scalable L2 blockchain solution built specifically for creators. It aims to facilitate the creation, minting, and trading of NFTs more cost-effectively and efficiently by leveraging the OP Stack technology, the backbone of Optimism's Superchain vision. This specialised tech allows Zora to offer rapid, cost-efficient transactions tailored specifically for NFTs.

The Zora Network was developed by the Zora team and is designed to alleviate Ethereum's transactional burden by handling NFT transactions off-chain. These transactions are then bundled and posted back to the Ethereum blockchain as proofs. This approach makes minting on the platform "faster, cheaper, and more enjoyable," with a focus on gas efficiency and scalability.

The network is integrated directly into all existing Zora create tools and is live today. It offers a gas-friendly L2 environment with the potential to become a dominant scaling solution for NFTs in the years ahead.

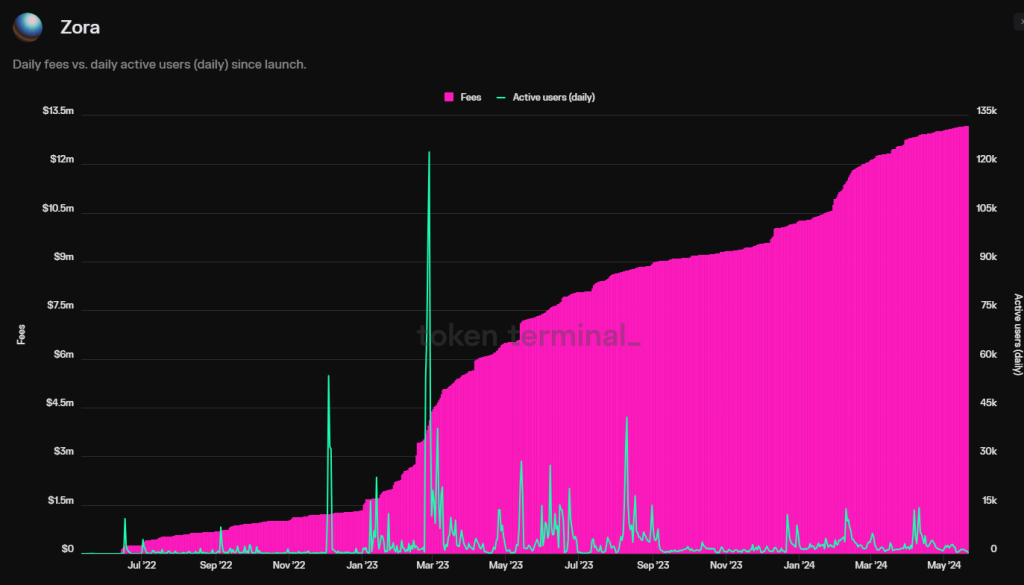

Since 2022, Zora has generated just shy of $13.5m in fees. Given its age, $13.5 m is rather low. In addition, the number of users is also quite small, with a daily average of around 15k.

However, one thing that has been up only is the capital bridged to Zora. Users have been consistently moving capital to Zora since July 2023.

Interest in Zora might be fueled by speculation regarding a potential airdrop. Zora doesn't have a token yet but raised $60m at a whopping $600m valuation from notable VCs like CoinBase Ventures.

Verdict

Massive funding stats aren't impressive, though. Although the strong backing might result in a decent airdrop, we don't see much potential beyond that at this point.If you want to farm Zora airdrop, here is an action plan

- Go to Zora

- List, sell, buy NFTs

- Repeat

- Done!

Stars Arena

Stars Arena is a SocialFi platform built on the Avalanche blockchain. It is a fork of FriendTech and features similar monetisation strategies. Users can sell and trade shares, turning their influence into financial assets. The platform uses market dynamics to determine the value of these assets.

The Avalanche Foundation on Twitter and its co-founder, Emin, have supported and endorsed Stars Arena. Shortly after its launch, the platform gained significant attention and experienced a surge in transactions.

However, the platform lost its momentum after it suffered a hack. Even though the stolen funds were recovered through negotiations, the incident seriously damaged the platform's brand. If we look at the "daily new users" chart joining the Stars Arena, we can see that momentum has been lost. After the hack, the adoption has been trending down-only.

Stars Arena doesn't have a token yet, but we believe with a TVL of $1.3m, it doesn't present a compelling airdrop opportunity as well.

Verdict

Stars Arena is backed by Avalanche and its founder.In the beginning, it was a solid competitor to FriendTech. I lost momentum after the hacking incident, and it shows no signs of recovery.

Therefore, we will strike this out of our SocialFi watchlist for now.

Bonus: Way too early, but worth watching

There are some other notable mentions; however, it is super early for these projects. Therefore, we will touch them briefly as we don't see an investment opportunity. However, it is worth keeping an eye on them.Circle

CircleTech is a platform allowing anyone to paywall access to their time, enabling users to connect through questions and private chatrooms.

It's designed for people to monetise their time by answering questions and allowing others to connect with them, whether for fun, business, connections, or relationships.

The platform provides an intimate space for people to find their inner circle, ask questions, join 1-on-1 chats, and build relationships. It is built on Base, Ethereum L2, and backed by AllianceDAO

Interesting concept, worth watching.

Drakula

Drakula is a video app that allows users to trade with social media creators. It is a blockchain-based short video platform designed to enhance social media interactions by integrating blockchain technology.

The platform is built on Safe, an account abstraction toolkit, and has seen significant user engagement. Drakula app is part of a growing ecosystem of Web3 social media platforms aiming to bring 1 billion people on-chain via social media.

Drakula has a strategic partnership with Degen, integrating DEGEN tokens into its economy. This integration has created a unique ecosystem where short videos serve as content and currency.

The platform has also introduced the Drakula Chat, a place for top creators and users to share suggestions and product feedback and get support from the team.

The product looks like reels from Instagram. Competing with Instagram can be very tough, but who knows…

Therefore, it is worth keeping an eye on.

Cryptonary's take

The state of SocialFi is positive, but it is still very early. Many new projects are trying to build and experiment in this sector.Some might succeed and become strong competitors to legacy Web 2 social media platforms.

At this stage, it is too early to jump to conclusions; however, this sector has some potential if we give it some time.

If you believe in this narrative and want to front-run this move, you can get exposure by investing a little bit into $FRIEND and farm Farcaster and Zora.

The rest of the sector seems too early to consider as an investment opportunity.

Cryptonary, OUT!