Solana DeFi's $8B TVL Comeback: Drift, Kamino, Jito, and More

Once considered down and out of the game, Solana has staged an incredible comeback that has left many disbelievers stunned. A blockchain some had written off has now re-emerged as a superstar, not only as a memecoin playground but also boasting a thriving DeFi ecosystem.

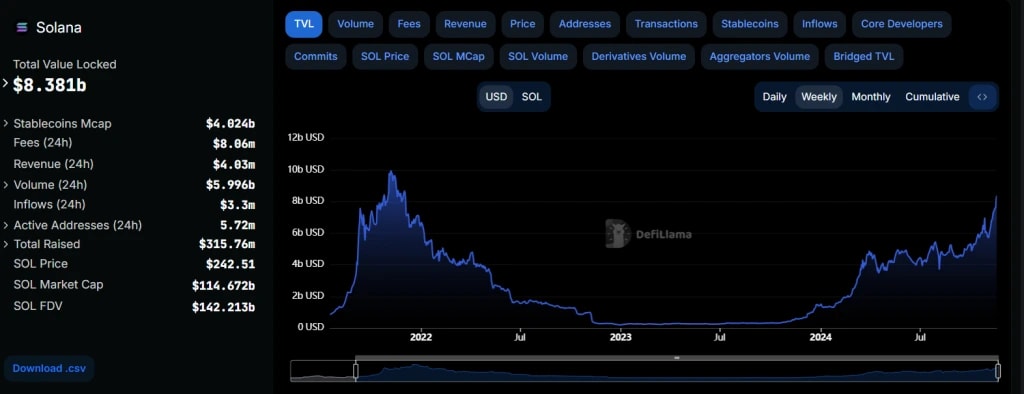

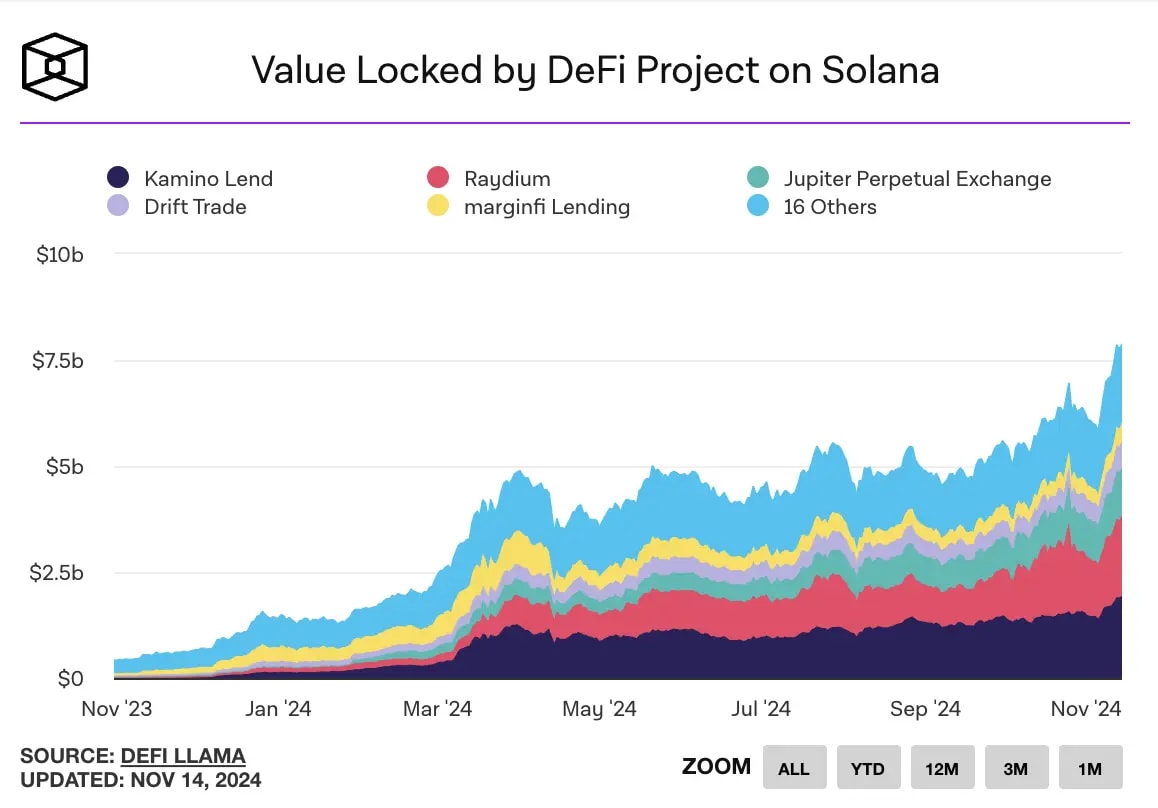

With over $8 billion in Total Value Locked (TVL) spread across lending, borrowing, and leveraged trading platforms, Solana has silenced sceptics and established itself as one of the preferred chains for decentralised finance. What makes this turnaround even more remarkable is the steep decline the ecosystem suffered—dropping from $10 billion to under $2 billion in TVL within a year. Fast forward to today, and Solana has reclaimed its momentum, not only nearing its previous highs but paving the way for even greater growth.

In this article, we will explore the Solana DeFi ecosystem, diving into five standout projects that exemplify its strength and innovation. These projects are not just rebuilding confidence; they’re reshaping the narrative around Solana DeFi being cool, and it is not just about memecoins.

Let’s dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results

Drift

Drift is a DEX that is transforming how DeFi enthusiasts trade on Solana by creating a powerful and seamless platform for trading with leverage. Built with speed, flexibility, and simplicity at its core, Drift taps into Solana's low-cost and fast-paced blockchain to offer users a fresh, efficient way to trade spot positions and perpetual positions.On top of this, it offers yield opportunities through lending markets and has specific programs in place to ensure deep liquidity. So, with all that in mind, it would be hard to lump it into the same group as the other DEXs.

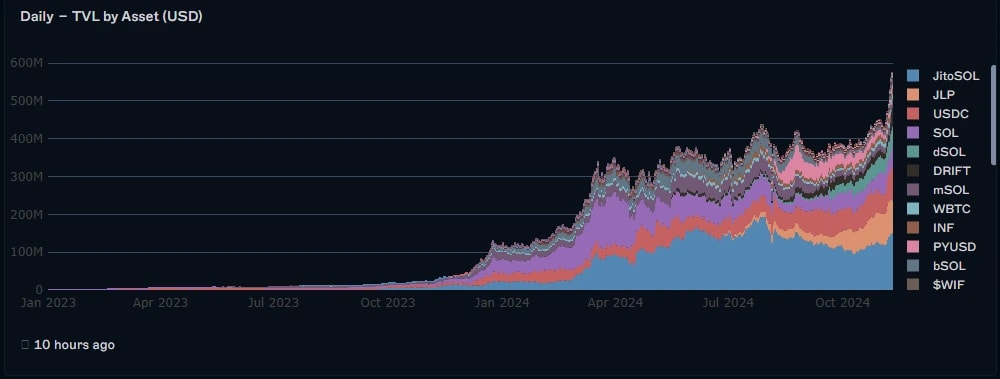

Okay, now that we know a bit about Drift, let's get into the details. We now want to put forward a couple of metrics we think bode well for the product. Kicking things off with TVL, we can see in the chart below that while Drift had a harsh 2023, this year has been quite fruitful. Bringing the TVL from sub $100m to almost $600m in less than a year is a pretty good sign of growth, and it shows that capital on Solana is coming to Drift.

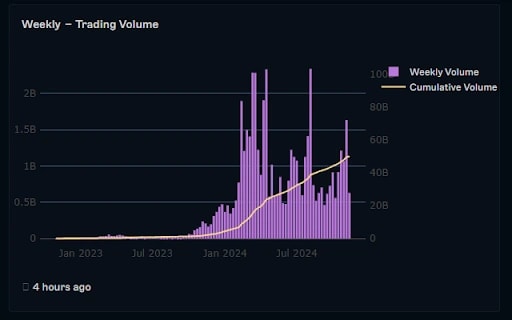

The other metric we really like is weekly trading volume. Here in this chart, we can see that weekly is solid (often in billions) and sticky, which means more and more people are coming to Drift to trade. This is very bullish because Drift seems to be finding product market fit among traders.

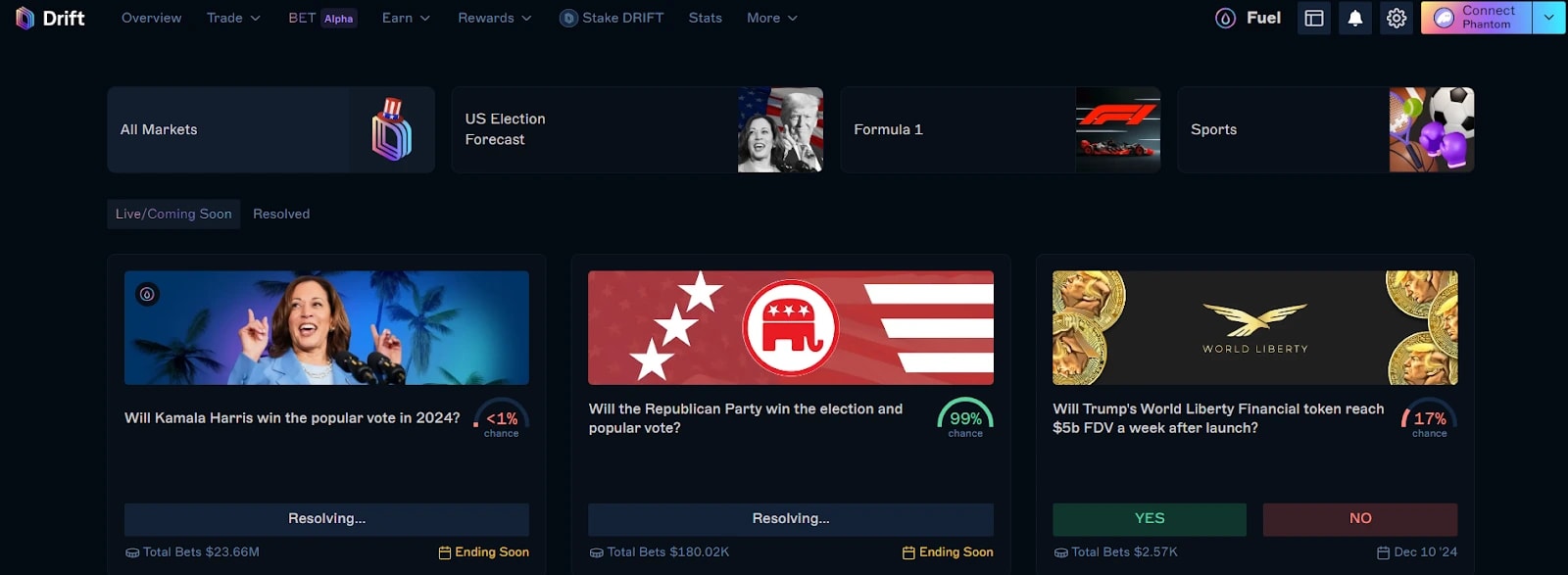

Moreover, following the success of PolyMarket, which gained massive popularity during the US presidential elections, Drift has launched a betting market where people can trade different outcomes on popular events.

The success of this move is yet to be seen; however, we can't appreciate the boldness of challenging the top dog in the betting market.

Tokenomics

Next up, we want to look into The $DRIFT token. As far as actual utility, it is said to power everything Drift has to offer. The stats back that up, and $DRIFT holders get access to benefits like trading fee discounts, voting rights, and rewards that grow as the platform evolves. All this is well and good, but as we continue to say in each article, what matters most is how the supply is being dealt with. So, let's take a peek…From the data below, we can see that $DRIFT is only 17% unlocked, meaning almost all of the actual supply has yet to hit the market. So, while there are use cases for the token itself, it seems like the incoming supply could null out those use cases when it comes to having a positive effect on price.

As far as how the tokens are split, it is good to know that over 50% has gone to the ecosystem, community and trading rewards, which is better than a lot of coins that hoard the supply amongst insiders. However, overall, we think that the supply going forward could remain a damper on the token price.

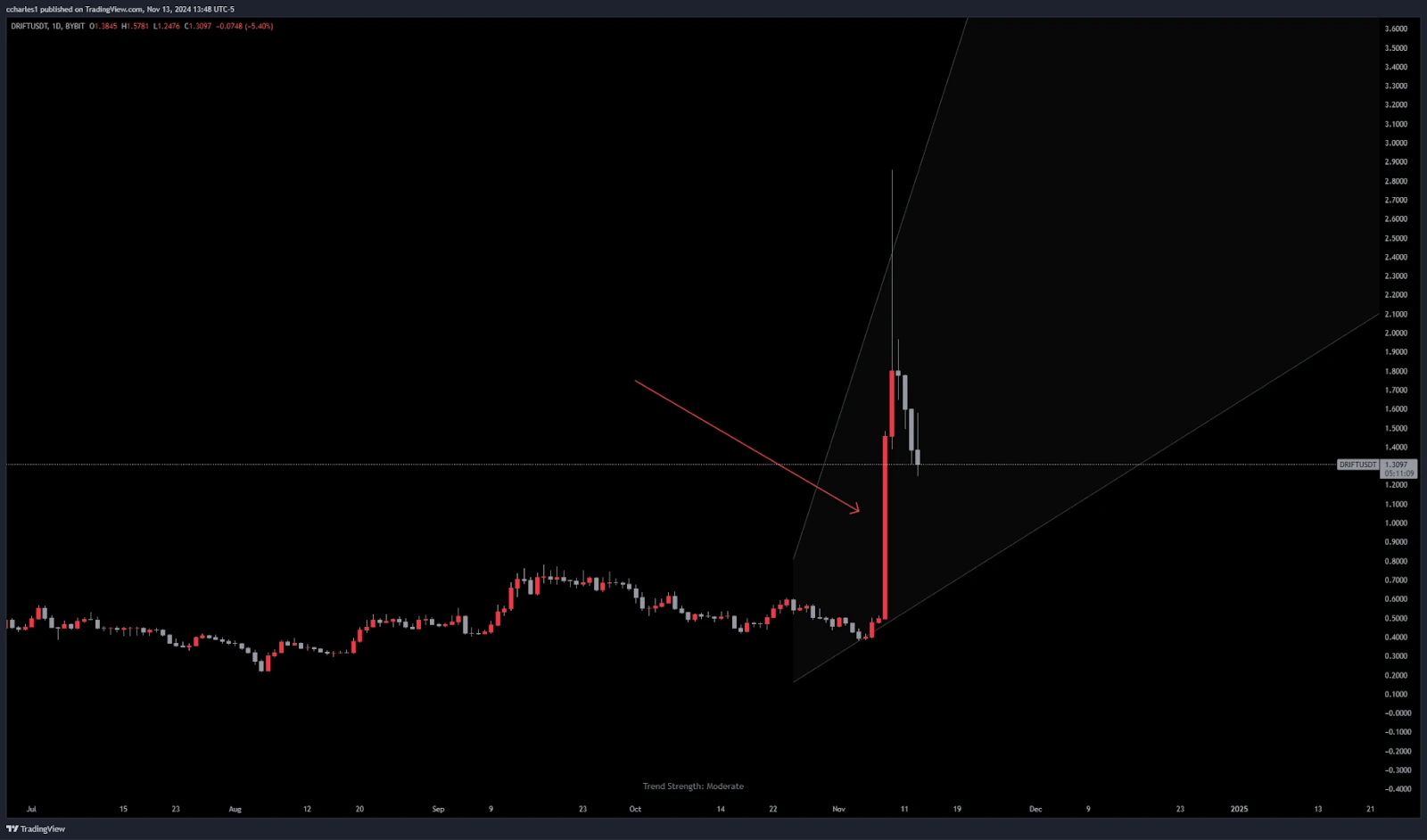

Technical analysis

Next, we want to take a look at the chart for $DRFT itself. Looking at this chart, we can honestly say it looks quite weak, especially when we figure out that the huge pump was caused by a Binance listing, which typically does bring big pumps but usually ends in a majority retrace. But if we take a look at what occurred before, we can see that Drift was taking the slow and painfully down to the left move, and despite all the bullish headwinds, it continues to show that weakness.

At the end of the day, Drift is set to become a pivotal player in the DeFi derivatives market, and we can see that as a DEX on Solana, it is a viable choice and continues to be chosen by the industry, however, because of the price action and the future token emissions we believe that currently, it is not at an investable stage but the product is definitely worth checking out.

KMNO

Kamino is the biggest DeFi powerhouse on Solana that unifies the three L's. Lending, Liquidity, and Leverage. It allows users to seamlessly borrow and lend their assets, provide leveraged liquidity, build their own automated liquidity strategies, and finally use concentrated liquidity positions as collateral.

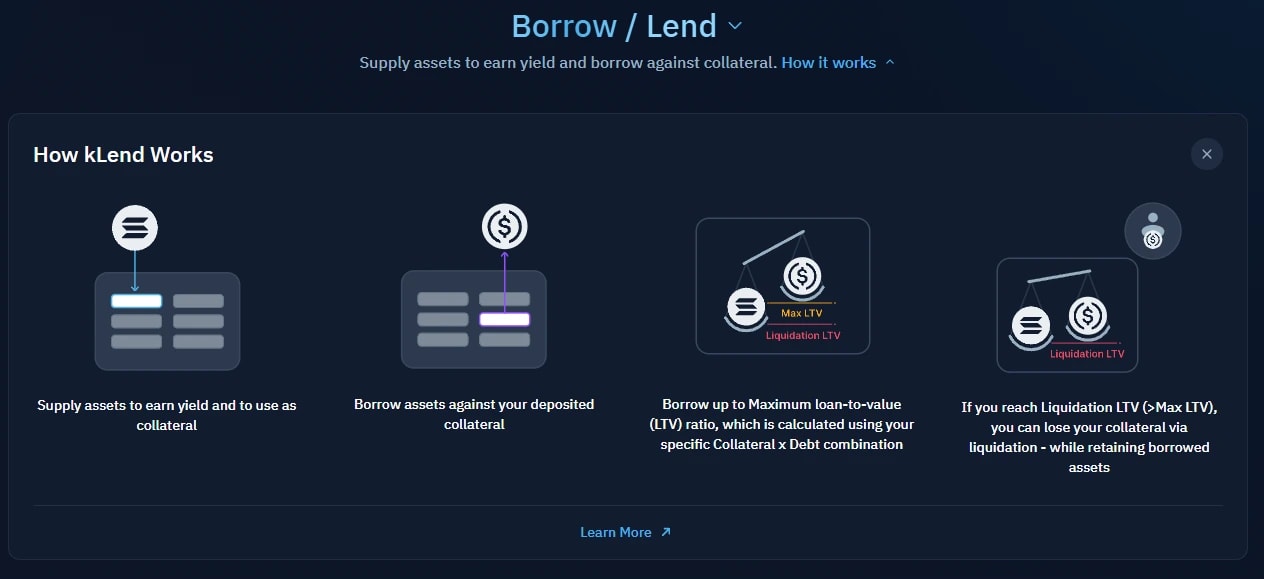

Before we get into why we like the product, we want to go a little deeper into what exactly Kamino provides by looking at 3 of our favourite products they offer. Starting with its KLend, we can see from the explainer below that this allows people to supply their assets to be borrowed and in return get yield, for example supplying Solana at the moment gets you an extra 6% APY. You can also borrow against what you have put in in case you need some extra liquidity.

The next product is their Long/Short Vaults. This is essentially a way to get leveraged directional exposure through your spot cryptos. For example, if we wanted to go long on $3,000 dollars worth of SOL but only had $1,500, we could take that amount to the long vault and get extra liquidity to go long for the full $3,000. However, there are variable fees involved!

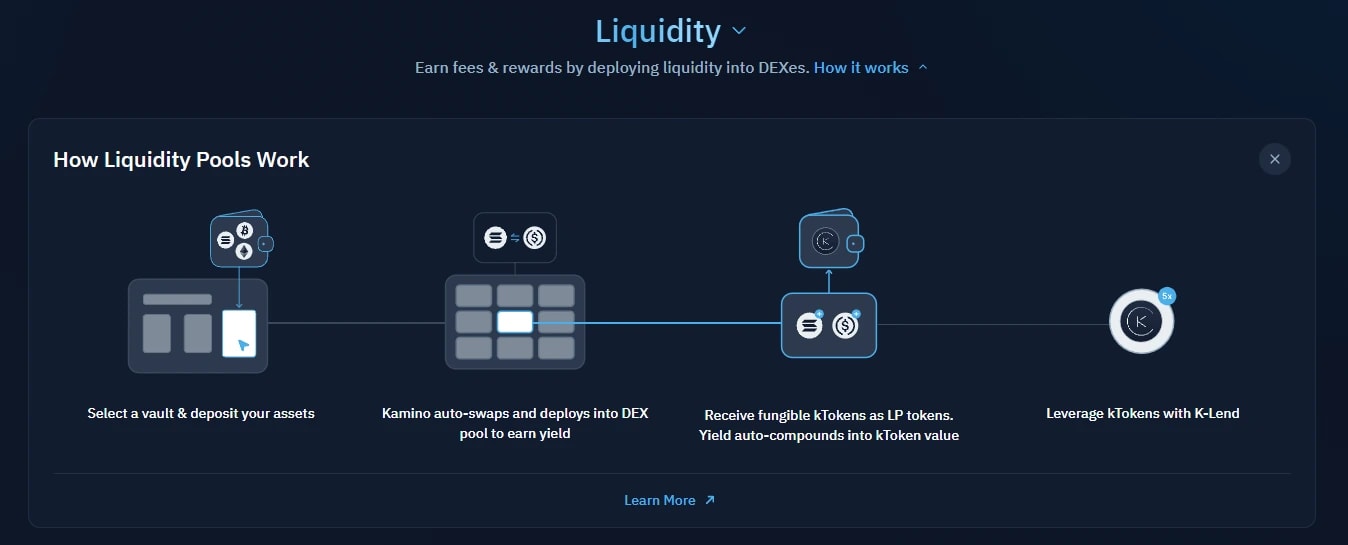

The last product we want to look at is their liquidity pools. This was, in fact, Kamino's first product ever, and it came out in 2022 and since then has been a leading product on Solana. Basically, you can supply your assets and earn a yield on them as you are supplying liquidity in DEXes. For example, if I had some Solana and some jitoSOL, I could provide both tokens and earn a 7% extra APY on my total position. Of course, as with most APYs, they are subject to change, but the idea behind it is that you get more return for holding the coins you are holding. Check out our yield reports(here and here) to discover the best strategies for maximum yield.

The last product we want to look at is their liquidity pools. This was, in fact, Kamino's first product ever, and it came out in 2022 and since then has been a leading product on Solana. Basically, you can supply your assets and earn a yield on them as you are supplying liquidity in DEXes. For example, if I had some Solana and some jitoSOL, I could provide both tokens and earn a 7% extra APY on my total position. Of course, as with most APYs, they are subject to change, but the idea behind it is that you get more return for holding the coins you are holding. Check out our yield reports(here and here) to discover the best strategies for maximum yield.

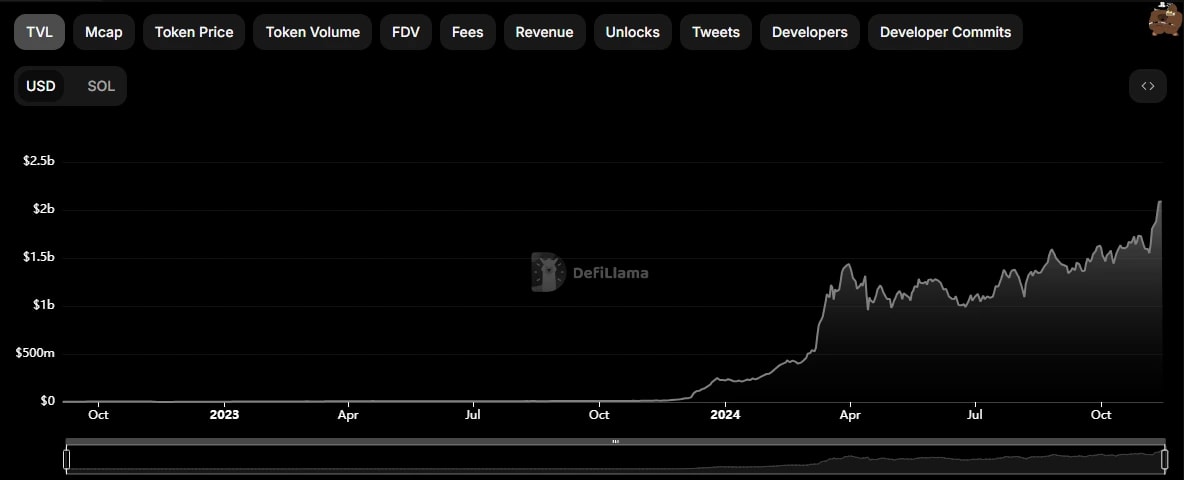

Okay, now that we have gone over what Kamino is and a bit about what it provides, let's get into the meat and potatoes and explain why we are bullish. Let's start with TVL. As we can see from the graph below, we can see just this month, Kamino has eclipsed $2b in TVL, meaning it makes up over 20% of the TVL on Solana - crazy! This means that the big boys on Solana continue to trust Kamino to earn them money and manage their positions.

Okay, now that we have gone over what Kamino is and a bit about what it provides, let's get into the meat and potatoes and explain why we are bullish. Let's start with TVL. As we can see from the graph below, we can see just this month, Kamino has eclipsed $2b in TVL, meaning it makes up over 20% of the TVL on Solana - crazy! This means that the big boys on Solana continue to trust Kamino to earn them money and manage their positions.

Finally, we want to talk about their recent V2 upgrade. The V2 has introduced a plethora of new things, such as permissionless markets, which we expect will explode TVL. Adding in more sophisticated spot leverage, and what we find the coolest is their new scam wick protection, which will attract a lot more capital.

Further, the upgrade includes improvements in risk management, security, and the liquidation engine. In short, we believe that with this momentum, Kamino will be one of the most important pieces of infrastructure for the Solana ecosystem.

Tokenomics

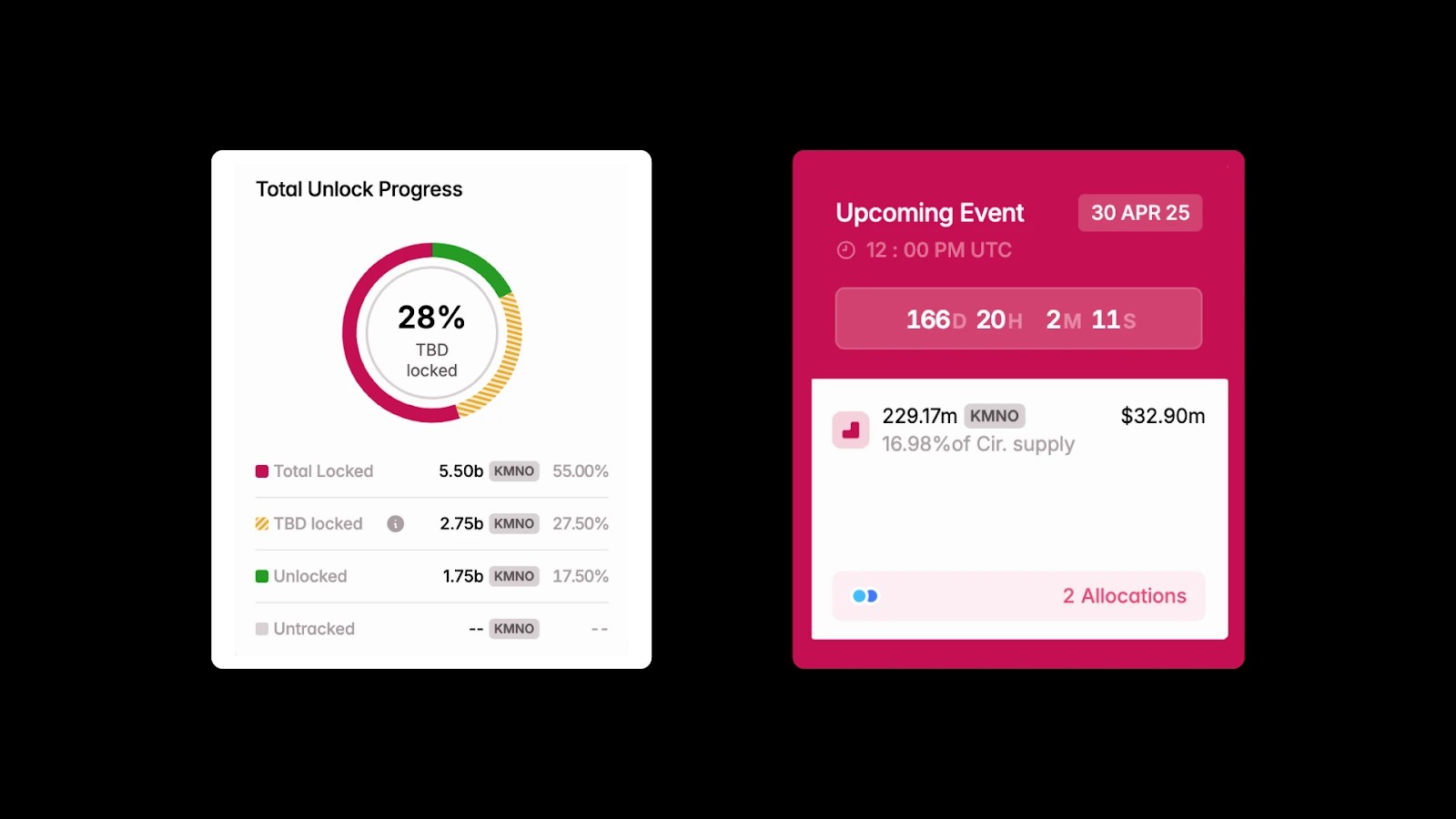

With all that now done, let's look into their tokenomics, more specifically, the unlock schedule. As we know, tokens with a lot of supply coming out, need a lot of strength behind them to have the ability to go up, so seeing that KMNO is only about 20% unlocked supply could be an impending issue.

Technical analysis

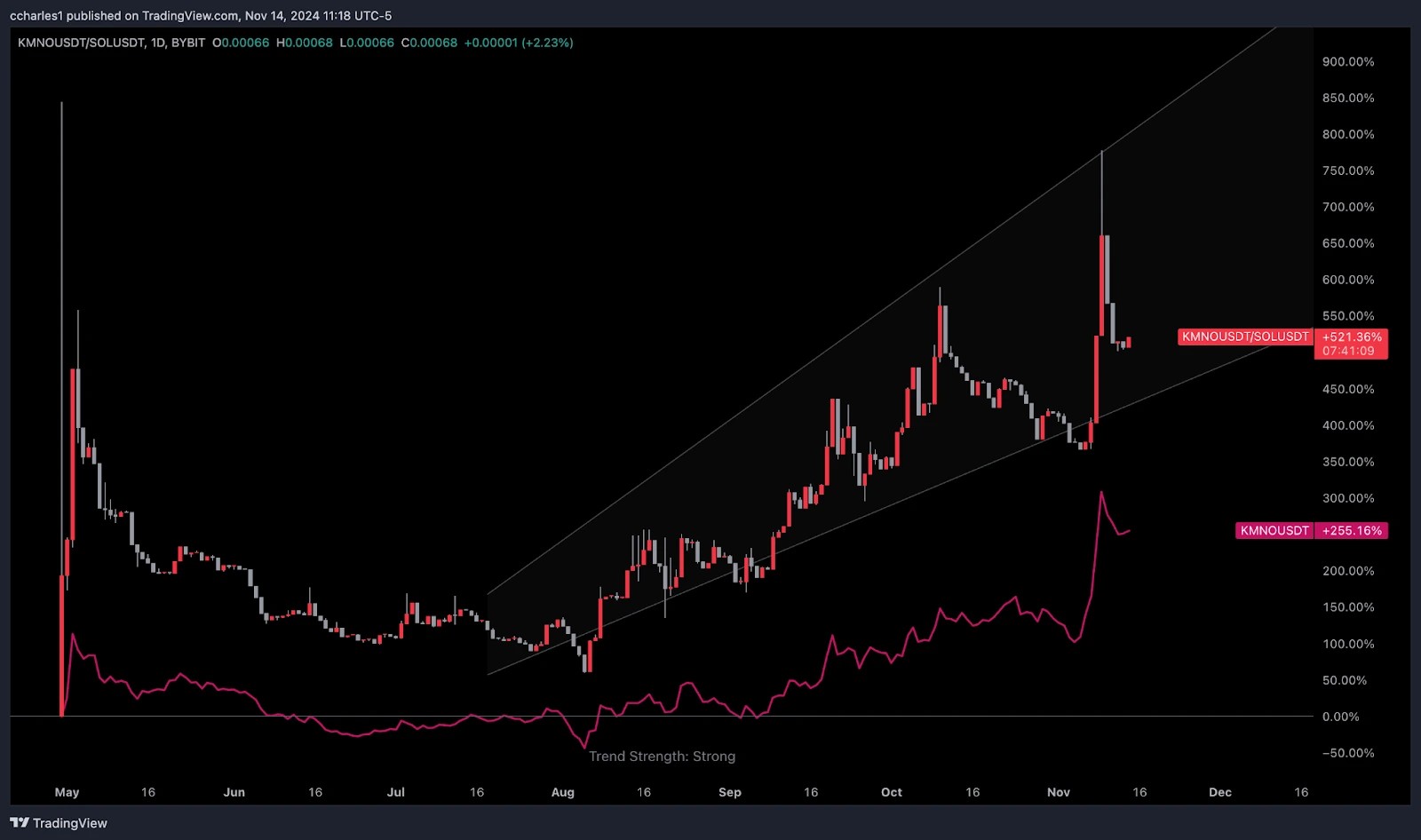

Even though supply is an issue looking at the chart, for this we are looking at KMNO/SOL with the USD pair below, we can see it is actually quite bullish and has a multi-month uptrend. On top of this, with TVL continuing to make ATHs, we think that as one of the major leaders of Solana DeFi, it has a chance to keep going in its uptrend.

In conclusion, we believe that Kamino's new upgrades, unique products, and bullish price action make it a real candidate for investment. Despite the supply concerns, we think that in this case, the good massively outweighs the bad, but as always, these markets are quite volatile, so keep an eye out.

Jito

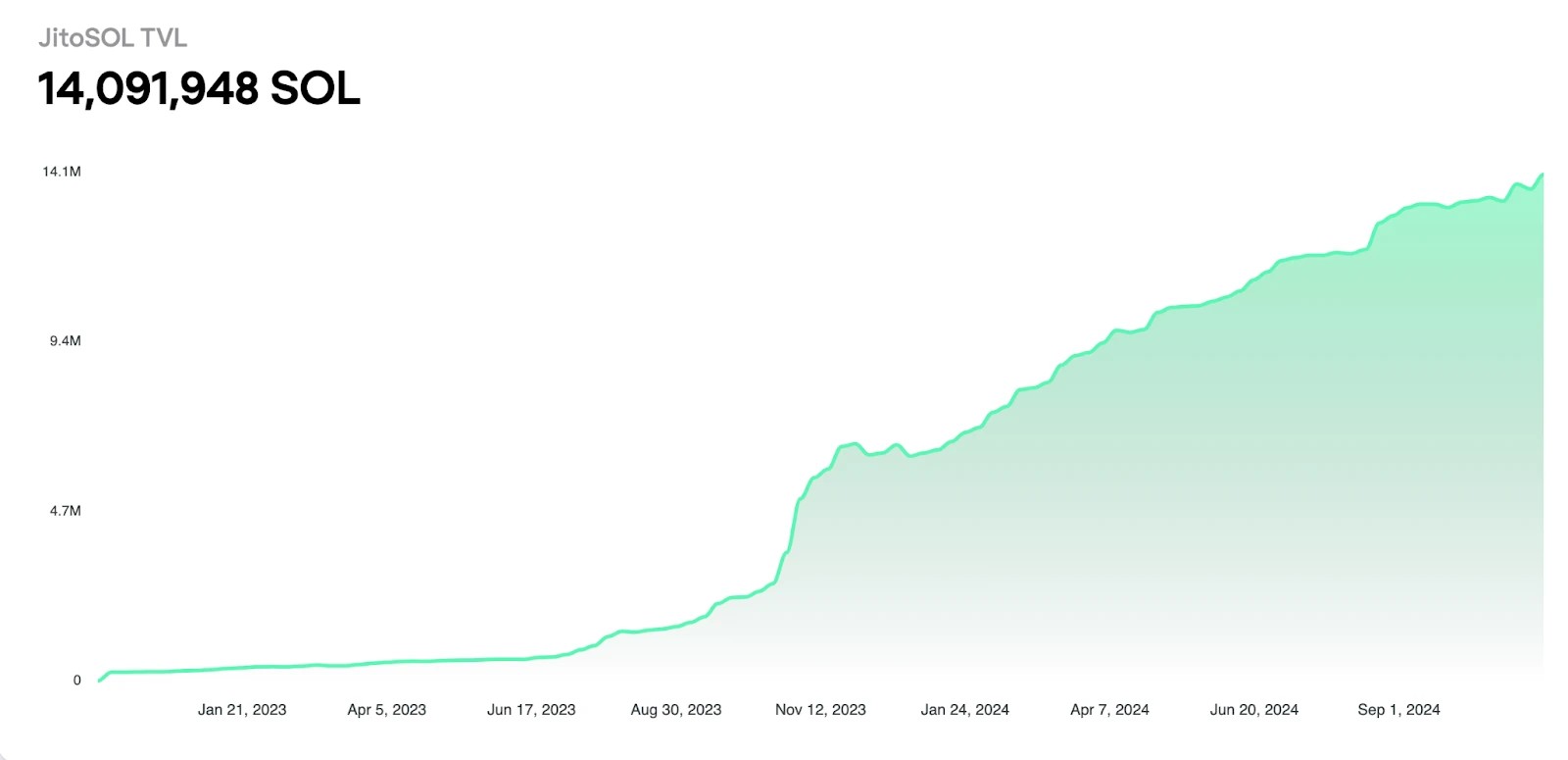

Next up, we have Jito, which is a platform that allows users to stake their SOL tokens in exchange for JitoSOL. JitoSOL is a token that is used for staking and MEV rewards. What is special about JitoSOL is that it allows the user to liquid-stake their SOL, which means they can stake and earn a yield on it whilst still being able to use their tokens on various platforms. Essentially, it is opening up the door to double the yield with less risk than borrowing.One of the best indicators of adoption for liquid staking providers is TVL. As we can see from the graph below, TVL is quite high, doubling and reaching over $2b since the start of the year. This is huge because, as we said at the start of the article, there are about 8 billion dollars of TVL on Solana alone, which means the TVL of Jito takes up over 20% of that.

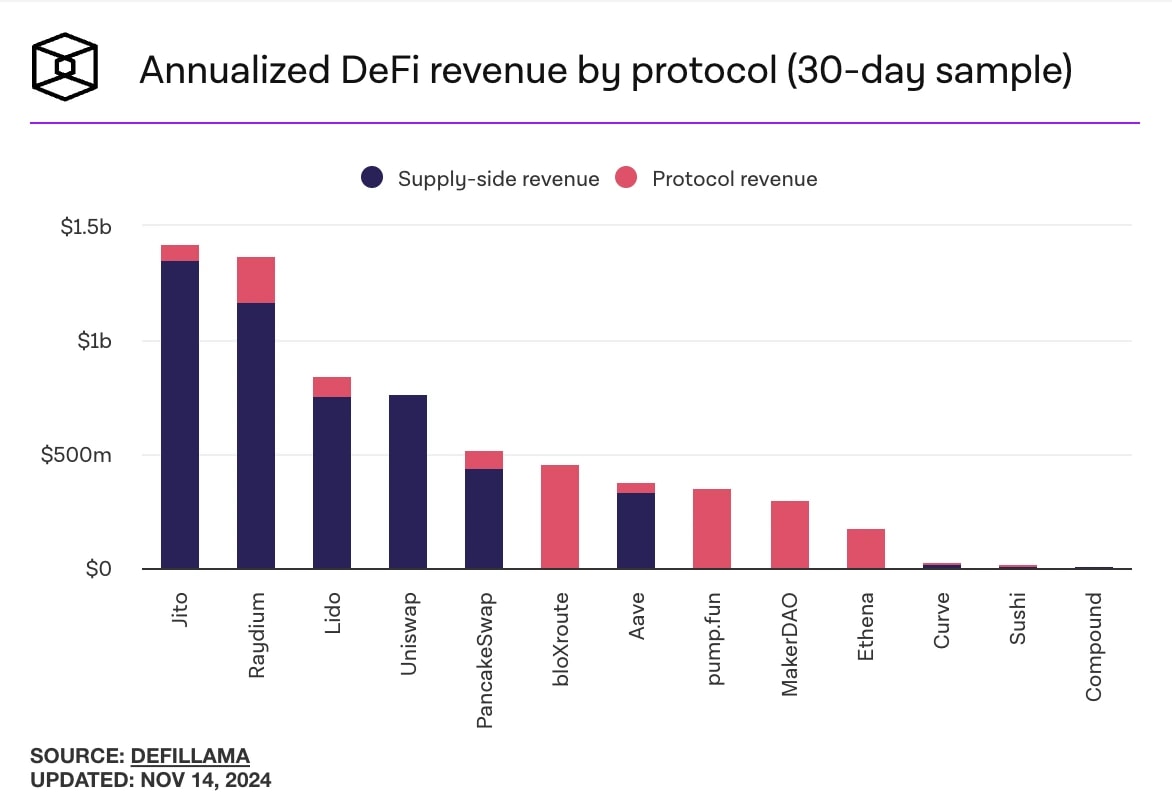

Next, we want to talk about revenue, and as we can see from the chart below, Jito absolutely blows the industry out of the water. In fact, it is almost 3x Ethereum's biggest DeFi protocol, Aave. To us, this screams bullish as currently, Aave has $16b in TVL, and with Jito having 8 times less and doing more revenue is insane.

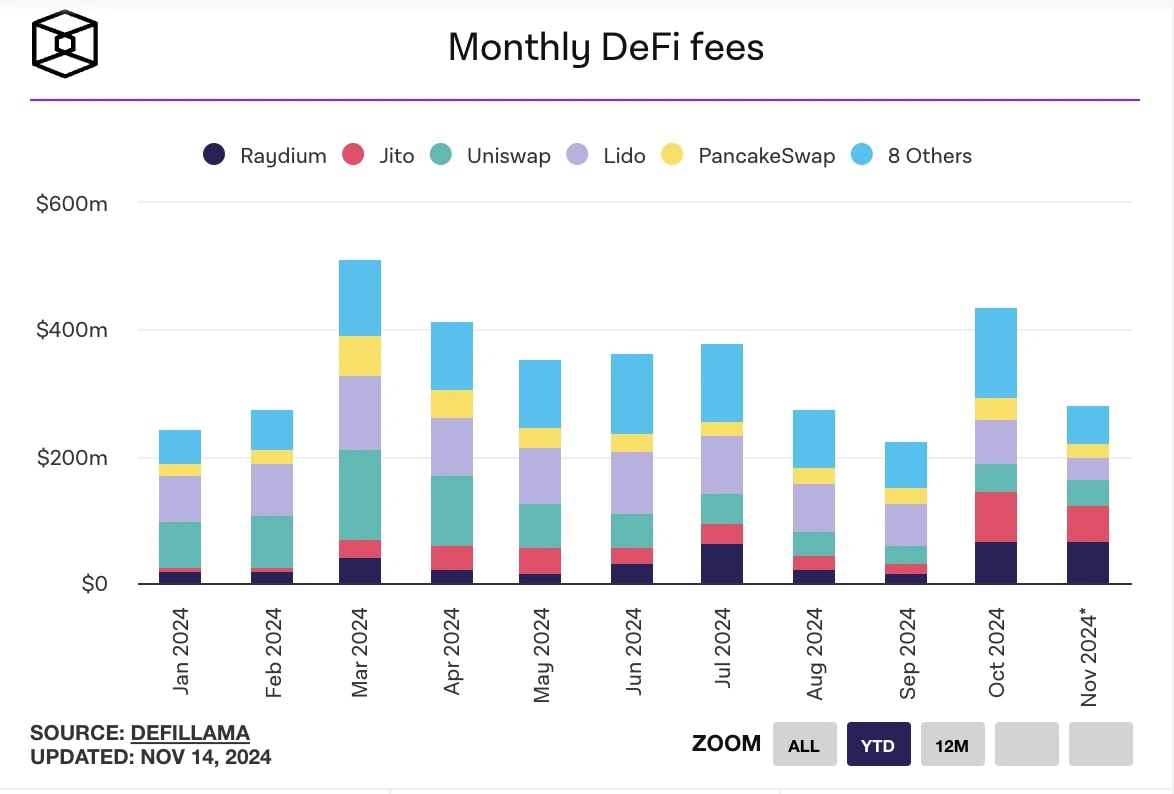

Next up we want to talk about fees, essentially fees are incurred by the users when they are using a platform or network and usually the fees are quite low so they are a good metric to see if a certain platform is being used a lot vs other platform. So, looking at the bar chart below, we can see that Jito, especially recently, has been killing it in the fee game, surpassing DeFi giants like Uniswap, Lido, and PanackeSwap, to name a few. We also see this as bullish as this means that more and more people are using the product.

Tokenomics

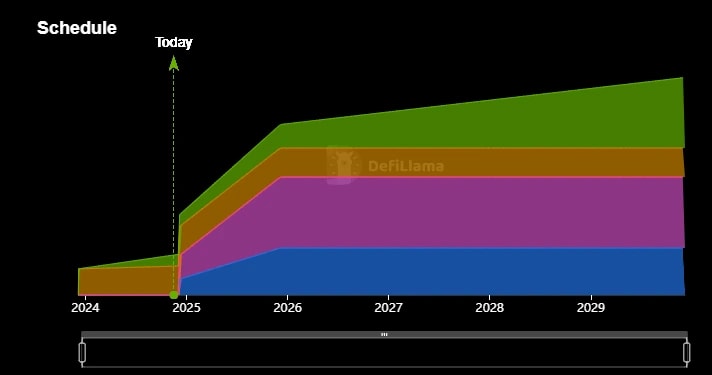

However, it is not all sunshine and rainbows. Let's talk about the tokenomics. From the token release schedule below, we can see that there is a huge unlock coming up this year. Additionally, only about 18% of tokens were unlocked at the time. This is a huge red flag for us, as we don't want insiders to be dumping on us. Despite the crazy fundamentals we presented above, the amount of supply that is about to hit the market is a bit frightening. We believe the token will struggle to gain traction.

Technical analysis

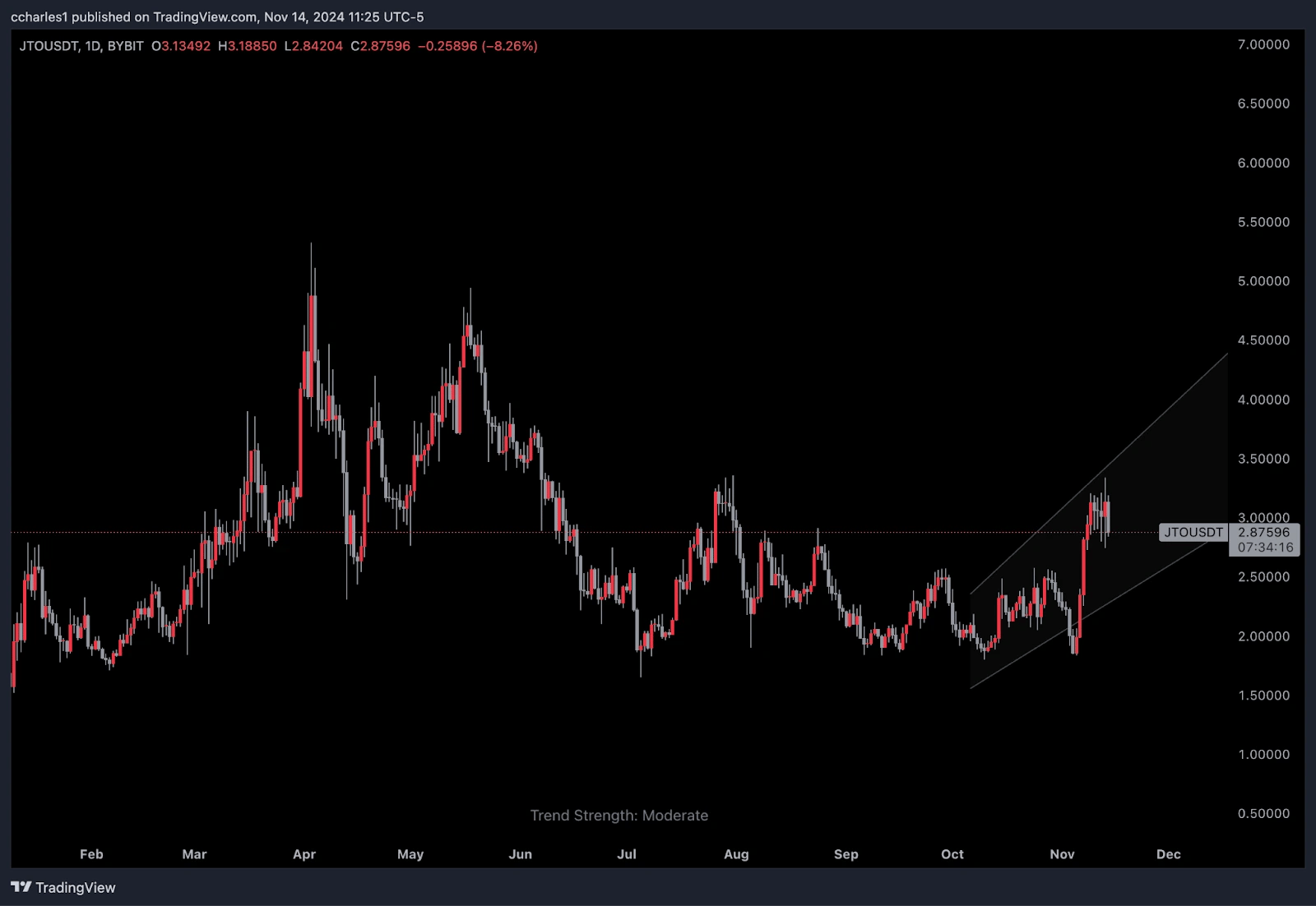

Now, when we look at the chart, it does look like it has been weak for some time and that the tides might be changing. However, with such a big unlock coming up, we think that it makes sense to wait for a large change in trend before wanting to allocate to the token itself.

Overall, we really love what Jito is doing. Its liquid staking product is a resounding success, and its growth continues to be exceptionally strong. However, the lacklustre token price action combined with the future unlocks make us stay sidelined when it comes to this token at the current time.

Raydium

Now, let's get into the memecoin MVP - Raydium. The platform is essentially an automated market maker (AMM). This allows users to get the most bang for their buck in each trade but also allows for deeper liquidity as it combines liquidity pools.As far as products, Radium is notorious for its DEX product, but it also has products for LPs and permissionless pool creation. We want to focus specifically on their DEX side of things, but quickly, when it comes to the LP product, it is similar to Kamino's lending idea, and for permissionless pools, it's bullish because it allows anyone to create a pool for people to swap between assets.

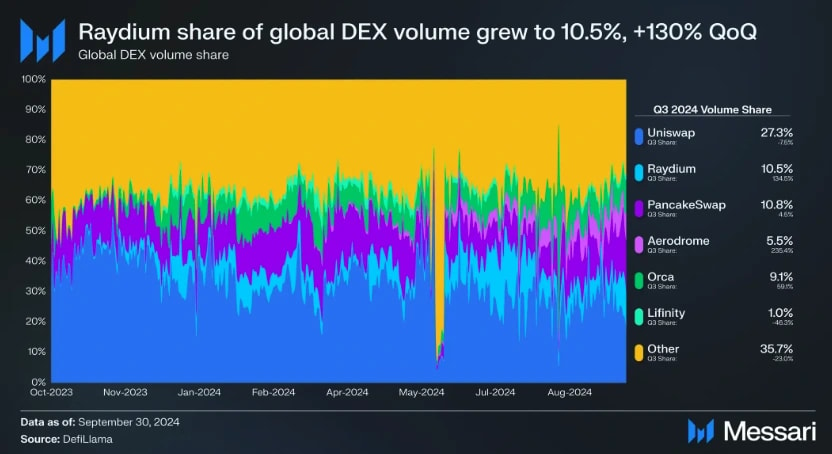

So, as we were just saying, what we like best about Raydium is their DEX, and the first thing we want to point out is how bullish their DEX volume is. As we can see from their chart, their Global DEX Volume share is 10%, which again is crazy as Ethereum has almost 8x the TVL of Solana as a whole. This is really bullish because this shows that although there is less capital using the products with similar scales, Raydium is blowing the Ethereum DEXes out of the water which shows that traders and LP's alike use Raydium a lot.

The next thing we want to talk about is the TVL, which, as you can tell by now, is a quite common theme for our Solana DeFi picks. Again, Raydium has over $2 billion in stake, which puts it in the big league of the projects that have over 20% of Solana's TVL. This makes an even more bullish case because it shows that the capital that runs supports projects of value continues to come to Raydium. On top of this, the chart also shows that Raydium's share of the TVL is in an uptrend, meaning the more capital that comes to Solana should also trickle into Raydium, which means future growth looks more than likely.

Tokenomics

Getting into the chart immediately, we can see that it is the strongest token on the list. Raydium has made new highs this year and is up a whopping 280%. We believe that this chart is exceptionally strong, and it is the fastest horse when it comes to Solana DeFi tokens.

Conclusion

Overall, Raydium has been displaying amazing growth from its increases in TVL and global DEX volume. The amazing chart, combined with the supply being fully distributed, makes us believe that Raydium is a great investment going into the future, with Solana DeFi continuing to grow.Jupiter

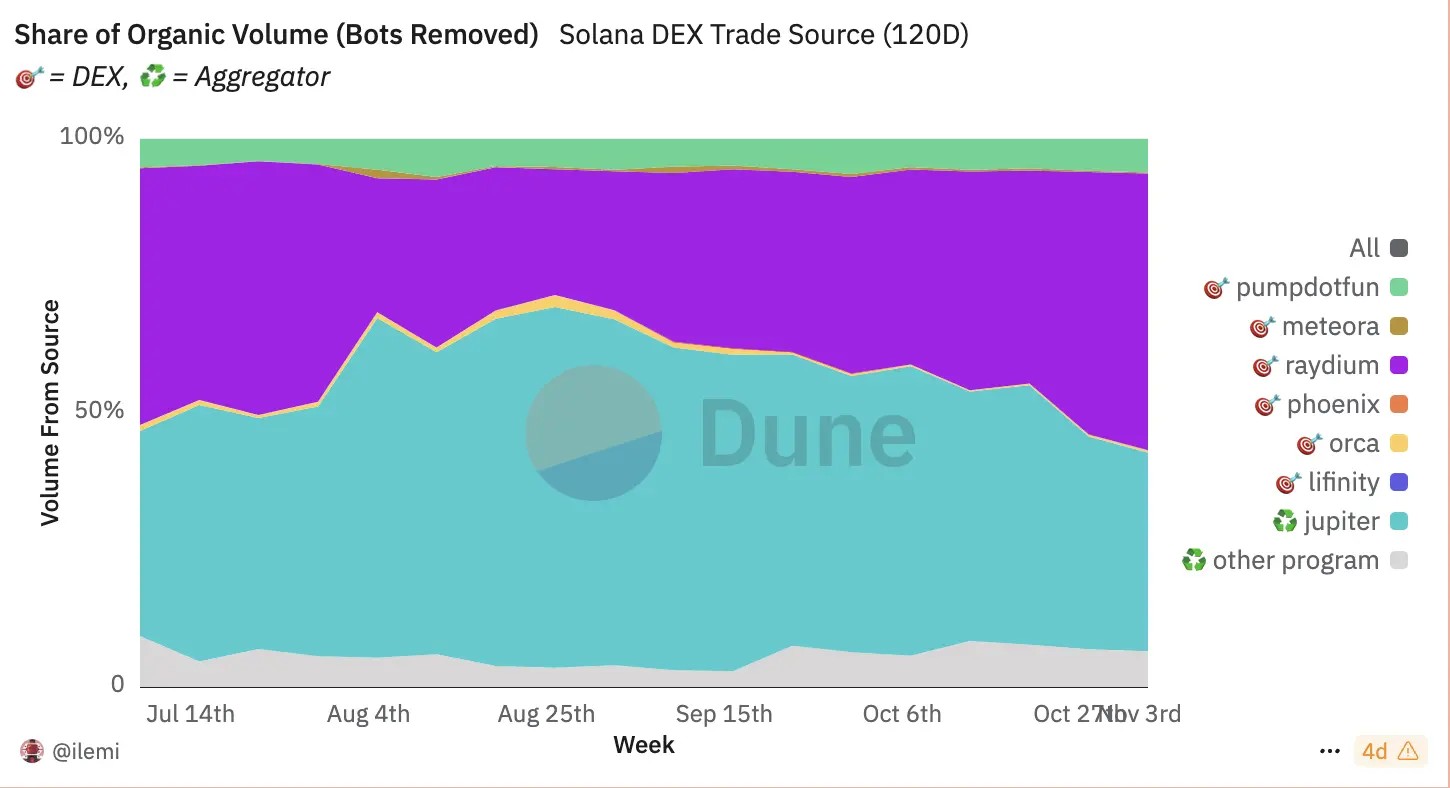

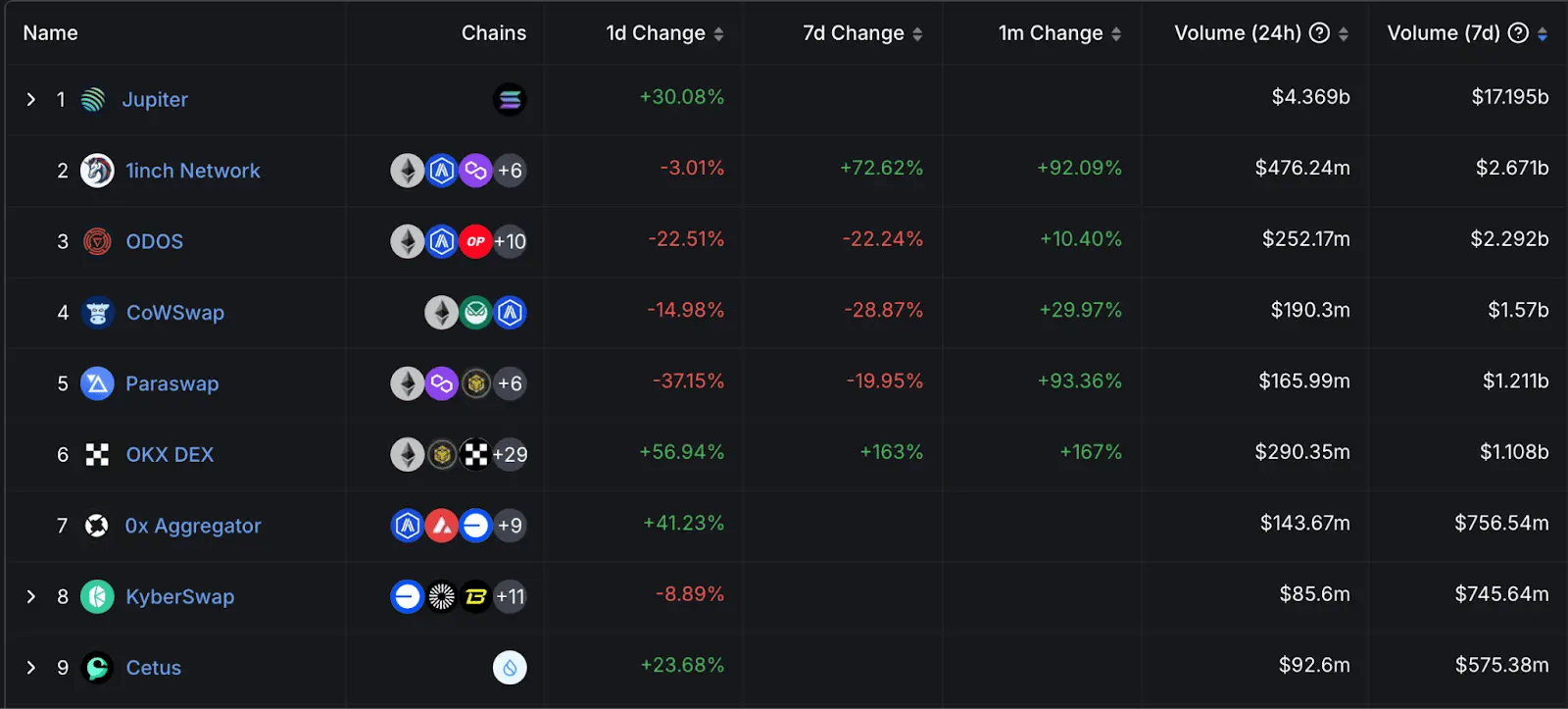

Jupiter is another DEX, but more specifically, it is a DEX aggregator. Basically, Jupiter aggregates liquidity from multiple DEXs and automated market makers on Solana, including Raydium, Orca, Saber, Penguin, Mercurial, and Supernova. This allows it to offer users the best token swap prices, functioning as a one-stop shop with the best prices.When we get into why we are bullish, we want to start with the share of volume. From the chart below, we can see that as an aggregator, nothing comes close to Jupiter on Solana. On top of that, we can also see that volume-wise, the only thing eclipsing it is Raydium by a few per cent. This is bullish because it shows that Jupiter is maintaining its dominance in the Solana DEX space.

However, what we believe is the most bullish is the volume Jupiter does as an aggregator. Looking at the stats, we can see that Jupiter surpasses not only Ethereum DeFi giants like 1inch and CoWSwap but also almost ten times higher than its counterparts. To us, this is huge for Jupiter as a product and Solana itself because it shows just how much more activity there is on the chain and that that activity is being done through Jupiter.

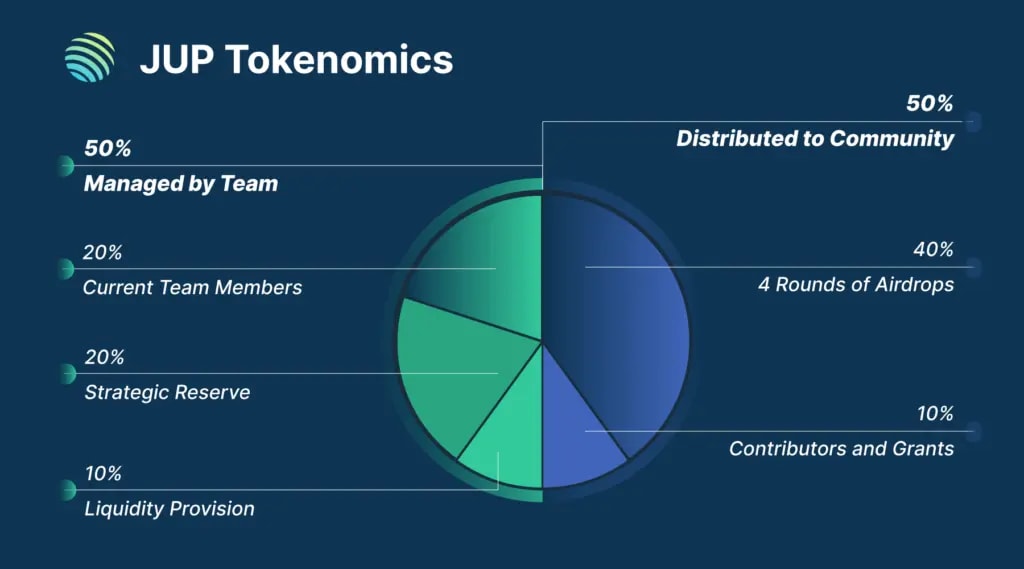

Tokenomics

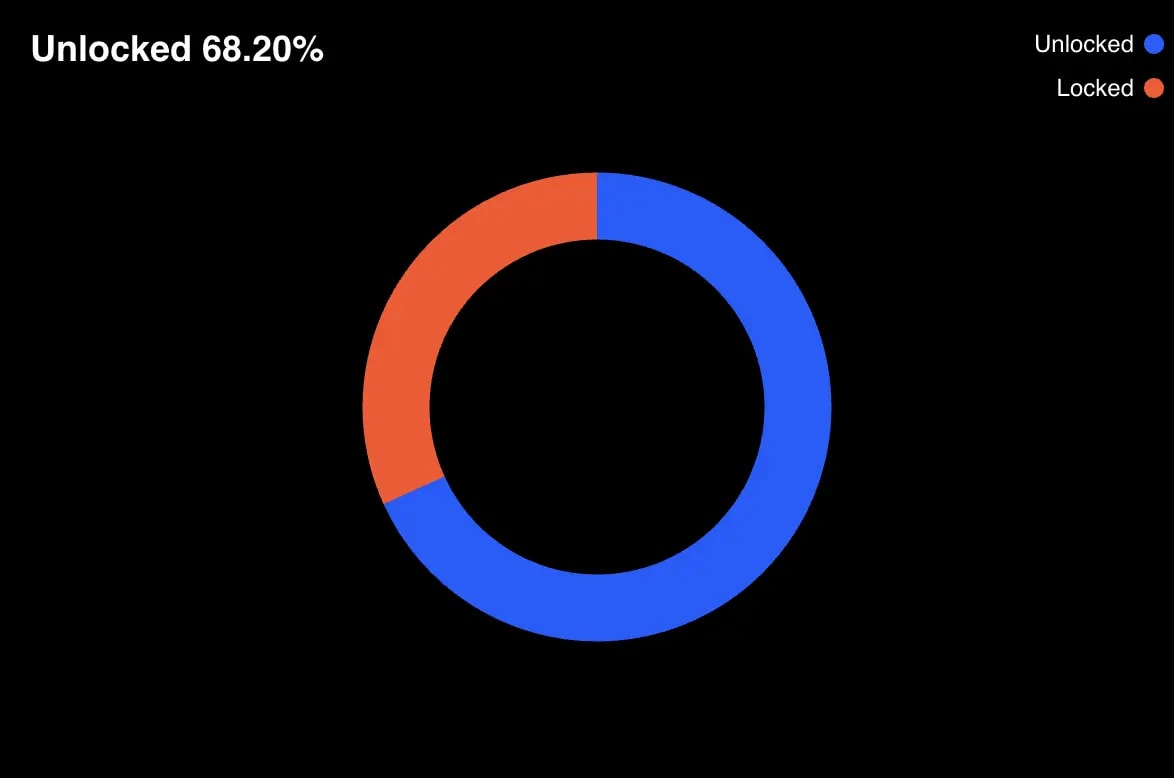

When we look at tokenomics, we see a quite interesting division. Jupiter went with a full 50/50 split between the team and the community when it came to the distribution of the tokens. That is a green flag! Further, when we look into the unlocks, we can see that it is almost 70% unlocked. With both of these things in mind, we think that these tokenomics are some of the best on the list. With the majority of the supply already out, we think that the emissions themselves won't negatively affect the price that much, meaning that if the price looks good, it should be able to go up.

Technical analysis

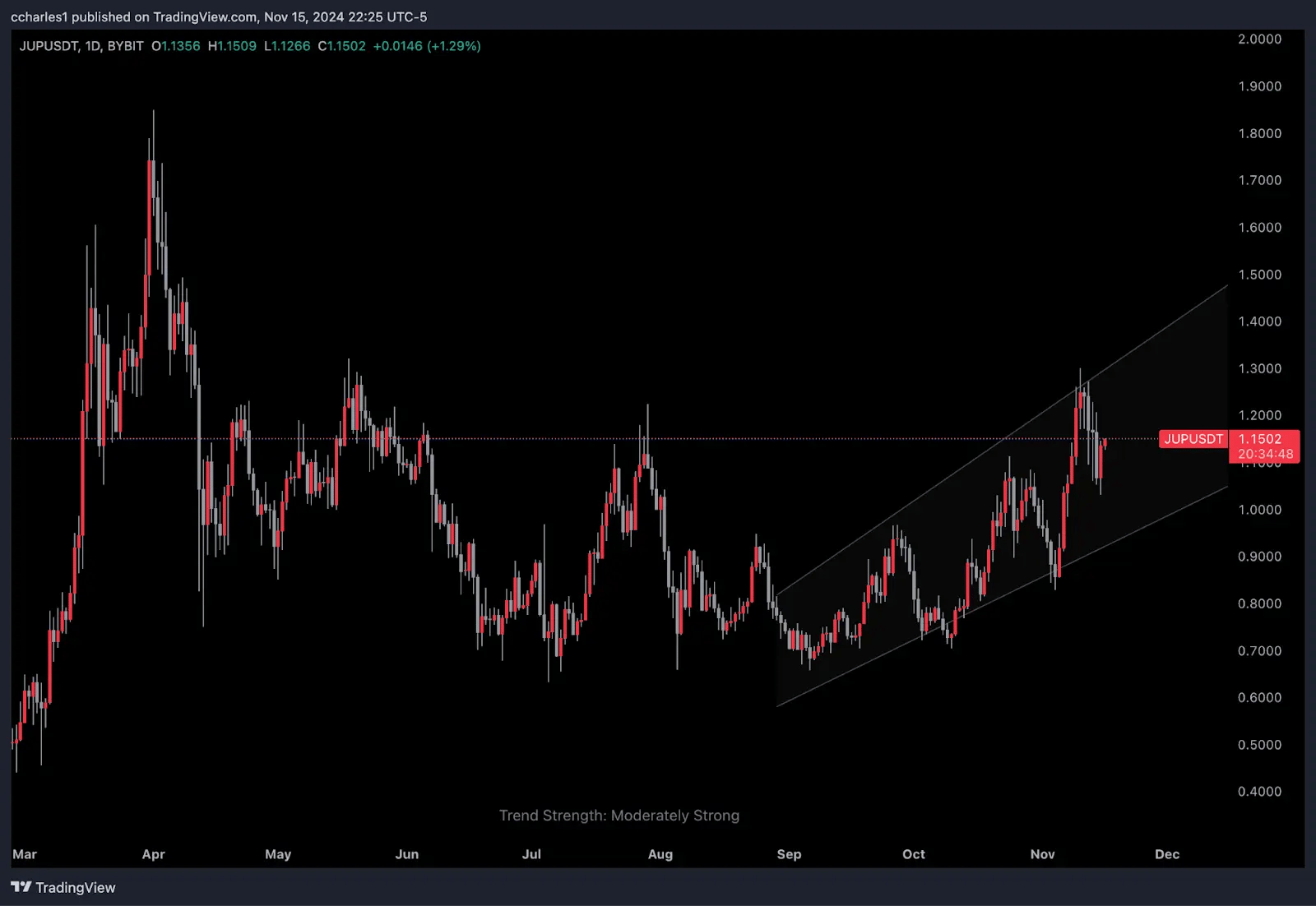

Looking at the chart we can see that it is quite muted for now, while it is in an uptrend it still hasn't made new 2024 highs. However, we do think the price action looks good, with a bullish trend in the past couple of months.

Overall, we really like Jupiter as a product, as their stats show consistent growth in the Solana DeFi space. When it comes to $JUP as an investment, we think that the chart and token emissions favour a bullish continuation. However, we do think the chart looks quite slow, and there will likely be faster horses in the race over time.

Cryptonarys Take

Overall, Solana's DeFi ecosystem isn’t just back—it is one of the best in the industry. With over $8 billion in TVL, it’s clear the ecosystem isn’t messing around. From lending and liquid staking to derivatives and DEXes, DeFi on Solana isn’t just alive—it’s proving why it’s one of the most exciting parts of Web3.At the same time, we know the memecoin supercycle is dominating the mindshare, pulling liquidity toward viral tokens while leaving serious DeFi projects, including Solana DeFi tokens, working harder to grab attention. It’s a tricky balance; however, even with the memecoin buzz, Solana’s DeFi ecosystem continues to shine product-wise. Its blend of innovation and community momentum is cementing its place as a leader in the space. While market volatility and token emissions remain challenges for these tokens, one thing is clear: Solana is proving it has what it takes to thrive—whether you’re here for the memes, the mechanics, or both.

As we strongly believe the meme sector will outperform all other sectors this cycle, we won't be heavily investing in DeFi tokens, even though Jupiter looks very attractive tokenomics-wise. However, one thing is clear, the DeFi and infrastruture on Solana is crushing it, however, it is not great time for investing timing-wise.

Peace!

Cryptonary, OUT!