Solana Ecosystem Watchlist

The Solana ecosystem has been gathering a lot of traction in recent months. While a vast majority of the work done has been on projects with very little value (i.e. sh*tcoins), there a few potential unique products and we present them to you in the following list 👇

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

COPE

COPE aims to create a leader board for all traders who use twitter to share their trades. Each trader is ranked with a numerical score between [0 – 1000] based on their call. Once the top traders have been identified, they will create an index consisting of 20 tokens which they have selected. Users will be able to invest with the use of smart contracts in this index. In similar fashion, COPE trading pools will allow users to follow top traders’ calls enabling copy trading. COPE also aims to offer users insight into their own or other traders trading performance and history with individualised COPE reports unlocked by burning COPE. There are currently 16.5 million COPE tokens in circulation, with over 90% of these being owned by the community. By 2025 there are expected to be 21million COPE tokens in circulation. An airdrop of 10 million COPE was used to seed the initial community. COPE is trading on both FTX and the Serum DEX. There is also a COPE|USDC liquidity pool on Raydium. COPE is currently burnt by other projects such as FTR, FROG and SAKITA to enable them to carry out automated airdrops to wallets holding COPE. COPEs’ lead developer can be found on twitter (@cyrii_MM), and progress since the 26th of March 2021 has been rapid. The team is in the upper echelon of developer teams working on the Solana ecosystem. This offers COPE a significant competitive advantage compared to other projects. The developer team also won the community choice prize in the previous hackathon. Since the start of June an unplanned addition in the form of COPE games is near release. For this Sollet Wallet has been integrated with the Unity Game Engine. This allows for players to connect their wallet and earn rewards in game which are delivered to their wallet. COPE is the subject of our most recent research report and has been analysed in depth.

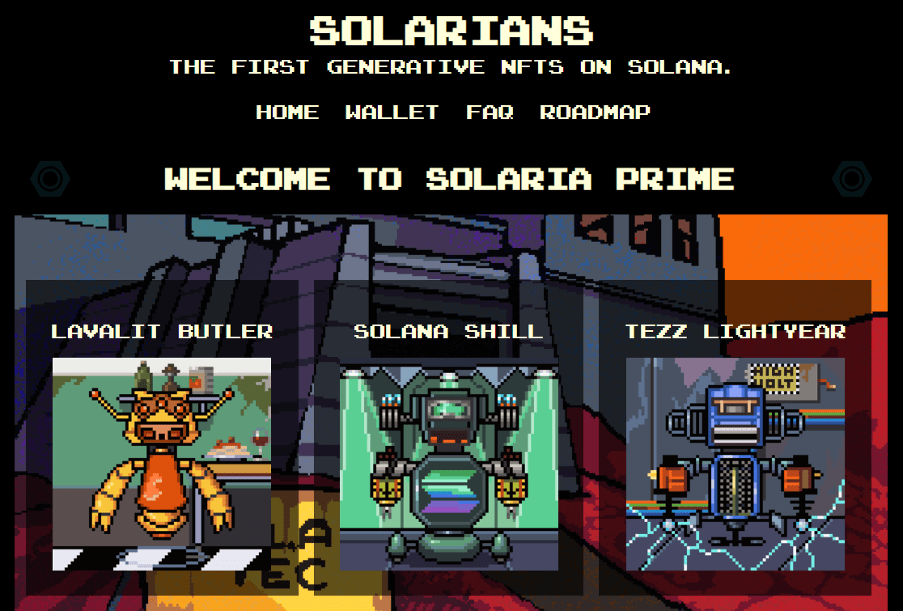

Solarians

The first generative NFTs on the Solana blockchain, based on a robot theme. Similarly to CryptoPunks, (generative NFT collectibles on Ethereum chain), there are only 10000 Solarians created, and each Solarian is unique. They are animated and generated from a pool of 1800 robot parts, with each part having a different level of rarity. Each Solarian will also have their own set of traits/attributes with varying rarities. Solarians are being sold on a rising price curve for public sales, starting from 4.0 SOL and having since increased to 12.9 SOL for Solarian #5207. Rarities to date have not yet been finalised, however the developers have stated they will be truly random and unlinked to the purchase price or serial number.

The developer team has announced that the design of all 1800 parts has been completed and that they are in the process of generating the finalised Solarian designs. Previews of purchased Solarians are possible using their wallet function. This is done by inputting the SPL address off the wallet holding the Solarians in the wallet section on the Solarian website. Recently, the developer team has also cooperated with other projects with Solarian holders receiving airdrops. Future plans are for creation of a dedicated NFT marketplace for Solarians, with Solarian holders receiving fees from marketplace transactions as rewards. The project has been making steady progress since its inception and has a functioning product (>50% of Solarians have been sold) with a simple and straightforward roadmap, as well as the ever important first-mover advantage from being the first generative NFT project on Solana. The risk/reward ratio on acquiring a Solarian is excellent in the long run, as there is a non-negligible possibility that Solarians become the equivalent of CryptoPunks in the Solana ecosystem. However, due to the fickle nature of the NFT market, the purchase of a Solarian should not be solely speculative but driven by an appreciation for the artwork and project, with the purchaser being aware that the value of the artwork could also decline in the future.

Mango Markets

Mango Markets is a decentralized, cross-margin trading platform offering up to 5x leverage and integrated limit orders on Serum DEX’s on-chain order book. Users can earn interest on deposits and margin positions, as well as trade with near zero fees. This is due to the protocol being built on Solana, taking advantage of the miniscule gas fees and sub second block times with near instant finality available. Sub second block times allow for low latency and an experience similar to trading on a centralised exchange (FTX/ Binance). Low latency is also important to market makers, allowing for more competitive prices to be offered with better liquidity. Low fees and decentralisation of the protocol allow for it to be censorship resistant, making leverage trading available to all Solana ecosystem participants. Users can also contribute SRM into a shared pool to reduce the fees for all traders on the platform.

Mango Markets won first position in the previous Solana Hackathon, and development has been ongoing since then. Currently Mango Markets is operational in live alpha offering access to margin trading on BTC/USDT and ETH/USDT. The protocol remained fully operational during the recent market crash as opposed to other centralised exchanges. A fully customisable Graphical User Interface with trading view tools implemented is offered, and the user experience is quite smooth and feels like trading on any centralised exchange. Outside of leveraged trading, Mango Markets also offers withdrawable borrowed funds against the collateral deposited at extremely attractive annual interest rates. The borrowed funds can be withdrawn and used elsewhere in the Solana ecosystem. During the second hackathon the developer team participated in the DeFi Demo Day, demonstrating how to use the protocol and their current progress, and touching on future plans. Specifically, inclusion of SOL and SRM markets along with their use as collateral is planned, with work continuing on their futures PERP contracts.

As a project which aims to be decentralised, the developer team has laid out a plan for creation of a governance token. There will be 10*10^9 (100%) tokens as maximum supply, with the initial circulating supply consisting of 2*10^9 (20%) tokens. The creators will be allocated 0.5*10^9 (5%) tokens and a further 0.5*10^9 (5%) tokens will be sold on the open market to create an insurance fund for the protocol. Another 1*10^9 (10%) of the supply will be used for temporary governance, until full governance mechanisms are launched. At that point the temporary governance fund will be returned to the DAO treasury. The remaining tokens in the supply (80%) will be locked until the governance mechanisms are live. A logarithmic supply model similar to Bitcoin has been proposed by the developers (50% of tokens unlocked over 2 years, 75% over 4 years, 87.5% over 6 years, etc..), but as the release mechanism will be decided via token holder governance, this is not set in stone.

The sale of 0.5*10^9 (5%) Mango tokens which will be offered on the open market will take place over 48 hours, in two distinct 24 hours intervals. During the first 24 hour period users will be able to deposit/withdraw their USDC in/from the Sale vault. At the conclusion of the first 24 hour period, deposits into the vault will stop, and users will only be able to withdraw their USDC from the vault if they wish to, for the remaining 24 hours. Once the full 48 hours have elapsed, all of the USDC remaining in the vault will be exchanged for all of the Mango tokens being offered. All buyers will receive their full allocation. This means that all of a users USDC remaining in the vault at the end of the day will become Mango tokens. Buyers get a pro-rata price and every participant gets the same price. The sale price per token can be calculated as:

Price per token = (USDC remaining in the vault after 48 hrs) / (500,000,000 Mango token)

The above sale mechanism is simple and fully transparent and offers everyone equal opportunity to participate in the token sale. The developer team has not yet released a date or timeline for the token release, however, the plans for a token release are well documented and thought out.

Pyth Network

Pyth network aims to become an oracle for price feeds based on the Solana ecosystem with utility across multiple chains. Specifically, they aim to offer high fidelity, time sensitive, real world data hosted and archived on chain and accessible by any DeFi application. The protocol is currently in testing on the Solana Devnet. The developer team demonstrated the Pyth network during the current Solana hackathon. Users can see a live demonstration of the speed of the oracle by visiting the Pyth website. Currently they offer prices for 24 markets with sub second latency, sourced from multiple high-quality nodes. Price feeds available range from stocks (AAPL, AMC, AMZN, TSLA etc..), major cryptocurrencies (BTC, ETH, SOL, BNB etc..), currency exchange pairs (EUR/USD, GBP/USD etc..) and commodities such as gold (XAU). High fidelity, low latency price data is necessary for any DeFi protocol, as price discrepancies/delays are an attack vector for smart contract exploits. A reliable oracle is necessary to guard against such as exploits. DeFi protocols which rely upon the price of a currency can be exploited if the price they receive is false or significantly different than the true price. Recently several protocols such as Rari Capital, Akropolis and others have fallen victim to similar attacks. Building on Solana enables low latency to leverage high speed price updates. Solana allows Pyth network to use the Wormhole to interact with other chains as well. The speed of Solana allows for price data to be disseminated to other chains at their native block speed. This would enable protocols across any Wormhole integrated chain access to a constant stream of price data, eliminating the price discrepancy/delay oracle vulnerabilities. Wormhole is also readily extendable to any other Ethereum based chain, so as Ethereum starts using L2 scaling solutions, Pyth integration should be straightforward for developers. Currently, Pyth is integrating with the Ethereum and Terra chains via Wormhole.

Additionally, Solana is the only chain with the compute bandwidth to apply processing on the price data to create smarter outputs. Pyth network collects the prices and confidence intervals published by its high-quality data providers. One of these data providers is GTS, a leading electronic market maker across global financial instruments. GTS will directly publish data it owns to the Network through a node it independently runs. Using price data from multiple different institutional grade data providers allows for the protocol to calculate how ‘true’ the final reported price is. This is one of the ‘smarter outputs’ and it is referred to as Confidence. In addition to the price data and Confidence, the network can include historical quality, potential stake at risk and other useful pieces of information. Applications using Pyth network prices can use this extra information with a great deal of flexibility. Markets that allow for leverage, could lower the amount of margin available at a given update with a low confidence price and be more conservative with liquidations.

The value proposal of Pyth effectively revolves around using the Solana blockchains’ higher level of compute power to solve the issue of oracle latency across multiple chains. They are aiming to be a cross chain oracle with sub second latency enabled by Solana. The concept and project are quite straightforward which has enabled an accelerated timeline, and a production release of the protocol should be upcoming.