Luckily for you, we have the Cpro assets update for Q2 hot off the press.

Are we still on track? Find out now!

TLDR

- Hivemapper's Bee dashcam incentivises passive income with strong long-term adoption potential.

- Chainlink is bridging TradFi and Web3 through a FIX integration that could increase institutional demand.

- Injective is on track with a recent Arbitrum integration advancing interoperability goals, even though price has retraced from highs.

- Synapse is adding chains/liquidity amid the market slowdown; we love the unique RFQ system, but the role of the SYN token remains uncertain.

- Lybra continues to underperform across metrics like TVL and stablecoin market share; it is time to get off this ride.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

Hivemapper (HONEY)

Hivemapper announced their Hivemapper Bee dashcam in February as part of their quest to provide the best quality street view images and mapping.

The Bee is designed with a dual purpose - record any incidents that a driver may need video evidence to back up (for insurance purposes, etc.) and produce high-quality images of streets for their goal of supplanting Google.

Essentially, the Bee takes passive income to a new level. Whenever a user drives around, they collect data, which can then be sent to Hivemapper for the usual rewards. Built-in sensors automatically record periods of extreme driving (emergency braking, swerving, etc.).

This is excellent marketing, as the product is multi-use and represents Hivemapper's implied entry into the dashcam market.

The Bee is a must-buy for those already providing Hivemapper with data. It has the potential to break into a new market, providing exposure to Hivemapper while collecting even more data.The unit is quite pricey, at $469—easily more than two times the expense of a regular (high-end) dashcam unit. The higher-end version ($569) uploads mapping data as you drive owing to its cellular connection—otherwise, data will be uploaded as soon as you get into your driveway and connect to Wi-Fi.

The difference between conventional dashcams and the Bee is that the Bee is specced for data collection, not just video evidence. In turn, this means the cost should (in theory) be recouped by selling that data to Hivemapper.

Once the pre-order user has mapped 2000km (~1240 miles), they are entitled to 2000 HONEY, which is around $174 at current prices, notwithstanding any potential price increases between now and the launch date. HONEY previously hit $0.33 in January; if that is achieved again between now and the end of the year, that represents a cool $660—the cost of the unit + profit, not including rewards accumulated throughout that 2000km.

The unit is expected to launch in Q3 2024, which gives plenty of time for those looking to acquire the bonus and additional benefits offered.

Regarding price action on HONEY, nothing major is expected - this is more of a long-term benefit that will increase exposure to both Hivemapper and the HONEY token.

Finally, the Bee is a clear example of the real-world use cases for Web3 - something many protocols have struggled with due to regulatory pressure or otherwise.

HONEY analysis

Honey has been forming a descending wedge, with downside momentum slowing down (lower lows losing their momentum in swings, swinging lower). This suggests a slowdown of momentum and a potential upcoming reversal.

We would like to see a reclaim and demand at $0.10.

Chainlink (LINK)

Chainlink continues to expand its connections with the Web2/TradFi world with its recent integration with FIX, which stands for Financial Information eXchange. By connecting Web3 to FIX, Chainlink enables banks and other financial institutions to relay and collect data from the Web3 world, facilitating use cases ranging from RWAs to renewable energy.

Rapid Addition, the company providing the FIX connectivity, is a huge supporter of Web3 solutions. In a statement, the CEO of Rapid Addition, Mike Powell, had this to say:

"Our users require access to liquidity and post-trade services regardless of the underlying technology. As a result of this collaboration with Chainlink, financial institutions will be able to leverage their existing trading infrastructure to enter the new era of digital assets."

It sounds like jargon, but the key point is that TradFi wants to tap into all liquidity and exchangeable assets—whether it's oil or ETH.

Again, although this appears to be a minor development on the surface, it further highlights the growing demand for access to blockchain tech and the ecosystems that comprise the space.

Chainlink is the centre of that, which bodes well for the future of LINK.

LINK analysis

LINK has broken its pretty steep bullish trendline but has held up at a very significant historical level of demand. When taken alongside the overall market and correlating key levels, this could be a great area to value LINK and see it hold up price action for further upside.

Injective Protocol (INJ)

Injective has been going from strength to strength with their most recent announcement of integration with Arbitrum.

Interoperability has always been the goal for Injective (apart from becoming the number one DeFi chain). So, the integration between the inEVM and Arbitrum represents another target hit for Injective.

To recap, the inEVM allows Injective to use the INJ token as a gas token, similar to ETH's role in the Ethereum ecosystem. The more chains they integrate with inEVM, the more transactions will occur and the larger the validator set that will be required. Since inEVM works as a proof-of-stake chain, this essentially means more INJ is locked up, which is great for price appreciation.

INJ peaked at $51 in mid-March, a 780% gain since December 2024. It has since retraced (thanks largely to the recent BTC movement) back to ~$25.

However, in terms of our original thesis, INJ is one of the more "on-track" assets on this list.

INJ analysis

INJ has a lot of recovering to do. The chart shows fantastic performance pre-cycle, which many assets also experienced, followed by a pretty dramatic sell-off.

This is normal from a market psychology point of view. It can lead to uncertainty and profit-taking at such significant prices so early in the cycle (halving).

Maybe this sell-off will bring about the health and new demand that INJ needs. A reclaim of $30.50 will be really positive for this asset.

Synapse (SYN)

Synapse has been hard at work, grinding to add more chains and access more liquidity (and, therefore, users/transaction fees). The most recent integration is with Spectral, a Base-based protocol that utilises AI to translate written language into Solidity code (the programming language of the Ethereum and Ethereum L2 networks).Synapse has had a great quarter in Q1, with revenue through the bridge spiking significantly in March/April.

The general market slowdown has affected revenue, but the same can be said for most DeFi protocols.

The Synapse treasury currently has over $16 million, which means they are well capitalised and eager to expand (this is evident in their ongoing interactions with almost everyone across most chains).

Additionally, Synapse's request-for-quote (RFQ) system is unique and a contributing factor to its success. It's essentially a "highest bidder" system—the user requests a bridge transaction, and providers on the destination chain try to outbid the other bridges for the transaction. Whoever can do it the cheapest wins the transaction. Synapse doesn't even have to facilitate the actual transfer; instead, it has become a marketplace for cross-chain protocols to compete for some of Synapse's revenue.

Although we've still had no further clarity about SYN's role in the upcoming Synapse Chain, there has been discussion (you can find the info here).

This conversation suggests that SYN will be the utility/governance token for the new chain, but it very much reminds us of the ATOM 2.0 discussion - there's no consensus. It doesn't confirm or deny anything.

Essentially, it is still in limbo on that front. The key point, however, is that SYN still ticks all the boxes from an investment standpoint.

SYN analysis

Synapse showed significant signs of demand in February, and since then, it's been correcting and selling off in alignment with the overall market.

A key significant area of demand is around $0.680, a crucial scene of support/key liquidity area dating back to Feb-March - we would be looking for buyers to show strength here.

Lybra (LBR)

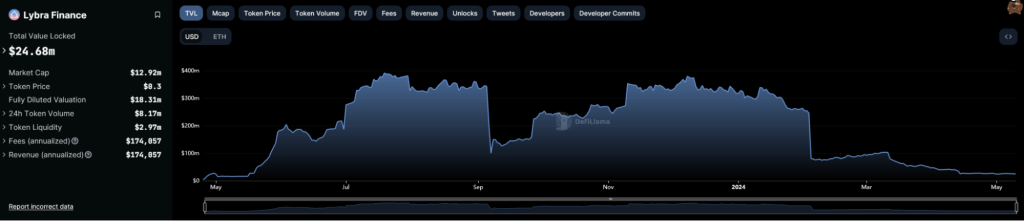

Everything has been positive up till now - but here comes the drama. Lybra, as a protocol, has been severely underperforming by basically all metrics.

TVL has been dismal, suggesting that users are going elsewhere to fulfil their LSD-Fi needs.

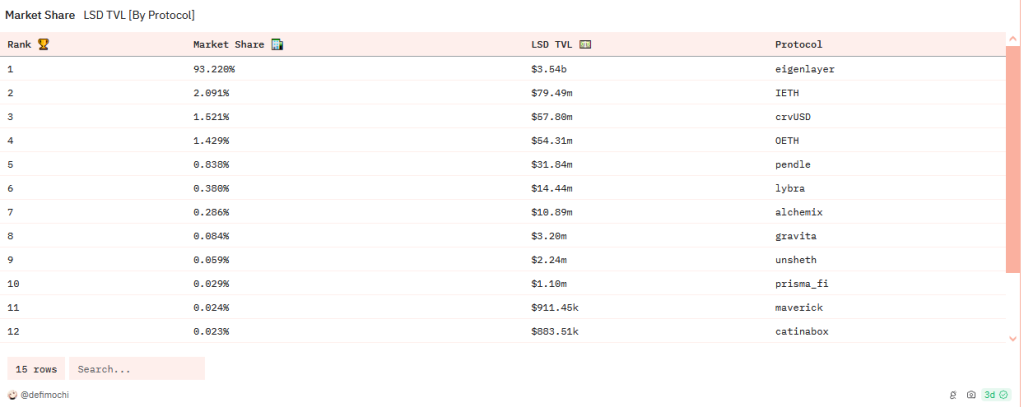

EigenLayer's major operational goal is to connect infrastructure developers with credible stakers to support a specific actively validated service (AVS) through restaking. Restaking enables the use of an existing stake (e.g. ETH staked to secure Ethereum) to facilitate the security and operation of an AVS, avoiding the risks associated with launching a native token.

Most of the assets backing Eigenlayer's operations are liquid staking tokens, like stETH.

Essentially, Eigenlayer is the promised land of LSD-Fi—an all-in-one solution for creating almost any protocol that already exists. Pendle is the outlier owing to its unique product offering.

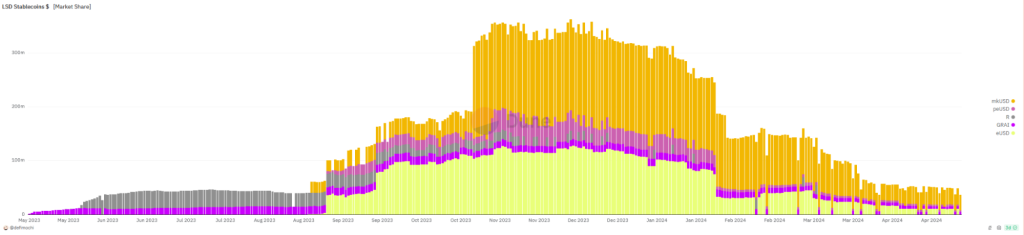

Additionally, if we look at eUSD's market share of LSD stablecoins, there is not much positive news. In general, the LSD stables market has virtually collapsed, and the dominance that eUSD once held is no longer there.

For these reasons, we're removing LBR from the assets we follow—there aren't enough reasons to remain bullish about the prospects of the protocol anymore.

LBR analysis

Lybra Finance is printing very bearish price action. Support isn't holding up at all when trading lower, and we have pretty strong bearish candles being printed.

Currently, it's using a recent key price point as resistance, so it appears buyers are struggling to regain control.

Cryptonary's take

Sometimes you win, sometimes you lose - LBR is a prime example. The introduction of Eigenlayer has reshaped the LSD-Fi game.On the bright side, progress is progress, and we can't take that away from SYN, INJ, LINK and HONEY. The original theses are still in play, if not surpassing our expectations. Although this hasn't been significantly reflected on the price charts, the key issue is adoption rather than fundamentals.

It could be argued that they're one and the same, but big money is hesitant to use DeFi in their day-to-day operations. Until regulatory clarity becomes apparent and LSD-Fi protocols are further stress tested, the money is going to do what it always does—follow the narrative.

And the narrative is firmly on Eigenlayer (at least in the LSD-Fi space).

So, to summarise, here’s an overview of where we’re at with these assets:

Until the next one,

Cryptonary, out!