From the optimism in the market at the start of the year to the January lows and back to the February highs, there's a reason the crypto market is not for everyone!

But here you are, reading this.

And you may be wondering what's been happening with our top picks.

Well, wonder no more!

Here is the latest scoop on the most exciting opportunities in crypto.

TLDR

- Lybra's stablecoin eUSD lost its peg due to flaws in the redemption mechanic for backing collateral. No clear path to restoring the peg has been communicated.

- THORChain is debating whether to expand beyond swaps or stick to the original value proposition.

- Synapse testnet activity is strong, but questions about actual usage and token utility remain.

- Synthetix has shown solid growth recently with new tokenomics and product expansions to improve usability.

- Despite trailing Arbitrum, Optimism still has the potential for significant growth in the bull run.

- Redacted Cartel's new and upcoming products are expected to drive revenue growth.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

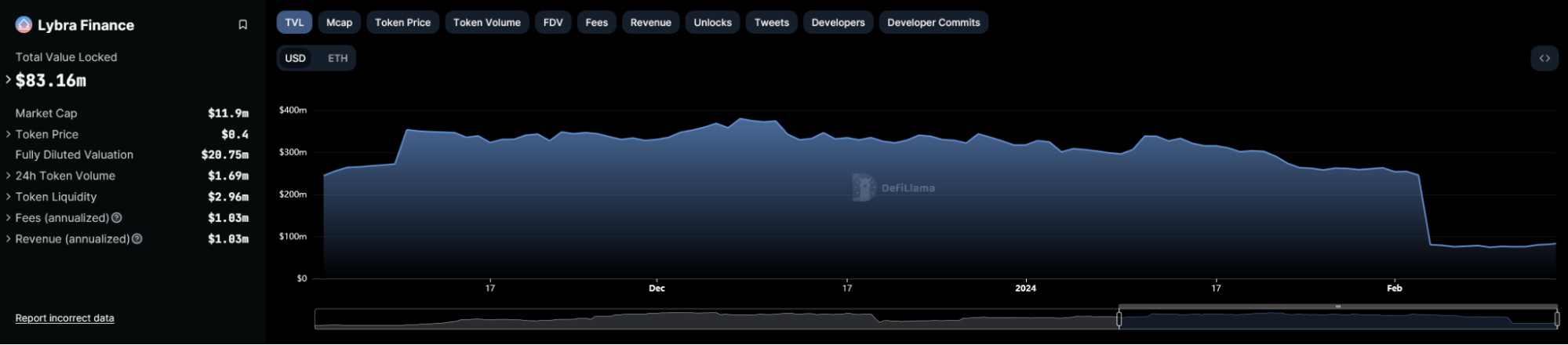

What is happening with Lybra Finance (LBR)?

Lybra has turned pretty gruesome the last couple of months. It all started with the depeg of eUSD, a stablecoin backed and maintained by Ethereum liquid staking and Lybra's flagship product.But did it really start there?

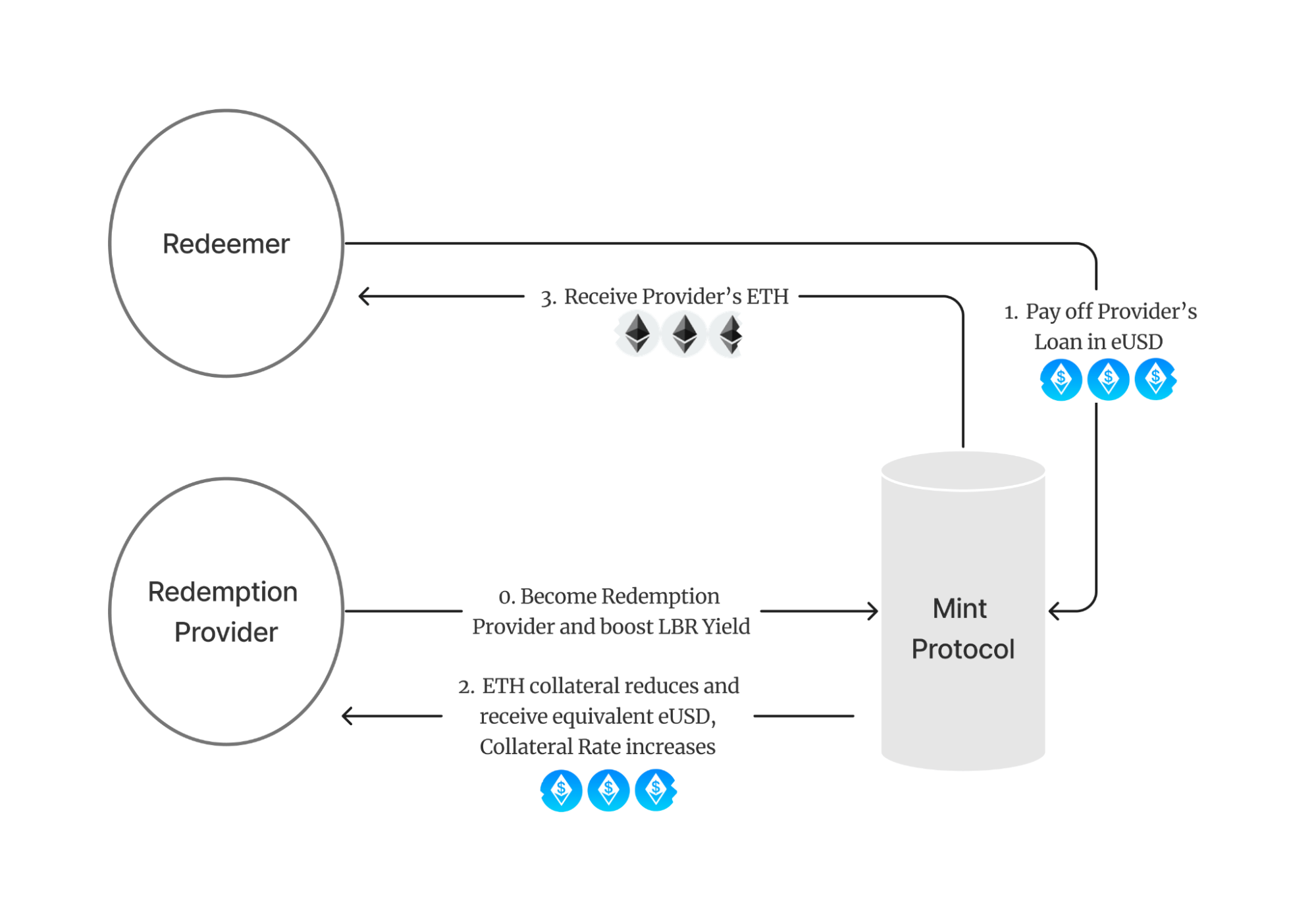

Let's look at the mechanics behind the minting and burning of eUSD:

All decentralised stablecoin providers must have some method of keeping the stablecoin pegged to $1. In Lybra's case, the collateral used to back the value of eUSD is Ethereum liquid staking tokens.

This does work, not just in theory. Arbitrageurs can purchase that stablecoin and redeem it for the underlying token whenever a stablecoin goes below its pegged value. This creates demand for eUSD, and the price goes up.

Conversely, when the price of eUSD goes higher than $1, it becomes profitable for arbitrageurs to deposit collateral to mint eUSD and sell it on the open market. This creates supply for eUSD, and the price goes down.

Now, in an open market, this is a good system.

And therein lies the flaw: it isn't an open market - users minting eUSD had the option not to allow redemptions of their collateral.

From this point onward, eUSD became a bit of a time bomb.

When the price of eUSD goes down, only a portion of the capital backing eUSD is available for redemption because only some depositors have enabled the option.

Once the pool of "redemption providers" is exhausted, there is no way for arbitrageurs to maintain the price of eUSD.

Redemption providers are offered a fee of 0.5% for becoming one. However, when the price of eUSD is more than 0.5% below the peg, where do we find new participants willing to become a provider?

That's the neat part; you don't.

In fact, the opposite happened…

Liquid ETH depositors make a killing

When the eUSD depegged, there was an opportunity for depositors to close their position on the cheap:- Purchase eUSD at a discount on the market.

- Repay your liquid ETH position in full using the cheap eUSD.

There has been radio silence from the team about how to proceed.

The latest update was this tweet on the 3rd of February:

Strangely, they have been tweeting and interacting as if nothing is happening and the stablecoin is stable.

This is likely part of an "ignore the problem until we have a solution" strategy on their part, which would suggest a solution is in the works.

Where do we go from here?

The path to recovery at this point remains unclear. Yes, the protocol is secure. But I can fill a cup of water, put it in a safe, and call it secure.Really, the response from the team is not good enough. User activity cannot be to blame. It wasn't the users that gave themselves the option to withhold redemptions.

After pondering the available information when something goes wrong, too often in crypto, we find ourselves at the point where there are only three options: sell, buy, or do nothing.

Here they are:

- If we believe that the protocol is done for and there's no route to recovery, or waiting for recovery will result in opportunity cost, we sell.

- If we think that the peg can be restored on time and confidence in the protocol will recover, we buy.

- We do nothing if we are already exposed and do not have full conviction in pulling the trigger on options 1 or 2.

- This is also relevant if we do not have a position in LBR.

The protocol is relatively new, and so the "benefit of the doubt" comes into play. There is a clear demand for the product, and it's a good fit within the LSD-Fi sector.

Our level of exposure is not high, and we're happy to ride it out.

Therefore, in our position, the reasonable option is number 3 - we wait. We give the team a reasonable amount of time to fix the peg and then reevaluate at the end of Q1 2024.

In case you missed it

THORChain (RUNE)

Our 90x had a shaky start to the 2024 public relations campaign after some internal debates within the community went very public:- There is a debate among THORChain developers about the future direction of the protocol.

- The "progressives" want THORChain to keep innovating by expanding beyond cross-chain swaps to stay competitive.

- The "traditionalists" believe it should stick to its original value proposition to avoid overextending resources.

- We are with the "progressives" on this. THORChain needs to keep innovating rather than risk falling behind.

Synapse (SYN)

With no further clarity around whether or not the SYN token will be part of the SYN testnet, here's what we found regarding Synapse:- Synapse's SIN testnet has shown strong activity, with nearly 9 million transactions and over $42B in volume.

- This has generated close to $27M in fees for the Synapse Treasury DAO. The DAO's balance has grown to $17M through fees and grants.

- SYN rallied 119% in early Jan around grant news and 67% later in the month when RFQ went live. Now down 24% in the last week.

- There are some questions about actual RFQ usage. One address is responsible for 99% of the volume, and there is suspected bot activity.

- Uncertainty persists around mainnet and token utility; therefore, the 50x thesis is on hold for now.

Synthetix (SNX)

Slated for investment in 2020, Synthetix was stagnant for a couple of years. All that has changed over the last year, and development has accelerated; here's the latest scoop:- Synthetix has shown solid foundational growth.

- The introduction of Perps V3 Andromeda Release expands Synthetix to Base and aims to enhance trading efficiency.

- New tokenomics offers a better deal with no inflation and an SNX buy-and-burn model.

- And what's more. Synthetix is launching interfaces to improve usability.

Optimism (OP)

Optimism might not have had the best start compared to its main competitor, Arbitrum; however, our latest research suggests that there is still a reasonable projection for growth:- L2 networks have processed a combined 585 million transactions over the past year.

- Polygon, Optimism and Arbitrum have periodically dominated the L2 ecosystem.

- Arbitrum recorded more revenue than Polygon and Optimism combined in 2023.

- Optimism can rise another 9.5x in this upcoming bull run

- OP investors can DCA into three price targets below $3.

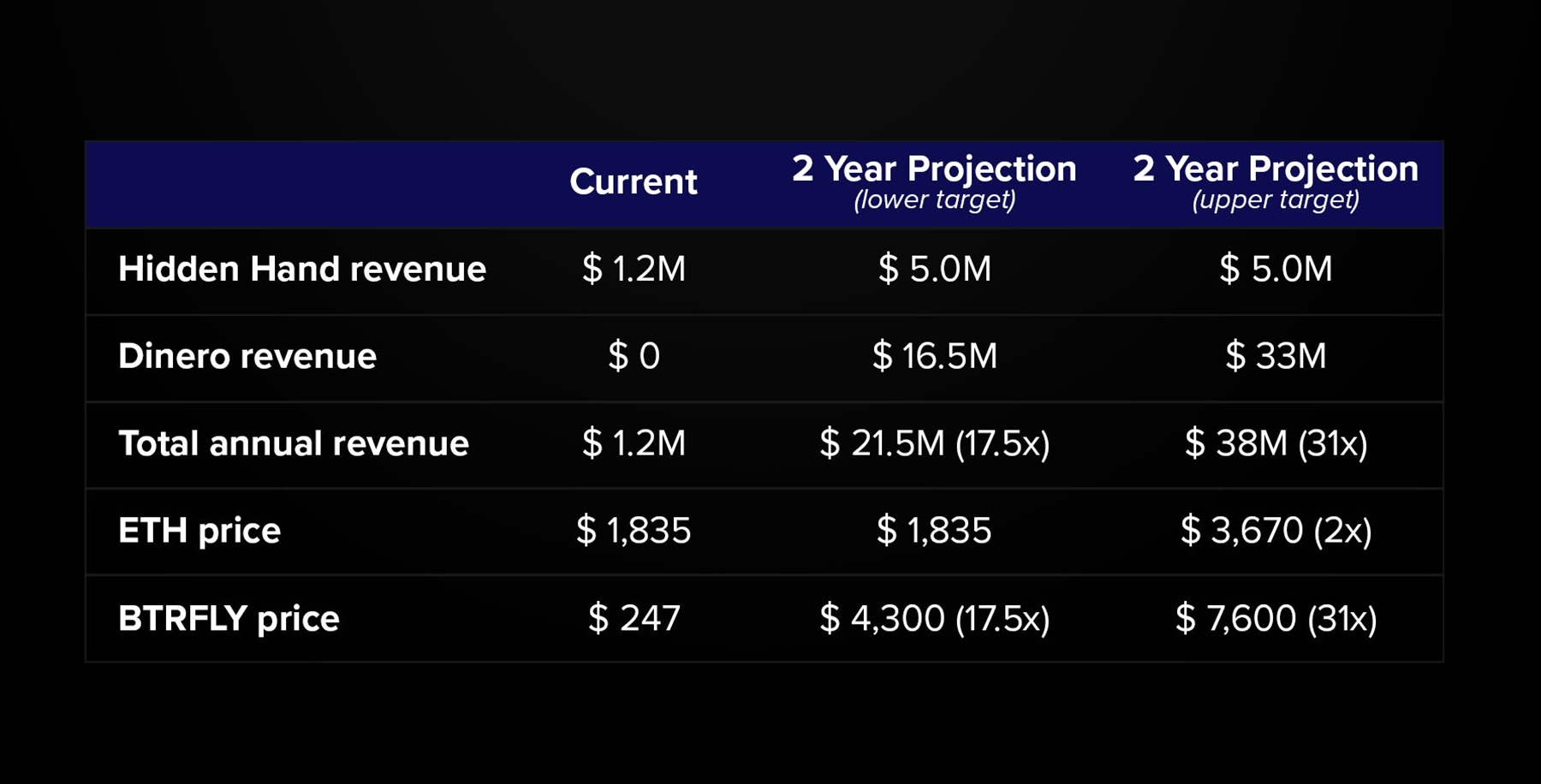

Redacted Cartel (BTRFLY)

One of the more obscure assets we have covered, we are nonetheless confident in our price targets.- In our initial report, we projected revenues for Redacted Cartel for 2024 through 2025, which we believe are still attainable.

- This optimism is partly due to the recent launch of their product, Pirex ETH, which is expected to be a major revenue generator + the fact that the project's other product, DINERO, has not yet been launched and that also is expected to generate a lot of revenue for BTRFLY holders.

- Given these factors, we maintain our valuation estimates.

- The valuations for its Hidden Hand product might end up lower than anticipated. However, an increase in the value of the tokens held in its treasury could offset any slower growth in this area.

For our latest take on Redacted Cartel, click here.

Rollbit (RLB)

Gambloors (in fairness, we all are) will be aware of Rollbit. However, have you listened to our debate on Rollbit, which was streamed last month?

Cryptonary's take

It's important to have a level of diversification in this market. Things go wrong sometimes, and many of the assets we cover are in the early stages of development. That is where the R:R comes into play: no risk, no reward.We will continue to monitor the market and bring you the most important updates throughout the rest of the quarter.

You can expect another report just like this next quarter, but in the meantime:

Don't fumble the bag