In this report:

- The recent performance of SPX

- Community, holders and sentiment

- Technical analysis

- Some passive income opportunities with SPX

- Our take on what is next and how to position

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

On the way to flip the stock market

When it comes to memes, we rarely miss them. SPX6900 (SPX) has become a standout performer in the memecoin sector in recent months. We shared it when it was around $0.01 on September 11, and it has seen a massive 15,900% increase since then. An amazing performance from the asset and community behind it. It achieved a massive 100x since our call before it sold off roughly 60%, which we, of course, called it again.However, we saw that the correction was healthy, and we didn't hesitate to call the bottom of the range and the consequent reversal. Fast forward to today, we have seen SPX break the $1 mark and reach as high as $1.6. Simply speaking, this asset has been one of our highlights in recent months, and we wanted to talk about it more and provide an update.

We want to start with the SPX community. We have been saying for a while that this community is a true, bitcoin-like cult, "seriously" thinking about flipping the stock market. Their mantras like "there is no chart" and "stop trading, believe in something" truly shape the spirit and the behaviour of the asset. Don't believe us? Let's look at the data:

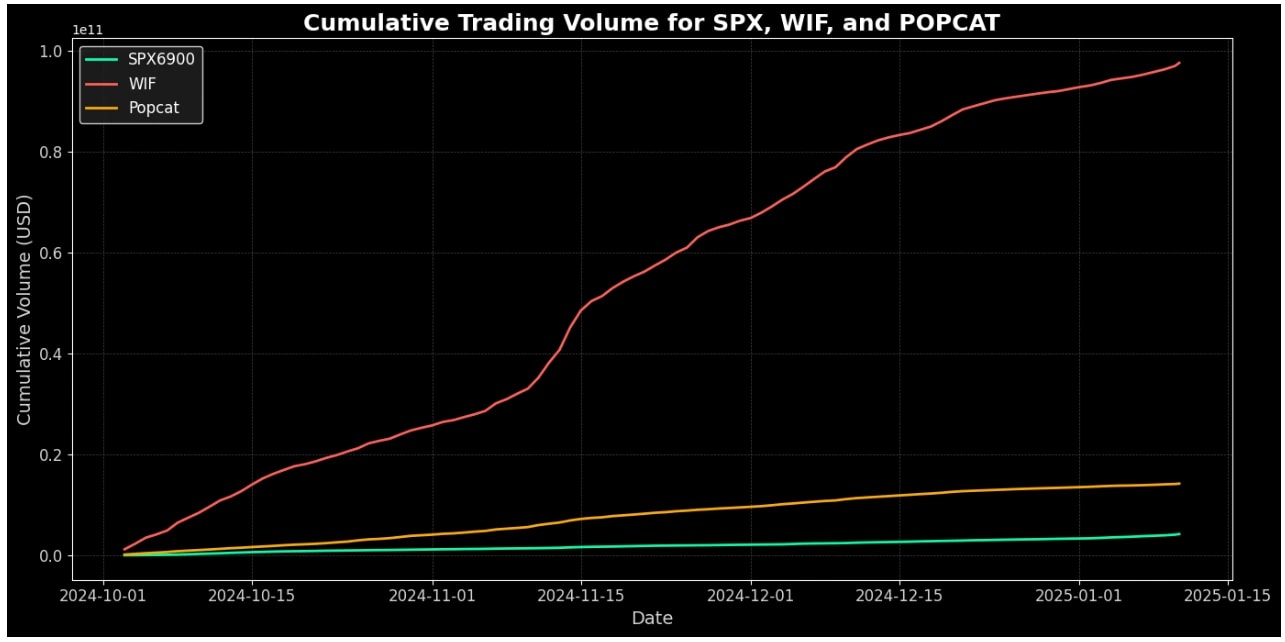

In the last 100 days (since we first shared SPX), the cumulative trading volume for SPX has been so little relative to WIF and POPCAT.

However, when it comes to price action, there is massive outperformance relative to memes and the rest of the market. What does it tell us? No one was selling the asset. The community believes in holding spots and forgetting about things like charts, macro or trading. They believe in it and just hold it. They are truly a cult that believes in something. They are fun on the X platform as well. They don't like charts and block people who post charts online. Quite funny and encouraging when we see such culty behavior in a memecoin community.

Holder count analysis

The interesting thing here is that the cult is growing, and its mantras and slogans are spreading further. Let's look at numbers across 3 chains SPX is traded.Ethereum Chain:

- 10th December: 29,617 holders

- Today: 37,051 holders

- Change: +25.06%

- 10th December: 34,428 holders

- Today: 40,657 holders

- Change: +18.10%

- 10th December: 19,800 holders

- Today: 72,338

- Conclusion: An abnormal spike suggests a redistribution of tokens, likely inorganic or some market makers or exchanges involved.

Sentiment and mindshare analysis

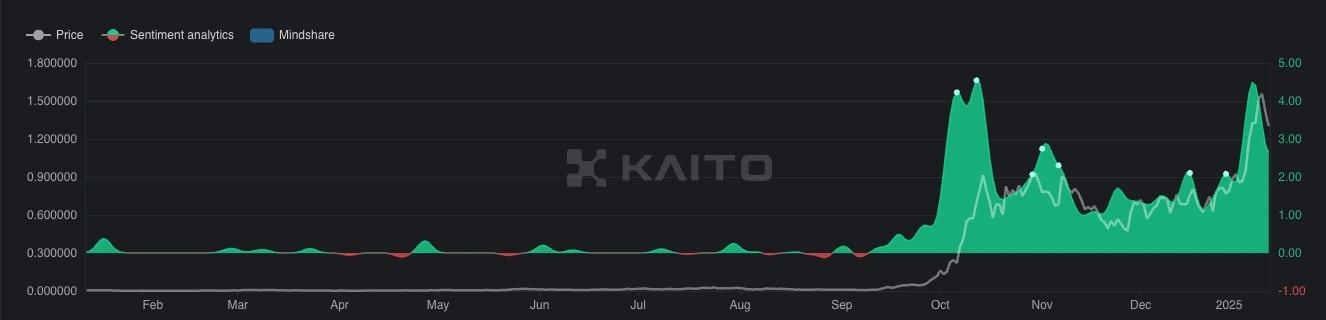

Other than volume, other things seem to be aligned with the recent price action of SPX as well. Let's look at sentiment and mindshare data from Kaito. Generally, The sentiment and mindshare metrics for SPX provide valuable insights into its social media traction and community engagement.Sentiment: it refers to the overall mood or opinion of the crypto community towards specific crypto assets across social media. Kaito uses AI to track conversations on social media platforms to assess sentiment, providing insights into whether the community's perception is bullish, bearish, or neutral. So here is the trend we see

Sentiment Trends:

- October Peak:

- Sentiment peaked at 4.00 - 4.55 when SPX reached its all-time high of $0.99.

- Consolidation Phase:

- During the pullback, sentiment held above 1.00, indicating sustained community interest.

- January Breakout:

- Sentiment surged to 4.49 as SPX broke above $0.99, making a new all time high, aligning with its price momentum.

Mindshare: This one indicates how much attention or discussion a particular token, project, or narrative is receiving within the crypto community. Kaito measures mindshare by analyzing social media engagement, mentions, and the influence of key opinion leaders (KOLs) or AI agents. This metric helps in understanding which projects or narratives are currently trending or gaining traction. So let's have a look…

Mindshare Trends:

- October Peak:

- Mindshare peaked at 1.86, correlating with the sentiment and price breakout.

- Current Status:

- Mindshare is at 0.28, while sentiment is at 2.64, indicating a steady recovery and continued interest despite the recent pullback.

Closing thoughts

SPX's sentiment and mindshare generally remain aligned with its price action, showing consistent community engagement. However, the second breakout hasn't seen an equivalent spike in mindshare, again suggesting that this move was probably caused by some exchanges or market makers. Important to note that this remains just a hypothesis for now.Technical analysis

We know that you guys will say, "there is no chart," but come on, let's have some fun. Despite the recent market-wide selloff, SPX is exhibiting, considering the wider market, a structurally sound price action. However, we have seen a considerable pullback in the last few days.

Historical price movement

- October 2023 local high:

- $SPX reached a high of $0.99 in early October before entering a consolidation phase.

- This period spanned 2.5 to 3 months, with a 55% retracement for a healthy market resetting.

- Consolidation:

- $SPX ranged between $0.91 and $0.581, briefly dipping below $0.581 to $0.475 levels in mid-November.

- It later broke above $0.91 in late December, signalling renewed momentum.

- January 2024 breakout:

- $SPX surged 64% from $0.99 to $1.626 between January 2nd and 6th.

- The breakout reestablished bullish momentum. However, we are seeing a market-wide correction at the moment.

Closing thoughts

Let's be real - it is clear that we are bullish on the community and the meme. However, we have recently highlighted the broader market-wide risks that can cause significant troubles for capital markets.To be short, the global liquidity has tightened and isn't likely to improve in the coming months. Trump's policies risk ending up being inflationary, which reduces the likelihood of further rate cuts. Just a few weeks ago, the market was expecting multiple rate cuts. However, today, the possibility of even one cut is still debatable. The short-term doesn't look very promising.

Therefore, the macro environment will likely be choppy in the following months and maybe even quarters. Thus, we believe SPX can experience a deeper pullback to as low as around $0.6-$0.75 in the short term. Again, these targets might not be reached, and there is no reason to panic here. However, all things considered, there is a good possibility that we will see these prices in the coming months. We will be bidding heavily in those areas.

How to buy SPX

- Step 1: Choose a centralised exchange for fiat on-ramp

- Step 2: Create and verify your account

- Sign up for an account on the chosen exchange and go through the verification process.

- Step 3: Deposit funds

- Deposit funds into your exchange account. You can typically use bank transfers, credit/debit cards, or cryptocurrency transfers.

- Check the exchange's supported payment methods if you are depositing fiat currency (like USD or EUR).

- Step 4: Buy SOL if you intend to buy SPX on Solana/ETH for Ethereum or Base

- Navigate to the trading section of the exchange.

- Search for the SOL or ETH trading pair (e.g., SOL/USDT, ETH/USDT)

- Decide on the amount of SOL you want to purchase and choose between a market or limit order.

- Market order: Buy SOL/ETH at the current market price.

- Limit order: Set a specific price at which you want to buy SPX. The order will be fulfilled once the market reaches your specified price.

- Review the order details and confirm the purchase.

- Step 5: Withdraw SOL/ETH to your wallet

- Step 6: Install Phantom/Metamask wallet

- Download and install the Phantom/Metamask wallet extension for your browser from the official websites above.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure. Keep it safe!

- Step 3: Fund your wallet

- On Ethereum/Base: Deposit Ethereum-supported tokens like ETH/USDT/USDC to swap them for SPX.

- On Solana: Deposit Solana-supported tokens like SOL/USDT/USDC to swap them for SPX.

- Step 4: Use the built-in swap feature

- Open the Phantom/Metamask wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDT) and select SPX as the output.

- SPX contract address:

- ETH: "0xe0f63a424a4439cbe457d80e4f4b51ad25b2c56c"

- SOL: "J3NKxxXZcnNiMjKw9hYb2K4LUxgwB6t1FtPtQVsv3KFr"

- Base: "0x50dA645f148798F68EF2d7dB7C1CB22A6819bb2C"

- SPX contract address:

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom/Metamask wallet.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated SPX balance in your Phantom/Metamask wallet.

Cryptonary's take

SPX has recently become one of the strongest assets; despite the wider market sentiment shifting from memecoins to utility, it has demonstrated very strong performance. An abnormal spike in holders on Base might be the signal that a Tier-1 exchange or a market maker is getting involved, which, generally speaking, will be positive for the assets.We are bullish on the community and believe it will be higher by EOY. We also believe in our base targets for SPX. However, we need to remain flexible here. The recent macro data and the overall environment are signalling some caution. Therefore, the coming months might be a bit shaky, and we need some upside confirmation before we start taking substantial risks.

Thus, we believe that there is a decent probability that SPX is due to a deeper pullback. If you are a holder, you can just sit on the spot and DCA when it goes lower. If you feel overexposed, it is always a good idea to take some chips off the table and have dry powder to deploy lower.

There is also an opportunity to yield-farm with SPX and earn some passive income while we wait for better market conditions. Here is our video tutorial on how to do that.

Peace!

Cryptonary, OUT!