The token is part of the Decentralised Finance (DeFi) ecosystem. One of the great aspects of DeFi, is protocols generate revenue through usage of those platforms. This in turn, is split between token holders that are staking. This does two things:

- Fundamentally valuable token through earnings

- Lock in supply (applies upward pressure on price)

In this journal we outline the full staking process for the 20X token, in addition to the risks associates with it. In reality, there exists two different methods: one that is native to he protocol that's quite complex while the other is much simpler and user-friendly.

Introduction

As you are aware, there’s more than one way to make a profit in the DeFi ecosystem other than simply holding assets for raw gain in price action. In this journal we will be going through a few of the options available for earning rewards by staking tokens.

Protocol-Native Staking

One option for SNX holders is to stake their tokens directly through the Synthetix network. Let’s have a look at the processes, the risks and the rewards!

SNX stakers receive 2 types of rewards:

- SNX staking rewards created through the inflationary monetary policy.

- Synth exchange rewards, which are generated by fees from trades on the Synthetix exchange.

These rewards equal a combined total of ~30% APY at the time of writing, although this is variable and in the longer term will not be as lucrative.

How does it work?

In order to stake SNX participants must mint sUSD through the staking.synthetix.io website:

- In order to mint sUSD the staker needs to stake SNX at a certain Collateralisation Ratio, normally between 600 to 750% (C-RATIO (%) = [Staked SNX / Minted sUSD] x100). This is subject to regular adjustment so stakers need to be aware of any changes to the ratio. Staker funds are also at risk of liquidation if the C-RATIO goes below 200% and has remained under 500% for 3 consecutive days.

- Stakers must manage their own assets in order to stay at parity with or above the C-RATIO.

- This is done by burning minted sUSD to increase the ratio or minting sUSD to reduce it.

- Weekly rewards can be claimed if the Staked SNX/sUSD ratio is maintained above this level.

Risks

Staking SNX through the network comes with some risk to your capital, other than variance in the price of SNX:

- When SNX stakers mint sUSD they create a debt that is equal to the amount of sUSD initially minted.

- Once minted, this debt is variable and is shared amongst all stakers as ‘Network Debt’ in proportion to the value they have staked.

- Debt is increased when traders on the Synthetix exchange are profitable, and is decreased when they are unprofitable.

- There are several strategies to avoid accumulating more debt as the market moves; the most common is to use your sUSD on the Synthetix exchange in positions that mirror the global positioning of traders – win when they win and lose when they lose, however they aren’t receiving the rewards for doing so!

This all sounds very complicated, so here’s a simplified practical example of the debt system:

- John & Jessica start with $50,000 sUSD each. Together this equates to $100,000 in network debt, of which each of them is responsible for 50%.

- John purchases sBTC with his $50,000 while Jessica simply holds sUSD.

- BTC increases by +50% in price which means his position is now worth $75,000, raising the network debt to $125,000 ($75k + $50k)

- John and Jessica are still both responsible for 50% of the network debt each. At $125,000, each one owes $62,500 to Synthetix. John's holdings increased in value by 50% ($25,000) which means he gets to keep $12,500 in profit after paying his $62,500 share of debt. Jessica on the other hand realises a loss - a loss for which earning network fees may not have compensated.

An individual staker must pay off their debt by burning sUSD before they are able to unlock their staked SNX. As you can see from the example above there is inherent risk involved in this process if you are not participating in the market in some capacity. This hands-on approach relies on the staker being active in managing their assets in order to maximise returns and minimise potential losses from movements in the Synth market.

SNX rewards are held in escrow for 12 months. Escrowed rewards cannot be transferred from the Synthetix network before the escrow period has passed; however the original stake amount can be freely transferred once you have cleared your debt giving you some degree of flexibility. Rewards can, however, be re-staked allowing for compounding returns.

Gas Fees

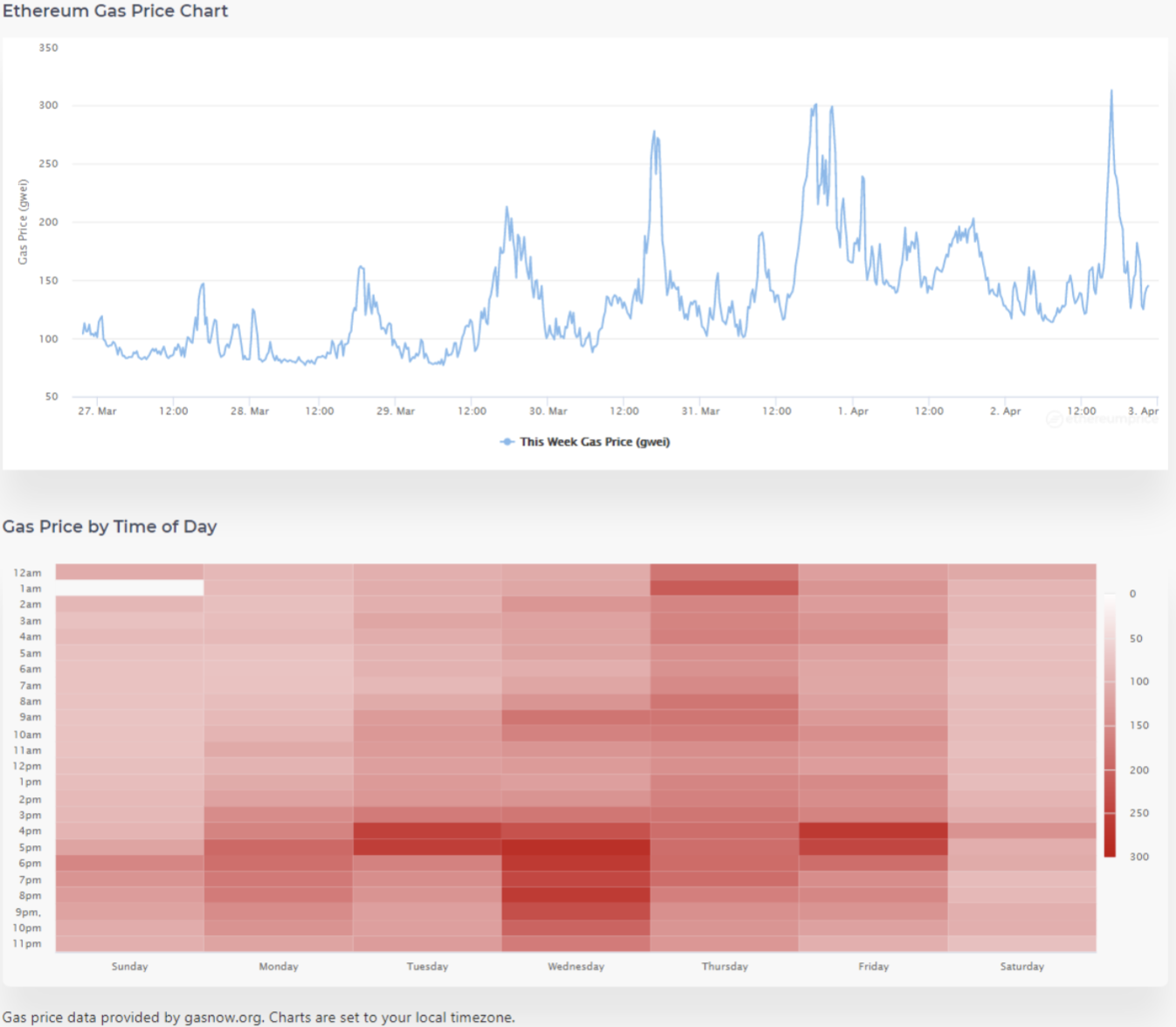

As you are aware, gas fees on the Ethereum network are extortionate at the moment and this directly affects the cost of minting sUSD on the Synthetix network. L2 will fix this, however currently many users with lower amounts of SNX staked on L1 are unable to claim rewards due to these high fees and stakers should be aware of this before staking smaller amounts of SNX. Staking is available on Synthetix Layer 2 however exchange functionality is not currently implemented. L2 staking is fee-minimal and provides SNX holders with less than 250-500 SNX a more profitable staking opportunity.

PRO TIP

High fees can be partially mitigated by choosing to mint/burn sUSD and claim rewards at times when the Ethereum network has lower traffic (at weekends and later at night/early morning GMT). This is true for all Ethereum based transactions not just Synthetix transactions.

Celsius Network Lending

Celsius is a centralised wealth management platform facilitating collateralised crypto borrowing and lending.

How does it work?

In order to borrow from Celsius you must put up crypto collateral equivalent to your desired loan at an LTV (loan-to-value) ratio ranging between 50% and 25% (2x and 4x your desired loan, respectively). This sounds counter-productive – why should I have to put up $4000 worth of crypto in order to borrow $1000?

Basically, this allows you to maintain your crypto holdings and receive a portion of your portfolio value (up to 50% depending on the collateral asset) as a loan subject to interest, meaning you do not have to sell your crypto and miss out on potential gains in the future if you need liquidity for whatever reason in the short to mid-term.

SNX

Celsius provides an opportunity for anyone to lend their cryptocurrencies and receive an annualised percentage yield. SNX is supported and currently has a 13.99% APY for SNX rewards, or an 18.99% APY for CEL token rewards.

CEL Token

CEL is the token linked to Celsius and can be held or used by anyone. Each week Celsius purchases CEL tokens from exchanges using interest accrued through lending and then uses the CEL to pay investors and lenders rewards for providing their capital – up to 80% of Celsius revenue is shared with users, who benefit not only from interest on investments but also can receive a 30% discount on their interest payments from any loans they have taken if they use CEL to pay.

Risks

Although centralised, lending SNX through Celsius comes with a lower risk and does not require anywhere near the same amount of time and supervision compared to staking directly through the Synthetix network.