State of the Market: Bullish trends, memes, and narratives

Welcome to our Q4 State of the Market report. A lot has changed since our last state of the market, from AI Agents to dino coins and DeFi; we have definitely entered bull mania, so strap in and let's dive into our final state of the market report for 2024.

In this report:

- The market is heating up

- Return of the dino’s

- AI agents are alive

- Defi is back

- When do our memes start to move?

- Following the hot ball of money

- Regulatory landscape

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The market is on FIRE!

So unless you have been under a rock, this Q4 has been insane for crypto prices, with BTC up over 50% this quarter. With this came a huge rise in funding rates and open interest, which, while still elevated, have dropped substantially from the recent nuke from 101k to 91k. While they do remain high, it is important to understand that funding rates and open interest are typically high in bull markets.And while almost all of 2024 has been really bad this month, we have definitely seen a shift in the tides. We will jump deeper into the hot sectors that are bustling with opportunity later on in the article, but for now, let's take a look at the chart below.

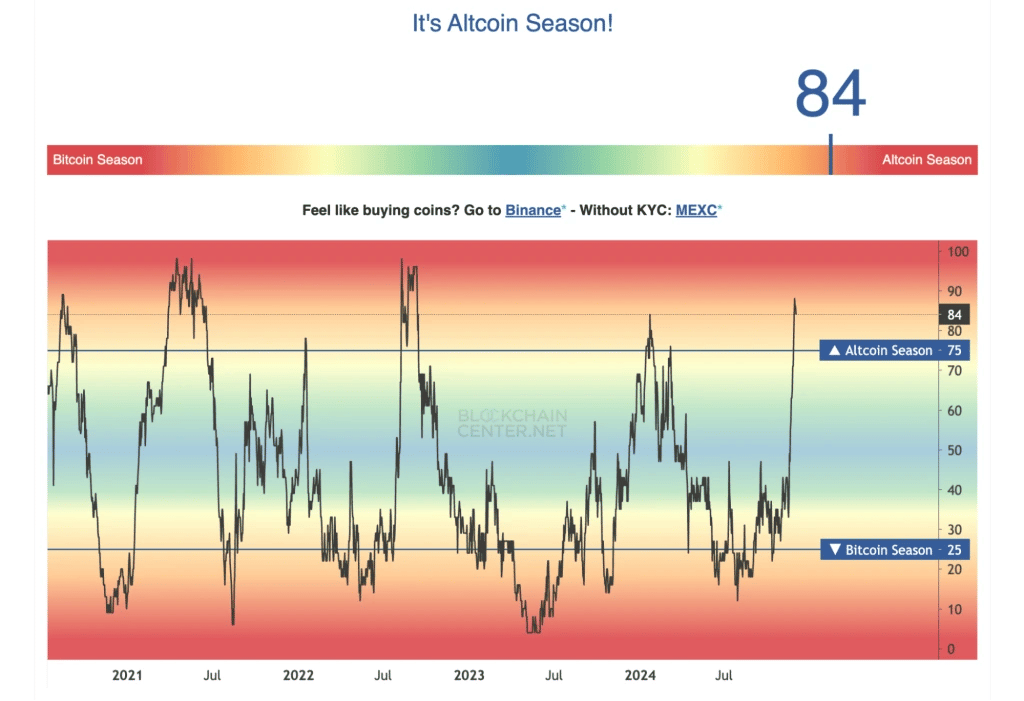

From this chart, which measures the top 75 coins vs BTC over the past 90 days, we can see that after all the pain, we have finally reached alt season in this past week and a half. Now, we don't know how long it will last, but typically, we can expect several weeks to a few months of momentum in alt land.

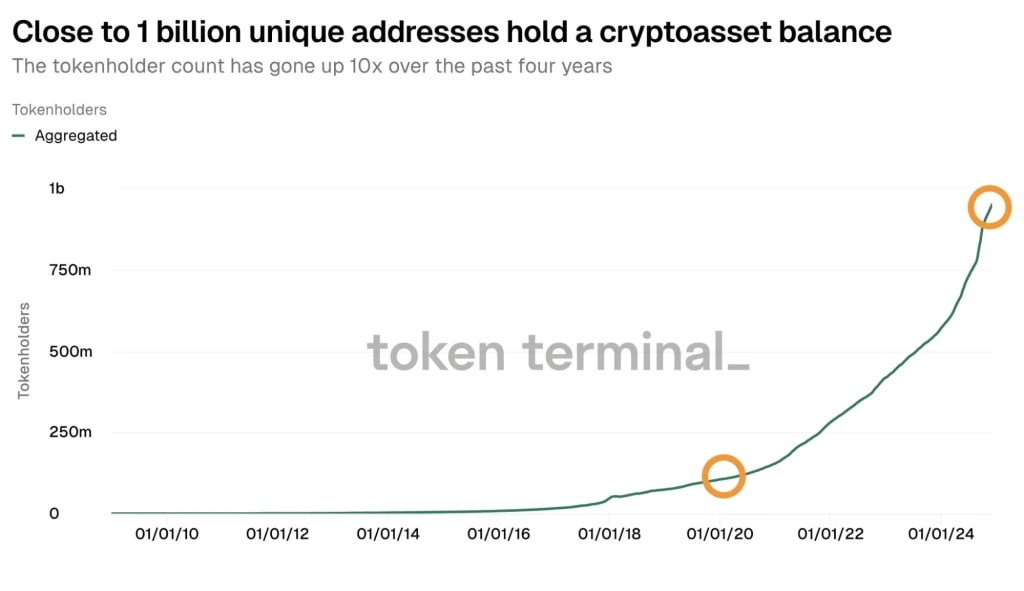

We can also see that adoption-wise, we are moving at speed as well! With almost 1 billion unique crypto addresses (obviously, it isn't 1:1 with a human), it is a 10000% increase in just 4 years, and the curve is getting steeper. This shows just how much interest is growing overall when it comes to crypto.

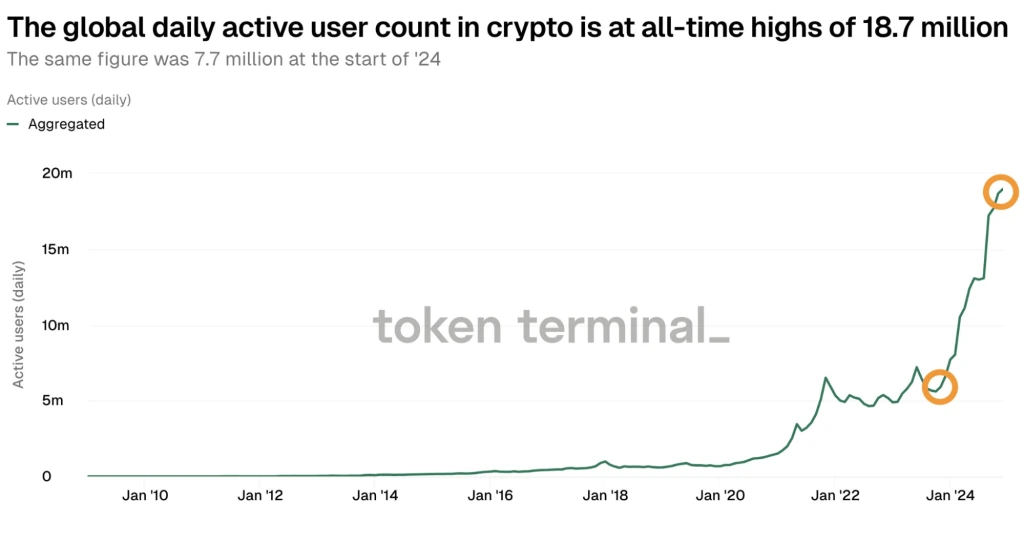

Additionally, the global daily active user count has also been mooning like crazy since the start of the year, almost quadrupling. This shows that more and more people are finding out about crypto and spending time being active on-chain, which means adoption is happening, and it's happening faster and faster every year.

And while 18.7 million seems high, it is important to note that it is only equal to roughly 0.24% of the world's population. Meanwhile, it is estimated that 3.6 billion people use digital banking on a daily basis, meaning that we still have a ton of upside to cover!

So, without further ado, we will dive into some of the hottest sectors in crypto of this quarter.

Dino coins - Back from extinction

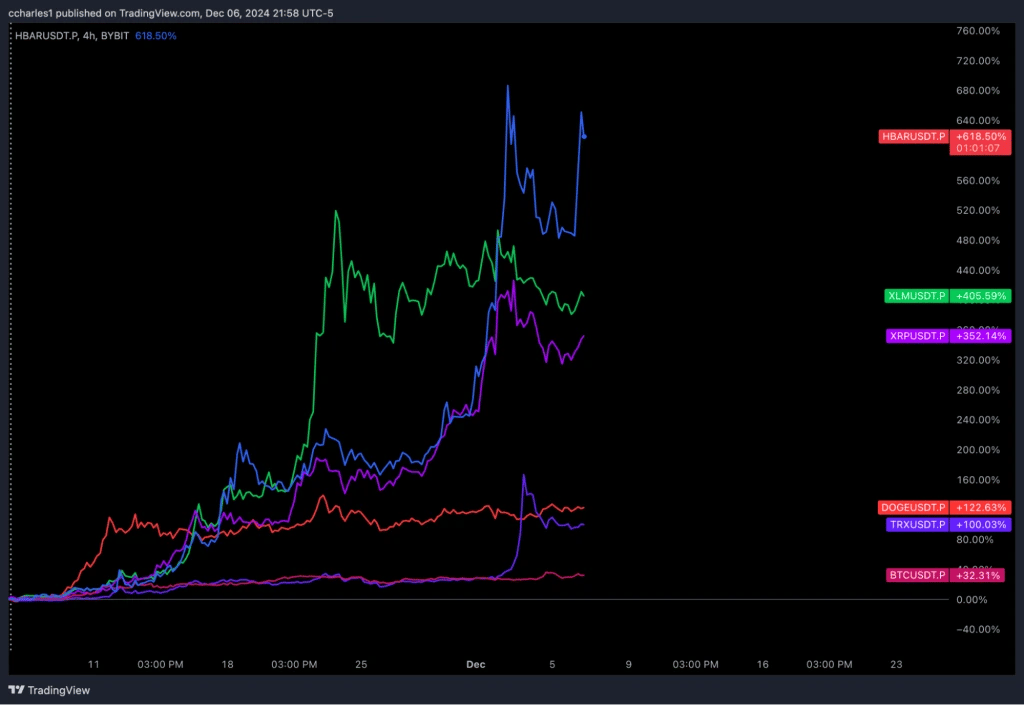

With the recent spark of altcoins, some unlikely contenders have appeared. We can see just how much these dino coins have pumped relative to BTC in our comparison chart below.

So what sparked the change of interest from the then-hot meme coins to Dino coins? The consensus is that with the new office change upcoming in the USA along with the crypto-friendly chair of the SEC, people are starting to think that big changes are coming to the regulatory space of crypto. Therefore, the idea is to bet on coins that have been around for a while, as those are seen by retail as the old faithful picks, and so far, it has worked.

An insane highlight of this is XRP, which, after the announcement of Trump going into office, rose 400%, adding over $100b in market cap in just over a month. However, in the long term, we aren't that hyped about it as only 43% of the overall supply is in circulation now, and the coin itself is also pretty weak fundamentally. Thus, there is more hype than substance here.

Overall, for the OGs, it is good to finally see some pickup around the dino coins; however, we wouldn't recommend chasing the pump. While prices could continue flying, it is prudent to note that it IS a bull market, meaning that opportunities are endless and there will be better risk-adjusted bets in the future.

AI agents

The next sector we want to talk about is AI agents; while we did talk about this in a recent article, we thought an update was important. As we can see from our tracker image below, the total market cap of AI Agent coins has eclipsed 8 billion dollars. What started off with GOAT, which went from $0 to $1bn in only 32 days, sparked a mass injection of AI Agent coins into the space, with many running to multiple millions in market cap like AIXBT, FARTCOIN, and ZEROBRO.Additionally, the main platform for launching these AI tokens, Virtuals, has also run an incredible 100% from our first time covering it. But with all that being said, what is our outlook on them going forward?

![]()

For now, we think this space is very interesting, and as we can see, the agents attract a lot of attention. However, with this being said, they are very easy to replicate, giving us a pause when it comes to long-term sustainability. However, while the market remains hot, we think that AI agents are not the best thing to bet on right now.

Return of DeFi

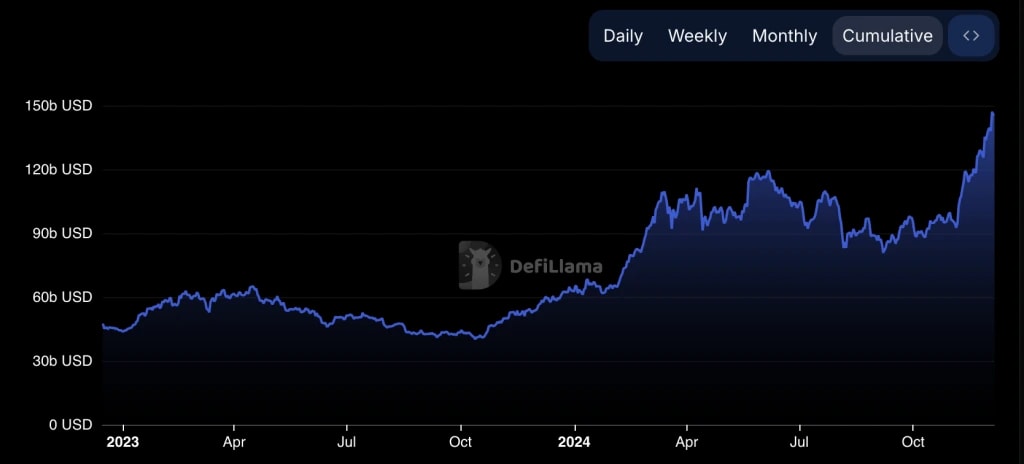

Another sector that is coming into the light is DeFi, and rightfully so! DeFi is one of the biggest attractions to crypto, and as we can see from the chart below, TVL in DeFi has grown 3x since the start of 2023. And with that rise of TVL has come some crazy gains from DeFi tokens as well like Uniswap, Aave, Sushi, 1inch, and one of the newer ones this cycle, Ethena.

The rise in DeFi TVL isn't all that's going on in DeFi land. With all the funding rates reaching higher and higher as we get into the bull market, stablecoin APY will continue to reach higher as well. For example, right now, the APY on stables from Ethena is a staggering 27%, which, if maintained through the year, would outperform almost every single hedge fund in the TradFi market. Despite the high and sustainable yield that is offered, there are also risks, and we covered them extensively here. This shows that the DeFi boom has opportunities not just for the coins that are going up but also for your stablecoins. We have our eyes on some excellent yield farming opportunities, and we will cover them soon.

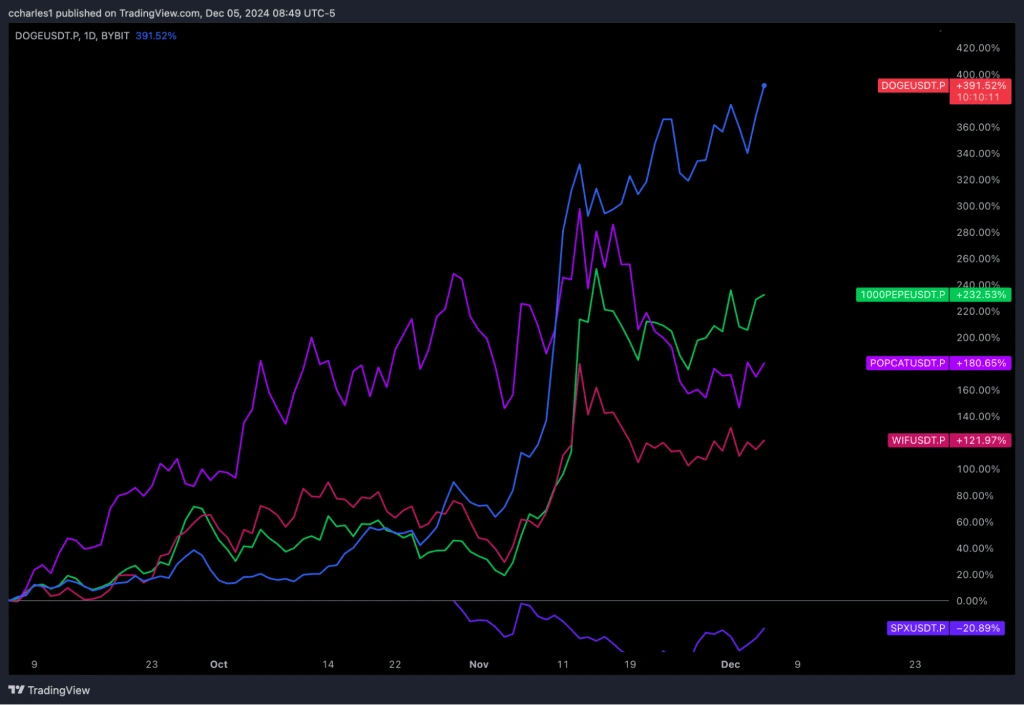

Are our memes dead?

So, in the past 3 months, we can really see that our picks, WIF, POPCAT, and SPX, have quite underperformed the OG memecoins like DOGE and PEPE. So, is this a change in the market? Well, in our opinion, we don't think so. In fact, we believe that the movement and strength of the OG meme coins spell out an even more bullish case for our memes going forward.

And while things do remain quiet for the most part, things are happening. For example, WIF recently got onto Coinbase, and SPX was listed on KuKoin. Additionally, each of our picks has maintained a bullish market structure, which helps with the long-term bull case. Overall, memes are very much alive as a whole, but the way liquidity works is it usually trickles down from the bigger, more well-known memes to the new generation. Because of this, outperformance at the start of the run is to be expected, and we are set to keep on holding until things pick up again, which they inevitably will!

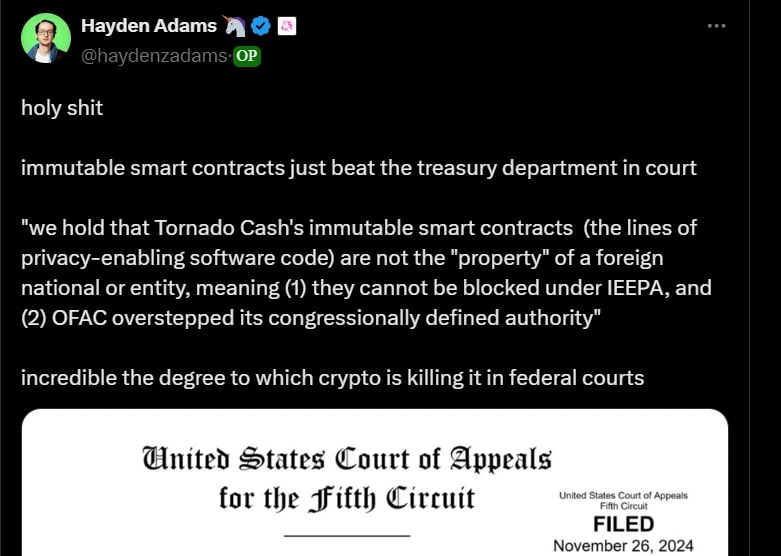

The regulatory landscape

While the regulatory landscape has already improved dramatically, we think this new development is causing a significant bullish headwind. We spoke about this in our privacy piece regarding privacy tools, but more importantly, we think that the biggest development is that the code is now a neutral expression, meaning that it cannot be sanctioned or banned in countries anymore.This is not only big for privacy but also for DeFi and L1s. This lets more of the regulatory scrutiny fears ease and helps investors have more confidence when approaching these coins.

So what exactly did happen? Recently, the US courts ordered Tornado Cash smart contracts to be unsanctioned, ruling them as not property of any foreign national or entity, meaning that users of such products can not be prosecuted for using them, and the product cannot be blocked. But, as we said at the start, this means more than what means the eye.

So what exactly did happen? Recently, the US courts ordered Tornado Cash smart contracts to be unsanctioned, ruling them as not property of any foreign national or entity, meaning that users of such products can not be prosecuted for using them, and the product cannot be blocked. But, as we said at the start, this means more than what means the eye.

What this really means is users of smart contracts, whatever they are, cannot be under any legal scrutiny for using them as long as they aren't committing crimes. This is important because it further legitimizes crypto products such as DeFi products and other decentralized tools. Another bullish headwind regulation-wise is the new SEC chair, Paul Atkins. Atkins is known for his pro-business stance and for being a strong backer of cryptocurrencies. This is very bullish as the ex-chair Gensler was vehemently against most things crypto-wise and took a harsh stance against most crypto products. Additionally, the Biden administration was rumoured to have run Operation 2.0, which was also a way to unbank crypto users. These two huge changes, chair-wise and in government, will play a big part in the future of cryptocurrency.

Overall, we can see that just this quarter alone, we have erased years of grinding gears and replaced them with real progress when it comes to regulation. These changes are important, and going forward, they will open up many more opportunities for more people to get involved in the space, which means more adoption and a brighter crypto future.

Cryptonary’s take

With the bull market, there is always tons of money to be made as long as you get the narratives for the week/month right, but oftentimes, where people go wrong is they try to chase every single pump in every single sector; this almost never ends well. In reality, the best move to make right now is to stay allocated to the bags you have now, be it memes, majors, DeFi, whatever it is, just hold on!This is because from looking at our chart below, we can see that we are still quite far from where our models predict the end of the bull market is, and even though we are in alt season now, typically, alts pump hard the closer we are to the end of the cycle.

Thus, we advise holders to practice patience and hold on for the ride ahead. If, however, you sold too early or you are now sidelined, don't worry; it's not over for you. From what we can see across most of the charts, things are very elevated, and leverage flushes are very common in bull markets. Typically, this happens when BTC begins to draw back, which can typically be anywhere from 10-20%; usually, alts will drop double that. This is where the opportunity arises to get in and hold for the remainder of the bull.

So regardless of whether you are in or not, the future is still very bright and full of new opportunities, be it new sectors, old ones waking up or chances to buy the dip, and there is still an abundance of wealth to be made!

That's all for us.

Cryptonary OUT!