State of the Market: October 2025

Crypto just endured one of the largest liquidation events in its history, with more than $19B in positions erased as last Friday's selloff rippled across markets. Yet by Monday, most major assets had recovered sharply. WTF has happened? Let's break it down and how to position heading into Q4...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Black Friday

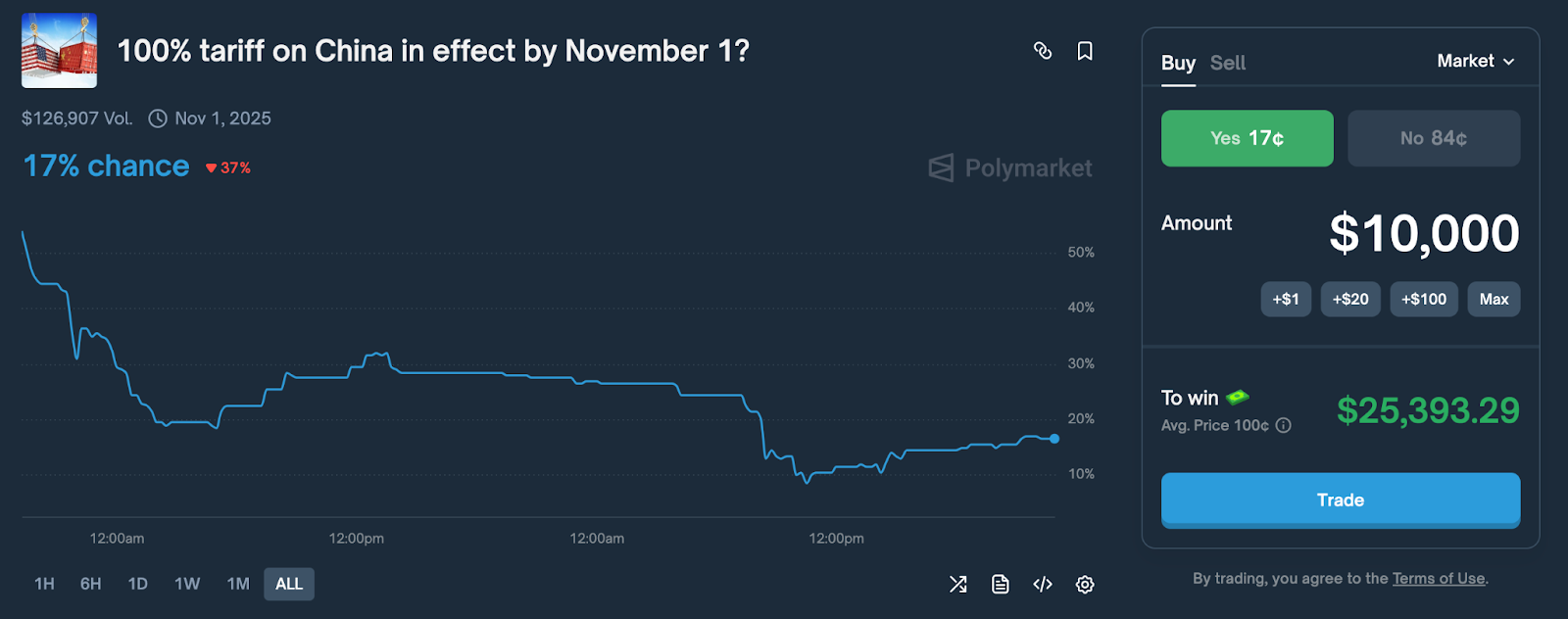

Markets started the second week of October with cautious optimism. Bitcoin held near $121,000, the S&P 500 hovered just below record highs, and liquidity conditions were improving across both traditional and digital markets. By Friday evening, that sense of calm had turned to chaos.The sequence began on October 9, when China imposed new restrictions on rare-earth exports, weaponising materials critical for semiconductors and electric vehicles. This marked the latest escalation in a trade standoff that has shaped much of 2025. Less than twenty-four hours later, President Trump issued an official statement on Truth Social, announcing a 100% tariff on all Chinese imports effective November 1.

The announcement landed just fifty minutes after U.S. markets closed, one of the thinnest global liquidity windows of the week. The reaction was swift and severe. U.S. equity futures tumbled, and the S&P 500 fell 3.4% to 6,552.51 in its sharpest single-day drop since April. As sellers scrambled for safety, the panic quickly spread to crypto.

The Liquidation Cascade

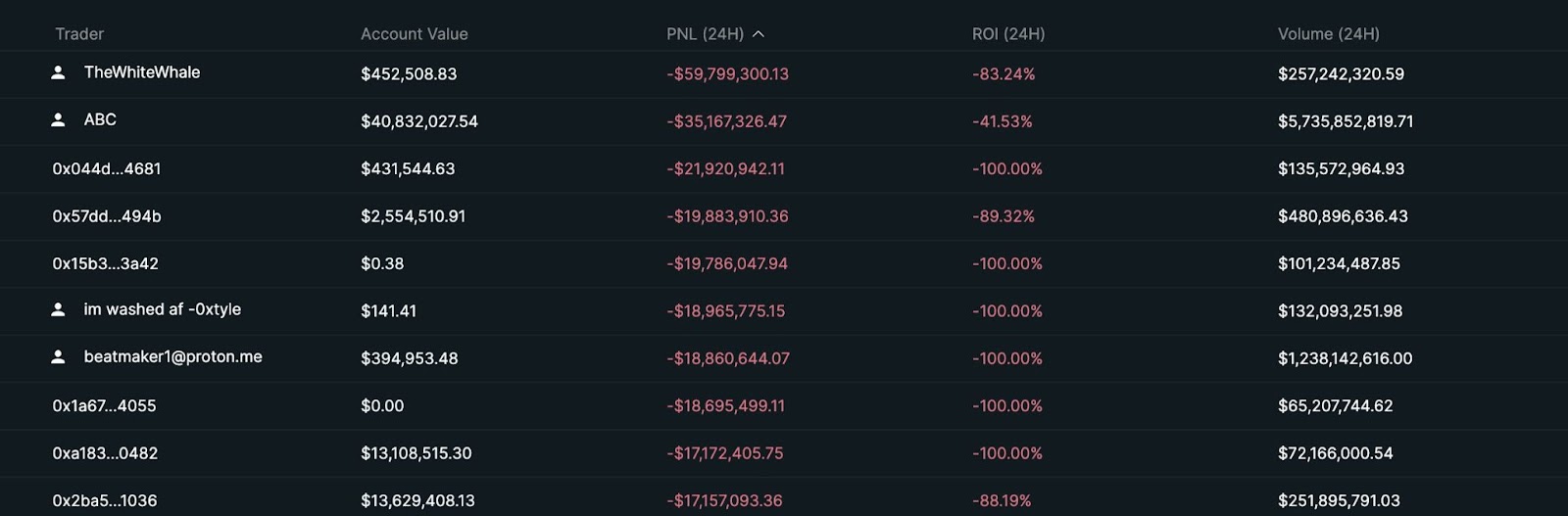

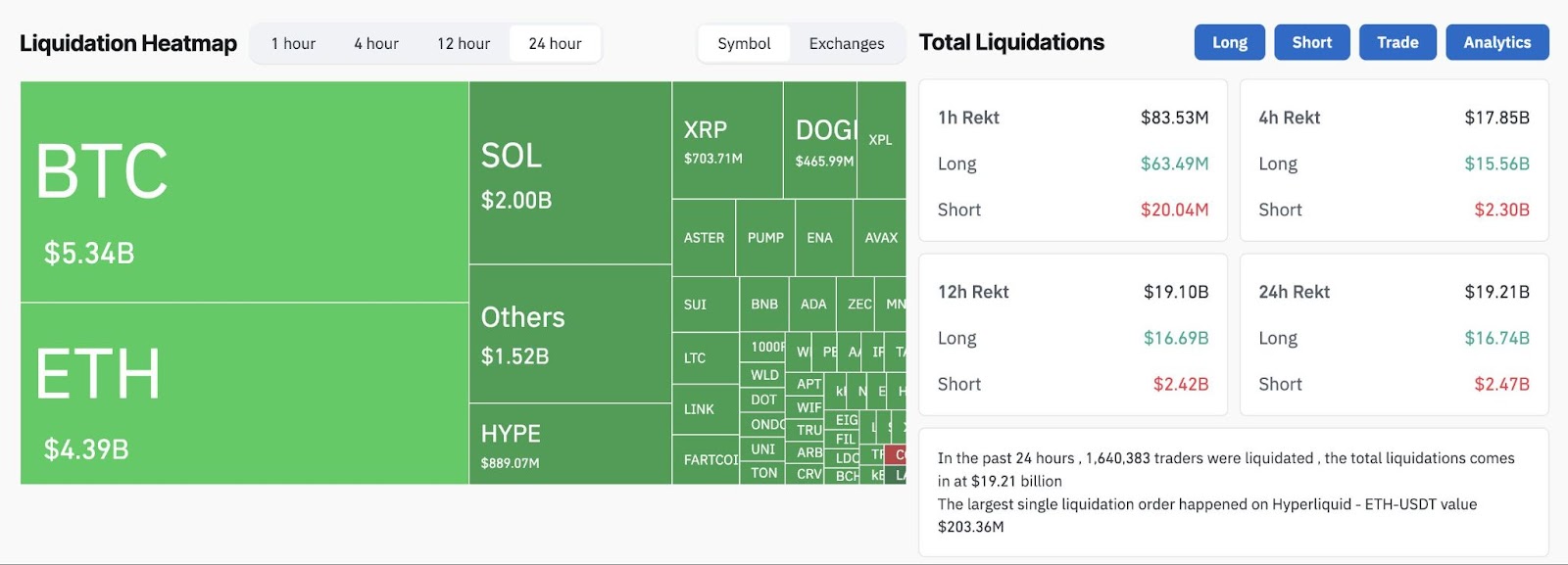

The selloff that followed exposed deep structural weaknesses across both centralised and decentralised markets. More than $19B in positions were liquidated, nine times larger than any previous single-day event, with 1.64m traders affected. According to Coinglass, 206 accounts lost over $1M each, including one trader on Hyperliquid who reportedly lost their entire $60M account.

The cascade was amplified by excessive leverage and an overheated derivatives market. Funding rates had remained elevated for weeks, and open interest across major venues was near cycle highs. Once margin thresholds broke, liquidation engines began firing across exchanges, triggering forced selling that quickly outpaced available liquidity. ETH and SOL fell 20–30% within minutes, while altcoins like ATOM briefly printed near-zero bids before rebounding.

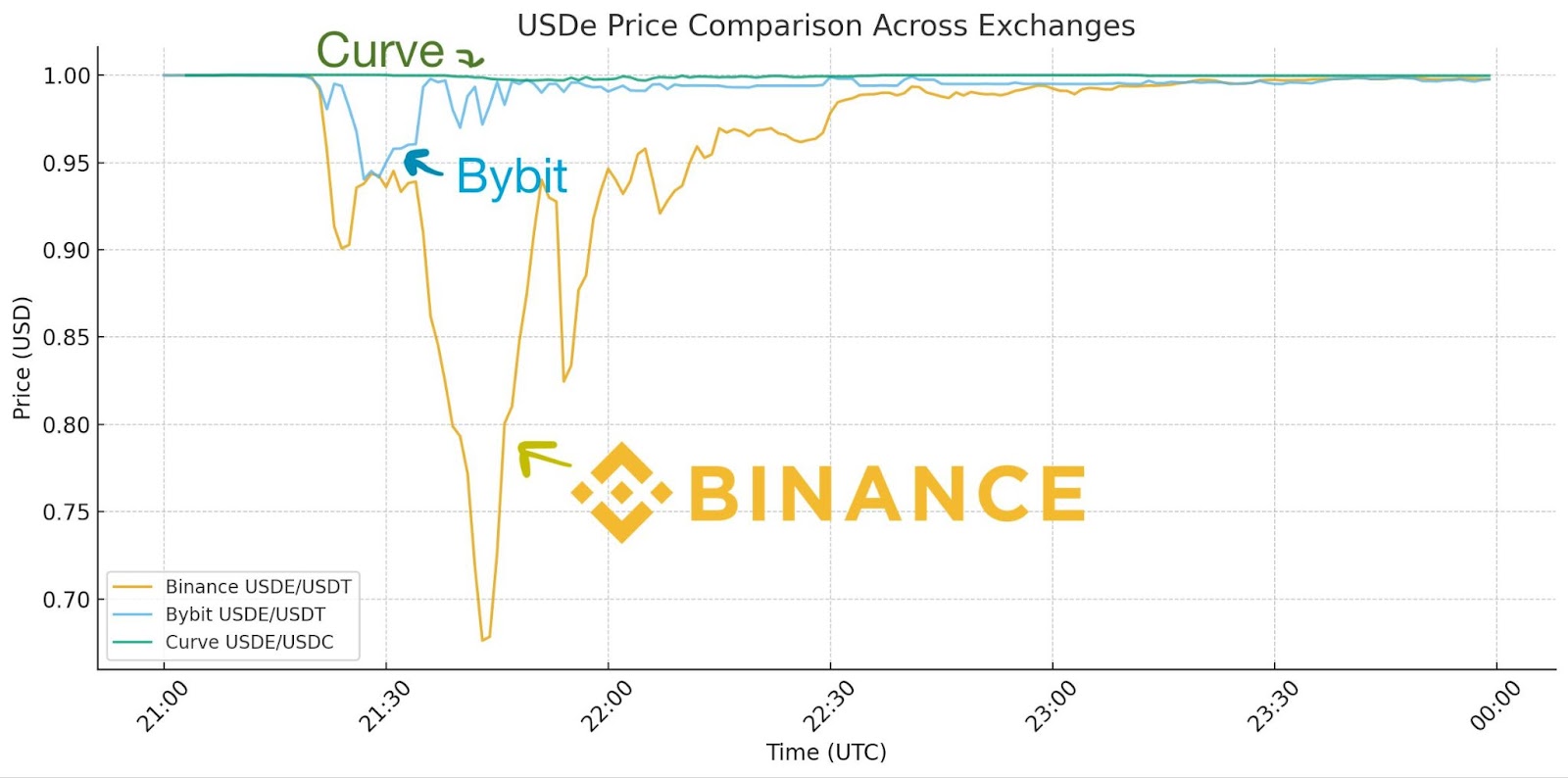

Binance sat at the centre of the breakdown. Cross-margined accounts began auto-liquidating wrapped assets such as wBETH and BNSOL at irrational discounts of up to 90% as oracle systems failed to distinguish between temporary illiquidity and real value loss. The exchange's internal pricing relied on its own shallow order books instead of referencing deeper on-chain venues, turning what should have been a short-lived dislocation into a system-wide contagion.

Because Binance remains one of the largest spot reference sources for the entire market, many derivatives platforms and decentralised exchanges use its prices within their own price index feeds. When Binance's quotes diverged from fair value, those same distortions cascaded outward, feeding into liquidation engines across multiple venues that mirrored the same faulty data. As prices fell further, market makers lost confidence in reference feeds and began pulling liquidity, widening spreads and accelerating the collapse.

The same flaw mispriced Ethena's USDe, which fell to $0.62 on Binance after roughly $60m-$90m in selling pressure distorted its local market. Since Binance used that price to value collateral, many leveraged accounts were liquidated even though USDe remained stable elsewhere. On-chain venues such as Curve and Uniswap showed minimal 20–30bps dislocations, confirming that the issue was isolated to Binance's infrastructure.

Ethena's founder later confirmed that the protocol's mint and redeem functions remained fully operational, processing over $2b in withdrawals within 24 hours. Analysts estimate that Binance's internal pricing error alone accounted for $500m to $1b of the total liquidation wave.

As the event unfolded, Binance's systems came under heavy strain. Deposit and withdrawal queues delayed arbitrage flows, while interface glitches briefly displayed "zero price" errors for assets like ATOM. With insurance funds nearly depleted, the auto-liquidation engine continued unwinding collateral across cross-margined accounts until the exchange intervened manually. Binance later confirmed a module malfunction and reimbursed roughly $283M in user losses within 24 hours.

As centralised exchanges struggled to stabilise, decentralised platforms showed mixed resilience. Hyperliquid triggered its first cross-margin Auto-Deleveraging (ADL) event in over two years, forcibly closing profitable shorts to maintain solvency across the system. While the mechanism functioned as intended, it reignited debate over fairness and risk distribution during extreme volatility. Still, Hyperliquid maintained full uptime and executed liquidations as it was designed in an open and transparent manner.

The episode highlighted how structural fragility, flawed oracle design, and excessive leverage can transform a contained macro shock into a full-blown liquidity event. Binance's pricing errors magnified the fallout, but transparent on-chain systems ultimately helped prevent the damage from spreading further.

Aftermath and Recovery

The collapse blindsided even seasoned traders. Entire portfolios were erased in minutes as liquidity vanished and order books thinned beyond recognition. What began as a technical cascade evolved into a psychological shockwave that rippled across the industry.Amid the chaos, the human toll became impossible to ignore. Social feeds filled with testimonials from traders describing years of work wiped out in hours. Screenshots of liquidation notices and frozen interfaces circulated widely, forming a grim mosaic of how quickly digital markets can consume their own participants. Reports later confirmed the death of a well-known Eastern European investor, underscoring that behind every liquidation lies a real person, and that volatility on this scale reaches far beyond financial loss.

Many familiar figures on Crypto Twitter shared their own collapses. Some, like prominent memecoin traders and large DeFi participants, wrote openly about losing eight-figure portfolios. Others used the moment to advocate for mental health awareness and accountability, reminding followers that survival matters more than reputation. Their transparency humanised an industry often defined by leverage and bravado.

At the same time, on-chain data revealed suspiciously well-timed short positions opened shortly before the tariff announcement, netting tens of millions in profit. While no misconduct has been proven, the precision reignited debates over information asymmetry, geopolitical catalysts, and the thin boundary between market strategy and privileged access.

A key turning point came on Saturday morning when President Trump posted on Truth Social, saying that the administration was seeking to ease tensions with China after days of escalating trade rhetoric. The post immediately calmed global markets and triggered a swift rebound across risk assets. Bitcoin surged more than 12% from its intraday lows, while equities and commodities stabilized in tandem. The timing reinforced how quickly sentiment can reverse when macro pressure gives way to political reassurance.

By Monday, markets had largely stabilised. Bitcoin recovered from lows near $104,000 to trade between $112,000 and $115,000, Ethereum rebounded above $4,000, Solana reclaimed levels above $200, and BNB climbed back over $1,300 after briefly touching $1,000. Total crypto market capitalisation sits near $3.9 trillion, well above Friday's $3.4 trillion low, though still shy of the prior $4.2 trillion peak.

Despite enduring the most violent liquidation event in crypto history, liquidity has returned swiftly and systemic confidence remains intact. This tells us that this was primarily a leverage-driven event, not a shift in fundamentals.

The "October Shock" will be remembered not only for its destruction, but for the resilience that followed. The ability to absorb nearly $20 billion in liquidations and recover within days suggests that the broader uptrend remains alive as the market heads into Q4.

Macro Recap

Markets enter the new week recovering from what is now confirmed as the largest liquidation event in crypto history. Roughly $19.5 billion in open positions were wiped out on Friday, surpassing the $3 billion seen during the Luna collapse and $1.6 billion during the FTX failure. Total open interest fell by 35% across both Bitcoin and altcoin markets, marking a full reset of speculative leverage throughout the system.

Currently, traditional markets continue to show resilience. The S&P 500 remains near record highs above 6,650, while gold has pushed past $4,050 per ounce, reflecting late-cycle hedging behavior and investor caution. The simultaneous strength of both assets signals a market preparing for easier liquidity conditions rather than risk aversion.

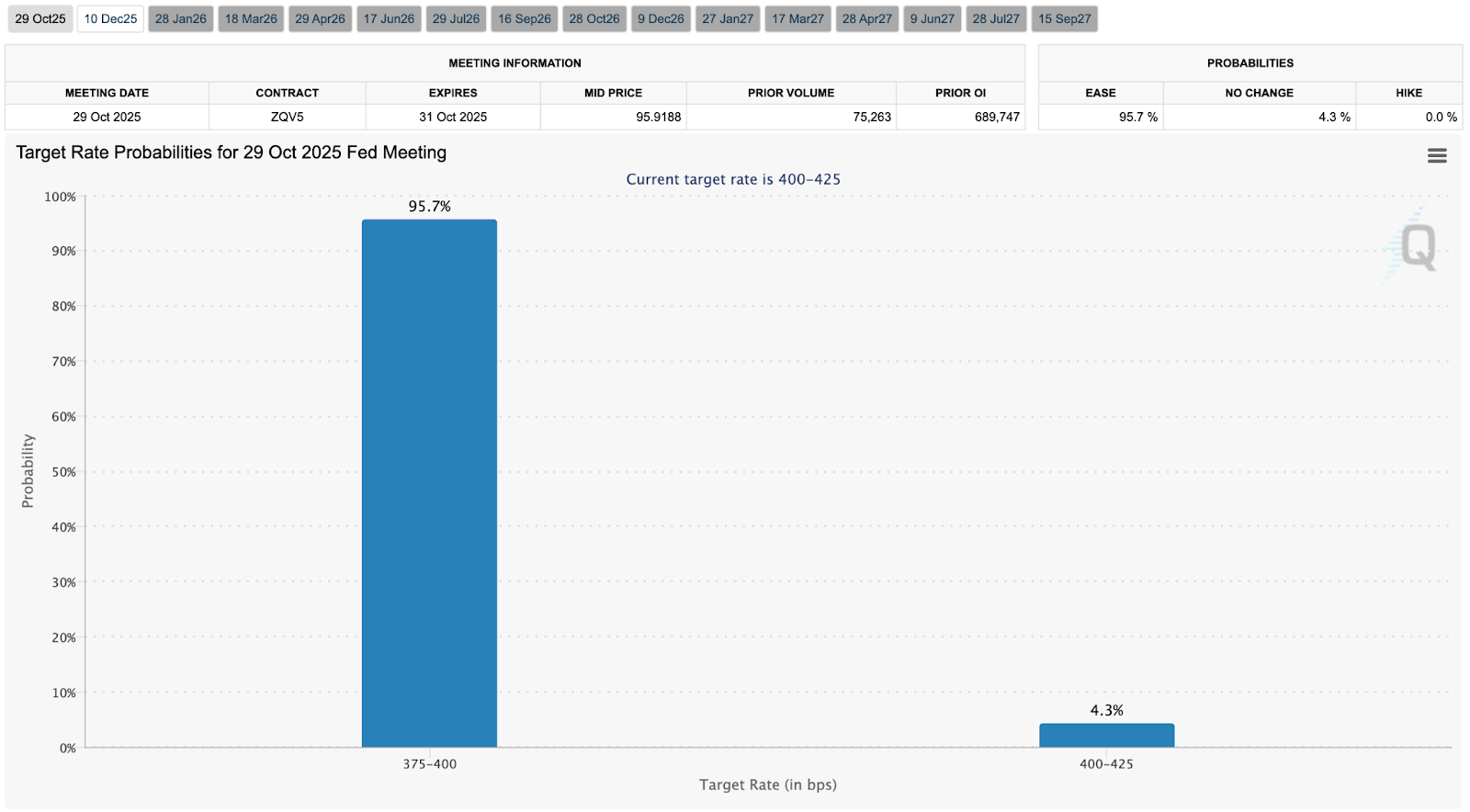

However, there are still some macro risks that remain. The U.S. government shutdown has now entered its second week, with Congress still deadlocked on a funding bill. Several federal agencies remain closed or restricted, delaying key economic data releases and creating uncertainty around fiscal policy. Yet markets continue to look through the noise, focusing instead on monetary conditions. Fed funds futures currently imply a 95% probability of a 25 basis point rate cut at the October 29 FOMC meeting, reinforcing expectations that the easing cycle is officially underway.

Inflation has moderated but remains above target, with headline CPI at 2.9% year-over-year and core at 3.1%. Policymakers are trying to loosen financial conditions without reigniting inflation.

On the geopolitical front, early signs of de-escalation in the Middle East have supported broader risk sentiment. The ceasefire agreement between Israel and Hamas announced on October 9 includes partial troop withdrawals and initial hostage exchanges, easing energy market pressures and reducing one of the year's key geopolitical overhangs.

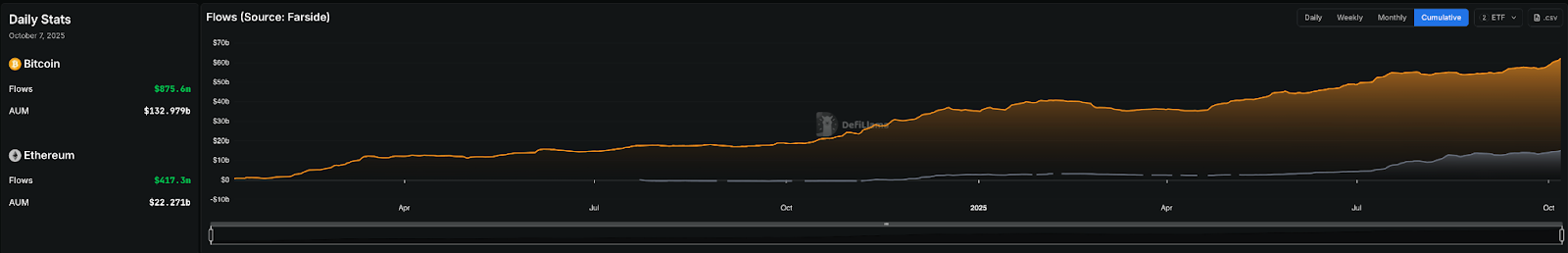

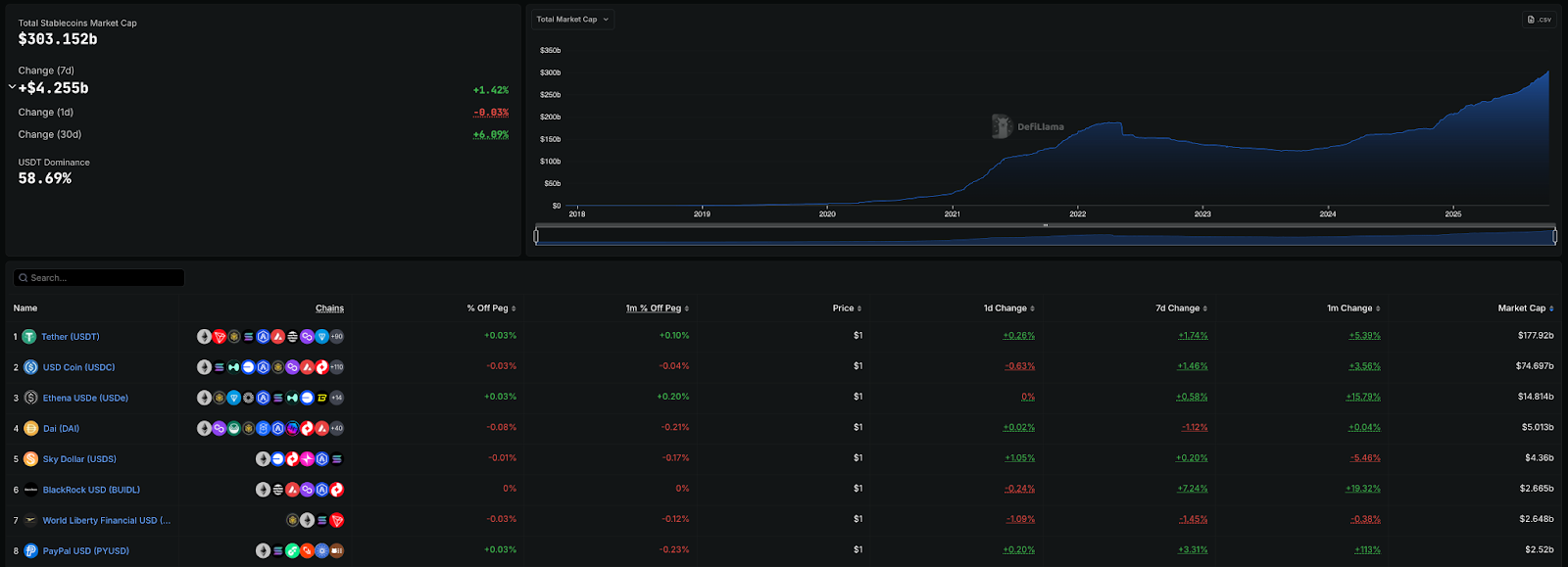

Beneath the surface, structural metrics continue to improve. ETF inflows totaled $875 million in the first half of October, bringing combined Bitcoin and Ethereum ETF assets under management to $155 billion. On-chain liquidity is also rebuilding, with stablecoin supply climbing to $303 billion, the highest level since 2022. This reflects renewed confidence and sidelined capital waiting for an entry point back into the market.

Gold's rally appears to be leading rather than warning. Historically, gold tends to move first in early easing cycles as real yields compress, with crypto following once confidence returns. If that pattern holds, the current uptrend in gold may be signaling another leg higher in digital assets before year-end.

As mid-October begins, the broader picture is one of cautious resilience. The largest liquidation event in crypto history failed to derail the broader uptrend. ETF capital is flowing, stablecoin supply is expanding, and monetary policy is turning supportive. Volatility may linger, but the structural setup for Q4 remains constructive. The market has been reset, not broken.

The Perp DEX Wars

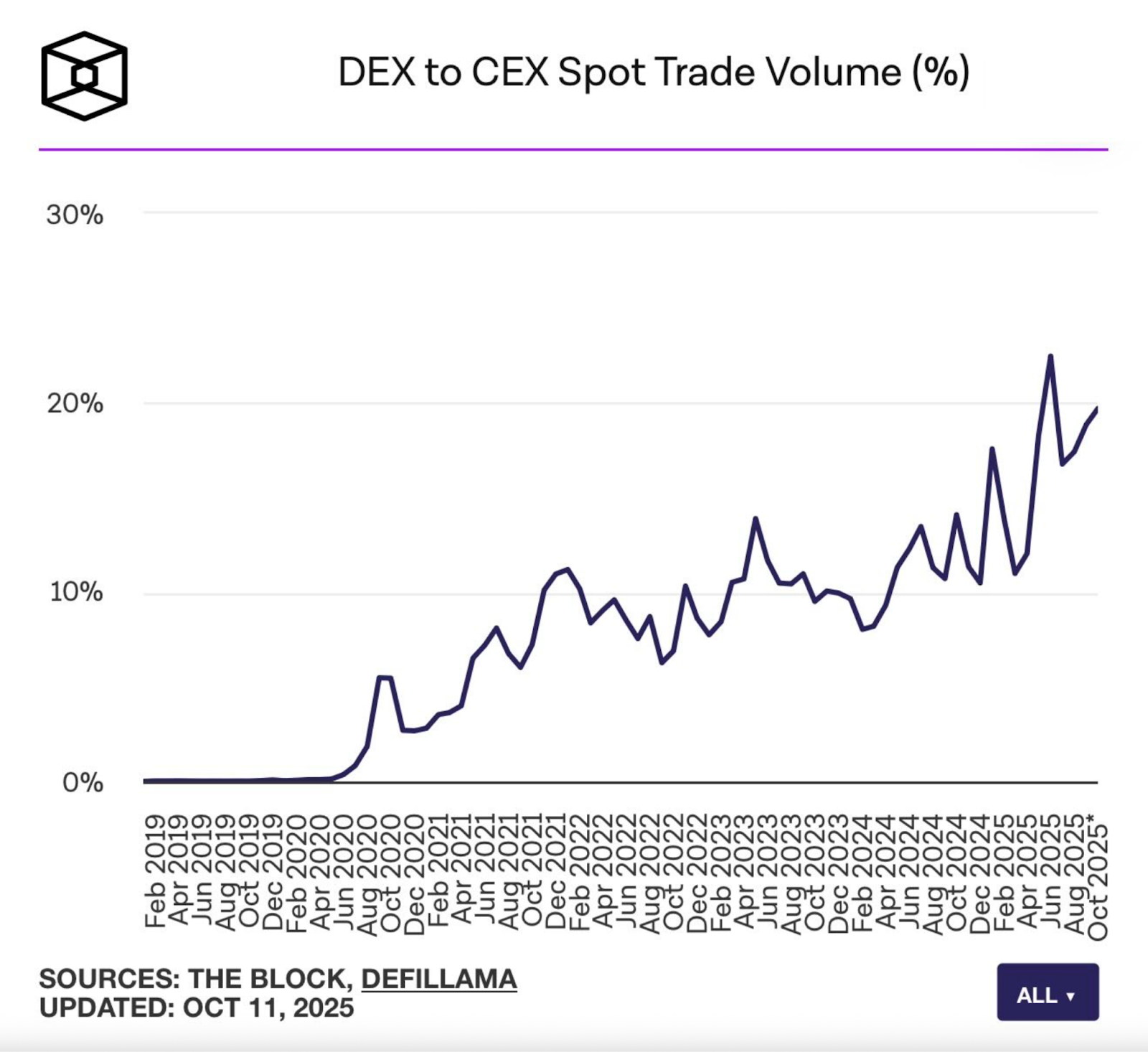

Perpetual DEXs have become the most hotly contested arena in crypto. What began as a niche experiment in on-chain leverage has evolved into one of the industry's most profitable and strategically vital business models. Perpetuals now account for the majority of on-chain trading activity and have become one of the primary sources of fee revenue across DeFi. Whoever controls the largest share of derivatives flow effectively controls one of the few sustainable revenue engines in the ecosystem. That reality has set the stage for a battle between innovation, capital, and credibility.

Hyperliquid's Structural Advantage

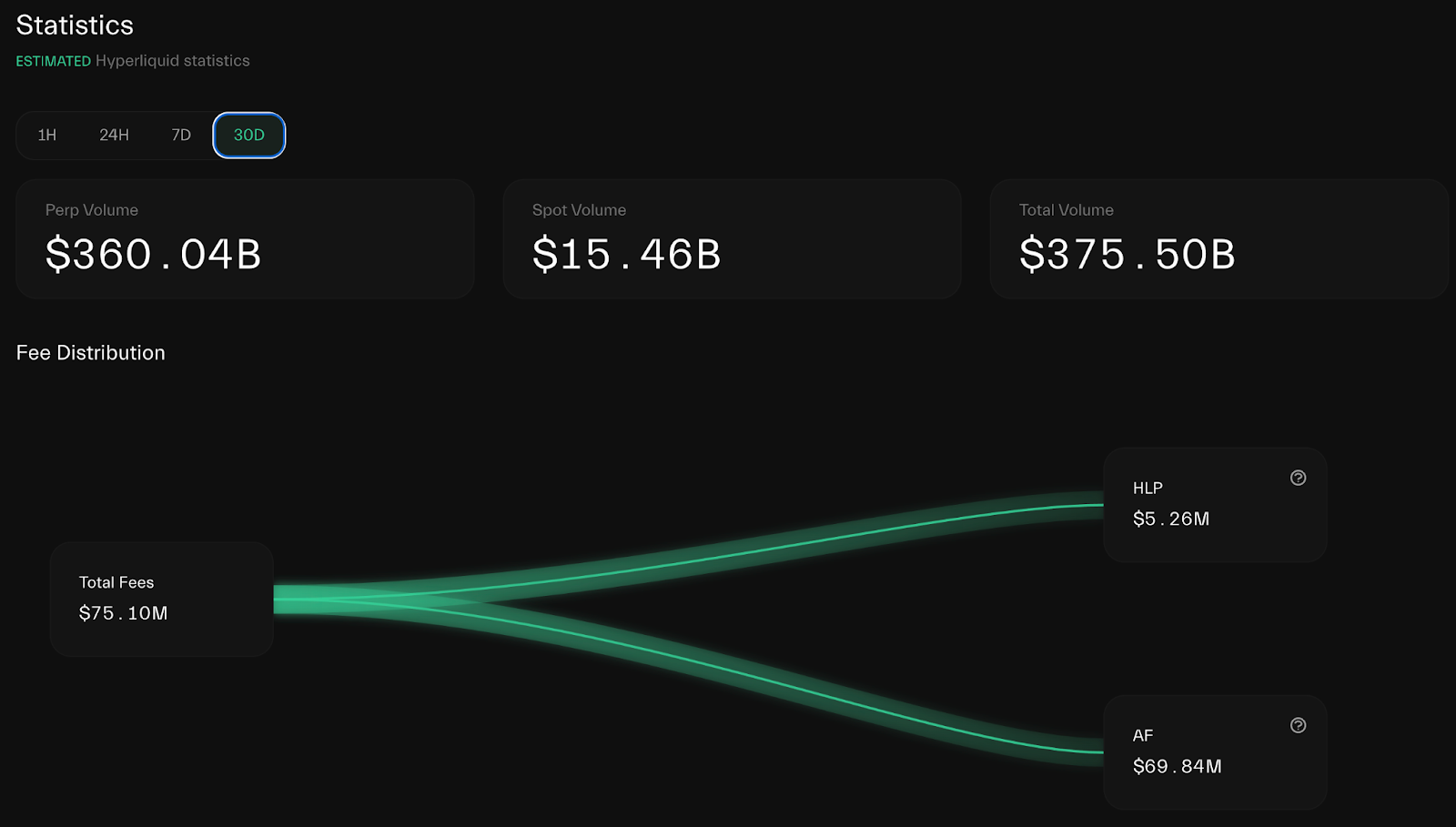

Hyperliquid remains the benchmark for on-chain derivatives. Its strength lies not only in scale but in the quality and consistency of its liquidity. Before last week's crash, daily volume exceeded $13 billion, open interest approached $15 billion, and total value locked stood above $5.8 billion. While volumes have since normalised, liquidity depth remains strong, underscoring the resilience of its fee capture model and its ability to deliver consistent long-term revenue.

Unlike competitors driven by short-term incentives, Hyperliquid's liquidity base is organic and sustained by professional market makers, algorithmic traders, and institutional funds that now treat it as a credible execution venue. This marks a key inflection point for DeFi. Established trading firms are no longer experimenting with on-chain systems; they are actively incorporating them into daily operations.

Hyperliquid's connectivity approach has been central to this transition. Partnerships with wallets such as MetaMask and Phantom allow traders to access the platform through familiar interfaces, reducing friction and streamlining order flow. Combined with transparent settlement and auditable data, this accessibility delivers execution quality on par with centralised venues. In doing so, Hyperliquid continues to set the standard for institutional-grade DeFi infrastructure.

CEX vs DEX: Transparency Under Stress

The October 10 liquidation cascade, which wiped out nearly $20 billion in open interest, was the largest in crypto history and a defining stress test for both centralised and decentralised exchanges. What followed was a clear contrast between two systems: hidden processes and open data.While centralised exchanges such as Binance stayed online, their reported liquidation figures told only part of the story. As Hyperliquid's Jeff noted, major CEXs often group thousands of liquidations into a single entry, meaning the real number can be underreported by as much as 100 times during periods of high volatility. This reporting method creates the appearance of stability while hiding the true scale of stress in the system.

In contrast, Hyperliquid's fully on-chain design made every liquidation visible in real time. During the height of the crash, the number of traders with open positions dropped from roughly 50,000 to 20,000 within minutes. Every closure, collateral adjustment, and forced unwind was publicly verifiable. This transparency made the event appear more chaotic, but it also revealed the platform's strength. Hyperliquid remained solvent, operational, and transparent, processing billions in liquidations with zero downtime and no bad debt.

CEX Accountability and Proof-of-Reserves

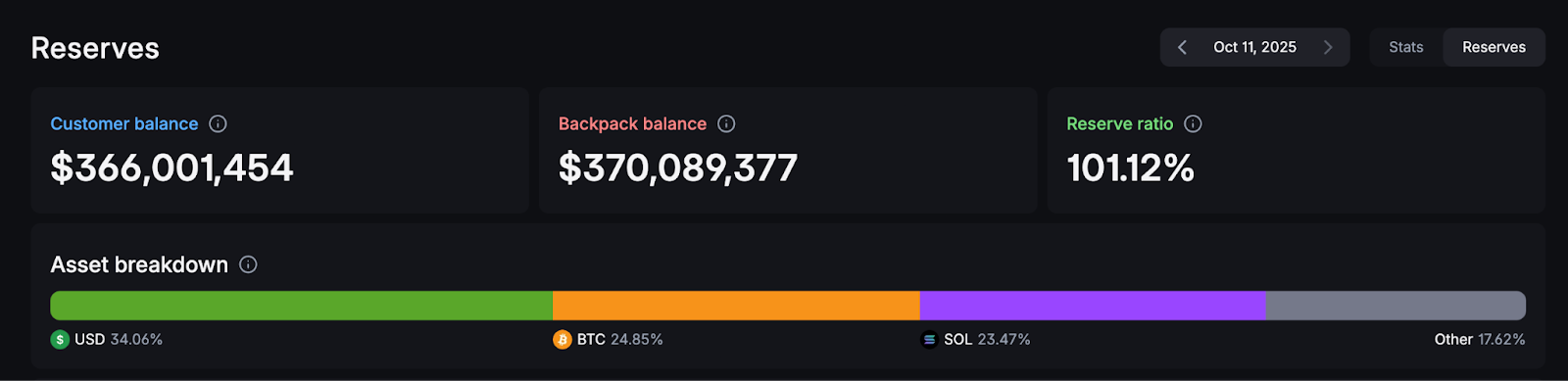

The recent crash sparked a broader discussion about exchange transparency. In contrast to the limited visibility of Binance and other centralized venues, Backpack Exchange emerged from the turmoil with its credibility strengthened.Despite heavy liquidations and network congestion, Backpack settled all positions automatically with zero clawbacks or socialised losses. CEO Armani Ferrante confirmed that all accounts were reconciled within 24 hours and that the exchange continued publishing its daily zero-knowledge verified proof of reserves, maintaining a 101% backing ratio. This commitment to real-time transparency provided a rare example of accountability in an industry often defined by trust gaps.

Backpack's peer-to-peer matching engine isolates counterparty risk directly between longs and shorts rather than relying on an exchange-managed liquidity pool. While this neutral design eliminates exchange-level exposure, it also left the platform temporarily vulnerable when external market makers withdrew during peak volatility. Ferrante acknowledged this limitation and indicated that future versions of the exchange may incorporate optional vaults or liquidity partners to stabilise markets during extreme events.

This structure, combined with verifiable reserve reporting, aligns Backpack more closely with decentralised infrastructure while maintaining the accessibility of a centralised exchange. These design choices are becoming increasingly important as the line between CEX and DEX continues to blur.

BNB's Counter-Offensive

Binance has responded to new competitive pressures with a clear strategic shift. The launch of YZi Labs' one-billion-dollar Builder Fund represents one of the largest capital commitments to ecosystem growth this year. The fund targets DeFi, real-world assets, AI, decentralised science, payments, and wallets. Teams receive financial backing, mentorship, and direct integrations into Binance's network of more than 460 million users.This initiative was announced alongside BNB's breakout above $1,300, marking new all-time highs and briefly pushing it past USDT in market capitalization. The timing was deliberate. Binance's leadership intends to ensure that as trading activity moves on-chain, BNB Chain captures that flow instead of letting it disperse across emerging ecosystems.

Early beneficiaries of the Builder Fund, including Aster and other BNB-based derivatives and lending protocols, are helping reposition the network as a central settlement layer for decentralised finance. BNB Chain now handles more than 25 million transactions per day, holds over $14 billion in TVL, and continues to expand on-chain fee generation. With deflationary tokenomics, institutional adoption, and sustained ecosystem funding, BNB has evolved into a vertically integrated platform asset.

Just before the October 10 market crash, CZ posted what he described as a "gossip tweet," addressing speculation about historical links between Hyperliquid founder Jeff and YZi Labs. In the post, he confirmed that Jeff had participated in Binance Labs' first incubation cohort in 2018 but clarified that Binance did not retain equity or tokens. The timing and tone of the post, given its lack of relevance to any current issue, came across as dismissive and intended to downplay the growing significance of Hyperliquid and its role in shaping the perpetual DEX sector.

The tweet reflected a deeper rivalry that has been building quietly between Binance and Hyperliquid. While Binance continues to expand its reach through ecosystem funding, infrastructure control, and strategic integrations, Hyperliquid's ascent has been driven by transparency, uptime, and verifiable on-chain execution. CZ's post was widely viewed as a thinly veiled attempt to minimise a competitor that has rapidly become the benchmark for decentralised derivatives infrastructure. In essence, Binance sought to reframe the narrative, but the market saw it for what it was: an acknowledgement that Hyperliquid is no longer an upstart but a genuine threat to centralised dominance.

As outlined in our September 30 BNB Deep Dive, BNB's acceleration is supported by real fundamentals: consistent fee capture from network activity, an expanding developer base, and a funding model that compounds value over time. The Builder Fund reflects Binance's longer-term ambition to guide the next phase of decentralised trading, using its scale and infrastructure to define how capital and liquidity move across networks.

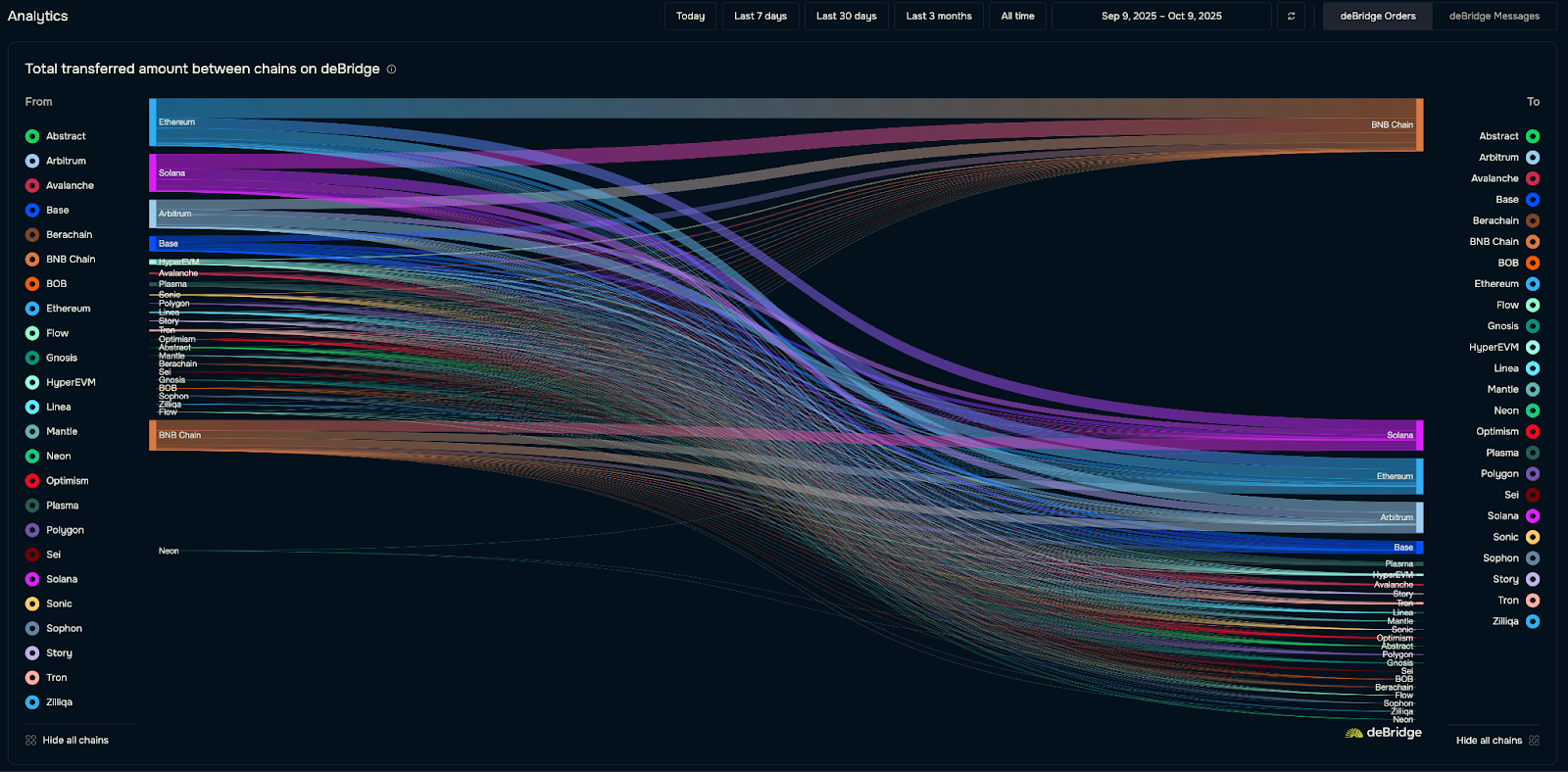

Cross-chain data from deBridge shows that liquidity has steadily migrated toward BNB Chain as traders and builders reposition for the next wave of on-chain activity. What began as opportunistic yield farming has evolved into a durable reallocation of capital into ecosystems with established infrastructure and leadership continuity.

Yet while Binance focuses on ecosystem control and capital deployment, most other perpetual DEXs continue to compete through incentives and short-term liquidity mining programs.

Institutional Migration and Structural Implications

One of the most important developments in this cycle is the gradual migration of institutional liquidity onto on-chain venues. What began as limited experimentation by crypto-native funds has evolved into sustained participation from quantitative firms, market-neutral hedge funds, and structured-product issuers integrating DeFi execution into their trading systems.

Hyperliquid's transparency, deterministic settlement, and uptime have become reference standards for this transition, giving institutions the confidence to deploy size without assuming custodial risk. Each incremental move away from centralised venues weakens the traditional exchange moat and strengthens the case for open infrastructure. The efficiencies that once justified centralisation, such as speed, reliability, and liquidity aggregation, are now being matched by verifiable data and decentralised architecture.

As this migration continues, legacy exchanges will likely adapt by integrating on-chain systems rather than competing against them.

Sustainability After Incentives

The true test for perpetual DEXs will come once the points and airdrops stop. More than a dozen tokenless platforms are competing for attention through aggressive reward programs. History shows that liquidity earned in this manner rarely remains for long. While Aster and Lighter are among the most visible, they remain part of a broader cycle of yield-driven experimentation rather than fully established markets.Hyperliquid, on the other hand, has already proven depth and reliability, though not all of its flow is entirely organic. Rumours of a potential second HYPE airdrop tied to EVM activity have kept liquidity elevated even during quieter weeks. Yet the difference is structural. Hyperliquid's integrations with MetaMask, Phantom, and other front-end tools have created lasting engagement that goes beyond short-term rewards.

As incentives fade, capital tends to consolidate around venues where execution quality, fee capture, and transparency are proven. Among all on-chain venues, Hyperliquid remains the most likely to retain durable liquidity, thanks to genuine integrations, consistent uptime, and a network effect that extends beyond speculation.

Prediction Markets

Prediction markets have evolved from DeFi curiosities into mainstream cultural and financial instruments. They now shape narratives across politics, finance, and media, transforming crowd consensus into a new class of asset where information itself becomes tradable risk.Polymarket leads this transformation. Its exclusive partnership with X (formerly Twitter) will soon deliver real-time event markets to millions, turning the world's largest social platform into a live information exchange.

This visibility, combined with a $2 billion investment from Intercontinental Exchange (ICE), parent company of the NYSE, has vaulted Polymarket's private valuation to $9 billion. With features on major news networks and in popular culture, and the recent addition of Donald Trump Jr. to its advisory board, Polymarket now sets the pace as both infrastructure and phenomenon. While a token airdrop or IPO is still rumoured, either path would redefine what it means for DeFi and Wall Street to converge.

MetaMask users will soon have direct access as well: the widely anticipated Polymarket integration is slated to launch later this year, embedding event trading directly within the most popular wallet for on-chain finance. The feature is not yet live, but the partnership signals broader adoption and wallet-native price discovery for prediction markets worldwide.

Limitless underscores the surging demand for prediction market exposure. It also marks a major milestone for the sector as the first prediction market to tokenise. Its model combines a points-based airdrop earned through trading activity with a public ICO conducted via the Kaito launchpad (though not funded by Kaito itself). The sale was oversubscribed nearly 200 times, attracting over $200 million in allocation requests for a $1 million target raise at a $75 million valuation. Backed by Coinbase Ventures, Limitless' hybrid launch model has captured investor enthusiasm across both retail and institutional audiences. Cryptonary recently featured Limitless in our latest airdrop report, including a full walkthrough on how to participate and qualify for rewards.

Valuations across the sector now reflect this surge in legitimacy. Kalshi, the only U.S.-regulated prediction exchange, remains valued above $1 billion, while Polymarket's $9 billion figure places it among DeFi's largest private networks. ICE has also committed to integrating Polymarket's event data into its institutional analytics suite, recognising prediction platforms as informational infrastructure rather than speculative novelty. Traders, analysts, and political strategists increasingly use these markets for live sentiment, policy probability, and event forecasting.

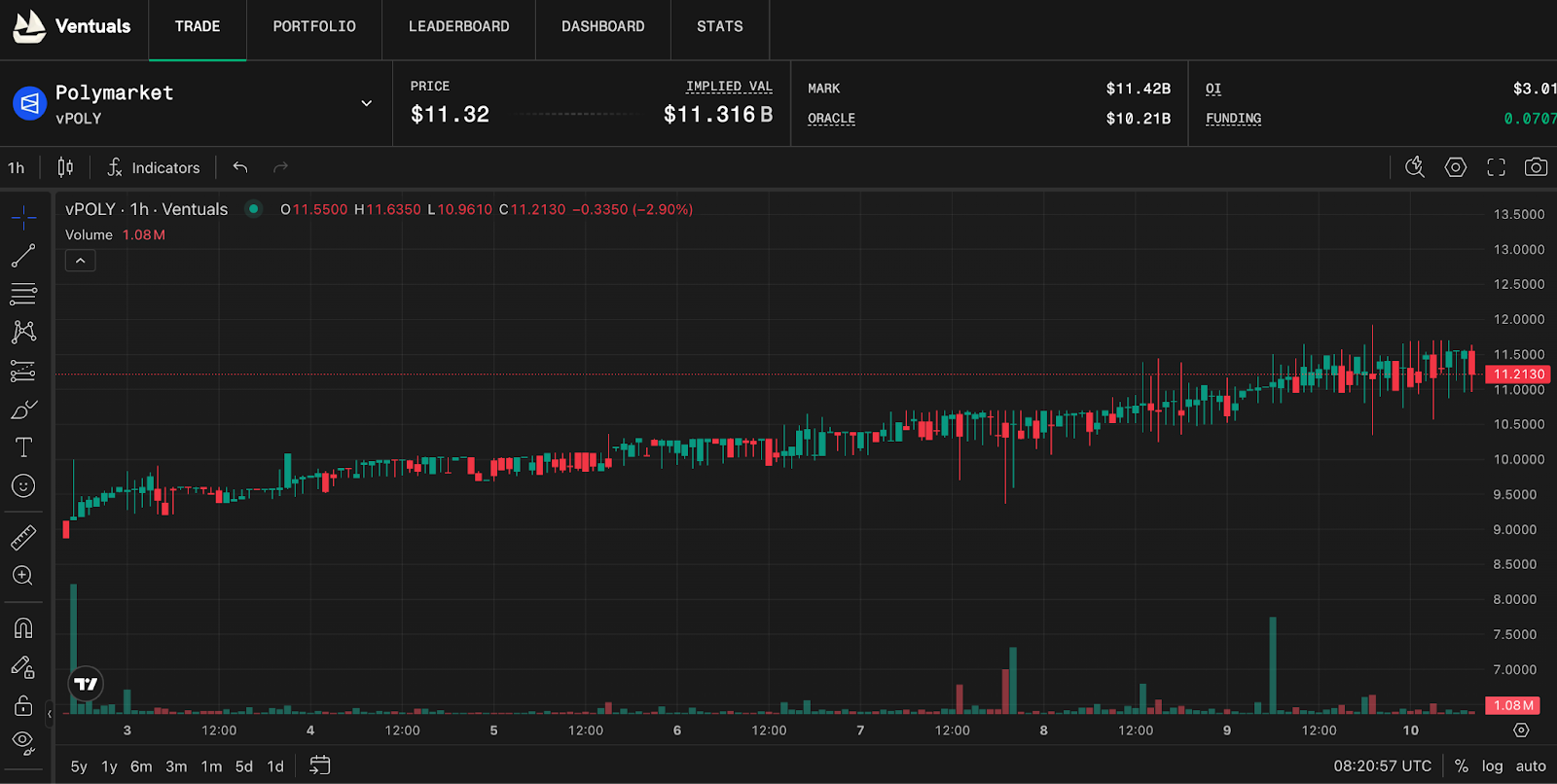

The next breakthrough is the advent of on-chain pricing for pre-IPO companies. Starting October 16, platforms like Ventuals will let users trade synthetic shares of private unicorns beginning with Polymarket contracts (vPOLY) on Hyperliquid through HIP-3. This marks the first time a private startup's valuation is tradable on-chain before listing, opening a new frontier for decentralised venture exposure. Early vPOLY activity already implies a valuation above $11 billion as DeFi-driven price discovery meets the world of venture capital.

Prediction markets no longer resemble speculative side bets. They now function as transparent, participatory systems that blend collective intelligence, capital, and data into a single layer of truth discovery. As DeFi, venture, and information economies converge, these networks are set to influence not only market narratives but also the policy and portfolio decisions that follow them.

Cryptonary's Take

The market has just endured one of the largest liquidation events in crypto history, erasing nearly $20 billion in open interest and shaking out excess leverage across every major sector. Yet within days, Bitcoin seems to have reclaimed the $110K region and the total crypto market capitalisation recovered sharply. The structure was tested but not broken.Total3, which tracks crypto market capitalisation excluding BTC and ETH, has once again rejected the upper boundary of its multi-month range near $1.15t – $1.17t and is now hovering around $1.05t. The pullback reflects the broader liquidation reset that swept through markets last week. Despite the drawdown, the chart remains constructive above the $1t support zone, which continues to define the lower boundary of the current accumulation range. A clean reclaim of the $1.15t area would mark the confirmation of a new breakout phase.

It is also an airdrop season, and conditions remain favourable. Protocols that have been waiting for optimal market conditions are now launching. Monad goes live on October 14, Hyperswap on October 20, and Meteora on October 23, with more expected to follow. For those who have been following our guides, multiple additional rewards are likely on the horizon.

This phase will not resemble the classic "alt seasons" of previous cycles when nearly every token rallied indiscriminately. Market participants are sharper, capital is more selective, and sector rotation now drives performance. Timing, selection and adaptability are now the key advantages.

We expect Bitcoin to continue performing well and potentially close the gap with gold in terms of relative strength. Stay positioned in high-conviction names like HYPE, SOL, and AURA, as they are set to outperform as liquidity rotates through various narratives. Prediction markets are also gaining traction as the next major theme, merging DeFi, data, and real-world sentiment into a single tradable layer.

From a macro perspective, the backdrop remains supportive. ETF inflows, expanding stablecoin supply, and an anticipated rate cut into year-end all point toward improving liquidity conditions. Historically, October has been one of Bitcoin's strongest months, closing green in eight of the past ten years with an average gain near 17 per cent.

The next few months will favour those who plan, not those who chase. Stay focused on liquidity and timing, align with narratives that have real traction, and don't forget to take profits on the way up.

Cryptonary, OUT!