Still waiting for the bull run? You can win with a DeFi summer

Many people are currently missing out on the action in the 2024/2025 bull run; in fact, we dare say that some people are still waiting for it to start. Yet, we are already a few months into the cycle—but this is understandable.

Suppose your portfolio is filled with altcoins, DeFi projects, ZK projects, and (we hope not) dino coins. In that case, it is easy to be stuck at the station waiting for the rally and possibly miss it because it was branded in AI and memecoin colours.

But does that mean that DeFi is dead? We don't think so.

But if you are wondering whether we will get a DeFi summer in this bull run, this report provides some answers.

Let's dive in.

TLDR

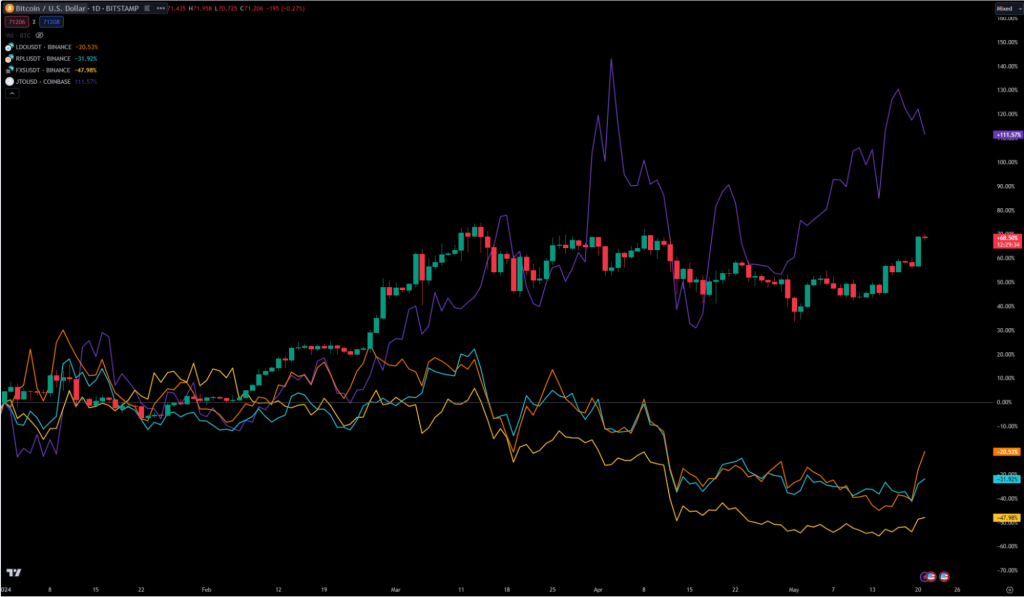

- A new crypto bull market has arrived, but DeFi has been a laggard compared to sectors like memecoins and AI.

- We look back at the last "DeFi Summer", which kicked off the previous cycle, to see if history may repeat itself.

- We dived into the current state of DeFi across different chains and ecosystems like Ethereum and Solana.

- We analyse the critical lending and DEX sectors to gauge if user activity foreshadows an impending DeFi boom.

- The emerging liquid staking sector is showing strength; we evaluate whether this new DeFi cornerstone can catalyse growth.

- We bring it all home by evaluating the overall market sentiment, concerns around regulation/security, and what catalysts are needed to reignite a "DeFi Summer" narrative.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The DeFi Summer of 2020

Let's jump in by looking at the current stats for DeFi and compare that to the Summer of 2020 leading into 2021 to see if we can draw any parallels.The DeFi summer of 2020 got the ball rolling in bringing DeFi to the limelight as a solid use case for crypto other than simply moving funds around.

At one point, it looked like the roaring 20s of crypto belonged to DeFi, as hundreds of protocols were launched, spurred on by the capital inflow that defined the last bull market.

However, DeFi had only begun to come into its full potential in giving TradFi a run for its money when the COVID-19 lockdowns started in March 2020.

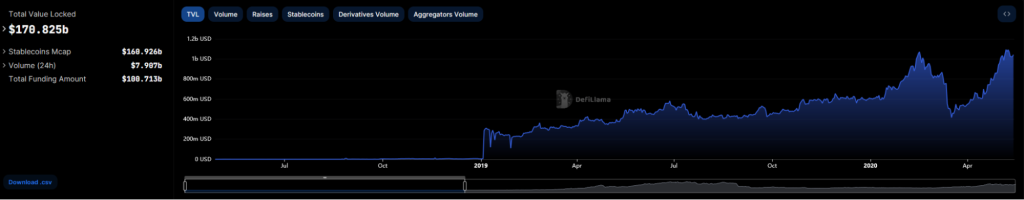

The announcement of these lockdowns rocked all markets, not just crypto. However, because crypto is much more volatile, it wasn't surprising that DeFi TVL dropped from just over $1 billion to $400 million—a 60% decrease in a matter of days.

But here's the thing about dark and gloomy days: they don't last forever. And now, we are beginning to see the smattering of light on the horizon for DeFi. Hence, the question, "Is there another DeFi summer in sight?"

From those low TVL of $400 million in 2020, DeFi has grown by a face-melting 57,200%, peaking at just shy of $230 billion in locked value by Boxing Day in 2022.

What caused this giant leap?

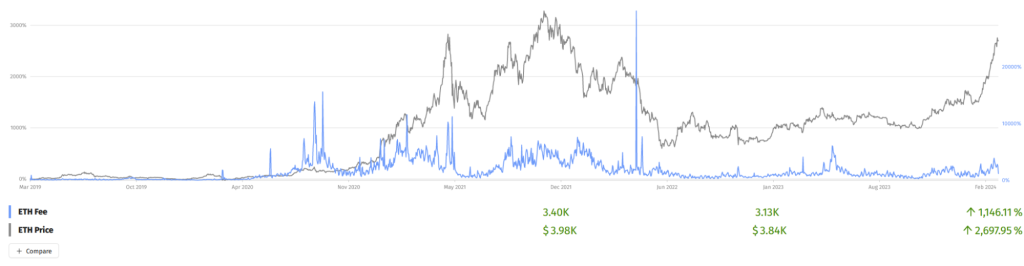

Looking at the average gas fees paid, we can see that even though on-chain activity has dramatically increased after the bear market we've just endured, gas remains relatively affordable compared to the previous bull run when average transaction fees tend to balloon as more transactions are recorded on-chain.

For DeFi, this is especially important as those with smaller accounts are not priced out of utilising Ethereum DeFi as they were in 2020/21.

The Dencun Upgrade has reduced transaction fees significantly on Ethereum L2s, making DeFi more affordable for retail users. Thus, we have our first positive catalyst that could facilitate another explosion of growth.

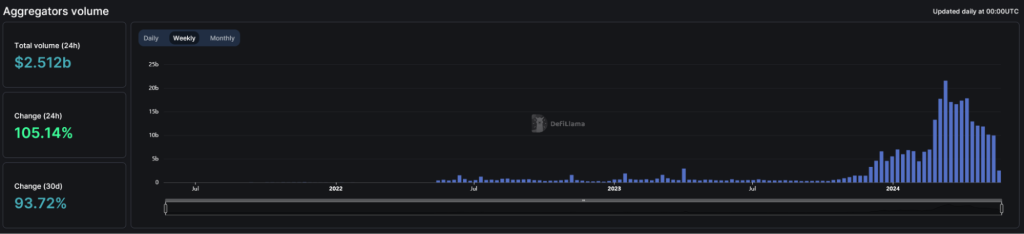

Aggregators are a relatively new invention in DeFi, but they now account for a significant portion of the total trading volume. Many different DeFi protocols offer various services, making it hard to keep track of and maximise the full potential of the composability that DeFi is supposed to deliver. DeFi aggregators consolidate multiple DeFi products, services, and contracts into a single dashboard and interface to simplify the user experience.

The current state of DeFi

Ecosystems

DeFi has had a slow start to this bull market compared to other markets like memecoins and AI. Performance has been "ok", but nothing to write home about.

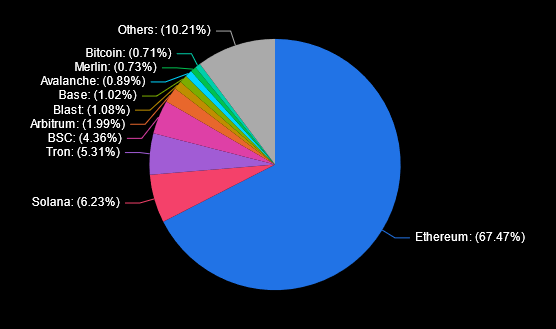

Overall, DeFi TVL has increased around $120 billion since the beginning of 2023 - a gain of ~440%, from $50 billion to $170 billion.

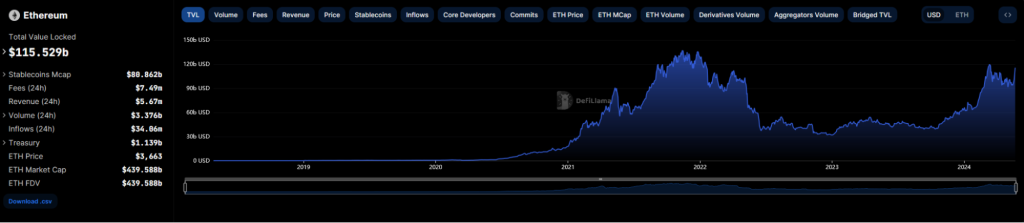

Ethereum remains the king of DeFi, with a TVL of $115.5 billion or 67% market dominance.

But Ethereum isn't the only DeFi ecosystem.

Who's winning?

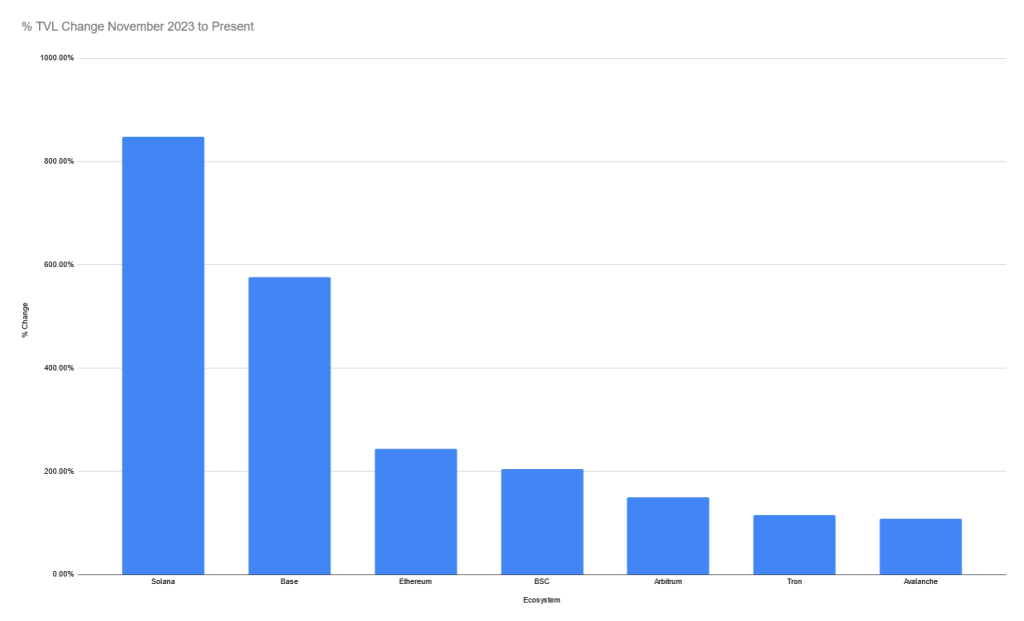

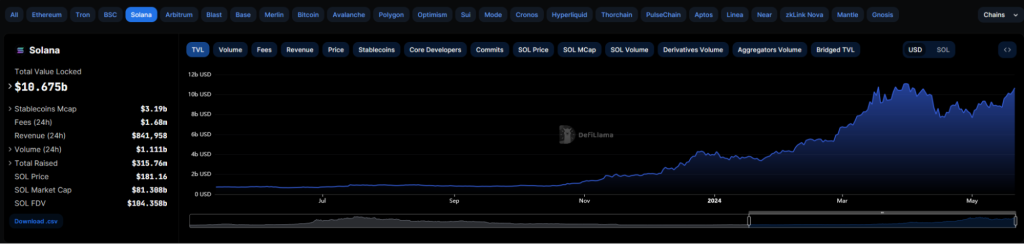

The ecosystem with the most significant gains in terms of raw numbers is Solana, with a huge increase of around 850% since November 2023.

This is due to many factors we have repeatedly highlighted in other reports, such as ease of use, cheap fees, and almost instant transactions.

Solana was not around for the start of the OG DeFi Summer, but it is clear that not only has the ecosystem captured a larger portion of the current DeFi market than in 2022, 6.25% at present compared to 5.3% at the peak in 2022.

Lending protocols and DEXs

The health of DeFi essentially boils down to lending and DEXs - the heart and lungs of on-chain financial activity. These two sectors give us a fairly comprehensive overview of the general state of DeFi.

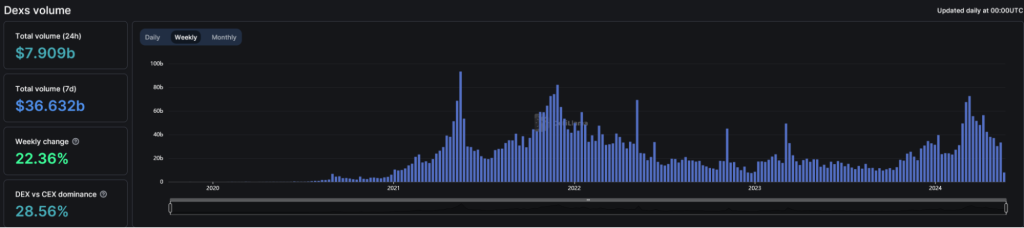

Generally, the volume patterns from 2020/2021 are similar to what's happening now. The period before the major spike in mid-2021 suggests we could be at the beginning of a similar exponential rally.

As is always the case with all financial assets, even in a bull market, things are never straightforward (straight up).

Let's take out the magnifying glass and examine UNISwap, the largest DEX (by far) across all metrics.

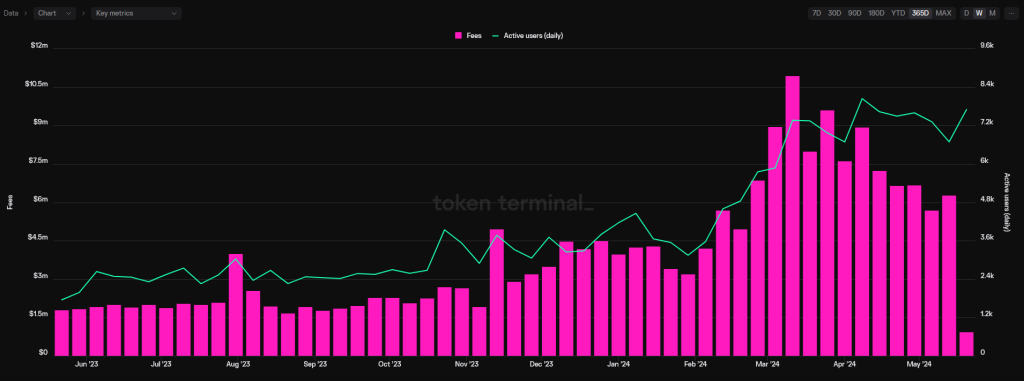

UniSwap's user count and fee generation have increased significantly in the last 12 months, with fees up over 300% since last year.

Next, we'll look at Aave, the largest DeFi money market.

Being the core of much of DeFi activity on Ethereum, it makes sense to take Aave as a benchmark for the lending sector. As seen above, the stats show that Aave fees significantly increased year over year, peaking at approximately $11 million per week. This represents a 7.3x increase in activity, with confluence developing in increased user count.

Similarly, the TVL statistics provide further evidence of a relatively healthy level of lending activity; locked value has increased by around 330% in the previous 12 months.

Liquid staking

The LSD sector wasn't even around in 2020. In fact, liquid staking is quite literally a brand-new concept. Although Lido has been around since 2021, it couldn't really be called a liquid staking protocol in the truest sense since ETH could not be withdrawn until the Shanghai upgrade.

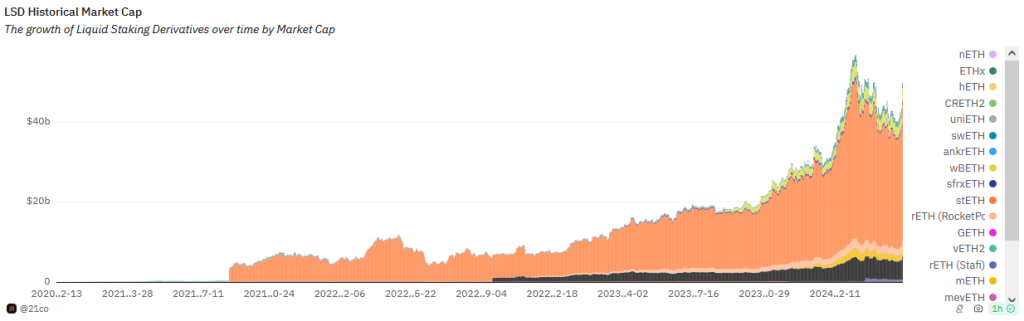

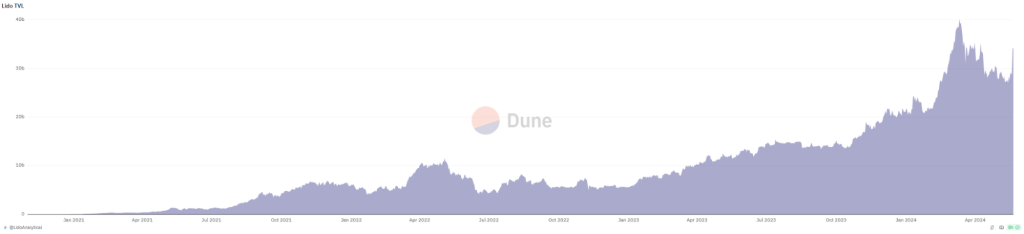

Looking at the figures, we can see the explosion in liquid staking activity on Ethereum, which is by far the largest market. The sector has been one of the few areas of DeFi that have shone in recent months, increasing ~390% in the year-to-date period.

Lido Finance, the top LS protocol, reflects the growth of the sector.

The issue with the liquid staking sector is that the vast majority of the tokens are governance tokens. They do not directly benefit from increases in TVL or usage other than when a large entity buys the token to participate in governance.

So, despite the sector's performance, we cannot say that LSDs are worth jumping on at the moment. Nor are LSDs likely to be the catalyst that spurs a renewed DeFi Summer.

Where are we in the cycle?

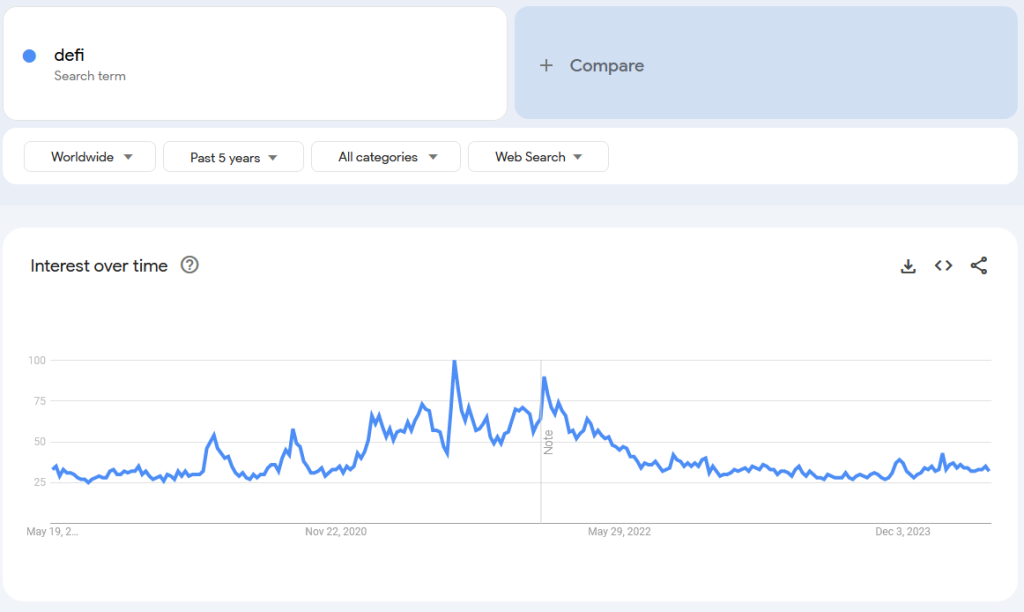

Most people use their browsers to access DeFi front-ends. This means we can look at common search terms and gauge sentiment and attention based on Google trends.

The simplest search, "defi," shows a confluence between the spike in DeFi activity in 2020 and the number of searches. We are way below the point that you could reasonably assume DeFi is in the spotlight - we are still ways off from a DeFi summer.

Again, it is much the same for the expanded search.

However, it is important to note that when searches spike, it is usually the case that the market has already moved, and more people are looking to jump on the bandwagon to join the party. It is much like when everyone from your grandma to your bartender starts talking about buying BTC; you'll often get those kinds of retail interest near the top rather than the start of a narrative.

So, while we can retroactively use search interest to understand the peak of the DeFi cycle, we cannot it is not prudent to use it as a proxy to determine when the DeFi Summer could begin.

That said, search volume tells us that the foundational bricks for a DeFi summer in the 2024/2025 cycle are already being laid.

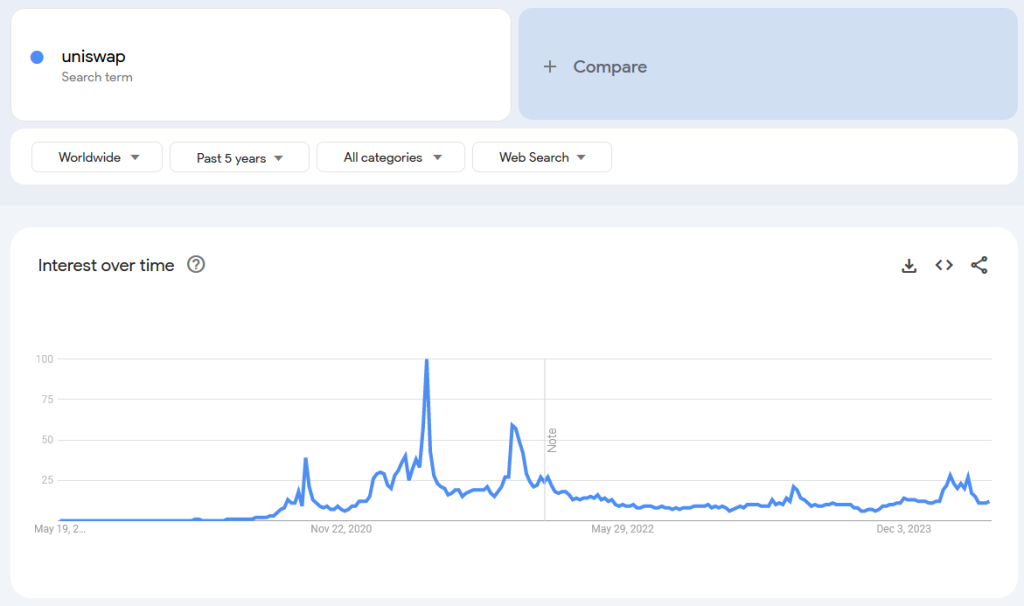

Let's look at Uniswap. UniSwap stands out because although user count, revenue, and TVL levels are all approaching 2020/2021 levels, the search trend suggests an elastic band is quietly stretched in the background.

From the numbers and statistics above, it is clear that the core users are jumping back on board - but the masses have not.

Why?

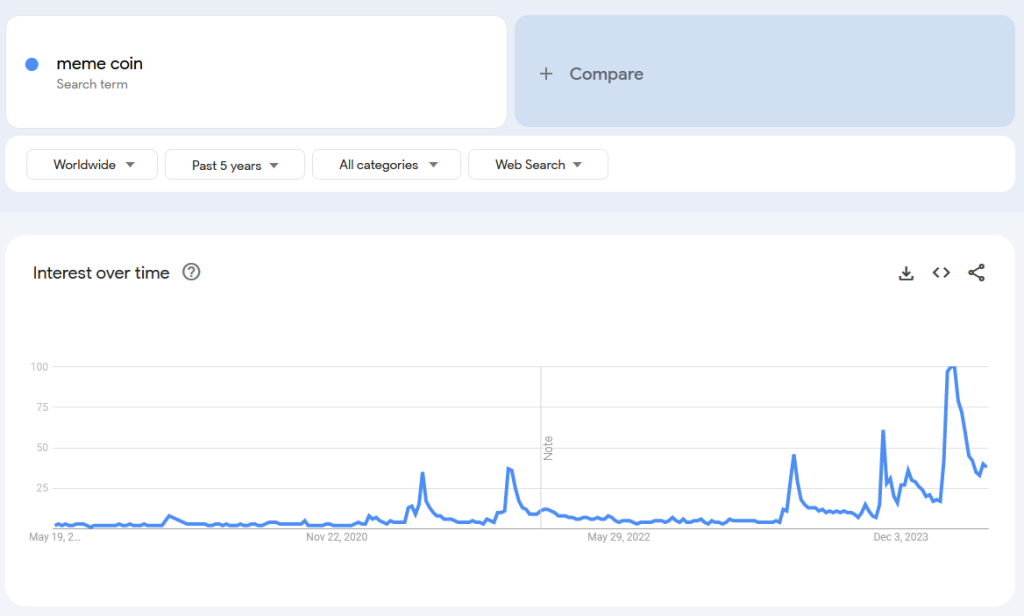

Well, the chart below clearly shows why -- memes have been catching all the attention.

We've said it many times, but it needs repeating: memes are a valid narrative in this cycle, and if you are still looking down, you need to think critically about why you are on the sidelines. Our memecoins masterclass is a wonderful resource for getting started with memes.

Cryptonary's take

When we talk about the future of DeFi, we're talking about trajectory.The charts and analysis above show that DeFi is on an upward trajectory. However, the pace of this trajectory has been lacklustre compared to the soaring gains seen between 2020 through 2022.

We haven't seen the dramatic acceleration that would warrant calling the current moves a "DeFi Summer V2".

Yet.

It's important to note that if the crypto market is in its infancy - then DeFi is still gestating.

From our analysis, adoption is likely to be a driving factor in the resurgence of DeFi. There has to be enough interest for capital to flood in.

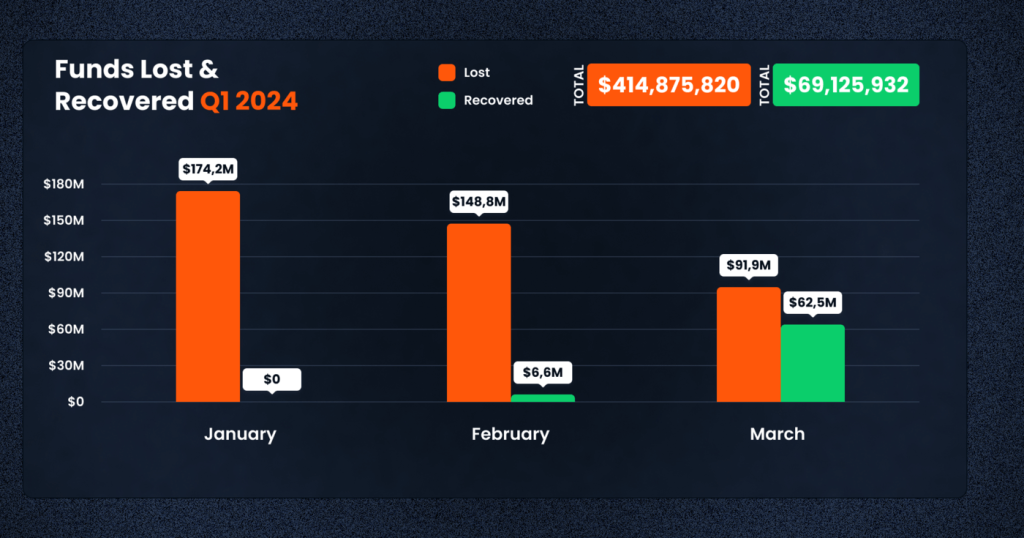

However, institutions are hesitant to use DeFi meaningfully because of the lack of regulatory clarity. Many are also hesitant due to security concerns, and rightly so—the stats below speak for themselves.

However, in a market worth $170 billion, 0.24% being lost to exploits doesn't sound like a lot. However, headlines reporting such hacks do the most damage, creating a "notorious" image for DeFi and making it a reputational risk for serious TradFi players to get involved.

You never hear much when a traditional bank loses a few billion here or there. Yet, when a DeFi protocol is exploited, it's as if the fire alarm has gone off, and people are running for the exits. The capital from big players is required to see the gains witnessed in the first DeFi explosion.

So, to summarise, we think three things need to improve:

- Sentiment towards DeFi, both in the eyes of the public and regulators.

- Institutions need the green light from lawmakers to legally interact with these protocols.

- Just like in 2020, the "DeFi Summer" narrative needs to make its way to the masses.

But for now, we wait.

We have part 2 of this report in the works. In part 2, we detail the top DeFi protocols to have in your portfolio ahead of the DeFi summer; now, that's a report you don't want to miss.

Cryptonary, Out!