Story Protocol: Are we long or short?

$61 trillion. That's the estimated global value of intellectual property, locked in rusty systems while AI rips through voices, art, and books in a flash, leaving creators high and dry. Story Protocol's betting big on flipping the script with a slick, on-chain fix to manage, monetize, and shield IP in the AI age. But is it a golden ticket worth going long on, or a hype bubble begging for a short? Let's find out…

The internet has made it easier than ever to create and share content, but it's also made it harder to protect, track, and monetize it. For creators, developers, and even AI agents, intellectual property (IP) has become both more valuable and more vulnerable.

Enter Story Protocol, a new blockchain built from the ground up to solve these challenges. As AI tools consume more content and Web2 platforms extract more value from creators, Story Protocol offers a programmable IP infrastructure, one that transforms static copyright into dynamic, automated licensing, royalty management, and legal enforcement.

With $143M in funding from top-tier VCs like a16z and Polychain, and early traction from over 100 ecosystem projects, Story Protocol is making a strong claim: that in the age of AI, IP needs its own blockchain.

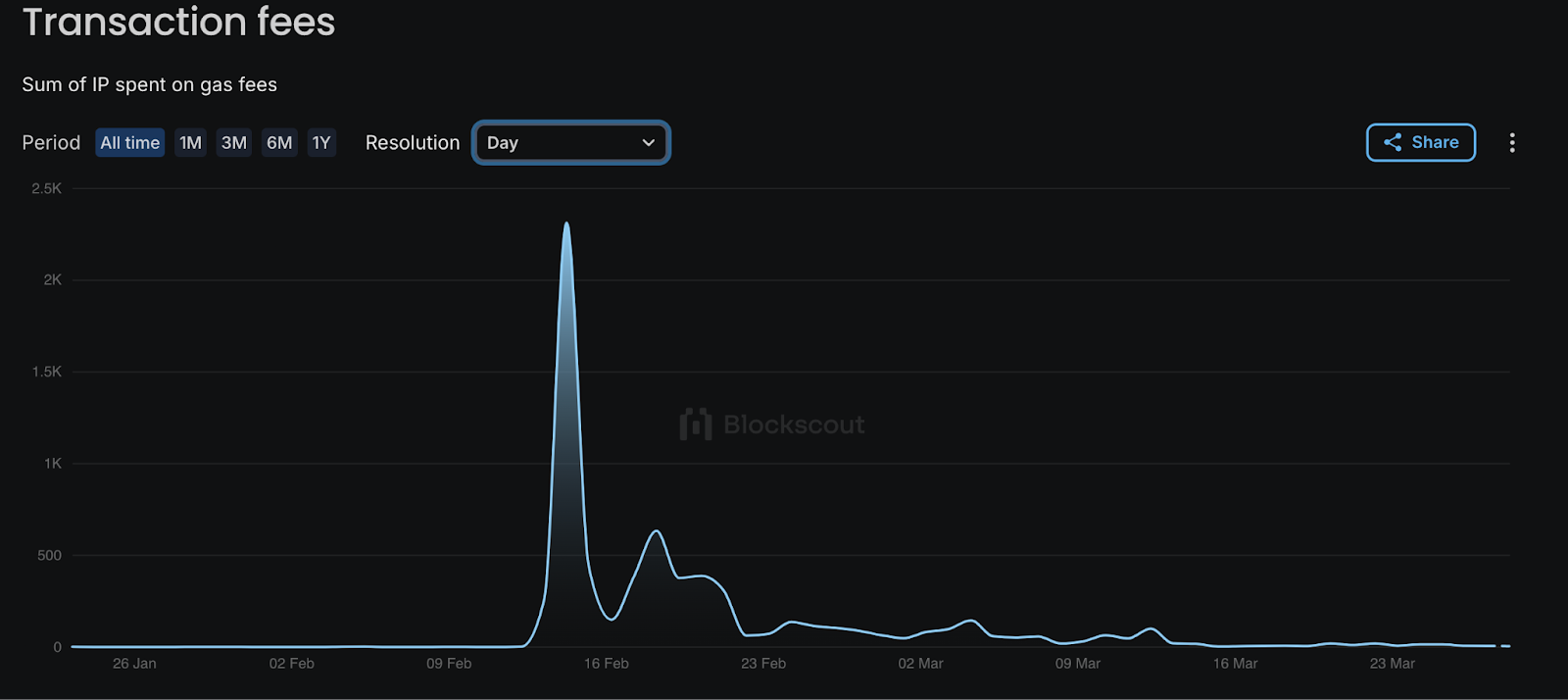

But early signs raise valid concerns. Insiders can stake locked tokens, introducing potential sell pressure. Cosmos' inconsistent track record (on which Story Protocol is built) also casts doubt on its long-term viability. Most critically, on-chain data shows daily fees are under $60s, which tells us that traction has stalled post-launch.

Story is a bold experiment. But bold doesn't guarantee success. This report explores both the vision and the risks, and why the next few months will be crucial for this ecosystem.

Bonus: There is a money-making opportunity here.

So let's dive in!

Disclaimer: This is not financial or investment advice. You are responsible for your own capital decisions.The vision behind the Story protocol

Story Protocol is trying to completely rewire how digitised intellectual property works. The team behind Story believes IP should be more than a legal shield; it should be a liquid, programmable asset class that enables collaboration, revenue-sharing, and innovation at internet scale.At the heart of this vision is a recognition that AI is accelerating the need for new IP systems. AI models are only as good as the data they're trained on, and increasingly, that data is copyrighted content scraped from across the web.

Whether it's OpenAI licensing articles from media giants, or synthetic actors replicating the voices of real ones, the battle for data rights is already underway. Story is betting that future AI systems will need permissioned data flows, transparent licensing, and enforceable attribution. And it wants to be the platform they plug into.

But the problem is deeper than just AI. Today's creators, from artists and musicians to indie game developers and meme makers all face a fractured IP system that is expensive, opaque, and favors incumbents. If you're a small creator, defending your work in court is almost impossible.

Story reimagines this entire process by making every work a tokenized asset, every license an on-chain contract, and every royalty a programmable flow.

This creates a new kind of incentive structure. Instead of discouraging remix culture, Story enables it. Want to build on someone else's character or song? You can, as long as you mint a license NFT and agree to the terms.

Ultimately, Story isn't trying to replace copyright law. It's trying to make it interoperable with the speed and complexity of the modern internet. Its hybrid architecture, combining blockchain finality with legal enforceability, lets it straddle both worlds.

And as the ecosystem of apps, protocols, and agents grows around it, Story aims to become the infrastructure layer for IP across AI, gaming, media, and beyond.

Core architecture & technical innovations

General-purpose blockchains often struggle with the kind of deep, nested logic required for IP use cases. For example, minting a derivative work that references dozens of parent assets could run into high gas costs or hit block limits on chains like Ethereum. Story's custom architecture solves this with graph-based IP management, optimized for traversal and royalty attribution at scale.Moreover, the team envisions enterprise-level adoption, platforms like TikTok or Spotify embedding on-chain IP frameworks into their creator workflows. These use cases demand low latency, flexible consensus, and seamless storage logic.

Hosting Story as a smart contract or Layer 2 would limit performance and composability. So, the team opted for a Cosmos SDK foundation with CometBFT for consensus, layered with a custom EVM-compatible execution engine via a fork of Geth.

A tradeoff worth scrutinizing

While technically sound, building on Cosmos introduces risk. The Cosmos ecosystem, while promising in theory, hasn't consistently delivered long-term success stories.Major Cosmos projects like Terra collapsed, while others have faded into obscurity despite early momentum. In contrast, Ethereum and its L2s have demonstrated greater staying power and developer mindshare.

Story's decision reflects a bold bet on architectural control and long-term scalability, but it also places them outside the proven traction of Ethereum's broader ecosystem. Whether this tradeoff pays off will depend on execution, adoption, and how well the chain can support real-world IP demands over time.

The protocol layer - From IP assets to automated royalty flow

The real innovation of Story Protocol is in how its infrastructure enables programmable intellectual property. From the moment a creator registers an IP asset to the second, royalties are split across dozens of contributors; everything is automated, auditable, and enforceable. Let's walk through how the protocol layer works.IP asset registration: The digital birth certificate

Every piece of IP on Story starts with a tokenized representation: an ERC-721 NFT that embodies ownership of the creative work. This could be a drawing, a melody, an AI model, or even a dataset. Through the IP Portal (Story's creator dashboard), users configure metadata like title, description, references, and links. This step creates the IP Asset, along with an IP Account, which is actually an ERC-6551 smart account tied to that NFT.This IP Account is programmable; it holds logic, records royalty policies, and tracks lineage. Think of it like a smart wallet that governs the legal, financial, and relational data of your IP asset.

Programmable IP licenses (PIL): Custom licensing, automated

Once an IP Asset is registered, the creator sets licensing parameters: Can others remix it? Can it be used commercially? What are the revenue shares? These terms are stored on-chain and simultaneously compiled into a legal document off-chain (the PIL file).When someone agrees to those terms, they mint a License Token-another NFT-that grants usage rights. This token is cryptographic proof of licensing, replacing traditional legal paperwork. It can be time-limited, revocable, or customized based on usage (e.g., AI training, live performance, digital reproduction).

This two-layer model, on-chain automation and off-chain legal enforceability. This bridges the crypto-native and legal-native worlds in a way no previous platform has done.

Royalty engine: Real-time revenue routing

Here's where things get interesting. Once a license token is minted and usage begins, for example, say, a song gets streamed or a dataset is used for training, royalties are triggered. Instead of relying on centralized agencies or spreadsheets, Story routes payouts using smart contracts.Each contributor along the asset's lineage receives their cut through Royalty Vaults. Even in complex chains like a movie based on a novel that used an AI tool trained on five datasets, the payments flow automatically and transparently to everyone entitled. These vaults use ERC-20 tokens, which means creators can even trade future revenue streams on secondary markets, opening up IP-backed financial instruments.

AI, agents & the future of autonomous IP

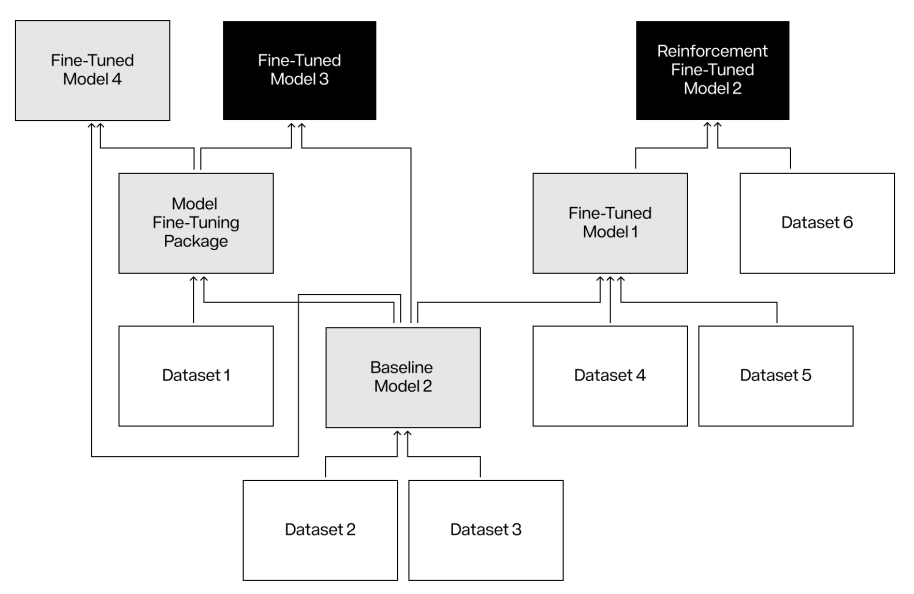

Story Protocol isn't just about creators. It's for the machines too. As artificial intelligence becomes more autonomous, we're entering a world where AI agents can write novels, compose music, design logos, and even negotiate contracts. But here's the challenge: how do we ensure that these agents respect intellectual property and don't become legal black holes? Story has an answer: Agent-to-Agent IP Transactions.(The above image represents an example graph of an AI-related IP asset as shown in the whitepaper)

The $IP token and economic design

If Story Protocol is the infrastructure for a new creative economy, then $IP is the currency that powers it all.The $IP token is the economic backbone of the Story ecosystem, designed to support creator incentives, secure the blockchain, and fuel automated IP transactions, from music licensing to AI agents buying datasets. In many ways, $IP is a bet that intellectual property itself can become a liquid, programmable asset class.

Utility breakdown

The token has four core functions:- Transaction fees: Action on the Story chain, whether registering an IP asset, minting a license, or executing an AI transaction, all require gas paid in $IP.

- Staking and network security: Validators stake $IP to secure the network and earn rewards. As activity grows across IP assets and AI applications, staking demand scales with it.

- Governance: Holders can propose and vote on protocol changes, economic parameters, and new feature modules, effectively steering how the IP economy evolves.

- Revenue routing: Royalties and licensing fees flow through $IP. It enables automated payouts to multiple parties across deep IP graphs, splitting earnings among original creators, remixers, and agents, all on-chain.

Tokenomics

Story's token design shows clear intent to balance decentralization, builder incentives, and ecosystem stability:- Total supply: 1 billion $IP

- Circulating supply (as of March 27, 2025): ~258 million

- Circulating market cap: $1.5 billion

- Fully diluted market cap: $5b

- 38.4% to ecosystem and community incentives

- 21.6% of early backers

- 20% to core contributors

- 10% each to initial incentives and foundation.

DeFi meets IP: What comes next

Perhaps the most intriguing part is how $IP enables financial primitives on top of creative work. Story introduces:- Royalty tokens (ERC-20): Claim future revenue from licensed content

- License tokens (ERC-721): Represent legal usage rights

- Revenue vaults: Automated smart contract accounts to split income

The idea is simple but powerful: if IP is valuable, it should be liquid. And if it's liquid, it needs a native token to move it around.

Ecosystem, partnerships, and real-world adoption

Let's break down the key players and the real-world momentum behind Story Protocol. Since its inception, Story Protocol has raised over $143 million, including an $80M Series B round in August 2024. That round alone valued the protocol at $2.25 billion, and it wasn't just crypto-native money piling in.Key investors include:

- Andreessen Horowitz (a16z) - long-time Web3 backer, leading Story's Series B

- Polychain Capital - focused on core protocol investments

- Samsung Next - a strategic bet from the tech giant

- Stability AI's Scott Trowbridge - connecting AI and IP

- Oxford and Stanford - via academic partnerships to explore IP innovation

Early builders: Who's building on story

A few standout projects:- Aria - Raised $10.95M to tokenize music catalogs from global artists like BTS, BLACKPINK, and Justin Bieber.

- Magma - A 3 M+ user collaborative design platform (think Figma for visual artists), now integrating Story's licensing rails.

What's notable here is the diversity: music, design, AI art, storytelling. This isn't one vertical but a broad push across creator segments.

Even Forbes and Product Hunt have spotlighted the project, with its IP Portal Beta trending shortly after launch in March 2025.

Technical analysis

On the 4H chart, $IP recently broke down below a key ascending trendline. Prior to this, it had briefly broken out above a descending trendline, but that move failed to hold, with the price falling back into the range and now breaking lower. At the moment, $IP is finding temporary support from the 200 EMA on the 4H timeframe ($5.1 region).

Given the broader market isn't showing strength in the short to medium term, this breakdown opens up opportunities for short setups. The first potential short zone lies at the retest of the broken trendline, roughly in the $5.80-$6.20 region.

If price reclaims and pushes higher, the second shorting zone sits near the previous local high from late February, between $7.00-$7.50. Both zones are marked with red boxes. Shorts should only be considered with clear confirmation signals. We'll post live updates and trade setups on our app and Discord.

On the downside, there are two key support zones to monitor-these also serve as potential profit-taking regions for active shorts and areas of interest for future accumulation:

- $3.70-$4.40, with the midpoint at $4.00

- $1.30-$2.20, with the midpoint at $1.80

Why are we looking for shorts?

No matter how promising the technology or how grand the vision, every protocol entering uncharted territory faces significant headwinds. Story Protocol is no exception. From adoption hurdles to legal grey areas, the path forward will be complex and competitive.Insider staking loophole

One of the most concerning issues is the staking design that allows locked $IP tokens held by insiders under long-term vesting schedules to begin generating liquid rewards immediately.These staking rewards are not subject to the same lockups as the principal tokens, which means early backers and core contributors can stake massive allocations and sell their rewards on the open market.

With insiders collectively holding 416 million $IP (21.6% (216M $IP) for early backers or 20% (200M $IP) for core contributors), even a conservative 5% APY on half that amount would generate over $60 million worth of liquid tokens annually, adding potential continuous sell pressure and undermining the spirit of long-term alignment.

While Story promotes the "fair launch" narrative, this design quietly gives insiders a financial head start over community members.

No network activity

Although Story launched its mainnet in February 2025 to much excitement, actual on-chain usage has been underwhelming. Gas fees generated by the protocol have declined significantly, with the most recent 24-hour transaction fees amounting to only 10 IP (roughly $50-60).

This level of activity is minimal, especially for a protocol positioning itself at the intersection of AI, IP, and blockchain, sectors that are expected to command global attention. Two months into the mainnet, these numbers suggest that real-world adoption has not yet materialized.

The cosmos question

While Story Protocol's decision to build its own Layer 1 blockchain was meant to optimize IP-specific workflows, the choice to build on Cosmos SDK raises legitimate concerns. Cosmos has a checkered history of projects that either faded into irrelevance or collapsed outright, most notably Terra, which erased billions in value in 2022.Other Cosmos-based initiatives like dYdX have seen poor developer traction and user activity post-shifting to Cosmos. Compared to Ethereum, which has supported long-term giants like Uniswap and Aave, Cosmos lacks a comparable track record of producing lasting, mainstream infrastructure. This makes Story's reliance on Cosmos less of a strategic edge and more of an untested bet.

Adoption will be a long climb

Most creators today still rely on traditional IP systems: copyright offices, royalty intermediaries, and legal contracts. Convincing them to abandon those workflows for a new on-chain alternative, especially one that still requires some Web3 knowledge, is no small task.Even with the simplicity of Story's IP Portal, onboarding creators en masse will require:

- Strong UX/UI that hides blockchain complexity

- Partnerships with creator platforms (e.g., music labels, publishing tools, marketplaces)

- Educational campaigns around licensing and monetization benefits

Legal uncertainty looms over on-chain IP

Programmable IP is a novel idea, but the legal world isn't known for moving fast. Story's off-chain PIL (Programmable IP License) attempts to create enforceable legal contracts, but it remains to be seen how these documents will be treated by courts around the world.Open questions include:

- Will courts recognize Story-registered IP and enforce licensing agreements?

- Can IP disputes resolved through UMA's arbitration system hold legal weight?

- How will Story handle takedown requests, copyright strikes, or global regulatory compliance?

Cryptonary's take

Programmable IP is a clever fix for the AI era, where creators need to license and profit from their work as models scrape the web. Story Protocol brings that to the table with on-chain licensing and real-world logic-something no other chain fully tackles.The IPFi vision, turning IP into a tradable asset, has potential. But adoption's a big "if." Usage is weak, insider staking rewards smell like a slow dump, and betting on Cosmos feels shaky given its spotty history. Daily fees under $60 scream low activity, and legal recognition is still a coin toss.

Risks outweigh the hype right now. Therefore, we're eyeing a short on $IP if it hits our levels, though we'll revisit mid-to-long term if traction picks up. For now, the numbers don't lie-Story's more of an experiment than an ecosystem, and you are likely to make money by betting against it in the short-term rather than betting on it.

That is it from us.

Cryptonary, OUT!