The debate was put to rest in 1983 by a bet between Richard Dennis and his partner William Eckhardt. “The Prince of the Pit”, Richard Dennis, is known for turning a mere $1,600 to over $200 million in a single decade. He believed anyone could become a successful trader with the correct system and training. His views were challenged by Eckhardt who believed successful traders were born, not made.

The legendary commodities trader Richard Dennis put his money where his mouth was. He released an advertisement in The Wall Street Journal looking for potential trainees whom he called “turtles”. After receiving thousands of applicants, he ended up hiring 14 people only. Diversity was a key element for fair and reliable results, therefore we chose trainees from different backgrounds, ranging from accountants, chefs, unemployed, and even women which was against the 1983 Chicago trading floors norms.

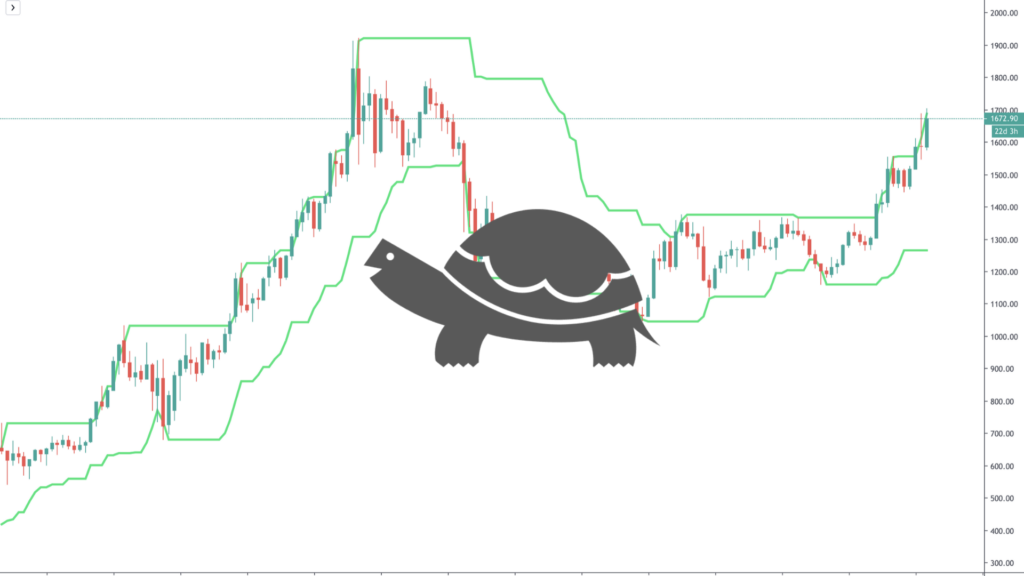

A two-week training was conducted before any of the students started trading. The turtles were given a set of rules they had to stick to, including entry and exit strategies, with a major focus on “trend-following”. After the training was over, Dennis would give each of the students an amount ranging from $500,000 to $2,000,000 from his own money to trade in the futures market. The account size largely depended on the student and Denis’ perception of their ability.

The results were spectacular. According to former students, Dennis personally trained two groups of traders who eventually grossed $175 million in 5 years while earning an average 80% annual return rate. Many of the traders left the experiment, left their original career and became successful money managers. The results were so shocking that even Dennis was surprised by the results. In his own words: “Trading was even more teachable than I imagined. In a strange sort of way, it was almost humbling”.

Jerry Parker was one of the turtles taught by Dennis that within a few short years founded his own fund Chesapeake Capital Management. He went on to personally earn $35 million annually. When asked about the effect of his intelligence on the fund’s success his response was: “I would hate it if the success of Chesapeake was based on my being some great genius. It’s the system that wins. Fundamental economics are nice but useless in trading. True fundamentals are always unknown. Our system allows for no intellectual capability.”

Trading seems like an elusive career path where only the gifted and intelligent can succeed. While being “gifted” and having a high IQ may help, it is by no means a requirement as shown by this experiment. There certainly is a learning curve, however the most important lesson will forever remain discipline.

As long as a trader can find a strategy where the odds are in their favour after a large number of repetitions and applies strict risk management rules, success is theoretically guaranteed by the concept of mathematical probabilities. That is the exact way casinos have a profitable business model despite certain players winning large pots at times, they have the mathematical edge.