Synapse | Deep Dive

We believe cross-chain communications are a fundamental pillar in the growth of crypto, as discussed in Show Me The Money. If you missed our coverage of this vital and highly lucrative sector, be sure to go over and read The Multi-Chain Universe & Thesis, which lays out our thesis and offers links to the rest of the series.

As part of our coverage, we will be looking at some of the solutions and taking a deeper look at their offerings – and shortcomings.

This report will be the first deep dive for the cross-chain comms sector, following on from our DeFi derivatives series and deep dives. One of the biggest questions is how Synapse will tackle the massive issue of bridging security and their plans for the future of the product. So, without further ado, let’s dive into Synapse!

Disclaimer: This is not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR

- Synapse offers a comprehensive solution to the cross-chain communications dilemma, integrating bridges, AMMs, and an inter-chain comms infrastructure.

- Synapse V2 will provide the means to create a multi-chain native ecosystem where DApps deploying on Synapse Chain will have a single point of access to any of the chains supported, reducing the workload, and dramatically improving gas efficiency for cross-chain transactions.

- Transactions and revenue have remained steady despite the bear market – the protocol is well funded, and the risk of insolvency is minimal.

- What’s next for Synapse? Find out at the end.

Product Overview

Synapse Protocol offers a cross-chain communications infrastructure that enables interoperability between compatible chains. The product has various components that all enable a comprehensive solution for communications, bridging, and swapping assets between Ethereum, Layer-2s, and the other EVM chains like Avalanche, Binance Smart Chain, Fantom, and more.Background

Synapse was first launched in August 2021 by the team behind Nerve Protocol (NRV), the first stableswap AMM on Binance Smart Chain. Nerve acted as one of the main on-off ramps for users looking to move stables between Ethereum and BSC. Building on the experience gained developing Nerve, the team decided to expand their product and rebranded to Synapse Protocol, offering a multi-chain solution for not only stablecoins but other crypto assets as well.

Prior to launch, NRV could be redeemed for SYN at a ratio of 1:2.5, and users were encouraged to remove liquidity from Nerve Protocol in preparation for the launch of Synapse liquidity pools. The launch of Synapse was an overall success. In November 2021, Synapse was exploited for approximately $8 million. Fortunately, the stolen funds could not be moved off-chain due to quick action by the developers and coordination with Saddle (another blockchain bridge). Ultimately no funds were actually stolen, and Synapse made a full recovery with no collateral damage.

Now that we have some context, where is Synapse now?

Synapse Bridge

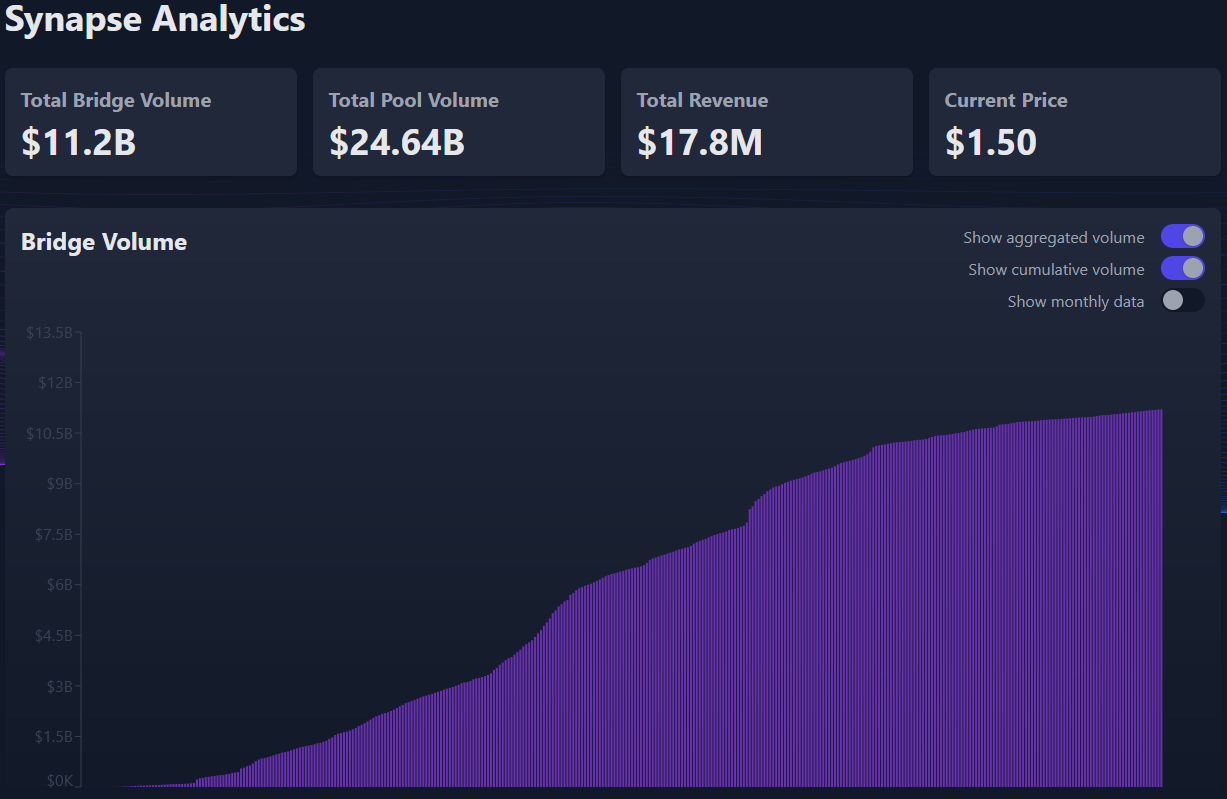

The first product built on the protocol, Synapse Bridge, is by far the most popular and used product on Synapse. Boasting $11.2 billion total volume to date and over 930,000 transactions since launch, the bridge is one of the go-to bridges for those looking to move assets between Ethereum and its Layer-2s.

The bridge itself offers 2 types of bridging:

- Canonical Token Bridging – bridging wrapped assets (e.g., WETH) across chains.

- Liquidity-based bridging – bridging native assets (e.g., USDC) across stableswap pools.

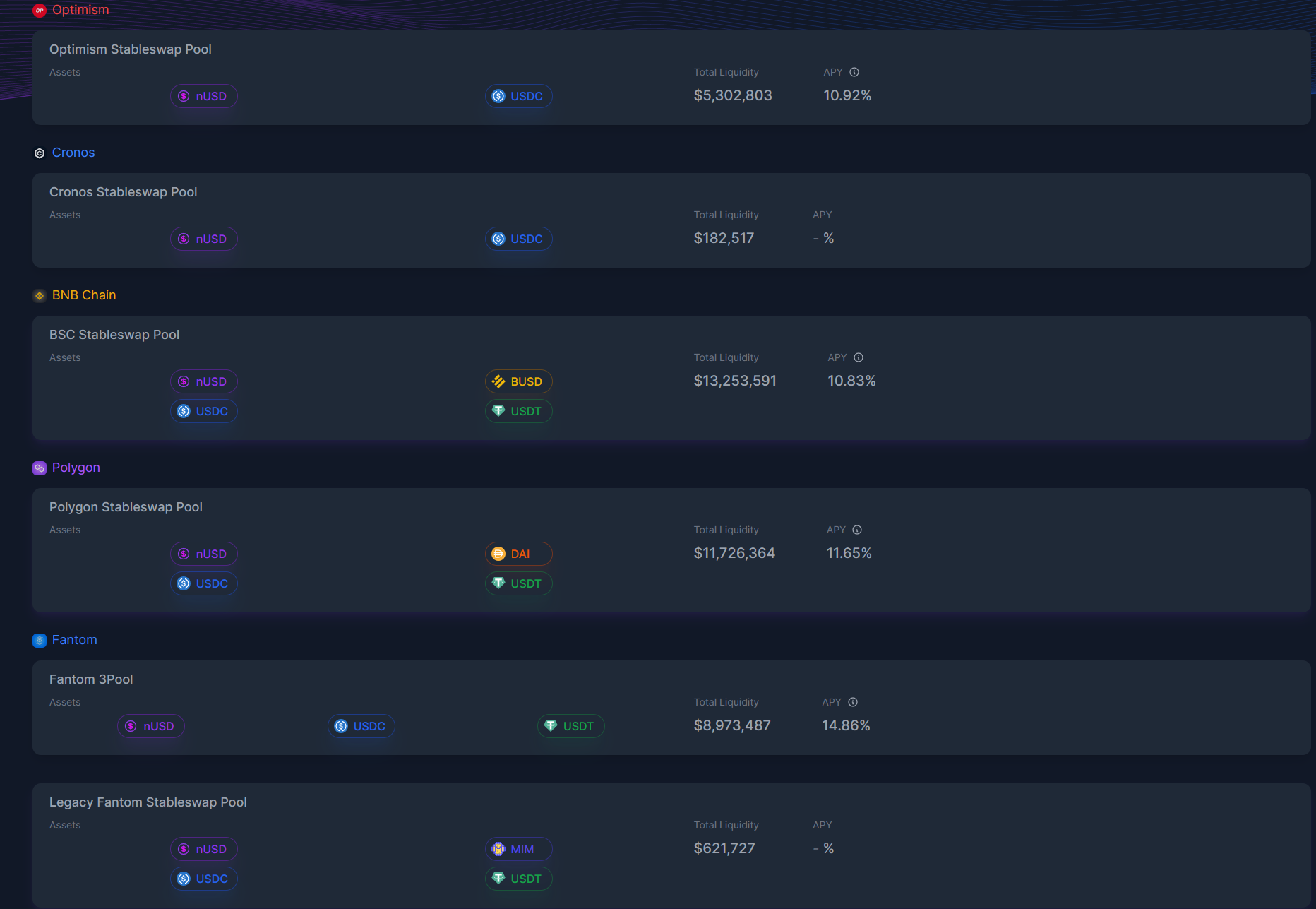

Liquidity-based bridging involves the use of liquidity pools containing stablecoins on all chains, and essentially when bridging, the user deposits a stablecoin on one side, and an equal amount of that stablecoin is released on the other – this is the Synapse AMM. Let’s dive a bit deeper!

xAssets: Cross-Chain Swaps

Synapse xAssets are multi-chain assets that can be used on multiple blockchains. Their purpose is to reduce the friction that is inherent when transferring assets between chains. Since xAssets are multi-chain, fewer operations are required to get liquidity where it needs to be since the assets are compatible with all the chains supported by Synapse.When creating an xAsset a new ERC-20 token contract is deployed on all chains, which acts as a peg. A user bridging a token from a source chain deposits the asset in Synapse’s bridge contract. The cross-chain messaging system transmits the validity of the deposit, and the contract on the target chain mints the token on the destination chain. The circulating supply of xAssets is constant – only a deposit can mint an xAsset.

The idea is that DApps that want to interact with multiple chains can create a token that is native to all chains supported by Synapse, supported by deposits of their original token. xAssets are a core offering for the future utilisation of the product; however, they are used currently as well. Synapse has created a couple of proof-of-concept xAssets – nUSD (Nexus USD) and nETH (Nexus ETH). Both assets are multi-chain tokens available on most of the EVM chains supported by Synapse, and they are used to facilitate the bridging of stablecoins and ETH.

Using nUSD as an example, when a user wants to bridge USDC from Optimism to BSC, the USDC is deposited into a USDC-nUSD liquidity pool on the source chain, essentially converting the USDC to nUSD. Since nUSD liquidity pools exist on multiple chains, and the token itself is multi-chain, the nUSD from the source chain is deposited into the USDC-nUSD liquidity pool on the destination chain. The nUSD can then either be automatically converted to USDC, or the nUSD itself can be used on the destination chain. nETH works in exactly the same way, except the deposit asset is ETH.

In this sense, the xAssets are acting as the intermediary, similar to how RUNE is the intermediary asset on the THORChain network – nUSD and nETH act as the core of Synapse’s cross-chain AMM. Synapse has an incentives model that encourages arbitragers to rebalance pools in the event of significant one-directional capital flows. Over and above fees generated from normal use; the fees paid by the arbitragers when reallocating capital around pools also adds to overall protocol revenue.

Cross-Chain Messaging

The most important component of the Synapse infrastructure is the cross-chain messaging system that goes beyond just swapping and bridging assets. What this inherently means is that applications are no longer constrained by the need to deploy on a single chain and can leverage Synapse to deploy on all supported chains at once.The messaging framework allows applications to transmit data across chains meaning that an activity carried out (through Synapse) on Ethereum, for example, is also valid on any of the other chains supported by Synapse. An example of this would be a user taking out a loan on an Ethereum application, moving the loaned assets to Binance Smart Chain (BSC), and being able to pay back that loan on BSC without having first to move back to Ethereum.

This kind of composability is similar to any of the other contemporary protocols that have messaging services – Polkadot with their XCM, Cosmos with IBC, and LayerZero with their infrastructure, amongst others. For more information on these protocols, click here. For us, cross-chain messaging is the most attractive solution to the interoperability issue. If messages can be passed between chains and validated, then it is not too much of a stretch for DeFi applications to no longer be constrained by the inherent incompatibility between chains. The future is bright!

By utilising cross-chain messaging, applications can develop the means to tap into various liquidity pools across multiple chains, which essentially solves the massive liquidity fragmentation issue. Liquidity fragmentation is one of the leading issues within DeFi across all ecosystems, although it might not be the most talked about point. This is due to several factors – maximalism (“Ethereum is the only chain I need” for example), indifference, awareness, and the centralised alternatives (CEXs etc.).

The vision is that aggregators similar to 1inch will be developed and capitalise on this infrastructure to create a network of liquidity that transcends any one single chain. For example, a user would put in a request to swap ETH to USDT on Avalanche. Yes, the swap could be carried out using existing pools on Avalanche – but what if that wasn’t the best price after fees, slippage, etc.? The aggregator could see that, even after transaction/bridging fees, the best price for the swap might be on Arbitrum. The swap could be carried out using bridges on the back end. The user hasn’t left Avalanche from their perspective, and they have the USDT they require for a price that wouldn’t have been possible had the swap simply been carried out on an Avalanche AMM.

Multi-chain DEX aggregation like this has already been developed and implemented – Rango Exchange and soon THORSwap are the most obvious examples. However, neither of these solutions offer bridging infrastructure and are purely limited to swaps. This is what sets Synapse apart from its contemporaries. The other examples are still valuable products, but users don’t always want to lose exposure to one asset and take on exposure to another. This is the reason wrapped assets exist – although ETH (ERC-20) cannot exist anywhere other than the networks that support the ERC-20 token standard, Wrapped ETH can exist anywhere there is an implementation for it.

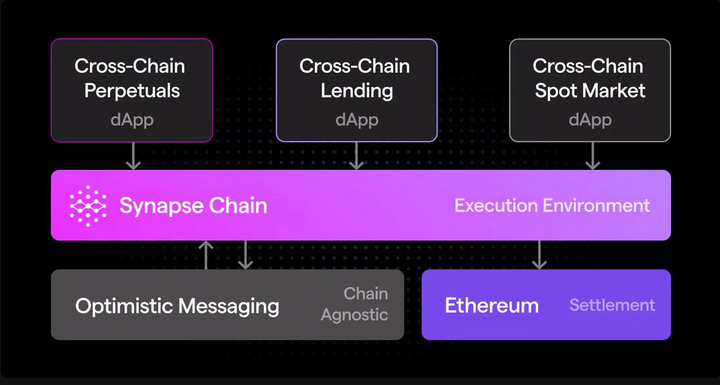

Synapse V2 - The Synapse Chain

Synapse V1 introduced the core concepts of Synapse – AMM/Bridge, xAssets, multi-chain contract deployment, etc. However, there are a few issues that cannot be resolved with the current infrastructure. Synapse V2 introduces a new system that will improve the security, reach, development environment, and tokenomics.

The core change is that Synapse will move to an Ethereum-based optimistic rollup chain secured by a Delegated Proof-of-Stake consensus mechanism. Through experience and discussions with cross-chain Dapp developers, the team has concluded that building cross-chain Dapps is much easier when there is a single programming environment specifically designed for the deployment of multi-chain applications.

Having a base on which to build cross-chain applications means the entire ecosystem shares the same state on a single chain whilst leveraging Synapse comms infrastructure to make the connection to other chains. Rather than having 10 different chains with 10 different contracts deployed, Dapp developers will be able to utilise fewer contracts at a single point of access to all chains through Synapse Chain. Let’s have a look at how they aim to achieve this!

Generalised Cross-Chain Messaging

Whereas Synapse V1 allows basic communication between chains, Synapse V2 will introduce a broader communications infrastructure that allows for any arbitrary data to be sent across chains. This includes NFTs, smart contract calls, and governance, enabling any application to be natively multi-chain from end-to-end. Expanding the communications infrastructure to encompass practically any information transfer is paramount to creating a native multi-chain development environment and one that we believe has the capacity to create an entirely new product and ecosystem that we’ve not really seen before.DPoS

By moving the security of the network to a Proof-of-Stake consensus, Synapse will be able to provide economic security to the optimistic verification system through the bonding and staking of SYN. We’ll get into the optimistic security model in a moment; however, over and above network security, this adds huge utility to the SYN token itself. SYN holders will be able to delegate to validators/guards and earn a share of the rewards, not only increasing the incentive to hold and use SYN but also encouraging more participation in network operation and security.Optimistic Verification - No More Exploits?

The security of cross-chain comms has been a hot topic over the last 18 months. Securing applications and infrastructure on a single chain is relatively straightforward. However, when support for multiple chains is required, the difficulty becomes exponentially greater with each chain added. Some of the largest DeFi exploits ever have come from the exploitation of bridges – Ronin Bridge, Wormhole (now Portal), Harmony, Qubit, resulting in the loss of hundreds of millions in funds. The vulnerabilities largely stem from the centralisation of the mint/burn mechanism for creating wrapped assets.The security model for most bridges can be generalised into one of three categories:

- Local Verification – only the parties involved in a cross-chain transaction verify transactions.

- Natively Verified – all validators on each blockchain involved in the transaction verify transactions.

- Externally Verified – a third party validates transactions between chains.

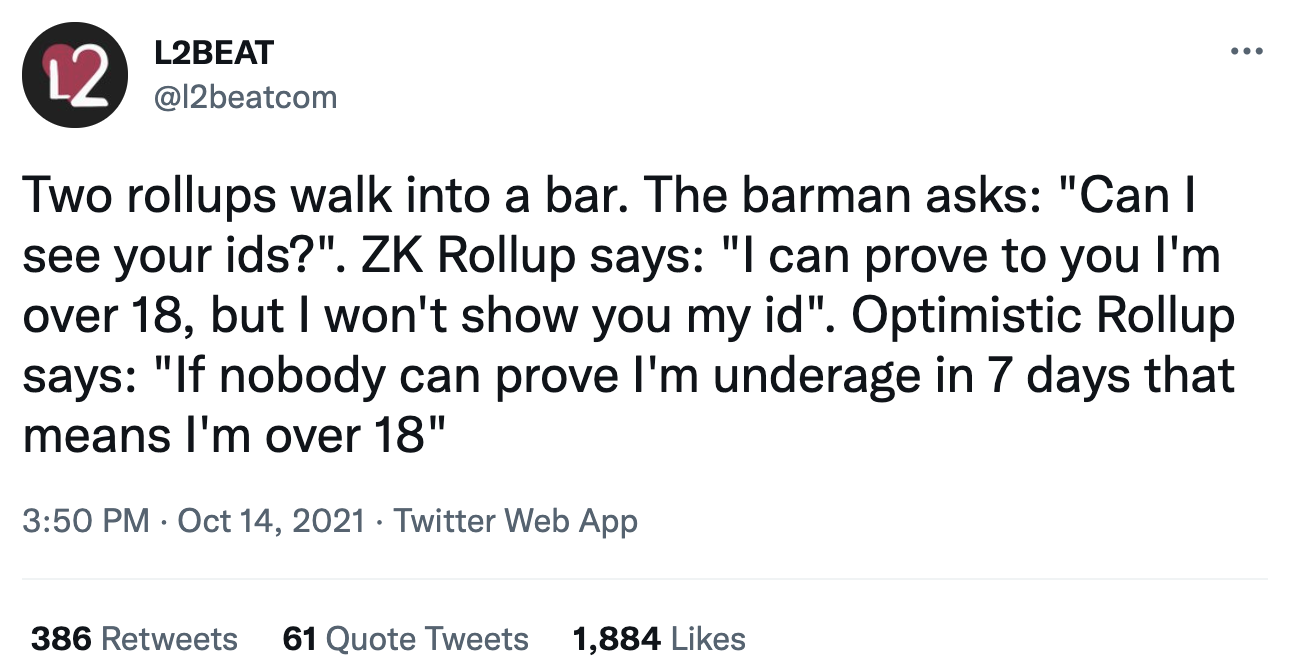

Synapse V2 will expand security through an Optimistic Verification system, inspired by Nomad Bridge and Celo. It is important to note that despite the recent Nomad exploit, it was not the security model that was exploited; rather, it was an implementation error on the developer’s part. With optimistic verification, every transaction is assumed to be valid until a third-party spots something wrong and submits a fraud-proof.

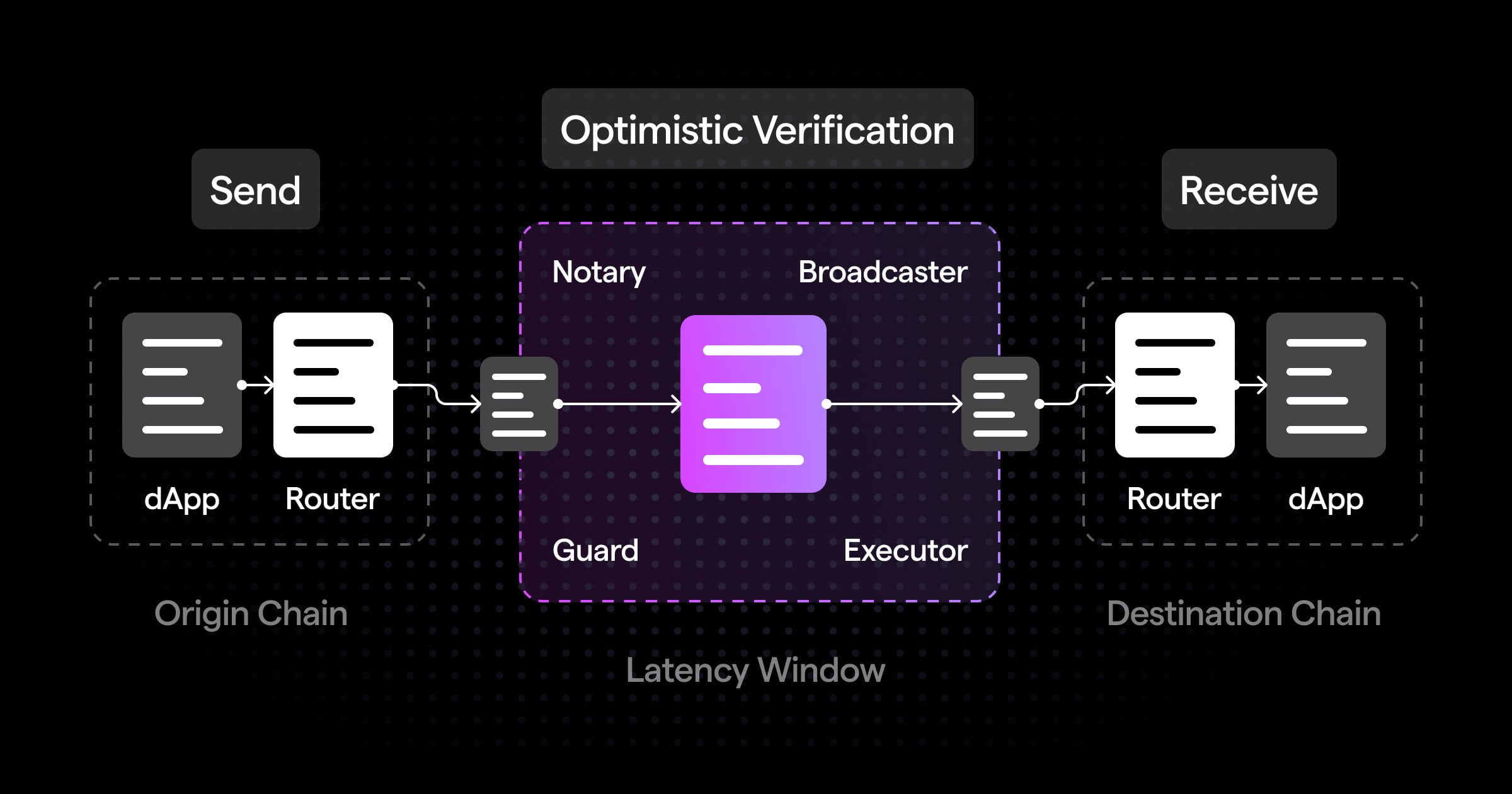

Here’s an overview of the Synapse V2 optimistic verification system:

There are 4 off-chain actors who are responsible for verification:

- The Notary is responsible for signing the Merkle root (used to make sure data blocks are undamaged/unaltered) and bonding SYN behind attestations of validity (basically saying “what I am doing is valid” and betting SYN that they are acting with good intentions).

- The Broadcaster is responsible for forwarding signed attestations from the Notary to the destination chain.

- The Guard(s) are responsible for observing the state of cross-chain messages and submitting fraud proofs in the event of a possible malicious transaction.

- The Executor is responsible for posting the finalised transaction once the latency window has expired.

- A user or Dapp submits a message on the source chain, which is routed to Synapse’s messaging contracts.

- The messaging contracts hash the message and insert it into its own Merkle tree (a data structure used to encode data efficiently and securely).

- Notary signs the attestation with the new Merkle root (see above for definition).

- Broadcasters forward the attestation signed by the Notary to the destination chain.

- Guards observe the attestation, looking for any malicious intent.

- Once the optimistic (latency) window has expired, the transaction is considered valid (see above tweet).

- Once the transaction is considered valid, the Executor executes the transaction on the destination chain.

- Rewards are provided to good actors making it worthwhile to carry out the required tasks.

- Punishments are handed out to make it costly to commit fraud.

The optimistic period can be set on a Dapp-by-Dapp basis, giving applications more freedom to determine the level of trust they place in their off-chain actors, which ultimately affects how quickly transactions can be verified. For example, a DeFi application would want complete trustlessness, whereas something like an NFT gaming application would want faster finality.

All transactions are eventually settled on Ethereum, which makes Synapse Chain an Ethereum rollup – similar to other Layer-2s like Optimism and Arbitrum. As such, all historical attestations are available to view on the Ethereum ledger. Block production will initially be managed by a sequencer responsible for providing state updates and submitting transactions back to Ethereum.

At the launch of Synapse Chain, gas will be paid by the sequencer in ETH with a view to tie the use of the sequencer to the native token, SYN, at a future date. SYN will be used by off-chain actors to stake and bond, so there is still a positive economic impact for the SYN token at the outset.

Next Steps

Subsequent to the announcement of Synapse V2, the developers have laid out their plan of action going forward for the rest of the year:- Launch a Synapse Chain testnet with comprehensive developer documents.

- Open source the generalised cross-chain messaging contracts.

- Open source the optimistic verification contracts, including a detailed specification for economic security.

- Launch a UI for staking SYN in the optimistic verification model.

- Create prototype Dapps for a showcase of Synapse capabilities in collaboration with other projects.

- Security audits for all smart contracts before deployment to mainnet.

Tokenomics

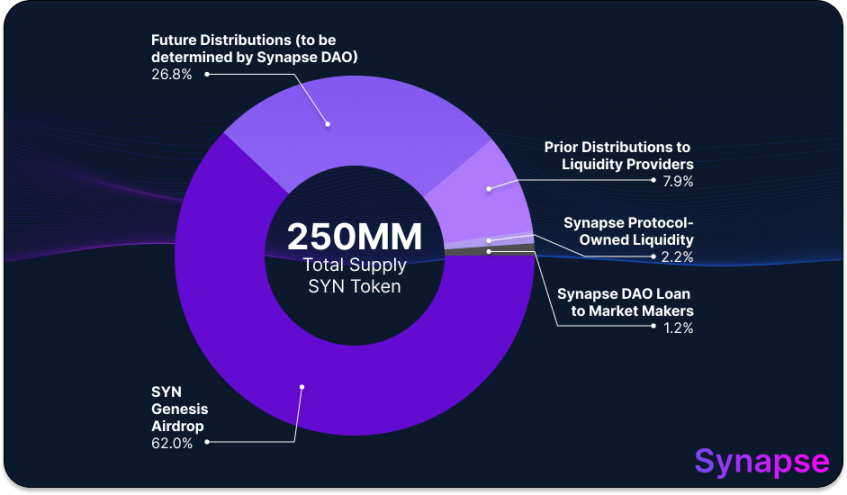

SYN is the utility and governance token of Synapse protocol. The token is multi-chain, meaning it exists on any chain supported by Synapse. Currently, SYN is mostly used to provide incentives for liquidity providers and to allow participation in network governance through the Synapse DAO. We briefly went through tokenomics in the 50x journal, but for completeness, we’ll go through them again in more detail. SYN is distributed as follows:

- 62% of SYN tokens were distributed in the Genesis Airdrop to NRV holders, as outlined in the redemption process above (1:2.5, NRV/SYN).

- 8% SYN liquidity allocated to the Synapse DAO for future use/incentives.

- 9% allocated to LPs.

- 2% to Synapse-owned liquidity (to bootstrap the pools).

- 2% DAO loans to market makers for liquidity purposes (DEXs, CEXs, etc.).

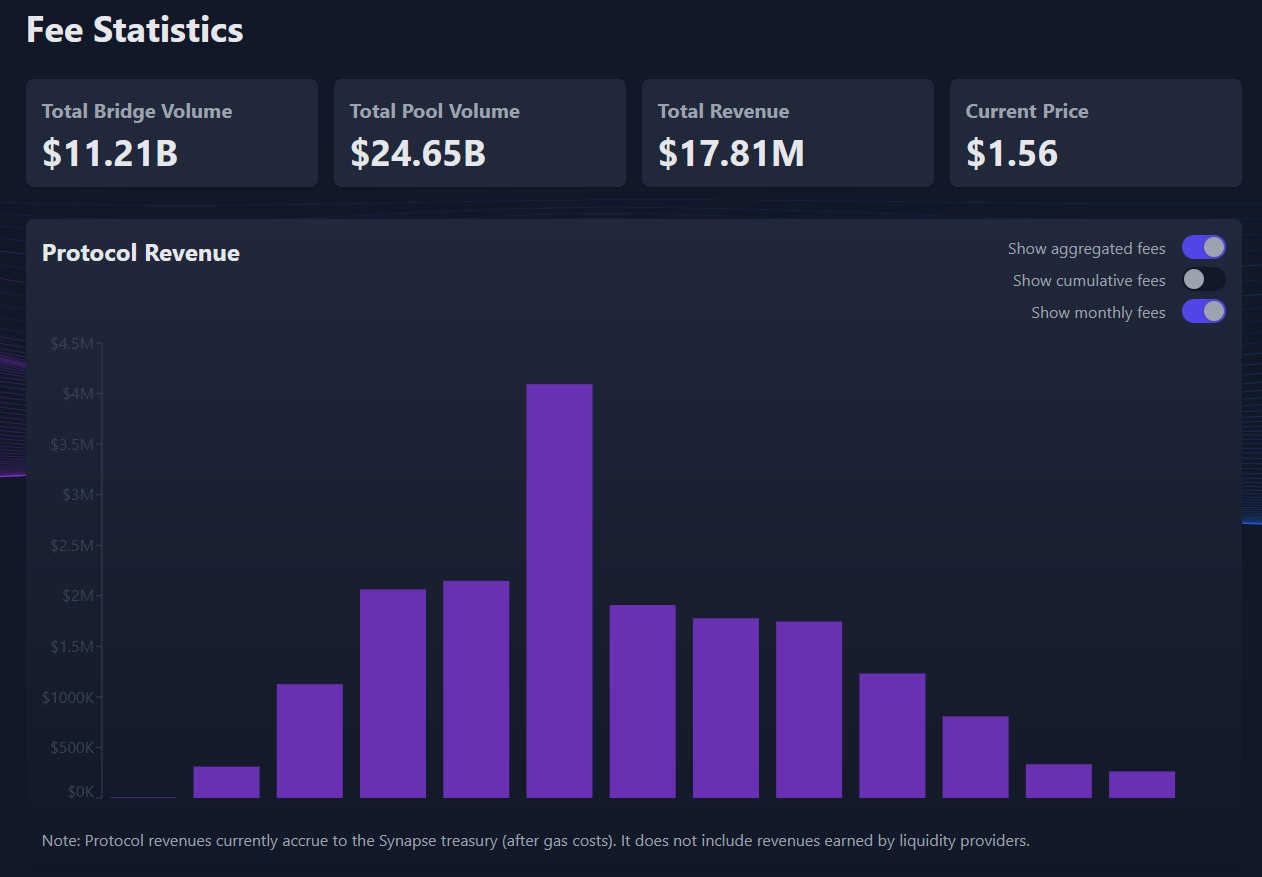

TVL & Revenue

At the time of writing, Synapse currently has a TVL of around $210 million spread across all supported chains. Peak TVL in January 2022 was around $1.15 billion and has since declined due to market conditions, in line with the rest of DeFi TVL – no significant underperformance.

In line with the wider view we have for the market, especially cross-chain comms-based protocols, we would expect this to increase rapidly at the onset of any sustained bullish market conditions as the demand for bridging and swapping returns.

Revenue

Synapse posted some impressive revenue figures at the beginning of the year, registering a monthly high of close to $4.1 million in January 2022. Obviously, with the onset of the bear market, this has decreased significantly (both as a result of less usage and the value of the assets traded taking a 70-80%+ hit). ~$330,000 revenue in July was the latest full month of figures.

Currently, all revenue goes towards the Synapse DAO treasury – not included is revenue earned by liquidity providers. Once Synapse Chain is live, some revenue will be shared with off-chain actors as outlined above as part of the incentives program; SYN staking will be a core characteristic of this mechanism. Similar to the TVL outlook, we expect revenue to return to the January highs, and beyond once the market turns around – especially after Synapse V2. There just simply isn’t the demand for cross-chain comms since on-chain activity on most chains has dropped massively over the last 6 months.

Governance

The Synapse DAO is the governing organisation for Synapse Protocol. Any SYN holder with over 50,000 SYN can put forwards proposals which then go to a DAO vote. For a proposal to be adopted by the DAO, at least 50% + 1 SYN token of the votes must be for the proposal, and the required minimum quorum (minimum level of participation, or “attendance”) is currently fixed at 10 million SYN. A full list of proposals can be found here.CPRO Outlook & Criticism

Overall, the planned Synapse Chain is arguably one of the most exciting developments we have seen within the cross-chain communications sector. The ability for developers to create applications that are cross-chain native is huge, and the level of efficiency that Synapse Chain will bring in terms of gas efficient inter-chain messaging cannot be understated. The user interface is also one of the best we have seen, and the ease of use is excellent – further development of UI is planned along with an interface for SYN staking once Synapse V2 is implemented.Over and above the already-established user base, there is consistent transaction and usage of the protocol – Synapse as it exists now has become one of the more convenient and trusted bridges to EVM compatible chains and L2s. Despite the loss of revenue and the general state of the market, we believe that Synapse is well-funded and well-positioned to continue development well into any extended bear market, with $300,000 in revenue in the month of July. The risk of insolvency is minimal - even if the Synapse team must delay Synapse V2 for whatever reason. Synapse V2 is not essential to the product right now; rather, it’s the next step in the development roadmap.

Major criticisms we have of Synapse is that the documentation feels incomplete and barebones. The effort required on our part to find the information to complete this report could have been reduced significantly if there had been comprehensive documentation. Although they have stated as part of the roadmap that complete documentation for Synapse V2 will be released in the coming months, we believe that the lack of available information over the last 6-8 months has probably affected the ability of researchers (such as us) to fully delve into the protocol at its most basic level. As such, coverage has been minimal, and we struggled to find any additional information, even from third parties. This is also partly because a lot of the code isn’t open sourced now, which is another concern. Again, the team has stated that the code will be open-sourced with the implementation of Synapse V2.

However, despite the lack of information available at this time, we have significant confidence that the team will be delivering the roadmap, and we have no other major concerns in terms of the security and development of the protocol – especially with the optimistic verification system. From listening to the team and through conversations with contributors, there are no doubts about the competency of the team.

As with all newer protocols, decentralisation is not where it could be; however, this is likely a feature, not a bug, as the protocol is still relatively early in development. We would be looking for good progress in this area going forward, something we believe is achievable with the new DPoS consensus mechanism and economic model.

Conclusions

As a comprehensive cross-chain communications solution, Synapse excels. With a tried and tested product and a relatively steady user base (despite market conditions), we believe that Synapse is well placed to capture significant volumes and adoption going forward. The creation of a native multi-chain ecosystem is likely to attract developers and DApps to leverage the Synapse infrastructure, driving revenue generation and transactional volume.

As we have stated multiple times before, there is a need for a comprehensive and user-friendly cross-chain communications platform. Indeed, protocols like Polkadot, Cosmos, THORChain, etc., all provide value in their niche offerings; Synapse encompasses many of the cross-chain solutions (bridges, AMMs, communications) into one package with an easy-to-use interface.

Any further developments or important information surrounding Synapse will be communicated in Discord, and we will provide further journals as required. For more information regarding our price targets, please check out the 50x journal! If you have any questions, please do not hesitate to message us on Discord or @ us in the channels.