In August 2022, we published a deep dive on the Synapse protocol in which we anticipated that Synapse would be a major player in the future of cross-chain communications.

Yet, the journey has been anything but smooth.

In September 2023, Synapse Protocol faced a major liquidity pull, courtesy of Nima Capital. The VC fund pulled $40 million in liquidity from the bridge, raising several questions from the community.

Fast forward to 2024, and we are taking another look at the Synapse Protocol to evaluate its recent progress and how that fits into our original 50x thesis.

Is Synapse still on track with our 50x thesis, or is it time to jump ship?

Let’s begin.

TLDR

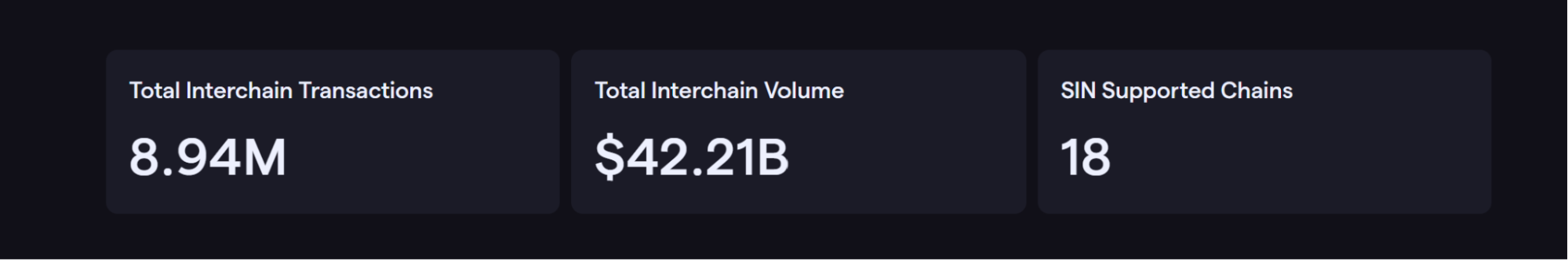

- Synapse's SIN testnet has shown strong activity, with nearly 9 million transactions and over $42B in volume.

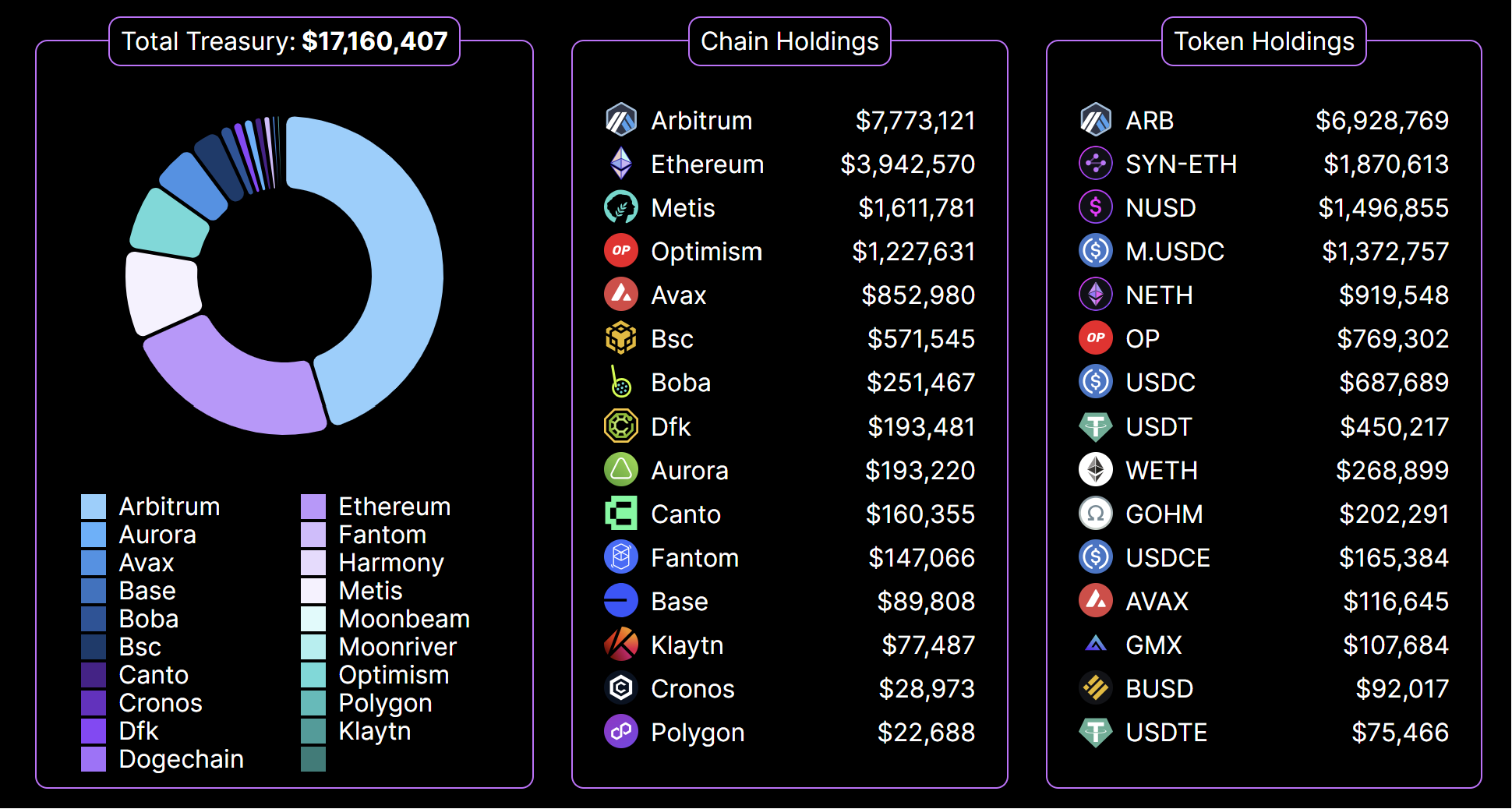

- This has generated close to $27M in fees for the Synapse Treasury DAO. The DAO's balance has grown to $17M through fees and grants.

- SYN rallied 119% in early Jan around grant news and 67% later in the month when RFQ went live. Now down 24% in the last week.

- There are some questions about actual RFQ usage. One address is responsible for 99% of the volume, and there is suspected bot activity.

- Uncertainty persists around mainnet and token utility; therefore, the 50x thesis is on hold for now.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Synapse overview

Currently, inter-chain communications infrastructure and modular blockchains are trending narratives, and the Synapse Protocol fits right into the story.Synapse Protocol is a widely used cross-chain communications network across multiple blockchains. The project aims to facilitate seamless connectivity and data transfer between different blockchains.

Previously, we highlighted two key components of the network:

- Synapse Interchain Network (SIN): The proof-of-stake interchain network where all the data aggregation takes place across all chains

- Synapse Chain: The L2-Optimistic rollup chain, where the data is ‘rolled up’ and then secured on Ethereum

The Synapse Bridge is the first user-based product built on top of an interchain communication network, and it allows users to swap on-chain tokens across 15+ EVM and non-EVM blockchains in a safe environment.

Now, let us discuss Synapse’s recent developments.

Synapse Interchain Network (SIN) testnet performance

The Synapse Interchain Network testnet was announced back in September 2023. We briefly discussed the announcement in our September report. We also noted that the testnet performance will be key to determining the protocol’s future.Now, a new data set is available, and overall, the Synapse ecosystem seems to be thriving.

Over the past four months, SIN has registered 8.94 million total interchain transactions, amassing over $42.21 billion in total volume. The SIN network currently supports a total of 18 chains.

Due to its strong network activity, the protocol has generated $26.83 million in fees.

The large revenue share played a role in reinforcing Synapse’s Treasury DAO.

Synapse Treasury DAO reaches $17 million

Over the past four months, the Synapse DAO’s holdings have improved to over $17 million in non-native crypto tokens.For context, it was around $8.5 million in September 2023. A majority of the treasury has been allocated from fees and grants.

One of the key advantages of Synapse DAO is that no VCs are involved anymore after the Nima Capital fiasco (more on that later). The fund is decentralised, and the objective of the Treasury DAO is to accelerate network growth and expansion.

RFQ bridging

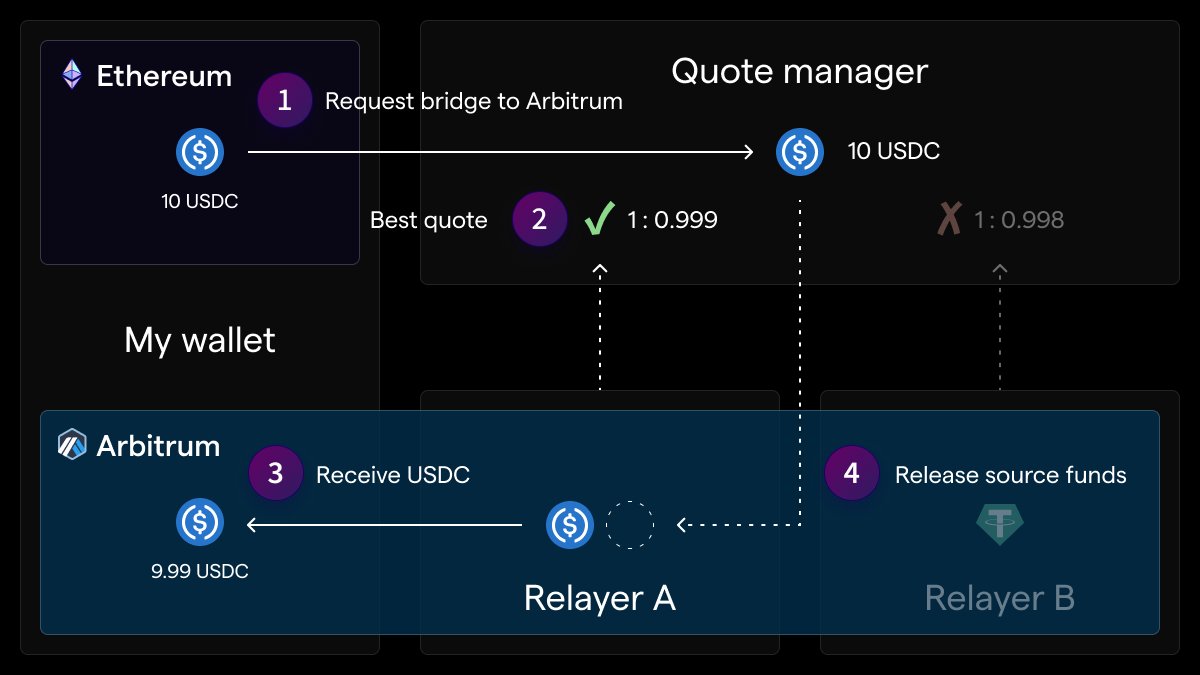

As mentioned earlier, Synapse Bridge announced a key upgrade to its functionality in 2024.The RFQ method is supposed to be the fastest in the network, and it serves as a step up on Synapse's previous two bridging methods - Canonical Token Bridging and Liquidity-Based Bridging.

The RFQ Bridging went live on the 19th of January.

The main process in RFQ bridging is that each transaction becomes an auction between relayers. The relayers compete to validate the transaction and give users the fastest and most affordable option.

Post-RFQ launch, the community was hyped about its utilisation. Last week, instant bridging was enabled for Ethereum, and the USDC limit was expanded to $100,000.

Additionally, the Synapse DAO also received a 2M ARB grant (valued at $3.8M at the time of approval) from the Arbitrum Short-Term Incentives Programme (STIP).

This grant aims to increase bridge usage and accelerate new efforts to make the bridge faster and cheaper, falling in line with the functionality of RFQ bridging.

Based on the above updates, the SYN price has also reacted positively in the charts.

SYN's price action

SYN remained on a downtrend for most of 2023 and did not enjoy the bullish market rally of Q4 2023.However, in 2024, the asset witnessed a strong bullish rally.

Between January 7th and 16th, SYN rallied by 119%. During this period, the ARB grant was approved.

Then, the price ascended another 67% between January 19th and 25th, around the time when RFQ bridging went live.

So, both of these updates served as catalysts to drive a rally.

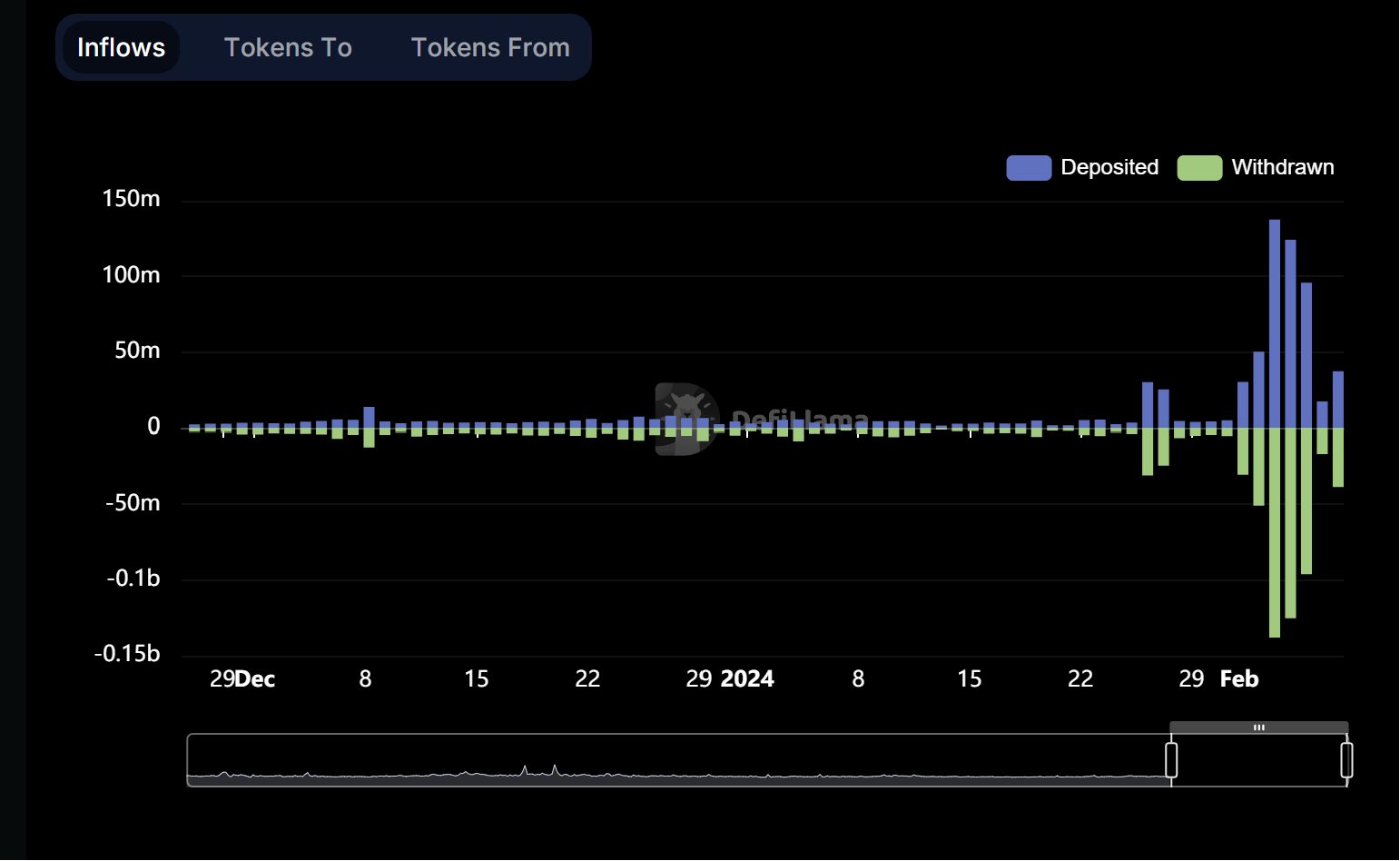

After the RFQ bridging announcement, SYN supporters expressed their excitement, and the on-chain data also supports the excitement.

The on-chain bridging volume on Synapse went up a notch at the end of January.

Synapse Protocol had the highest 7-day volume until February 6th, with over $550 million.

Circle CCTP has now overtaken Synapse, but the protocol remains in 2nd place with $461 million.

However, there was more to it than meets the eye when RFQ bridging and its activity were closely analysed.

RFQ bridging data: real or fake?

When we analysed the volume data closely, we identified a few anomalies.On February 5, Synapse’s daily trading volume registered $96 million, out of which $93.5 million was processed by one address. This was on the Arbitrum chain, and basically, out of 123 transactions on that day, one address was responsible for 99% of the volume.

Further investigation showed that RFQ bridging might not have been involved at all.

When we looked into the addresses, most transactions moved USDC, and assessing CCTP bridging led to the same address, which was also responsible for or partly involved in the $93.5 million move.

Now, this doesn't prove any wrongdoing, but the fact that there are $0 fees for transactions on the bridge raises the possibility that bots, rather than human users, might be pumping volumes.

If we spotted the possibility of a fake bridging volume, others would have also spotted it. So, it is unsurprising that the price has reacted accordingly over the past week.

SYN has declined rapidly from $1.00 to $0.68, registering a 24% decline.

Unresolved issues on SYN's utility and the Nima Capital fiasco

In our previous report, one of the biggest issues we highlighted with Synapse Protocol was their incident with Nima Capital. We raised several queries, like:- How was Nima Capital allowed to sell those tokens immediately?

- Was there a legal contract in place?

- The existing liquidity dropped TVL to $101 million then, but it still hasn’t improved.

While the team releases a monthly report on all the important updates in the ecosystem, the team has not properly addressed the Nima Capital incident until now.

Apart from glossing over it once, it appears the team has decided just to look the other way and hasn’t given the community any clarity into what happened.

This brings us to the next issue: $SYN Token Utility.

Yes, the network has generated a massive amount of revenue from their SIN testnet, but there is still no clarity on the $SYN utility. The transaction gas fees are still paid in ETH.

The mainnet launch is still TBD, and the message remains the same: $SYN will be used in a form that has not been clarified yet for the mainnet.

The Synapse forum currently hosts multiple proposals from community members. One of the commonest requests is to define the role of $SYN in network security and staking rather than just a gas token for Synapse Chain.

The wait continues on that particular note.

Cryptonary’s take

We will give credit where credit is due.Synapse’s SIN testnet can be considered successful based on the on-chain activity. The protocol is still in line with its long-term vision. From a cross-chain communications perspective, the Synapse protocol serves its purpose with its modular architecture approach.

However, the Synapse team has not been vocal about its mainnet launch, and speculations are still out about its release. More importantly, there's still no clarity on SYN's function in that network.

If you aren’t currently positioned in SYN, we are not sure that there is a strong enough incentive to start buying SYN tokens now.

Besides the bullish rally in January 2024, there is a reason SYN did not undergo a market rally in Q4 2023. People are using the bridge, but there’s no direct value accrual from all that activity to the token.

However, if you have a SYN bag already, there is no harm in holding it long-term, provided it is not a large bag – the opportunity cost of holding a large SYN bag doesn’t look great from a risk-reward point of view.

The 50x thesis is on hold until further information is released from the team.

We will keep an eye out for updates to formulate a clear investment plan in the future.