We have identified several winners since the bull market got underway.

However, while the market entered a corrective and consolidation phase over the past few weeks, some of the protocols we covered started giving back some of their previous gains.

Drawdowns are part of the game, but sometimes, you must identify whether the losses are a momentary setback or signs of a shift in the opposite direction.

In this report, we are re-evaluating three projects that are now exhibiting bearish sentiment instead of showing strength.

Is it time to bid them farewell, or should we continue to hold through the storm?

Let's find out.

TDLR

- This report analyses three projects that we expected to be winners in this cycle but have underperformed so far.

- Thala Labs: On-chain data looks good, but the price has dropped significantly.

- Vector Reserve: It recently changed its tokenomics and rebranded to Kernel Protocol. The move to Karak Network has potential, but there is uncertainty.

- Veil Exchange: Revenue is down, even though privacy protocols as a whole are gaining some momentum. However, Veil Exchange is losing market share, and better opportunities exist elsewhere.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Thala Labs (THL)

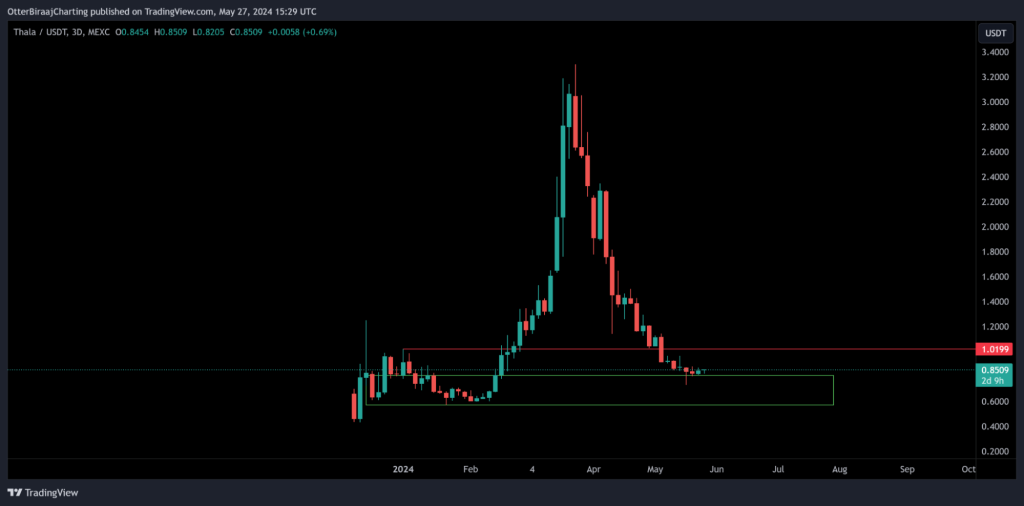

Thala Labs is one of those projects that seemed undervalued when we drafted our first deep dive report. Its on-chain statistics on the Aptos blockchain were impressive, and it also demonstrated an ideal price-to-sales ratio with respect to revenue.Yet, the current price direction could not be more bearish. From its all-time high of $3.13 on March 21, it is currently down 74%.

We looked into the project, and it still seems solid. The protocol has a thorough roadmap, and on-chain activity has witnessed only a minor decline, but the price has taken a nosedive.

Let us break it down in detail.

On-chain update

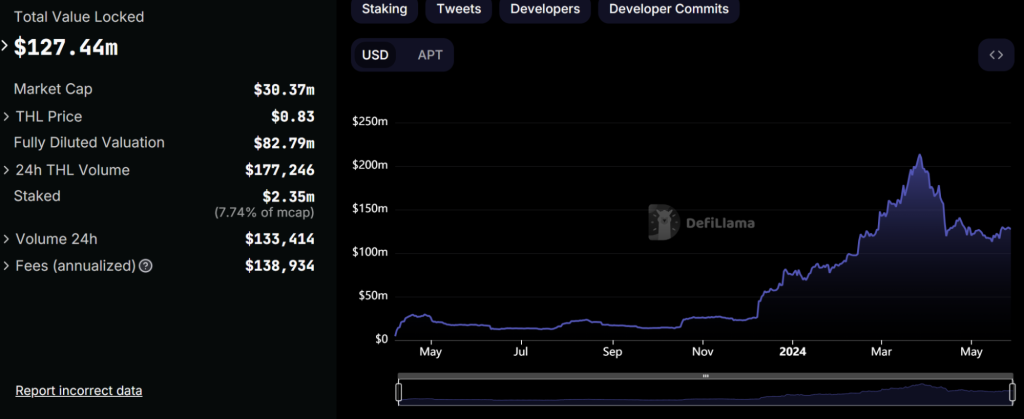

Thala Labs is an important DeFi protocol on the Aptos blockchain. It is the third largest protocol based on TVL and continues to foster activity for the L1 network.However, since our first report on Thala, the ecosystem's TVL has dropped from $213 million to $127 million. In comparison, Aptos' TVL has fallen from $412 million to $387 million, a slight decline. In fact, Aptos is flourishing in terms of L1 activity. On May 24, Aptos broke the record for the most daily transactions at 95.6M/day, outperforming the likes of Solana, Ethereum, NEAR, and TON.

Messari also highlighted several positives for the Aptos blockchain. Quarterly revenues in USD increased by 37% quarter over quarter to $475,000, with all the fees burned. Aptos network usage also improved by 66%, and average active addresses increased by 97%.

It is important to note here that Thala activity is recorded in these statistics; when it first wrote the report, Thala was the most dominant DEX on Aptos, with more than 70% of the DEX volume on the Aptos network and represented around 50% of Aptos' TVL.

Thala roadmap update for 2024

The numbers continue to remain strong for Thala Labs. According to its recent roadmap and ecosystem update, Thala has enabled over $535 million in volumes through Thalaswap. Its first incubated project, Echelon, which we discussed in the first report, reached a TVL of $50 million. Thala's existing products, Move over Dollar or MOD and sthAPT, have also displayed strong functionality, with close to 9.9 million MOD tokens currently circulating.The roadmap also highlighted new products and the integration of new vertices, including Real World Assets. While the positive announcements seemed great, they were not enough to overshadow the negative price action.

Here's what went wrong

Since THL seems to have fallen from grace, something must have affected the project negatively. One area foremost on our minds as a debilitating factor for THL is its inflationary tokenomics.Since our first report in March, the circulating supply for $THL has increased to 36.7 million from 32 million. This could have accentuated the drawdown. We highlighted that THL emissions have been reduced by 50% since March, but the reduced token emissions haven't helped slow its price drop.

The second factor is the relationship between Thala and Aptos – Aptos in the foundational L1, while Thala brings liquidity directly to Aptos. Thala's incubator program is also responsible for the growth of DeFi protocols on Aptos. Hence, a negative price performance for $APT affects $THL as well. Since the recent market-de drawdown, $APT is already down 50%, so, understandably, THL has also seen significant selling pressure.

Lastly, the state of the general market is another factor responsible for THL's price action's weakness. Simply put, the liquid staking and re-staking category narrative isn't active or trending right now.

Cryptonary's take

When a token is down over 70-80%, we need to examine the project seriously and decide whether to cut losses. We have reached a similar dilemma with Thala Labs. However, based on actual business performance, this is one such project where you need to trust the process and be patient.From a completely objective point of view, the on-chain fundamentals for Thala and Aptos remain sturdy. The roadmap highlights key developments, partnerships and activity, which is tangible. So, over the long term, the price of $THL will likely follow the positive on-chain metrics.

The price action is extremely depressing for $THL, and a lack of strength at any level is also concerning. However, can Thala decline any lower? Hopefully not. The idea would be to allow $THL to breathe again in a bullish market when there is a collective rise across the altcoin market.

Additionally, if existing holders want to improve their average entry position, they should wait until the charts show a bullish trend shift.

If $THL can close above $1 on the daily or weekly chart, we suggest another small buy of 20-25% of the initial allocation to improve initial entry.

Right now, we should trust Thala's on-chain data and be optimistic that a positive price action could soon follow.

Action plan

- Existing holders should hold and add 20% more after $THL recovers above $1

- New Holders can allocate a small position to take advantage of a potential swing-high

Vector Reserve (VEC)

The rise of Liquidity Providers, or LPs, set the stage for a dynamic market that needed different types of financial instruments to meet market needs. This is where LPDFi came in, and we presented Vector Reserve as a potential long-term bet on the LPDFi sector.Since then, the VEC valuation has suffered a massive 74% drop. This is a major decline, so we are evaluating its on-chain data and fundamentals to determine what changed and why it derailed from its initial trajectory.

On-chain update

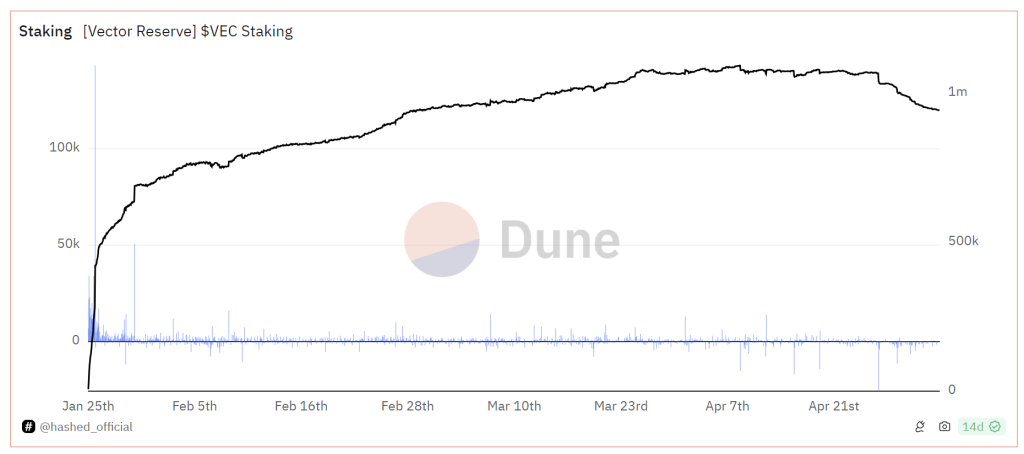

Starting with TVL, Vector Reserves' total value locked value fell from a high of $56.57M to the current TVL of $12.85M. The total amount of $VEC token staked has also declined marginally.

On the flip side, one positive development that must be highlighted is the FDV to Mcap ratio drop. The current FDV value is $19.2M, compared to $200M+ in March 2024. In our previous report, the FDV/Mcap was close to 10, which meant immense inflationary pressure built up on the tokenomics side of things. Right now, the FDV/Mcap ratio is around 2.8.

A lower FDV/Mcap ratio indicates undervaluation, while a higher value suggests overvaluation.

As a basic rule of thumb,

- FDV/Mcap value below 1= Undervalued

- FDV/Mcap value between 1-4= Fairly Valued

- FDV/Mcap value above 4= Overvalued

VEC adopts a brand new tokenomics

Last month, Vector Reserve announced a new tokenomics moving towards a deflationary buy-back and burn model from its previous inflationary setup.Earlier, VEC token holders received rewards in the yield form of VEC rebates. This means VEC tokens entered circulation in the form of rewards, but long-term, this was an inflationary system.

Now, Vector Reserve mentioned that it currently has two sources of revenue,

- Yields from treasury strategies deployed using the $10m+ VEC treasury

- Surplus profit from the LPD strategies applied to the vETH backing

- 40% to buy back and burn

- 40% back to the treasury for sustenance

- 20% to protocol operations

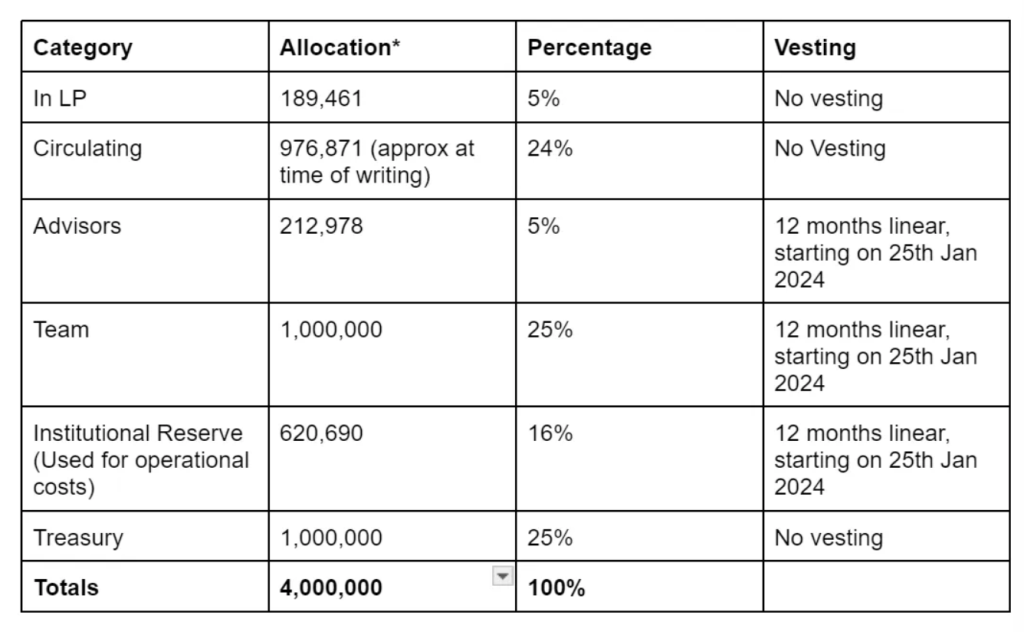

It is also important to note that the core team has relinquished 50% of their previous allocations, divided between the treasury and the institutional reserve. The table below highlights the current breakdown:

Rebranding to Kernel Protocol

Beyond the impressive tokenomics overhaul, the team is going the extra mile to give the project a chance to survive.Earlier this month, Vector Reserve announced that it is moving away from the EigenLayer ecosystem to the Karak Network. The Karak network recently caught the attention of the crypto market after Eigenlayer's airdrop disappointment sparked outrage in the community (Read our Eigenlayer airdrop report for more context).

EigenLayer's recent airdrop also left a sour taste for its DeFi users, and Karak is claiming to commit towards a DeFi-centric approach. Now, eyeing this opportunity, Vector Reserve has planned to jump ship, and they aren't just abandoning Eigenlayer; they are doing it with a complete rebranding.

With the rebrand, the protocol name will change to Kernel Protocol. It will offer Karak Native LRTs, which allow users to restake assets on Karak and receive LRT tokens, which can be further used in yield-bearing DeFi protocols.

Vector mentioned that they shifted from EigenLayer to Karak because the latter offered a better product fit through multi-asset re-staking. While EigenLayer only allows the staking of ETH and ETH LSTs, Karak allows its users to restake any crypto asset.

Lastly, $VEC tokens will soon migrate to $KERN tokens and be pegged 1:1 with $KERN.

Cryptonary's take

Vector Reserve has a lot on its plate, but that might be an understatement.There is a lot of uncertainty, from a tokenomics revamp to a complete project rebranding. These changes seem positive on paper, but the protocol is entering uncharted territory.

The move from EigenLayer to Karak could be a game-changer. If you compare the TVL between EigenLayer and Karak, it is clear that there is more opportunity for growth with the latter. Karak has demonstrated significant growth over the past few weeks, and considering the recent fall of EigenLayer's image, it can play a part in Karak's rise. In that case, $VEC or should be launched $KERN can derive significant growth, supported by its deflationary tokenomics.

But before all that, liquid re-staking needs to pick up as a trending narrative again. For the time being, if you are holding $VEC, keep holding them, as things can get really exciting for the protocol.

That said, we don't recommend that new entrants take a position with $VEC until its migration to $KERN is completed.

Action plan

- $VEC holders should hold and wait for $KERN token migration to decide on whether to buy more or jump ship

- New investors should not take a position until after the $KERN migration.

Veil Exchange (VEIL)

When we analysed $VEIL back in Q1 2024, we were clear that its simplicity had caught our attention. It was a no-nonsense protocol around privacy that seamlessly worked. The tokenomics were strong and its ecosystem had generated strong revenue numbers.

It was trading around $0.009 then, and we recommended getting in around $0.005. The coin made an ATH of $0.0137, 173% up from our recommended entry and 52% up from the publication date.

However, none of that matters much now because the asset is now down almost 70% since we wrote that report.

We took another look to uncover why it has deviated from the initial upward trajectory that it printed.

On-chain update

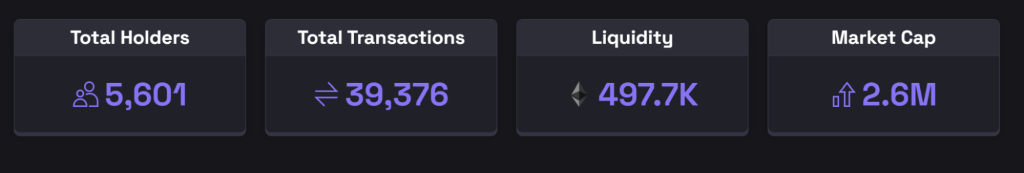

Since our last evaluation, the total number of holders for VEIL has increased from 4710 to 5601, i.e. 19% rise. The total number of transactions is also up by ~20%.From a revenue standpoint, numbers remain solid. The total amount paid to the VEIL token holders over the past 81 days(since our last report) is $63,000.

Considering 20% of of revenue is paid out, that means the total generated revenue is $315,000. Now, this period's revenue gives an annualised revenue of around $1.3 million, marking a decline from its previous record of $2.46 million annual revenue in March 2023. Nonetheless, it is still a respectable return, considering the better part of this period has been majorly bearish across the market.

However, one red flag identified is that its whitepaper is not available anymore –this is not a good sign.

Looking beyond the VEIL

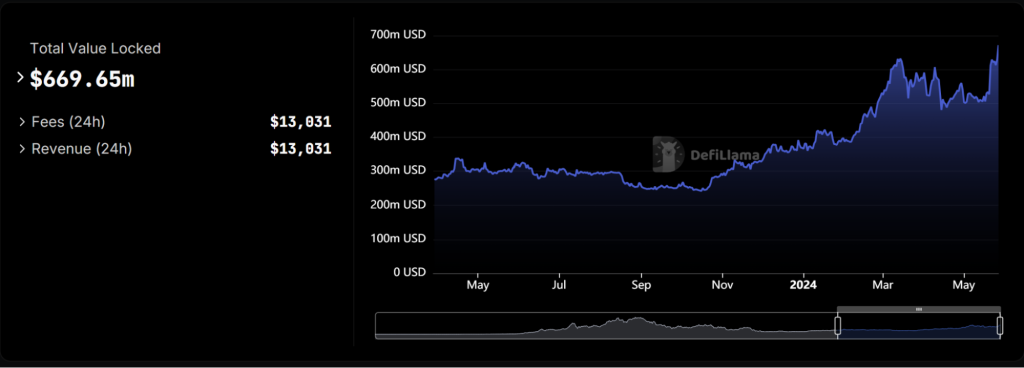

In that March report, we mentioned that VEIL is a high-risk project that depends on the privacy narrative.Looking at privacy protocols, the collective TVL had actually reached a new yearly ATH at $670 million. So, privacy projects have been gaining momentum off-late, but unfortunately, the momentum doesn't seem to have trickled down to Veil.

In addition, the liquidity situation has not improved. This project needs more listings for liquidity to improve, but MEXC and UniSwap are still the only available options. On a related note, liquidity has taken a major hit, and this is directly related to the decrease in market cap.

So, the project is doing okay, but it is not benefiting from the rising momentum of its sector, and the lack of more listings means the token is not being positioned to get the attention that will trigger a strong rally.

Cryptonary's take

The good thing about VEIL is that it managed to pull off a 46% recovery in the charts—this project is not dead; it is functional and generating revenue.Blatece making that slight recovery, it has again been consolidating within a small price range. The current trading volume for the token is also concerning, with only ~$17,000 over the past 24 hours.

While the protocol hasn't displayed any grave on-chain shortcomings, VEIL might just not be gaining any interest from the larger community right now. The privacy narrative doesn't look like it will be trending anytime soon, and the disappearance of its whitepaper is a little suspicious.

There are better opportunities in other market sectors right now. While there's a chance that it can still go up and return to its previous high, right now, it is showing weakness rather than strength.

Action plan

- Existing holders should hold and be ready to sell on the next leg of the recovery rally.

- If you don't have a position in VEIL already, you may be better off looking elsewhere.