- $20,000 Airdrops

- 100x in a Year

- Generational Wealth Creation

It’s not coming to crypto, it’s already here.

A few weeks back, we presented our thesis (for free) on DeFi Derivatives given the fact that they're incredibly undervalued. After going down the rabbit hole of research, we're now back with our projection of the winners in this race - ahead of the pump.

LFG

TLDR

- Aunty Doris isn’t buying Bitcoin yet.

- Crypto presents opportunities, it would be rude for us to ignore them.

- Our top picks for a defining sector in DeFi!

- Target prices included.

- We are early…

Winners

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility and only you are accountable for the results.

After careful, tedious and lengthy evaluations of the DeFi Derivatives sector we have arrived at its culmination. We looked into every nook and cranny, left no stone unturned.You know what options there are, you’ve been informed there might be treasure in DeFi options vaults, and you believe that the future(s) is DeFi derivatives.

Now, let me tell you which protocols are racing to the pot of gold at the end of this rainbow.

First, a bit of commentary…

As you know from the previous reports in this series (links above), derivates are the most important tool in any financial system. They define markets. Estimated at over $1 quadrillion dollars globally, they boast a notional value of 3x the estimated value of all global wealth. If you don’t understand how that could be possible, check out Is This Sector Going to the Moon in 2022.

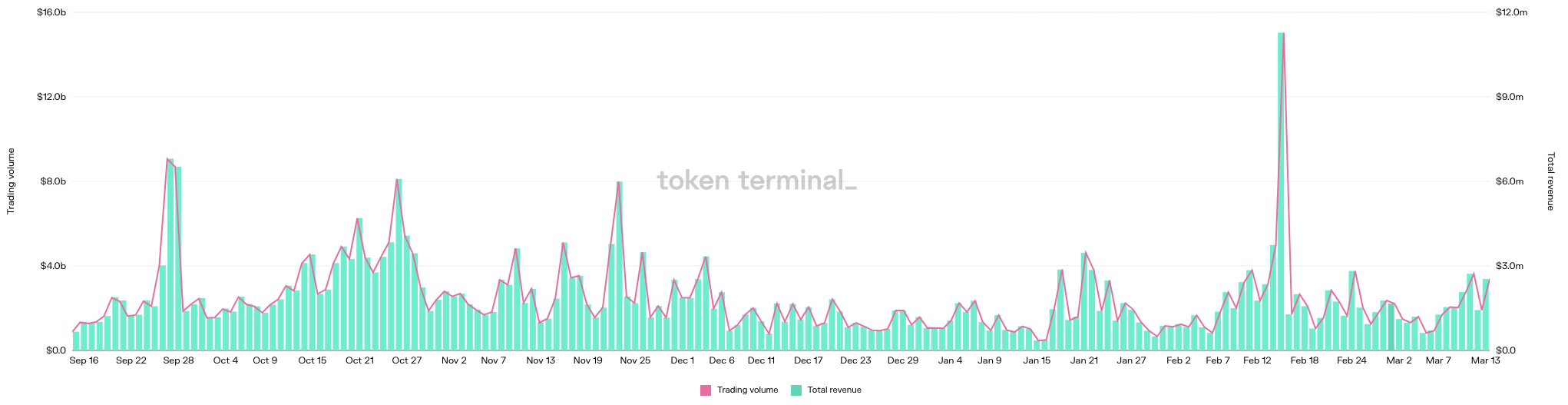

Derivatives are already in crypto, making up over 60% of trading volume. But this is dominated by centralised exchanges.

It’s time for a change… it’s time for DeFi to take over.

CeFi - For Boomers

Now, don’t get me wrong. There will always be a place in the world for our centralised friends over at FTX and Paradigm. Institutions and hedge funds have all sorts of regulatory requirements that don’t make DeFi an easy option for them.Alongside this, Aunty Doris, even if she gets involved in crypto, may never trust DeFi.

I can almost hear her saying “I’ve already bought the magic computer money, there is no way I’m giving it to the blockchain”.

DeFi – The Bull Case

By now, you already know how important transparency and censorship-resistance are in the world of finance.

DeFi = Wall Street On-Chain Without the CorruptionThe true gem of DeFi, though, is the ‘money-Legos’ ethos that it embodies and allows. Protocols can build on top of each other, helping facilitate their respective goals and building previously non-possible products - take that TradFi.

Don’t make me say it again… (cough we are early)

The Winners

Disclaimers:

- Not financial nor investment advice. Any capital-related decisions you make is your full responsibility and only you are accountable for the results.

- CPRO RESEARCHERS OWN TOKENS MENTIONED IN THIS REPORT.

Futures

If you missed it, make sure to read this to understand our bull case as the potential here is massive.Since writing, we have published our deep dive on dYdX, which can be found here.

Futures MVP: DYDXA game-changer in DeFi.

dYdX was the first decentralised futures exchange to use an orderbook market-making style which gave traders the CeFi-like experience we love - they also have an iOS app on the way.

The protocol is running away from the rest of the market, and whilst we don’t see there being only one winner, it is hard to see how anyone can compete with the might of dYdX.

It is vital to note that DYDX doesn’t accrue revenue from the protocol. This is something that we see potentially happening in the future, as they have announced full decentralisation plans at which point token holders can vote it into existence.

Timeline: 18-24 Months

Target MCap: $22.4 Billion

Price: $32

7XTake Profits - 25% of inital investment at:

- $8

- $16

- $32

- Hold rest, or sell at will.

Options

Since publishing this report, we have dug deep into both protocols, and a clear winner has emerged. As they stand now, Premia has taken the lead, with a clear value proposition and strong project. Full details on each, and our logic for this decision, can be found in the deep dive reports (Premia and Dopex).Since writing, we have published our deep dive on Premia and Dopex) - check them out for more info!

Given its nascency, picking the ultimate winner from the start line has a low probability of success. This is why we opted to choosing two winners.

Options MVPs: PREMIA & DPX

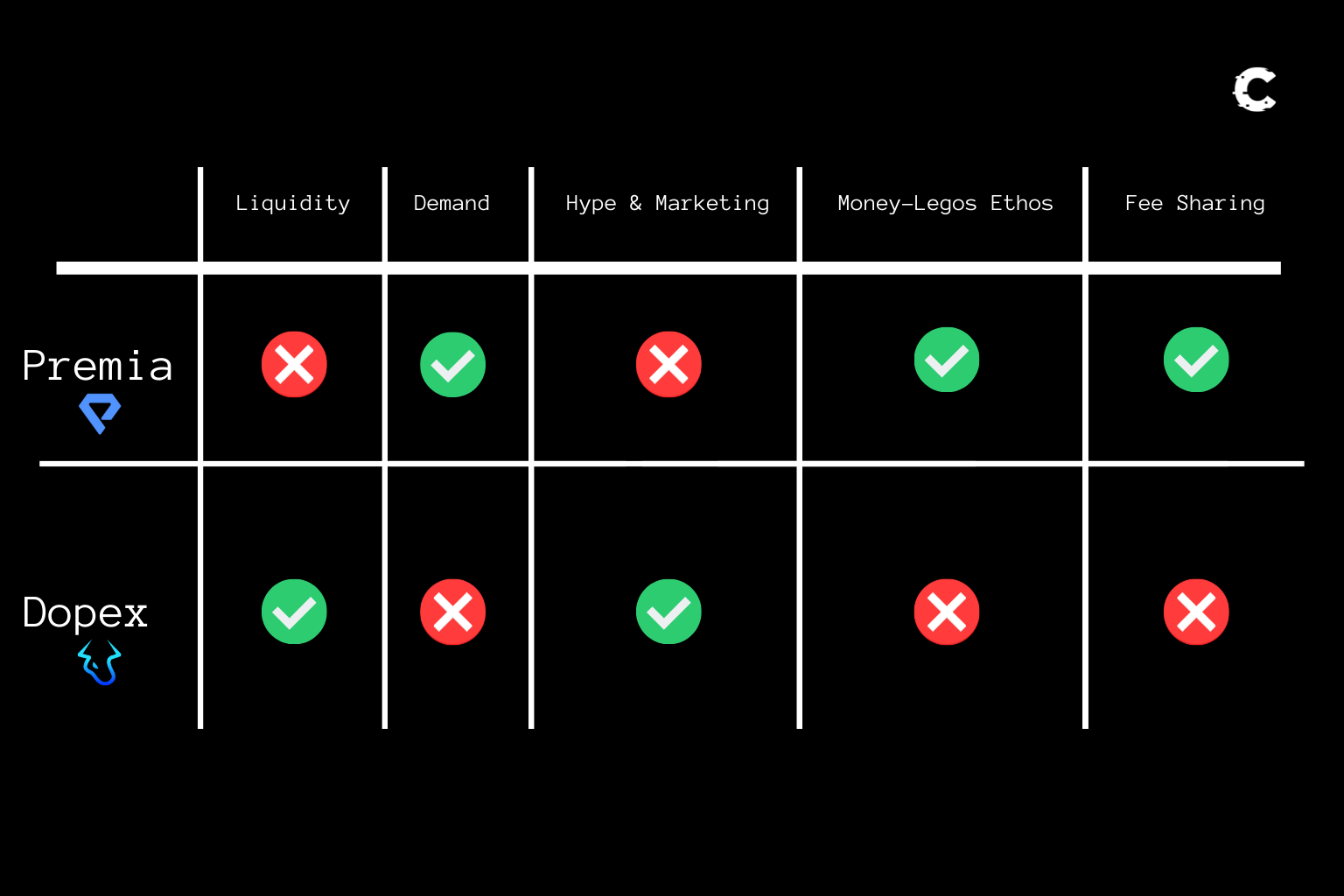

The diagram is overly simplistic, but it shows the battle.

Dopex has excessive liquidity ($110m – making it Goliath), with less demand to buy options than there is liquidity to sell them.

Premia has the opposite, with more demand, and less liquidity ($15m – this is our David).

Goliath is a king of hype and marketing, taking more of a shout loud and build fast approach, whilst David slaves away building a tech-first, decentralisation focused protocol, with a clear target market and end goal (to be the DeFi options platform of choice, and have a wide array of DeFi protocols built on top of it).

Premia is built from the ground up to allow other protocols to build on top and into it (they have a ‘money-legos’ ethos), whereas Dopex seems to have a ‘do it all ourselves’ ethos. Dopex has partnered with JonesDAO, but this sees JonesDAO as more of an extension of Dopex than its own entity.

Fee sharing is already live on Premia, with PREMIA stakers receiving 80% of all fees generated. Dopex plans on implementing this, but some distance in the future, and has yet to decide on the details and fee splits.

The question is, can David beat Goliath? Or, will Goliath keep generating hype and eating up liquidity, and simply step on David when the time comes?

Our view – Yes. David can beat Goliath. But there is a set of challenges to overcome first.

Since writing this report, we have conducted deep dives into Dopex and Premia. As you will know if you have read them, we are considerably more confident on David beating Goliath now, and have invested both personally and with Alpha DAO into Premia.

Timeline: 18-24 Months (when we are in a bull market)

Target MCap: $1.5 Billion

PREMIA: 14XTake Profits - 25% of inital investment at 4X, 8X, 14X and let rest run, or sell at will. Prices will vary depending on inflation and hold length.

DOVs

The DOV market is brand new. Ribbon, as a first mover, has very high TVL, but there are flaws. Newer protocols are learning from them and trying to capitalise on their mistakes.DOV MVP: FriktionSince writing, we have published our deep dive on Friktion, which can be found here.

Happily, our DOV MVP stands out. Discussed in our 80% Yield!? Is it Sustainable, Friktion has entered the market on Solana and is here to make waves.

Choosing to build on Solana was a great strategic move for Friktion. Rather than entering the already crowded Ethereum and Layer 2 markets, they are able to innovate and build in relative peace, knowing competition is much less intense.

And innovate and build they have!

They pay attention to our good friend delta hedging, and are currently working on releasing one delta-neutral vault for liquidity providers, and one to protect against impermanent loss (for traditional liquidity providers). Much more is in the pipeline, but these are the next two.

With the funds, they are building institution and DAO treasury management through their Circuits. They aim to become the one-stop shop for asset management.

Already onboarding treasuries, and with a clear path to success, our MVP certainly stands out.

There is huge room for growth for this protocol, and the best bit?

No token (yet).That means we can try to farm an airdrop; in case they choose that. If not, their token launch could present an opportunity!

Valuation target to follow, once the token has been released. We can’t wait to go into detail in the deep dive, and see what they can do long-term.

Conclusion

DeFi derivatives are coming. If you don’t agree, read this series again or comment below why.The market is very immature at the moment and this opens us a large opportunity. We have certain target prices for further entries and we’ll also be following up with their development as we’d like to see them progress or else we’d jump ship.

What’s Next?

We will be doing deep-dive reports into all the assets discussed in this report, and some which haven’t been mentioned. Keep your eye out for those, as they will look into tokenomics, current valuations, future plans, and anything else that needs to be considered when deciding an investment approach.

We will also keep you up to date with developments on the protocols, and publish reports if and when we decide that they may be a good investment opportunity for us personally (not financial advice).

For details on these deep dives, and links to them, check out DeFi Derivatives So Far.

Thanks for reading Diamond Handers!

Calculations

If you’re intrigued by how we got to our target valuations and want to see the maths, this is for you.DYDX Valuation

We assumed that dYdX could reach FTX’s current valuation in 18-24 months. So, our target valuation was FTX’s current value, taken from their most recent raise, which puts it at $32bn.We then calculated roughly what % of dYdX tokens will be circulating at that point, which was 70%. Multiplied our fully diluted market cap target of $32 by 0.7 (to represent the 70% circulating supply) to give us the market cap at that time.

Options Valuation

- Our growth target was for the winning protocol to reach the same options volume as Deribit in 18-24 months.

- We calculated the price to earnings multiplier for both FTX and Coinbase:

- Average volume multiplied by fees charged (as they charge 0.03%, we multiplied by 0.0003) = Revenue

- Divided by current valuation (from most recent raise) = our price to earnings ratio.

- This was 15x and 25x respectively.

- We then added up Deribit’s Options volume for the last 12 months, multiplied that by the fees charged (same as above), giving us their revenue.