The Aftermath of Celsius, Three Arrows Capital & Voyager

Welcome to the series finale of insolvency! We previously covered how Celsius, Three Arrows Capital (3AC), and Voyager went bankrupt. Today we will look into the future.

We will investigate each company's financials, creditors, on-chain movements, and digital assets held by 3AC that are soon to be unlocked.

This report is quite lengthy & different from standard research reports because it contains information from court filings & on-chain activity.

TLDR

- Celsius holds more than 400,000 stETH - potential to dump 6-12 months post-merge.

- Celsius holds more than 37% of the total CEL token supply - the potential to dump if withdrawals go live again.

- FTX are the 11th biggest holder of CEL and has been increasing its holdings.

- Ripple labs are interested in purchasing assets of Celsius.

- Alameda Research is the biggest lender ($75mn) to Voyager.

- $1.47bn will be accredited back to Voyager unsecured creditors.

- Voyager to return $270mn in cash to affected customers - withdrawals are back live with a limit of $100,000.

- 3AC owes unsecured creditors $3.5bn - Genesis ($2.3bn) & Voyager ($665mn+) at the top of the list.

- 3AC are prominent investors in early projects - they will presumably dump their holdings in the upcoming unlocks.

- NEAR, MEAN, WOO & LDO are the closest tokens to become fully unlocked for 3AC from August to December 2022.

Notes.

Words you need to know while reading:

- Chapter 11 Bankruptcy: a form of bankruptcy that reorganises the debtor’s business affairs, debts, and assets - allows the company to stay in business (with the permission of the court) and restructure its obligations in hopes of becoming profitable again.

- Chapter 15 Bankruptcy: a form of bankruptcy that provides an efficient mechanism for addressing insolvencies that involve debtors, creditors, and assets associated with more than one country (cross-border insolvency) - facilitating the rescue of a financially troubled business, and protecting the value of the debtor’s assets.

Celsius

Balance Sheet

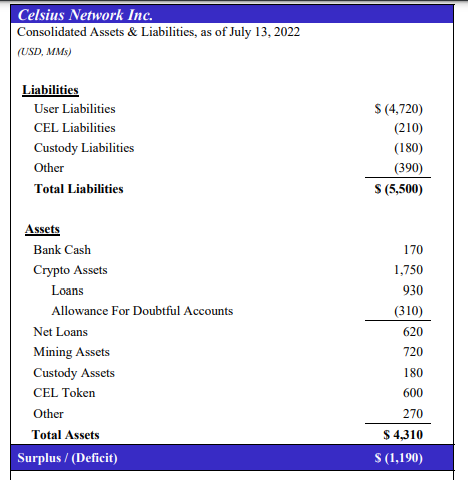

Celsius filed for chapter 11 bankruptcy after reporting a $1.19bn deficit in its balance sheet.[caption id="attachment_228265" align="aligncenter" width="468"] Total liabilities of $5.5mn exceed total assets of $4.31mn.[/caption]

Total liabilities of $5.5mn exceed total assets of $4.31mn.[/caption]

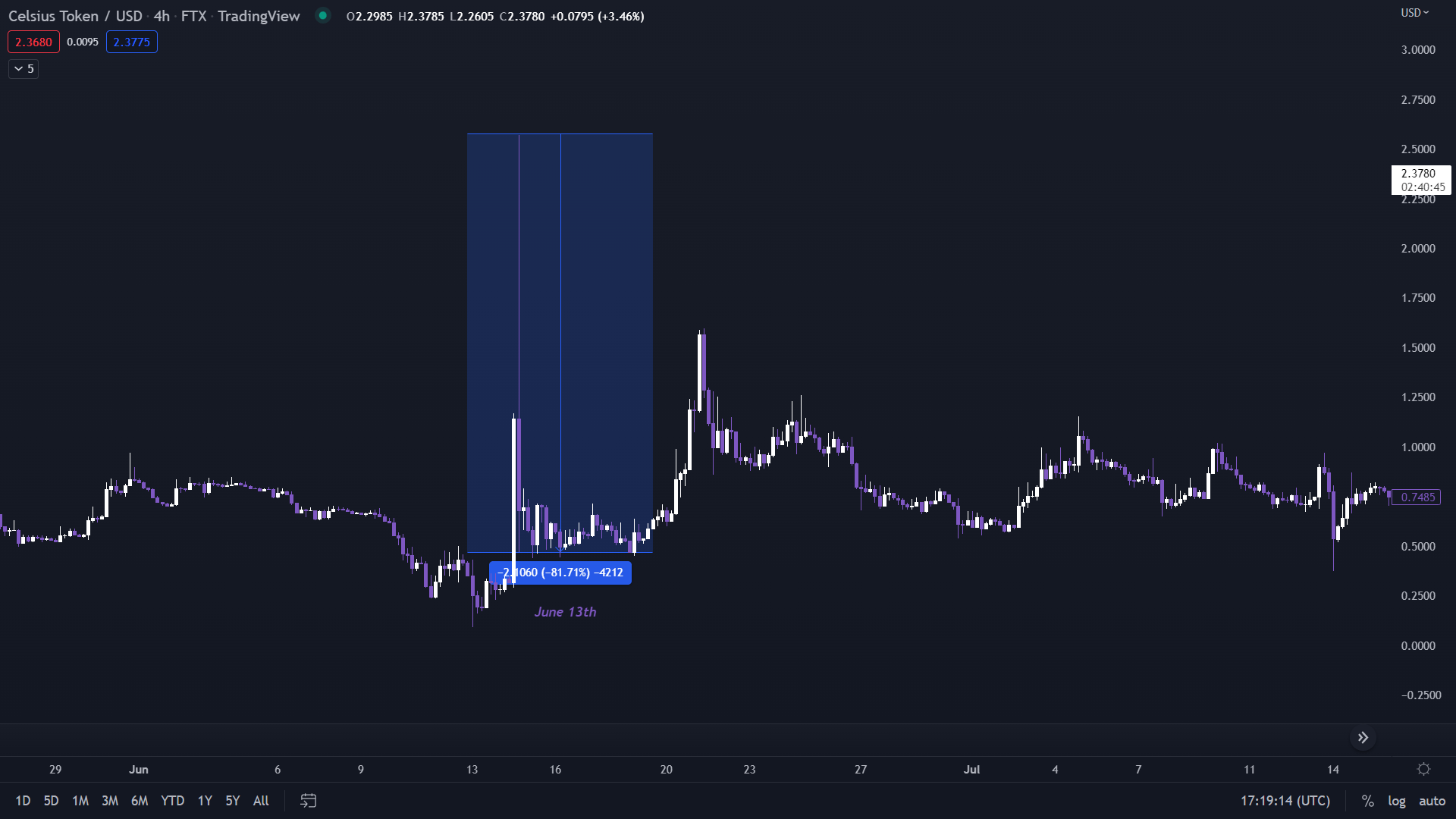

Celsius holds $600mn worth of CEL tokens - more than 37% of the entire supply is held by Celsius. Freezing Celsius’ transfers meant that a large part of the total supply of CEL tokens is locked on the platform, and only a fraction of the tokens trade on exchanges. Celsius relies heavily on its native token CEL to carry out operations. The CEL token is used to take loans, provide rewards, and make payments - users are incentivised to use and hold the token. If Celsius collapses, CEL would also collapse.

[caption id="attachment_228266" align="aligncenter" width="1920"] CEL crashed when Celsius halted withdrawals & rumoured insolvent.[/caption]

CEL crashed when Celsius halted withdrawals & rumoured insolvent.[/caption]

As with a mcap of $1bn at the moment (with reduced liquidity) - if Celsius closes its doors does it turn into a meme coin?

Celsius holds $720mn worth of BTC as part of their mining subsidiary which includes more than 43,000 mining rigs that generate 14.2 BTC daily. They have other business plans to expand their mining operations by 2023 to reach 112,00 mining rigs and generate more daily BTC.

Celsius owes users $4.72bn worth of assets - There is no word on when customers will receive their assets, but as part of the chapter 11 bankruptcy, customers will have access to some in the future.

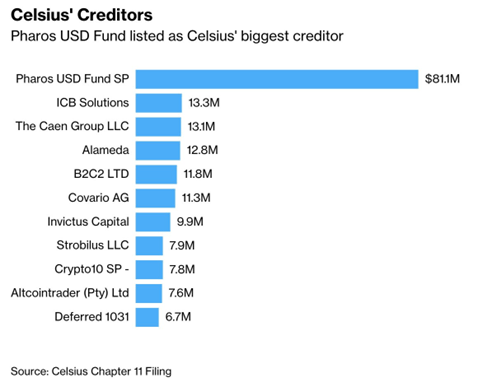

Creditors

Celsius owes money to more than 100,000 creditors.[caption id="attachment_228267" align="aligncenter" width="478"] The largest creditors on the list.[/caption]

The largest creditors on the list.[/caption]

A Google search for Pharos USD Fund ISP yields few results, while a job posting on the Lantern Ventures website describes Pharos as a London-based proprietary trading firm that specializes in crypto.

Pharos is listed as a Lantern affiliate in an SEC filing back in April 2022. According to the filing, the company manages approximately $400mn worth of assets.

Lantern employees had employment histories that overlapped with those of Sam Bankman-Fried, the founder and CEO of FTX. Tara Mac Aulay, the company's CEO, also claimed in a November statement that she is a co-founder of SBF's crypto trading company, Alameda Research.

When contacted by Bloomberg, Alameda representatives stated that Mac Aulay was a founding member of the company and that the company has no ties to Lantern Ventures.

Wallets & On-Chain Activity

On etherscan, all assets held by Celsius can be tracked. These assets are not confirmed to whom they belong, whether to customers or to Celsius, but after tracking specific addresses, we concluded that at least some belong to Celsius themselves.Current major holdings:

- 7,091.6 ETH ($12,764,880).

- 256,239,400 CEL ($589,350,620).

- 4,222,634 USDC.

- 76,912 UMA ($237,659)

- 3.32 CORE ($21,656).

- 6,477 LPT ($78,758)

- 449,546 SNX ($1,834,149.3).

- 618stkAAVE ($68,915.6)

- 82,777 TGBP ($127,170)

- 3,220 LPT ($38,996.3)

- 21,046 ZUSD ($20,822.2)

- 1,684AAVE ($185,734.7)

- 3,257LPT ($39,762).

- 22,513 GUSD.

- 17,894 USDT.

- 19,102MATIC ($17,786.2)

- 10,865 KNC ($17,601.6).

- 48 BNB ($15,731.6).

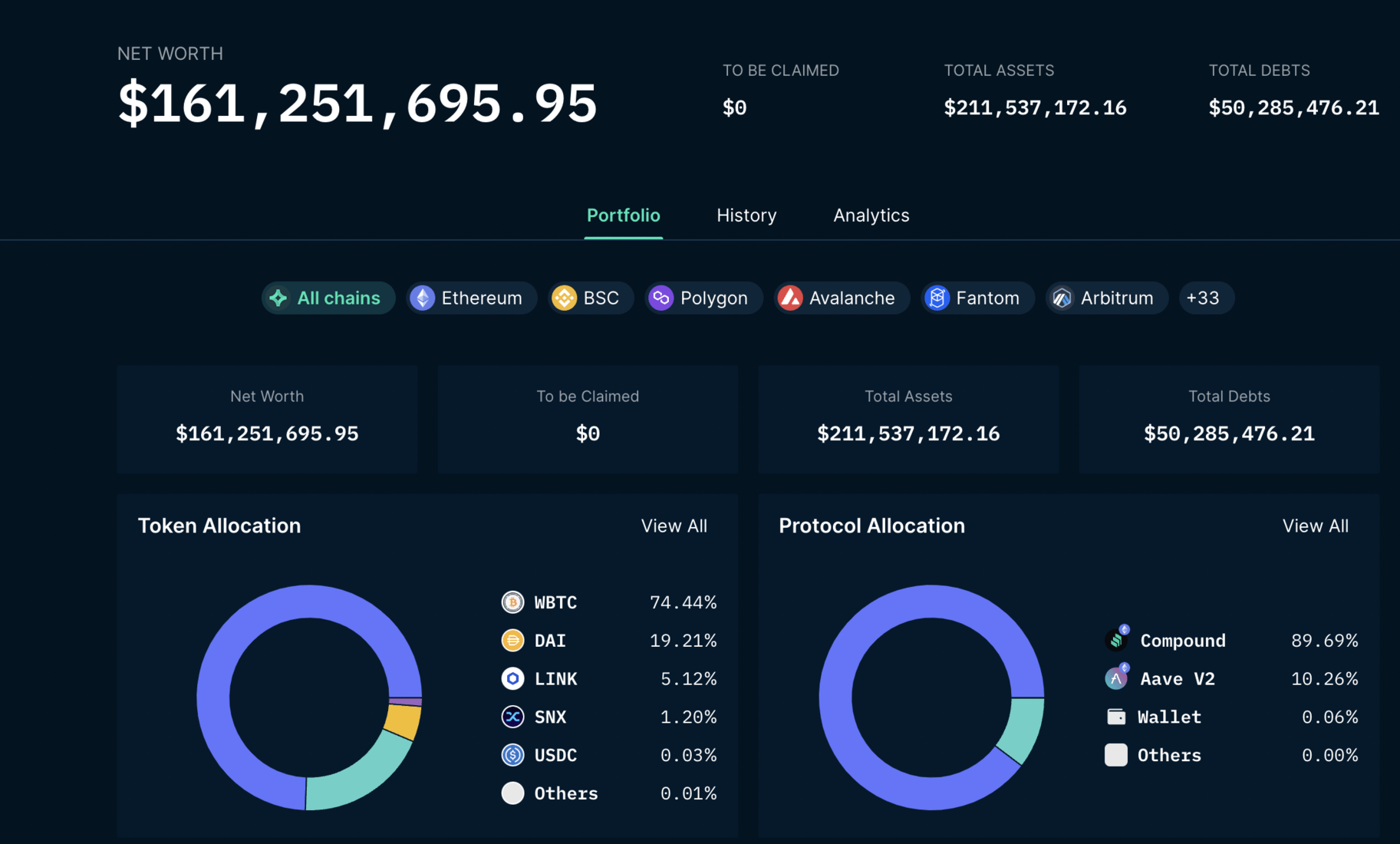

Celsius has repaid their on-chain loans to Compound, Aave, and Maker, unlocking the rest of their collateral ($10mn in stETH, $13mn in LINK, $3mn in SNX, and $440mn in WBTC) - this information can be found here.

[caption id="attachment_228268" align="aligncenter" width="2200"] July 13th, before Celsius repays its on-chain loans.[/caption]

July 13th, before Celsius repays its on-chain loans.[/caption]

Celsius is one of the largest holders of stETH - more than 400,000 of stETH held.

One of the addresses linked to Celsius transferred over 440,00 stETH to an unknown unlabeled wallet back in July.

When the merge goes live on mainnet (expected September 15th or 16th), stETH will be redeemed for ETH 6-12 months after the merge, allowing users to exchange it for stablecoins. Celsius might consider selling its stETH to reduce its debt, which could affect ETH’s price drastically if the company does not improve its obligations.

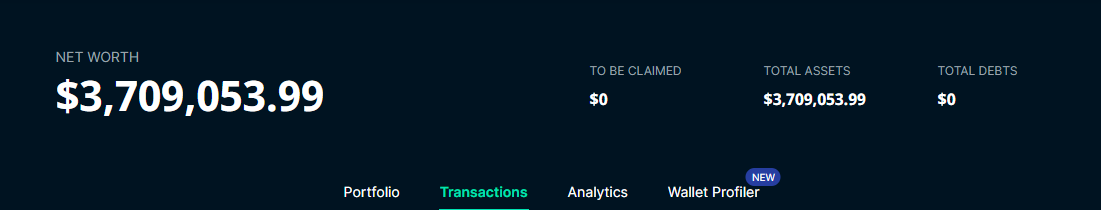

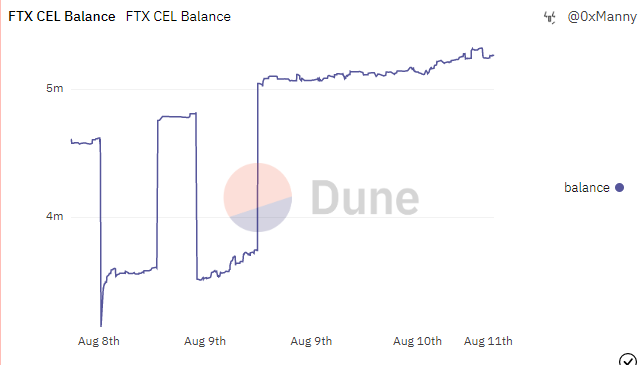

FTX is the 11th largest CEL token holder, with 5,261,823 tokens.

[caption id="attachment_228271" align="aligncenter" width="643"] Since most tokens are locked and only a few are available on exchanges, FTX is currently trading CEL by increasing its holdings.[/caption]

Since most tokens are locked and only a few are available on exchanges, FTX is currently trading CEL by increasing its holdings.[/caption]

Celsius CEO cashed in recently - The wallet sold CEL tokens in multiple transactions. Swapping 17,475 CEL for $28,242 worth of ETH on Uniswap.

Summary

- Celsius holds more than 400,000 stETH - potential to dump when the merge goes live.

- Celsius controls more than 37% of the CEL token - the potential to dump if withdrawals go live again.

- FTX are the 11th biggest holder of CEL and has been increasing its holdings.

- Ripple labs are interested in purchasing assets of Celsius.

Voyager Digital

Balance Sheet

Voyager declared bankruptcy under Chapter 11 - Three Arrows Capital's default on a $655 million loan is part of the reason. The court filings did not specify their assets and liabilities in detail. However, we know that their estimated assets and liabilities are between $1bn - $10bn, with liabilities exceeding assets.Creditors

More than 100,000 creditors lent to Voyager.Only two creditors were listed in the court filings, Alameda Research Ltd ($75 million) and Google LLC ($959,776).

Alameda and Google are fully operational, and the defaulted loan had no significant impact on their finances.

Holdings

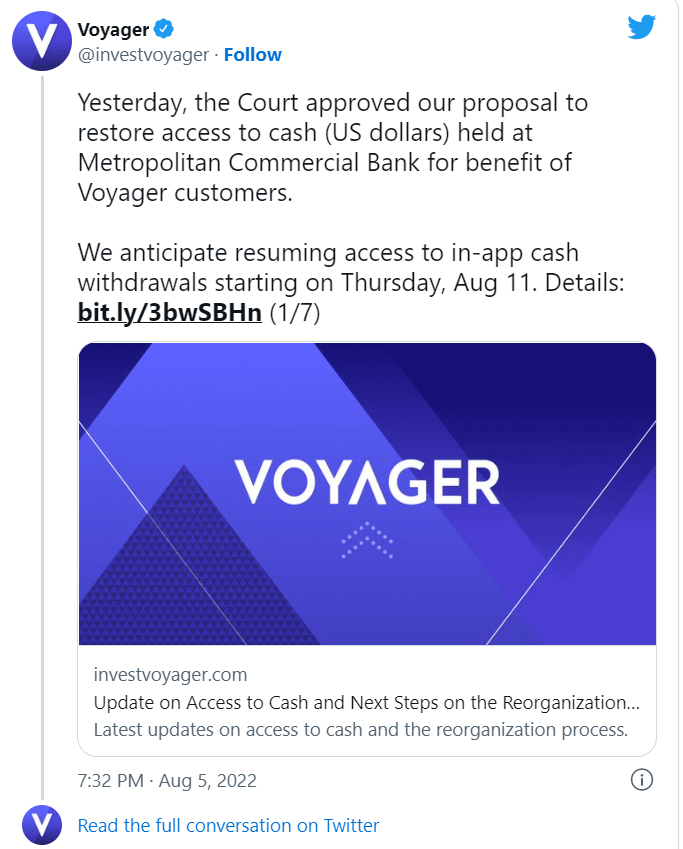

We were only able to come across 2 wallets on etherscan for Voyager. Current holdings represent more than $1.47bn. The top 3 holdings are SHIB, USDC, & LINK. These assets will be distributed to creditors.Voyager has been approved by the court to distribute $270mn (part of the $1.47bn) in cash to affected customers – withdrawals are now available again.

Voyager stated that 88 potentially interested parties have been contacted so far during its restructuring process, 46 parties have signed non-disclosure agreements, and 22 parties are actively involved in its sales process. The final bid deadline is August 26th, and the sale hearing is scheduled for September 7th.

The bid from FTX to purchase Voyager is the lowest so far. As a result, FTX is unlikely to acquire Voyager because they previously rejected the offer.

Summary

- Alameda Research is the biggest lender ($75mn) to Voyager.

- $1.47bn will be accredited back to Voyager unsecured creditors.

- Voyager to return $270mn in cash to affected customers - withdrawals are back live with a limit of $100,000.

Three Arrows Capital (3AC)

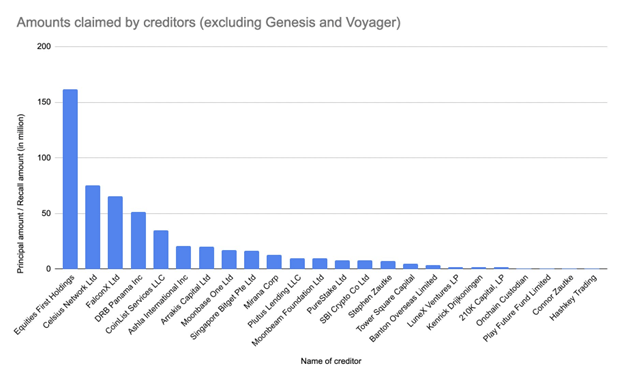

3AC has declared bankruptcy under Chapter 15. Court filings do not specify or even estimate the number of assets and liabilities.Creditors

Genesis lent $2.3bn and Voyager lent more than $685 million - 3AC currently owes creditors $3.5bn.

DRB Panama Inc, the parent company of crypto exchange Deribit, lent 1,300 BTC and 15,000 ETH, as did Celsius (which lent around $75 million in USDC), CoinList Services ($35 million in USDC), and FalconX ($65 million).

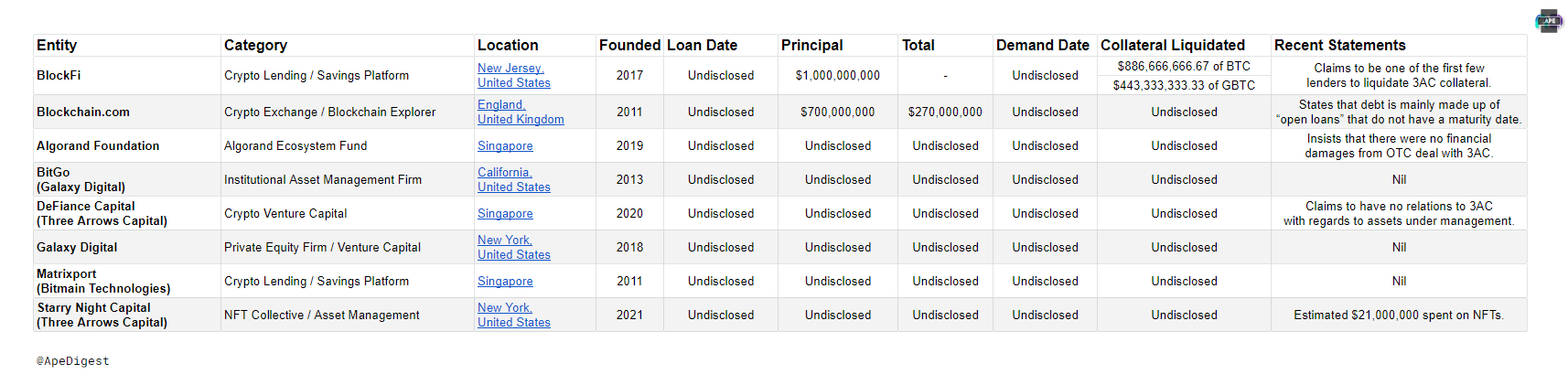

[caption id="attachment_228274" align="aligncenter" width="1714"] BlockFi, Blockchain.com and Algorand Foundation part of 3AC unsecured creditors.[/caption]

BlockFi, Blockchain.com and Algorand Foundation part of 3AC unsecured creditors.[/caption]

BlockFi claimed to be among the first to liquidate 3AC - $886,666,667 in BTC and $443,333,333 in GBTC. According to Blockchain.com, the majority of the debt is made up of open loans with no set maturity date. The Algorand Foundation retains that the OTC deal with 3AC caused no financial harm.

Wallets

The first wallet contains 3,104,630 LDO ($8,599,824,07) and the second wallet contains 27,844 USDT.Hundreds of tokens were found in the same wallets with a value of less than $100.

3AC Holdings

Finally, the most vital part of this report. 3AC was a prominent crypto hedge fund that managed over $10bn in assets at its peak. 3AC used to fund big projects in their early stages. As a result, they were able to acquire tokens at a very low cost.3AC is in liquidity shortfall and might need to sell some of its assets to cover its insolvency.

Keep an eye on these assets. These are 3AC’s primary holdings. They’ll presumably look to dump during upcoming unlocks.

Note.

We avoided large-caps because 3AC was not included in their early funding rounds and eventually would have less supply of the coins & tokens - BTC, ETH, AVAX, SOL, DOT, & AAVE.

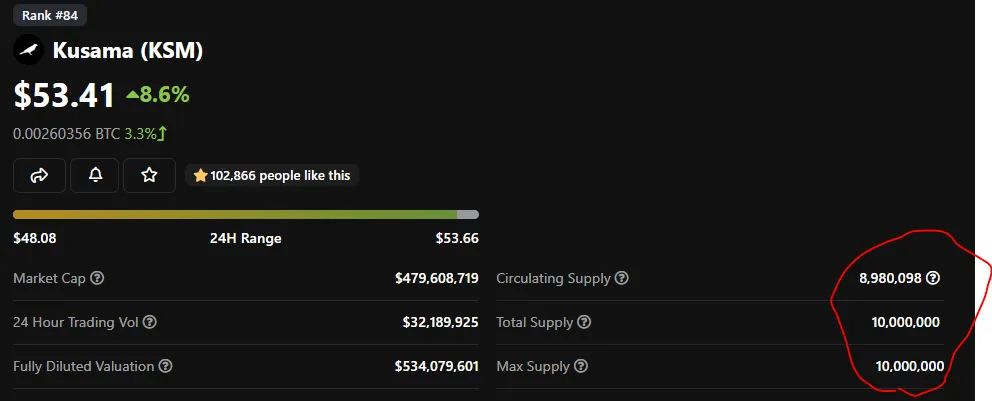

Kusama (KSM)

- Unlock dates are not relevant as most supply is already circulating.

Assets are split into 2:

Fully unlocked & token-less:

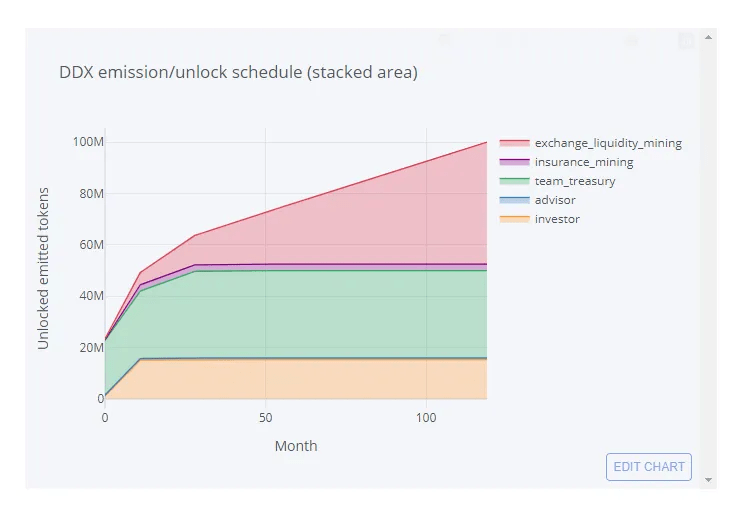

Derivadex (DDX)

• Should be fully unlocked.

Perpetual Protocol (PERP)

- 3AC allocation should be included in the “seed / strategic” allocation (28m tokens). This should be fully unlocked.

- Seed / private sale price: $0.08.

Synapse (SYN)

• Investors should be now fully unlocked.

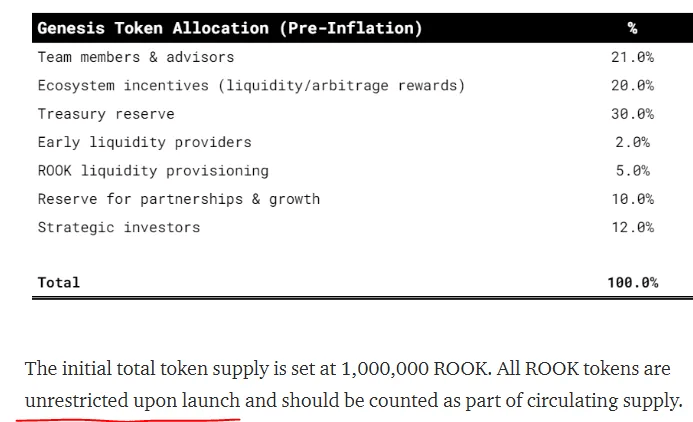

KeeperDAO/Rook (ROOK)

• Strategic investors should be already fully unlocked.

Kyber Network (KNC)

- 3AC allocation should be included in the “private sale” allocation (75m tokens). This should be fully unlocked now.

- Private sale price: $0.375.

ThetaNuts Finance

- This is a token-less protocol.

Tokens to unlock:

Mina Protocol (MINA)

- 3AC allocation should be included in the “backers” allocation (200mn tokens). This should unlock linearly until June 2023 with 5% inflation per month (calculated on circ. supply).

- Seed price range: $0.07-0.15.

Near Protocol (NEAR)

- 3AC allocation should be included in the “prior backers” allocation (230mn tokens). This should unlock linearly until October 2022 with 1% inflation per month (calculated on circ. supply).

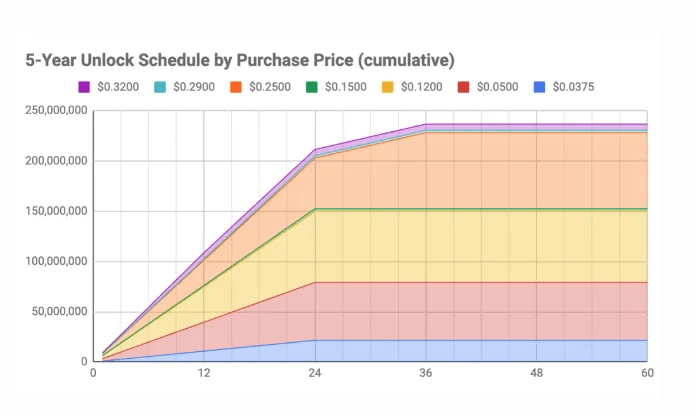

- Backers / Seed / Private price range: $0.0375-$0.32

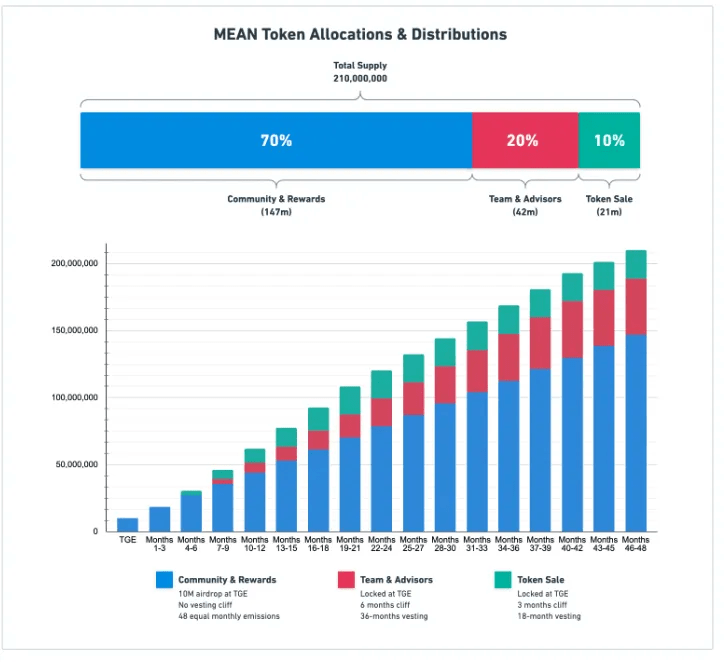

MeanFi (MEAN)

• Unlocks linearly until September 2022 with 1% inflation per month (calculated on total supply as the circulating one is not available on Coingecko).

Ardana (DANA)

- • 3AC allocation should be included in the “seed / private” allocation. This should unlock linearly until February 2024 with 5% inflation per month.

- Seed / private price range $0.24-0.3.

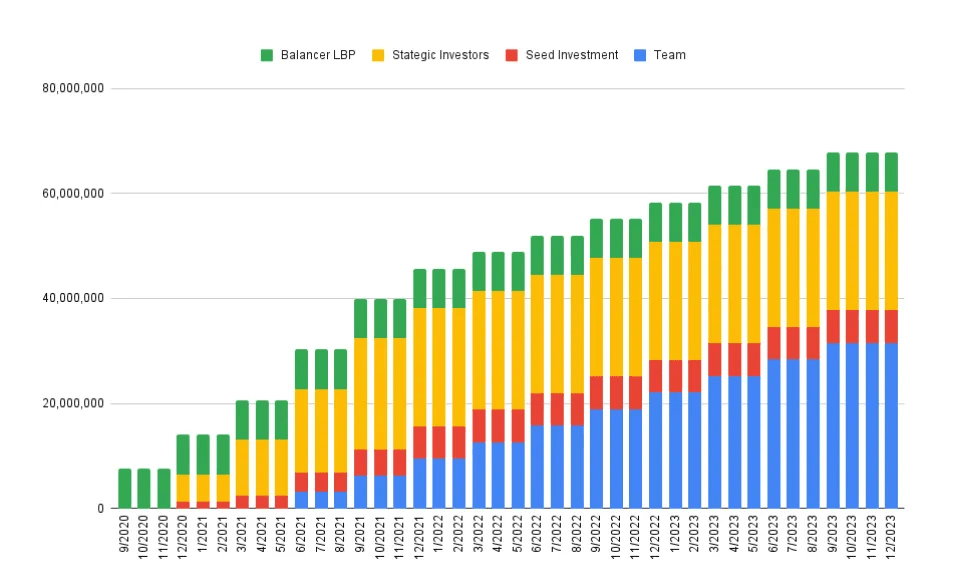

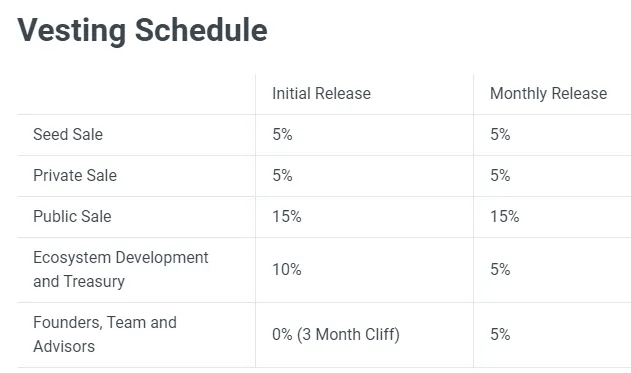

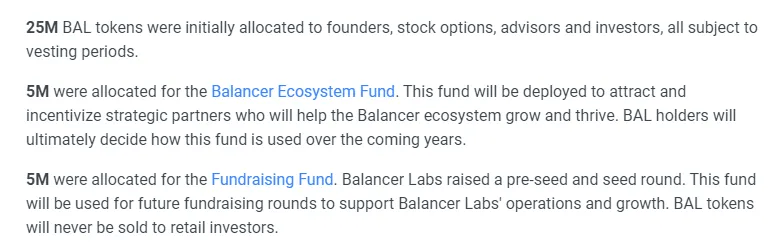

Balancer (BAL)

- No info on fundraising allocation unlock.

- Seed price: $0.6.

Multichain (MULTI)

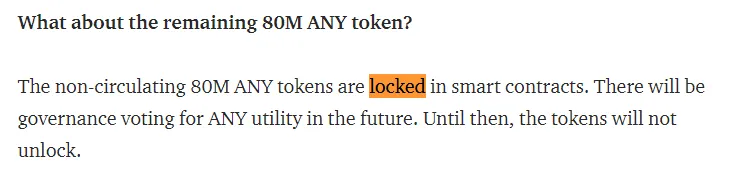

• Website mentions: “Non circulating coins are locked in smart contracts. There will be governance voting for ANY / MULTI utility in the future. Until then, the tokens will not unlock”

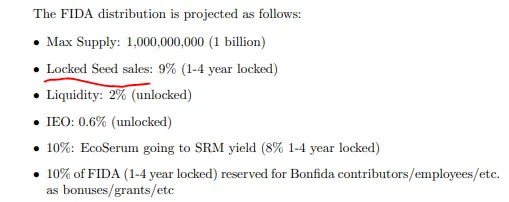

Bonfida (FIDA)

• 3AC allocation should be included in the “seed sale” allocation (90mn tokens). This should unlock linearly until December 2024 with 4% inflation per month (calculated on circ. supply).

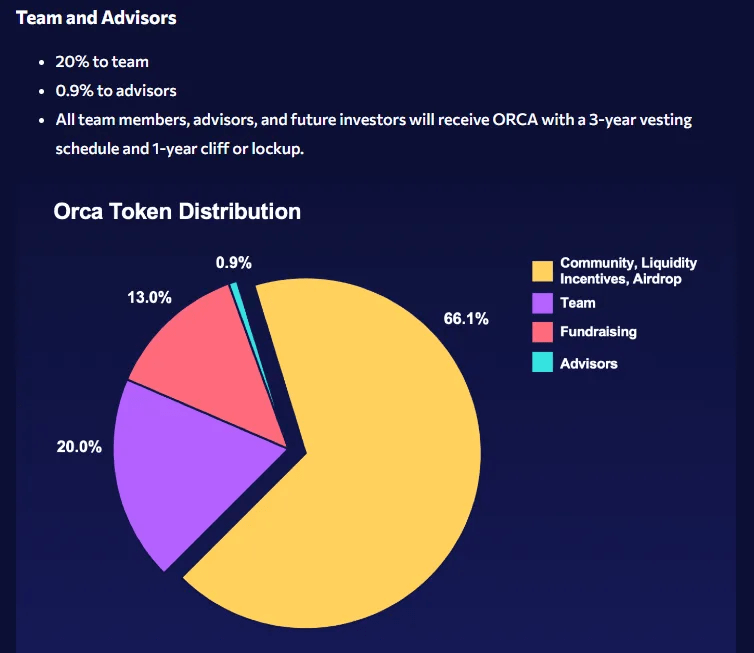

Orca (ORCA)

• 3AC allocation should be included in the “fundraising” allocation. There is no precise info on the website but it should follow the team’s allocation vesting schedule: linearly until August 2025.

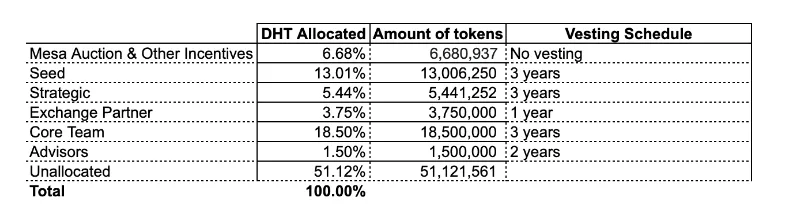

Dhedge (DHT)

• 3AC allocation should be included in the “seed / strategic” allocation. This should unlock linearly until December 2023 with 2% inflation per month (calculated on circ. supply).

Woo Network (WOO)

- 3AC allocation should be included in the “Seed / private” allocation (540mn tokens). This should unlock linearly until August 2022 with 3% inflation per month (calculated on circ. supply).

- Seed / private price range $0.01-0.02.

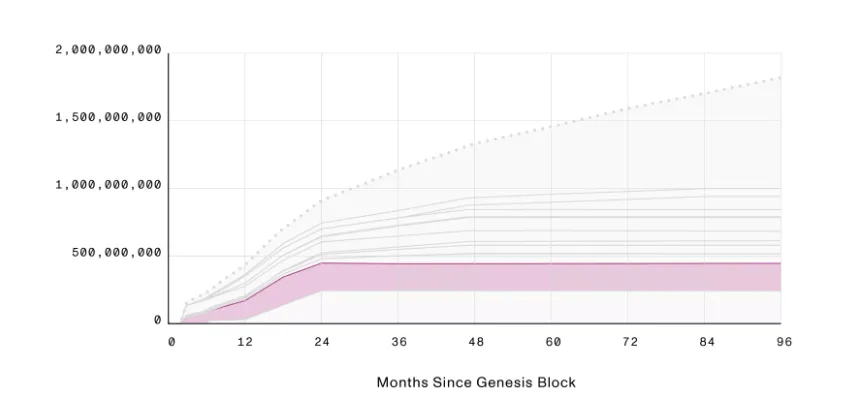

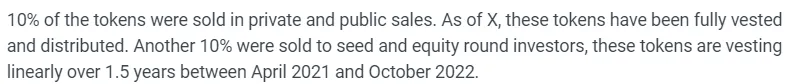

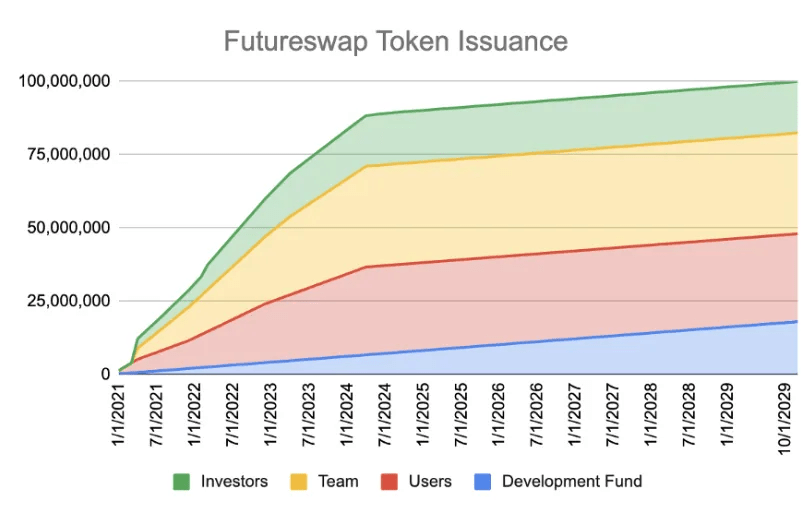

DYdX (DYDX)

- 3AC allocation should be included in the “investors” allocation. This should unlock linearly until September 2025

- Different inflation rates across the period: the Mar23 - Aug23 period will have intense inflation.

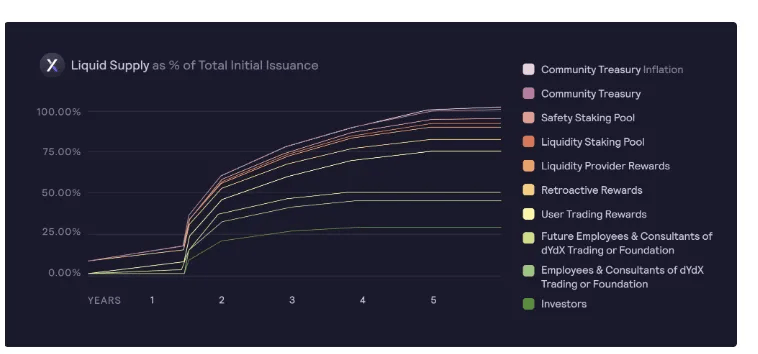

FutureSwap (FST)

• 3AC allocation should be included in the “investors” allocation (13mn tokens). This should unlock linearly until April 2024 with 2% inflation per month (calculated on circ. supply).

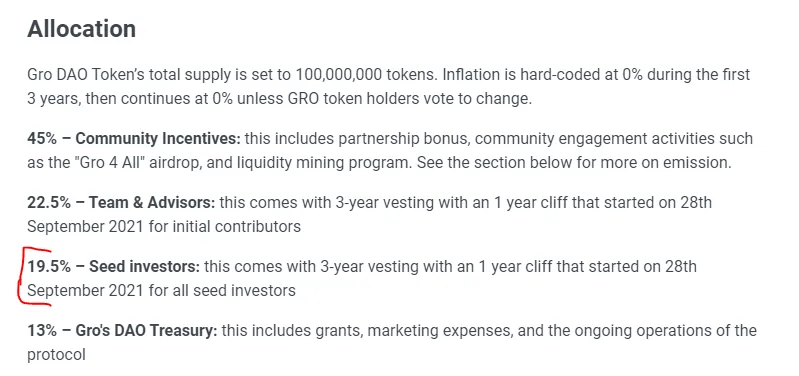

GRO Protocol (GRO)

• 3AC allocation should be included in the “seed investors” allocation (19mn tokens). This should unlock linearly until from 28th September 2022 to 28th September 2025 with 14% inflation per month (calculated on circ. supply: 19m tokens unlocked across 3 years, vs. circulating supply of 4m tokens).

Trader JOE (JOE)

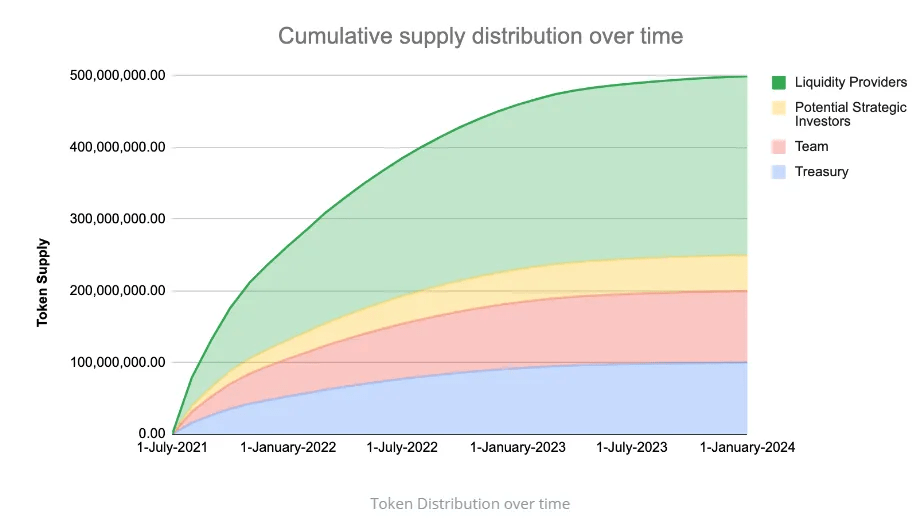

• There are no pre-sales, private sales or pre-listing allocations of the JOE token. Difficult to say which is 3AC allocation. Could be “potential strategic investors allocations” which unlock linearly from 3rd July 2021 to 3rd January 2024.

Tranchess (CHESS)

• 3AC allocation should be included in the “seed” allocation (15mn tokens). This should unlock linearly until 23 September 2023 with 1% inflation per month (calculated on circ. supply).

Lido (LDO)

• 3AC allocation should be included in the “investors” allocation (222m tokens). This should unlock linearly until 17 December 2022 with 4% inflation per month (calculated on circ. supply).

Summary

- 3AC owes unsecured creditors $3.5bn - Genesis ($2.3bn) & Voyager ($665mn+) at the top of the list.

- 3AC are prominent investors in early projects - they will presumably dump their holdings in the upcoming unlocks.

- NEAR, MEAN, WOO & LDO are the closest tokens to become fully unlocked for 3AC from August to December 2022.

Final Words

We have covered this series in great detail and explained how the insolvency of Celsius, 3AC, & Voyager resulted in a crypto cascade event that ultimately resulted in bankruptcy. The space was affected massively by these issues, but crypto continues.The wisest course of action is to exercise caution on the impending unlocks for 3AC because 3AC gets a sizable supply of the tokens and, given their current financial situation, dumping their holdings is a probable action that they may undertake to improve their financial obligations.