The agile team that’s writing a new chapter in DeFi – with a 12x growth potential

This report is outdated and no longer reflects current market conditions or our investment thesis. Please don’t act on the information here. For the latest picks and insights, visit our Asset & Picks tool or check our most recent articles

Welcome to an unexpected twist in the DeFi saga, where the unlikeliest of players, the Federal Reserve, is secretly fueling a revolution.

Now, before you dive in thinking this is a 'get rich quick' scheme, let's set the record straight: This is no flash-in-the-pan, overnight success story. This is the story of a project building the future of our financial system and at the heart of it a token that can one day become a real blue-chip.

This secret nexus is attracting sharp eyes and heavyweight capital, all converging on a token architected to directly reap the rewards of this growth - a growth potential of 12X 👀

Are you ready to unravel this enigma and discover the potential hidden gem in the vast, volatile ocean of crypto?

LFG 🐂

TLDR 📃

- Stablecoins are a booming part of DeFi, and Frax Finance is in the thick of it.

- Frax's DeFi strategy is a two-player game involving FRAX (the stablecoin) and FXS (a volatile token) that create a dynamic balance.

- Frax aims to increase the prevalence of FRAX in DeFi using what it calls algorithmic market operation controllers to manage assets.

- Frax is planning significant moves, including a connection with the US Federal Reserve, the introduction of frxETH, and a shift to a 100% collateral ratio.

- We believe in the future that Frax is building and we think it will remain a frontrunner in the stablecoin race.

- FXS price targets could reach $76.70 – a 12X gain.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Craving the full, in-depth institutional experience? Go ahead, click here!

Stablecoins are a proven killer use case of DeFi 🗻

The growth chart for stablecoins is like a constantly rising mountain slope. This isn’t a trend, it’s the future.[caption id="attachment_272880" align="aligncenter" width="1800"] Aggregated Market Caps of: USDT, USDC and DAI.[/caption]

Aggregated Market Caps of: USDT, USDC and DAI.[/caption]

[caption id="attachment_272879" align="aligncenter" width="1528"] Aggregated Market Caps of: USDT, USDC and DAI.[/caption]

Aggregated Market Caps of: USDT, USDC and DAI.[/caption]

Today, most of the market share belongs to the centralised USDC and USDT. We’re betting the future will include larger shares for decentralised options.

It’s no wonder established DeFi projects are introducing stablecoins. Whether it's Curve’s crvUSD, Aave’s GHO, or Redacted’s DINERO, people love the flexibility of holding dollars on chain.

Launched in 2019, Frax Finance is a veteran decentralised stablecoin project. Although it commands an impressive market cap of about $1B, it is gravely misunderstood and widely mischaracterised.

And when there’s a mismatch between a project’s fundamentals and the public’s perception, we smell opportunity.

How Frax works 💵

Frax Finance uses two tokens: the stablecoin FRAX and Frax Shares (FXS). FRAX is the star player, with its value designed to stay at $1. FXS works like a safety net. When the market gets rough, FXS helps keep FRAX's value steady.FRAX is created using a mix of USDC (another stablecoin) and FXS. The mix changes based on how the market is doing. In good times, there’s more FXS in the mix. In less stable times, there’s more USDC. The goal is to keep FRAX steady and reliable.

Most FRAX is backed by USDC. The USDC goes into a sort of treasury that is managed by what Frax calls algorithmic market operation controllers.

AMOs are like smart money managers. They help grow the treasury's value by doing things like lending FRAX, putting USDC and FRAX into places where they can earn more (like Curve liquidity pools), and using idle USDC to earn yield through decentralised apps.

Here's the cool part: The people who hold FXS tokens get a say in these decisions. It's a democratic system where token holders have a voice.

Right now, every $1 worth of FRAX is backed by:

- $0.60 in assets in the Curve AMO

- $0.15 in assets in the Investor AMO

- $0.10 in assets in the Lending AMO

- $0.08 in assets in the Liquidity AMO

- $0.01 of USDC

- $0.06 of FXS

Frax has been quite strategic in its operations. It's like a good political campaign, where the goal was to gather as much voting power as possible. This happened during an event called the Curve Wars. The more voting power Frax gathered, the more it could encourage users to add money (liquidity) to its pools. This helped keep the value of FRAX stable.

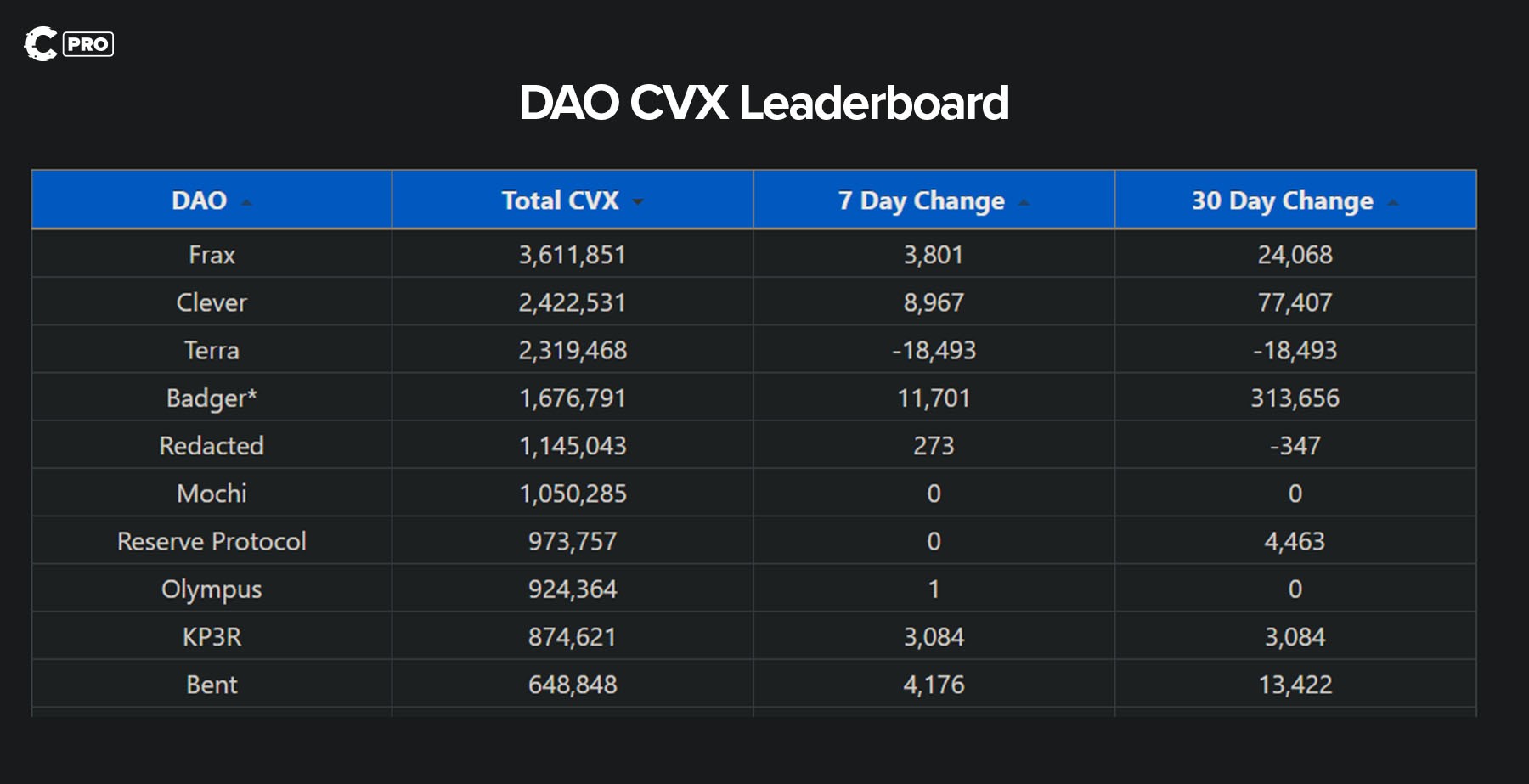

Curve is the place where a stablecoin called UST lost its value anchor, its peg. So having voting power there is crucial to keeping FRAX stable. Frax ended up becoming the largest holder of CVX tokens among DAOs (decentralised autonomous organisations).

Frax recently introduced a new element: frxETH. You get this token when you trade Ethereum (ETH) for Frax's offering. It's similar to Lido’s stETH. Once you have frxETH, you have two options:

- Change your frxETH to sfrxETH (which is simply staked frxETH). This lets you earn rewards, much as you with Lido.

- Use your frxETH in other parts of DeFi. For instance, you could lend your frxETH to liquidity pools (like frxETH-ETH in Curve) to earn trading fees.

Imagine that 100 users each trade 1 ETH for frxETH. Half choose to stake their frxETH for sfrxETH (option A), while the other half lend their frxETH (option B). Suppose the staking reward on ETH is about 4%.

Frax earns staking rewards for all 100 ETH, but it gives the rewards only to the 50 users who chose option A. These 50 users end up earning double the rewards: 8% instead of 4%.

The Frax rocket 🧑🚀

Frax's journey is like a rocket launch. Each stage pushes it closer to its goals.The first stage is creating a Master Account with the US Federal Reserve. This would give Frax direct access to US Treasuries, similar to the access banks have. It would give token holders a risk-free return on their investments and could lead to a new token called frxUSD, where FRAX is backed by real dollars instead of USDC.

The second stage is the WETHER Program. This is designed to make frxETH more common in DeFi, offering an alternative to the current favourite, wrapped-ETH (WETH). The more frxETH that's not staked, the higher the returns for those who stake it. It's like getting free electricity on a sunny day from your solar panels.

The third stage is Frax’s adoption of a 100% collateral ratio. This would eliminate the unpredictable part of FRAX's backing. When Frax reaches 100% CR, any extra revenue will go to veFXS holders, creating a big benefit for them.

The final stage is Frax v3. It's like the rocket reaching a new orbit. This update will make Frax more decentralised and less dependent on traditional stablecoins. The details are still a mystery, but we expect it to be a big step forward.

FXS price targets 🎯

Brace yourself: It’s time for the main event, a look at FXS token valuation and targets.When the FRAX stablecoin becomes more popular, the value of FXS goes up. We've found that for every billion FRAX in circulation, FXS's price increases by about 5.9 times. So if FRAX’s market cap is $0.5 billion, we'd expect FXS to be about $2.95. If FRAX's market cap rises to $3 billion, FXS could be around $17.70.

A look at other stablecoins gives us targets for FRAX. We want it to reach at least the market cap of DAI, which is $4.68 billion. Our big goal is for FRAX to make up 10% of all stablecoins, which would be about $13 billion.

We think the total stablecoin market will grow in the future. We believe future innovations will further increase FXS’s value. But we're using today's numbers to be conservative.

If we hit our conservative targets, we're looking at FXS prices of $27.72 (a 4.4x increase) and $76.70 (a 12.2x increase).

Invalidation criteria ❌

If any of these events occur, we might choose to reduce or eliminate our FXS exposure:- De-peg event. We will reduce our exposure if FRAX de-pegs below $0.90 for longer than one day.

- Lack of decentralisation. If Frax’s attempts to decentralise their multi-sig are unsuccessful over the next several months, we will likely reduce our exposure.

- Competition. If other decentralised stablecoin projects (like Curve's crvUSD, Aave's GHO, Redacted's DINERO, or Tapioca's USDO) start challenging Frax's supremacy, we'll look at diminishing our stake. These projects should coexist amicably, but we'll keep a sharp eye out for discord.

- Resistance to change. If Frax fails to diversify beyond the dollar in a shifting financial landscape, we'll think about retracting our investment.

Cryptonary’s take 🧠

Frax Finance is a brilliant example of an agile DeFi team. They have a scary ability to foresee the future of the DeFi landscape, and we are very impressed.We believe in the future that Frax is building toward, with FRAX becoming more useful and more censorship-resistant as a way for users to hold dollars on the blockchain. And while there are other exciting stablecoin projects launching (we like a lot of them too!), we are confident that Frax will remain one of the frontrunners.

Action points ✏️

Here is how we are planning our entries and exits for FXS, assuming our invalidation criteria do not apply:- We’re buying weekly until Mid-June (which should align with the collateral ratio reaching 100%).

- Selling 33% at $27.50.

- Selling 67% at $76.50.