However, there is one solution that we have not covered – bridges. Cross-chain bridges are the most commonly used method of moving assets between chains. But why have we left them till last?

Well, bridges come in many forms – and a few of the bridges out there also utilize concepts covered in the previous journals. So, without further ado, let’s dive into the expansive (and sometimes controversial) world of cross-chain bridges!

TLDR

- Bridges allow users to port assets from one chain to another.

- Bridges are easy to use – deposit on one chain, and redeem on the destination chain.

- A wrapped token allows native tokens to be represented and used on chains with different token standards.

- The minting and burning of wrapped assets, as well as the custody of the underlying asset, is (for the most part) highly centralized.

- This represents a security risk for most bridges.

The Basics

A bridge, within the context of blockchain, is an infrastructure that allows users to port their assets from one chain to another. However, in most cases, assets can only exist on their native chain as defined by the token standard. This means there must be a way to represent the bridged asset on the destination chain. Most bridges achieve this by depositing the native asset on one side and then minting a wrapped asset on the other. “What is a wrapped asset?” I hear you ask.Wrap Battle

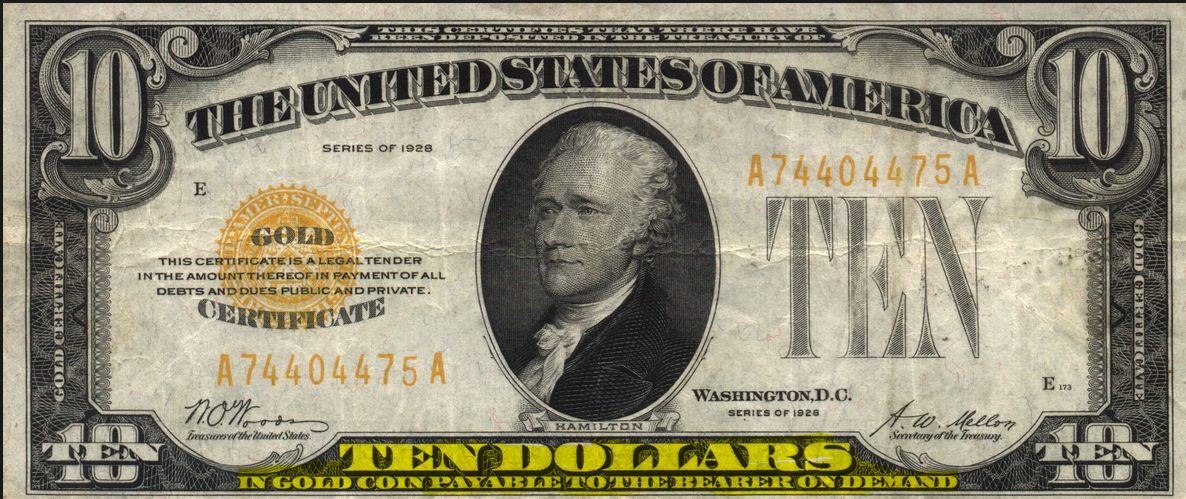

In the simplest terms, a wrapped token is a representation of another token that cannot exist on the chain it is intended to be used on. It has the same value as the underlying token because it is backed exactly 1:1 by the underlying asset on its native chain. One of the most well-known examples is WBTC (Wrapped BTC). Native BTC cannot be used on Ethereum because it cannot exist on Ethereum. To get around this, WBTC was created as a solution - a representation of Bitcoin on the Ethereum network. It is an ERC-20 token, and to mint WBTC, native BTC must be held “somewhere” in order to maintain 1:1 value and ensure that WBTC can always be redeemed for BTC.The same is true for any wrapped asset – they are merely representations, not the real thing. For most intents and purposes, however, they are effectively an I.O.U. receipt. Remember when traditional currency was redeemable for gold or other precious metals? Me neither, but apparently, it was the standard:

That’s essentially what a wrapped asset is – WBTC is a banknote, BTC is the gold.

So, how is this done? There are a few methods depending on the bridging protocol, the chains involved, and the asset being bridged – let’s have a look!

Smart Contracts

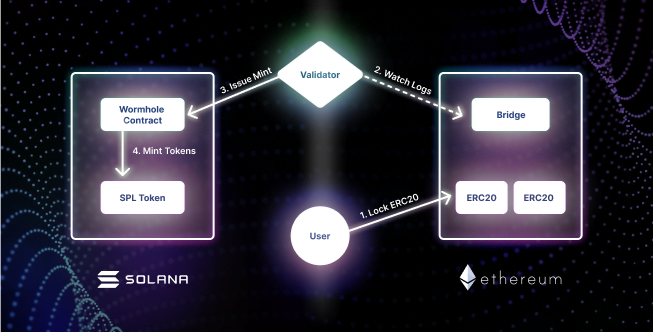

With this method of bridging, when the user deposits the desired asset into a smart contract on Chain A:- The protocol registers the deposit as valid and then mints an equal amount of the wrapped token on Chain B.

- When the user wishes to bridge back from Chain B to Chain A, they deposit their wrapped assets into the smart contract on Chain B.

- The wrapped asset is burned, and the protocol validates the burning of the assets, and passes along this validation to the smart contract on Chain A, which then releases the user’s initial native asset deposit.

One of the main issues with this is that the system is not completely trustless. Most protocols using this method have “in-between” validators that run a full node on each chain on each side of the bridge. Generally, these validators are only a few individual entities (in the case of Wormhole, only 19 “Guardians”). Locked assets are also in the custody of the bridging protocol until redeemed.

This brings into question the level of decentralization of the bridge and the trust placed in the bridging protocol – what happens if a majority of these validators decide to act maliciously? Or a majority of validators are compromised in a hack or exploit? Someone manages to send false information to one or both sides of the bridge? Nothing good, to say the least.

With billions of dollars worth of native assets locked on one side of a bridge, and the ability to technically mint unlimited wrapped assets on the other, security is of major concern for bridges, and indeed the largest DeFi exploits have mostly come from bridge exploits. The main point of weakness is the part “in-between” the chains.

Liquidity Pools

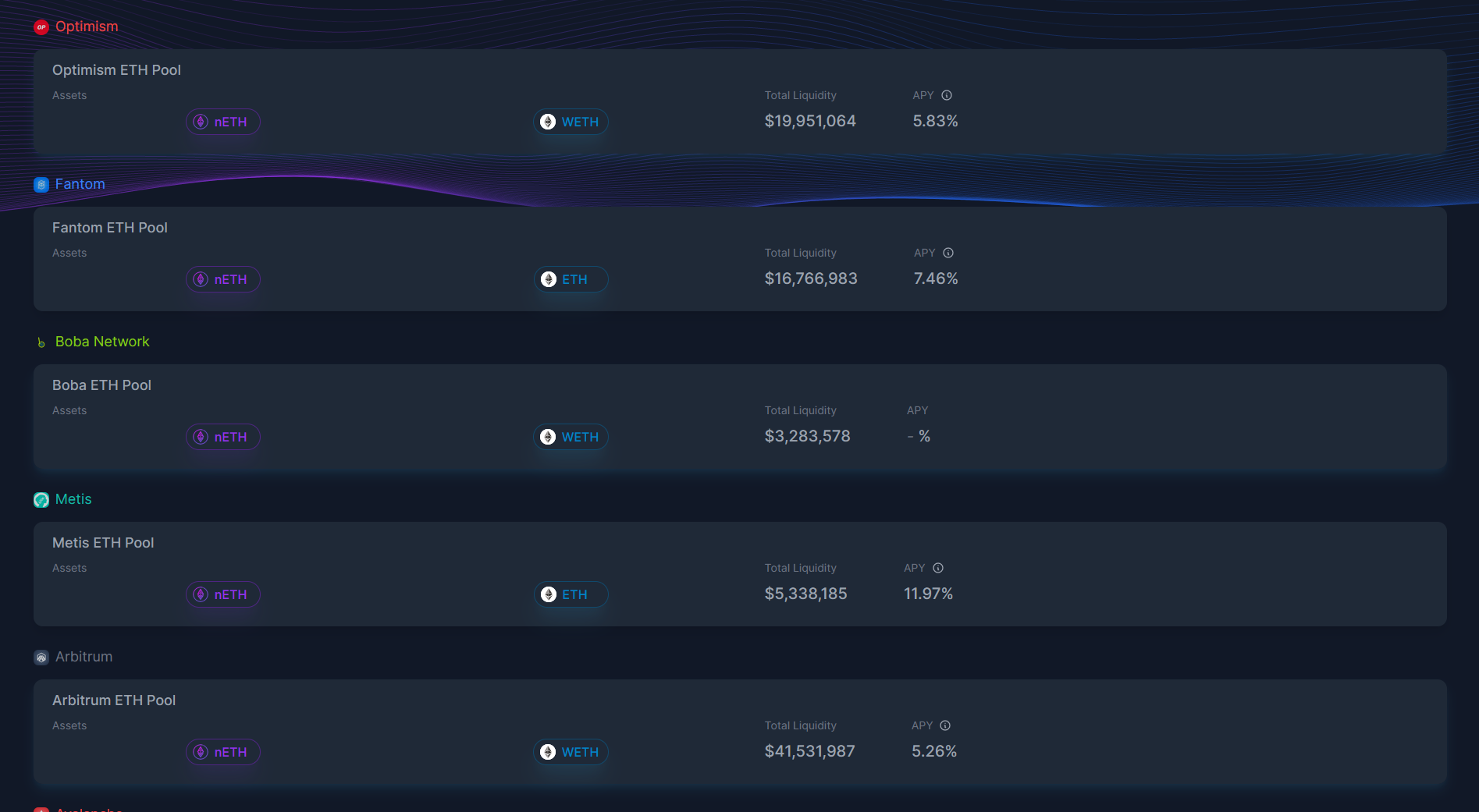

Another method of bridging is using liquidity pools. Before you ask – no, not the same as the liquidity pool model we outlined in this journal. This method can be used for bridging assets that exist on multiple networks, just with different token standards, as well as wrapped assets. For example, USDT, USDC, wETH, etc. It’s quite simple:- The user deposits their asset into a liquidity pool on Chain A.

- The protocol registers the deposit and releases an equal quantity of the token on Chain B.

- Liquidity providers earn a yield based on the fees paid by people using their pooled liquidity.

Still, there is the weak point of the “in-between” part, whereby a lot of trust is placed in a few validators. Additionally, since base layer assets such as Solana (SOL) cannot exist anywhere other than on the Solana blockchain, there is still the necessity for wrapped assets if the user wishes to keep exposure to/use the base assets on other chains.

The above is an example of a few Synapse Protocols ETH pools – the protocol has created a derivative nETH that is backed by ETH locked by users. By using nETH as the common denominator between various chains, they can establish a network of liquidity between these pools without the user having to bridge back to the Ethereum network before moving to their chosen destination chain.

Future of Bridges

Cross-chain bridges were one of the first solutions for interoperability to appear. They are also by far the most utilized out of all the solutions we have covered up till now. The user experience going from one chain to another is fairly simple – deposit on one side, receive assets on the other. Where they fall short, however, is mostly down to security.One of the main security concerns is the use of wrapped assets, which has been a major pain point for cross-chain comms. The trust placed in the protocols that these wrapped assets is huge and there are no guarantees that they won’t lose user funds locked in their vaults. Additionally, the minting process is largely a centralized ordeal – remember the I.O.U example we used earlier? Again, there’s no guarantee that wrapped assets will be redeemable for the underlying asset – only a “trust me bro” from the protocol or organization that minted them (for the most part).

Still, wrapped assets are still a necessity. But as we’ve seen in the past with the many bridge exploits involving wrapped assets, the infrastructure for managing those processes could be more refined, trustless, and decentralized. There’s always room for improvement.