The Crypto Handicap: CZ and Binance vs. Hyperliquid

Earlier this month, we called BNB as the asset most likely to outperform BTC. This week, we’re calling out Binance as the biggest systemic risk in crypto. The ‘10th October’ $19b liquidation cascade changed the landscape: exposing flaws, manipulation, and conflicts of interest that can’t be overlooked. Let’s dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

The October 10th Cascade

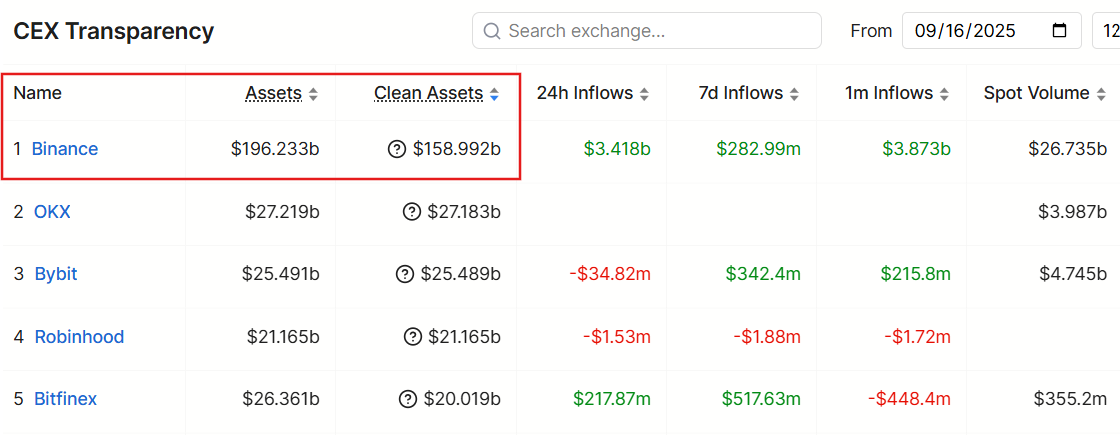

The October 10th 2025 liquidation cascade, which erased nearly $20 billion in open interest, marked the largest wipeout in crypto's history and was a true stress test for both centralised and decentralised exchanges. While the black swan tore up the market, one venue stood at the centre of the storm: Binance.As the world's largest crypto exchange, Binance oversees almost $200 billion in user assets and handles over $20 billion in daily trading volume. But during the sell-off, its systems became the source of a much deeper breakdown.

Total assets managed by CEXes

The trigger came shortly after former President Trump announced a 100% tariff on all Chinese imports via Truth Social on Friday evening (during one of crypto's thinnest global liquidity windows). Within minutes, futures and spot markets began to unwind, setting off a chain reaction that exposed deep structural fragilities across exchanges.It began when cross-margined accounts on Binance started automatically liquidating wrapped assets like wBETH and BNSOL at extreme discounts (some as steep as 90%).

The problem wasn't just the broader market derisking amid macro uncertainty, but how Binance's oracle systems failed to recognise that these were temporary liquidity gaps on Binance itself rather than genuine value losses across the market. Instead of referencing broader on-chain markets, Binance's internal pricing leaned on its own shallow order books, turning what could have been a brief dislocation into a full-scale contagion.

Furthermore, because Binance prices act as a core reference for much of the crypto ecosystem, those distorted quotes quickly spread. Many derivatives platforms and decentralised exchanges feed Binance prices into their own index systems. When Binance's valuations slipped below fair value, liquidation engines across multiple venues kicked in, copying the same faulty data. Market makers, seeing unstable references, began pulling back, widening spreads, accelerating the downturn, and causing further cascades.

As the event unfolded, Binance and other parties came under heavy strain. Deposit and withdrawal queues across CEXes delayed arbitrage flows, while interface glitches briefly displayed "zero price" errors for assets like ATOM. With insurance funds nearly depleted, the auto-liquidation engine continued unwinding collateral across cross-margined accounts until the exchange intervened manually. Binance later confirmed a module malfunction and reimbursed roughly $283 million in user losses within 24 hours.

Price action of $ATOM on Binance during 10/11

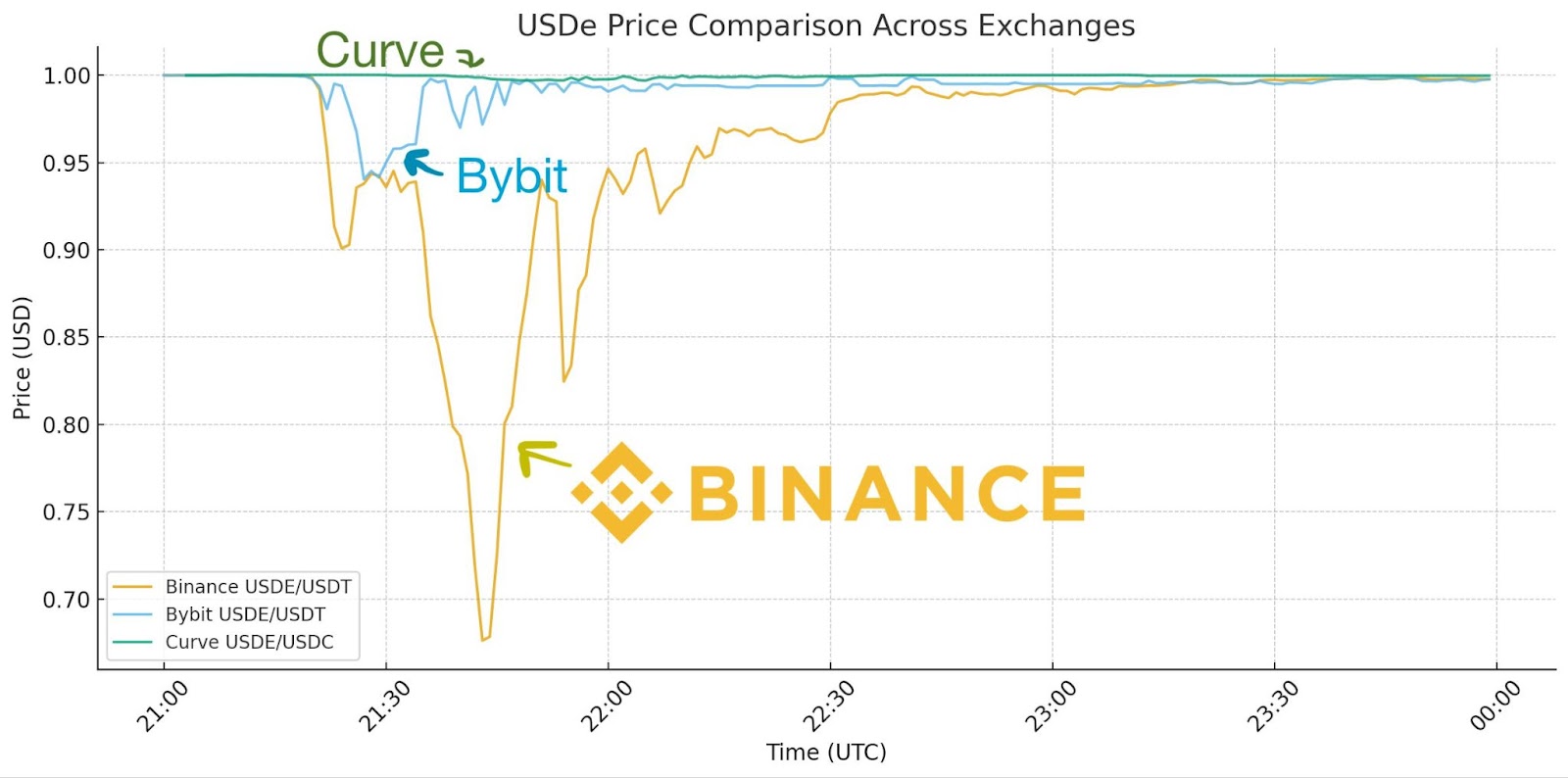

Even then, the full scale of the event remained obscure. As Hyperliquid's Jeff pointed out, major centralised exchanges often aggregate thousands of liquidations into single entries, making the real figures appear far smaller than they are. This creates a misleading sense of stability during times of extreme stress.The same flaw caused mispricing in Ethena's USDe, which plunged to $0.62 on Binance after $60 - 90 million in selling pressure hit its market there, despite the token staying largely stable elsewhere. Because Binance used its own prices for collateral valuation, many leveraged traders were liquidated unnecessarily here as well. In contrast, on-chain venues like Hyperliquid, Curve, and Uniswap showed only minor dislocations of 20–30 basis points, making it clear that the issue wasn't market-wide; it was Binance's infrastructure itself that failed under pressure.

USDe de-peg comparison

Binance's response

Binance publicly confirmed a module malfunction in its pricing system, which failed to account for temporary liquidity gaps and instead used distorted internal order book data. Within 24 hours, Binance reimbursed approximately $283 million in user losses caused by the module malfunction in its oracle pricing system. This malfunction led to irrational liquidations, particularly of wrapped assets like wBETH and BNSOL.However, despite being at the centre of the largest liquidation cascade in the history of crypto, CZ (founder and ex-CEO of Binance) indirectly attacked Hyperliquid, an onchain platform and competitor to Binance. He reposted a post saying Hyperliquid and others had more liquidations than Binance.

However, this rhetoric quickly backfired. The truth is, centralised exchanges are like an opaque black box since no one except them can verify what's happening on their books. Major CEXs often group thousands of liquidations into a single entry, meaning the real number can be underreported by as much as 100 times during periods of high volatility.

In contrast, Hyperliquid and other DeFi apps' fully on-chain design made every liquidation visible in real time. Every closure, collateral adjustment, and forced unwind was publicly verifiable. This transparency made the event appear more chaotic on the books, but it also revealed the platform's strength. Hyperliquid and DeFi platforms remained solvent, operational, and transparent, processing billions in liquidations with zero downtime and no bad debt.

This wasn't the first time Binance and its former CEO, Changpeng Zhao (CZ), have targeted Hyperliquid in an attempt to undermine its credibility. Here are three notable instances:

- JELLY incident: In March 2025, an attacker exploited Hyperliquid's liquidation mechanism using a small-cap meme token, JELLY, to force a massive short liquidation that ended up inside the protocol's HLP vault, ballooning losses to over $13 million. Hyperliquid's validators swiftly froze JELLY markets and forcibly settled all positions at $0.0095, preventing a full-blown collapse. Shortly after, Binance listed JELLY, potentially to cause a frenzy that would magnify the exploit and wipe out the vault entirely had the intervention from Hyperliquid's validators come any later.

- Vampire attack with Aster: CZ and Binance's investment arm YZi Labs backed Aster, a direct competitor to Hyperliquid, launching aggressive incentive programs that drove speculative hype. The $ASTER token surged 10x in a short period, temporarily stealing liquidity and attention from HYPE. Yet, Hyperliquid's superior UX and deep liquidity quickly reasserted dominance. Later, DeFiLlama ceased reporting Aster's volumes amid growing suspicion that its data was artificially inflated by Binance-linked activity.

- Indirect attack on Hyperliquid's liquidation: Following the historic October 10 liquidation cascade, CZ indirectly criticised the scale of liquidations on Hyperliquid, while ignoring that most centralised exchanges underreport liquidations due to their opaque systems. His comments were viewed by many as an attempt to deflect attention and discredit the transparency of Hyperliquid's on-chain liquidation reporting.

Market Turns Against Binance

Following these developments, market sentiment toward Binance deteriorated sharply. For years, Binance positioned itself as the backbone of the industry. But the recent events exposed deeper structural flaws in our reliance on Binance as an industry leader.This wave of outflows and liquidation cascade has also reignited scrutiny over Binance's internal practices, particularly how it extracts value from its users and listings rather than fostering a fair and transparent market.

Dead Listings and a Broken Model

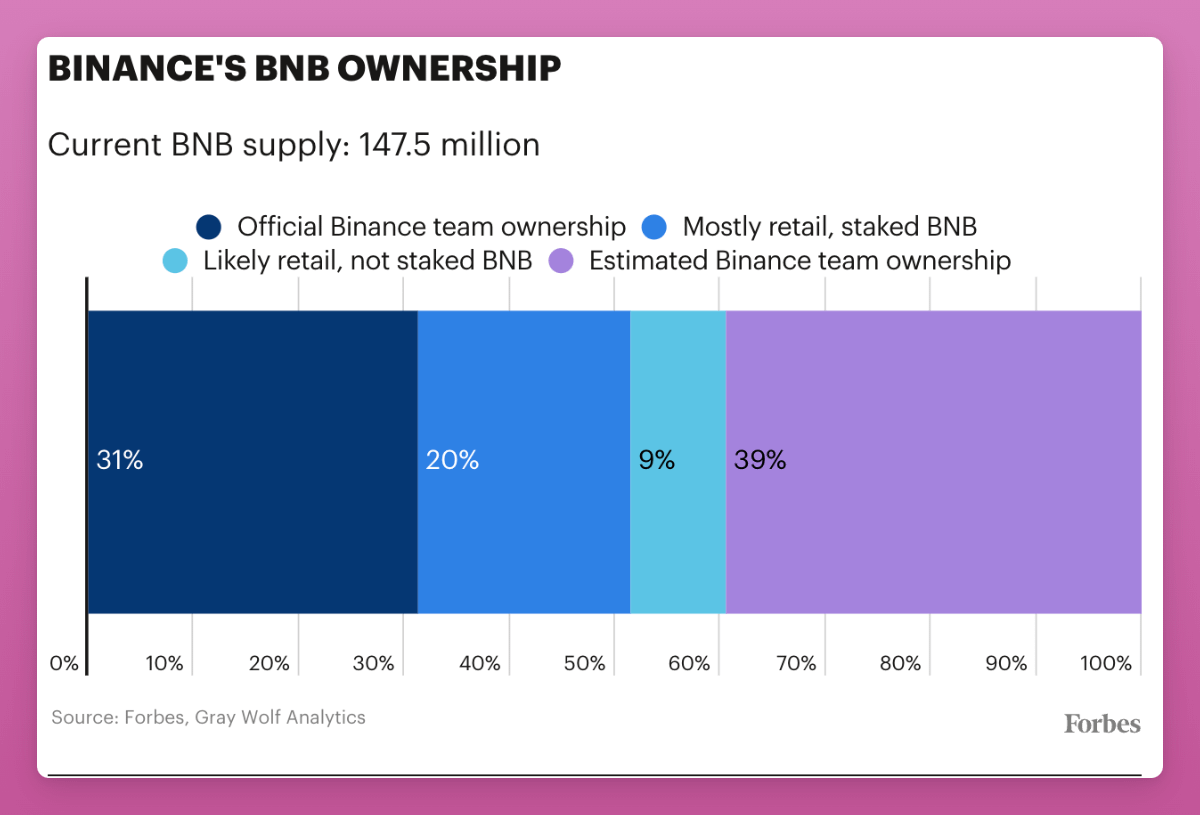

For example, even though Binance claims there are no direct listing fees, projects report indirect costs that can total 7-15% of their token supply or millions in cash equivalents. If Satoshi launched BTC today, it would not be able to get a Binance listing...Furthermore, Binance claims to reward its existing holders via airdrops from these listings. However, roughly 71% of those rewards go to Binance/CZ. Forbes estimates that CZ owns around 64% of the total $BNB supply. Thus, in reality, the majority of the listing extraction goes to Binance and CZ, and not ordinary token holders.

BNB's supply distribution

This extractive structure has coincided with a sharp deterioration in tokens' performance post-listing. The majority of Binance's newly listed tokens in 2025 have turned into "Dead Listings". As of April 2025, 89% of the 27 tokens newly listed on Binance posted negative returns, with losses ranging from 23% to over 95%.Anyone who bought Binance-listed tokens is likely down on their investments. The listing process is structured in a way that lets BNB holders dump airdropped tokens for quick yield, making BNB appear more attractive while draining value from the market.

Binance often lists low-float, high-FDV tokens that are easy to manipulate and offer little transparency around how or why they were listed.

This model ultimately extracts liquidity from genuine innovators and retail investors, benefiting the exchange at everyone else's expense.

Cryptonary's Take: The Path Forward

It's time for the market to move beyond Binance's dominance. For too long, Binance has acted as both gatekeeper and referee of the crypto ecosystem by setting prices, deciding listings, and shaping narratives. This centralisation of power has created distorted valuations, opaque practices, and extractive mechanics that work against the very ideals of crypto.The crypto space must break free from Binance's stranglehold on liquidity and price discovery. The future lies in transparent, on-chain environments where listings are merit-based, data is verifiable, and incentives are aligned with innovators and their users.

Platforms like Hyperliquid have already demonstrated what that future can look like: real-time transparency, fair liquidations, no gatekeepers for listings, and zero downtime during crises. On-chain price discovery brings valuations back to reality with lower, fairer valuations driven by true supply and demand.

While BNB may still perform well in the near term (we published a Master Thesis on its potential outperformance just a week ago), the latest developments have forced us to reassess. In light of recent events, BNB will not be our pick going forward. Performance alone cannot justify supporting systems that contradict crypto's core principles and the risks they pose to users.

Thus, the path forward is simple:

- Ditch Binance and other CEXes: Stop rewarding extraction and opacity.

- Embrace on-chain finance: Not your keys, not your coins. Don't hold a significant portion of wealth on centralised exchanges.

- Support transparent listings: Don't chase Tier-1 listings. Support onchain platforms where anyone can verify fairness and liquidity.

Again, not your keys, not your coins. On-chain is the only way forward.

Peace!