We noticed there’s a common mistake to our and other people’s approach to this market. While we’ve found certain success with it, two problems emerged:

- Tiring as hell because you have to try and keep up with hundreds of assets

- You’ll never find a predictive path for the next thing

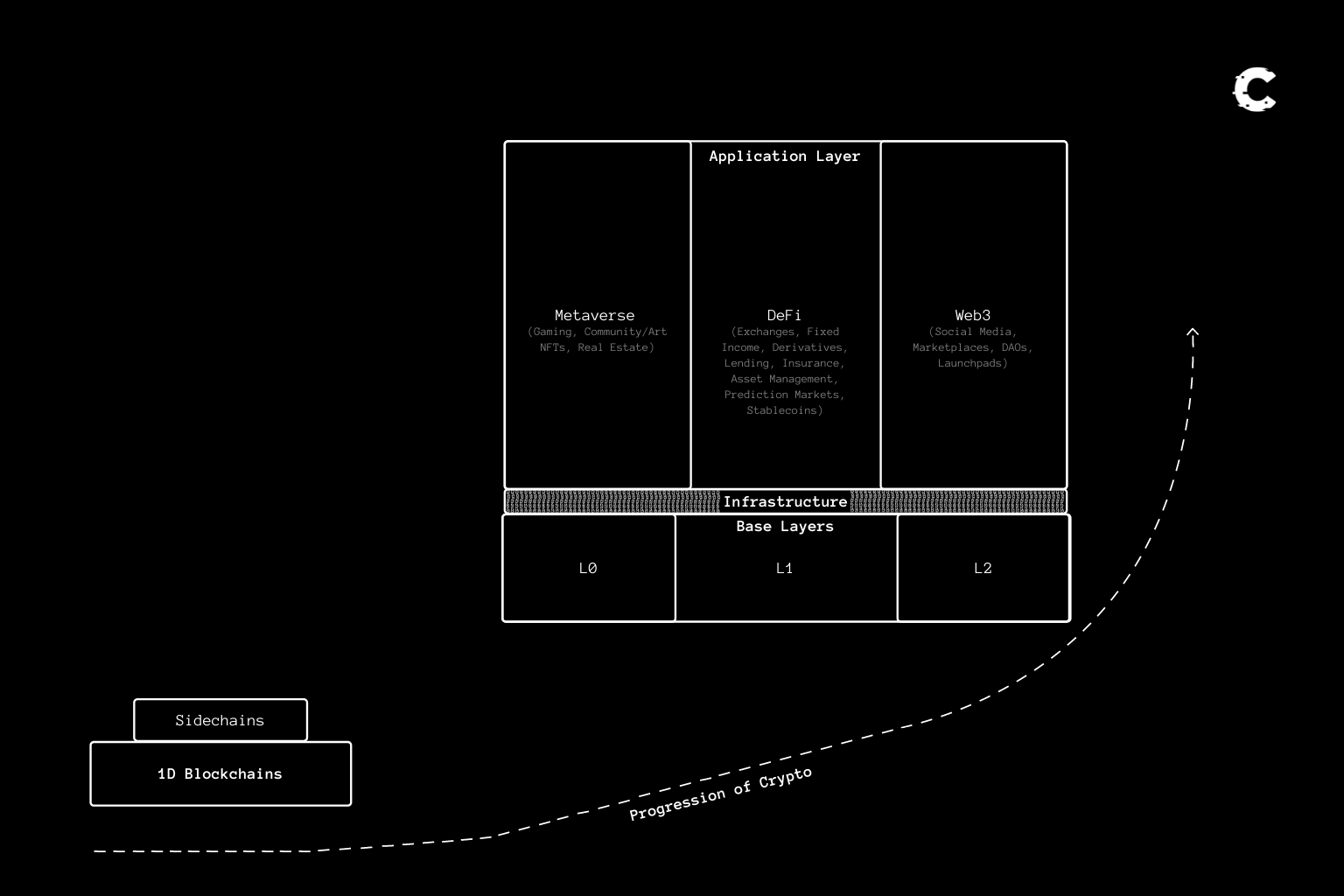

The solution is as simple as going from “Sector” to “Asset” instead of the other way around, as most do, and that’s where crypto’s progression, since the inception of Bitcoin from the 3rd of January 2009 to this date, started to make sense.

Below we share with you our findings on which we are basing all of our research for 2022 onwards.

TLDR

- 2010s was the decade of 1D Blockchains

- 2020s signaled the entry of Base Layers which is where we still stand

- Infrastructure & Application Layer come next

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make is your full responsibility.

The Logic

1D Blockchains

Crypto started off with Bitcoin, which is what we refer to as a 1D Blockchain (one-dimensional) in the sense that you can only transact peer-to-peer on it - send money to someone else and vice versa. In the early 2010s, this was a new concept being trialed but it was not “approved” by society just yet. Over time, usage grew and it became clear that P2P/Censorship-Resistant/Decentralised currencies were needed and the biggest proof is Bitcoin’s price.

During its time of trial, which we can roughly quantify as the decade of the 2010s, other assets were created to compete to be “Bitcoin-killers”. Think of Litecoin, Dash and Monero.

Base Layers

Once the concept of decentralised money was proven to be needed and became established, it became time to build on top of it. Enter, Ethereum with smart contracts. The timings overlap but Ethereum mainly caught (fundamentally-backed) traction in 2020 when we saw the DeFi TVL start to grow exponentially. Competitors to Ethereum came about and we began seeing their rise with the likes of Solana, Terra and Avalanche. Base Layers are split into three different types and the market is still in the testing phase:

- Layer 0s: New architecture allowing developers to build blockchains with shared security from the base, Polkadot and Cosmos offer it.

- Layer 1s: The simple layer where dApps can be built, think Ethereum/Solana/Avalanche/Terra/BSC

- Layer 2s: New layer taking advantage of the L1’s security, mainly offers scaling solutions. The most prominent ones are Ethereum L2s.

Infrastructure

With multiple chains grow new problems such as communications between chains, liquidity fragmentation and decentralised data storage of the information. This is where the infrastructure sector becomes crucial. Logically speaking, the largest boom ought to happen once the fight for “Which Base Layers will we choose for the industry?” is completed but there can and will be overlaps in timing if we base ourselves on history.

Application Layer

All of the building happening in the previous three sectors has one purpose: build the application layer. This is where you have DeFi, Web3 and the Metaverse. Base layers and their infrastructure must be completed in order for the application layer to become scalably usable which is crypto’s end goal.The Anatomy

Now that we’ve explained the logical progression of crypto, it’s time to break down the different elements and lay them out on the table for a clear-cut vision. The Crypto Market can be split into: 4 sectors, 6 sub-sectors and 24 verticals.- 1D Blockchains

- Base Layers

- L0s

- L1s

- L2s

- Infrastructure

-

- Wallets

- Cross-Chain Communications

- Oracles

- Staking Solutions

- DAO Tooling

- Data Storage

- Front-Ends

- Privacy

- Bandwidth/Data Availability

-

- Application Layer

- DeFi

- Fixed Income

- Derivatives

- Exchanges

- Lending Markets

- Insurance

- Asset Management

- Prediction Markets

- Stablecoins

- Metaverse

- Gaming

- Community/Art NFTs

- Real Estate

- Web3

- Social Media

- Marketplaces

- DAOs

- Launchpad

- DeFi

Visualise Crypto

For the visual learners, this image should help you clearly see crypto’s path.

This is the natural & logical progression that crypto is taking and we project it will continue on this path for at least another decade. All CPro Research will become based on the above and you will notice a shift from randomness to order. If you’re in crypto for the short or long-term, understanding the logic of this seemingly irrational market is a necessity.Next up will be a Research Report breaking down our thesis on which narratives will be the largest driving forces for 2022.