The day trader's secret weapon: Mastering the trading journal

Do you trade based on price action and take multiple trades per week? Are you looking for ways to sharpen your edge? If so, this article is for you. This article is part 2 of our Journalling series in which we tell you why it's so important for you to keep and have a journal as a trader.

In this article, we will touch on new things that are zeroed in on specifically how you as a day trader can benefit from Journalling.

What we will go over in this article:

- Why day traders should journal

- Day trader performance benefits from Journalling

- Psychological benefits

- Trading Journal breakdown

- Interpreting data from the journal

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Why day traders should Journal

Let's start from the top. Journalling is an essential practice for day traders as it helps with virtually every aspect. Unlike swing traders, day traders go in and out of positions many times a week, making it extremely hard for them to effectively grow without a documentation process.By keeping a journal, day traders can track every aspect of their performance, be it entries, exits, position sizing, risk management, and more. This documentation helps identify strengths and weaknesses, making it easier to improve over time. But that isn't all there is, Journalling not only helps on the performance side of things but as we touched on in the last article, it is also crucial for upping your mental game as well.

Overall, there are no cons to journaling and only a plethora of positives, with that being said, let's look into exactly how we can use it to up our performance as day traders.

Psychological benefits of Journalling

Journalling isn't about numbers, but about emotion, and emotion is a huge component of trading decisions. Day traders, in general, are prone to psychological traps of overtrading and revenge trading. Let's see how journaling can help traders overcome them.

Day traders are most susceptible to psychological traps of overtrading and revenge trading in the wake of losses. Through journaling, they can look beyond Behavioural patterns and notice if they're over-trading because of losses or if they are trading poorly due to emotion. Through observation of their Behaviour, day traders can take corrective actions, such as not trading after a couple of two losses in a row, to prevent trading in emotion.

In addition, day traders also have to make quick decisions typically in a matter of minutes. Through journaling, they can train their mind to make timely but rational decisions in the longer run, which eliminates impulse trades in frustration, overconfidence or otherwise.

Another major challenge day traders face is decision fatigue. The pressure to stay focused and to make decisions quickly throughout the day can take a heavy psychological toll. Through energy and decision quality measurement over time, we can observe where decision fatigue is producing errors. Journalling also exposes where they are allowing FOMO or doubt to dictate their choices, and this is causing them to take bad trades or miss trades. Lastly, journaling exposes where they are 'on tilt'.

It is a term in poker to describe the frustration, which ultimately results in bad decisions and losses, which could have been avoided. By catching emotion cues early and in time through the review of the journal, day traders can step back, recharge, and ensure they are trading a strategy and not emotion, which ultimately will significantly improve their performance.

Common Journalling mistakes & how to avoid them

A trading journal is worth about as much time and energy put into it, and most of them suffer from several of the following errors which deprive them of their potential. One of them is inconsistency-only recording successful trades or not including bad performance days tends to deprive them of having a complete picture and of really understanding what is making their trading succeed or not. The solution? Turn journaling into another part of the trading ritual- schedule a time of day to report trades, successful or not.

Another common flaw is not recording enough detail. Writing down merely entry and exit prices and not recording setups, reasoning, or risk of the trade will not provide enough detail to assist in improving.

Traders should instead write down reasons for entering, how they felt before entering, and whether they followed their strategy of risk. In time, this greater detail can assist in identifying psychological tendencies, such as not wanting to take a setup or entering bad setups impulsively.

Many traders also make the mistake of focusing too much on their win percentage and not enough on profitability. It is not necessarily going to turn a trader profitable if they have a high percentage of winners but their losses exceed their gains.

Traders should not tally their journal entries of losses and gains but should look over their journals to examine their risk-reward ratio and consistency in the long run. Traders can gain maximum benefit and better knowledge of their trading performance by not doing this and journaling daily.

Trading Journal template breakdown

Now, let's break down what goes into a trading journal, why each element matters, and provide a template with examples to help you get started.What to include in a day trading journal:

Trade details: Date, time, asset traded, direction (long/short).- The reasoning behind this is so that eventually we can see if there are any signs as to what times, directions, and assets we trade are more profitable.

- Reviewing how an entry and exit played out helps traders determine whether a setup is worth using in the future.

- Recording why you have certain stop-loss levels, take-profit levels, and the risk/reward ratio ensures traders can assess whether their risk management is effective over time.

- This is a basic section that allows for a quick recap of the trade

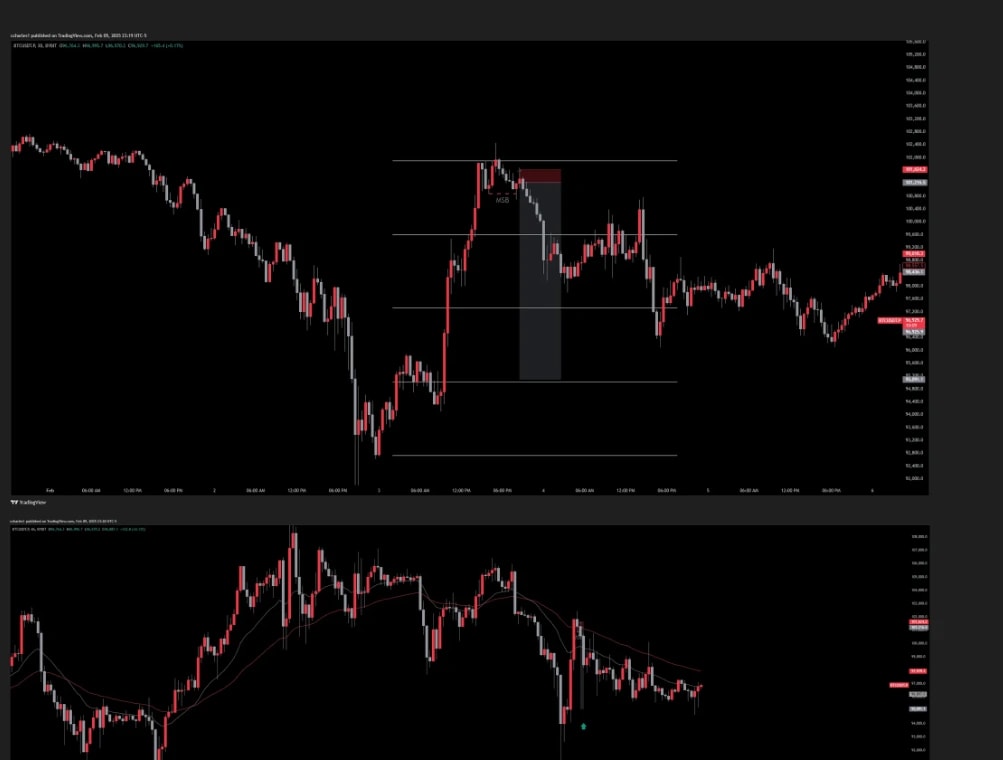

Below we can see an example of what a properly structured journal entry looks like. Here we can see the date and time, the position direction, notes, PNL, risk/reward, the session it happened in, the setup the trader used, and finally the final summation of the trade

We can also see that for this trade the trader also included a couple of photos of the setup on multiple timeframes.

We have made this into a template which you can access here and below we have a video you can watch on exactly how to use it.

Performance tracking & data interpretation

The first step to performance tracking is understanding how journaling helps track performance metrics and improve trading strategies. Keeping a detailed trading journal, it allows day traders to Analyse key performance metrics and refine their approach. This is done by reviewing their trade entries.Sessions

Traders can determine the best times to trade based on their success rates in different market sessions. For example, your win rate could be 50% in the Asian session, but during the London session you see it drop to below 20% based on that information alone, you can decide to stop trading during that time to boost your performance.

Strategies

Journalling also helps assess how various market conditions impact strategy effectiveness, revealing which setups work best in different volatility environments. Additionally, traders can compare the success of different trading styles, such as scalping versus trend trading, to identify which approach yields better results.

Execution

Beyond strategy review, journaling can also help to fine-tune entries and exits through the identification of stop loss placements that are too wide, missed entries, or issues of slippage, which can subsequently be fine-tuned where appropriate to ensure consistency.

Risk management

Lastly, you can also apply your Journal to manage your risk better. This can be done by reviewing previous trades and if and how well you remain in compliance with your risk because there are ways which work better using stationary risk % per trade. You can also look and see if using different risk percentages for different set-ups would contribute to profitability.

Further interpreting the data from your journal

To add to the above, a trading journal is worth something if and only if there is time to look over and Analyse data. Review of trades from time to time can assist in pulling valuable lessons, of which succeeded and which failed, and why. By recognising recurring errors, trades can appreciate loser trade patterns and rectify strategy deficiencies. Finally, journaling facilitates ongoing strategy adjustment, where position sizing, stop-loss placements, and entries can be modified in light of performance data in reality and not assumptions, which is worth it.How to analyse and improve using your journal

Keeping a journal is half of the battle; the most critical thing is how one reviews and responds to the data to better improve. It is not uncommon to find many traders journal their trades but never review them, robbing them of Journalling's full potential. Having a formal review process can help to find strengths, weaknesses, and areas to improve.

A great review is to look for patterns in profitable and unprofitable trades. Ask yourself questions such as: Do I perform better in one half of the day? Do losses outnumber gains? Do I remain true to my rules of risk? Knowledge of these tendencies can help enlighten you to what is and is not functioning, and how to improve better. An example is, if your journal reveals that you overtrade after two losses in a row, you can add to your rules to take time out after two losses in a row. In another example, if your most profitable trades take place in trending conditions but in chop, you can adjust your strategy to avoid ranging conditions.

One of the best ways to improve is to conduct monthly performance reviews based on journal data. Classify trades each month into setup, time of day, or market condition, and review each of their performance. In the event that one of them has significantly better performance in their win rate, you should concentrate on it moving forward and discard or optimize less profitable strategies that could be worth considering. Through Journalling and going over trades consistently, you turn it into a valuable means of constant improvement and development.

Cryptonary's take

Keeping a journal is a game-changer for day traders. With the fast pace of day trading, it's easy to lose track of what's working and what's not. Your journal is one of the most powerful tools for refining your strategy. By tracking trade details, exits, risk, and market conditions gain a clear picture of what works and what doesn't. More importantly, journaling helps you trade with discipline, ensuring that every trade aligns with your plan instead of emotions.But a journal is not better than how you apply it. It needs to include trading details, reasons for entering trades, levels of risk, and thoughts following this means that you can see patterns in errors and achievements.

Over time, this results in identifying which trading sessions suit you, which strategies actually work in different market conditions, and how to perform better. The real magic is when, time and time again, you go over your journal, learn from past trades, and tweak your method upon factual data instead of intuition.

A trading journal isn't just a tool-it's your roadmap to success. Every top trader keeps one. The question is: Will you?

Cryptonary, OUT!