The DeFi Loan that repays itself

We believe that DeFi is the future – it is inevitable. The adoption of BTC by El Salvador now means that crypto undeniably has a foot in the door. Presently, DeFi just seems like a novelty to many. Concepts such as collateralised crypto loans seem pointless to most people when you must put up 3-4x the loan amount as collateral. TradFi has the advantage here, as things like credit scores allow for loans/mortgages etc to be taken with next to no collateral compared to the borrowed amount.

Additionally, most loans charge an interest rate. For example, if we were to borrow through Celsius using BTC as collateral we would be paying ~9% interest per annum. This makes sense, right? Every other loan on the planet is the same.

But what if we were to say that there was a way to take out a loan that repays itself without any interaction – your only investment is time.

Disclaimer: THIS IS NOT FINANCIAL OR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.

The name ‘Alchemix’ comes from Alchemy – an ancient “science” where alchemists would attempt to turn Lead and other base metals into Gold. Obviously, this turned out to be impossible. However, we like the usage here and it fits well with the premise of the project.

Alchemix – What is it?

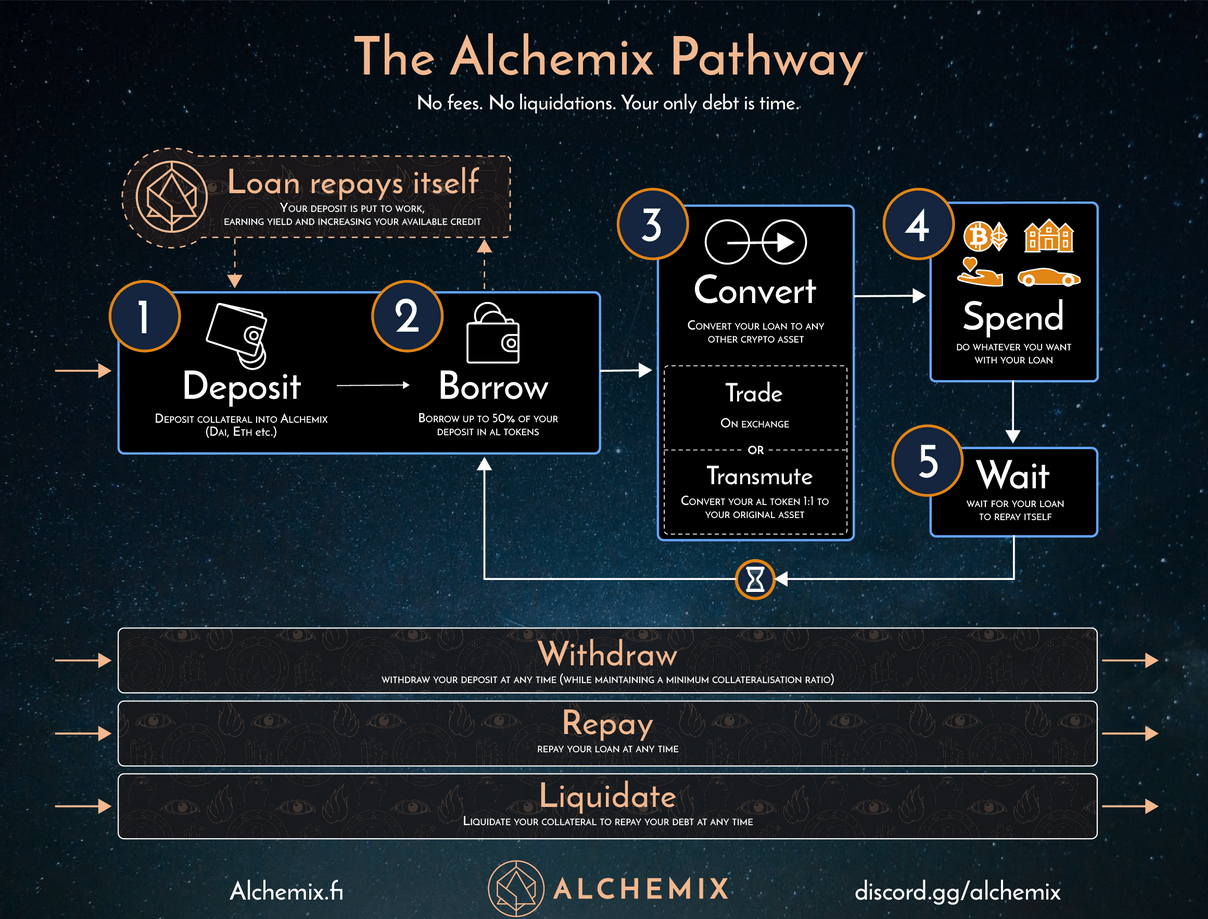

Alchemix is essentially a yield farming mechanism with a twist. When DAI is deposited into the protocol the user can borrow up to 50% of their DAI collateral and receive a stablecoin called ‘alUSD’. The alUSD can then be exchanged for DAI and withdrawn to be utilised elsewhere or reinvested to generate more income. Imagine that – generating income on yield that hasn’t even been earned yet!The DAI deposited by the user is sent to the yearn.finance yDAI vault. Yield generated by this DAI is used to pay down the debt in the Alchemix vaults. This means that over time the loan that a user has taken out against their collateral is paid back automatically, essentially making it a self-paying loan. To give an example:

- Liam deposits 1000 DAI into the Alchemix vault and uses this as collateral to borrow 500 alUSD.

- Liam then trades his 500 alUSD on Curve.fi for 500 DAI.

- He withdraws his DAI to FTX then sells it for USD. This allows him to withdraw his $500 to his bank account, and he buys a new $500 phone.

- 24 months down the line Liam comes back to check his Alchemix vault. His original collateral is still there, and additionally the 500 alUSD he borrowed has been earned from the yield of his 1000 DAI initial deposit.

- Liam is now able to withdraw his original funds, plus he has a phone paid for by the yield generated by his collateral.

These are valid questions, and to answer them we must look at what is happening when a loan is taken through Alchemix. When the user takes a loan out against their collateral, they are essentially getting an advance on the future yield of their assets. This allows them to spend yield long before it has been generated.

Let’s have at the various components of Alchemix.

Vault

The Alchemix vault is the core of the protocol and the interface is used by participants to manage their collateral and debt. If the user wishes to withdraw their funds before the loan is paid, they can liquidate a portion of their collateral to pay off the debt and withdraw the remaining funds. Additionally, the user can take out any earned yield as another loan if their collateralisation ratio is above 200%. (Collateralisation Ratio = Collateral/Loan * 100)

Behind the scenes, a smart contract manages user funds whilst the yearn.finance yield aggregator handles the generation of yield which is then returned to the vaults. 10% of generated yield goes to the Alchemix treasury, and 90% is used to pay off user debt. A portion is also sent to the Transmuter.

Transmuter

Since 1 alUSD must always be equal to 1 DAI there has to be a process by which this peg is achieved – this is where the Transmuter comes in. Normally, users can swap their alUSD for DAI on Curve.fi. However, in the case that alUSD is trading below $1 on Curve, the Transmuter is where users can go to ‘transmute’ their loaned alUSD into DAI to ensure that they always receive 1 DAI for 1 alUSD, no matter what.

Users deposit their borrowed alUSD into the Transmuter, and once enough DAI has been generated through the yield farm to compensate them for their alUSD, they are able to withdraw DAI equal to the amount of alUSD they have deposited. The deposited alUSD is then burned in order to maintain the peg. Excess DAI from the Transmuter is sent back to yearn to provide extra funding, increasing the yield for all users and speeding up the loan repayment process.

alETH

Alchemix recently made ETH a collateral option. The process is exactly the same as the process for borrowing alUSD, but users are loaned alETH instead. The only difference is that the collateralisation rate is 400% instead of 200%, meaning that ETH collateral must be 4x the size of the alETH loan (1 alETH backed by 4ETH). Since funds in Alchemix cannot be liquidated, any ETH deposited into the protocol is secure. As long as the user does not sell alETH for fiat, then the risks are the same as just HODLing ETH (loss of USD value).

The high collateralisation ratio and debt limits are there to ensure the launch of the ETH pools goes smoothly. It is likely that the collateral requirement will be lower in the future and more alETH will be available for borrowing. We believe that the cautious approach to this launch will be beneficial to the project in the long term.

ALCX Token

ALCX is the governance token for Alchemix, providing holders with an input in the future of the protocol, as well how the Treasury funds are used. Currently Alchemix is managed by the developers using a multisig, however, the plan is to gradually move away from this and hand control over to a community-driven Decentralised Autonomous Organisation (DAO).

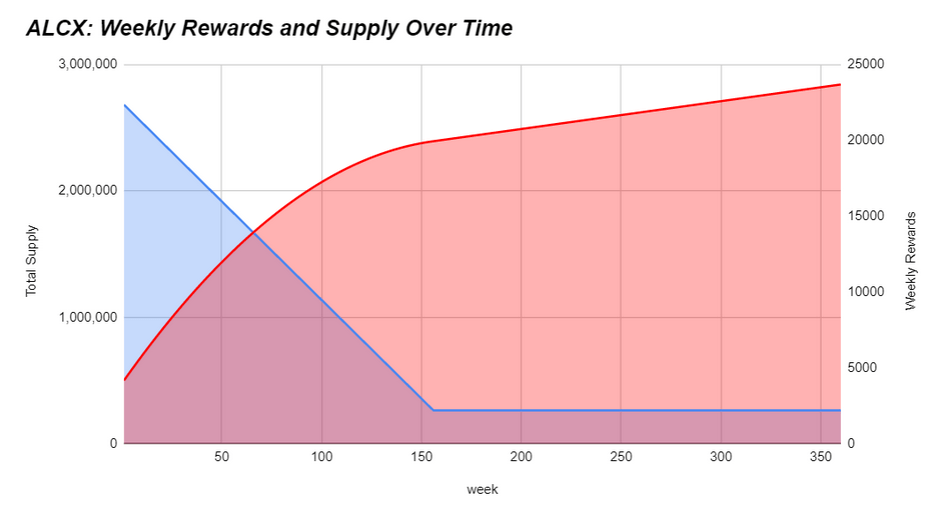

At the time of writing there is a circulating supply of approximately 355,000 ALCX, trading at $740 per token. After roughly 3 years the rewards emissions will level off to a constant 2,200 tokens per week, inflating the total supply by 4.5% per year.

We would also like to stress that we are not investing in the ALCX token. It is not used for anything other than governance at the present and so as an investment it is not particularly attractive. We are purely interested in the functionality of the project and we believe that there is a strong use case here for us in the future.

Staking Pools

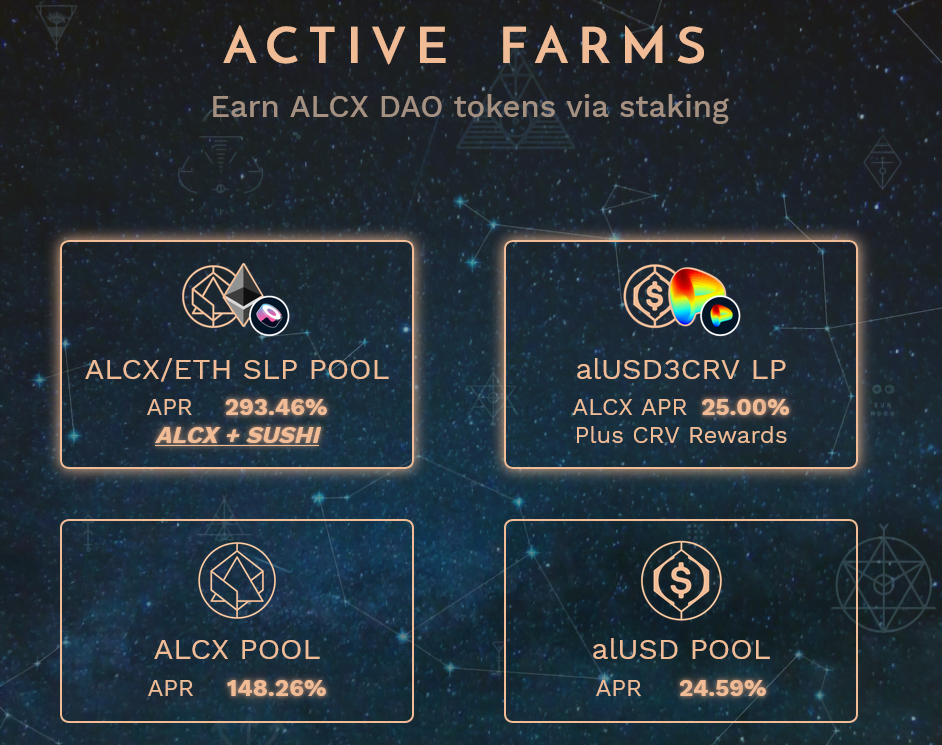

Participants can stake their ALCX and alUSD to earn ALCX rewards. Alchemix currently has 4 active pools:

- A low-risk single-sided ALCX pool where holders can easily stake their tokens through the platform.

- An alUSD pool where users can stake the Alchemix stablecoin and receive ALCX rewards.

- An ALCX/ETH SLP (Sushi Liquidity Provider) token pool where users can farm yield through SushiSwap using their LP tokens to earn ALCX and SUSHI rewards. Participants must provide liquidity through SushiSwap to receive ALCX/ETH SLP tokens. Impermanent Loss is a risk here, however the yield is quite high (290%+ at the time of writing).

- An alUSD3CRV LP pool where users can earn both ALCX and CRV rewards.

Use Cases

The most attractive use case for us would be to utilise Alchemix as a financial product. The premise of being able to purchase things on a sort of reverse finance deal is very innovative, and one we will likely utilise.Through the staking pools it is possible to earn yield on borrowed funds, in addition to the yield that is generated from your initial DAI deposit. This is a speculative method of maximising returns and is completely optional. Due to the volatility that the ALCX token has seen over the last few weeks Impermanent Loss is something to consider before entering a pool.

Tutorial

Conclusion

The sheer number of DeFi alternatives to TradFi services that have been popping up over the last few years is staggering. Alchemix has certainly cornered a niche in the DeFi space. With over $1 billion Total Value Locked, there is clear demand for the service being provided by the protocol.However, one thing we should mention is the debt ceiling. This is the maximum amount of alUSD that can be minted and issued as debt to users. The reason for the ceiling is to ensure the stability of alUSD as a stablecoin and that all alUSD minted is 100% backed by DAI. What this means for the user is that sometimes there will be no alUSD available to loan. In the long term though this is good for the project as it shows that the developers are diligently managing Alchemix.

Alchemix has also recently started working with Runtime Verification, who will audit their contracts (they’ve done a lot of work auditing ETH2 code). This added security will boost user confidence in the development team and the project itself.