We’ve uncovered a web of interconnected products, lucrative schemes, and revenue-generating strategies for token holders, revealing an astonishing 31X potential. This is the DeFi Cosa Nostra, where influence, innovation, and privacy rule.

Join us as we venture into the realm of meta-governance. We'll show you why missing out on this opportunity would be a costly mistake.

Just to make sure you're serious, the Don has put a little quiz at the bottom of the page.

TLDR 📃

- Redacted Cartel invented the concept of meta-governance, in which one DAO participates in the governance of another.

- By amassing stakes in some of DeFi’s most prominent protocols, Redacted has become a shot-caller in the industry.

- Redacted products feed off one another to fuel sustainable revenue flow for Redacted’s BTRFLY token holders.

- Dinero introduces a novel stablecoin that is unlike any other.

- This adds up to a BTRFLY price target of $7,600 within two years: a multiple of 31X.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Meta-governance: An offer they can’t refuse 🦹🏼♀️

Decentralised finance breaks down long-standing barriers in TradFi, but it also creates new challenges. One of these is governance: Who, exactly, is in charge of these protocols?DAOs, or decentralised autonomous organisations, have emerged as the best answer. They allow token holders to propose changes and vote on them. DAOs work something like a board of directors for DeFi projects.

It didn’t take long for the Redacted Cartel to recognise an opportunity to get a piece of the action. They could accumulate tokens to gain power in influencing DAOs. With this strategy, they could wind up running the action all over the crypto world. The Redacted family began accumulating tokens to earn it places on other DAOs, where it could inaugurate an innovative form of influence and control: meta-governance.

Redacted's Partnerships Lead, Chapo, describes it like one Mafia family muscling into another family’s territory: “Redacted slowly acquires shares in companies that have sway in their respective industries. Eventually, we hope to have board seats at these companies. Our valuation is derived [from] which companies we have within the treasury and the power of our vote.”

Redacted is taking charge with a suite of interconnected products that align to a dual mandate:

- Build a productive treasury consisting of protocol governance tokens.

- Leverage the treasury and products to generate revenue for token holders.

Have a cigar. This won’t take long.

Building a governance war-chest 🪖

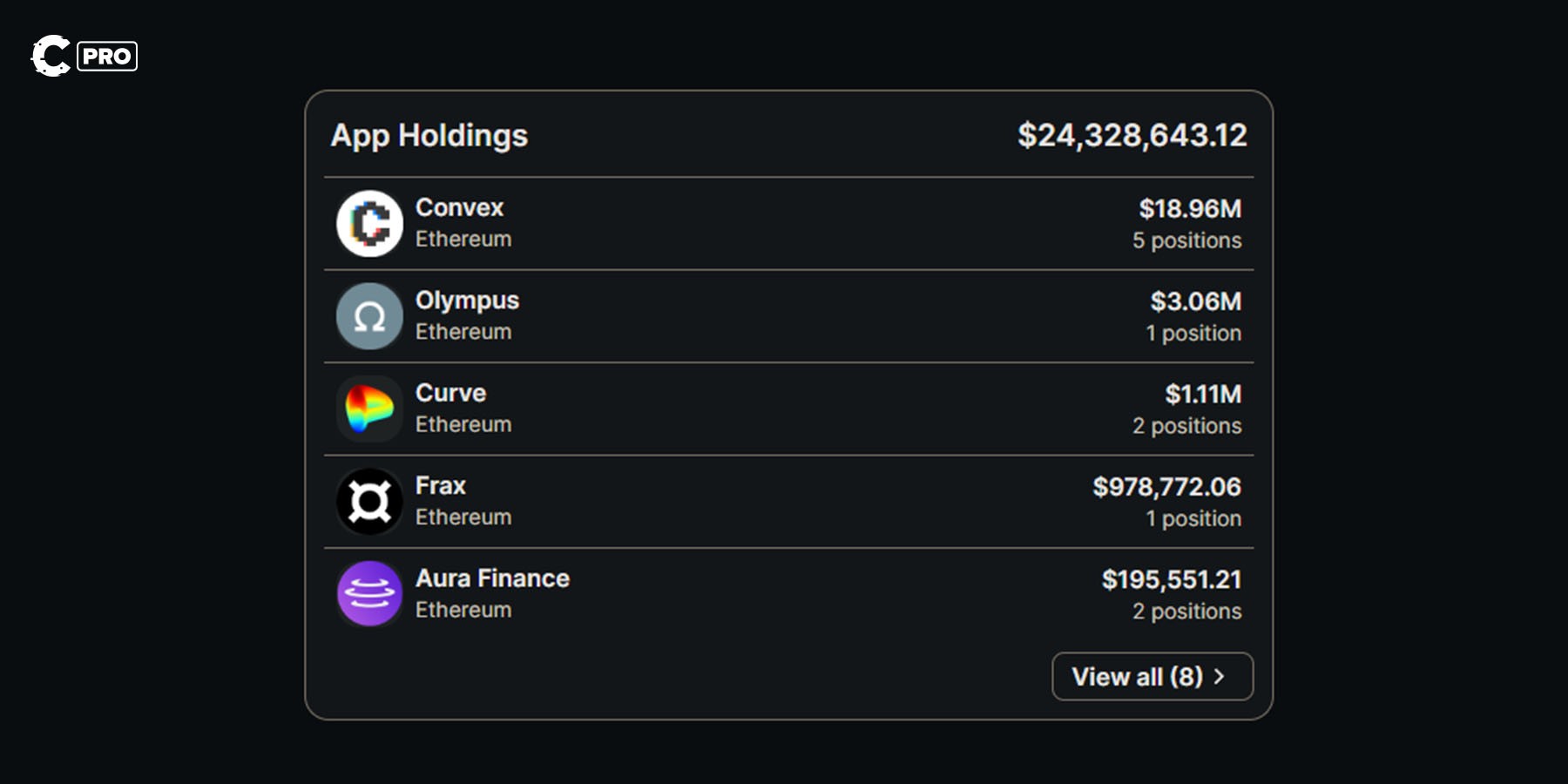

Redacted takes care of the community. Hidden Hand and Pirex put tokens to work more productively for platforms around the internet.The same strategy builds Redacted’s productive treasury. In this case, “productive” means that instead of simply sitting on their assets, they earn yield on their tokens to expand the Cartel’s reach. Redacted’s products funnel cashflow into the treasury to fuel growth.

Yields from these assets are earmarked for Redacted token holders once the war-chest reaches pre-determined self-sustaining levels. (You can track these wallets here.)

And that brings us to Redacted’s own token, BTRFLY.

BTRFLY is the governance token of the Redacted DAO. It can be locked for 16-week periods to convert it to revenue-locked BTRFLY. Along with voting power, holding rlBTRFLY grants you the rights to a proportional share of the protocol’s revenue each fortnight.

This revenue is paid in ETH and it’s currently bolstered by additional BTRFLY emissions.

Weapons in the Redacted armory 🔫

The Redacted Cartel has built out a striking line-up of products. Hidden Hand, Pirex, and (soon) Dinero dovetail with one another to form a DeFi infrastructure that doesn’t exist anywhere else.Hidden Hand: Pulling some strings

Redacted’s Hidden Hand is a cutting-edge marketplace for governance incentives, better known as "bribes." With Hidden Hand, protocols can streamline their governance procedures and incentivise voters like never before. Users can earn extra yield on governance tokens through this innovative bribery system.

If you are unfamiliar with how bribing works, we suggest checking out our recent Research Report on Bunni (a new Redacted partner). Other notable projects leveraging Hidden Hand include Aura, Balancer, Frax, Ribbon, and Floor DAO.

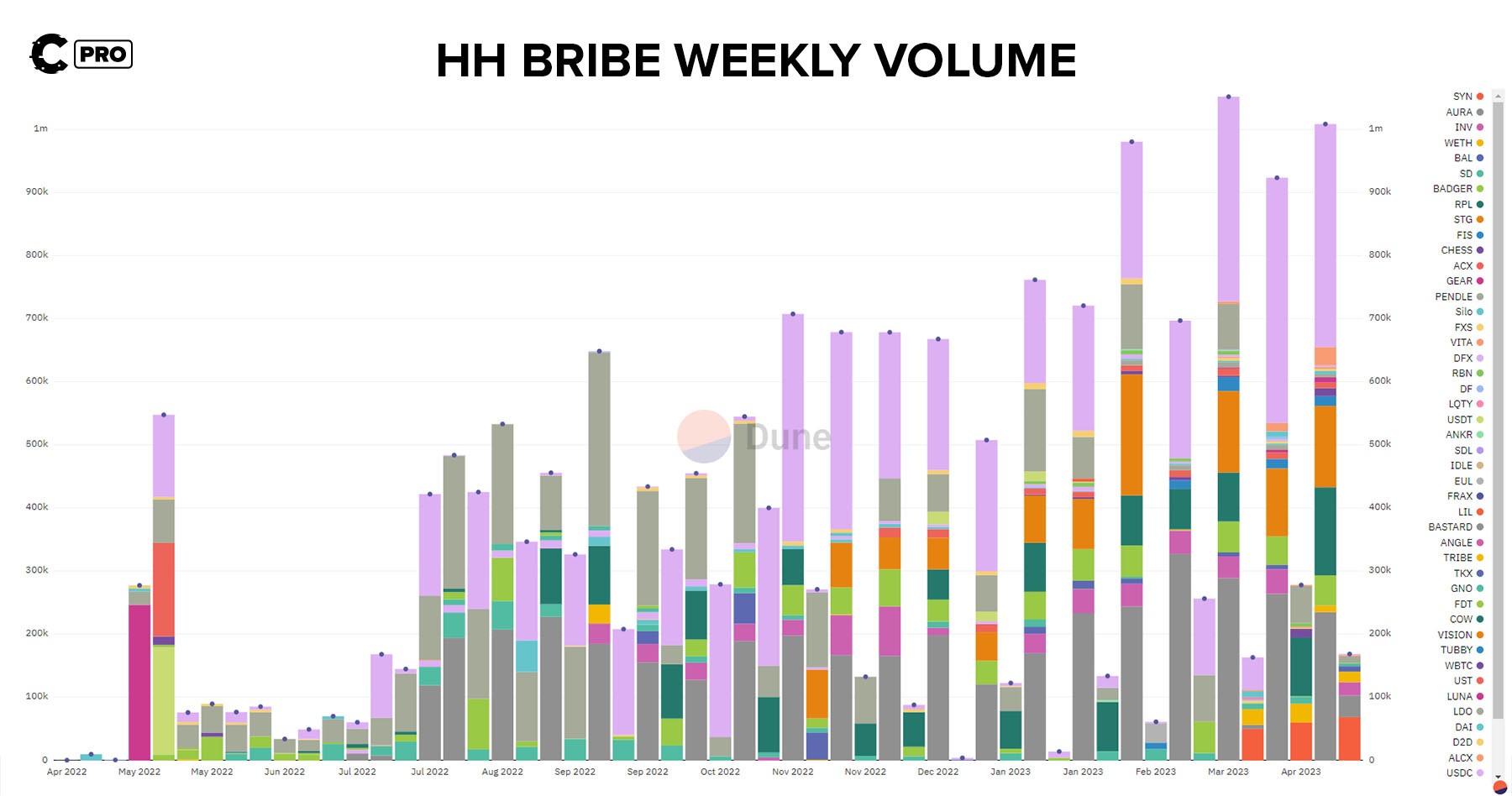

Business is booming. Hidden Hand revenue continues to rise week in and week out - recently breaking the $1M/week landmark. Since both Redacted’s treasury and rlBTRFLY holders receive a cut of these profits, times have been good for the cartel. With more partners on the way, the future remains bright for this part of Redacted’s strategy.

Pirex: Simplifying the management of locked tokens

DeFi can be complicated. That’s why Redacted built Pirex. But even if you’re a seasoned DeFi pro, you’ll find a lot to like in the way this innovative tool manages locked tokens:

- Auto-compounding

- Yield management

- (Advanced) Liquid wrappers for secondary markets

- (Advanced) Tokenisation of future yield and voting events

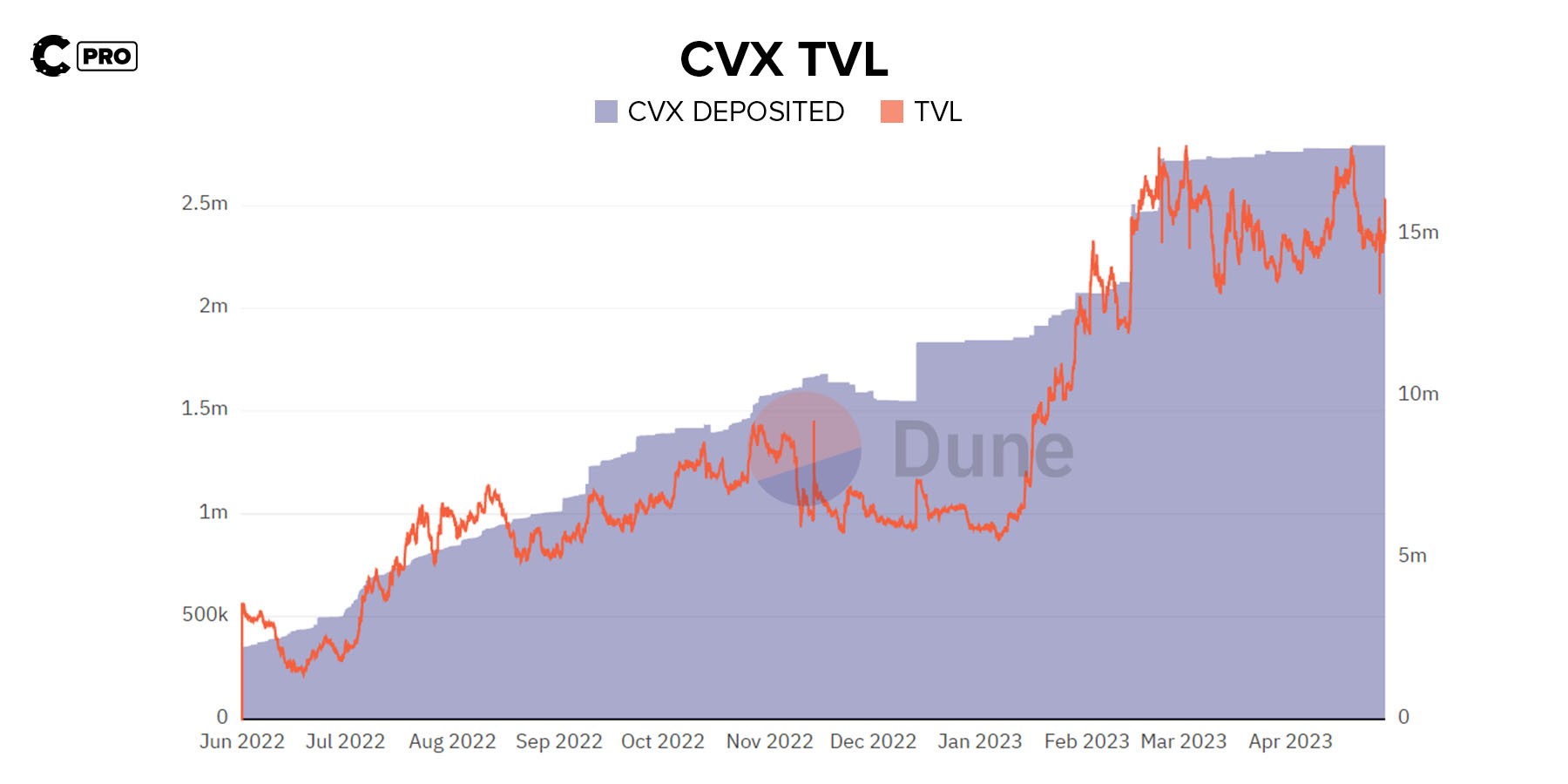

With total value locked charts like this one, we’re confident that Pirex has proven its product-market fit:

Dinero: Reinventing the stablecoin

First, a disclaimer: Dinero is not yet live. What we know comes from a Redacted litepaper. Team members say they won’t hesitate to pivot if they come across better architectures during development. Here’s what we understand of the current plans:

Think of the Dinero project less as a stablecoin project and more as a plan to build up the Redacted ecosystem using a stablecoin as the medium of exchange. The use of DINERO for access to this premium blockspace is a novel concept that brings new utility that other stablecoins can’t match.

The Dinero ecosystem relies on the Redacted Relayer, which allows users to submit blocks on Ethereum. Users wishing to send private transactions or pay for their transactions using DINERO can submit the transactions to Redacted’s premium Relayer instead of the default relayer in their wallets.

This scheme has two parts:

- The DINERO stablecoin. Backed by ETH, it allows you to conduct transactions on the Redacted Relayer using DINERO as the medium of exchange.

- pxETH. This is Redacted’s custom ETH liquid staking derivative. It’s minted from user-deposited ETH. Users can borrow DINERO against their pxETH. The underlying ETH will power Dinero protocol validators.

Valuation price targets 💰

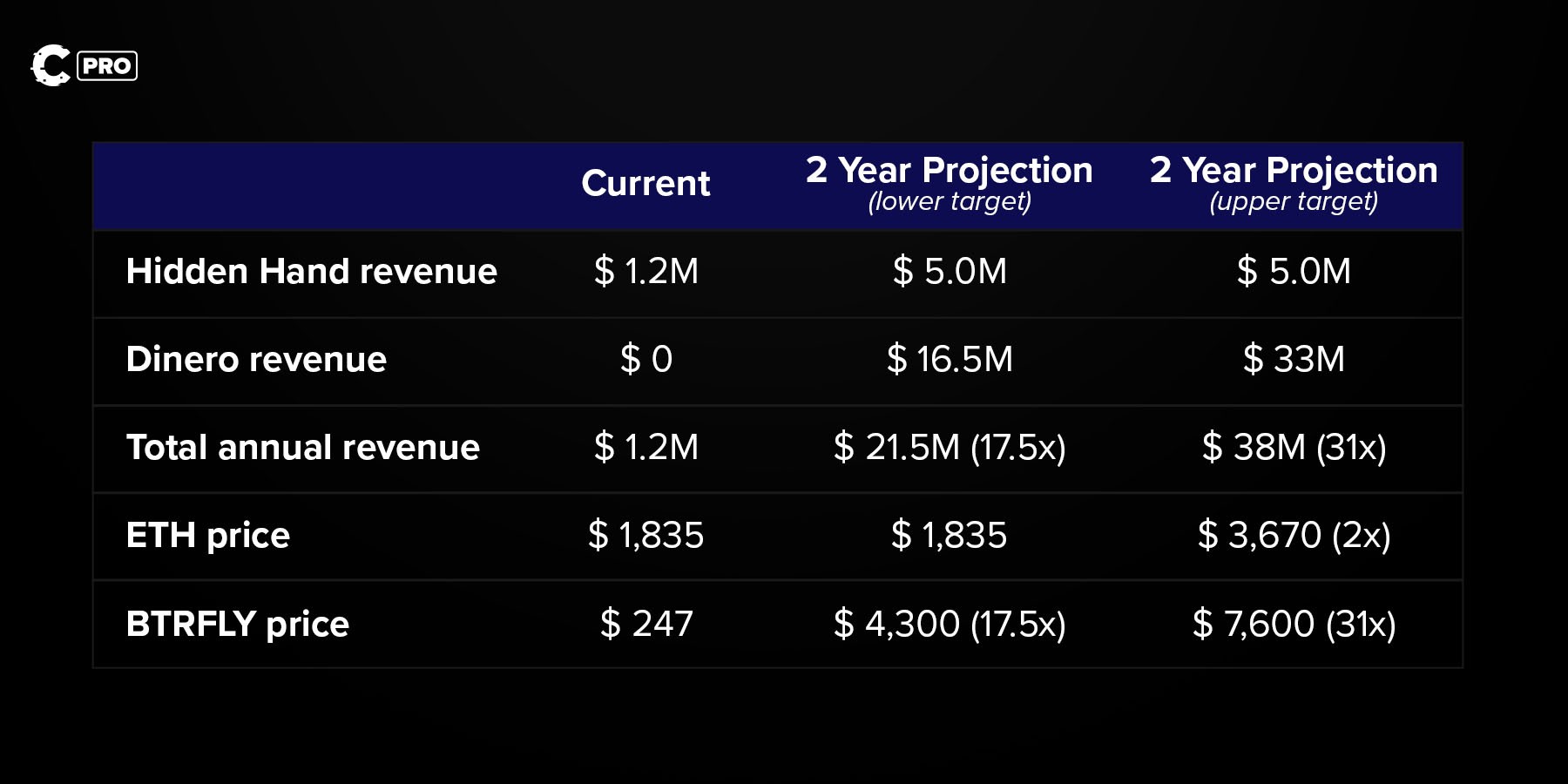

Redacted is a unique case. Since there isn’t a similar protocol or DAO to compare it to, we’re going to value Redacted based on current vs projected cash flow.Today, Hidden Hand is the main revenue driver, producing roughly $1.2M in annualised fees to rlBTRFLY holders and the treasury. These fees have been on a steady uptrend, and if this trend continues, could breach $5M within two years.

To value Dinero, we look to the success of Frax’s frxETH liquid staking derivative as a similar project. Both projects aim to incentivise high APRs for using their liquid staking derivatives, and both count on large CVX holdings to reward holders of their LSDs.

Let’s be conservative and assume it takes two years for Dinero to reach the same level Frax’s frxETH reached after 6 months. This would put Dinero’s TVL over $300M, even assuming no price increase for ETH. At a staking rate of 4.5%, this would bring in a whopping $13.5M in annual fees alone to Redacted validators. On top of this, users pay interest to borrow DINERO. If we assume an interest rate of 2% and a borrowing rate of 50%, this brings in an additional $3M annually.

Add our Hidden Hand estimates, and this puts Redacted’s annual revenue at about $21.5M in two years, or an increase of 17.5 times current revenue. Apply these assumptions to token value, and we get a price target of $4,300 per BTRFLY.

If we assume that ETH (only) doubles in two years, we get a multiple of 31x, or an upper price target of $7,600 per BTRFLY.

This wouldn’t even require ETH to break its previous all-time high. And it doesn’t include revenue generated by Pirex, which is currently small but could greatly improve with the collaboration of GMX or Dinero.

Pullbacks are for buying 🛒

A word of caution: Team and OlympusDAO allocations are set to begin over the next couple months. For this reason, we would not be surprised to see prices decline in the short and medium term. We see this as a positive during our accumulation of BTRFLY as long as our invalidation criteria are unmet.We will monitor the selling activity of these insiders, whose allocations will come from this wallet address.

Invalidation criteria ❌

We may reduce or completely cut our position in BTRFLY if certain triggers are met.- Hidden Hand's moat is of utmost importance to Redacted, as it currently provides most of the revenue. There are no major competitors currently, but a token from Votium, the bribe marketplace for Curve, may be bearish for Redacted's success. Votium has focused solely on Curve so far; we'll keep an eye on their forums to stay up-to-date. If they plan to take a piece of Hidden Hand's pie, we may need to reduce our BTRFLY exposure - and possibly add Votium exposure.

- The adoption of Dinero is the most important question on every BTRFLY investor's mind. Its success could bring a whole new paradigm to Redacted. If Dinero flops, we may need to adjust our valuation and reduce our exposure.

- Although Redacted may be lower on the SEC's radar than other tokens, it is not entirely safe. Regulators have made it clear that tokens that provide income and depend on the work of others could be considered securities. That might not spell doom for Redacted, but it could make us reduce our BTRFLY exposure.

Cryptonary’s take 🧠

Conviction Level: 30%Conviction level, or odds of success, is based on our experts' confidence in an investment's probability of success based on past performance and the challenges the investment may face in the future. Conviction is expressed as a percentage of 0% to 60%.

Having weathered both bull-market euphoria and bear-market doldrums, Redacted Cartel’s focus and drive to deliver have been great selling points. They’ve shown that they are willing to pivot at the first sign of a better solution, and we’re watching their progress closely.In addition to innovating on their own products, the team has close ties to other protocols that we're excited about, including New Order DAO, Pendle, Bunni, Frax, GMX, and Berachain, which we see as a sign of their composability prospects.

The BTRFLY token was among the first to deliver real and consistent ETH returns. With a solid roadmap ahead, we plan on joining the DeFi Cosa Nostra and locking our BTRFLY to earn some ETH.

Action points 🎯

We wouldn't be surprised to see some price weakness over the next few months. Actually, we would welcome a slight softening of the price in order to accumulate more. It’s like the market making us an offer we can’t refuse. Assuming none of the invalidation criteria are met, here is our plan for entering and exiting our BTRFLY position.- We will accumulate BTRFLY monthly at prices below $400.

- Each time we accumulate, we will revenue-lock our BTRFLY (to convert to rlBTRFLY) to receive additional ETH and BTRFLY rewards over the holding period. (Learn more here.)

- We will sell one-third of our position at $1,600 (around 4x) to cover our cost basis.

- We will sell another third at our lower target of $4,300.

- Finally, we will sell our last third at our upper price target of $7,600.