The first reason is the macroeconomic situation and federal reserve effect described here. The second reason is discussed further in this report.

The 2021-2022 bear market will be remembered as the cycle that witnessed catastrophic events that triggered systemic risk in the crypto industry.

Terra’s LUNA & UST collapsed in May ($60 billion wiped out from the market), followed by the insolvency of major crypto entities that were managing digital assets worth over $40 billion in June.

$1.05 trillion was wiped out from crypto in 40 days!

Celsius, Three Arrows Capital, Voyager, and Zipmex went bankrupt, and BlockFi was rumoured insolvent!

These events have caused scepticism in crypto!

We will start in sequence with what caused these events, and what happened afterwards.

Finally, we'll discuss whether the fallout from these events is significant enough to cause a crypto industry crisis! - The End of Crypto?

Notes.

Terms you need to know while reading:

- Subprime Mortgage Loans: a type of mortgage issued to borrowers with low credit ratings, even individuals with no income.

- Mortgage-Backed Securities (MBS): bonds backed by mortgages that are sold as securities.

- Collateralized Debt Obligations (CDOs): a credit derivatives product backed mainly by mortgages and sold in the secondary market.

- Credit Default Swaps (CDs): a type of insurance protecting the investor from the risk of default by the other party.

- Quantitative Easing (QE): a program in which the federal reserve decides to buy financial assets (i.e. bonds) to add more money to the economy.

The 2008 Financial Crisis - The Great Recession

The Great Recession is the most significant economic disaster since the 1929 Great Depression. The Great Recession saw the U.S. economy lose $10 trillion in wealth, a decline in GDP by 4.3%, the most since world war II, unemployment rose from 5% to 10%, and the stock market crashed by 60%.

Causes

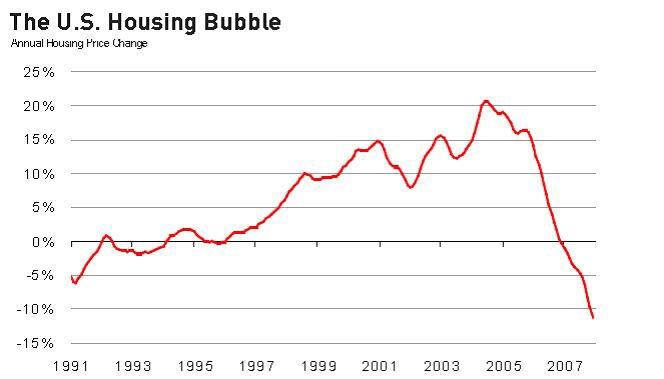

The great recession was caused by the housing bubble & deregulation in the financial industry.

The residential housing market was booming by the early to mid-2000s, encouraging people to invest in property and buy homes.

To capitalise on the boom, mortgage lenders rushed to approve many unregulated risky complex products of mortgages that offered great returns - Subprime Mortgages, MBS, and CDOs.

The market flooded with new homebuyers. Housing demand increased as a result of easy credit. Many homebuyers took out loans without understanding the risks involved to take advantage of a hot market and low-interest rates.

By mid-2006, home prices had peaked and the market began to slow. When supply began to outstrip demand, buyers found it extremely difficult to make mortgage payments due to the combination of high-interest rates and falling home prices.

The subprime mortgage crisis was in full swing, spreading beyond the real estate industry thanks to CDOs, followed by a credit crisis due to CDs.

Decisive action by the Federal Reserve and massive government spending ($700 billion) to bail out banks kept the U.S. economy from total collapse - a combination of reducing interest rates to zero and quantitative easing.

Too Big to Fail

During the 2008 financial crisis, former President George Bush's administration popularized the phrase "too big to fail," explaining why it needed to bail out some financial firms to avoid global economic collapse.Bear Stearns was the first bank that was too big to fail. When the mortgage securities market crashed, the federal reserve lent JPMorgan $30 billion to buy Bear Stearns.

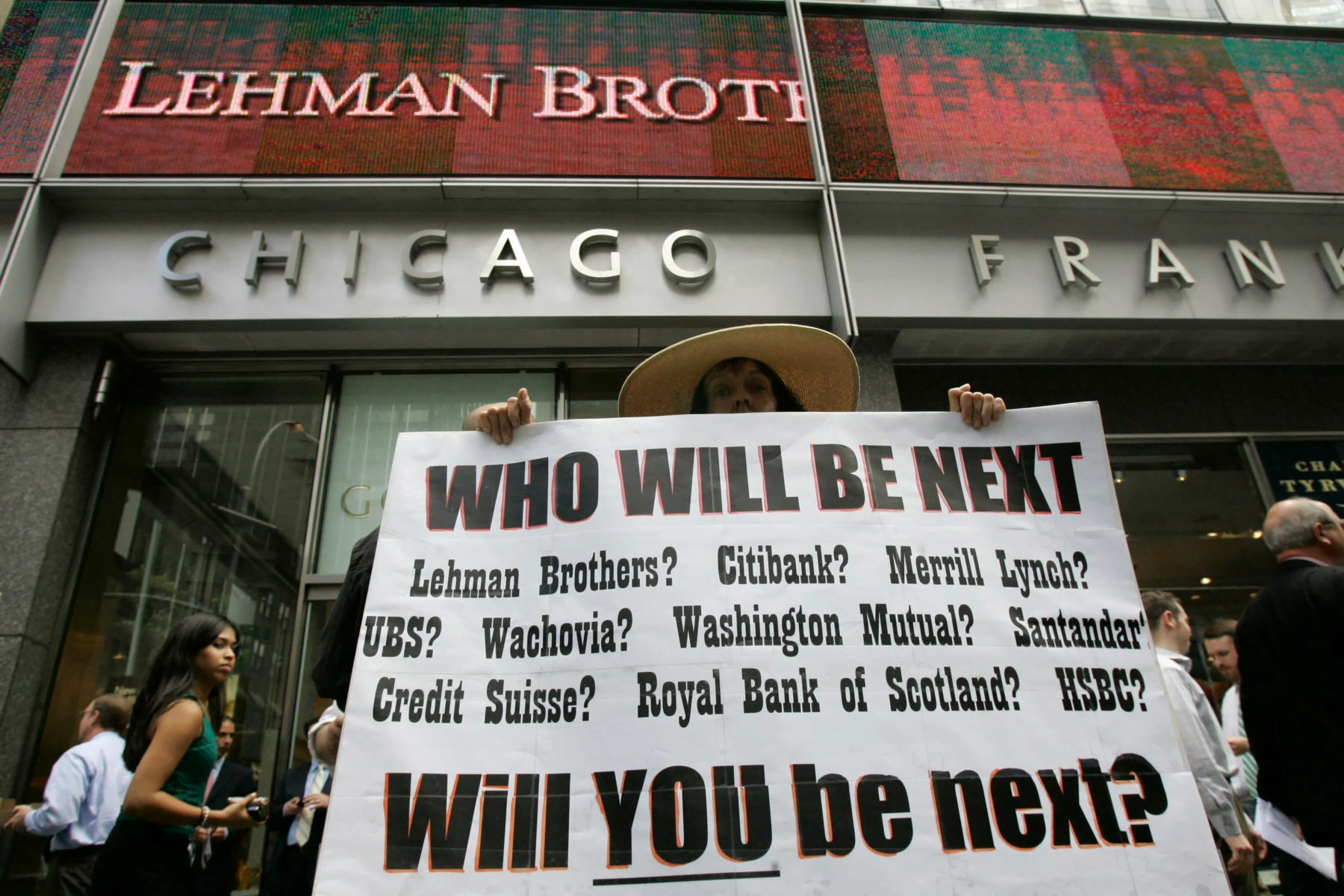

The crisis also hit Lehman Brothers. Unlike other investment banks, the government decided not to bail it out. As a result, the Lehman Brothers declared bankruptcy - the largest bankruptcy in U.S. history ($613 billion in debt).

The federal reserve bailed out investment banks Goldman Sachs and Morgan Stanley, allowing them to become bank holding companies, which means they would be regulated by the government.

Too big to fail became true.

The government cannot intervene to bail out an entity in crypto when it fails. Instead, the market corrects itself, increasing the volatility but remaining natural.

The 2008 financial crisis, caused by risky lending in pursuit of high returns, resulted in institutions defaulting when supply began to outweigh demand and prices fell. This exact phenomenon occurred recently in crypto, causing prices to capitulate.

The Celsius Saga - Crypto’s Lehman Brothers

Celsius is a centralised lending platform. Users' assets are loaned out to other institutions and exchanged for a higher yield, much like how a bank makes money with your money.When the market started to crash, Celsius’s assets under management (AUM) fell by 50% ($24 billion down to $12 billion), facing a liquidity crisis.

The company also made $8 billion in loans, some of which defaulted.

Eventually, Celsius announced to halt withdrawals due to extreme market conditions, rumoured to become deeply insolvent - due to a lack of liquidity, 1.7 million users were unable to withdraw their funds.

Celsius declared bankruptcy on July 13th, with a $1.2 billion deficit and $4.7 billion owed to users.

The company’s bankruptcy filing shows that Celsius also has more than 100,000 deposits from retail investors, some of whom lent the platform cash without collateral.

The Fall of Three Arrows Capital (3AC) - Broken Arrows

3AC was one of crypto's most prominent hedge funds, founded in 2012 with $10 billion AUM at its peak.3AC lost $200 million from LUNA and UST, together with billions from GBTC, an institutional bitcoin product.

3AC were buying shares in GBTC and then selling shares on over-the-counter (OTC) markets for a premium, netting them a tidy profit and making the trade appealing to investors.

GBTC's premium has fallen over the last year, reaching a new low in June. The following effect resulted in massive losses for investors like 3AC, who had amassed billions of dollars in exposure to the product using leverage to boost returns. Sadly, it resulted in tears.

3AC continued to borrow from lenders ($3.5 billion) anticipating a market rebound, until Bitcoin fell to nearly $20,000 in late June, causing the firm's positions to go wrong and unable to repay any loans.

3AC was also a significant holder of stETH. As stETH lost its peg to ETH, 3AC fell below margin requirements, causing positions worth $33 million in stETH to be liquidated.

3AC declared bankruptcy and now owes $3.5 billion to 27 entities.

Failed Broker & Lender Voyager

Voyager is a centralised crypto lending and trading broker with over $5 billion in AUM.Voyager froze customer funds (3.5 million users) on July 1 to avoid insolvency. A few days later, it filed for bankruptcy after lending more than $685 million to 3AC in Bitcoin & Ethereum - 3AC failed to repay the loan. However, Voyager was engaged in much riskier lending, resulting in massive liquidity losses.

The 30-year-old billionaire Sam Bankman-Fried has extended loans to crypto broker Voyager Digital, totalling $485 million, so that it can deal with its balance sheet and navigate the platform with strength.

Sam Bankman-Fried’s companies (FTX & Alemeda Research) proposed to buy the crypto lender’s assets out of bankruptcy so that users could withdraw and access their funds.

However, Voyager refused. Voyager representatives claimed that their proposed plan to reorganize the company is superior because it would deliver all of their customers' cash and as much of their cryptocurrency as possible as soon as possible. The offer is still valid.

Alameda has borrowed $377 million worth of crypto from Voyager, its second-largest loan after the one extended to 3AC.

The stall of BlockFi

BlockFi is a centralised lending platform with $4 billion in AUM as of Q2 2022. BlockFi's business model is similar to Celsius, which halted withdrawals to avoid potential insolvency. Worse, BlockFi was a significant creditor of 3AC.BlockFi "reported" it loaned $1bn to 3AC. BlockFi liquidated 3AC on June 16 due to 3AC's inability to repay its loan. Eventually, it was rumoured that BlockFi was insolvent.

However, BlockFi avoided the fates of Celsius, 3AC, and Voyager because Sam bailed it out. FTX provided a $400 million emergency line of credit to BlockFi, which is subordinate to client funds.

FTX is reportedly planning to acquire the company for $240 million to integrate both FTX and BlockFi products in a way that is superior to either separately.

The Latest Victim Zipexmex Exchange

The recent victim that filed for bankruptcy protection on 29th July after halting withdrawals, fell under the attention of Thailand’s SEC - Thailand-based crypto exchange Zipmex.Zipmex lent over $50 million to Celsius and Babel Finance which was not repaid. Both Celsius and Babel Finance incurred massive losses due to falling prices.

Zipmex started to face liquidity issues back in May when both LUNA & UST collapsed.

Lessons Learned

Pursuing high yields and returns with poor risk management can destroy everything you've built, especially with leverage, given how volatile crypto is. Nothing can continue to rise in price indefinitely, there must be a limit.Never store your crypto on a centralised exchange because the exchange owns your private keys and can misuse your funds and potentially lose them like Celsius and Voyager. To avoid this potential risk, store your assets in a cold wallet like a Ledger.

Not your keys, not your coins!

The collapse of these entities proved the need for decentralisation - the core tenant of crypto. Humans are greedy and require a lot of trust in them. Computer code, however, does not require trust.

Final Words

It all started with Terra collapsing, spreading contagion to Celsius, 3AC, Voyager, BlockFi, and now Zipmex. Are the systemic risks of these crises, over?If not, is there further damage to the industry that can cause the End of Crypto?

This is what we will discuss in the following report.

In the following report, we will examine whether these entities' assets have been completely sold, or whether there are still assets that can be sold into the market and cause prices to go down further.

Also, we will look into the tokens 3AC invested in that will be unlocked soon!

Updates

On November 8th 2022, one of the most shocking moments in crypto's history occurred. FTX & Alameda Research were both declared insolvent, causing Bitcoin's price to plummet to $15,500 for the first time since 2020!On November 11th 2022, FTX & Alameda Research declared bankruptcy with estimated liabilities of around $10 billion - $50 billion!

It appears Alameda Research was insolvent since the blowup of Terra. Sam Bankman-Fried was using customer funds from FTX to cover it up until liquidity started to drain, and both FTX & Alameda went underwater.

The FTX Alameda situation is crypto's Lehman Brothers moment. This situation is tearful for the industry as many users have their entire net worth on the exchange.

The market is currently facing extreme fear as trust in exchanges is lost.

The "hero" of crypto, as it may seem, turned out to be the ultimate person who let us all down by using users' funds to his advantage.