The future of DeFi trading: one token, all chains - a 17x potential

Did you know that Prime Brokers are some of the largest financial institutions in the world? That includes the likes of Goldman Sachs, UBS and Interactive Brokers - all of which are worth tens of billions.

Imagine if you could buy into these businesses early on?

Today, we have similar businesses being built in crypto but they aren't reserved for the ultra-rich, anyone can use them and anyone can invest in them. That's the democratisation that DeFi brings.

1Inch does something similar, so does MetaMask with their swap function, and they both rake in millions of dollars already. But spot trading, as popular as it obviously is, is second in line to the king of crypto products: Perpetual Futures.

Picture a DeFi prime broker specifically designed for perpetual futures trading, optimising the execution of leverage trades for the savvy and rich (they trade really big volumes).

Now, think bigger. Imagine it as multi-chain too and even better, imagine it with a great economic model (unlike 1Inch's token).

Well stop imagining, this token is here and it has 17x potential.

TLDR 📃

- MUX Protocol is revolutionising crypto trading, delivering the best trading prices across multiple exchanges, a dream for whales and institutions.

- The service MUX offers benefits other perp DEXs too, driving up their volumes and, by extension, their profitability. It's a win-win situation.

- MUX supports a host of chains including Arbitrum, Avalanche, BNB Chain, Optimism, and Fantom with more coming soon.

- The current MCB price of $10 is undervalued. Based on a conservative estimate we've calculated a price target of $172 for MCB.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

Introducing MUX Protocol 💹

Say hello to the MUX Protocol! It's here to shake things up in the world of crypto trading.

When the FTX collapse shocked the industry, it highlighted a shining beacon: decentralised marketplaces. These new kids on the block like dYdX, GMX, Perpetual Protocol, and Gains Network, took centre stage, delivering billions in trading volume and earning millions in fees

But even the best can get better. Consider GMX, with its focus on a select number of trading pairs, and dYdX that prioritises specific chain transactions. Far from being limitations, these are strategic preferences, and here's where MUX Protocol turns the spotlight!

MUX Protocol is your personal trading concierge, checking out exchanges to fetch you the best trading prices. Whether it's GMX, the largest perpetuals exchange on Arbitrum, or Gains with its diverse offerings, MUX fetches the optimum execution - a dream come true for whales and institutions.

But wait, there's more. MUX lets you trade from chains like Arbitrum, Avalanche, BNB Chain, Optimism, and Fantom, eliminating the need to shuffle funds between chains. Yes, MUX is a game-changer!

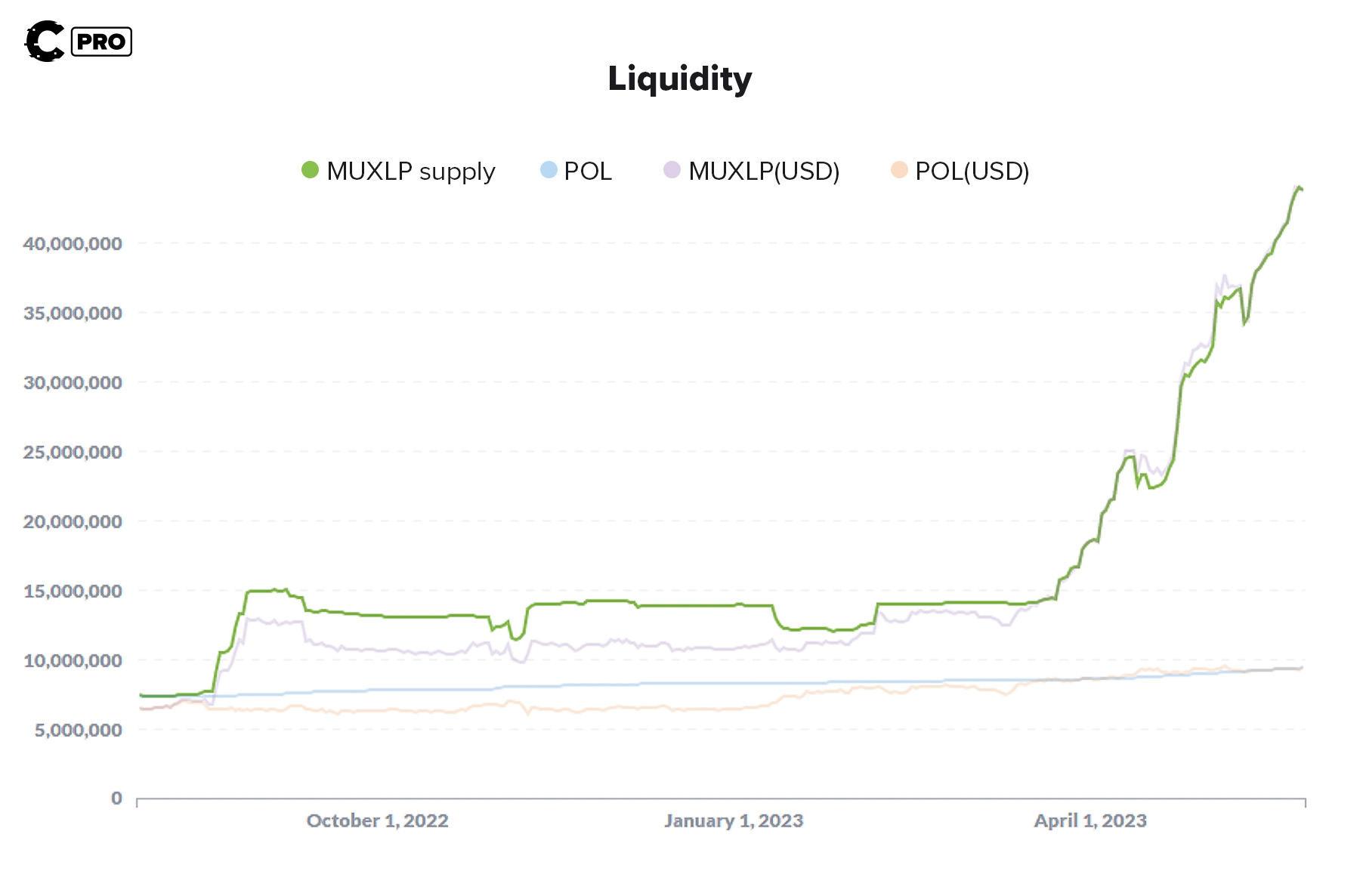

Then comes MUXLP, MUX's internal offering. MUXLP is a buffet of volatile assets and stablecoins, offering you diversified exposure. For liquidity providers on MUX, there's a cherry on top - extra fee revenue, boosting their profits. This lucrative yield has led to a surge in MUXLP adoption, drawing more traders and amplifying MUX's allure.

Onwards & upwards with MUX 🐂

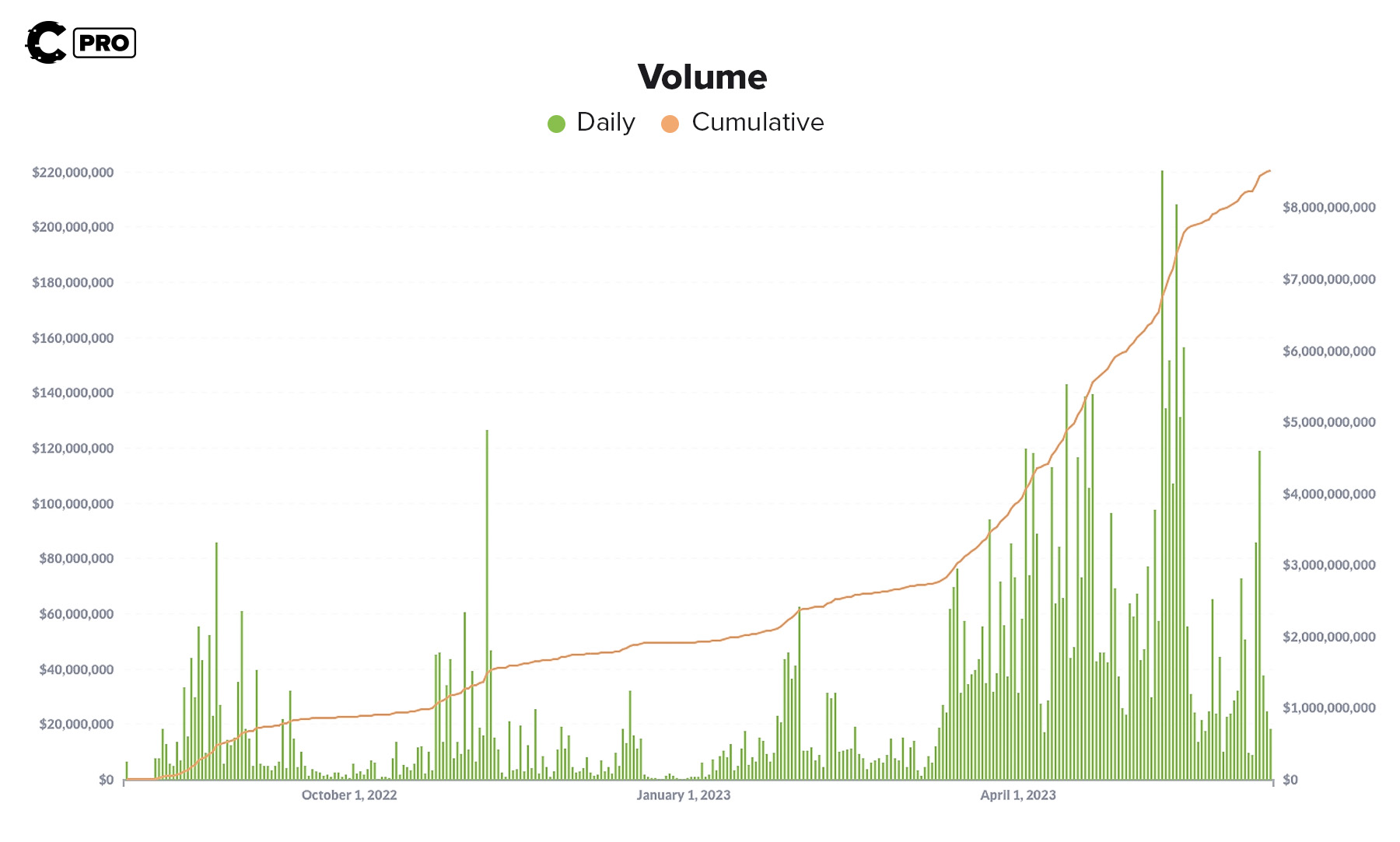

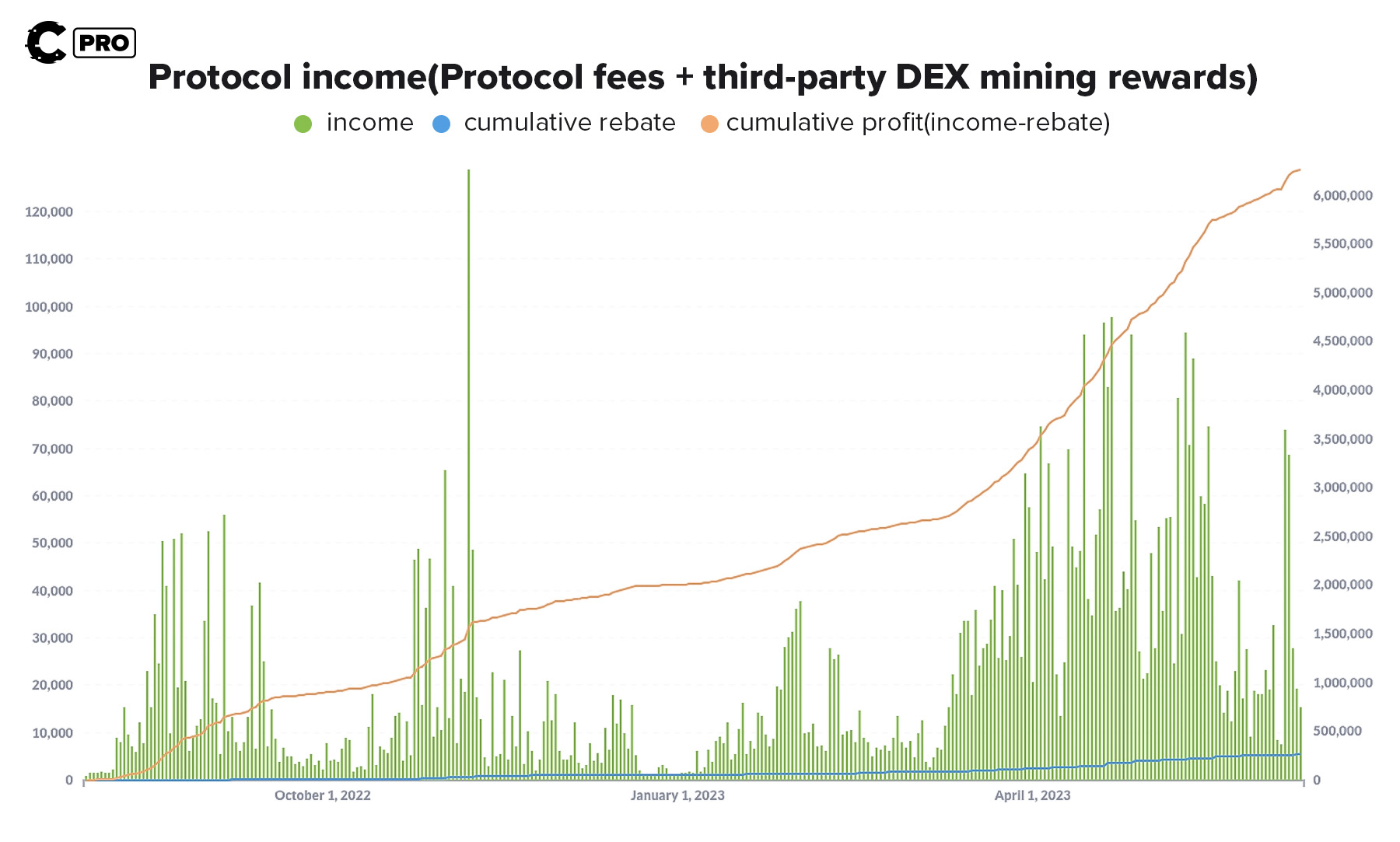

MUX is the talk of the town lately. Sure, the token might be trailing a bit, but don't let that fool you. The fundamentals are booming, backed by their escalating volumes and revenues.

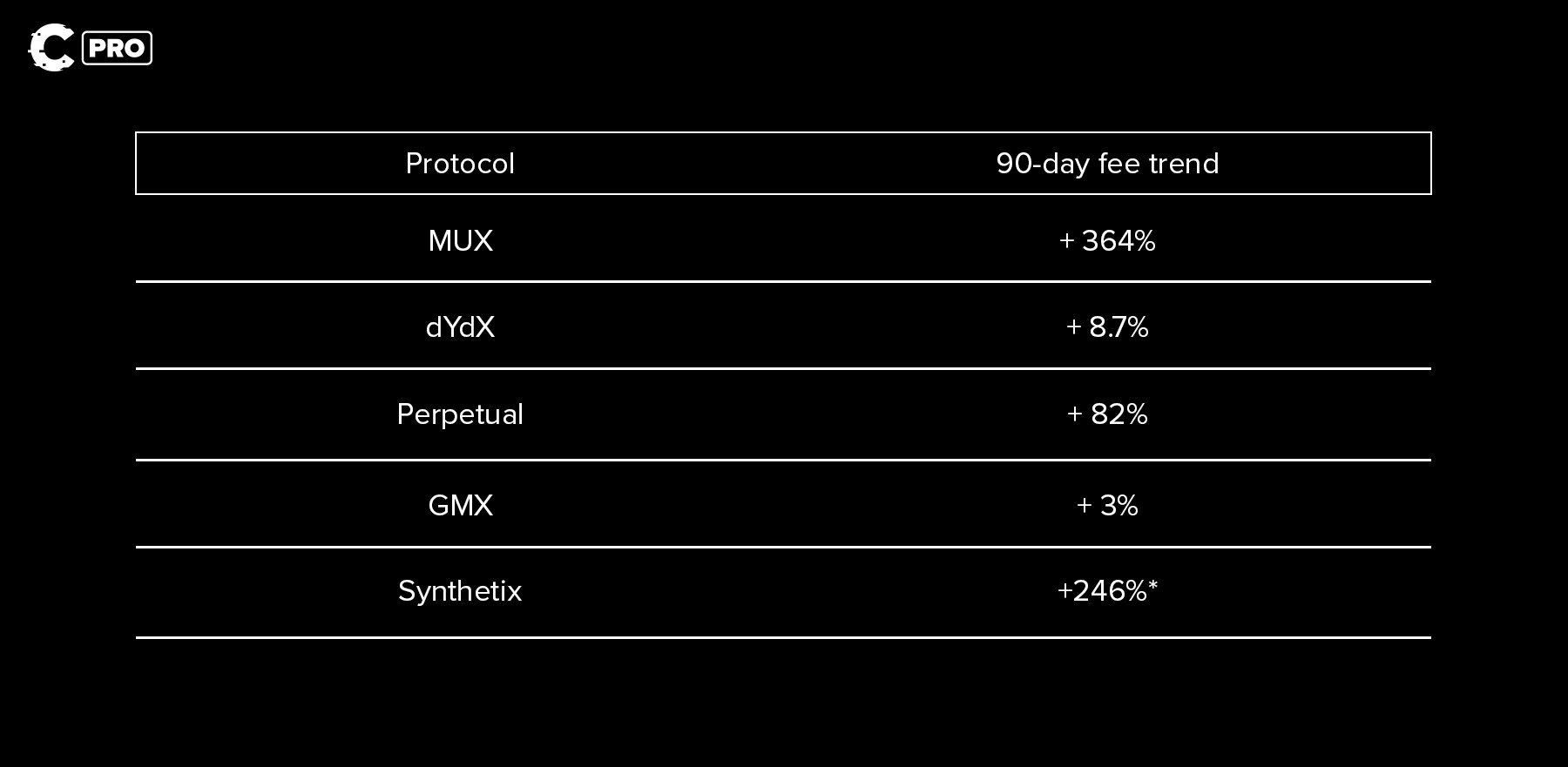

As we peek into MUX's promising future, it's clear they're not just expanding, they're refining their product-market fit. Just one glance at the fee generation trend shows MUX's meteoric rise.

And when you stack its growth against others, MUX is clearly sprinting ahead

[caption id="attachment_274763" align="aligncenter" width="1800"] *we take Synthetix’s recent growth with a grain of salt given their recent token incentive programs.[/caption]

*we take Synthetix’s recent growth with a grain of salt given their recent token incentive programs.[/caption]

The beauty of MUX's growth? It's not a solo act. As MUX flourishes, it's helping other exchanges grow their wallets too. Today, it's playing catalyst for Gains and GMX, but tomorrow, the stage is set for many more. It's a self-reinforcing, mutually beneficial cycle. So, what's cooking in the MUX kitchen?

Next up, MUX is integrating Synthetix's trading pairs, expanding trading avenues and firing up fee competition. Also on the agenda is roping in more perpetual exchanges, aimed at continually upgrading the user experience.

And it's not just about the here and now. MUX has its eyes on new territories, with chains like zkSync, Polygon, and Scroll marked on the roadmap.

MCB the token & targets 🎯

Important note: Do not confuse MUX and MCB. MUX is the name, MCB is the token.MUX's lifeblood isn't labelled 'MUX', it's known as MCB. Here's the fun part: lock up your MCB and you're in for a treat, earning both protocol fees and bonus tokens!

If you're a detail hound, the nitty-gritty of this token economy is just a click away in the documentation. But, to keep it simple:

- Max supply: 4,800,000 MCB

- Circulating supply: 3,800,000 MCB

- You can buy MCB on Arbitrum through Uniswap or on the BNB Chain via PancakeSwap

We’re valuing it like we would a traditional company, by gauging its earning potential against its competitors.

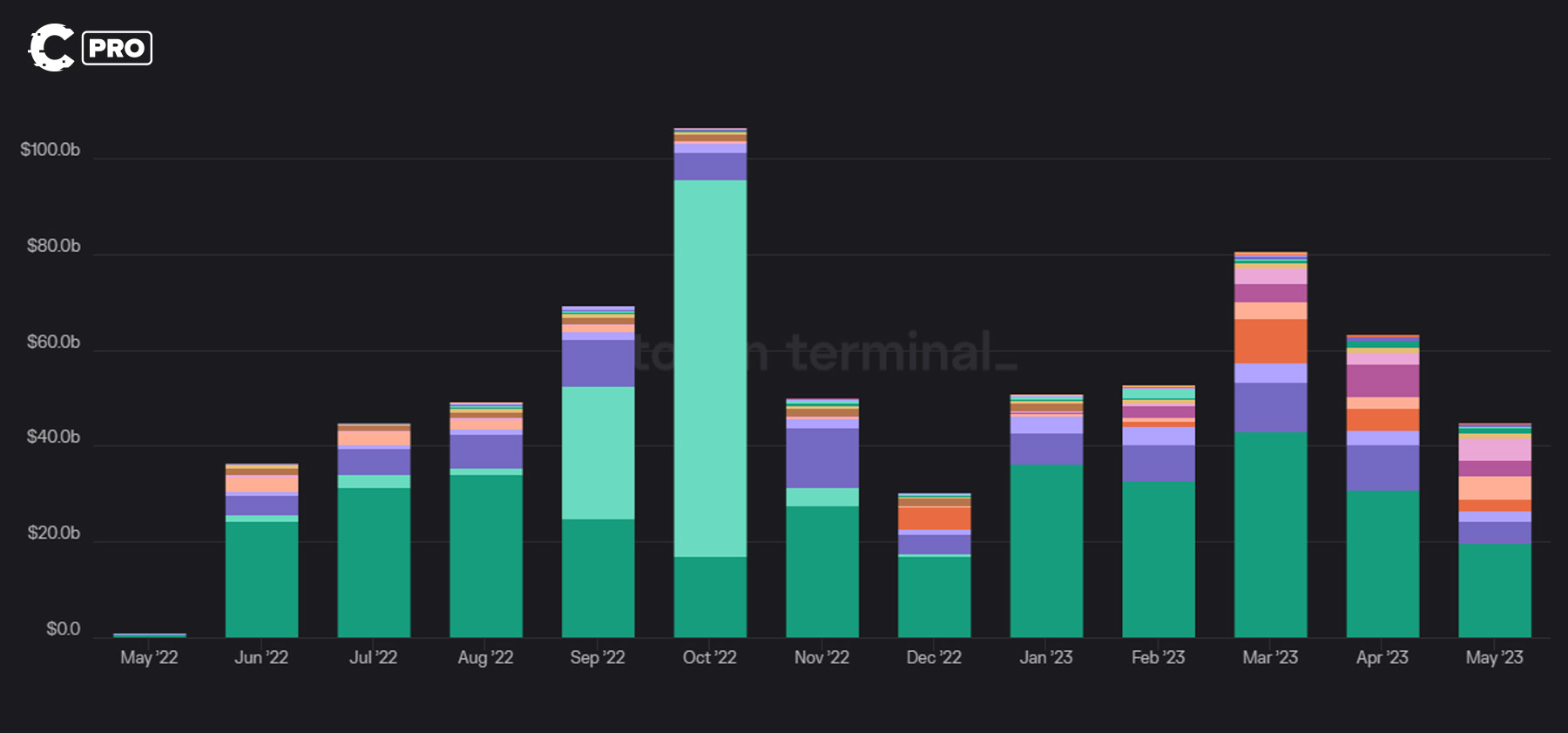

The on-chain derivatives market has been between $20-100B in volume over the past year. We'll use a conservative $50B target for our calculations.

Our prediction? MUX can secure 10% of this volume – that's $5B monthly. This suggests an 8.7x increase over MUX's current monthly volume.

Also, the market is underpricing MUX. Compared to GMX's earnings, MUX's valuation is about half what it should be.

Here's our calculation:

- Volume/Fee Growth: 8.7x

- Fair re-pricing based on GMX valuation: 1.975x

- Combined target multiple: 17.2x

- With MCB's current price at $10, our price target is $172

Invalidation criteria ❌

Our stance on MCB isn't set in stone, we'll certainly reassess our position if:- Despite MUX's lead in perpetual exchange aggregation, competitors like UniDex and DEUS DAO could challenge its dominance. If they start outperforming in TVL/Volume, we may reduce our exposure.

- Big players like Matcha and 1inch, currently focusing on spot asset swaps, could pivot into perpetuals. This would be a significant shift, and could lead us to reduce our exposure.

- MUX's growth is dependent on the cooperation of perpetual exchanges. If key contributors such as GMX, Gains, Synthetix, or new integrations pull back due to competitive concerns, we might cut back our exposure and rethink our projections.

Cryptonary’s take 🧠

How about snagging the best prices across a sweeping array of trading pairs, all from your go-to networks? That's MUX for you - a ground-breaking innovation!Riding the wave of decentralised perpetual exchanges, MUX didn't waste any time in launching a one-of-a-kind product. Their passion for perfecting before promoting speaks volumes about their commitment to building a lasting legacy.

Now, MUX might be the new kid on the block, but it's got the game down pat. With some exciting upgrades in the pipeline, the only way for MUX is up. So, if they keep acing the trader experience, we're in for quite a thrilling ride.

Alright, let's hit pause for a sec before we dive into our action points! Did you catch all that? It's quiz time - let's see how well you've absorbed the deets of this deep dive!

MUX quiz ❓

Loading...Action points 📝

Here's our game plan for the MCB token, barring any invalidation scenarios:- We're putting half of our earmarked money into MCB in the next two weeks.

- The other half? We'll buy more MCB with it (DCA) over three months.

- Once our investment doubles, we'll sell half to keep those gains safe.

- We'll sell the rest when MCB reaches our goal price of $172.