The hidden AI play the markets waiting to unfold.

Something big is brewing quietly in the AI sector, a structural shift that almost no one is watching. In December, a network that pays machines for real work will undergo its first halving: supply cuts in half, rewards tighten, and competition intensifies. It’s the kind of hidden catalyst that once separated early Bitcoin believers from everyone else…

This asset sits where crypto meets real work. The network pays machines for useful work (real inference, real scoring), then routes more rewards to what performs. With the first halving around the corner, competition for rewards will heat up, driving stronger value accrual for the asset.

Curious to know more? Let’s dive in…

In this report:

- We’ll map the core token drivers

- The subnet leaderboard (who’s winning and why), governance and security (what changed, what matters)

- Catalysts vs. Risks into the halving window

- TA for the token, etc. along with our take on the whole thesis

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What is Bittensor (TAO)?

Bittensor is a decentralised network that pays machines for useful AI work, things like answering queries, generating images, storing data, or training models. Instead of a single company controlling the stack, anyone can plug in models or hardware and earn TAO for delivering value. The result is an open AI marketplace where only performance decides who gets rewarded.The bet behind Bittensor is simple: align incentives so many independent models collaborate and compete, and you get a faster, cheaper “hive mind” that improves over time.

By pushing rewards toward what users actually consume, Bittensor chips away at the bottlenecks of centralised AI, closed data, paywalled access, and opaque pricing. As AI demand rises, TAO becomes the unit that coordinates this activity.

It runs on subnets, specialised mini-networks for tasks like image gen, storage, or prediction, scored by validators using a proof-of-intelligence approach (quality over raw compute).

Three main actors power the flywheel:

- Miners (provide models/compute)

- Validators (score usefulness and route rewards)

- Subnet owners (design rules and take a share).

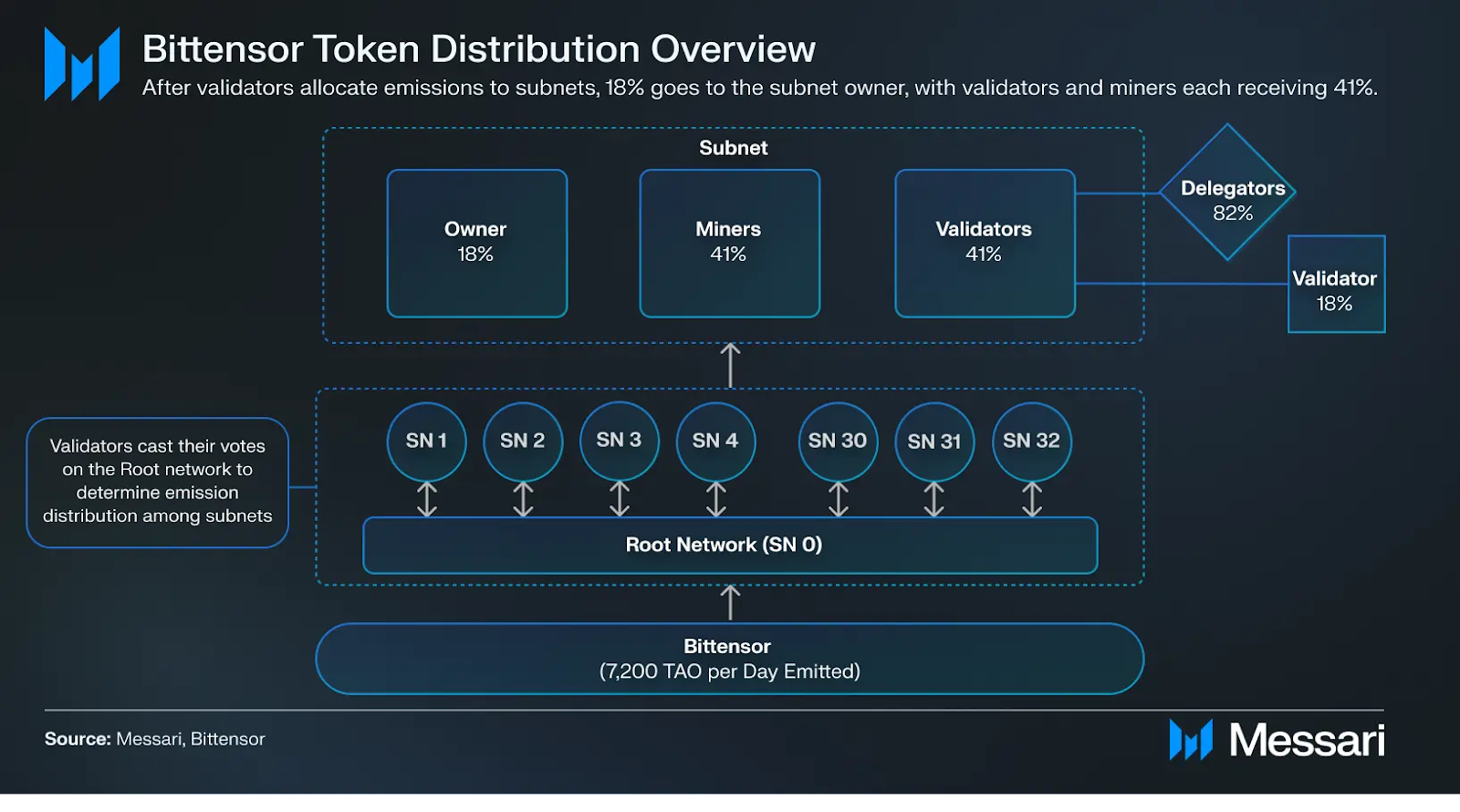

TAO token distribution overview

Stakers delegate TAO to the best validators, reinforcing what works and starving what doesn’t, so rewards, usage, and model quality keep pulling each other higher.Halving: Less TAO, Higher Bar

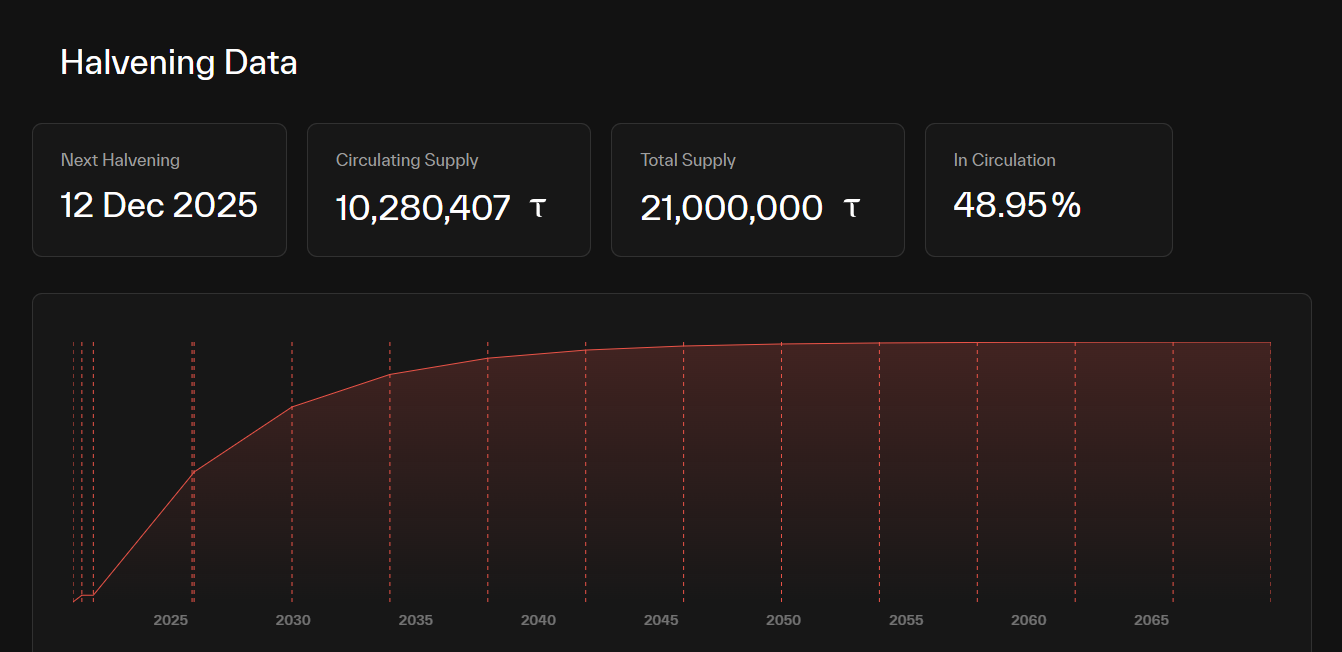

Most people still don’t have this on their radar, TAO’s issuance halves in the upcoming December. That flips the game from “grow the pie” to “compete for a smaller pie.”, accruing more value to the token. With most of the supply already staked (over 60%) and emissions scored by usefulness, every subnet and validator will have to earn more with less. Scarcity raises the standard, and exposes who was coasting.

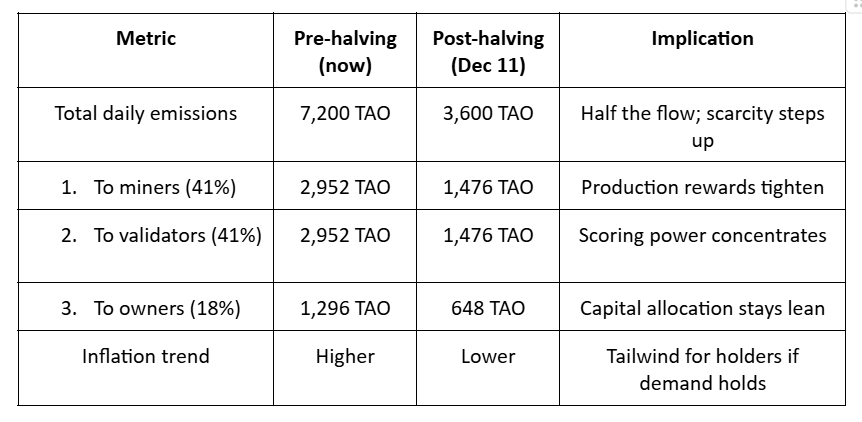

What actually changes on Dec 11th…

- New TAO created per day gets cut roughly in half.

- The reward split doesn’t change (41% miners, 41% validators, 18% owners).

- Same number of players, fewer tokens to pay them → tougher competition.

- If your “work” isn’t clearly valuable, your share shrinks. If your “work” proves valuable, your relative share can grow even as totals fall.

- Expansion → Efficiency: Less issuance forces the network to reward real usage

- Quantity → Quality: Emissions concentrate where inference, validation, and uptime are strongest.

- Narrative → Data: Subnets must show measurable output (requests, accuracy, latency) to defend their slice.

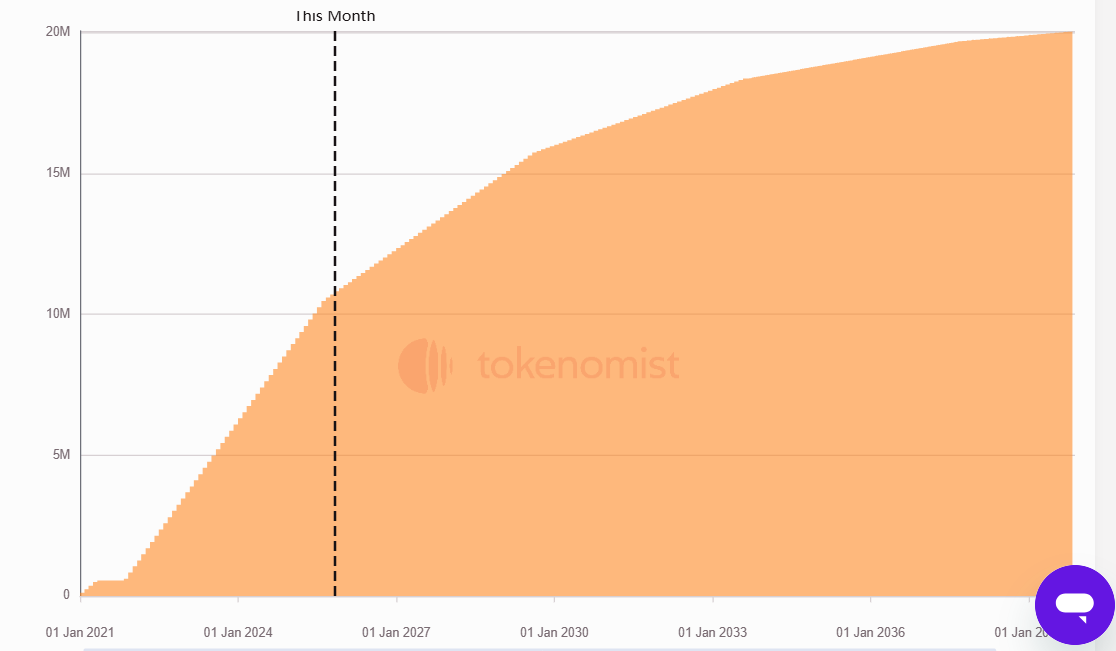

Expected circulating supply of TAO over time

Pre/Post halving snapshot

When the faucet tightens, only useful work clears the bar.

Float, Staking, Holders: Who Can Sell?

When 68% of TAO is staked, the market trades a fraction of the headline supply. That compresses the liquid float and magnifies price moves when demand shows up. Add a fair-launch design (no VC cliffs, no big unlock overhangs – similar to Bitcoin) and the only steady “new supply” is emissions, which halve in December.Net effect: fewer coins available, and a larger share controlled by participants who typically re-stake.

TAO emission schedule

Practically, this means seller flow is concentrated in a few cohorts, reward earners (miners/validators/owners), market makers, and a handful of large holders. If depth on top venues stays firm, price will be set at the margin by how these cohorts react to yield, funding, and narrative, more than by any calendar unlock.Where the TAO Tokens Flow

On Bittensor, validators score outputs in real time, emissions follow the work that actually gets used, answers served, images generated, data stored, predictions consumed. The effect is a live marketplace: subnets with demand and consistent throughput gain share, laggards leak it.

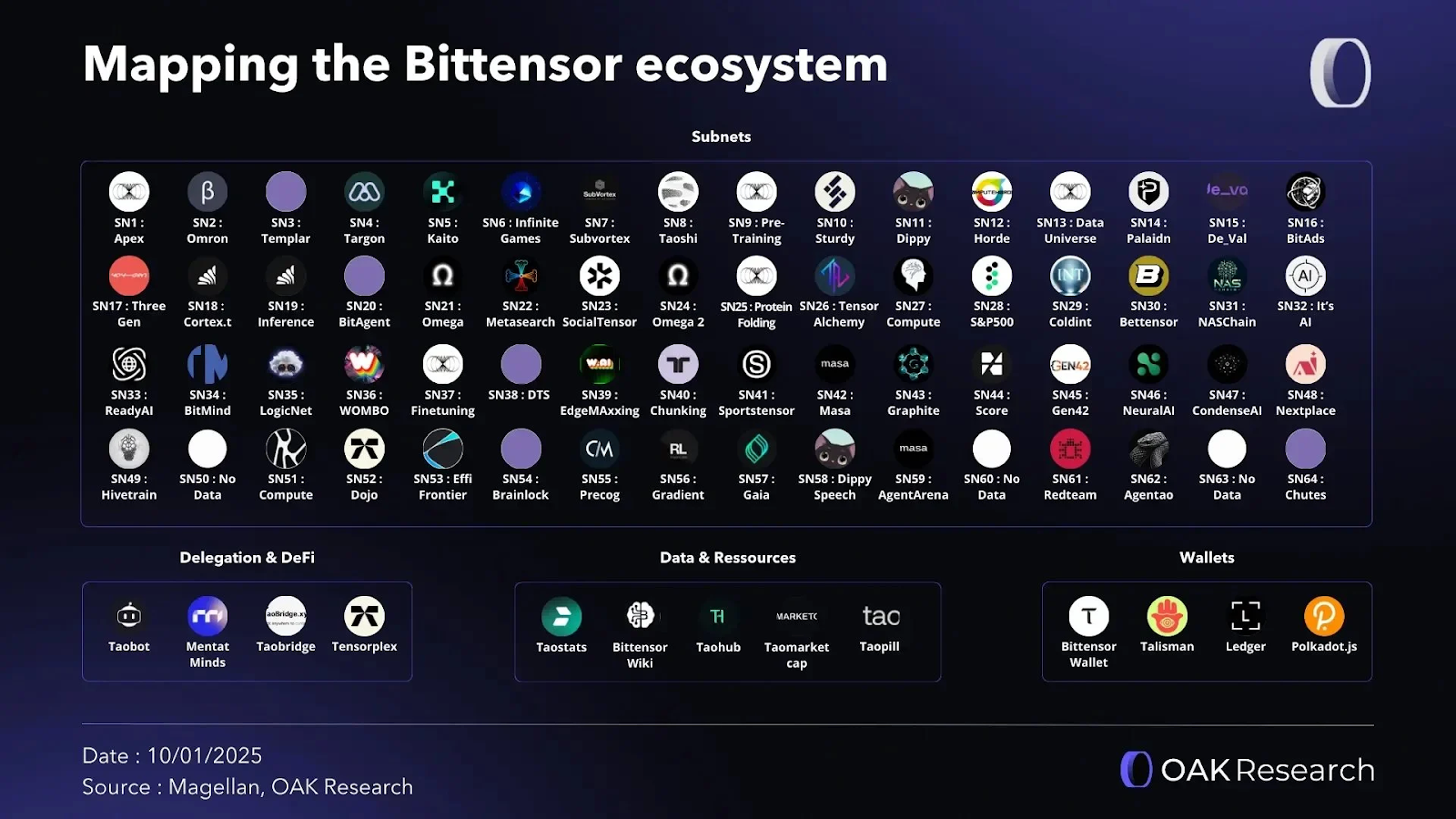

Bittensor subnet ecosystem

Here is some more context:How scoring funnels rewards: Higher-quality, lower-latency outputs earn higher validator scores; emissions are allocated proportionally, so subnets with real user pull and steady reliability attract more TAO over time.

Why concentration can snowball: More emissions → more budget for GPUs, models, and liquidity → better performance → even higher scores. Positive feedback favors execution.

What changes post-halving: With the daily pool halved, marginal subnets feel APY compression first, capital and attention consolidate into leaders that can maintain throughput, depth, and score stability.

To sum it up, compete or be competed away.

Usage > Hype: Case Studies

Thus, emissions always follow work. When validators can verify throughput, correctness, and latency, the network pays the products that people actually use. That’s why the flywheel keeps locking onto a few leaders: demand → rewards → better service → more demand. Below are snapshots that show how that plays out in practice.Chutes (SN64): Uber for AI tasks

What it is: A serverless, decentralised compute router + execution layer. Developers hit one endpoint with an AI job (generate an image, run an LLM function, execute a Python snippet, transcribe audio), and Chutes auto-matches the request to the best miner across the network based on model capability, hardware (GPU/VRAM), historical quality, and latency. It handles scaling, failover, and cost optimisation under the hood, no servers to manage, no model hosting to set up. Think AWS Lambda meets an LLM/API marketplace, but governed by on-chain incentives.

- How it works on-chain: Requests → routed to miners → validators score latency/accuracy/cost → emissions accrue to high-performers.

- Usage proxy: Millions of inferences/month; 6–7% emissions share.

- Why it earns: High, verifiable throughput + clean validator scoring = durable TAO flow.

Ridges (SN62): AI coding factory

What it is: A code-generation + regression-testing subnet where AI agents tackle real software tasks, fix a bug, add a feature, pass a failing unit test, or refactor a module. Miners submit patches, if the tests pass (and performance targets hold), they’re scored higher. The subnet functions like a decentralised CI pipeline that pays for provable engineering output.

- How it works on-chain: Patches from miners → validator test harness → pass/fail + quality metrics → emissions concentrate on reliable solvers.

- Usage proxy: Thousands of validations/day; 6% emissions; steady 2025 climb.

- Why it earns: Binary, benchmarked results keep incentives honest and compounding.

Dippy (SN11/SN7): Always-on AI companions

What it is: A network of personal LLM agents designed for sticky, everyday chat use, study help, journaling, lightweight therapy-style support, and storytelling. Users create personas with memory and style, sessions run on miner-hosted models tuned for coherence, safety, and long-context recall. The value is in habit-forming, low-friction conversations that drive repeated inference at scale.

- How it works on-chain: Ongoing chats hit miners, validators score coherence, safety, satisfaction proxies, emissions follow sustained traffic.

- Usage proxy: 4M+ MAU, millions of daily requests with weekend spikes, 1% emission (approx)

- Why it earns: Repeat engagement is clean proof-of-use, post-halving, consistency gets rewarded.

Pricing Lens Into / Post-Halving

Markets price the story first (scarcity), then demand the evidence (usage). Into the halving, narrative beta can pull TAO higher on “less issuance,” but what sustains it after is where the flow lands: depth that can absorb size, emissions consolidating into real products, and staking that keeps float tight without choking liquidity. If those three line up, the post-halving tape rewards builders over broadcasters.Signals to watch next...

When more of the daily rewards keep flowing to high-use subnets (image, inference, storage), the network’s “cash-flow” proxies improve. That strengthens the case for higher valuations because emissions are funding real activity. If rewards start spreading back to low-use subnets, the signal weakens and so does the case for a higher multiple.

If staking climbs toward 72–75%, the circulating float shrinks. With less liquid supply, the same level of buying can move the price further. If staking falls or large delegations rotate out, supply loosens and pullbacks can run further down.

After the halving, volatility may rise. If sell-offs get bought near key zones, it suggests the market is absorbing lower issuance. If we instead weak/failed bounces (lower highs), that’s narrative fatigue and a caution signal.

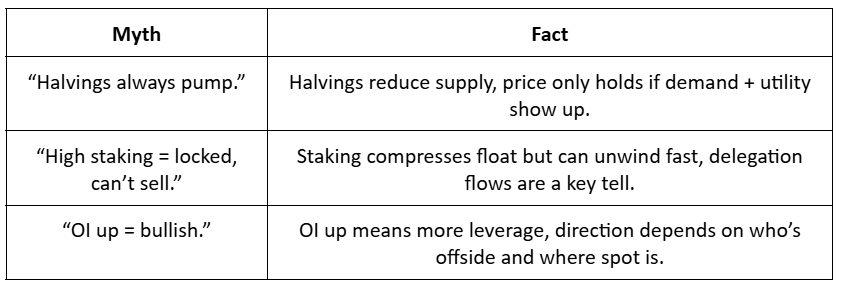

Myth vs Facts

Now, let’s have a look at how can we take advantage of the upcoming halvingTechnical Analysis

TAO/USD (1D)

TAO shrugged off the 10 Oct flush with a clean impulsive leg higher, taking out the flush swing high and printing a fresh local HH, evidence of real dip absorption and active buyers. That bounce arrived after the price broke out from the local downtrend from Dec ’24 in mid-Jul ’25, then spent months consolidating just above that break.Step back and the bigger picture is unchanged, TAO is still compressing inside the wide March ’24 range ($200–750) beneath a larger descending supply line that has rejected twice (Dec ’24 and a few days ago early Nov ’25). The near-term pivot is $487, a weekly close and hold above it would finally flip the current working range ($200–487) into the upper band near $741, dragging the long trendline with it.

On the bid side, the daily demand block sits around $288-331 (mid 309, approx) with a backup shelf at $274. That’s the area to watch for higher-low attempts if momentum cools.

On the topside, $487 is the trigger, $741 is the measured range objective once $487 is secured, and ATH $781 comes back on the table if momentum and breadth follow through.

TAO/USD chart daily

Constructive recovery inside a bigger coil. Until 487 is reclaimed on a weekly timeframe, treat strength as range trades, above it, treat pullbacks as opportunities into $741 first, and then ATH around $781 next.TAO/BTC (1W)

Against BTC, TAO has been trading in a year-long consolidation between Line 1 (range base) and Line 2 (range cap) since the start of this year around mid Jan. Price broke out from a downtrend inside that range in Oct, but is now pressing directly into Line 2, the resistance that’s mattered all year. A decisive reclaim/hold above Line 2 would mark a one-year range breakout and shift relative trend in TAO’s favor.Above Line 2, the roadmap opens to Line 3 (base case), Lines 4/5 (bull extensions). According to the chart, Line 2 → Line 3 implies roughly +60–65% relative outperformance, CMP → Line 3 is +100–110% versus BTC. Until that break materializes, it’s still a range, monitor for higher-low construction above the former downtrend, and let confirmation do the heavy lifting.

TAO/BTC chart weekly

Cryptonary’s Take

Halving is a structural reset for supply-demand dynamics of TAO. Issuance halves (7,200 → 3,600/day) while a big share is staked, so float stays tight. The setup reminds us a little bit of BTC but with AI tweaks: No VCs, halvings, no supply overhang from insiders, etcLess mint but higher standards for subnets.

- After the halving we expect emissions to migrate to productive subnets

- We also expect staking to creep up or hold.

- TAO/USD clears and holds $487 to flip the long range and open $741.

Peace!

Cryptonary Out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms