The hidden blockchain beating Solana and Ethereum at its own game!

What if we told you the most used blockchain in the world of stablecoins isn't Ethereum or Solana, but this blockchain… and chances are, the average crypto investor has no idea it's happening.

Ask most crypto users what the most used blockchain is, and you'll probably hear Ethereum or Solana. Maybe BNB. However, people almost never mention this one. And yet, the data tells a very different story.

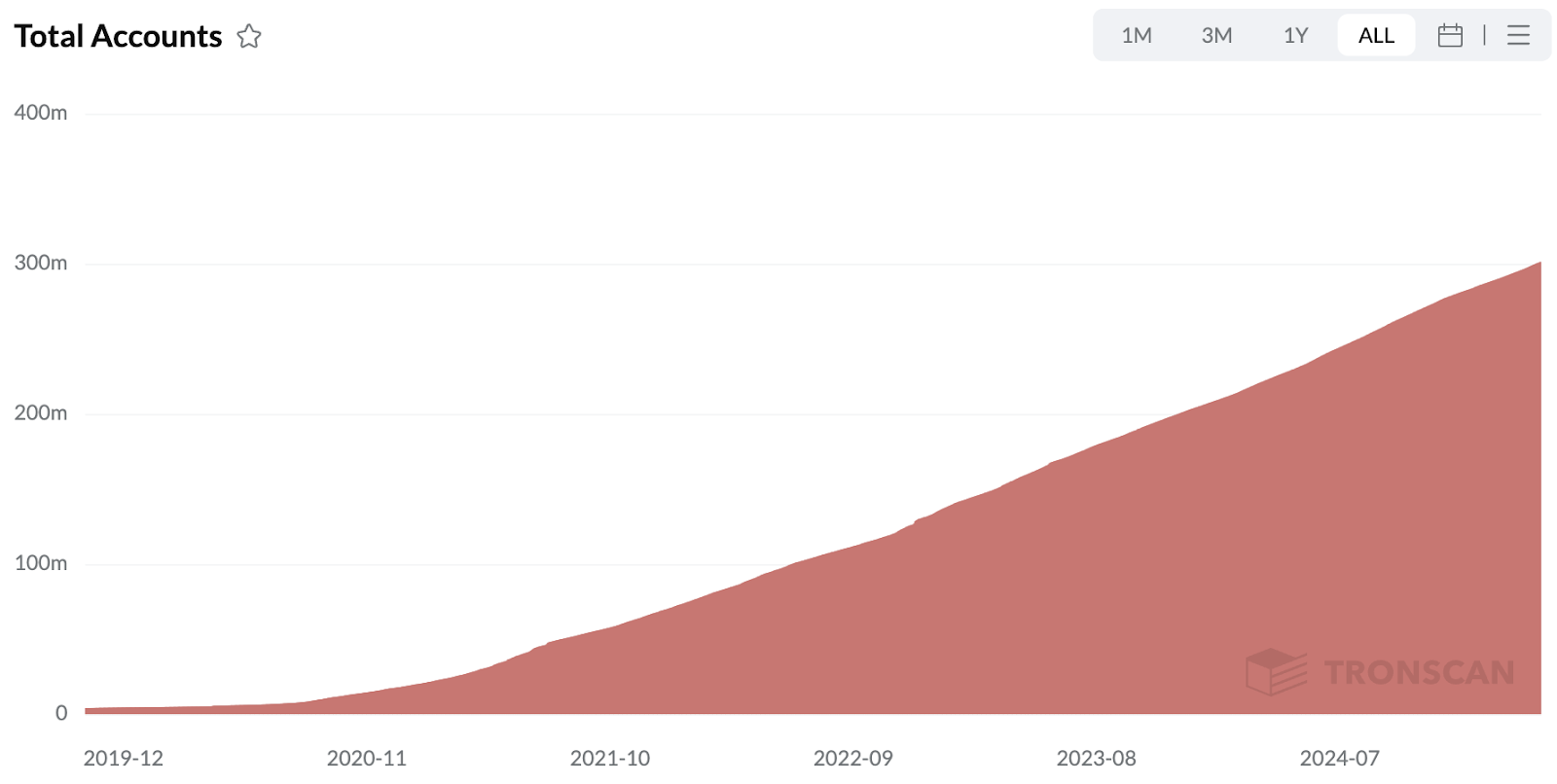

As of Q2 2025, this blockchain consistently leads the industry in stablecoin transaction count, not by a small margin, but by a wide one. It's quietly processed more stablecoin transfers than Ethereum, Solana, and BSC combined on certain days, according to Visa-backed metrics. It also holds one of the highest cumulative stablecoin volumes and supports over 300 million on-chain accounts, all without much noise from the mainstream crypto crowd.

So, how did it get here?

Its formula is simple: low fees, high speed, and relentless focus on payments and stablecoins. While other chains build modular architectures and hype up technical upgrades, this blockchain has found its lane in emerging markets, where efficiency matters more than narrative.

Curious to know what it is? Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Stablecoin powerhouse - TRON's real-world use case

TRON is a layer-1 blockchain platform focused on high-throughput, scalable smart contracts and dApps, aiming to create a global digital content ecosystem. Founded by Justin Sun in 2017, it supports fast, low-cost transactions using its native TRX cryptocurrency.While Ethereum dominates headlines with institutional adoption and Layer-2 innovation, TRON dominates the metrics that matter in the stablecoin economy, especially in emerging markets where crypto isn't just speculative, it's functional.

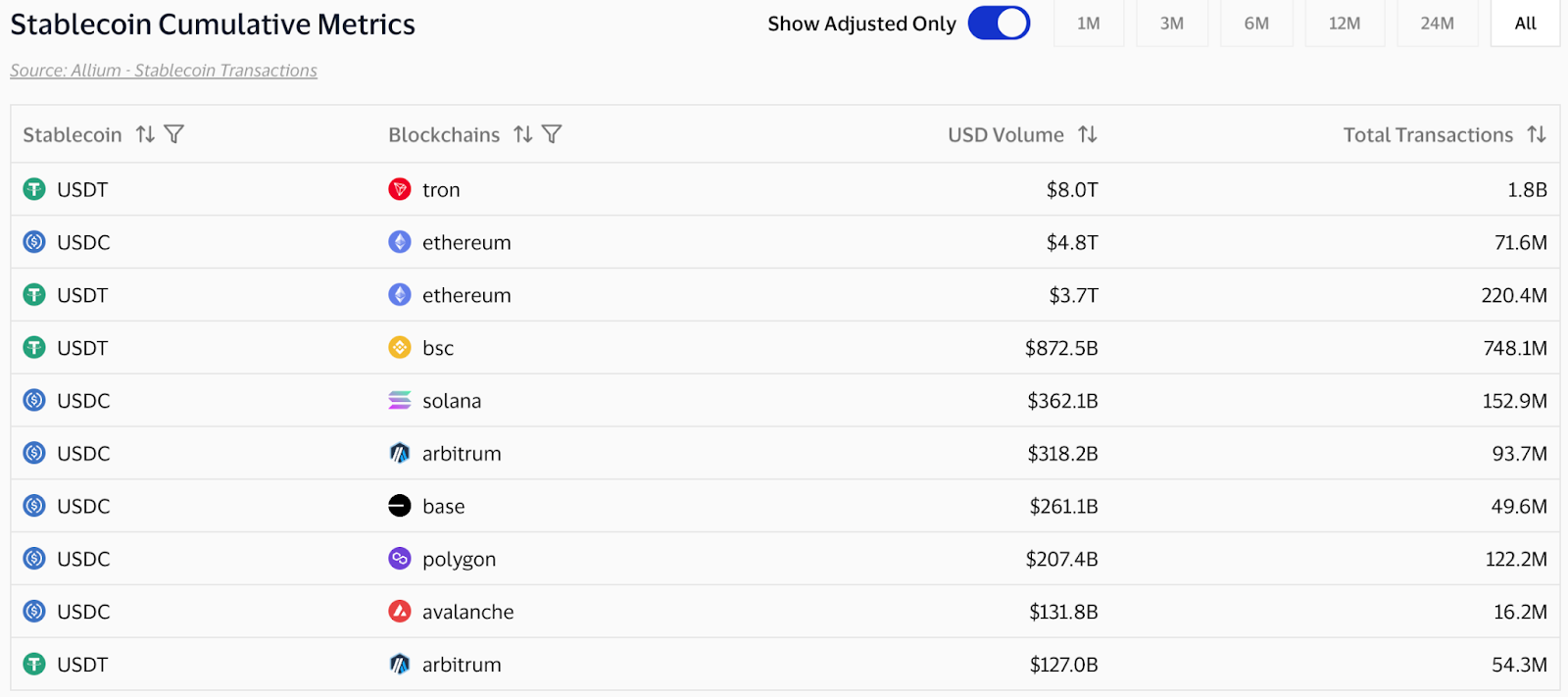

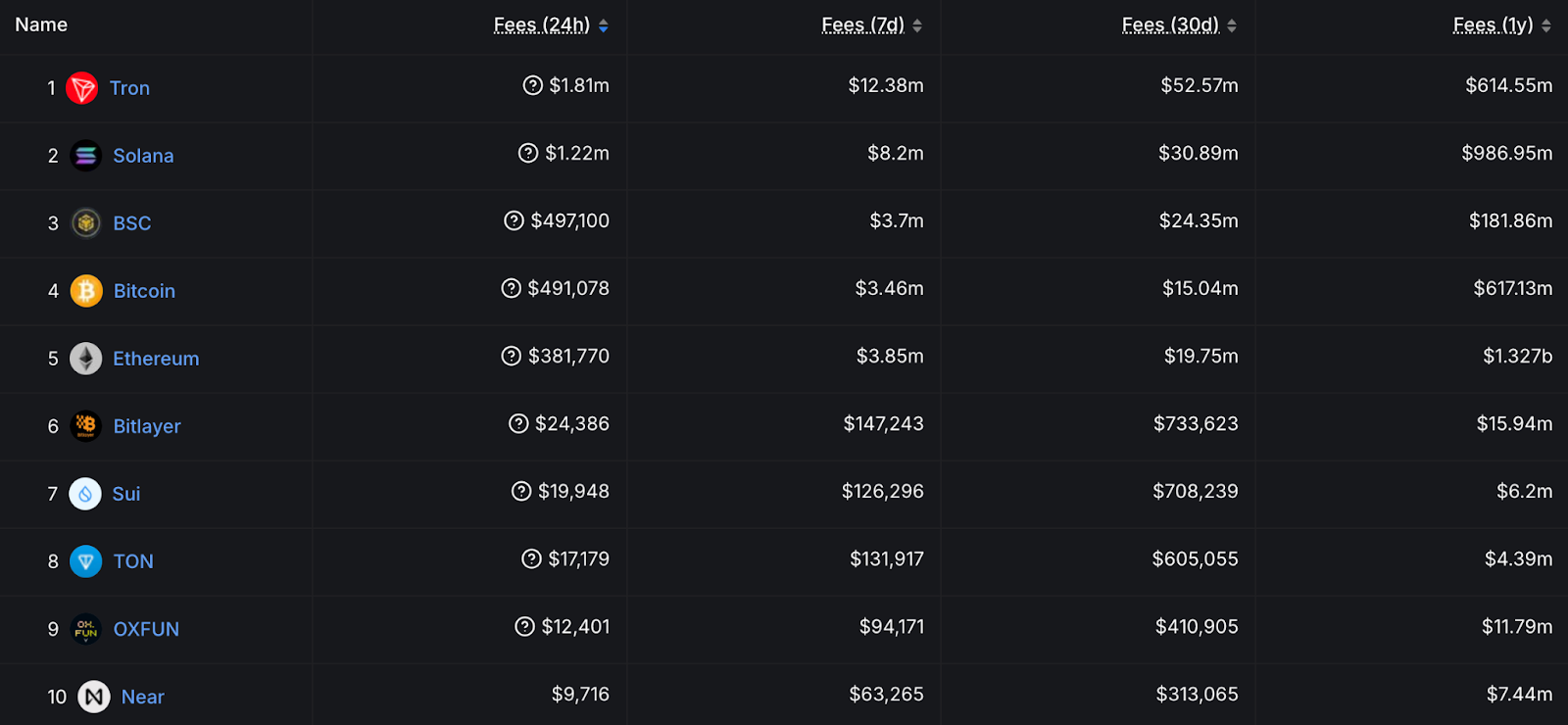

Let's look at the numbers:

- Stablecoin transaction count: TRON has led all blockchains in stablecoin transfers since late 2020. In April 2025, TRON processed more transactions than Ethereum, Solana, and BNB Chain combined, continuing a trend that's flown under the radar.

- Cumulative stablecoin metrics: According to Visa's stablecoin dashboard, TRON ranks #1 in cumulative stablecoin transfers, a clear signal that usage isn't just hype but sustained.

- Daily volume: Although Ethereum reclaimed the volume lead in early 2025, TRON still handled billions in daily transactions, showing it remains the preferred choice for high-frequency, low-cost payments.

So why does TRON win here?

The key lies in TRON's architecture and economic design. Its delegated proof-of-stake (DPoS) model enables ultra-low fees and fast finality, ideal for remittances, commerce, and day-to-day payments. Combined with Tether's (USDT) deep integration on TRON, users in Asia, Latin America, and Africa have gravitated to TRON not because it's trendy, but because it works.

That said, it's not all upside. Streets argues that TRON's reliance on a small number of Super Representatives, its close alignment with Justin Sun, and its limited developer ecosystem make it less decentralised, and potentially less innovative than its competitors.

Still, you can't dismiss real-world usage. TRON may not be leading the next DeFi primitive or gaming meta, but in stablecoin-based payments, it's hard to find a blockchain that is doing more.

What’s next?

As TRON surpasses 300 million accounts and climbs to #1 in protocol revenue behind Ethereum, can it shake off its centralisation stigma—or is it quietly rewriting the rulebook for utility-led adoption?Behind the numbers - Ecosystem growth & network activity

TRON's stablecoin dominance is only part of the story. Peel back the layers, and the network reveals a surprising level of sustained user activity, expanding integrations, and new category pushes, even if they don't make front-page headlines.- 300 Million Accounts. As of April 2025, TRON crossed the 300M total accounts milestone, with 2.94M daily active addresses, among the highest in all of crypto.

- Over 10M daily transactions. TRON consistently clears 8-10 million transactions per day, with near-zero fees, a feat few Layer-1s can match, and one that speaks to its role in volume-heavy applications like remittances and retail payments.

- Revenue Leader. Despite being dismissed by many as "non-innovative," TRON generated $ 600 M+ in protocol revenue last year alone, ahead of most L1s except Ethereum. The kicker? This revenue comes mostly from real economic activity, not speculative DeFi loops.

Beyond the numbers, TRON's ecosystem is quietly diversifying:

- Memecoin support. With the rise of meme tokens on Solana and Base, TRON has launched a $1M developer incentive program to onboard memecoin teams. The campaign includes zero-fee trading, free resource access, and grant support.

- Cross-chain liquidity. In March 2025, TRON announced TRX integration on Solana, allowing trading on Solana-native DEXs like PumpDotFun. It's a small step, but one that reflects TRON's intention to expand beyond its own sandbox.

Still, from a network utility lens, TRON is delivering. Whether it's payments, exchange flows, or wallet creation, the chain keeps onboarding users, even if it's not winning developer mindshare.

Governance, centralisation & the Justin Sun question

For all of TRON's on-chain activity, one thing continues to overshadow its growth story: the outsized role of Justin Sun.Officially, TRON DAO promotes a decentralised image. The network uses a Delegated Proof-of-Stake (DPoS) system with 27 Super Representatives that validate the chain. But in practice, power is concentrated, and critics argue that the same entities rotate through validator slots, many believed to be affiliated with Sun or his allies.

Centralisation trade-offs

TRON's structure has helped it scale. The DPoS model allows for low-cost, high-speed consensus, fueling the kind of throughput needed for stablecoin transfers and low-fee remittances. But the trade-off is trust:- Who really controls TRON?

- Can validators act independently?

- Would governance withstand internal conflict?

The SEC case

Sun's legal entanglements also add friction. Since March 2023, the SEC has pursued civil fraud charges against him for allegedly conducting unregistered sales of TRX and BTT and for participating in wash trading schemes. As of early 2025, the case is in settlement talks, but the cloud hasn't lifted.Still, it's hard to argue that TRON would've gotten this far without him. Sun's aggressive business tactics, bailout of TrueUSD, and direct calls against competitors like FDUSD show a founder who operates like a CEO, not just a figurehead.

He's been called:

- A market manipulator

- A visionary operator

- A central point of failure

So what?

For users in emerging markets sending money or trading stables, governance concerns may not matter. But for developers, institutions, and capital allocators, it does.If TRON wants to evolve beyond just "the chain people use for USDT," it may need to detach from Sun's shadow and build a narrative rooted in systems, not personalities.

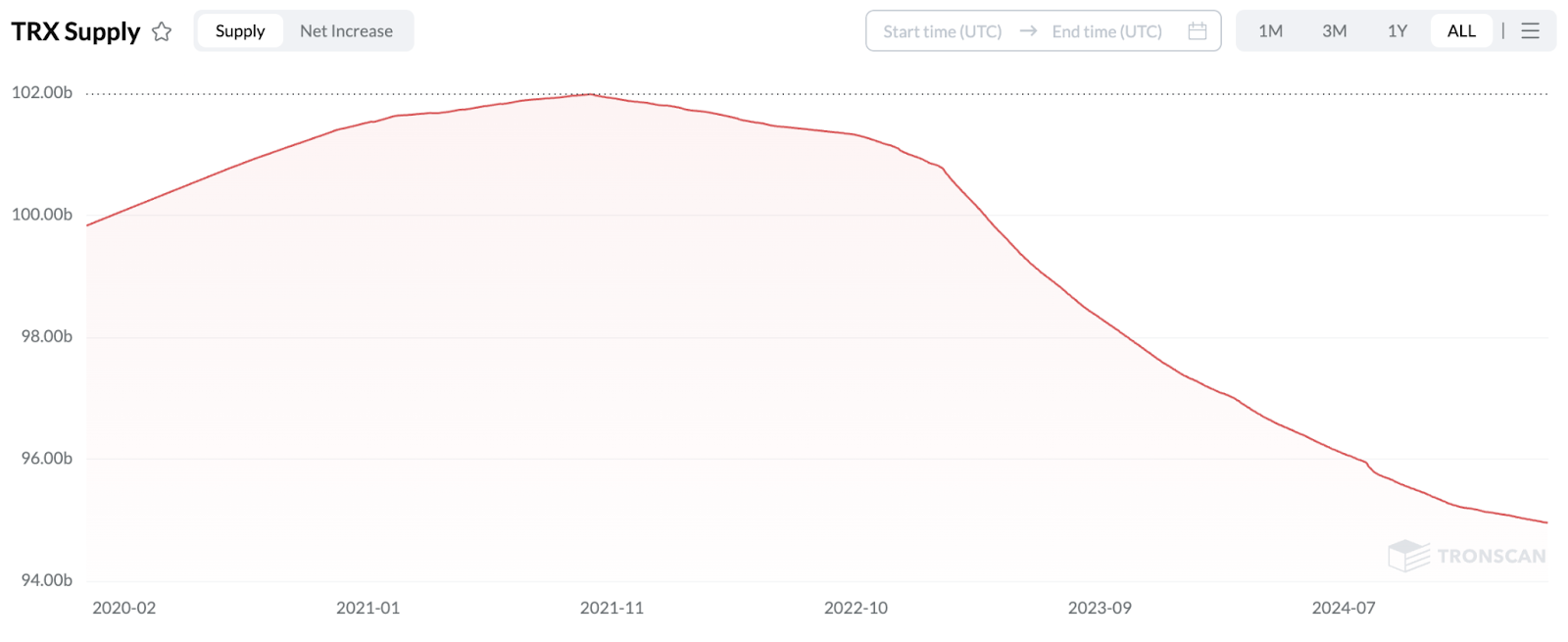

The TRX token

TRON's token, $TRXs economic model and usage data reveal a surprisingly strong asset. From powering the ecosystem's operations to emerging as a utility token in DeFi and payments, TRX plays a much bigger role than it's often given credit for.A shrinking supply? Yes, really.

While most Layer 1 tokens trend toward inflation, TRON's supply has actually declined. TRX peaked at around 102 billion tokens in November 2021, but as of April 2025, the circulating supply has dropped to 94.82 billion.This deflationary trend has been driven by:

- Transaction fee burns via its resource model (Energy & Bandwidth)

- On-chain staking and validator slashing mechanisms

- A growing ecosystem where TRX is used as gas, leading to consistent token sink dynamics

TRX use cases

TRX underpins much of the ecosystem's daily activity:- Fee payments: TRX is the default fee token for all network transactions, including DEX trades, stablecoin transfers, and dApp interactions.

- Staking: Users stake TRX to receive bandwidth or energy and earn staking rewards via Super Representative voting.

- Collateral in DeFi: TRX is used across TRON-based DeFi platforms, particularly in JustLend and JustStable.

- Cross-chain utility: With recent integration into Solana's DEXs, TRX's liquidity profile is improving outside of its home chain.

A halving on the horizon?

In March 2025, Justin Sun floated the idea of a Bitcoin-style halving for TRX's block rewards. While no timeline has been finalized, the move is positioned to:- Reduce issuance and increase scarcity

- Incentivize longer-term staking

- Align TRX with more deflationary models like BTC and ETH post-Merge

Security, regulation & compliance

T3 crime unit: Quiet but effective

In 2023, TRON DAO, Tether, and TRM Labs formed the T3 Financial Crime Unit, a cross-industry task force targeting illicit on-chain activity. Since then, over $130 million in stolen or suspicious funds has been frozen, a rare feat in crypto.Enforcement tools: Blacklisting & reissuance

TRON's network includes mechanisms like address blacklisting and token reissuance. While this may raise decentralization questions, it's a major selling point for regulators and institutions needing real-world risk controls.Real impact: Illicit activity dropped by 50%

TRON reports a 50% YoY decline in illicit usage, suggesting its enforcement infrastructure is working. It positions TRON ahead of many other L1s in terms of compliance maturity.The Justin Sun dilemma

Despite these achievements, TRON's reputation still hangs in the balance due to ongoing SEC litigation against founder Justin Sun. While TRON's tooling is regulation-friendly, its leadership optics aren't, which may limit institutional confidence.Strategic roadmap & innovations

USDT gas: A frictionless onboarding edge

TRON allows transaction fees to be paid in USDT, removing the need to hold TRX for gas. For non-crypto users, this simplifies the entire experience and is particularly effective in retail payment flows.Stake 2.0: Smarter staking in progress

A proposed upgrade to TRON's Delegated Proof-of-Stake (DPoS) system, Stake 2.0 introduces more flexible validator slashing, programmable liquidity, and modular reward logic. It's designed to future-proof TRON's validator ecosystem.BTTC: Cross-chain ambitions

TRON's BitTorrent Chain (BTTC) serves as an interoperability layer with Ethereum, BNB Chain, and others. It's meant to move value across ecosystems without relying on centralized bridges.Solana integration: Unlikely collaborations

In March 2025, TRX became tradable on Solana DEXs like Pump.fun. While it's early, this marks a noteworthy step toward TRON embedding into broader DeFi culture.Technical analysis

TRON has been consolidating in a tight range since making its all-time high at $0.449 in early December 2024. After retracing sharply to the $0.22 zone, it's spent the past few months moving sideways between $0.2249 (range low) and $0.262 (range high), with multiple rejections and deviations at both ends.What's notable is TRON's relative strength. While the broader market faced heavy corrections, TRX held its ground and remained within its range. Even when it briefly dipped below $0.2249, it found strong support at the 200 EMA (currently near $0.22), quickly reclaiming the range. This behavior signals buyers are defending key levels well.

If TRX breaks above $0.262 with confirmation, the next resistance is at the $0.30 psychological level, also the 2018 cycle top. A clean breakout above $0.30 could open the gates back toward the $0.449 all-time high, with little major resistance in between.

On the downside, a break below $0.2249 would bring support at the 200 EMA ($0.22) back into focus. If that fails, the next key demand zone is around $0.1922.

TRX is showing strength. But until it breaks out, it remains range-bound, and traders should wait for confirmations before positioning for the next leg.

Risks & uncertainties ahead

Founder risk: Justin Sun's oversized role

TRON's growth is inseparable from Justin Sun's personal brand. While his bold moves, like the TRX-Solana bridge and the memecoin push, drive visibility, they also centralize risk. Ongoing SEC litigation and controversial interventions (e.g., TUSD bailout, FDUSD accusations) keep regulatory scrutiny high. If Sun steps away or faces enforcement action, the network's credibility could wobble.Governance centralisation

TRON's Delegated Proof-of-Stake model concentrates power among 27 Super Representatives, most of whom are opaque in ownership and operations. This opens the door to governance manipulation or cartel behaviour, especially with Sun-linked entities rumoured to control large portions of the network.DeFi & developer ecosystem lag

While TRON dominates stablecoin transfers, its DeFi and builder ecosystems still trail behind. It lacks the composability and community experimentation seen on Ethereum or Solana. The memecoin push and Stake 2.0 upgrade are attempts to change this, but they're early steps in a longer journey.cvUSDD & algorithmic stablecoin exposure

TRON's own algorithmic stablecoin, USDD, remains small ($270M market cap) but carries risk. Its peg history is shaky, and its backing is loosely defined. As regulators clamp down on algo stables post-Terra, any missteps here could invite scrutiny or erode trust in TRON's broader ecosystem.Cryptonary's take

TRON isn't new, but its relevance in 2025 is surprising even to seasoned market watchers. While most of the crypto spotlight shines on Ethereum rollups or Solana scalability, TRON is quietly powering the highest number of stablecoin transactions, leading revenue charts, and capturing real-world utility across emerging markets. This is real usage.What stands out most is how TRON became useful without needing to be loud. It has quietly embedded itself into the rails of global remittance and stablecoin flows, often overlooked by institutions and crypto natives alike. But the numbers speak: $151M in annual revenue, over $50B in stablecoin value moving through its ecosystem, and more users than almost any other chain.

The challenges are real too. Justin Sun's outsized presence is both a strength and a risk. The developer ecosystem is underwhelming compared to other L1s. And centralization concerns still hang over the project. TRON is efficient, but it's not necessarily open. It's trusted for now, but not trustless.

If TRON can evolve beyond Sun and decentralise further, while keeping its lead in payments, it may remain a dominant force in the background of crypto's global expansion. We have previously been pessimistic about Tron due to its bad reputation, however, the price action of TRX remains interesting, so we are switching our stance from sceptical to neutral-to-early positive.

Cryptonary, OUT!