The Hidden Kraken Airdrop Everyone’s Sleeping On👀

Kraken is quietly setting up one of the biggest ecosystem plays heading into 2026, and almost nobody is paying attention. Their new Layer 2, Ink, is already attracting serious capital, and early activity is being indexed right now. This is the window where the earliest movers usually earn the most. Let’s break down how to position before the crowd arrives.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Background

Kraken is quietly preparing up one of the most significant ecosystem expansions heading into 2026, and most people still haven’t connected the dots. Their new Layer 2, Ink, is built on the Optimism Superchain architecture and is designed to onboard Kraken’s massive user base directly into on-chain finance. In the same way Binance used BNB Chain to supercharge its platform, Kraken appears to be preparing Ink to play a similar role.

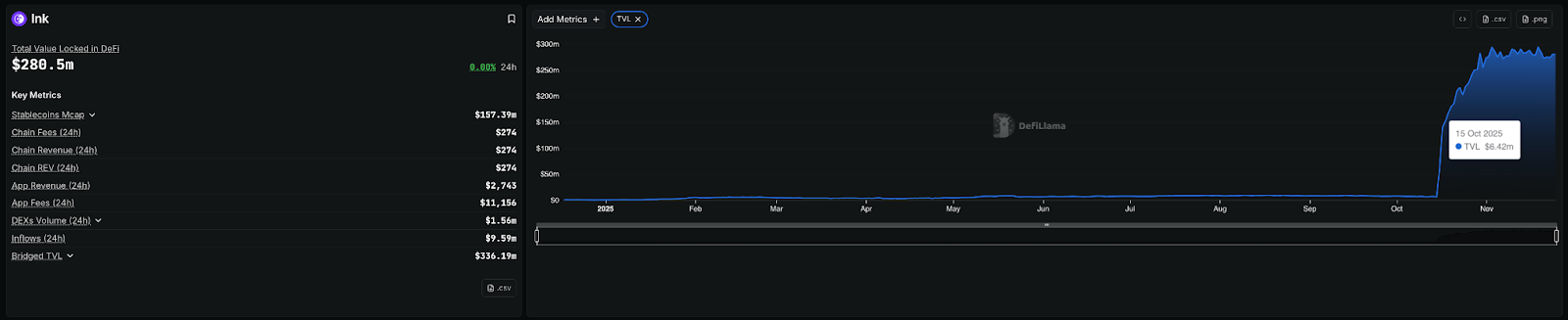

For most of 2025, Ink looked inactive. TVL was flat, activity was minimal, and the chain showed no signs of life. That changed the moment Kraken openly confirmed a reward program and activity indexing. As soon as incentives were mentioned, TVL ripped from roughly $6.4 million to over $285 million in a matter of weeks. That kind of move only happens when users and market makers recognize that the pre-airdrop window has officially opened.

TVL of Ink

The timing aligns perfectly with Kraken’s corporate trajectory. The company recently raised $800 million at a $20 billion valuation, and multiple sources have confirmed that Kraken has already filed confidentially for a potential IPO in the first half of 2026. A public listing would give Kraken every reason to push Ink aggressively, showcase ecosystem traction, and distribute meaningful rewards to early participants.

CNBC coverage of Kraken IPO

Our strategy is the following: Position early in the protocols most directly tied to tracking on-chain activity and capturing likely retroactive allocations.We focus on two core pillars: Tydro for predictable yield that scales with size and Nado for active, high-value participation.

1. Tydro: Ink’s Battle-Tested Lending Hub

Tydro is the primary lending and borrowing protocol on Ink. It is a friendly fork of Aave V3, the strongest and most audited money-market codebase in the entire industry. Because the underlying architecture is already battle-tested, much of the uncertainty normally associated with new lending markets is removed.Tydro supports assets such as wETH, kBTC (Kraken’s wrapped BTC), USDG, USDT0, and GHO, with USDG being the standout.

Why USDG matters

USDG is issued by Paxos, fully backed 1:1 by short-duration U.S. treasuries and regulated cash equivalents. Paxos also issues PayPal’s stablecoin (PYUSD), which places them among the most heavily regulated and institutionally integrated stablecoin operators in the industry. They manage billions in reserves and were even a finalist for Hyperliquid’s USDH mandate earlier this year. From a stablecoin risk perspective, USDG sits near the conservative end of the spectrum.The core play: We lend USDG

- Current APY: 7.65%

- Yield is organic, not heavily subsidized

- Tydro logs all user activity on-chain in real time

Tydro is the foundation for anyone seeking:

- safe yield

- minimal directional exposure

- guaranteed activity indexing

- long-tail eligibility for $INK incentives

2. Nado: Kraken’s Flagship Perp DEX

Nado is being positioned as the flagship on-chain perpetuals exchange directly connected to Kraken’s ecosystem. Once their initial announcement went live and TVL began moving, we took a deeper look at the documentation and found something explicit.“Points are earned by engaging in various activities on the Nado DEX. Nado Points will later be convertible to $INK tokens.”

It doesn’t get clearer than that. All activity on Nado is indexed in real time, and a leaderboard is already confirmed as “coming soon.” The platform is still in private alpha, which means every action taken now is happening at the absolute front of the curve. Early participation almost always receives the heaviest weighting in point-based reward systems.

The only friction is access.

Nado requires an invite code. Fortunately, several of our researchers and community members have already secured early access. Members can request codes directly in our Discord.

Once inside, we recommend joining the Nado Closed Alpha Telegram. Fewer than 250 members are currently inside, and early community involvement is often included when protocols distribute additional retroactive rewards.

For anyone highly technical, Nado also offers a bug bounty program. Reporting reproducible bugs is another vector for free upside, since many protocols treat bug reports as whitelist qualifiers or bonus airdrop multipliers.

How to Farm Nado Efficiently

You can approach Nado with two pathways:- Delta neutral trading

The goal is simple: Generate real volume without taking unnecessary directional risk. Nado indexes all activity in real time, and trading is historically the highest-weighted category for points systems.

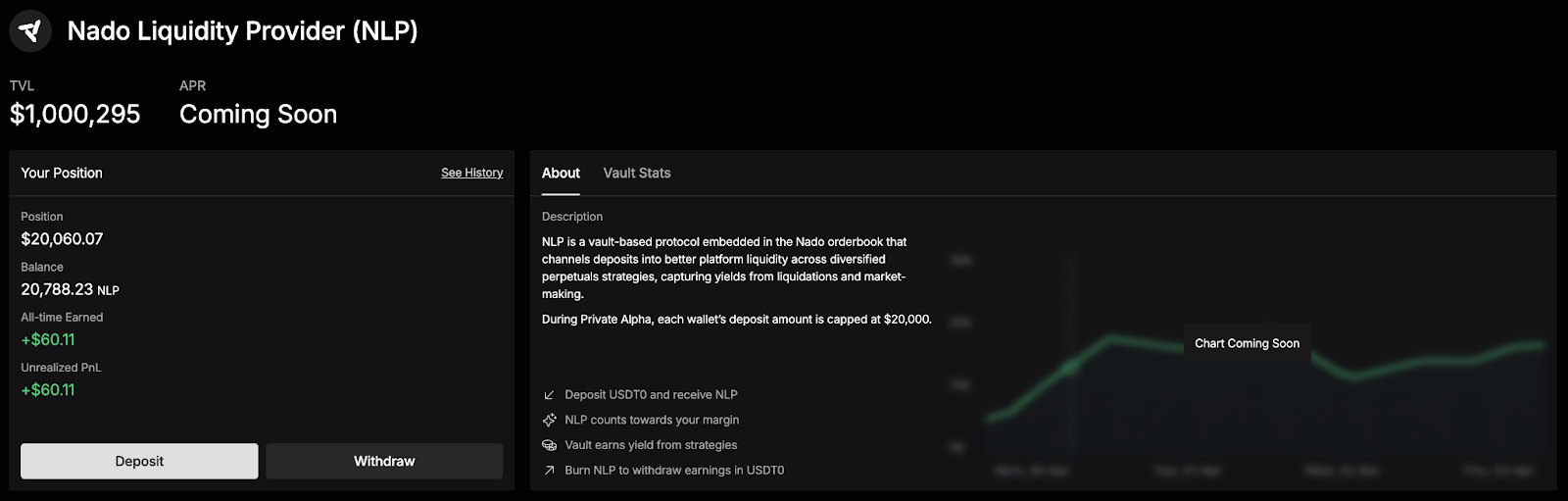

- Alternatively: Use the Nado LP Vault

If you prefer a low-maintenance approach, the Nado LP vault operates similarly to Hyperliquid’s HLP. We tested it directly, and initial yields during private alpha have been strong. Vaults in early phases typically benefit from outsized returns while still generating meaningful activity points.

Step by Step: Getting Funds Onto Ink

1. Get some ETH on Ink for gas- Use Jumper

- Bridge a small amount of ETH from any chain

- This covers all transaction fees on Ink

You have two clean options depending on whether you want convenience or zero slippage.

- Option A: Easiest Route (USDC → USDG in one step using Jumper)

- Open Jumper

- Select:

- From: USDC on your source chain (Solana, Ethereum, Arbitrum, etc)

- To: USDG on Ink

- Enter your Ink EVM wallet address (USE RABBY!)

- Execute the swap + bridge in one click

- Bridges USDC from your source chain to Ink

- Converts it directly into USDG on arrival

- Option B: Low-Slippage Route (for those who want perfect execution). One extra step but avoids swap slippage

- On Ethereum mainnet, swap USDC/USDT → USDG using Jumper

- Use Stargate to bridge USDG from Ethereum → Ink

- You arrive on Ink with native USDG ready to supply to Tydro

Step by Step: Tydro (USDG lending)

- Go to https://app.tydro.com/

- Connect wallet and ensure network = Ink

- Click Markets

- Select Global Dollar (USDG) and press Details

- Click Supply

- Enter amount and confirm

- View your live position under Dashboard

Step by Step: Nado (trading and vaults)

Access requirements- You will need a Nado invite code

- Ask in our Discord if you need one

- Once logged in, consider joining the Nado Closed Alpha Telegram for potential extra benefits

- Open Nado

- Choose a trading pair (we recommend BTC for minimal slippage)

- Open a long OR short

- On a second tokenless DEX (Lighter / Extended / Backpack), open the same size position in the opposite direction

For exact execution examples, users can refer back to our previous delta neutral walkthrough video on Extended and Lighter and apply the same logic here with Nado.

Option B: Nado NLP Vault (hands-off)

- Navigate to NLP Vault

- Deposit USDT0 (or supported stable)

- Confirm transaction

- Earn passive yield + Nado Points

Cryptonary’s Take

Kraken controls one of the largest user distributions in the industry, and if they follow through with an IPO in 2026, they will need an on-chain ecosystem that demonstrates real traction. That almost always guarantees a generous incentives program and a meaningful $INK distribution. The OP Stack foundation only strengthens this thesis, since every major Superchain reward has followed this structure.Most important: we are extremely early.

Ink’s TVL spike is only a few weeks old. Nado is still in private alpha, and their point system isn’t even live yet. This is the earliest stage of an ecosystem rollout, when activity is typically weighted the highest and competition is at its lowest.

This is exactly why our approach uses a two-pillar structure.

Tydro gives us the defensive, conservative yield foundation that earns while we wait.

Nado gives us the high-impact engagement that historically captures the largest retroactive upside.

Together they offer one of the strongest risk-adjusted opportunities available in all of crypto. Kraken’s funding, regulatory position, and IPO trajectory all point toward a visible, well-funded incentive cycle ahead.

Happy Farming!

Cryptonary, OUT!