This journal is exclusively written for Cryptonary Pro members.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.The Initial Pump

XRP made a massive move a few days going all the way from under $0.25 to $0.79 in two-weeks, that’s a 200%+ movement.

Many attributed this move the upcoming Spark (FLR) airdrop to XRP holders. But that’s not until the 12th of December, a reasonable timeline for an FLR-induced pump would be a week before, not weeks before.

What if this pump was induced by front-running traders holding some inside information? After all this type of scenario is not foreign to the world of cryptocurrencies.

The Keys to the Crypto Universe

As of today, the biggest capital contributor, the largest flood of capital is expected to come from one specific source. It will open up the floodgates of new retail money.

PAYPAL

There is not doubt about it, they have over 340 million customers with an average account balance of $500. They hold billions of dollars in customer funds and opened up a way for them to invest in cryptocurrencies right from their platform.

We know what you’re thinking right now: “But Cryptonary, only BTC/ETH/LTC/BCH are on PayPal”

Our answer is: “For now”

Whatever coin makes it onto PayPal will have the largest chance at a rally. Think about it: Bitcoin with a $300B+ market capitalisation and $30B+ in daily trading volume jumped from $12,000 to $19,000 since the PayPal news broke out on the 21st of October.

What would happen if they announce “Buy, sell, hold XRP” while it has a market capitalisation under $30B and less than $2B in daily trading volume?

The Details

What was discussed above is all well and good, but what are the actual details indicating that XRP would be next on the PayPal list?

First and foremost, there is no doubt that PayPal will expand the list of crypto-assets offered because otherwise their platform would turn obsolete in this industry and everyone would go elsewhere.

So, if they want to expand, it’s not about what they “want” to offer but what they “can” offer. Regulations are tight.

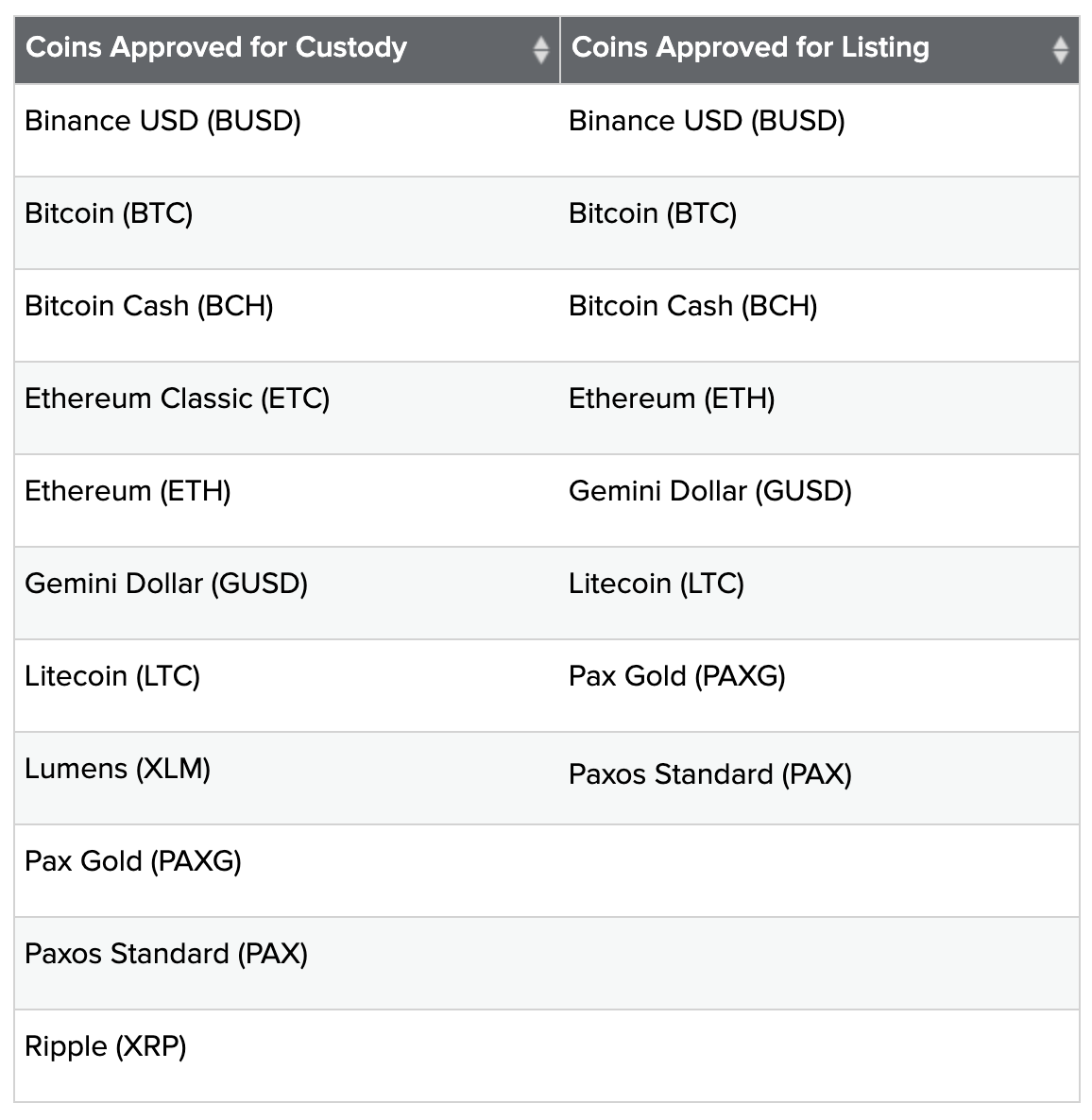

Who’s the company enabling PayPal to offer crypto trading and custody? Paxos.

The exchange Paxos uses, which is their own, is called itBit. So whatever asset PayPal ought to offer to its users should first start trading on itBit.

Paxos, itBit and PayPal are all regulated by the New York Department of Financial Services (NYDFS), so whatever asset itBit is going to list must first be given the green light by the NYDFS.

Lucky for us, they have a list!

What has PayPal listed? All the coins in the “approved for listing” column (ignore stablecoins). Three coins are approved for custody but not yet approved for listing: ETC, XLM & XRP.

See where we’re going with this?

There’s a reasonable chance that the next batch of PayPal listed coins includes XRP.

Retail Mania

Let’s wind the clock back to December 2017. The market was booming, Bitcoin was rallying like nothing else, some Altcoins began moving as well and that led to immediate media coverage worldwide which brought all eyes to crypto.

New inexperienced retail had a few options, obviously they were too lazy to look down the MCap list and perform adequate research. All they saw were a few options:

- Bitcoin: “This thing is too expensive, I can’t own enough of it”

- ETH: “$600? Not bad but what about…”

- XRP: “$0.20? You mean I can own thousands of these? What if they become the next Bitcoin?”

Obviously their reasoning was flawed from whatever direction you look at it, owning “more coins” doesn’t equal “more profits” and just because Bitcoin went from cents to thousands doesn’t XRP would ever do the same (difference in supply).

But this drove XRP from the $0.20s all the way up to $3.3+ in a few weeks time, that was the power of retail in 2017. Despite the opportunities PayPal is missing on, such as DeFi (which will hold a lot more value than most of the coins they offer), they are bringing retail back, billions of dollars of retail.

When Bitcoin breaks its all-time high, where will the herd go?

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.