Well, first off, we cannot simply pass through this headline without recognizing the importance of this upgrade - a true monumental event that's been awaited since 2017. The Merge happened without a hiccup and that alone is a testament to the developers skill given that this upgrade is really the equivalent of changing an airplane's engine mid-flight.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your full responsibility.

The Merge

For those unfamiliar, Ethereum used to validate transactions using a consensus algorithm called: Proof-of-Work (the same one Bitcoin uses and it requires miners). The plan always was to eventually move Ethereum to a Proof-of-Stake model in order to achieve its final form with high scalability and throughput. Today, that shift has happened.Why do we call it "The Merge"? A PoS chain was launched in December 2020 and it ran in parallel to the PoW chain we all used until a day where they "merged" which happens to be today.

Now let's go through the effects on ETH.

- Ethereum is Green: Without the heavy duty equipment needed to mine, Ethereum's upkeep requires -99.80% less energy which makes it "green". Why does this matter? Three letters: ESG (Environmental, Social and Governance). This framework alone moves certain funds towards "eco-friendly investing" whereby Ether beats Bitcoin. We have seen both the European Union and the U.S. Congress talk about actions towards their concerns on PoW energy consumption. We would just like to note that we do not agree with Bitcoin being as bad for the environment as it is portrayed by the media.

- Less Supply: The supply reduction comes from multiple sources. First, we have the reduced inflation from 5,500,000 ETH issued per year to only 600,000 ETH. Second, miners used to represent constant selling pressure on the market given that their businesses' fees were denominated in fiat, without miners that pressure is gone. Last but not least, this reduced supply paired with the ETH burn from EIP1559 with every transaction, ETH could turn into a deflationary asset in theory or at the very least much less inflationary. Less supply with equal ir increased demand yields higher prices.

- Productive Asset: Income is sough after by everyone, especially passive income. Fairly speaking, this type of income is mainly lucrative for those who already are wealthy on a short-term basis. On a long-term basis everyone can benefit through the power of compounding. Staking ETH (either directly or through a liquid staking service) yields an annual return that's estimated to start in the neighborhood of 5%-15%.

The First Flippening

"The Flippening" has turned into a meme in crypto because of how often it's been used and never materialised.Note: The Flippening refers to ETH surpassing BTC in market capitalisation.While a meme for some, it's become somewhat of a fact for us. Simply think of it this way: what's more valuable to the world? A tech platform powering the world or an improved version of gold? The answer is pretty clear to us.

Back in the day, ETH had no economic model whatsoever, it was quite literally non-existant. However, in August last year that started to change with the introduction of a burning mechanism reducing supply with increased usage via EIP1559. Today, that model improved even further as explained above in the "less supply" clause, alongside the locked supply that now comes from people wanting to earn yield. In the world of Game Theory, these factors play out for an increase in ETH price.

The timing of that happening is an unknown factor but we're comfortable saying within the next 1-3 years and that's where the technicals/chart come in probabilistic agreement.

In order for ETH to flip BTC, the ETH/BTC ratio must cross the 0.16 mark.

After 2.5 years of consolidation, ETH broke out against BTC and started a bullish trend that we believe will lead towards new ATHs on this chart and the flippening to occur.

Once ETH claims the Top 1 by MCap spot we’ll see a repricing of tech in crypto which includes other base layers, infrastructure plays such as cross-comms and DeFi.

The Second Flippening

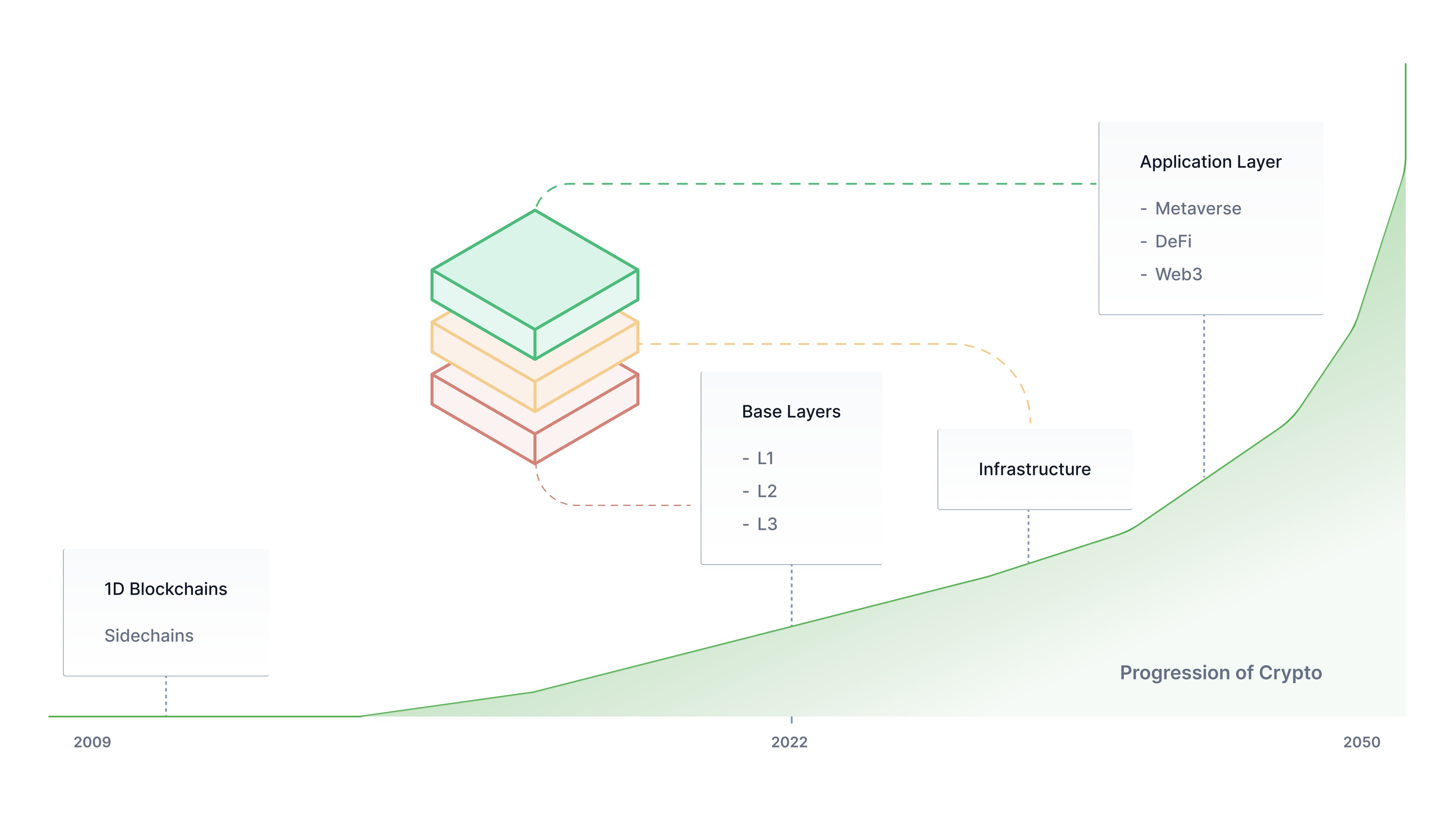

This is a new, first time you hear about it, correct?Well, that is because this one is quite far off and will take multiple years to materialize. Crypto is a long-term game so one must have a long-term plan.

- Bitcoin was a proof of concept

- Ethereum and other base layers such as Solana introduced the ability to build on this new decentralised concept

- Infrastructure needs to be further built around these platforms such as storage, cross-chain communications and wallets to have the complete experience.

- All of it culminates to the "Application Layer"

Everything we are seeing today is the building blocks for the application layer so the analogical question that begs itself is: "Is the internet or the applications built on top of it larger by valuation?"

This is a question I have personally contemplated for a long time and the conclusion I've reached is that the applications are and will be larger.

Therefore, the second flippening will consist of certain applications whether that may be Games, Decentralised Social Media or DeFi dApps becoming larger than Ethereum and all other base layers. These applications have users and earn revenue, having a share in the winners will be the equivalent to hitting the jackpot. How to do so? Read & Research.