A few weeks ago, one of our technical analysts, Maleigh, MKF|Cpro, asked the community for their preferred content format technical analysis request, and the overwhelming vote was for video content.

Over the past few years, the video streaming market size has increased multifold. In 2022, 82% of total internet traffic went to video content.

Today, we want to examine whether decentralised platforms can disrupt this centralised industry – and if they do, can investors profit from the disruption?

We have identified three decentralised streaming projects that could emerge as trendsetters.

Let us dive in!

TDLR

- The video streaming market has grown significantly, valued at $554.33 billion in 2023 and expected to reach $672 billion in 2024.

- Centralised streaming services face challenges like high subscription costs and infrastructure maintenance.

- Decentralised streaming is emerging as a revolution that streamlines costs, distributes ownership, and aligns incentives in a way that centralised incumbents cannot match in the long term.

- We analyse three decentralised platforms aiming to disrupt the market to deliver these benefits.

- One project incentivises users to share computing bandwidth for faster content delivery using blockchain.

- The second focuses on reducing video transcoding costs by up to 50x through a peer-to-peer architecture.

- The third integrates live TV with blockchain, offering a "watch-to-earn" model and targeting multiple revenue streams.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

The current state of the video streaming market

Social Media platforms and the recent rise of fast internet connectivity have led to a steady growth of the video streaming industry. The market size was valued at $554.33 billion in 2023 and is expected to rise to $672 billion in 2024.Major trends in the video content market include the rising adoption of low-latency video streaming, live streaming, and increased demand for video-on-demand streaming services.

However, most users around the world pay quite a premium for these streaming services. The cost of OTT subscriptions has gradually increased, and the rate at which the subscription premium charged for content rises is alarming.

Now, these centralised companies face challenges with the cost of infrastructure, transcoding, and maintaining bandwidth for a smooth experience. These are reasons why the subscription premium has been on the rise – thankfully, decentralised streaming protocols are bringing new solutions to these challenges.

Theta Network (THETA)

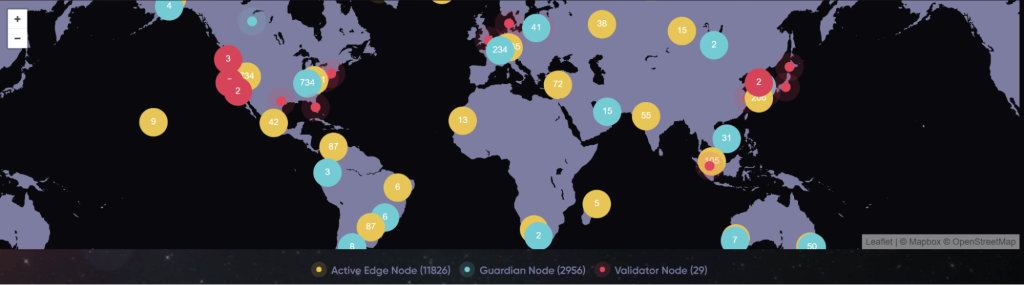

The Theta network is a blockchain-based peer-to-peer network that incentivises users to share their computing bandwidth to ensure fast content delivery networks (CDNs). The Theta blockchain is not replacing YouTube or Twitch; instead, it is an underlying network solving video streaming issues.Theta's video API, powered by the Theta Edge Network, allows users to add video to any website or application without central servers, content delivery or video hosting software. Therefore, users watching streams or video content can relay over the Theta network on a peer-to-peer basis, leveraging Theta's infrastructure.

Tokenomics

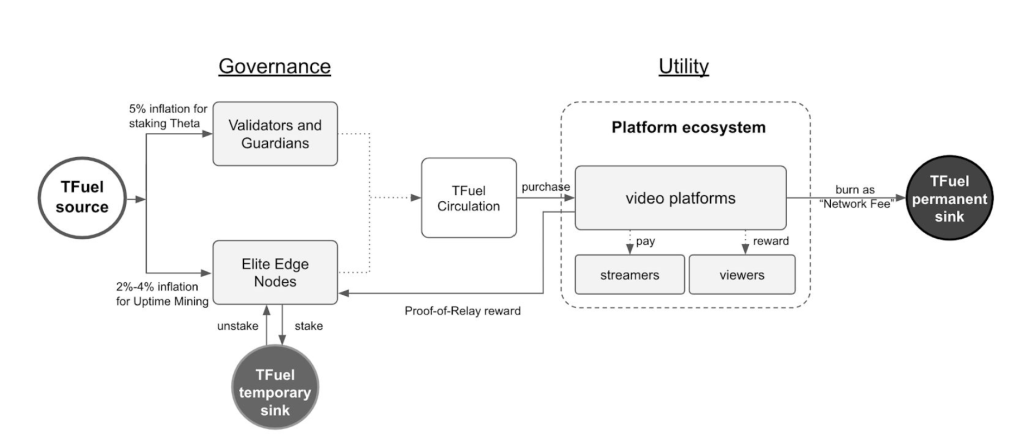

Theta Network employs a two-token design, comprising the Theta Token (THETA) and Theta Fuel (TFUEL). THETA is the governance token for staking as a Validator or Guardian node. Stakers earn TFUEL as a reward for their contributions to block production and protocol governance.

The supply of THETA is capped at 1 billion tokens. In the case of TFUEL, 5 billion tokens were minted at Genesis, but the supply increases annually at a fixed rate. The dual token economics include TFUEL inflation, staking, and burning, which are explained in detail in their whitepaper.

Overall, Theta's tokenomics are good because both THETA and TFUEL are constantly utilised. For example, when a content creator or streaming company/website wants to join the Theta network, they can stake THETA tokens by becoming Enterprise Validator or Guardian nodes. This secures the network and democratises the earning process, allowing a wide range of users to participate and benefit. Theta has major enterprise validators, including Google, Sony Europe, Binance, Blockchain Ventures, Samsung and Dapp Radar.

Unique value proposition

Theta's unique proposition is that it can be viewed as a "dual network" with two subsystems: the Theta Edge Network and the Theta Blockchain. By dipping its toes in the AI sector, Theta is extending its utility across other parts of the industry.

This brings us to Theta's new EdgeCloud, a fully decentralised network for AI edge computing, data storage, and delivery. As of February 2024, this edge network has grown to over 10,000 nodes worldwide.

Another noteworthy point is the presence of high-profile advisors on the Theta network. The project is backed by Steve Chen and Justin Kan, the co-founders of YouTube and Twitch, respectively. Other advisors include Dovey Wan from Primitive and Fan Zhang, co-founder of Sequoia Capital.

Valuation exercise

To estimate a valuation target for THETA, we need to address the total addressable market (TAM) share for video streaming.As mentioned, the global video streaming market is valued at around $560 billion and is projected to rise to $672 billion by the end of 2024. Therefore, TAM will be equal to $672 billion in 2024.

This is the collective market cap value of all companies involved in this industry. However, data suggests that revenue generated by these companies for video-on-demand services in 2024 is projected to be $182.40 billion. The expected annual growth rate or CAGR is also about 8.27% from 2023 to 2027, so demand should also rise.

(Please note, the above data will be used for Livepeer and Script's market valuation as well)

THETA's valuation cannot be estimated based on only its video streaming capacity or revenue generation. Its value proposition dictates that the team is also trying to make inroads into the AI industry, and annualised revenue in the AI market is also projected to be, ironically, $184 billion in 2024.

In 2023, THETA's annualised revenue was around $4.4 million. Theta Network's current market cap is $1.98 billion, so it is fair to say that THETA has a major revenue gap to bridge.

Right now, the adoption and utilisation of the THETA blockchain is still nascent, so it may not disrupt the centralised marketplace in the 2024-2025 bull market.

However, narratives can play a big part, and THETA has already broken away from a two-year consolidation range in the market. If the momentum continues, we see a bull-case scenario for THETA to touch $15 per token, i.e. 7.5x from current prices.

This target is just above its all-time high; for now, this is potentially THETA's highest expectation over the next couple of years.

Technical analysis

After reaching a yearly high of $3.85 on March 11, THETA declined by 49% on May 1.

However, over the past few days, the token has made a 26% recovery in the charts and is currently valued at $2.35. The asset found strong support from its 1st order block between $1.78 and $1.98, and it is presently positioning itself above the EMA-100 (orange line), which is bullish.

Considering THETA breaks above the descending trendline (yellow line) over the next few days, a potential trend shift could be in play for the token.

The Relative Strength Index is also becoming more neutral, and the selling pressure is beginning to subside.

Livepeer (LPT)

The next project on our radar in the decentralised streaming industry is Livepeer, a decentralised video streaming platform providing video transcoding and distribution services.Now, what is transcoding? It is the process of taking a raw video file and formatting it to ensure it can be viewed at the most optimal resolution on the internet despite bandwidth limitations.

Transcoding is expensive, and costs can increase exponentially on the infrastructure side with the rising demand for 4K and 8K videos.

Livepeer aims to solve these issues and reduce the cost of transcoding video files by up to 50x. The network architecture is a peer-to-peer network, but the revenue distribution layer is set and managed on Arbitrum.

Now, how does Livepeer maintain the quality of video streaming? It has two important roles: Orchestrators and Delegators. The roles are explained in the next section.

Tokenomics

The total supply of Livepeer tokens stands at 32,047,969.33; of those, 13,396,071.78 are staked. Livepeer refers to this ratio (41.8%) as its' participation rate'. There are no ecosystem unlocks as such.Here's a simplified breakdown of Livepeer's economic structure and tokenomics:

Economic structure:

- Demand-side Revenue: Broadcasters pay ETH to Orchestrators for their transcoding services. Orchestrators' ETH revenue depends on their transcoding capacities and the amount of LPT they have staked.

- Supply-side Revenue: Delegators (including Orchestrators) earn LPT through staking rewards and a share of the ETH fees for transcoding services.

- Bond & Slash Model: LPT is a bonding mechanism in a delegated proof of stake system. Protocol violations can lead to slashing, creating incentives to secure the network against various attacks.

- Stake for Access Model: LPT is required for staking to work as an Orchestrator, ensuring their participation in network activities.

- The goal is to achieve a 50% participation rate, meaning half of the LPT is staked to Orchestrators. When participation increases, daily token issuance decreases, and vice versa.

- Initial Distribution: Ten million LPT tokens were initially allocated to various stakeholders, with around 63.4% going to network participants.

- Current Inflation: LPT issuance dynamically adjusts. Issuance increases slightly when the participation rate falls below 50% in a round. Conversely, if participation exceeds 50%, inflationary issuance decreases somewhat.

Unique value proposition

Taking a page from its competitors, Theta, Livepeer has also released a new roadmap, "Joy type abstraction", to introduce generative AI capabilities on the platform.AI generative videos have become extremely popular over the past few months. Such models based on open source can represent increased utility and adoption, leading to better revenue capacity for Livepeer in 2024.

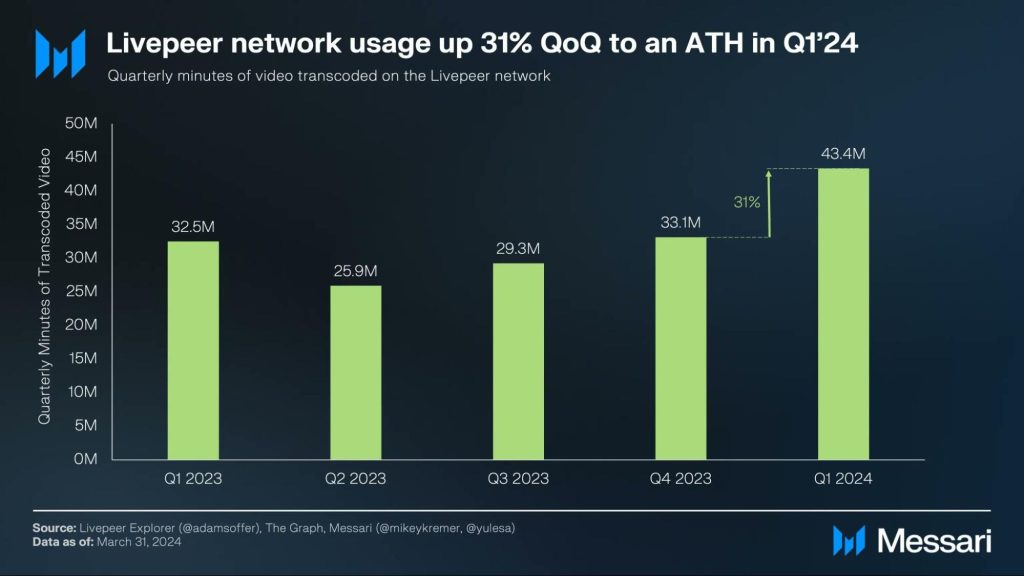

From the point of transcoding, Livepeer is also dominating the market, with a consistent quarter-on-quarter increase in transcoded minutes. In Q1 2024, a 31% increase was witnessed, meaning user retention and growth are progressive.

Valuation exercise

Let us re-consider the TAM illustrated in THETA's valuation model.Video streaming market share or its TAM equals $672 billion in 2024.

However, for Livepeer, rather than streaming, it is the number of hours transcoded with amounts to revenue and adoption. In 2023, Livepeer transcoded close to 150 million hours of video, which falls to around 0.01% of the total hours per year.

It is important to note that its GPU network segment is also estimated to generate $3-$5/minute on generative AI videos and $0.003/minute on transcoding. Livepeer generated roughly ~$800k in fees in 2023, and if the above data is transposed, then in the future, the revenue can increase by up to 12x-15x.

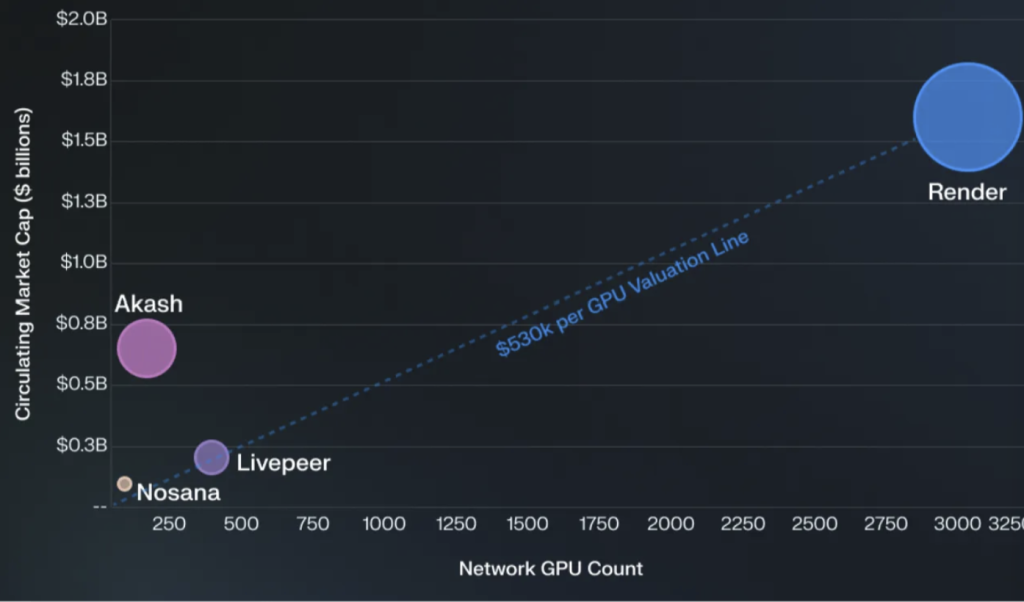

Additionally, Livepeer is also the lowest-valued network based on GPU resources available, with approximately $530,000/GPU, and GPU resources are considered a commodity.

Therefore, based on these findings, we can make a bull case for Livepeer's LPT to touch $100-$125 per token, i.e., 8.5x-10x from current prices.

Technical analysis

LPT's price action has demonstrated a sense of urgency over the past few days. It has recovered almost 40% in value since May 1. This is a strong price bounce, and the asset has already breached above the bearish descending trendline.

For further bullish confirmation, the token must break out of its bearish structure and possibly close above the $16-$17.5 (green box). That should indicate a trend reversal.

Currently, the token has found support from EMA-50, EMA-100, and EMA-200, which has helped it bounce in the past. Livepeer's price structure is pretty positive right now.

Script Network (SCPT)

The last project in this report is a newly launched protocol.Script Network is an L1 open-source live TV platform and storage network. The protocol had a fruitful beta phase in 2023. After harnessing 165,000 users and over 1.5 million minutes of weekly content streaming, the network launched its $SCPT token towards the end of December.

The network aims to integrate live streaming and television with blockchain technology, promote content creators, and incentivise consumers through its 'watch-to-earn' model. Script Network believes that televised content should be easily accessible and users should not have to pay a large premium.

Users must purchase NFTs, known as Script Glasses, to interact with Script TV. These glasses enable users to earn tokens as rewards for viewing content on the platform. More on that later.

Tokenomics

The total token supply for SCPT is capped at 1 billion. At TGE, the fully diluted valuation was $10 million. Like Theta, SCPT tokenomics also consists of a dual-token design, where the SCPT token is used for governance, and $SPAY is the transactional gas token.The token distribution is listed on their whitepaper, but the gist is that it is split 50-50 between the holdings of the team and investors and the distribution of the community. The token supply is expected to be released linearly over 26 months to mitigate price volatility.

Overall, the tokenomics are decent, but they are not exactly the most investor-friendly. From the above chart, there is clear utility for both $SCPT and $SPAY tokens, but the inclusion of linear release affects such a setup, as inflation can seep in.

Unique value proposition

Script Network has quite a lineup of products. The integrated ecosystem comprising Script TV, Script Marketplace, Script Enterprise, and Script Blockchain caters to viewers, content creators, and businesses. Its 'watch-to-earn' mechanism enhances this.

Its watch-to-earn model is the 1st of its kind, and its community-focused approach has an expansion-based narrative. The more users consume content or stream on Script TV, the more they are incentivised to do so.

Additionally, The platform's capacity to generate revenue through various avenues like creating content, tailored advertising, premium services, and transactions in digital marketplaces demonstrates its flexibility and ability to adjust to the changing digital environment. A detailed explanation of it is listed in the next section.

Valuation exercise

The valuation exercise is tricky for Script Network since it is a new protocol and does not have concrete or long-term revenue data like its competitors in Livepeer and Theta.The TAM remains the same: $672 billion in 2024. The expected revenue for video streaming in 2024 is $184 billion.

However, with a market cap of just above $8 million, Script Network can multi-fold in valuation over the next 12 months. For starters, the project has mentioned multiple revenue streams in its whitepaper.

It includes:

- Script TV operates like traditional television with non-skippable ads every 10 minutes.

- Revenue is generated based on minutes watched.

- Advertisers pay Script Network for ad slots.

- Revenue from ads is separate from rewards but contributes to a buy-back-burn program.

- Script Network earns fees from transactions on its blockchain.

- Selling original content to other distributors is another revenue stream.

- Short animations inspired by BearX NFTs are being developed.

- The NFT marketplace offers exclusive drops and transactions for ScriptGLASS upgrades.

- Premium TV channels are available for ad-free viewing and special content.

- dStorage and content distribution services offer savings for enterprise clients.

Script Network's current valuation is $8 million, a micro market cap.

With the above integrations and a very large TAM, the bull case for Script is a $200-$250 million market cap, i.e. a 25x-30x upside from current prices.

However, it is important to note that $SCPT carries the highest risk factor since Theta and Livepeer are established protocols, and SCPT is still new in the industry.

Technical analysis

$SCPT has re-tested the recent long-term order block at $0.018-$0.023, and it is currently registering a recovery. However, for a long-term trend shift, the asset must break above the yellow descending trendline in the daily chart and close above. Unlike its competitors, SCPT hasn't found significant momentum over the past few days, thus lacking any credible recovery.

Cryptonary's take

The decentralised streaming industry hasn't gained bullish momentum yet, but these projects are building good products. Traditional streaming is still a difficult market to disrupt, but recent on-chain data indicating interaction with these platforms suggests an opportunity to be discovered.While all these projects make a great case for an investment position, right now, Livepeer makes the best overall case in terms of utility and security. SCPT is still new, and the revenue streams must become active for long-term growth. Theta is extremely established, but it is currently undergoing a change in direction with its AI and GPU proposition, so there is some form of uncertainty with them.

Overall, these projects should do well in the long term. They have a consistent roadmap, token utility, and a product that can target the addressable market size of the streaming industry.

But if we are keeping it real, decentralised video streaming isn't the centre of attention (at least, not yet) in the 2024/2025 bull run, and attention equals momentum, and momentum yields performance.

Want to know what other projects we are betting on to deliver exceptional returns? Check out Cryptonary's Picks.

Until next time,

Cryptonary out!