The Next DYDX | A High-Risk, High-Reward Opportunity

Perpetual futures, or perps for short, are DeFi’s golden goose. If you’ve ever traded with leverage, that's a perp.

Perps give traders huge leverage and the ability to go long (buy) or short (sell), something that was previously very challenging for the everyday investor.

With the recent blow-up of FTX, people have woken up to the need for DeFi. Users are looking for a safe place to trade, and DeFi is that place.

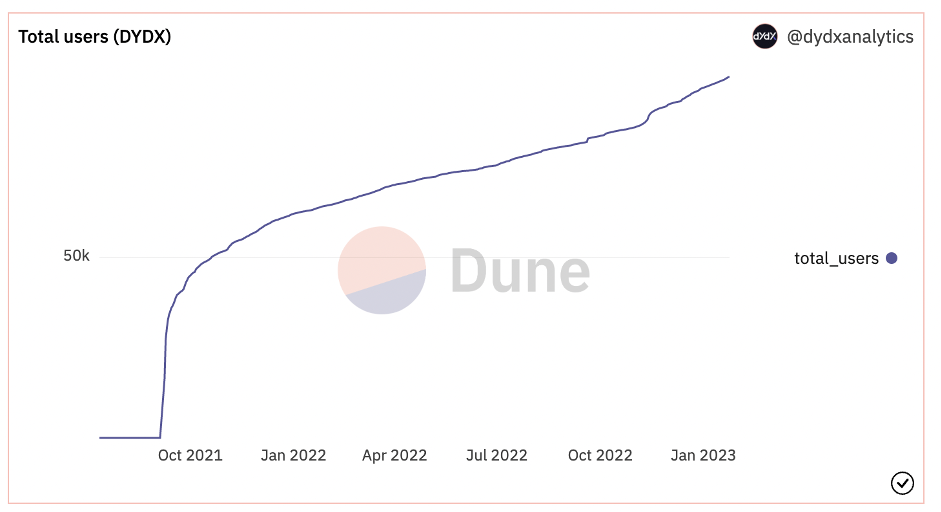

We’ve already seen volumes picking up on popular exchanges dYdX and GMX. See the spike in dYdX users below, while November was the FTX blow-up.

Today, friends, we’re looking at a small-cap crypto that’s ready to ride the bull and give us massive returns through 2023!

We see this project outperforming both DYDX and GMX and forecast a potential 13.5X return in 2023.

Let's dive in!

Disclaimer: Not financial nor investment advice. This report is for entertainment purposes only. Any capital-related decisions you make are your full responsibility and yours only.

TL:DR

- Perpetuals are popular trading instruments with huge potential. The fall of FTX opened the market for competitors to sweep up the spoils.

- Our number one choice for a perpetual exchange is dYdX. It’s the most fundamentally sound on the market, and we foresee 7X potential in 2023.

- There is, however, an alternative. Meet Perpetual Protocol. As an asset, we don't believe it’s fundamentally better than dYdX, but due to its small market cap, we believe it can outperform. It’s expected performance? 13X!

- Here's how we’re investing in PERP, along with our price targets.

If you’ve been part of the Cryptonary family since early 2022, you’ll recall our series on derivatives.

In the futures article, we discussed Perpetual Protocol, an interesting perps platform that was the reigning champion until dYdX launched on Layer 2, allowing it to absolutely dominate the market.

Our perpetuals winner: dYdX

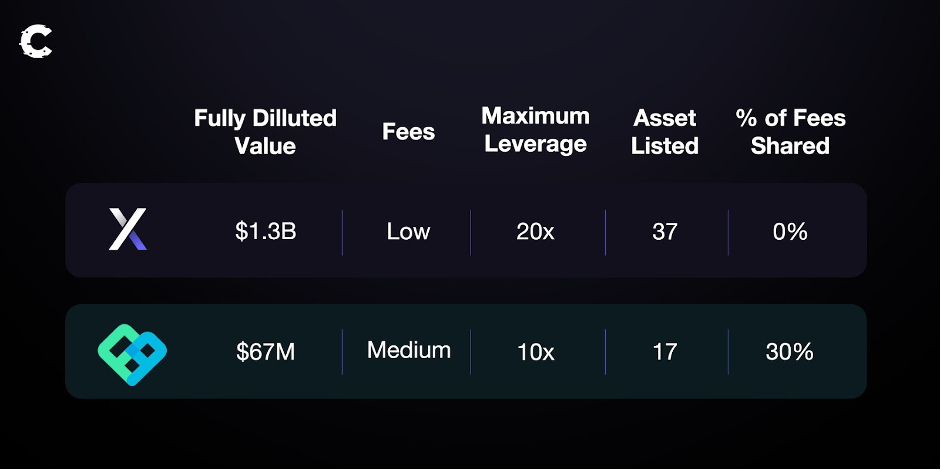

For those who don’t know, dYdX was crowned our winner in The $1 Quadrillion Bet. It is clearly the number one option, and we are expecting a 7X return in 2023.However, by crypto standards, 7X gains are relatively modest. dYdX’s potential is limited due to its already huge fully diluted value.

This is where Perpetual Protocol comes in

Since we first mentioned it (14th March 2022), the PERP token has dropped by 90%, from $4.50 to $0.45. Its fully diluted value now stands at just $67m, only 1/20 of dYdX’s!

What does this mean? Perpetual Protocol has serious potential!

It’s not better than dYdX from a fundamental perspective, but its small market cap and discounted price point (largely caused by the market crash and lower trading volumes) make it a great investment.

Now, as we know, with greater reward, comes greater risk. That’s what PERP is for us, an alternative investment with greater potential and higher risks.

While it’s very early, so far in 2023 we’ve seen volumes pick up to $20m per day on average.

The fully diluted value has dropped significantly, whilst fees have stayed relatively flat, and even started picking up again.

This is all positive news for PERP, which we expect will push it in the right direction.

So, what is going on at Perpetual Protocol and why are we covering it now?

Well…

The holy grail for holders

One thing that makes Perpetual Protocol a valuable product is its fee sharing. Investors that stake PERP can earn 15% of the protocol’s revenue.

This is possible thanks to the launch of vePERP (vote-escrowed PERP), which means the token is locked up for between a week and a year. When locked, holders get voting rights in governance decisions and a share of the fees and PERP rewards.

The end result – even with the relatively small trading volume currently on the platform, stakers earn 30-50% APY!

Liquidity providers continue to receive 80% of fees, sufficiently incentivising them, but token holders are now rewarded too.

The impact this has on token value cannot be understated.

There is, however, an issue that needs to be discussed…

The liquidity dilemma

How do the big players handle liquidity? Well, they might rely on inflation to incentivise market-makers (by distributing tokens to them, like dYdX)? Or they might make it easy to provide liquidity, but limit how many assets that can be listed (like GMX, the other big perpetual protocol)?Perpetual Protocol chose to use a complex liquidity provision method to solve high costs, but at the same time, make it almost impossible for retail investors to provide liquidity…

Now, we have concerns about this model, but it certainly is interesting.

Using Uniswap V3 as the base, providing liquidity on Perpetual Protocol involves choosing a price range, and that is extremely complex. For the purpose of this analysis, all you need to know is that to be profitable as an LP (liquidity provider) on Uniswap and Perpetual Protocol, you need to be a quantitative analyst or trader (or use strategies that were created by one).

Not exactly appealing to the newbie traders entering from CeFi. This is, of course, very limiting, and a major contributor to PERP’s poor performance.

That’s one reason the total value locked on right now is only $17m, compared with GMX’s $480m!

The solution?

Vaults, partnerships, strategies.We actually sat down with the Perpetual Protocol team and discussed how the liquidity dilemma could be resolved.

One method they’re working on involves vaults that retail users can lock USDC in. A protocol could then provide liquidity to Perpetual Protocol using a quantitative (mathematical) strategy.

This, if successful, solves the liquidity issue faced by both GMX and dYdX. It’s a very interesting but challenging plan.

Oh, and if the protocol is used more, fees will go up, which makes providing liquidity more profitable, which brings in more sophisticated LPs. It’s a positively reinforcing bull cycle.

Cryptonary’s Take

To be clear, Perpetual Protocol is not our overall perps winner. dYdX is. PERP is, however, a higher risk, higher reward play.Its future is uncertain and there are many moving parts, especially around providing liquidity.

It does, however, offer a range of attractive features, like multi-collateral, low fees, and a great interface, as well as some unique selling points.

With the right marketing, research, partnerships and products, it will take market share– and we will see massive returns!

Our price prediction

Currently, PERP is at $0.46. We see it growing to $6.20.How did we come to this conclusion? Through some very simple logic.

If it has unique benefits that differentiate it from dYdX and GMX, and whilst it may not come out on top, it’s fair to assume it can recapture some of its market share.

With the idea of a 10% capture of market share on the table, we can calculate this as a 13.5X return for PERP in 2023.

Assuming in the bull run, dYdX and GMX grow by 5X (a conservative figure), that puts their combined fully diluted values at $9.5bn.

With Perpetual Protocol taking a 10% share, that means its fully diluted value would be $950m, or 13.5X from the current level!

Action Steps

- We intend to invest a small amount of capital, something we are comfortable losing, as this is a higher-risk, higher-reward play.

- For those who are looking for a lower-risk protocol, consider dYdX. You can find details on the protocol in our derivatives article series here.

- If you’re interested in Perpetual Protocol, test it out and see what you think.

Let us know what you think in Discord! Thanks for reading!