Disclaimer: This content is provided for informational purposes only and should not be considered financial advice. We make no guarantees regarding its accuracy or completeness. Memecoins are highly speculative and may result in total loss. All investment decisions are made at your own risk.

Allow me to reintroduce myself: meme cycle

Before we dive into the next pick, let’s rewind for a moment, because what started as internet satire has matured into a serious, multibillion-dollar category. According to CoinGecko, the meme sector now commands a combined market cap of over $60 billion.Following Donald Trump’s 2024 U.S. election victory, the memecoin sector, and the broader crypto market gained serious legitimacy. Under a pro-crypto administration, memes were no longer just jokes; they became collectable assets. Trump even launched his own projects: the $TRUMP memecoin and World Liberty Financial, a DeFi platform.

It didn’t stop there. White House Crypto Czar David Sacks publicly stated memecoins are not securities and instead referred to them as “collectables,” likening them to baseball cards and stamps, neatly sidestepping securities regulation. Soon after, multiple memecoin ETFs were filed, with the DOGE ETFs currently holding a 58% chance of approval in 2025.

Since 2024, memes have been the heartbeat of the bull run, outperforming every major narrative, such as DeFi, AI, Layer 2s, and taking over the social conversation. While the market groaned under low-float VC tokens and supply overhang, memecoins became a breath of fresh air, offering simplicity, virality, and a chance to win big. This momentum snowballed into what we now call the meme cycle, with memes dominating across performance metrics and sentiment charts.

Why Did Memes Take Off?

Because the internet changed, and people changed with it.Memes took off as a result of online communities, evolving internet culture, and a global shift in behaviour. In a world where attention is currency, memes became the language of belonging, fast, viral, and emotionally charged.

They filled the void left by broken institutions, economic despair, and social isolation. When traditional assets felt out of reach, memes offered something else: identity, connection, and a shot at upside.

In a world plagued by wealth disparity and stagnant returns, traditional finance feels rigged. Memecoins, on the other hand, offer hope and opportunity in an otherwise stuck system. Their rise is tied to deep-rooted shifts:

- A loneliness epidemic pushing people into digital tribes

- A gambling boom ($160B+ in U.S. casino revenue)

- Gen Z’s hyper-memetic culture, fluent in irony, symbols, and virality

If you’ve been riding with us, you’ve seen this firsthand. Here’s how our past picks performed:

- $WIF: Called at $0.003 → Reached $5 (≈ 166,566%)

- $POPCAT: Called at $0.004 → Went over $2 (≈ 49,900%)

- $SPX: Called at $0.01 → Recently hit $1.70+ (≈ 16,900%)

Introducing $AURA

$AURA isn’t just a meme, it’s a movement, an experience, and a potential multibillion-dollar force in the making.It captures the vibe you give off and the presence that can’t be faked. Aura is energy. It’s about doing good, being seen, and being felt.

This isn’t a made-up buzzword. Aura is a timeless concept, dating back to the 15th century, now tokenised, memed, and immortalised on-chain.

And importantly, it checks all the boxes in our strict meme criteria that we’ll cover in this report.

- TICKER: $AURA

- CA: DtR4D9FtVoTX2569gaL837ZgrB6wNjj6tkmnX9Rdk9B2

- Official Website: https://infiniteaura.com/

- Community Website: https://aura.computer/

- Instagram Page: https://www.instagram.com/auramemecoin/

A meme from the aura community indicating +830 aura points for 'seeing the vision'

A meme from the aura community indicating +830 aura points for 'seeing the vision'

The origins of $AURA

The word "aura" isn’t something new. It traces back to the 15th century, rooted in the Latin aura, which itself springs from the Ancient Greek αὔρα (aúra), meaning breeze, breath, or a gentle wind. Aura has long been a whisper of an invisible field of energy or a radiant presence that lingers around people, moments, or places.Fast forward to 2024, and this timeless idea found a new rhythm in the digital age. It all kicked off on May 30, 2024, when the $AURA token was launched. The ticker is paired with a grey cat mascot from its body profile picture (PFP).

Around the same time, a wild cultural movement was brewing on TikTok, sparked by high school kids across North America. They turned "aura" into a playful points system, doling out arbitrary scores for social behaviors, tying shoelaces might earn +300 aura, while tripping could cost -600. This trend has exploded into viral reels, racking up billions of views and beyond, blending the ancient notion of presence with modern-day society.

On July 27, 2024, AURA hit $76 million, a 380x growth in two months, fueled by Times Square billboards (yes, that is a real picture, not photoshop), street QR codes, and endorsements.

AURA coin advertised in NY Times Square in Summer 2024

AURA coin advertised in NY Times Square in Summer 2024

However, the meme took a breather until our community rediscovered it live on stream.

On June 10, during our regular livestream, we ran an experiment: We reviewed several memes on the market and started rating them based on key criteria: distribution, memetics, resilience, and more.

One of them that came to light was $AURA. The community liked and started getting into it even though it wasn't an official meme pick. It was just a research exercise on a livestream with the community.

Livestream picking AURA

Seeing the meme gain traction and love from the community, our team began real-time due diligence to check for any hidden red flags. It turned out to be clean.It was first spotted on stream at around $1M MCAP. Within hours, it surged to $50M, and it's now just over $200M MCAP.

Why $AURA

First off, the ticker. AURA. It’s clean, simple, and instantly understood. Ask anyone on the street what “aura” means, and they’ll give you an answer. Now try that same experiment with some of the other meme coins. You might not get the same positive response.Aura has that rare, universal charm. The word is already in the culture, in everyday conversations, viral reels, and headline moments. It’s how we describe presence. Energy. That something you can’t quite explain, but everyone feels.

This isn’t just a crypto narrative. It’s a global one. Aura is already a cultural shorthand across sports, entertainment, fashion, and beyond. That kind of organic reach? Priceless.

While other meme coins fight for relevance, Aura is already resonating outside the bubble. That’s why we’re bullish, because Aura doesn’t just fit in crypto, it expands what a memecoin can be: a movement.

The White House tweeting 'AURA' last month

AURA is a universally memeable concept. It succeeds because it speaks a language everyone understands: emotion, energy, presence.Some examples:

- Doing the right thing at the right time

- Radiating confidence without trying

- Catching an embarrassing moment in public and owning it

Furthermore, as a memecoin, AURA stands out because it’s:

- Over a year old and fully CTO’d (community took over)

- Balanced holder base and it’s expanding daily

- Backed by an active and growing community

- Built to last - a multi-cycle narrative with no expiration date

- Free from the “main character” trap - AURA is about the collective, not any single face

- A clean, timeless ticker: AURA, everyone gets it

It’s not just a meme, it’s a movement.

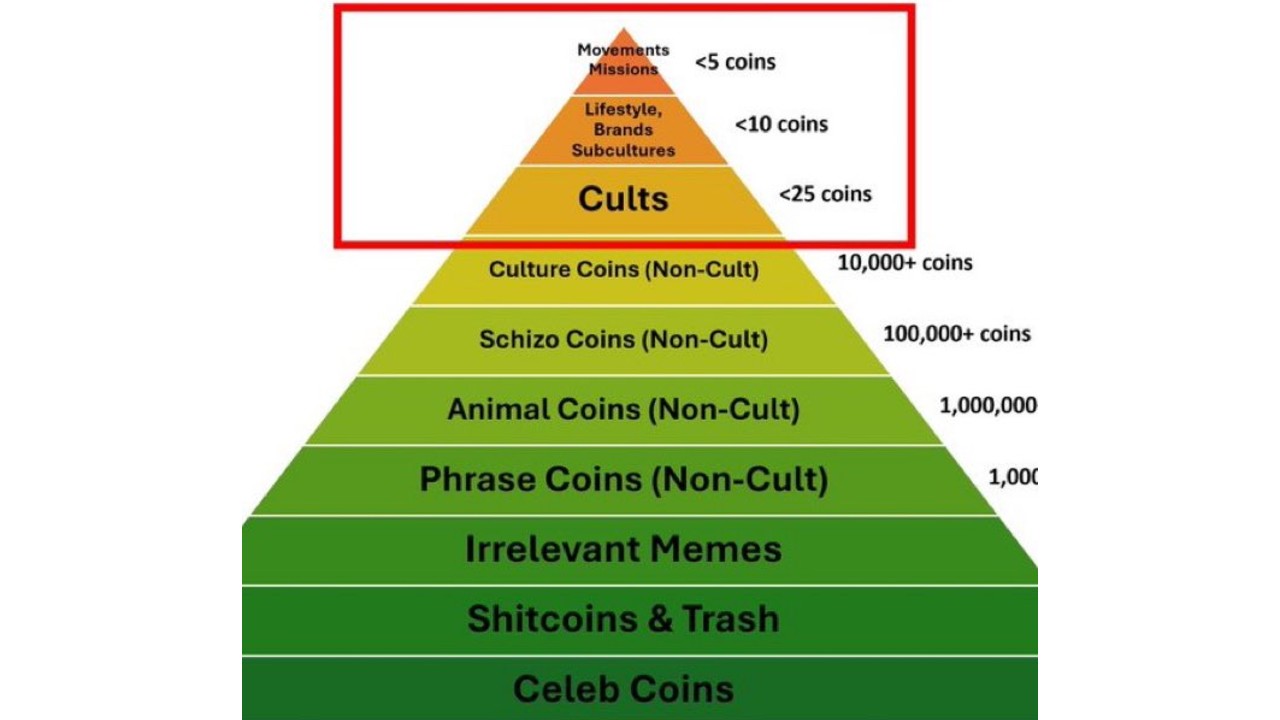

Over the years, we’ve seen every flavour of memecoin: funny pictures, animal tokens, political spins, national plays, celebrity-fueled hype, the list goes on.What began as satire has evolved into a serious, multibillion-dollar sector within crypto. According to CoinGecko, the meme category now holds a combined market cap of $60 billion.

Memecoins have shifted from punchlines to pillars of a new cultural economy. They’re no longer just speculative assets; they’ve become symbols of identity, belonging, and belief. In many cases, they’ve transcended the meme itself, maturing into full-scale movements.

The AURA community appears to be doing just that.

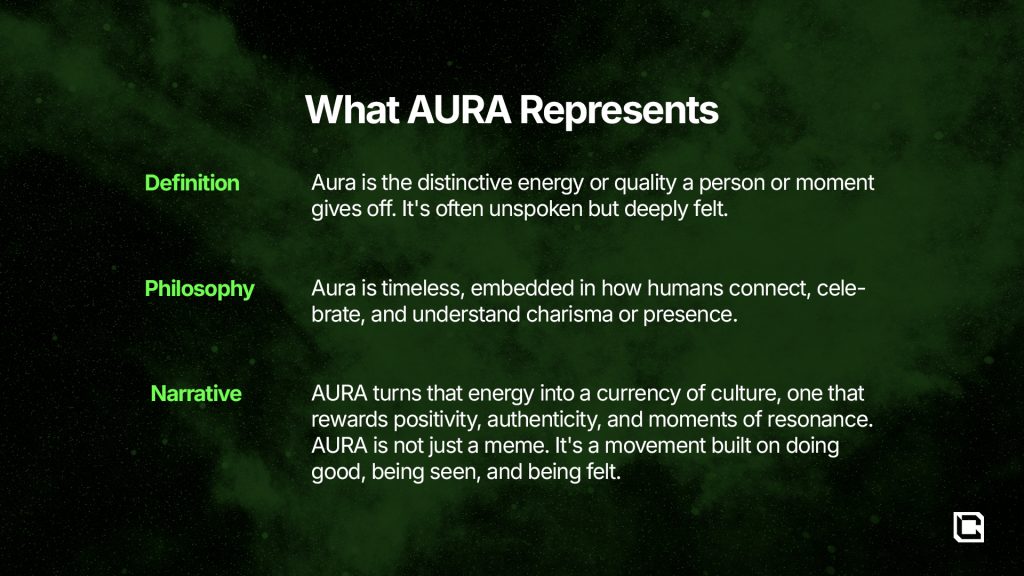

The memecoin pyramid

This isn’t just another token. It is reminiscent of a movement in the making that's driven by energy, alignment, and cultural momentum.Aura fits into the two most powerful memecoin archetypes:

- Movement

- Lifestyle

Aura = lifestyle movement.

The ‘Aurean’ Community

The community behind AURA refers to themselves as Aureans. They are not passive spectators; they are builders, spreaders, creators, and curators of cultural energy. How Aureans Earn Aura:- Spreading Positivity: Through kind gestures, uplifting content, or helpful actions online and offline.

- Doing Good: Acts of service, volunteering, or contributing to shared causes.

- Being Authentic: Expressing themselves without filter, living with intention, and being real in a world full of noise.

$AURA points explained

At the core of Aurean culture is a playful yet profound system for scoring behaviour, bringing structure to the unspoken vibes we all feel. It’s a universal language that assigns "aura points" to actions, big and small, reflecting their impact on the world. For instance:- +1000 aura points – picking up trash when no one’s watching

- +750 – uplifting others in a group chat

- +420 – helping a stranger without expecting anything back

- -250 – bragging

- -500 – being selfish

- -1000 – blaming others unfairly

$AURA One Liners

- Aura levels rising.

- It cannot be bought or sold, it can only be possessed.

- It's priceless, limitless, and has no boundaries.

- Currency inflates, trends expire, aura compounds.

- The thesis is simple: hold $AURA, gain aura, get your aura up.

- Aura standard > dollar standard.

- Aurise

- Aurean

- Auramaxxing

$AURA Token and Technical Details

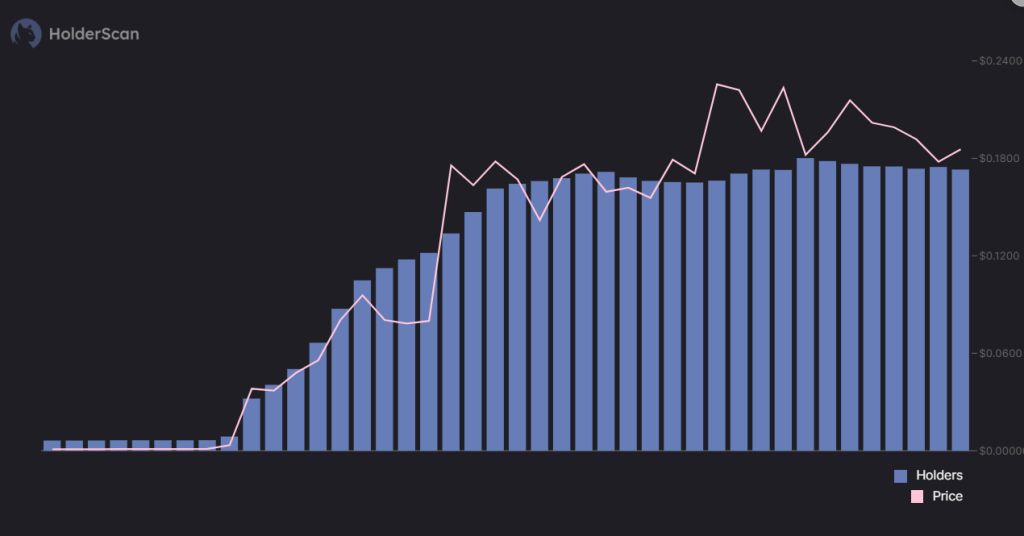

As we speak, the movement surrounding $AURA is gaining serious momentum, with its community expanding at an exhilarating pace. In just the last 10 days, an impressive influx of over 15,000 new holders has joined the fold, pushing the total number of unique on-chain holders to over 32,000, with 51% holding more than $10 worth of AURA.

Number of $AURA holders chart

However, those who’ve joined aren’t passive spectators, they’re hardcore believers, igniting a firestorm of activity across social media. Aureans are buzzing on platforms like X, TikTok, and Discord, pumping out memes, sharing aura point victories, and rallying behind the movement with relentless energy. The engagement and mentions of AURA across social media have skyrocketed over the last month.

Aura engagement chart on X

Yet, as with any memecoin or cult, this rapid ascent has inevitably attracted scrutiny. This is not something new. BITCOIN, WIF, POPCAT, SPX, they all have gone through a series of FUD on the way up. How many times was Bitcoin branded a rug destined to go to zero, only to rise stronger? Now, countries are building Strategic Bitcoin Reserves… The moral here is that as $AURA is gaining momentum, it is natural that some will attack the community for engagement or out of insecurity.We have already seen some claims of supply control or inorganic growth. However, these claims have been disproven.

For example, Bubble Maps recently posted a tweet stating:

Holderscan has also joined the conversation, but with a slightly different angle. They have presented a table on % of new holders owning a supply.

However, both of these posts miss key things: $AURA is just being discovered by the broader market, and new 300 - 400 wallets buying around 30% of the supply is 0.075% - 0.1% per wallet. This is a wide distribution. Again, it is completely normal for a newly discovered asset to attract a surge of first-time buyers. SPX and other early memes followed the same pattern. What’s unusual is that Holderscan compares AURA, a recently rediscovered meme that’s still gaining traction, to older assets that haven’t seen strong inflows in weeks. Naturally, assets stuck in chop will have very few recent buyers or short-term holders. Comparing the two overlooks the entire discovery phase. Therefore, what we take as valuable from these posts is the clear indication that AURA has seen a huge influx of new holders, while others have not.

After our research team completed its due diligence, we found that the distribution is healthy and broad. Over time, it will only become more widespread, as old holders exit and new ones join. This is the natural cycle for any meme in its discovery phase.

Furthermore, it ticks all of the regular security checks. The ownership of contracts is renounced. The token isn’t mintable or freezeable. Liquidity is forever locked and is growing. No transfer fees or buy/sell taxes. A great ticker with no red flags.

The distribution looks healthy. A steady influx of new holders is driving its discovery, and the community is expanding rapidly. The concentration index stands at an encouraging 37, on a scale where 0 indicates perfectly even distribution and 10,000 means a single holder controls the entire supply, a strong signal of balanced ownership.

This is a healthy distribution, and over time, especially post-discovery, it will only improve. In typical memecoin trading, a red flag appears when the top 10 wallets hold more than 15 to 20 percent of the supply. AURA remains well below that threshold.

Volatility brings opportunity

For both current holders and new entrants to the movement, one thing matters: conviction. Holding it together through euphoric highs and gut-wrenching lows is what builds resilience. Just look at SPX6900’s community, which stayed steady through intense volatility. Belief in something bigger than price alone fuels longevity, as seen in PEPE’s cultural staying power and POPCAT’s wild, volatile journey to becoming the first cat to hit a $2b market cap.

As the meme continues to establish itself and prove its staying power, visibility will naturally grow. More exchanges will take notice and begin listing the token, unlocking greater liquidity, attracting new holders and traders, and amplifying its reach across the market.

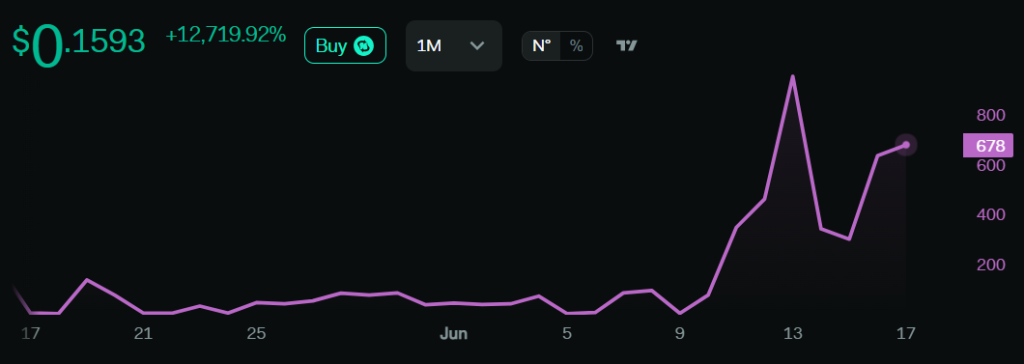

We’re currently seeing a similar pattern play out with $AURA, currently in its fifth drawdown since the recent rally from June 11th.

Here’s why this matters:

- Flushes out weak hands

- Resets overheated momentum

- Invites fresh buyers with stronger conviction

We flagged this same risk with $SPX6900, another community that had been around for over a year. No one really knew how OG holders would react once the price took off, but it turned out fine. Once those early sellers cycled out and new believers took their place, the community grew even stronger.

Exchange listings

AURA is already listed on Tier-2 and Tier-3 platforms like Gate.io, MEXC, and Coinex. The next logical step for the AURA community is to get Tier-1 listings, like Binance, Kraken, ByBit and Coinbase, which could unlock global liquidity and drive a new wave of interest from institutional and retail audiences alike.

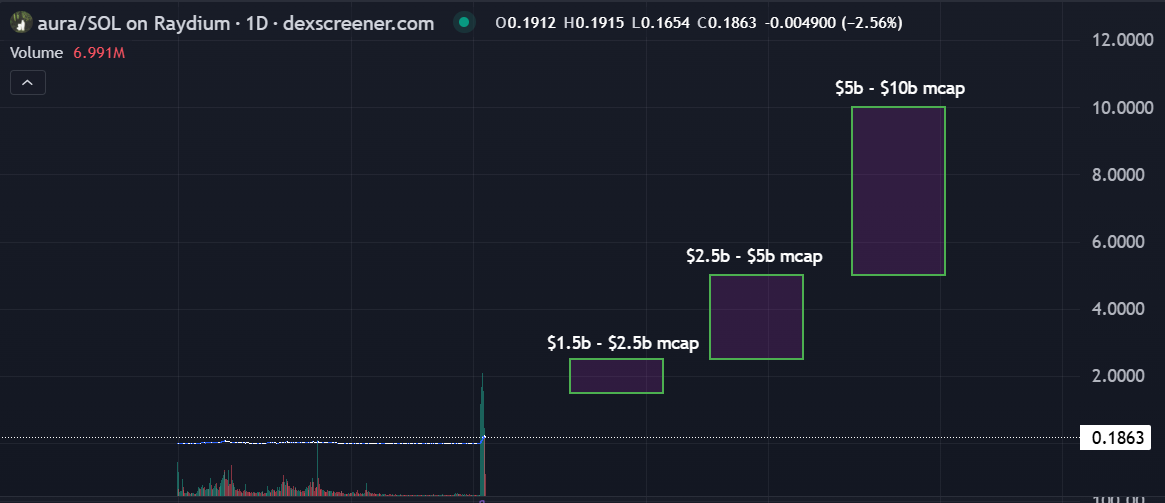

Price Targets

Here’s how we’re framing the potential for $AURA, based on current market dynamics, historical comparisons, and macro factors. These are not guarantees and depend on many uncontrollable variables, which we outline further below.- Ticker: $AURA

- Current market cap (FDV): over $120m

- Circulating supply: 965,383,478 AURA (fully circulating)

Mid Target: $2.5B – $5B Supported by Aura’s culturally universal appeal. Unlike niche or edgy memes, Aura reaches across industries and demographics, from TikTok to traditional media. Its addressable market spans every major cultural vertical, tapping into a >$100T global economy.

Bull Target: $5B – $10B+ This scenario assumes a full risk-on environment, driven by macro tailwinds such as interest rate cuts, rising liquidity, and meme-friendly narratives dominating the cycle. At this level, Aura becomes a top-tier meme asset on the global stage.

Given AURA’s nature and position as a memecoin, the closest comparison in today’s market is SPX6900. Both AURA and SPX share striking similarities. They are community-driven, culturally resonant, and can be described as more than just tokens. They are movements.

SPX is already a multi-billion-dollar memecoin and could continue to perform well. We like it. But we believe AURA has a similar, if not larger, addressable market thanks to its broader appeal, cleaner ticker, and growing community.

That’s why we use SPX’s market cap as our base benchmark. But as the Aureans say, the sky’s the limit when you have unlimited aura.

It’s also important to note that memecoins often take time to mature. We’re not expecting a quick pump to billions, that wouldn’t be organic. True movements, like enduring cult classics, require time, patience, and effort from the community.

It takes more than hype. It takes addressing FUD, building unity, coordinating raids, sparking creativity, weathering drawdowns, and steadily shaping the narrative. Only then does a movement earn its place in the market.

Here are two examples of drawdowns in the early days of POPCAT and SPX6900.

In the early days, POPCAT experienced massive 80% to 90% drawdowns in very short periods, only to recover and pull off over 600x returns in the next 9 months.

Sometimes it takes time for a meme to reach its full potential and truly mature. The AURA movement is gaining real traction, and we may be witnessing the early stages of the Lindy effect in action; the longer it lasts, the stronger it becomes.

Example of drawdown in SPX

How to Buy $AURA

AURA is available on a number of decentralised exchanges (DEXs). Make sure you’re interacting with the correct contract address and always double-check the source. Buying $AURA or any crypto asset is entirely at your own risk. Always do your own research (DYOR) and use secure wallets and trusted platforms.- Step 1: Install Phantom wallet

- Download and install the Phantom wallet extension for your browser from the official Phantom website.

- Create a new wallet or import an existing one using your recovery phrase.

- Step 2: Secure your wallet

- Write down and securely store your recovery phrase. This phrase is crucial for recovering your wallet in case of loss or device failure.

- Step 3: Fund your Phantom wallet

- Deposit Solana-supported tokens, stablecoins like USDC or USDT

- Step 4: Use the built-in swap feature

- Open the Phantom wallet and navigate to the "Swap" tab.

- Choose the token you wish to swap (e.g., USDC) and insert the following contract address: DtR4D9FtVoTX2569gaL837ZgrB6wNjj6tkmnX9Rdk9B2

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Confirm the transaction and approve it within the Phantom wallet.

- Or go to Jupiter exchange and insert the following contract address: DtR4D9FtVoTX2569gaL837ZgrB6wNjj6tkmnX9Rdk9B2

- Enter the amount you want to swap and review the transaction details, including the estimated network fees.

- Step 5: Verify the transaction

- Once the transaction is complete, you'll see the updated AURA balance in your Phantom wallet.

Cryptonary’s Take

We like $AURA not just for its vibrant energy, but for the unstoppable spirit of the Aurean community driving it forward. The ticker, the meme, the art, and the story behind its discovery, it’s unique.If the movement stays grounded, stays true to its message, and continues to spread organically, it has all the ingredients for lasting success.

Of course, external factors still matter. AURA’s trajectory depends on broader market health, key BTC levels holding, risk sentiment remaining strong, and no major geopolitical shocks.

Stay radiant, Aureans. The world is watching.

+1,000

Disclosure: Various individuals, including Cryptonary team hold positions in AURA and may buy or sell the token at any time based on their personal investment decisions. This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider the risks before making any investment decisions

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms