In crypto, most traders and investors think money can only be made when prices go up. But some of the biggest opportunities come when things actually go down. That's where shorting comes in.

Shorting is the process of betting against an asset, profiting when the price drops instead of rises. Let's say your friend has the latest iPhone, which is going for $2000. You believe the price is going to drop to $1000 because Tesla's about to release a killer new phone that's going to steal iPhone's thunder. So, you borrow the iPhone from your friend for a fee (interest) and sell it for $2000. A few months later, Tesla drops its new phone, and iPhone prices fall to $1000. You buy back the iPhone at the lower price, return it to your friend with the interest, and pocket the difference. That's shorting.

In financial markets, this is how smart traders capitalise on inflated valuations, fake traction, or manipulated assets that are propped up.

Previously, we have been quite good at shorting vapourware. We profitably shorted OM, BERA, IP and, most notably, LAYER (Solayer)

Our previous short: LAYER chart

Now, we're eyeing three more tokens that we believe are headed the same way — down to zero or close to it.Let's dive in...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

IP (Story Protocol)

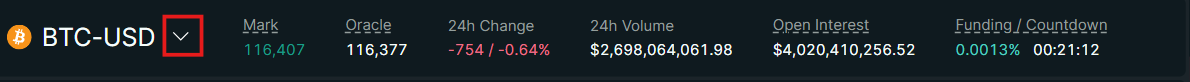

Okay, the first one on our list is IP (Story Protocol). Story Protocol is a sovereign Layer-1 (L1) blockchain built on Cosmos designed to "revolutionise intellectual property (IP) management in the AI era". Sounds fancy, right? But it is not solid if you look deeper into the asset. We've been watching this asset for quite some time now, and previously, we shorted it quite profitably. However, it has gone up considerably since then, and we are eyeing yet another short play.

IP's Price Action

As we can see, it’s been performing quite well lately, showing strong price action. However, we still think it is a great short if it's timed well. Here is why...As mentioned earlier, IP is a Layer-1 blockchain targeting the intellectual property market. It’s currently valued at over $10 billion in fully diluted value (FDV) and $3.1 billion in circulating market cap, meaning only about 30% of the total supply is in circulation. This type of distribution is what we call "low-float, high FDV" token. $10 billion market cap is a lot of money, and any platform that has such a high valuation should have meaningful adoption or development.

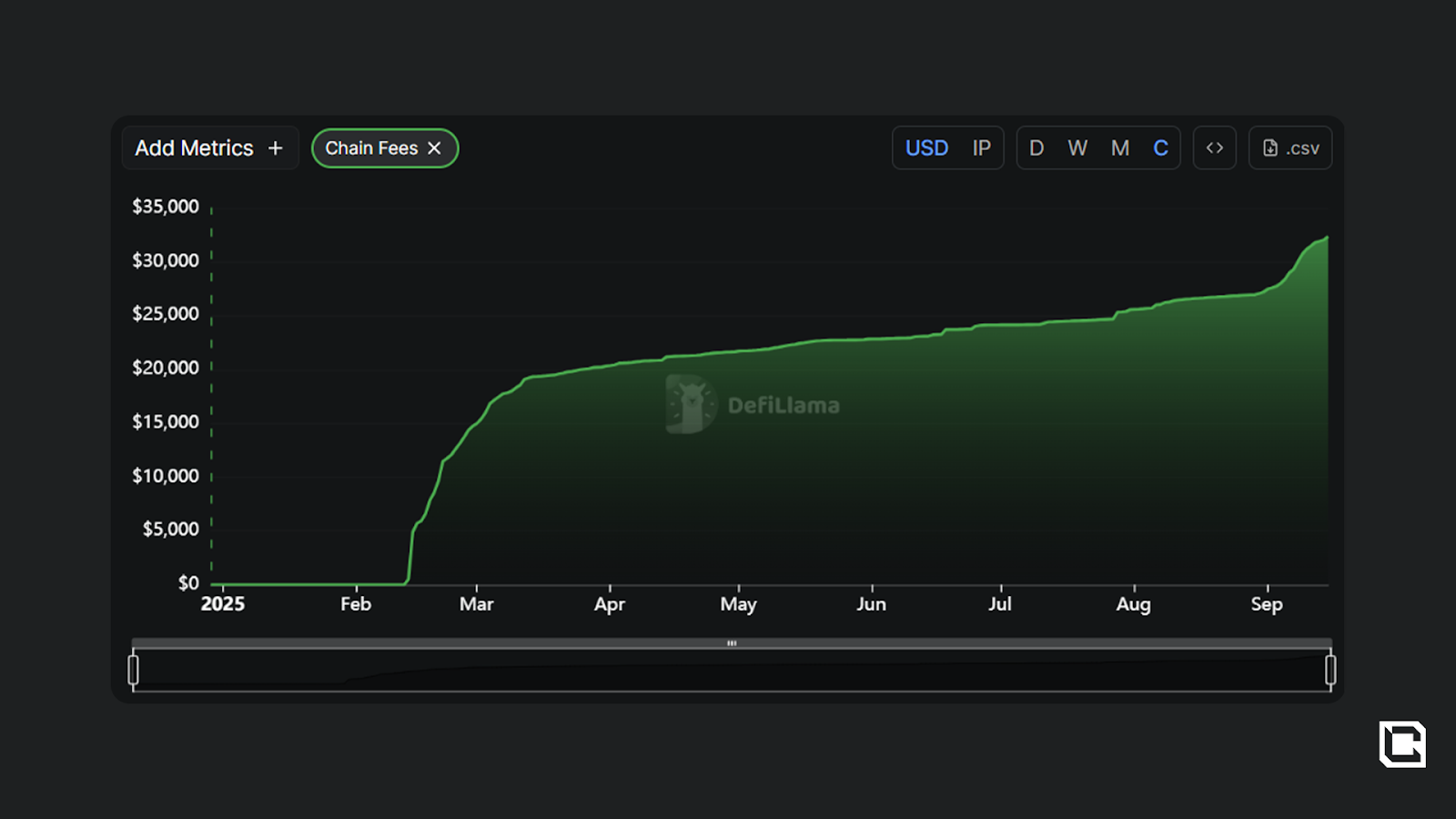

However, at present, the IP ecosystem has little of substance to justify its valuation. For example, since its inception in February 2025, the cumulative fees generated by the chain are slightly over $35k, while the total value locked (TVL) stands at $36 million. $35k in fees for an asset valued at over $10 billion. This is insane.

Story Protocol: Cumulative Fees

Story Protocol: Total Value Locked (TVL)

Moreover, the token is highly inflationary because it must subsidise the security of the chain. But what's worse is that, despite insiders' tokens being vested, they are still allowed to stake them. This means they receive a portion of the emitted tokens and are free to sell them even before their positions are fully unlocked.Previously, this kind of design was a disaster for the new token's price action (e.g TIA, DYM). Coupled with an aggressive vesting schedule, IP has a massive supply overhang and structural selling pressure.

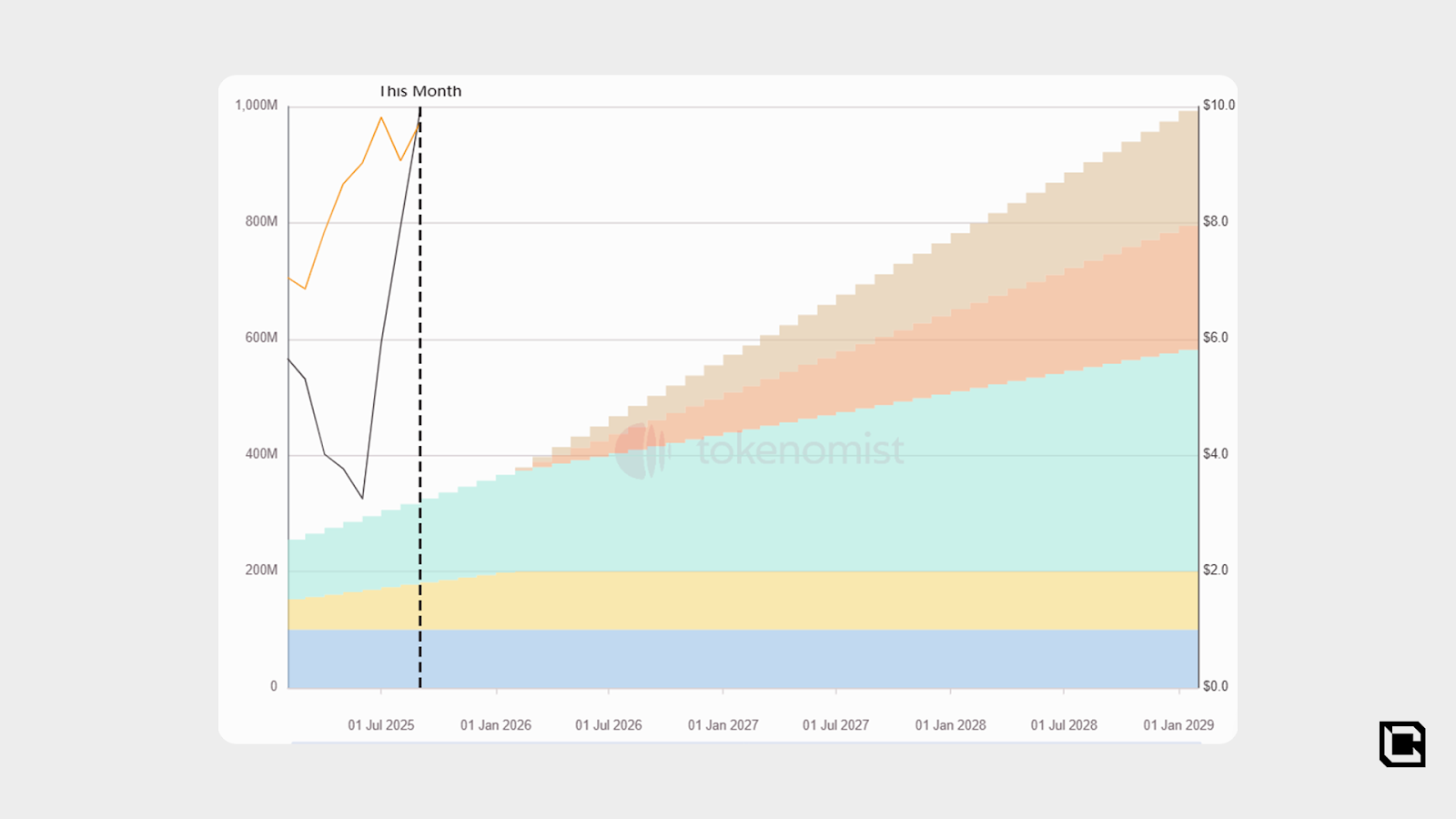

IP's Vesting Schedule

Cryptonary's take: But why, despite all these flaws, IP has one of the strongest price actions in the market? We believe the price is being manipulated and artificially propped up. We have seen vapourware to trade at ridiculous valuations before, only to crash 90% at some point when market makers have extracted enough money. We think IP is one of those cases.Again, the chain that generates less than $1000 a day can't organically be valued at over $10 billion market cap. Coupled with a massive supply overhang, IP is a great candidate for a short.

However, timing is very crucial. It can be dangerous to go against market makers or whoever is pushing the price. We have seen many cases when traders have been squeezed and liquidated due to poor timing. But should the market show signs of weakness, we will be shorting IP with conviction and sharing the trade on our website and Cryptonary's trade channel.

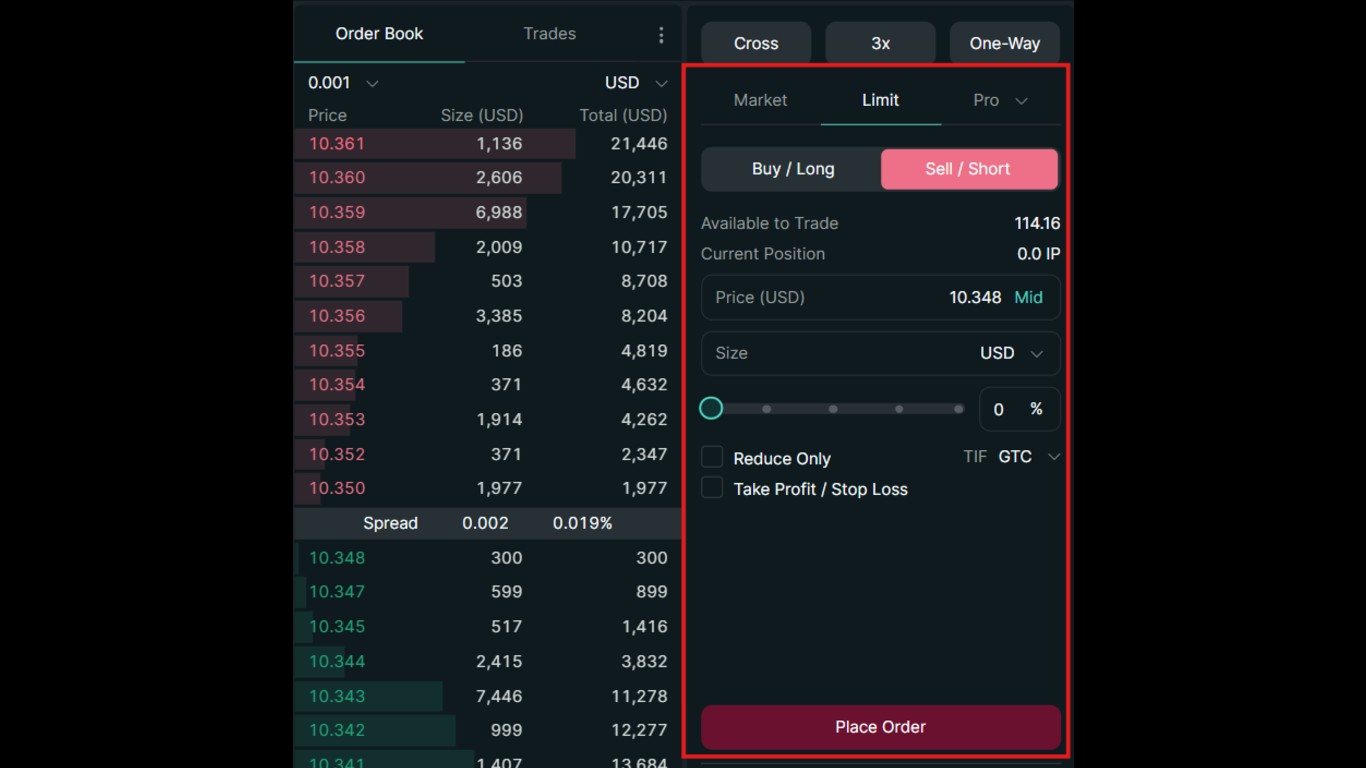

How to short: The best market to short IP is on Hyperliquid.

- Go to Hyperliquid and deposit USDC

- On the token selector, choose IP/USD

- Leverage is set to 3x (this is max on Hyperliquid) by default. Note, higher leverage increases your risk of liquidation, but generally, we consider 3x to be a reasonable leverage to manage.

- Click on "Limit" and then on Sell/Short tabs.

- Choose a price you want to sell short the asset, and the size of your short

- Click place order

- Your order will be filled when the asset touches the price you set for the short

- Congrats, this is your short position.

- Important: We are not taking the trade right now. The overall market is leaning bullish. We will short the asset when the timing is right. Stay tuned!

M (MemeCore)

The next asset we're looking to short is $M (MemeCore). MemeCore is a Layer 1 blockchain designed specifically for "Meme 2.0." It's an EVM-compatible chain, similar to Avalanche or HyperEVM. However, despite being a standalone L1, the native token $M is issued on Binance Smart Chain and listed on Binance's centralised exchange. This is quite unusual, as native tokens are typically minted on their own chains rather than on third-party platforms.That said, we still looked into MemeCore, and it's a ghost town. Often, there are no transactions at all, and most of the activity appears to be wash trading.

Wash trading transactions on MemeCore

Furthermore, the asset isn't listed on any established data platforms such as DeFiLlama or Token Terminal. Even the official website is slow, laggy and unpolished. We believe there is no real product behind the project, and the market simply doesn't need yet another L1 with no product-market fit.Additionally, $M is another example of a "low-float, high FDV" token, meaning there is a massive supply overhang. As shown in the vesting schedule below, there will be significant structural selling pressure over time.

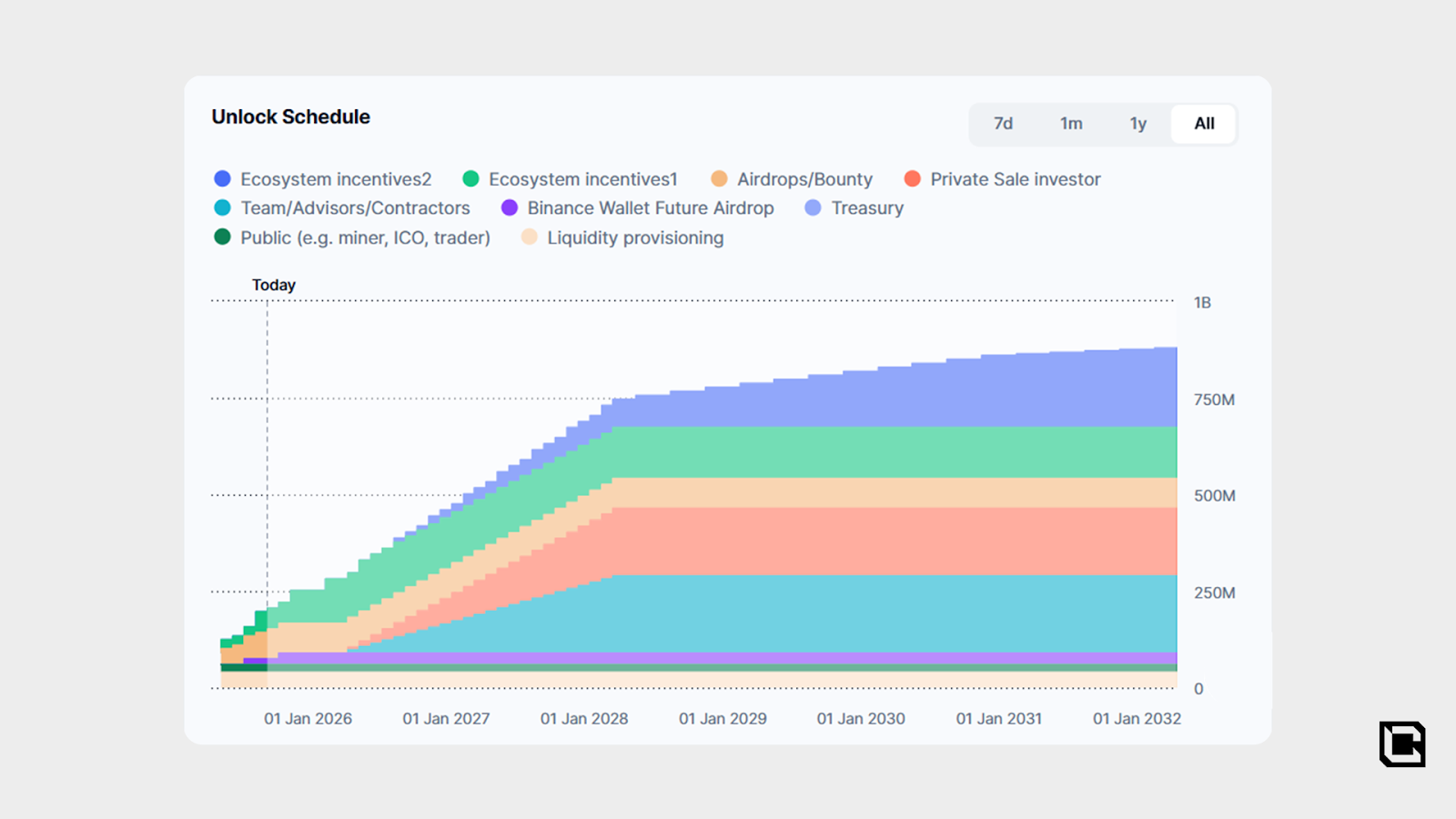

M's Vesting Schedule

However, despite all of this, the price has recently exploded without any meaningful catalyst. $M is currently valued at over $25 billion in fully diluted value (FDV) and $3 billion in circulating market cap. This is an absurd valuation for an L1 asset with no real adoption, product or utility. Similar to other tokens on our watchlist, we believe $M is being artificially propped up and manipulated by market makers on Binance. This is not an organic price action of an L1, and we think it will spiral down to zero when the market shows any structural weakness.

M's Price Action

Cryptonary's take: Same story here: assets that are artificially propped up and manipulated almost always end up spiralling to the downside. As such, we are actively monitoring $M for short opportunities – but, again, timing is crucial.Shorting in a broadly bullish market is extremely risky, so we are not rushing into this trade. Instead, $M remains on our watchlist, and when broader market conditions begin to weaken, we will short this asset with conviction.

MYX (MYX Finance)

Last asset we are watching for a short: MYX. MYX Finance is a derivatives exchange (DEX) built on Binance Chain (Previously Binance Smart Chain). On the surface, it might seem like regular perps exchange with working products and users. However, what is different here is that MYX is valued at over $10 billion fully diluted market cap, and over $2 billion circulating. This is massive; we were surprised it flew under our radar.We expected it to be generating a ton of revenue and fees to justify such a high valuation. But frankly, it isn't worth even $10 million mcap, let alone $10 billion. We obtained the latest Income Statement for MYX Finance, and the reality is staggering:

MYX Finance: Income Statement

The average quarterly earnings are around $10,000, which is approximately $166 per day. This is a major red flag. It strongly suggests that the reported $98b volume is being manufactured, likely through wash trading, to create the illusion of product-market fit and traction. Real volume would have correlated with meaningful fee generation. In this case, it simply does not.So, despite being marketed as a high-growth DeFi Perp DEX, the protocol is essentially not generating any meaningful income. And yet, it's been given a $10B+ fully diluted market cap (FDV), which is a valuation higher than protocols like Uniswap, Jupiter, AAVE, which have tens of millions in quarterly earnings and real user demand.

Furthermore, similar to IP and M, the tokenomics of MYX are aggressively unfavourable to long-term holders. MYX is low-float with massive supply overhang: over 80% of tokens are still locked and will gradually be released to the market.

MYX Vesting Schedule

Despite these critical flaws, the token has recently done over 1,500% out of nowhere. We believe the tokens are being manipulated and propped up just like what to LAYER, BERA, OM, IP and M. No way, the asset that has generated around $10k in earnings during the whole quarter should be valued at $10b. We believe Market Makers on Binance (MYX is listed there) squeezed the shorts there to extract liquidity from this market.

MYX's Price Action

Cryptonary's take: As we've seen time and time again, unsustainable rallies with no earnings, weak fundamentals, and aggressive dilution eventually revert:- Price could crash 80-90% overnight

- Or enter a slow bleed over months

- But in either case, the destination is the same

However, despite our conviction, this needs to be timed well. We expect the next 6 to 9 months to be bullish. You don't want to be short in bullish environments. However, if the market turns, we will short this asset with size.

This is shaping up to be one of the cleanest asymmetric short setups along with $M and $IP. Again, timing is important here. We will post on our website and Cryptonary's trade channel when we take this trade.

How to short: The best market to short both MYX and M is on Binance.

- Go to Binance and deposit USDT

- Transfer USDT from Spot to Funding

- On the token selector, choose MYX or M

- We generally use small leverage (up to 3x)

- Click on "Limit" and then on Sell/Short tabs.

- Choose a price you want to sell short the asset, and the size of your short

- Click place order

- Your order will be filled when the asset touches the price you set for the short

- Congrats, this is your short position.

- Important: We are not taking the trade right now. The overall market is leaning bullish. We will short the asset when the timing is right. Stay tuned!

Closing thoughts

We believe these three assets — $IP, $M, and $MYX — will eventually follow in the footsteps of LAYER, OM, and BERA, trending to zero or close to it. Right now, they're trading at absurd valuations, likely due to artificial price manipulation and market maker-driven pumps.Interestingly, all of these tokens are listed on Binance, which may explain the aggressive short squeezes and retail traps we've observed. But as we've seen time and time again, once the shorts are squeezed and liquidity is extracted, these types of assets tend to collapse.

That said, as we've emphasised throughout this report: timing is everything. This is not a call to short these assets immediately. In fact, it might be too early, as we expect broader market conditions to remain bullish over the next 6-9 months. We need to see signs of weakness in the market before executing these trades with conviction.

For now, these tokens remain firmly on our watchlist. And when the time is right, we'll share our full short entries, targets, and strategies on our website and in Cryptonary's Trade Channel.

Stay tuned.

Cryptonary, OUT.