The Privacy Meta: Zcash, Monero, and the Return of Hidden Money

Zcash turned an old idea into the newest narrative in crypto. After years of silence, privacy coins are back in the spotlight, reviving one of the industry’s original missions: making money truly private again. Zcash and Monero are at the heart of this mission. But which one will dominate the privacy sector? Let’s dive in…

In this report:

- Privacy coins are back. Here’s how and why

- The 2 assets leading this revival

- The key technological and ideological differences between them

- And finally, which one we’re choosing.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A quick primer

As crypto has been increasingly dominated by institutions and corporations, interest in privacy assets has been building throughout 2025. In our August report Betting on the Dark Horse, we highlighted Monero as an overlooked play and argued that privacy was evolving from a niche narrative to an essential escape route for those who still align with the original ethos of crypto. That view has since been validated.

XMR performance YTD

The inflection point came in late September when Mert Mumtaz, CEO of Helius Labs, posted a chart of Zcash with the caption “did you fade?” The post gained traction across Solana circles and was soon amplified by investor Naval Ravikant, who reframed the conversation with a single line: “Bitcoin is insurance against fiat. Zcash is insurance against Bitcoin.” That was pretty strong...That moment marked the beginning of the current privacy meta. Within days, the narrative spread across Crypto Twitter as Solana influencers, trading accounts, and meme pages coordinated to position ZEC as the next major rotation. What started as a philosophical statement quickly evolved into a full-scale market movement.

Zcash/USD price performance

By November, ZEC had surged more than 700% from its September lows, outperforming every major asset and briefly surpassing Monero in market capitalisation. The privacy sector as a whole has repriced higher as well.

The Return of Privacy

Privacy has always been central to crypto’s identity and the earliest vision of it was rooted in privacy and autonomy. The word “crypto” means hidden or secret, yet transparency became the necessary compromise that made public blockchains work.

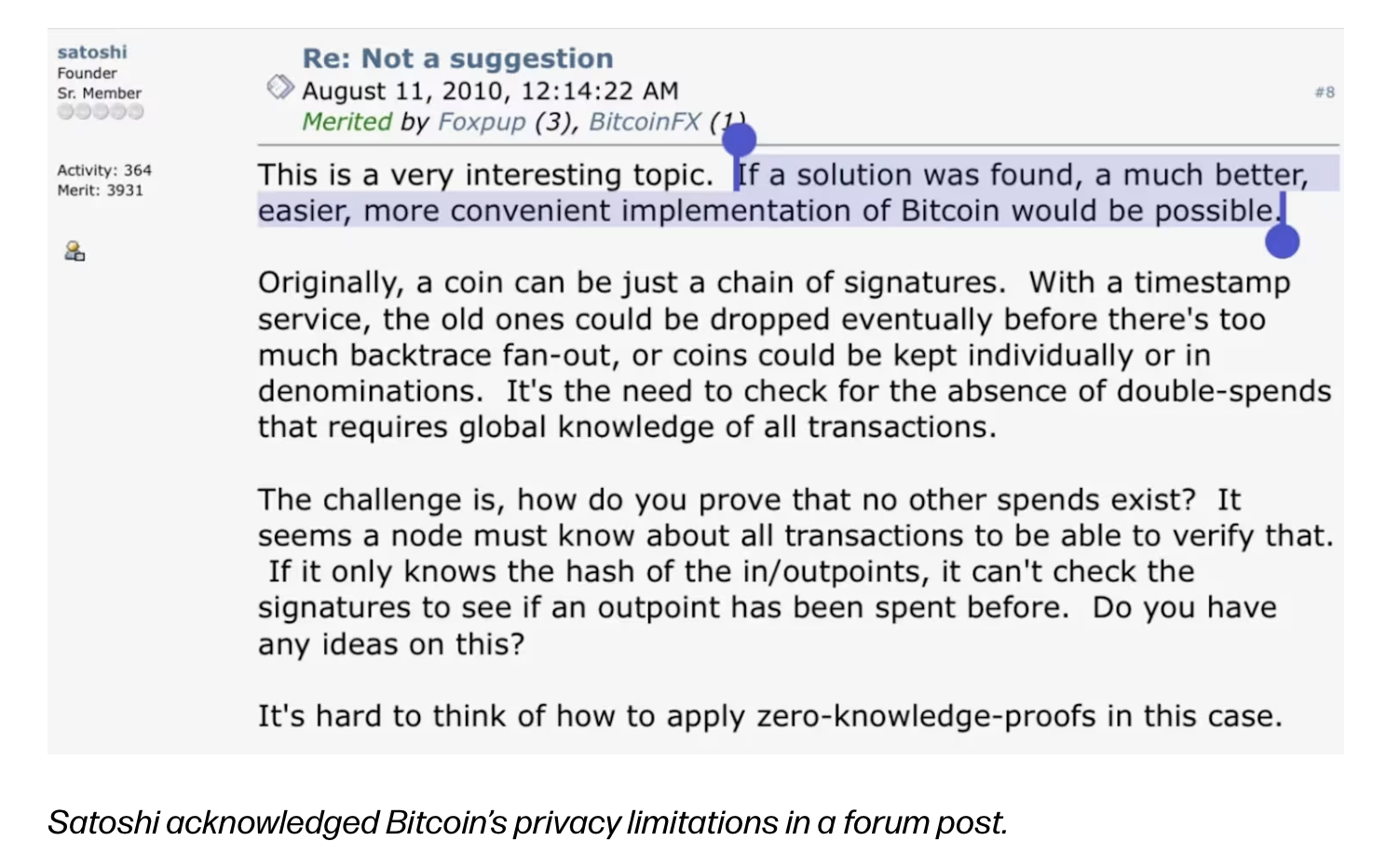

Satoshi Nakamoto acknowledged this limitation in the 2008 Bitcoin whitepaper, warning that transaction inputs could expose ownership patterns. Over time, that weakness evolved into a systemic issue as governments and analytics firms began tracking flows across public ledgers with increasing precision. Attempts to reintroduce privacy through tools such as CoinJoin, Samourai Wallet, and Wasabi ultimately collapsed under regulatory pressure, leaving most Bitcoin transactions fully traceable.

Zcash was created to solve that problem at the protocol level. Introduced in 2016 as a fork of Bitcoin, it preserved Bitcoin’s monetary framework while using zero-knowledge proofs (zk-SNARKs) to verify transactions privately. This design directly addressed the transparency issue Satoshi identified more than a decade earlier.

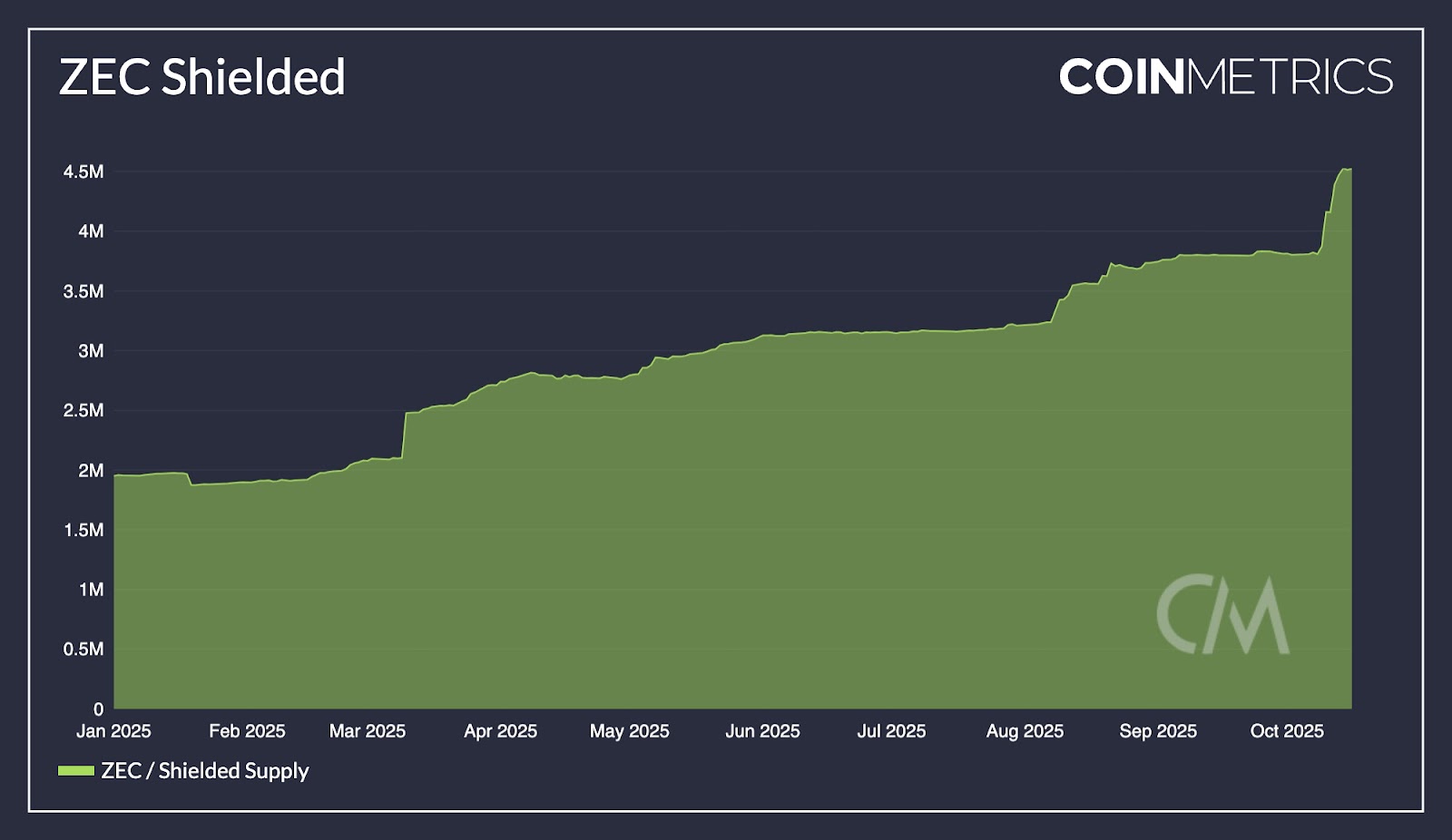

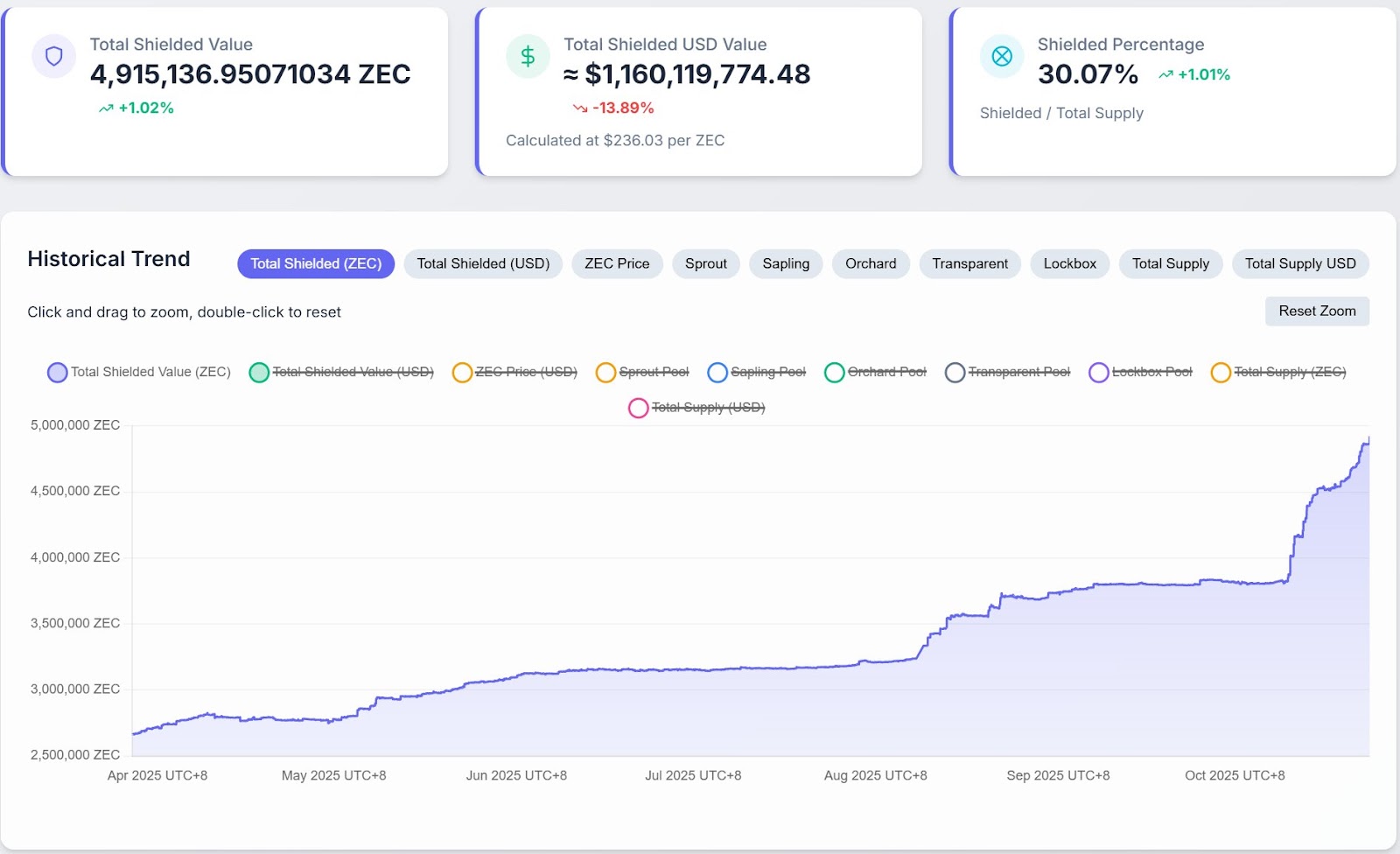

Number of shielded ZEC tokens

Network upgrades have strengthened that foundation. "Sapling" improved efficiency, "Heartwood" enabled shielded mining, and "Orchard" upgrade introduced modern private pools. Today, more than 4.5 million ZEC, roughly 25–30% of total supply, is held in shielded pools, while transparent supply has declined from about 14 million to 11.4 million coins.

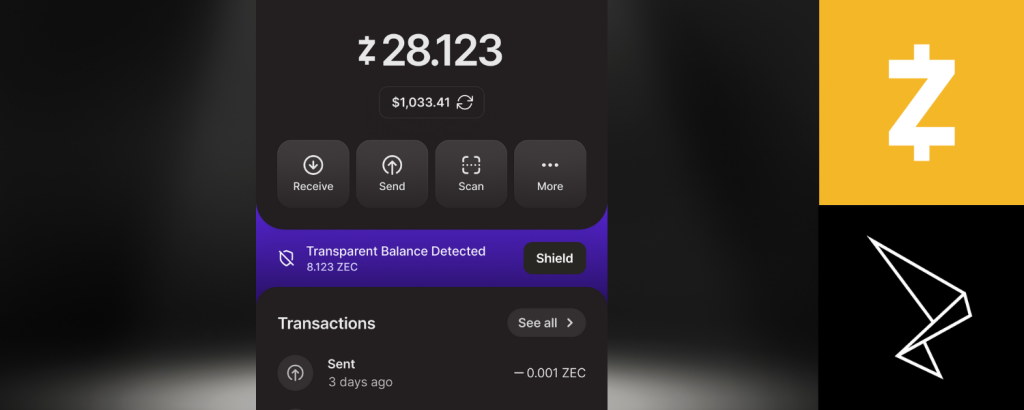

Zashi wallet interface

The 2024 release of the Zashi wallet simplified shielding through unified addresses that support both transparent and private transactions. Integration with Near Intents enabled seamless movement between networks, transforming Zcash from a theoretical privacy project into a functional cross-chain network.

Sector performance in crypto (1M period)

The broader environment has reinforced this shift. More than 130 countries are piloting or developing Central Bank Digital Currencies, raising concerns about programmable money and state-level control. In October 2025, the U.S. Department of Justice seized 127,000 BTC worth $15 billion from a criminal operation, showing how transparent systems can also enable surveillance. Against this backdrop, demand for privacy has grown sharply. The combined market capitalisation of privacy coins has risen more than 70% year-to-date, reaching roughly $25 billion by early November.

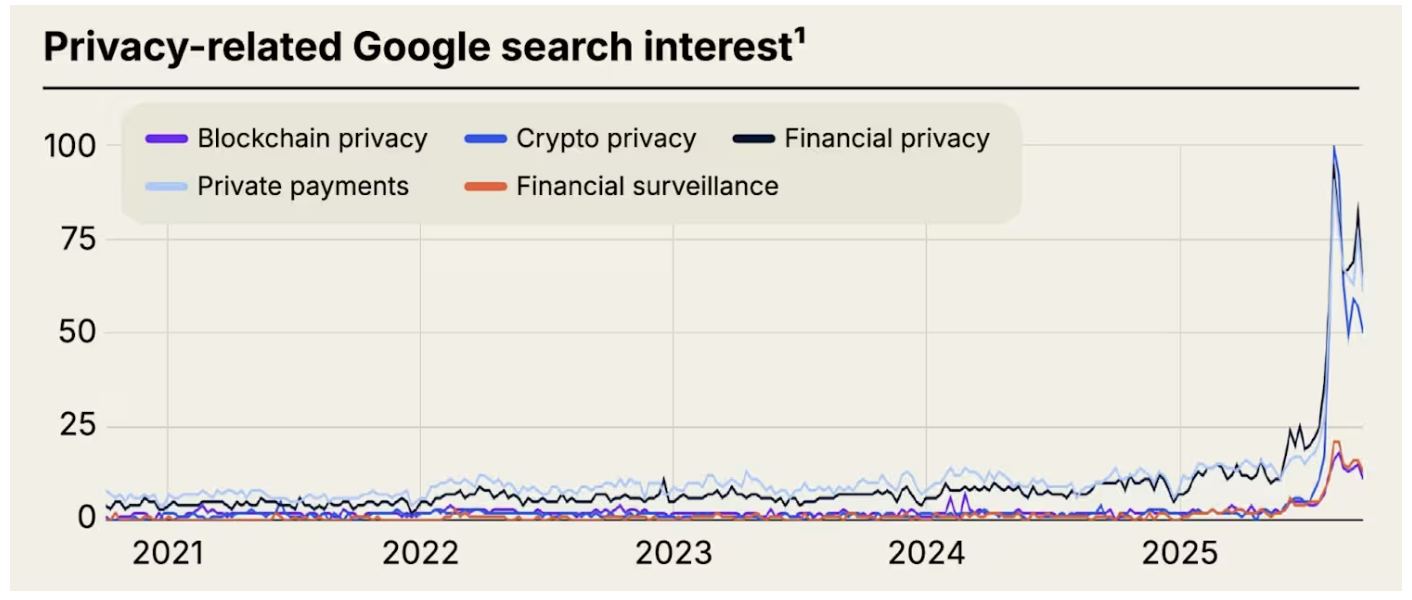

Privacy-related Goggle searches

Zcash has become the emblem of that rotation. Institutional interest through the Grayscale Zcash Trust surged to $165 million in assets, with a 919% rise in NAV over three months. In an age where surveillance and data collection are routine, the return of privacy represents the renewed emphasis on privacy and it is what we, as a society, need. It signifies a structural realignment with the foundational vision of crypto and a rebellion against banks, governments and corporations.How a Narrative Sent ZEC Parabolic

Zcash’s rally was driven by a combination of social amplification and genuine technological progress. Once discussions around privacy began circulating, the Solana community accelerated the narrative since Zcash community has build a bridge to Solana via Near intents.Prominent accounts such as Ansem and ThreadGuy repeatedly promoted ZEC, framing it as the next major rotation. Even Solana co-founder Anatoly Yakovenko joined in, publicly referencing the movement and giving it further legitimacy.

This concentrated attention gave ZEC access to one of the most active and coordinated trading ecosystems in crypto. Solana’s culture of rapid liquidity movement and collective sentiment turned ZEC into a high-velocity trade. What began as a dormant narrative was repackaged through Solana’s network effects, reaching traders who had previously ignored privacy assets.

Technical progress reinforced the trend. Integrations through Near Intents and Raydium connected ZEC to Solana’s DeFi ecosystem, providing cross-chain liquidity and easier access to shielded transactions.

Historical patterns played a role too. Privacy coins have often rallied late in market cycles, when traders seek discretion and reduced traceability. Both Monero and Zcash experienced similar surges in 2017 and 2021, reflecting a tendency for capital to rotate into privacy assets near euphoric peaks. The current cycle appears to mirror that behavior, though, we still expect bullish EOY and Q1 2026.

Zcash’s rally was driven by real upgrades, amplified attention from Solana’s community, and late-cycle investor behavior that pushed privacy back into focus.

Monero vs Zcash: Two Philosophies of Privacy

We were anticipating this narrative well before it became a thing. Back in August, we expected the privacy sector to take off but we aligned with Monero as a bet on the privacy sector.

Both XMR and ZEC are currently the biggest but ideologically different privacy coins in the market. It’s interesting that the competition between Monero and Zcash defines the modern privacy spectrum in crypto. Both were built to protect financial confidentiality, yet they differ fundamentally in how they achieve it and what they believe privacy should represent.

Core differences between Monero and Zcash

Monero, launched in 2014, enforces privacy by default. Every transaction is shielded through ring signatures, stealth addresses, and confidential proofs that obscure senders, receivers, and amounts. This approach guarantees anonymity and fungibility but limits interoperability. Its rigid structure appeals to privacy purists and those focused on censorship resistance, though regulatory scrutiny and exchange delistings continue to limit accessibility.Zcash, introduced in 2016, gives users flexibility. It uses zero-knowledge proofs (zk-SNARKs) to verify transactions without exposing details, allowing transfers to be either transparent or shielded depending on user preference. Institutions can use viewing keys for audits, combining confidentiality with accountability. This hybrid model makes Zcash easier to integrate across financial systems and more accessible to everyday users. For many, this sounds like a good balance of trade-offs.

Monero and Zcash both use proof-of-work (PoW) consensus mechanisms to secure their blockchains with slightly different mining algorithms.

The difference extends beyond technology. Monero views privacy as a right that must never be compromised, while Zcash treats it as optional and a tool that must function within interconnected systems. Monero’s privacy is default and enforced on a protocol level. Every transaction is private — no exceptions. Zcash gives freedom to choose whether your transactions are private. Many critics of Zcash argue that true privacy isn’t optional but should be provided as default, reinforcing the view that optional privacy isn’t privacy.

Indeed, Edward Snowden once said “Arguing that you don’t care about privacy because you have nothing to hide is like saying you don’t care about free speech because you have nothing to say.”

The results reflect those ideologies. Roughly 30% of ZEC activity now occurs in shielded pools (private transactions), compared to Monero’s full default privacy.

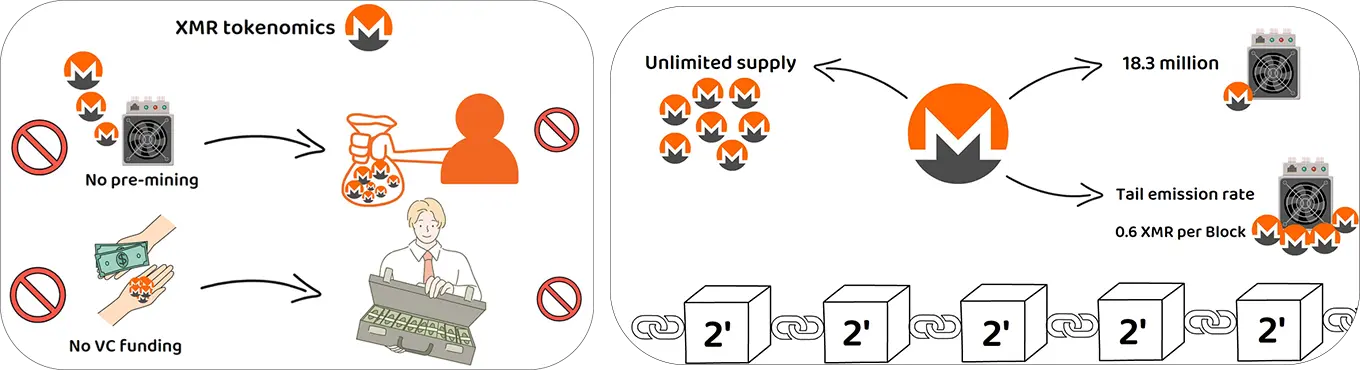

Furthermore, the differences in ideologies are also reflected in tokenomics of these assets. Monero has an infinite supply with a tail emission similar to Ethereum and Solana. The network emits 0.6 XMR per block (approximately 0.87% annual inflation, decreasing over time) ensures miners are incentivised to secure the network indefinitely, preventing a “security budget” problem (where declining rewards reduce network security, as seen in some PoW coins including Bitcoin).

No pre-mine, initial coin offering (ICO), or founders’ fund. All XMR is distributed through mining, aligning with Monero’s decentralised ethos.

In contrast, Zcash has a hard cap of 21 million ZEC. The network uses a halving-based emission schedule, with block rewards halving every ~4 years (similar to Bitcoin). The most recent halving occurred in November 2024, reducing the block reward from 3.125 ZEC to 1.5625 ZEC per block.

Unlike Monero or Bitcoin, Zcash has less organic distribution. For the first four years (until the first halving in 2020), 20% of block rewards (10% of total supply over time) went to a founders’ fund to support development, research, and the Electric Coin Company (ECC). This amounted to ~2.1 million ZEC allocated to founders, developers, and early investors. This raises questions whether ZEC is actually aligned with true cypherpunk values of crypto.

The 21 million ZEC cap definitely creates scarcity, appealing to investors who value assets with fixed supply. However, as the emissions halve every 4 years, there is a growing concern whether miners will have enough incentives to keep securing the network if the adoption of the platform (transaction fees) doesn’t grow in commensurate rate

Despite this, the market rallied behind Zcash in the last couple of months and Zcash briefly surpassed Monero in market capitalisation, with approximately $6.39 billion compared to Monero’s $6.1 billion.

Despite the rally being caused by few influential people publicly endorsing Zcash, the rise of the privacy narrative is a positive shift for the whole market and the right path forward.

Cryptonary’s Take

After years on the periphery, privacy coins are back as one of the best performing sectors of the last few months. Zcash and Monero, two projects long associated with crypto’s privacy ideals, are once again at the forefront of discussions about financial confidentiality, data ownership, and the meaning of “crypto” itself.This meta has brought the market back to crypto’s foundation. Zcash represents the evolution of privacy into a modern and usable form with serious backing from influential figures but sacrificing true ideals of privacy. Monero, on the other hand, continues to serve as the uncompromising core, preserving total anonymity for those who demand it.

Back in August, we saw Monero as a solid bet for a privacy narrative due to its strong privacy focus. When comparing XMR and ZEC, we are still leaning towards XMR as it is closer to true cypherpunk values of crypto in our view.

But rising tides lift all boats. As the industry moves closer to on-chain identity, institutionalisation, real-time surveillance, and CBDC deployment, the demand for privacy infrastructure will continue to increase whether you are privacy purist or okay with softer alternatives.

We think with the recent performance of ZEC, the whole sector will continue its repricing over time. Flushouts or corrections are possible but we are comfortable to say that this sector isn’t going anywhere mid-to-long term.

For now, we remain bullish on XMR and feel comfortable holding it mid-to-long term over ZEC.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms