And while problems are generally seen as bad things, there are good problems.

Having too many users is a good problem to have.

And right, one of our favourite DeFi ecosystems has run into one of the best problems a protocol can have.

The entrances are packed, and there is a bottleneck developing…. Something has to give.

Does it have what it takes to turn its current success into a stepping stone for bigger wins, or will it be a victim of its own success?

Let’s find out!!!

TLDR

- We've added Chainlink to the list of assets on our radar.

- THORChain saw an influx of users, but there's more to the story.

- Lybra's migration from V1 to V2 leaves some holders without a clear solution, with a proposal for migration with a 3% fee being considered.

- Solana experiences a surge in new tokens but without a corresponding increase in DEX volumes.

Disclaimer: This is not financial or investment advice. Any capital-related decisions you make are your full responsibility and yours only. The information made available in this report is NOT for replication. The purpose is to share the thought process behind our decision-making for entertainment purposes only.

State of the market

Before we dive into good and bad problems, let’s quickly touch on the state of the market.You’ll notice that we’ve added LINK to the list of assets.

Really, Chainlink should have been on this list the entire time. Well, this week, we published an alpha piece on Chainlink – you can find it here.

Read the report, and you’ll understand why LINK has more than earned its place on our watchlist!

Speaking of the watchlist, our latest market outlook suggests that base layers are falling out of favour/losing any momentum they had. Of course, there are outliers like SOL that contradict this outlook.

However, mediocre performance is still mediocre performance; thus, we have downgraded the base layer sector to a yellow rating.

The cross-chain comms sector has been thriving recently, and we would have loved to update that sector to green. The thing is, there have been a bunch of unflattering stories about many projects in that sector… sometimes, success comes at a price! So, the cross-chain comms sector retains its yellow rating in this report.

WTF happened to THORChain?

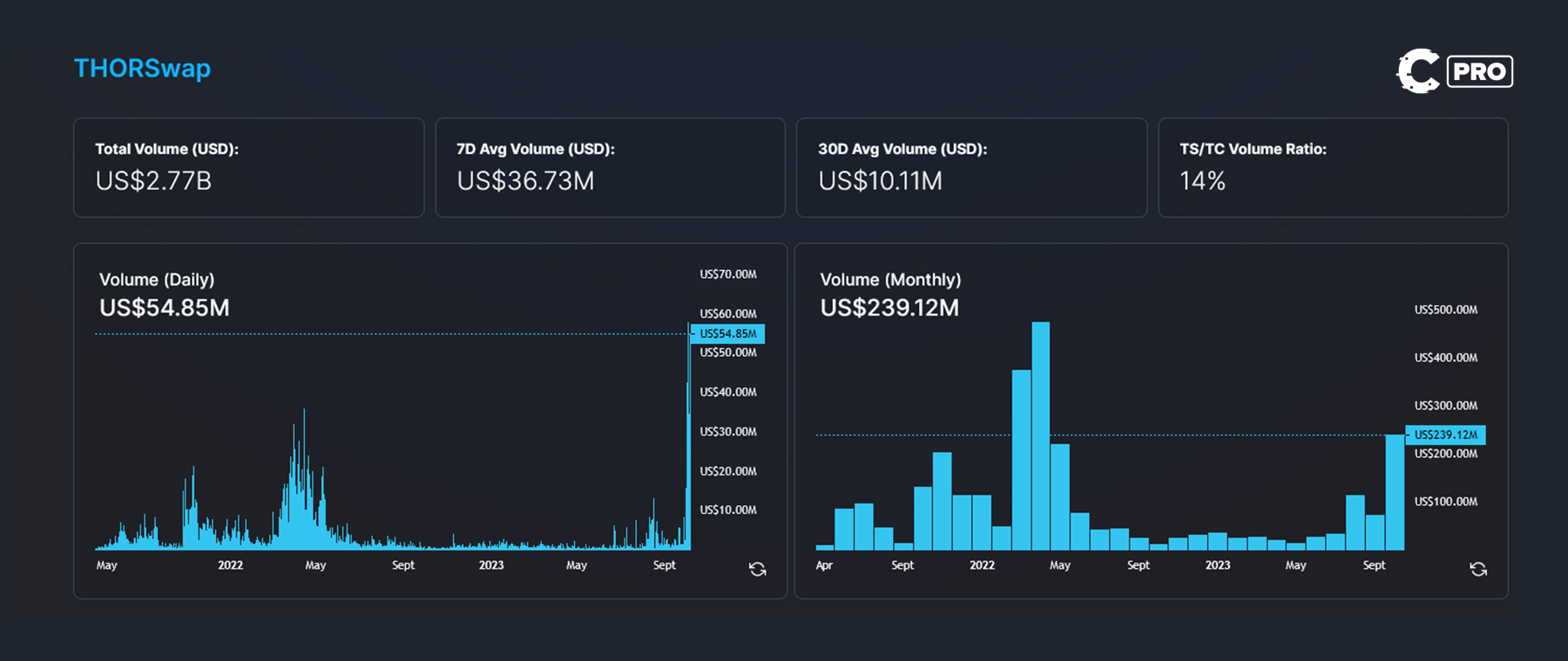

THORSwap and its token THOR have been notable performers in Cryptonary’s watchlist.But over the past week, that ecosystem has been in the news.

Let's start with the influx of transactions. Barely five days into October, THORSwap had processed 2.5x more volume than the entire months of August and September combined.

Now, this is good, right? Absolutely!

However, it appears this influx of transactions has strained THORSwap/THORChain’s infrastructure.

So, while having users flock to your protocol is great, it can be challenging if you don’t have the proper infrastructure to manage that uptick.

And then the bigger issue surfaced! It appeared that North Korea and Russia were using THORSwap to funnel stolen funds. At the very least, the FTX hacker was using the service.

With news breaking that hackers were funnelling stolen funds through Thor and protocol going into maintenance mode, it's been general mayhem for all involved.

Granted, THORChain was less affected due to decentralization. But reputation and node support may suffer in the short term.We wrote a detailed report highlighting what we know about the unfolding situation at THORSwap and what it could potentially mean for your portfolio. Read the report here.

Lybra inadvertently rugs their holders

Although not officially a part of our watchlist, we have interacted with LBR in the past through Skin in the Game.The recent migration from V1 to V2 has left a lot of holders high and dry.

Obviously, the idea of removing all LBR tokens that did not migrate from circulation is never going to be a popular option. Not least because 13% of the circulating supply across 2,000 wallets would be “rugged”.

The team is trying to come up with a new solution. If you hold LBR, we recommend reading this document here.

Key takeaways:

- Deleting V1 LBR tokens is not in the best interests of either the community or the protocol.

- A proposal was set out that will allow V1 holders to migrate to V2 for a 3% fee.

- The fee would be used to compensate LBR V2 stakers as the assumption would be that 13% of LBR tokens stuck in V1 would be staked and thus represent a loss of APY for current stakers.

Keep checking in to Discord for further updates, or drop us a message/email if this is you.

Solana's shitcoin season? Not really

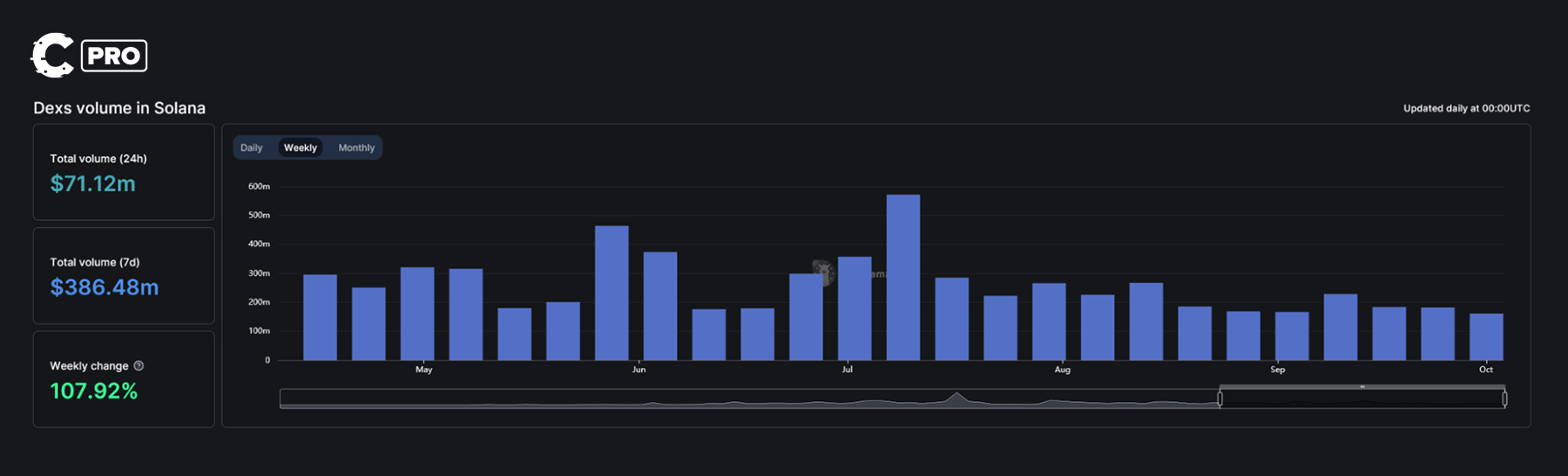

Over the last couple of weeks, Solana has seen a large uptick in the number of memecoins created.1700+ new tokens have been launched - an average of 243 per day over the last week.

However, this has not translated over to increased DEX volumes:

So, it’s fair to deduce that this is not a true shitcoin season - there’s no additional volume.

The key piece of news for Solana is that the validators have adopted v1.16.

This upgrade enhances the overall performance of the network. However, one key update is additional support for zero-knowledge math. This suggests that Solana is heading towards offering zk-tech natively.

What will come of this?

We’re not 100% certain yet, but they did mention that some features will be rolled out over time.

As we have stated time and time again, it really feels as if Solana is doing everything within its power to make the chain as marketable as possible. And to be a highly marketable chain, it all comes down to user experience and features.

Exciting stuff…

Cryptonary’s take

Overall, September was a relatively uneventful month for crypto in general. We expect UPtober to be much more eventful.Key assets to watch will be THOR and RUNE (when are they not good assets to watch?!) and a special emphasis on Solana.

For more information on individual assets, don’t hesitate to ask.

Additionally, we’ve rolled out our new analysis format. There, you can find out our thoughts on the market in real-time.

We have big things planned for our watchlist and portfolio…. Stay tuned!