The smart money's secret to Arbitrum!

In our last smart money piece, we followed the moves of some of the brightest investors in the game.

While last week's smart money focused on traders in the Ethereum ecosystem; we understand that the fees on that network makes it harder for regular people to break even.

Today, we're exploring an ecosystem with significantly lower fees.

However, we didn't pick a random chain. No ser! We are bringing you a chain that is leaving competitors gasping for breath. Drum roll – Arbitrum.

Since we are on about smart money, you’ll meet four traders who have been thriving in the Arbitrum ecosystem. Are you ready? LFG!!!

TLDR 📃

- The smart money has recently allocated significant funds to Mux Protocol and its MCB token.

- GRAIL, PENDLE, RDNT and GMX are noteworthy investments in the Arbitrum ecosystem.

- One trader has leveraged their portfolio with BTC loans.

- GND Protocol, a new project on Arbitrum, has attracted significant investment and is worth monitoring.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Smart money overview🔎

Quick gist on the smart money inflow. While most of the big bucks have been flocking to stablecoins like USDC, USDT, and ETH; MCB is breaking free from the crowd. In the past 30 days, smart money wallets have allocated $500K into Mux Protocol.Remember when we spilled the beans about MCB in our alpha report just last week? The smart money seems to be aligning with our killer thesis.

However, looking at the overall flow of funds, many people are playing it safe and cosying up to stablecoins. It seems smart money isn’t expecting major fireworks from altcoins right now.

Trader 1: Wildwood 🦉

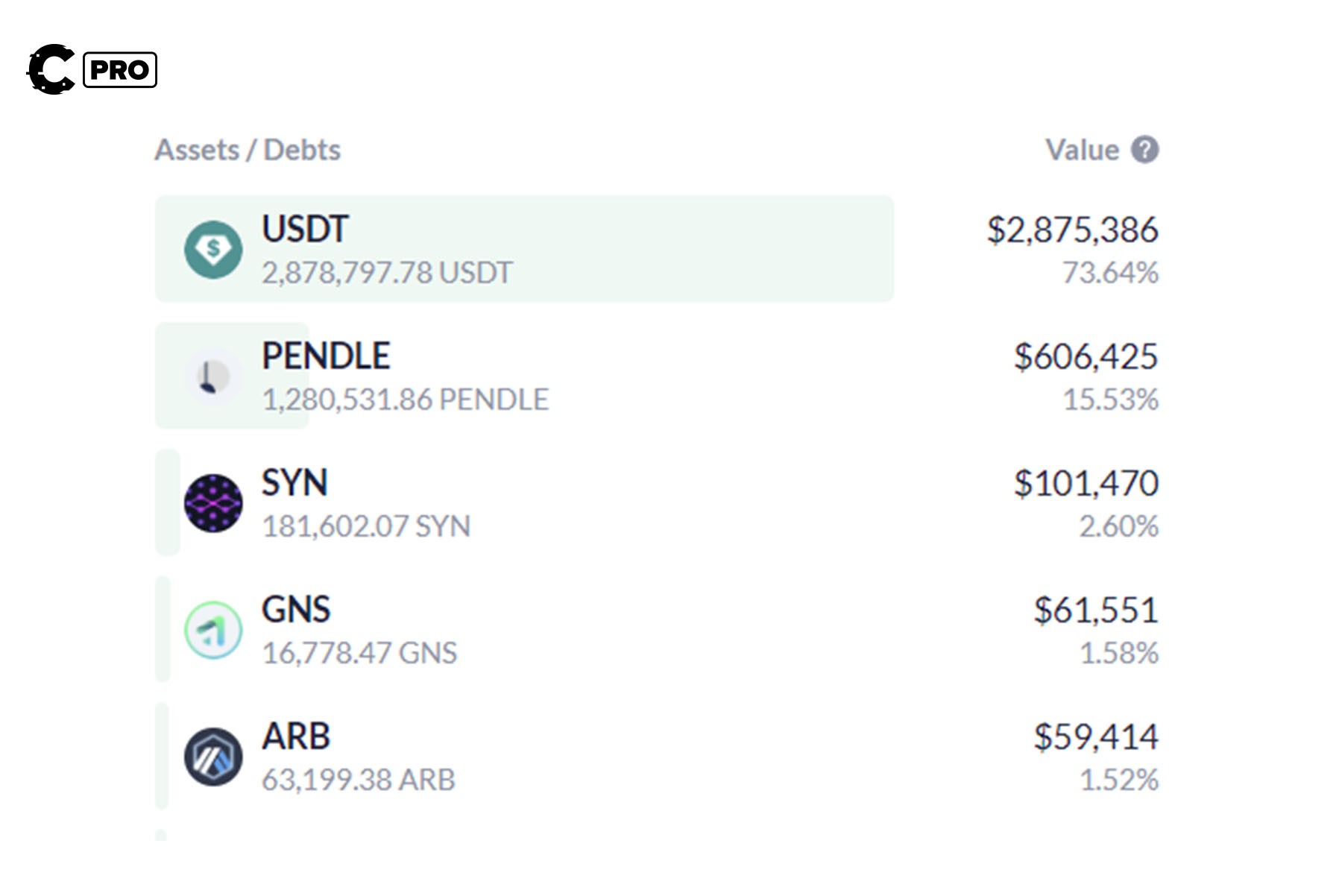

Wildwood is methodical and precise in his approach, much like how an owl gracefully hunts its prey. Unsurprisingly, his dollar-cost averaging strategy in 2022 has yielded significant returns. However, he has now taken most of his chips off the table, sitting at 74% USDT.- Net worth: $4,111,314

- 2023 ROI: 293.68%

- Style: Dollar cost averaging

- Wallet address: 0x698b9d56abec3faa97ffce6478a4c7ddbadd4116

- Top pick(s): PENDLE

Portfolio

Big wins

- Wildwood accumulated 1,861,973.7931 PENDLE and made a profit of $115,326.23 when he sold some earlier in the year.

- He still holds 1,280,124.173 PENDLE tokens, which are worth $606,425, resulting in a net profit of $450,867.23.

- He bought $181,144.51 worth of GMX and sold his position for $487,401.48 to mark a net profit of $306,256.97.

Strategy

Wildwood is no stranger to taking risks, even if it means being a tad too early to the party. He took a risk on GMX in 2021 and early 2022.Though he eventually sold his GMX, he still keeps the faith in PENDLE, which happens to be his biggest altcoin position. At Cryptonary, we've also written about PENDLE and invested in it through our Skin In The Game portfolio.

Apart from PENDLE, Wildwood isn't afraid to venture outside the Arbitrum ecosystem. Recently, he threw $100K into SYN (Synapse), representing a modest 2.5% of his overall portfolio.

The big driver is here is probably the upcoming Synapse Chain launch; we've written a lot about SYN ourselves.

Trader 2: Swiftclaw 🐆

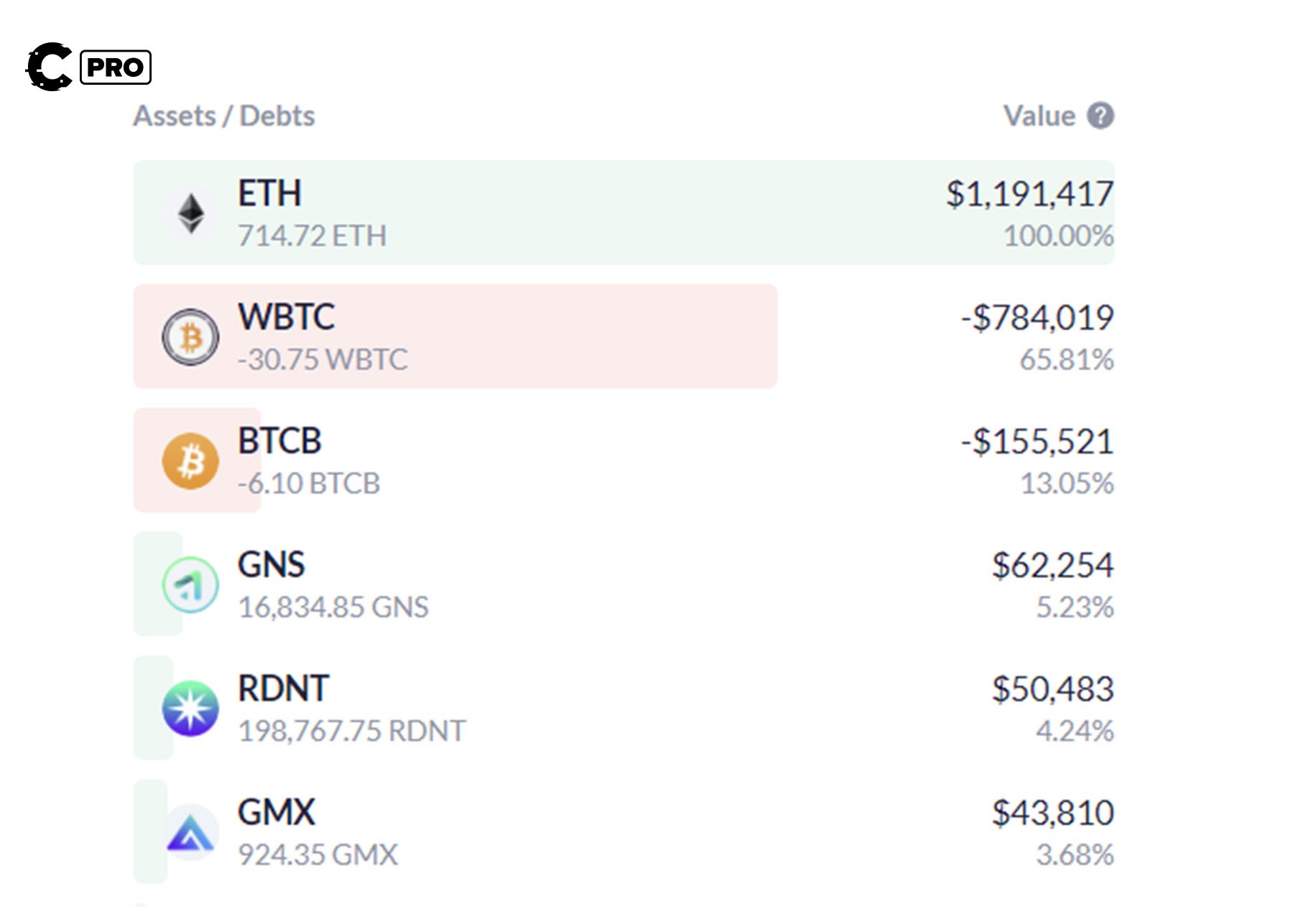

Swiftclaw is a swing trader who initially made money on early Arbitrum plays like GRAIL and GMX but has now changed his strategy. He has converted most of his portfolio into ETH and borrowed $963,761 worth of BTC against it to leverage up his portfolio.- Net worth: $464,172

- 2023 ROI: +539.8%

- Style: Swing trader & lending & borrowing capital

- Wallet address: 0x7b8cc1c88d1f754f51ae97a512c5212e27f9948b

- Top pick(s): BTC

Portfolio

Big wins

- The initial investment in GRAIL was $36,756, purchasing 37 GRAIL for $219, 21 GRAIL for $464, 14 GRAIL for $676, and 15 GRAIL for $627.

- He sold 87 GRAIL at an average price of $2,402.06, resulting in a profit of $209,191.21 and an ROI of 469.13%.

Strategy

Swiftclaw definitely made a killer move with GRAIL. They spotted the trend early and didn't hesitate to sell. However, their other altcoin trades didn't quite hit the same high notes. But you know where they really stood out? Leverage!Instead of going wild and buying every altcoin in sight, this trader decided to put the ETH they earned from selling GRAIL into a significant BTC position. Right now, they've got a whopping $963,761 loan in BTC, all collateralised by ETH.

Over the past four months, Swfitclaw has been steadily increasing his position by selling some of the borrowed BTC for a sweet profit. Then they convert those profits back into ETH and use it as collateral for even more BTC loans.

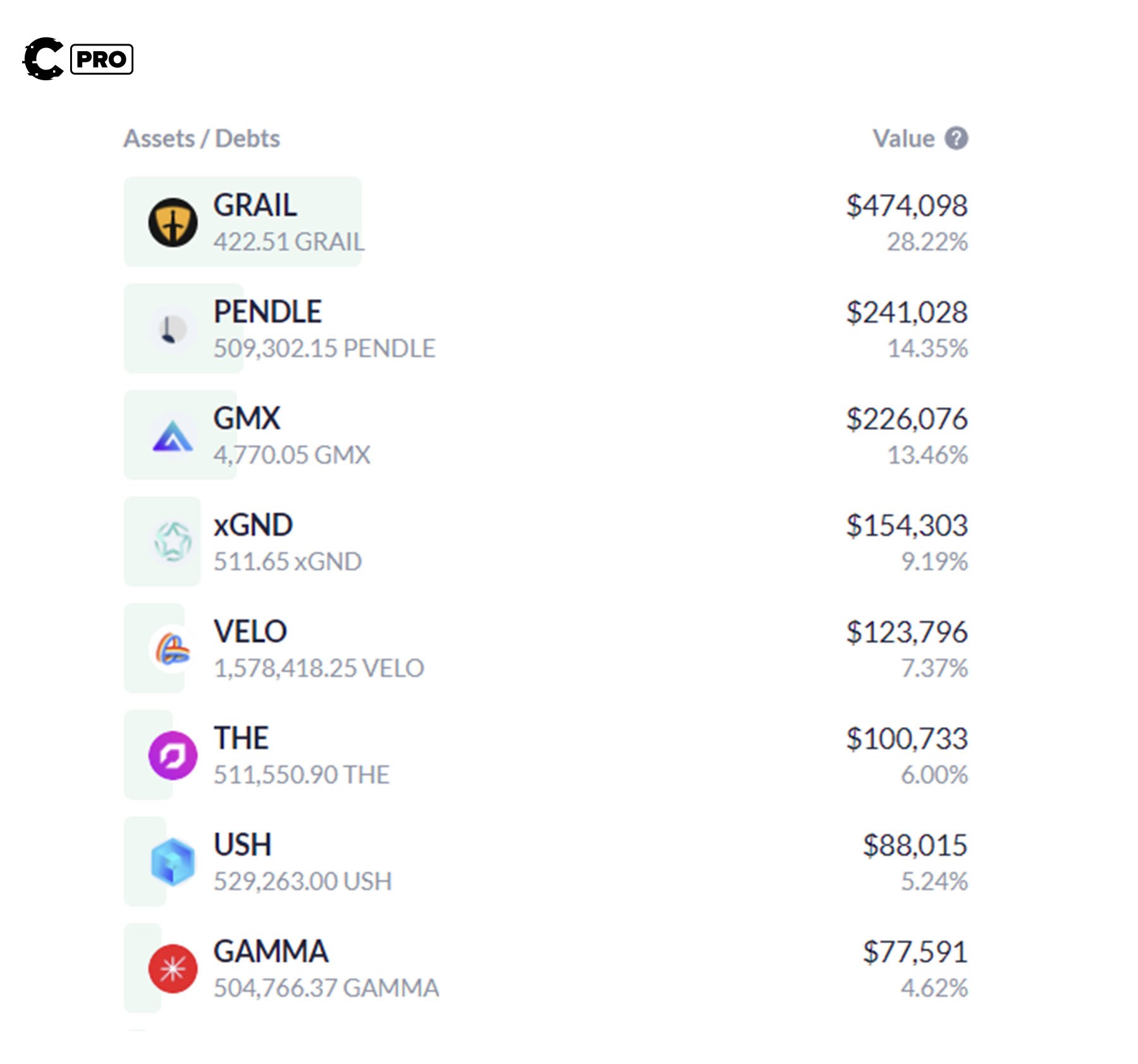

Trader 3: Raindancer 🐜

Raindancer maintains a balanced approach, investing in multiple assets like GRAIL, PENDLE, GMX, and GND, while also considering a hedge in Velodrome outside the ecosystem. She is building a long-term portfolio because she has chosen to retain all of her positions despite the market downturn.- Net worth: $1,616,624

- 2023 ROI: 154.33%

- Style: Long-term investor

- Wallet address: 0x133d93566f9699b3af46fe150daa8a67a9563ed6

- Top Pick(s): GRAIL

Portfolio

Big wins

- She bought 375 GRAIL at an average price of $237.70 per GRAIL, staking rewards brought the total amount of GRAIL up to 422 GRAIL. The pot is now worth $474,098, to give a 431.89% ROI.

- She bought 511 GND at an average price of $180, investing $91,980, now worth $154,303, resulting in an ROI of 67.76%.

Strategy

She's got a diversified portfolio.So far, GRAIL has been the shining star with the biggest returns. She's also been scooping up some PENDLE and GMX. Interestingly, she is eyeing GND, the native token of the GND protocol, even though it's market cap is just $30 million.

Now, stepping outside the Arbitrum ecosystem, her favourite pick is Velodrome. We have also written about Velodrome.

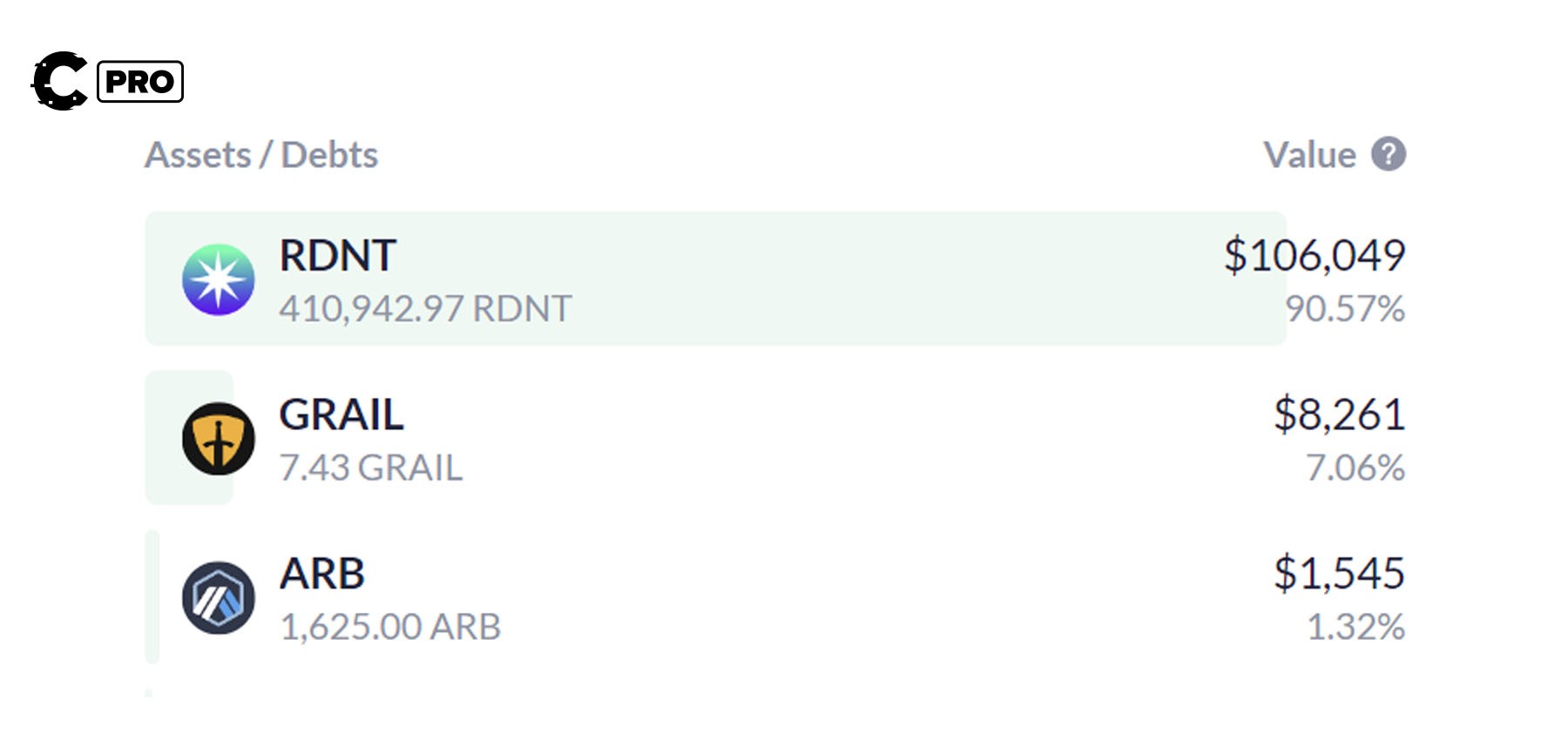

Trader 4: Steelheart 🦁

Steelheart is an ambitious and high-conviction trader who has achieved substantial returns with limited capital. They are known for their ultra-high conviction bet on RDNT, which led him to achieve a six-figure portfolio.- Net worth: $114,987

- 2023 ROI: +447.58%

- Style: High-conviction trader

- Wallet address: 0x24f137864874aca6626ed2655694b9f6d0ae26fd

- Top Pick(s): RDNT

Portfolio

Big wins

- They invested $17,455.64 in RDNT on 2 February for $0.0425, now worth $103,982, with an ROI of 495.69%.

- They invested $1600 in GRAIL at $239 on 7 December 2022, which is now worth $8,341 with an ROI of 421.31%.

Strategy

Steelheart was successful because they adopted the trend on Arbitrum early, becoming one of the first to invest in GRAIL. They later repeated this strategy with more capital on RDNT, to score significant returns. While they demonstrate talent in knowing what to invest in, you can also notice some rookie mistakes, such as holding 90% of their capital in RDNT.Cryptonary’s take 🧠

The traders we've analysed in the Arbitrum ecosystem have demonstrated diverse strategies. One trader has heavily allocated their portfolio to USDT, while another has shifted towards BTC and ETH, indicating a cautious stance in the current market environment.However, the most important point is their early adoption game and the unwavering belief in their chosen assets. PENDLE, in particular, has captured the hearts of these traders.

Additionally, we find GND Protocol intriguing, especially because of substantial investment from one of the traders.

How you follow the smart money depends on your unique circumstances, the most important question is this; how strong is your conviction?

Action points 📝

- Create accounts on DeBank or Zerion to track the wallets of these traders.

- Check out our research reports on some of projects profiled; including Synapse, Velodrome, and Mux Protocol.

- Got questions? Hit us up on Discord!

Cryptonary, out!