The S&P 500 of crypto: Revisiting JLP index

Chasing hype and timing the market usually ends the same way: stress, losses, and regret. But what if there was a way to capture the upside without the chaos? A strategy that mirrors traditional finance's most reliable wealth-building tool built for crypto? Let's dive in…

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Intro

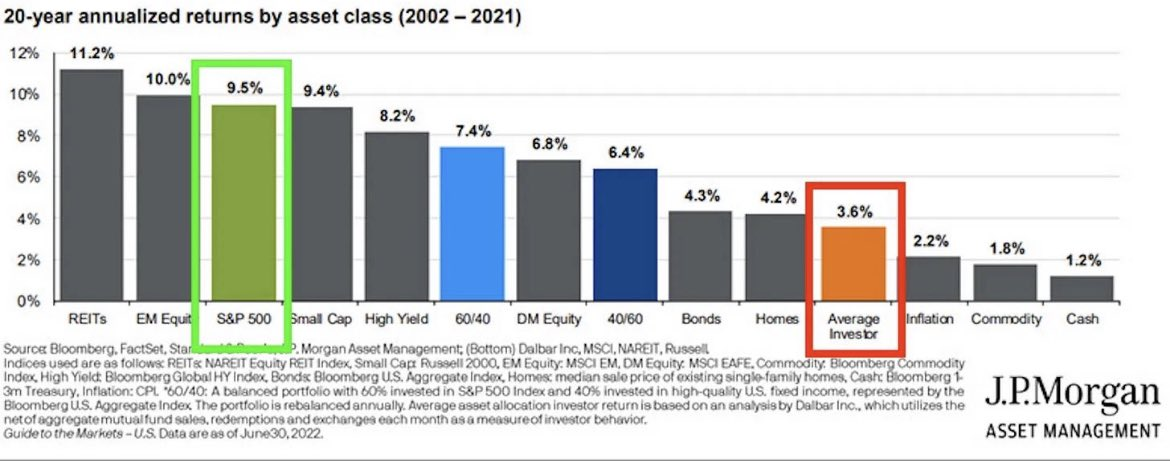

Beating the market is a brutal game-most don't win. Study after study shows the average investor chasing hot stocks, timing crypto pumps, or riding a few select assets ends up bruised and broke.Meanwhile, the slow-and-steady index approach like the S&P 500-diversified, unglamorous, reliable-keeps stacking gains with way less drama. It's not exciting, we get it, but it is what works for most people: lower stress, higher odds. That's the old-school wisdom in traditional markets.

Crypto, though? It's been missing a solid index play-something with a proven track record of outperforming BTC consistently. Newbies and busy folks with no time to track every market twitch could thrive with a strategy mirroring traditional markets' winning formula.

For years, that's been the gap: no crypto index has delivered the goods. Until now, maybe. Enter JLP, the Jupiter Liquidity Provider token. We dug into Jupiter last summer when markets were choppy, and back then JLP's streak was solid but the historical data was insufficient at the time.

Fast forward to today, and its case is looking a whole lot stronger. While BTC has increased 37% since last March, JLP has delivered double of that with a higher Sharpe Ratio. This means JLP had better risk-adjusted returns with less volatility and downside. Impressive, right? Let's see how it works…

The fundamentals: what makes JLP tick?

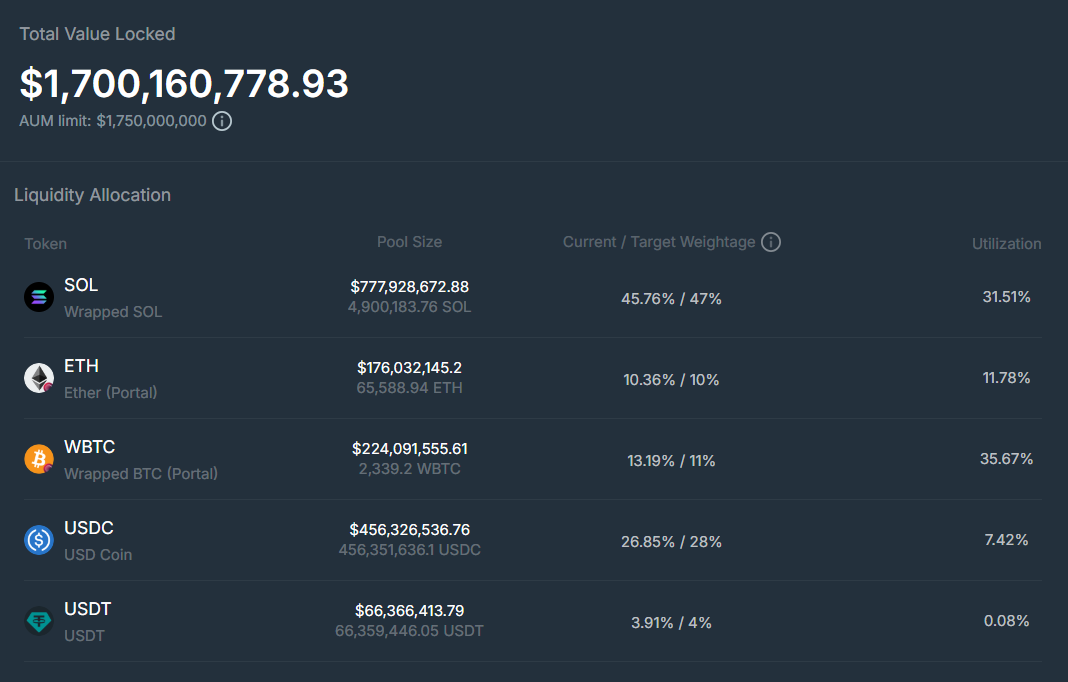

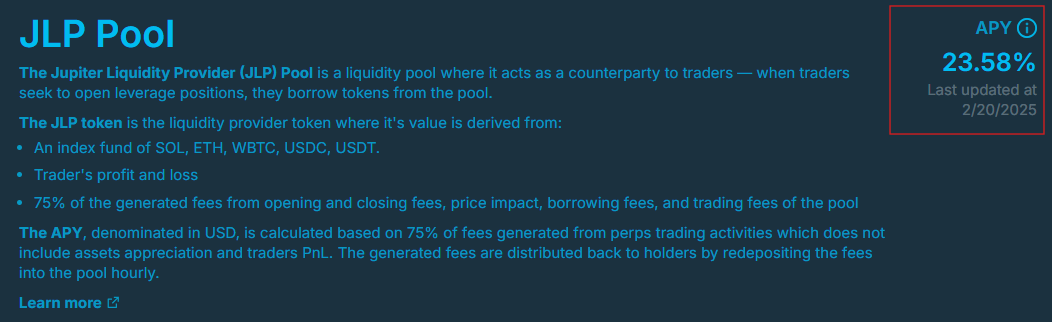

At its core, JLP is a liquidity pool token on the Jupiter Perpetuals platform, built on Solana. Think of it as a diversified basket of assets similar to the S&P 500. It consists of roughly 45% SOL, 10% ETH, 13% WBTC, and a hefty 30% in stablecoins like USDC and USDT.It's a balanced portfolio rolled into one token. But here's where it gets clever: JLP doesn't just sit there. It earns you a cut of the trading fees from Jupiter's perpetual futures exchange-75% of every opening, closing, and borrowing fee flows back into the pool. That's real yield, stacking more of the assets in the basket.

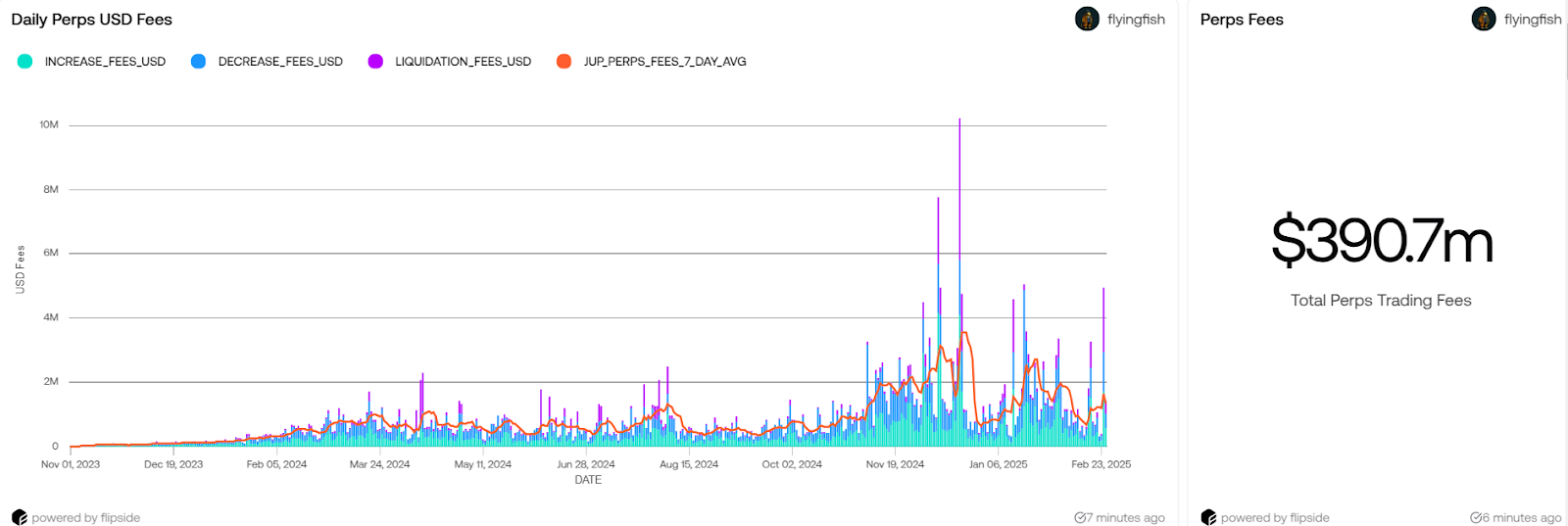

Traders borrow from the JLP pool to leverage their positions, and whether they win or lose, the pool keeps humming along. When traders profit, the pool takes a hit, sure-but historically, most traders lose in the long run (sorry, degens).

That means JLP holders often end up on the winning side of the house edge. It's like owning a slice of the casino instead of being the gambler sweating at the table.

Stress-free investing

We've seen too many investors burn out chasing the latest flavour of the week only to underperform BTC at the end of the day. JLP takes the edge off. You're not glued to charts, praying for the next pump. The diversified base and steady fee income mean you can park your money and let it work for you. No leverage, no liquidation risks, and no sleepless nights wondering if Trump's next tweet will tank your portfolio. It's crypto exposure with training wheels-still thrilling, but less likely to throw you off a cliff.The numbers back this up. As mentioned earlier, since early 2024, JLP has posted a 63% gain, while BTC has delivered only half of that. That's not blind luck; it's the structure doing its job. You get growth, yield, and a buffer against bloodbaths in one package.

How does it work?

Here's the rundown: you buy JLP through Jupiter Swap, and your investment gets you exposure to that asset mix plus a share of the fees. No need to stake or harvest yields manually-the profits are baked into the token's price, accumulating hourly as trading activity pumps cash into the pool.The current APR? A nice 23% as of late February 2025, though it fluctuates weekly based on trading volume and market conditions. What's powering this? The pool's stablecoin chunk-35% of its value acts as a shock absorber.

When SOL, ETH, or BTC take a nosedive, JLP doesn't crater as hard because a third of it is pegged to USD. Meanwhile, in a bull run, you still ride the upside of those crypto heavyweights, just tempered a bit by the stables. It's a hybrid that smooths out the ride without killing the gains, while also earning yield on top and outperforming BTC.

Risks to consider with JLP

This isn't risk-free though-nothing in crypto is. Here are some risks to consider with JLP- If traders suddenly turn profitable en masse, JLP's value could dip. But historical data (like FlyingFish's stats showing $390.7 million in fees vs. $13 million in trader losses) suggests the house edge ho

- Bridging adds another layer-ETH and WBTC come over via Wormhole, and if that bridge glitches or gets hacked (like its $320 million exploit in 2022), those assets could be stolen.

Bonus: Want to juice your JLP further?

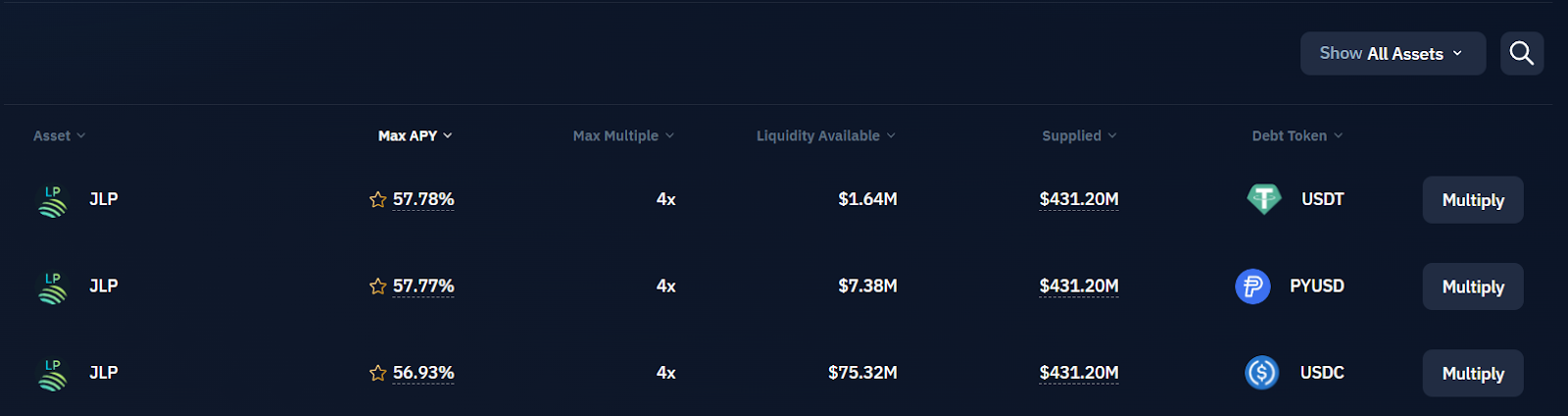

Enter Kamino, a Solana-based DeFi platform that lets you multiply your exposure. Here's how it works:You deposit your JLP into Kamino's automated vaults, which use a delta-neutral strategy to leverage your position by borrowing stablecoins against your JLP to buy more of it while earning additional yield from fees.

Kamino automates the whole process, aiming to boost your APR up to 57%. We have seen effective yields north of 100% in hot markets, though it scales with trading volume on Jupiter. Overall, You're still riding JLP's core strengths-diversification and fees-just with a bigger stake in the action.

You deposit, and it does the heavy lifting. No need to micromanage; it's built for the same set-it-and-forget-it crowd JLP attracts. But again, it's not a free lunch-leverage cut both ways. If JLP's value dips hard (say, from a trader win streak or market crash), your losses amplify too, even with hedges.

Liquidation is less likely than raw margin trading, but it's still a risk if volatility spikes. Fees (slippage) on Kamino nibble at profits too small, but they add up.

At the moment, we would be careful with leverage, but when there is a bottoming pattern in the broader market, leveraged JLP is a very cool way to supercharge your exposure to the market. Follow us closely on Market Directions and Market Updates for that….

Cryptonary's take

Right now, the market's a mess (good thing we are all in stables). Things are uncertain, leaning bearish, with BTC shaky and altcoins stumbling after 2024's run. Inflation is sticky, geopolitics are tense, and liquidity is constrained. Timing and picking winners feels like a coin flip for most average investors. We, at Cryptonary, always strive towards getting the timing and asset selection right, however, we do also understand for some, it might be easier to just ride the broader wave.An index approach, something like JLP, makes sense because it spreads your bets across majors and stables-no single crash wipes you out. It's even outperformed BTC over the last year. Plus, it's a sanity saver. You're not glued to screens, second-guessing every dip or sweating a bad call. It's stress-free investing-set it, forget it, and sleep at night knowing you're riding a broader wave.

However, at the moment, we do believe there is room for a deeper correction, and the JLP price will follow the market even though the impact will likely be mild. The best way to start getting exposure is when the market will start showing a bottoming pattern (We will be here to inform you about that).

However, if you are the kind of investor who checks up on the market once a month, it is a good idea to just set a DCA strategy and ride the broader trend since we still expect higher prices for majors by the end of the year.

Peace!Cryptonary, OUT!