This AI coin is in price discovery: Is it too late to join the party?

The AI market is projected to reach over $10 trillion by 2030, so it's no surprise that interest in AI-related projects and tokens is skyrocketing.

AI coins are gaining traction as the next big narrative in the crypto world. Many investors and traders predict that artificial intelligence will be the winning sector in the next bull run. Even Vitalik Buterin, the co-founder of Ethereum, recognises the potential value in Crypto x AI.

While some people are still sceptical about the practical applications of AI in the crypto world, we found an innovative project that offers a way to use AI-powered smart contracts to enhance efficiency in daily tasks. Unsurprisingly, this project has been one of the top performers in the market recently – it recently set new all-time highs and is now heading into price discovery.

Is it too late to join the party? Let’s find out.

TLDR

- Massive progress in AI development; interest in AI is skyrocketing

- This project intends to be the foundational layer for AI agents and startups

- There is a clear link between the success of the protocol and the value accrual of the token

- The sector is in the early stages, but competition is already heating up

- This project is a decent bet as a proxy for the AI narrative

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

AI is thriving

The release of ChatGPT in late 2022 marked a turning point in the AI industry, sparking a race among major tech companies to develop their generative AI models. The recent release of Sora AI also generated significant buzz and excitement about AI’s capabilities.Beyond OpenAI, NVIDIA’s progress in recent years with a focus on generative AI has led to the development of various AI tools revolutionising how we interact with technology.

And when you consider all these factors, you’ll understand why we highlighted Crypto x AI as a winning sector in our 2024 projections.

And as you probably already know, in crypto, money flows where attention flows.

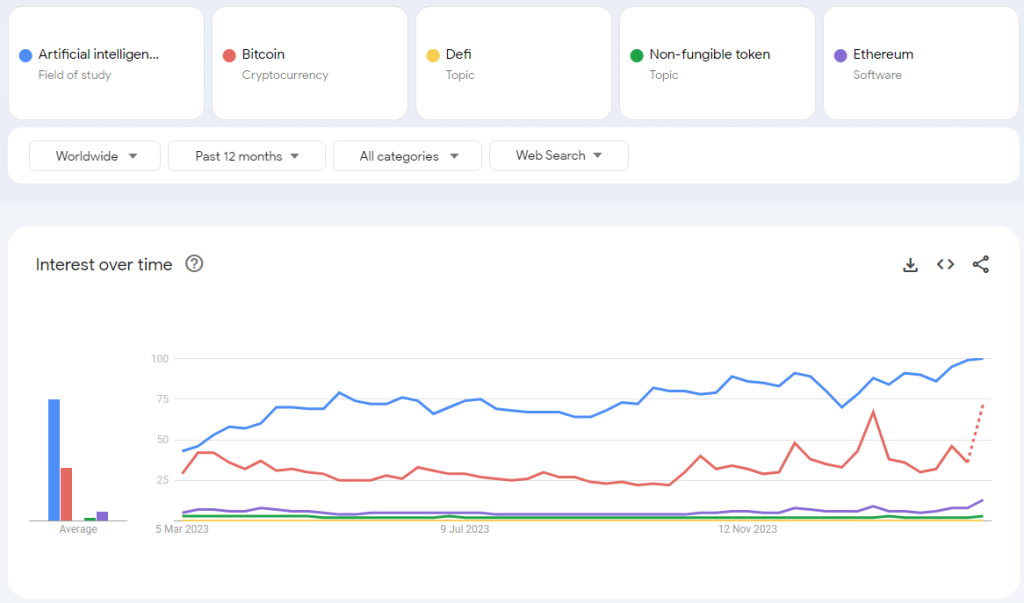

AI has been gaining huge attention recently – see Google trends below.

We can see from the chart above that during the last 12 months, interest in AI has been much bigger than in other crypto sectors.

So, if Crypto x AI is set to continue pumping, how can you profit from the narrative?

Cpro’s got you covered!

Here’s a deep dive into one of the recent winning AI coins in the sector

Introducing…

Fetch AI

Fetch AI combines blockchain technology, artificial intelligence, and machine learning to create a decentralised digital economy. This innovative ecosystem allows autonomous economic agents (AEAs) to interact with one another and make independent decisions on behalf of their owners.

Fetch AI empowers developers and organizations to bring legacy systems into the AI world without revamping their core API stack. OpenAI, WhatsApp, Slack, Discord, Google Calendar and more -- you can essentially leverage Fetch to transform all these into AI agents for your everyday workflow.

We wrote that we are bullish on AI and Autonomous Agents previously. If you missed that, have a look at our report on Olas.

In essence, AI agents can be considered as an evolution of smart contracts. While smart contracts simply define the rules of blockchain transactions, acting as trustless agreements between parties without intermediaries, AI agents are autonomous pieces of complex code that generate economic value without human intervention.

These agents can interact with one another and function based on pre-defined logic and real-time data, making them more versatile than smart contracts.

So, AI agents can be seen as a more advanced and versatile form of smart contracts, capable of generating economic value autonomously.

Fetch AI intends to be the foundational layer for AI agents and startups.

To fulfil this mission in March 2021, The Fetch AI team has launched its chain based on Cosmos SDK to host AI-powered applications.

Traction

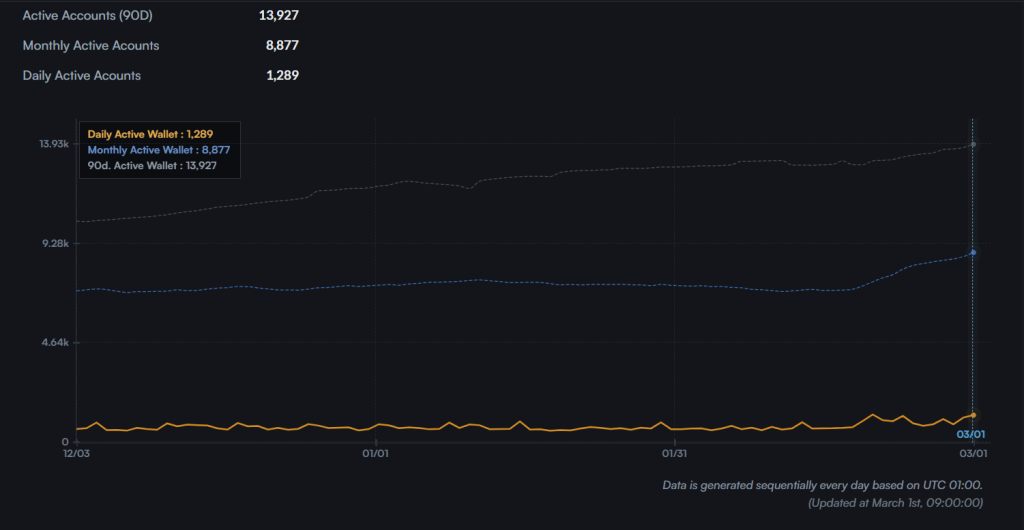

Seeing on-chain activity can show us how much adoption the Fetch AI’s agents are getting in adoption.Let’s look at the number of users:

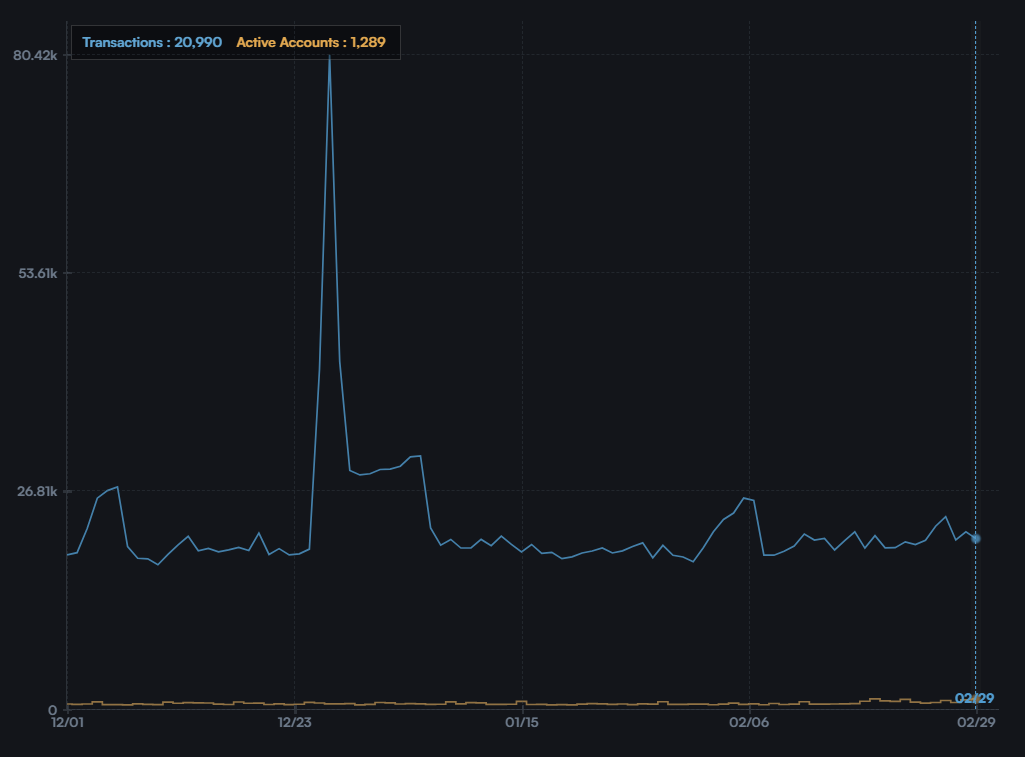

The trend has changed and started picking up in February. Number of users are growing. A quick caveat, though: despite the growing number of wallets, the number of transactions doesn’t show any sign of growth.

But the stagnating transaction count may improve soon enough. For one, to facilitate growth, Fetch AI has developed several tools and applications for developing and deploying Autonomous Economic Agents (AEM). It also has an Open Economic Framework (OEF), which provides a decentralised search and discovery mechanism for agents to find and connect.

Additionally, Fetch AI has recently launched AgentVerse.

The Agentv=Verse is a Software as a Service (SaaS) platform for creating and registering AI agent solutions. It provides a user-friendly environment for developers to build, test, and deploy AI Agents that can interact with the Fetch.ai ecosystem and other AI Agents.

The Agentverse simplifies developing and managing AI Agents by offering a range of tools and libraries for building, training, and integrating agents into various systems.

We can see from their explorer that there are over 100 agents with at least one interaction.

Tokenomics

- Token: $FET

- Circulating mcap: $1.3b

- Fully-diluted mcap: $1.9b

- Max supply: 1,152,997,575 tokens. This total supply is distributed across three networks: Ethereum, Binance Smart Chain, and the Fetch.AI Mainnet.

Use cases

The $FET token serves multiple purposes within the Fetch.ai ecosystem. It is used as a means of payment for AI services, staking, and participating in the network's governance. Additionally, AI agents need to deposit FET to be able to operate within the network.This wide range of use cases ensures the token’s value is directly tied to the network's success.

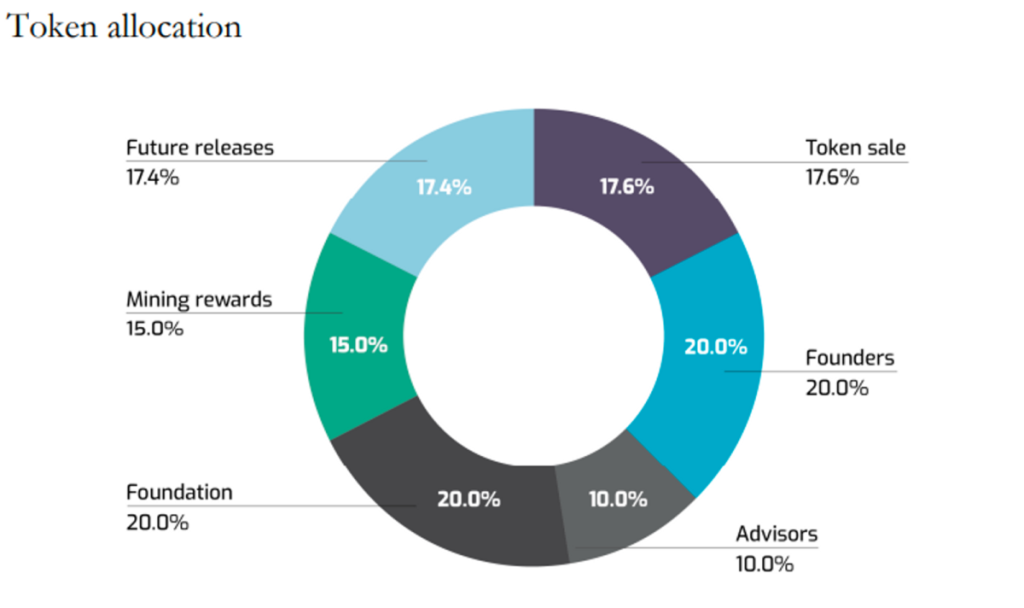

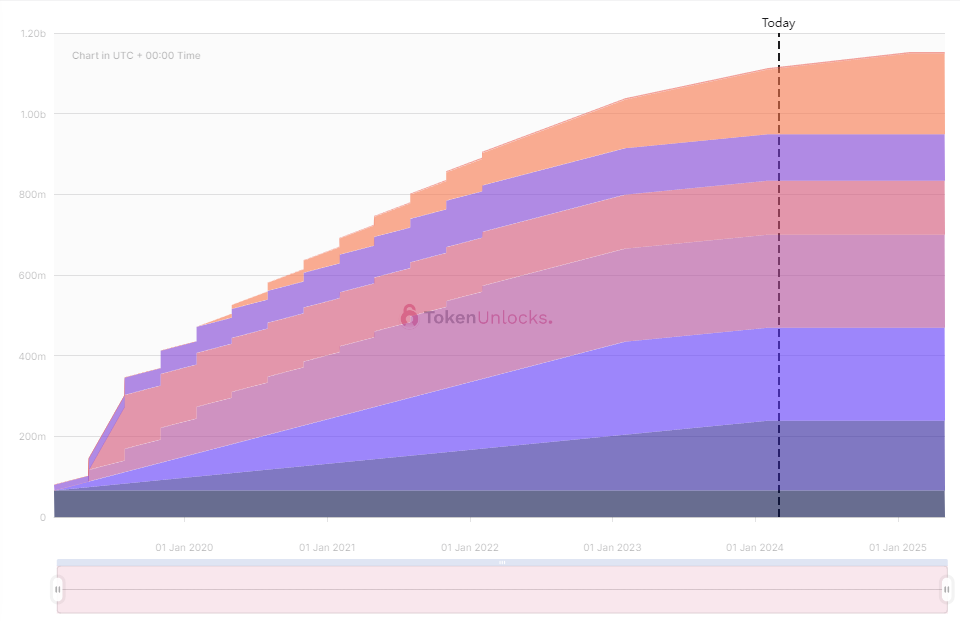

While the value accrual of the token looks good, the initial distribution of the token is a bit alarming:

More than 60% of the tokens were allocated to insiders.

However, the initial token allocation was over four years ago. Almost all insiders’s tokens are vested and now fully circulating.

As we can see from the image above, almost all of the supply is unlocked and circulating, which is certainly encouraging and eliminates the risk of a supply glut.

Competition

Despite being one of the first projects focusing on AI agents, Fetch AI has yet to gain escape velocity – and this here could be your opportunity.That said, the main author of Fetch’s whitepaper, David Minarsch, has left Fetch AI to build his AI-focused project that competes with Fetch in the AI sector.

David's work at Fetch.ai centred on the consensus and governance mechanisms of Fetch.ai's smart ledger and the design and implementation of an autonomous agent framework. He has a PhD in Applied Game Theory from the University of Cambridge.

So, we guess that was quite a loss for Fetch AI.

David Minarsch moved on to create the OLAS platform focused on developing AI agents we covered previously.

While Fetch AI has developed its blockchain on Cosmos, OLAS remains blockchain agnostic and offers AI agents on Ethereum, Gnosis, Solana and more coming.

That said, the focus of both projects is slightly different as well. Olas focuses on providing a unified platform for services like automation, oracles, and co-owned AI agents. Its vision is for AI agents to perform on-chain actions such as managing treasuring on-chain, on-chain governance, etc. Its main audience is on-chain users.

Fetch.AI, on the other hand, is a platform that aims to enable autonomous economic agents (AEAs) to perform tasks like booking and finding tickets. Their vision is to use AI agents for day-to-day actions. Their main audience is off-chain users.

FET vs OLAS

We are still in the early stages of AI agents, but competition is intensifying.Olas has a strong chance of achieving network effects and emerging victorious due to its youth, blockchain-agnostic approach, and focus on markets with existing users, such as Ethereum and Solana. Furthermore, its tokenomics incentivises and rewards developers for contributing code. This might not benefit investors in the short term but could lead to a thriving ecosystem in the coming years.

On the other hand, Fetch AI is battle-tested, having been around since 2019. It boasts superior tokenomics without supply overhang and clear use cases. It has services like Agentverse that can onboard traditional Web 2 companies into AI and blockchain. Therefore, Fetch may have a clearer path to immediate success. Unsurprisingly, the FET token has rallied about 200% in the last 30 days. However, it doesn't have to be a zero-sum game because both projects have the potential to perform well. They also have different visions and target audiences, allowing for healthy competition and collaboration.

The main competitors in this space are centralised AI companies like OpenAI and Microsoft -- betting on FET or OLAS is betting on the possibility that decentralised AI solutions will gain ground over centralised players.

Therefore, if you want to bet on AI narrative, Fetch AI is a safer bet but is also the less-rewarding option. Olas is probably the way to go if you are more risk-tolerant and want bigger rewards. The choice is yours!

How high can $FET go?

With a market cap of $1.5b, $FET has already crossed its previous ATH and is in price discovery as of the time of writing.

We believe $FET is a decent bet on the AI narrative. However, due to a lack of on-chain adoption and meaningful growth in daily users, we have conservative price targets for $FET.

We have reasonable confidence that the AI narrative will be one of the few winners in this cycle. Based on this assumption, $FET can achieve a $3b- $5b market cap.

It is not recommended to ape into an asset when it is in such a price discovery. Therefore, if you can catch a meaningful pullback, that is nice 3x-5x from current prices.

If you decide to get into FET, here is a technical analysis to guide you.

Technical analysis

FET is up 160% in February, reaching an all-time high on March 3. Right now, while the token is undergoing price discovery, the rally is overheated. The relative strength index or RSI is above 80 on the daily and weekly charts, respectively, indicative of an overbought situation for the asset.

So, a pull-back down to between $1.06 and 1.24 is an expected correction range between the 0.5 and 0.618 Fibonacci retracement. This range also coincides with a previous resistance-turned-support range.

Hence, a bounce back from this range is foreseeable.

Cryptonary’s take

Integrating AI into daily life is transforming various industries, including blockchain.The current bull market has seen a surge in AI-related coins, with numerous innovative solutions emerging. As a result, the AI sector is a prominent winner, attracting increased interest and investment.

If you want to bet on AI narrative in the short term, Fetch AI might be a better bet because of its tokenomics. We expect a big announcement from Fetch AI tomorrow. We will notify our community if we assess the announcement is significant, If you want to bet on AI agents long-term, Olas is a better bet because it focuses on growth and network effects in the long term, though at the expense of their token’s value.

Whether it is FET or OLAS, one thing is clear: the AI narrative will be one of the outperforming sectors in this bull market.

Are you ready to ride the AI wave in the crypto market?

Cryptonary, OUT!