Collectively, AI coins have a market cap of more than $33 billion. Over the last year, hundreds of crypto AI projects have launched, and many more will launch as the bull market progresses.

The challenge, however, is separating the promising projects from those simply trying to capitalise on the buzzword without real substance.

Some projects have impressive underlying AI technology but lack a compelling investment case. Others position themselves as "AI crypto" projects when the AI component seems more like an afterthought rather than a core part of their value proposition.

Today, we are looking at two crypto x AI projects that combine strong AI technology with solid tokenomics and investment potential.

What's more, these coins are uniquely positioned to surge when the second leg of the current bull market kicks off in Q3.

Sounds exciting? Well, let's dive in right away!

TLDR

- We explore two promising crypto x AI projects positioned for major gains in the next leg of the bull run leg.

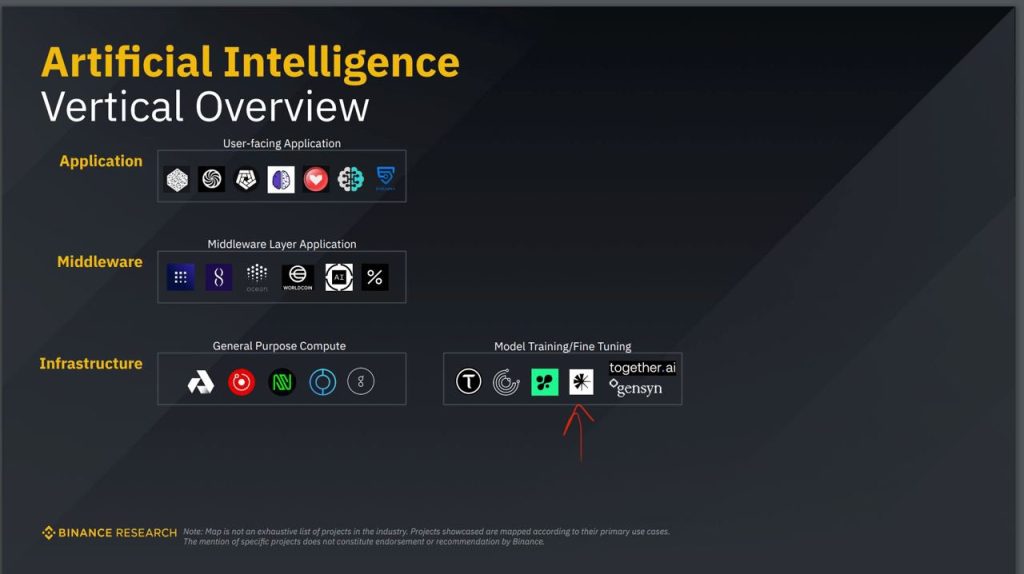

- First, we break down the AI tech stack, exploring infrastructure, models (centralised vs. decentralised), and applications.

- We then analyse a bluechip crypto x AI project offering a 3x-10x upside potential.

- Next, we evaluate a small-cap crypto x AI project with an upside potential of 7.5x to 13x upside potential.

- As AI adoption soars, these two protocols and many others are well-positioned to ride the wave.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A quick primer on the AI technology stack

For most people, AI technology probably just means applications like ChatGPT or Midjourney. They won't be able to differentiate other components from the top of their heads, and that's okay.For most people, a car takes you from point A to point B, and you don't really care about how what's under the hood works.

But what's under the hood of AI technology?

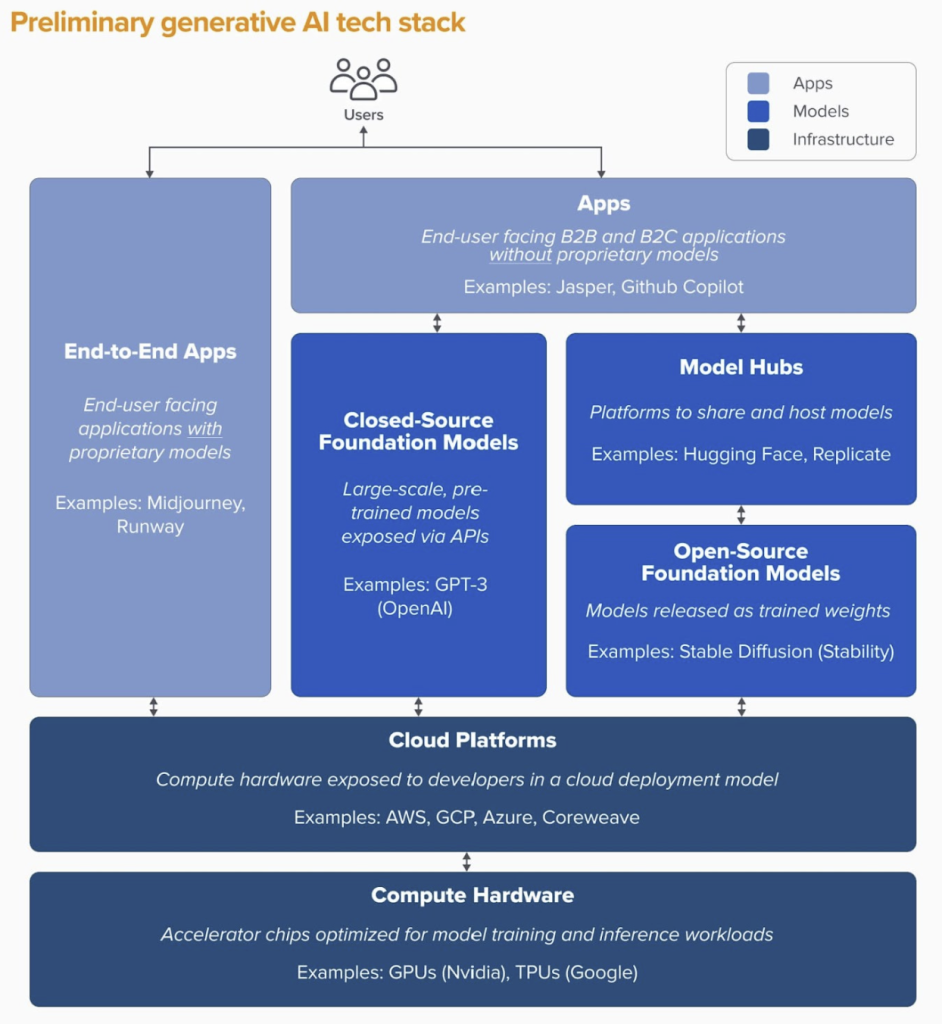

A broad classification includes:

- Infrastructure: This is the hardware part of the technology comprising physical components such as neural processing units (NPUs), graphics processing units (GPUs), and tensile processing units (TPUs).

- AI models: This part of the technology is possibly the most crucial. It involves training the tech, or Machine Learning, as we speak. The data can be categorised as open or closed source. The better the range of data fed into the computational systems, the more transparent the final product will be.

- Applications: This is the final layer that users usually interact with. These apps, such as ChatGPT and Replika, leverage AI models to build their products.

Centralised and decentralised AI/ML

When you hear the differentiation between centralised AI and decentralised AI, the difference often applies to the machine learning component.In simplified terms, the ML models represent the brain of an AI system. The Machine Learning component is probably the most critical part of the AI tech stack. Machine learning is why AI applications can perform tasks without explicit programming instructions.

These machine learning models are broadly categorised into,

- Open source

- Closed source

However, the training process is opaque. The challenge is that using opaque datasets to train public-facing AI models can inadvertently lead to certain biases showing up in AI-powered services that are supposed to be neutral. This can range from influencing the user base towards a certain product or, in an extreme case, pushing certain political beliefs.

This is where decentralised AI Machine Learning Models come in.

Decentralised AI systems are designed to be transparent, accountable, and governed democratically. This ensures that decision-making includes and represents a variety of interests and perspectives.

Bittensor (TAO)

Imagine participating in a marketplace where you can lend your GPU or CPU power to projects that need computing power to train AI models. Bittensor is paving the way for such a future by integrating key players within a blockchain-based incentive framework.Bittensor is taking an approach to creating a decentralised, open-source project where developers can create AI dApps and enable data exchange between Machine Learning AI models.

To address the formation of AI bias, the protocol incentivises diverse pre-trained models for the best responses, as validators reward top performers and eliminate underperforming or biased ones.

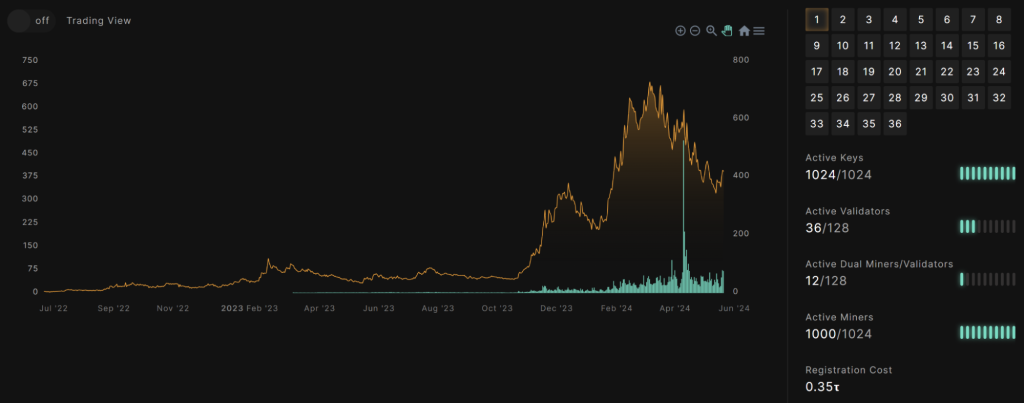

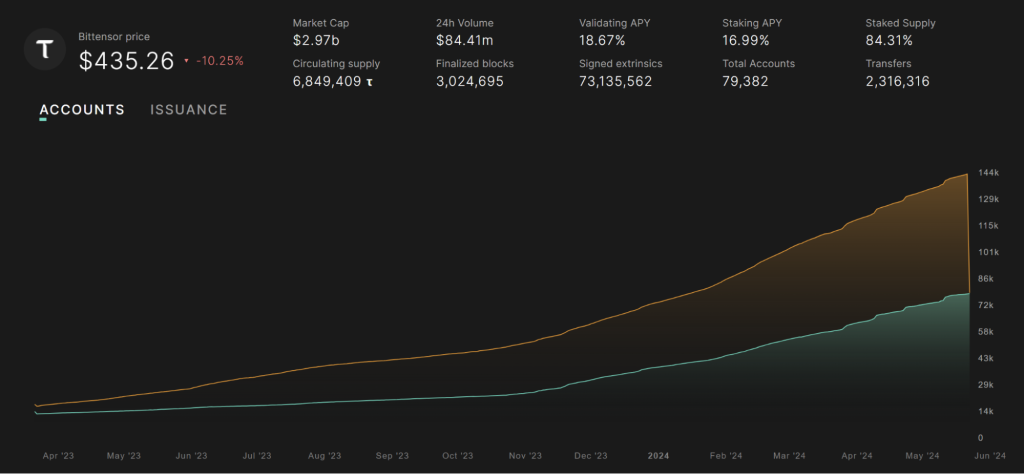

From an on-chain perspective, Bittensor has displayed commendable progression with 36 subnetworks utilised for ML of chatbots, image generation, language translation, and more.

Now, Subnets are groups of machines working to complete an AI task, such as labelling data, predicting financial markets, or devising the best response on a customer service call. The subnet owners are rewarded with $TAO in exchange for creating and maintaining a subnet.

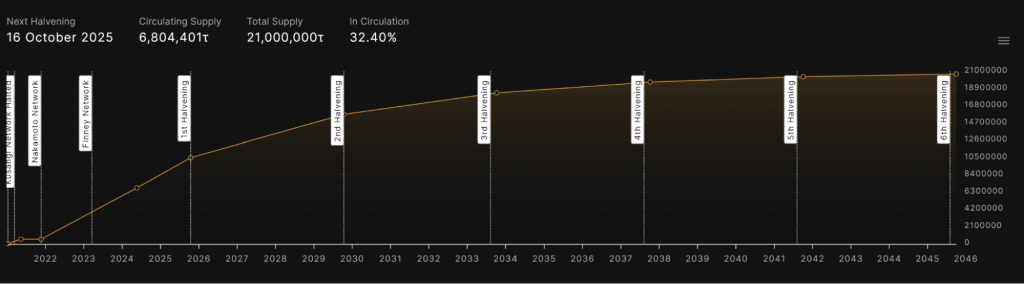

Tokenomics

Bittensor's tokenomics setup is very similar to Bitcoin's in a certain way. The total supply of 21 million is pre-programmed, and like Bitcoin, the token is issued into circulation through a halving period every four years. The current supply is 6,804,401 TAO tokens, representing 32.40% of the total supply.The Bittensor protocol generates new tokens at a fixed daily rate, currently 7,200 TAO, which will halve to 3,600 TAO in the future. This makes mining highly competitive, and as more miners join, profitability decreases, pushing miners to find ways to lower their operating costs.

Miners and validators play a key role in the ecosystem. Each token is tied directly to a piece of data the miner contributes to the network and verified by a validator.

To be a validator, users need to acquire TAO, while miners must pay registration fees in TAO. Token holders can also delegate their TAO to a validator to earn staking rewards. In return, validators distribute over 80% of their rewards to the delegates through TAO.

Investment thesis

TAO is getting ready for the next leg of the bull run.The TAO token utility is very efficient in the system, which resembles a circular economy. The expectation is that more demand will create more work from the miners, which will increase validators, delegates and overall token holders.

Bittensor has no VC, insider, advisor, etc., and token allocations are not available other than to network participants. Hence, there is no threat of a token dump or inflation pressure. This is as decentralised as possible, aligning with the company's vision.

The token utility includes,

- Governance: TAO tokens are used to vote on proposals and changes to the Bittensor network

- Staking: TAO tokens can be staked to participate in the consensus mechanism and earn rewards. The current staking APR is also pretty decent at 15.33%

- Payment: TAO tokens are used as a means of payment for accessing AI services and applications built on the Bittensor TAO network

Bittensor's goal is extremely ambitious, and the protocol is moving in the right direction at the moment.

Valuation exercise

Bittensor's market cap is currently $2.9 billion, and its FDV is around $9 billion.Now, from a purely valuation perspective, it might seem that TAO's further upside is limited, but a few scenarios need to be considered.

As mentioned in the previous section, $TAO has no VC or advisor, and its circulating supply operates like BTC's distribution structure, involving periodic halving. There is a clear token utility involving governance, staking, and payments, which plays an essential role in its economy.

Before underlining a valuation target, we need to define a clear path for its growth.

Only a small minority on the internet cares about centralised or decentralised structures. For the majority, user experience is most important. A decentralised AI alternative's path to success will emerge if it outperforms its centralised counterparts in results, requires fewer computing resources, and can reach a broader audience through marketing.Marketing requires funds, but Bittensor currently lacks the funds for marketing and growth to compete with the likes of OpenAI or Google Bard. It depends on organic marketing and reputation growth in the decentralised Web3 ecosystem since it is bootstrapping its network of miners, validators, and subnets.

This is where a few positives can be identified.

Taoshi, a price forecasting subnet on Bittensor, has paid $12.6M to miners in TAO, which is estimated to be around $64m/year at that current rate, as recorded in March 2024.

Additionally, Bittensor released an impressive LLM in partnership with Cerebra last year, which has caught mainstream adoption.

Based on these examples and the current ~80,000 active accounts, revenue will start to flow for Bittensor. Since subnet owners, validators, miners, and all earning emissions are already 7200 tokens, that is worth $3.1M at the current price.

Coupled with the fact that crypto AI is a trending narrative right now, we reckon there are key catalysts for TAO to perform in the market, both on-chain and sentiment-wise.

Hence, the price targets for Bittensor for the next 12-18 months are,

Base case: If the AI narrative declines, $ TAO's slow adoption might not attract investors, and price action can slow down. $9 billion or 3.4X multiple is possibly minimal ROI.Bull case: A 5X multiple is the market average for most emerging assets in a bullish environment. $15 billion or 5X, in that respect, is an ideal target

Best case: Now, considering both AI narrative and adoption for TAO continues, a 10X return could be an easy target since there are signs that TAO continues to improve.

Hence, if everything falls into place for Bittensor, our best-case target is $30 billion, or 10X.

Technical analysis

After reaching a peak valuation above $750 (ATH at $782) at the beginning of March, TAO registered a significant correction period over the past few weeks. After dropping down by almost 50%, the token is now forming a couple of bullish patterns.

The asset has been consolidating in a descending channel, and an inverse head-and-shoulder pattern can be observed over the short term.

Both these formations usually carry bullish connotations, and after re-testing the support range at $310-$365, the token is primed for recovery. At the moment, the price has yet to breach any of the patterns. A daily close above $438-$490 will lead to a break of structure and a potential trend reversal, commencing the AI token's second leg over the bull market.

Now, let's look at a small-cap crypto x AI project with a larger upside - you can't afford to miss this opportunity.

enqAI (ENQAI)

At a $2.8 billion market cap, Bitsensor (TAO) is a blue chip AI coin. If you want something relatively newer, enqAI looks like a great small-cap AI bet for this bull run.enqAI is an unrestricted AI platform fully powered by a network of decentralised GPU nodes. The platform provides image and audio generation to large language models. Think about a product exactly like ChatGPT.

enQAI's flagship product, Eridu, is somewhat of a ChatGPT replica. It is an unfiltered large language model that operates without restrictive data inputs, producing outputs reflecting its decentralised nature.

Eridu's AI capabilities have been built with 45 billion parameters and trained on over a trillion tokens drawn from diverse text sources. For a detailed understanding of the protocol, read enQAI's whitepaper.

Its other application is noiseGPT, a voice cloning, text-to-speech and lip sync engine.

Tokenomics

enQAI's had a fair token launch back in February 2023. The current circulating supply is 973,546,542 out of a possible 1 billion tokens. It has nearly 100% of its token supply in circulation, with no future emissions.Like Bittensor above, enQAI has no hidden VCs or early investors holding the token.

To operate as an active node and earn from processing AI inferences, entities must stake enqAI tokens, ensuring only committed participants maintain the network's integrity. Token holders can also delegate their tokens to nodes, earning indirectly from the nodes' inference activities.

Revenue from user subscriptions and B2B API clients is distributed to nodes (including those with delegated tokens), a grant program managed by token holders, and a buyback program for enqAI tokens.

Overall, enQAI tokenomics are investor friendly.

Investment thesis

Building an investment case for a protocol where the product has functionality utility always helps.We tried enQAI's Eridu LLM and were pleasantly surprised. While the response got repetitive after a while, it was pretty good version 1.0 and will possibly get better with further parameters and training.

Looking at their roadmap, enQAI also has staking and slashing mechanisms lined up for the upcoming period, further incentivising users to hold on to the decentralisation of the models.

From a security perspective, the protocol has zero underlying issues, with the creator balance of the contract being less than 0.01.

Smart money and whale traders are also beginning to hold $enQAI in their wallets. The 30 wallets holding enQAI are worth $4.23M, inferring that it is in the books of some early investors. One hundred fourteen whale wallets also have $12.92M worth of the token.

The project also feels it is in a really early stage, and with strong tokenomics in the background, a rise in adoption will immensely benefit enQAI's token value.

The project was also recently mentioned on Binance Research's AI Vertical Overview, which opened a speculative discussion about a future listing. However, users should not read too much into this. It is a positive development but not a needle-mover unless there is an actual listing.

Valuation exercise

For enQAI's 2024-2025 price target, we still need a better dataset to estimate a concrete long-term valuation. Still, we can determine a ballpark range based on a list of "pumpamentals", if not fundamentals. So, we must be clear that this token falls into the risk-high reward category.From a tokenomics point of view, $enQAI is extremely solid. Following a similar path to Bittensor, there are no emissions, complete total supply in circulation, and clear token utility. Smart wallets and whale wallets are also getting involved, and overall, a functional product is available at the centre of it all.

Adoption and revenue generation are two aspects that are yet to take off for $enQAI, possibly the only concern right now. But in bull markets, we have often witnessed that the speculative nature of theoretically impressive projects drives its price action. We also mentioned earlier that we expect prices for AI projects to front-run performance in 2024-2025. Keeping that in mind,

As a base target, $ENQAI can reach a $400M market cap, i.e. 7.5X multiple, considering it is a micro-cap token. Such low-valued assets moved faster in bull-market conditions.

As a bullish target, $ENQAI can reach close to $ 750M if adoption and narrative pick up for the asset, where a 10x-13x multiple is fairly possible.We also believe that $ENQAI can perform in cohesion with Bittensor since both are very similar in terms of tokenomics, product ethics, and decentralised vision. So, as the bull market progresses, capital rotation might occur from $TAO to $ENQAI, as can be inferred from certain smart wallets.

Technical analysis

Since peaking at its all-time high of $0.15 on March 6, $ENQAI faced a significant correction of 86% until the beginning of May. However, the micro-cap asset has turned, moving almost 400% from its recent local bottom since then.

With its recovery, the asset has broken the bearish price structure and formed a bullish position above the 50-exponential moving average (EMA). Ideally, we would like to see a daily close above the $0.08 mark, bringing more bullish momentum for the asset and potentially re-testing its previous ATH over the coming weeks.

It is important to note that the trading volumes associated with $ENQAI are very small, so the coin may project bouts of strong volatility.

Cryptonary's take

A rise in AI adoption seems inevitable right now, which means Machine Learning Models will play a crucial role in developing the parameters and learning of LLMs.Our analysis of Bittensor and enqAI showcases the current market readiness and the future potential of both projects. With AI adoption on an inevitable rise, decentralised models like those implemented by Bittensor and enqAI are set to play a pivotal role in shaping the future of AI-driven applications.

The distinguishing factor for these projects lies in their robust tokenomics and decentralised ethos, which positions them advantageously when AI takes centerstage during this bull run. Our evaluation suggests that as AI continues to evolve and integrate within the crypto sphere, these projects could lead the charge, offering significant returns on investment under bullish market conditions.

We will continue to monitor these developments, providing you with strategic insights to navigate this exciting confluence of technologies. Stay tuned for more updates as we follow this trend closely.

Until next time,

Cryptonary out.