This report delivers our thesis on a GambleFi project that has emerged as the biggest house in crypto gambling. This digital casino behemoth churns out millions in daily revenue. Yet despite dominating the sector, its token remains drastically undervalued.

Our analysis projects at least a 900% upside on this project, and it could soar all the way to 1800%.

If a 900% upside isn’t too small for you, read this report today!

TLDR

- There is a massive overlap between people who love crypto and people who love to gamble.

- This project has established itself as the clear frontrunner in crypto casinos.

- Revenue generation has been immense despite the bearish conditions, with the project set to produce almost $500M over the next year.

- It also has an exciting buy-back-and-burn program, which places enormous buying pressure on its token.

- We expect a major repricing on the token over the next 24 months.

- Today, you can get on ground zero with crypto’s biggest casino.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Rollbit overview

Crypto and gambling have gone hand-in-hand since basically day one. It is no wonder that “GambleFi” has gained traction throughout this bear market - people love to gamble, whether or not the market is moving up.

Rollbit has emerged as the clear frontrunner in the crypto-native gambling space, with a higher market cap, stronger community, and healthier financials than any other.

Rollbit currently offers three major products:

- Casino games

- Sportsbook (sports betting)

- Crypto futures trading

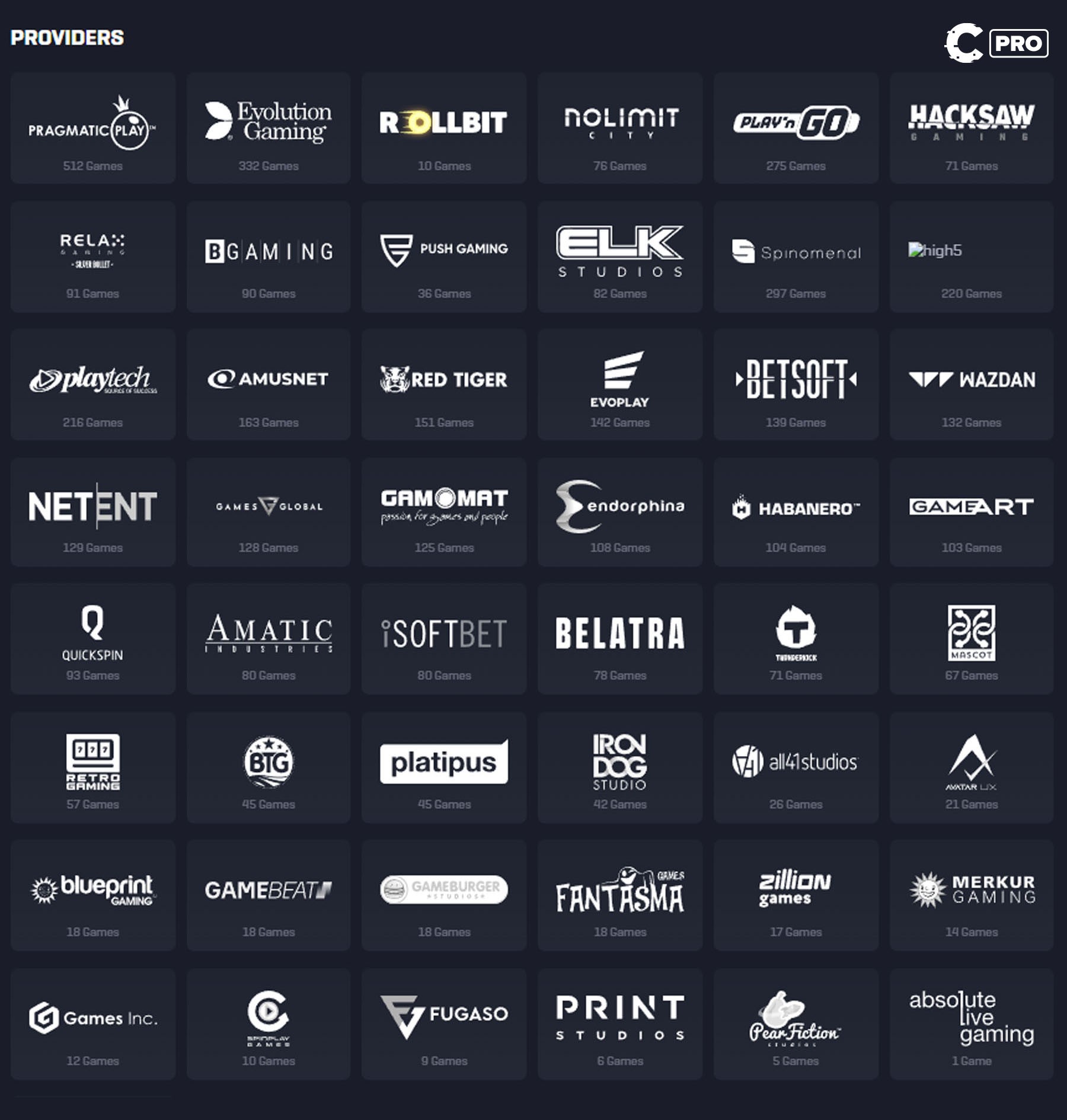

By collaborating with dozens of game providers (and producing a few of their own), one provider going offline won’t hurt the casino’s uptime in any meaningful way.

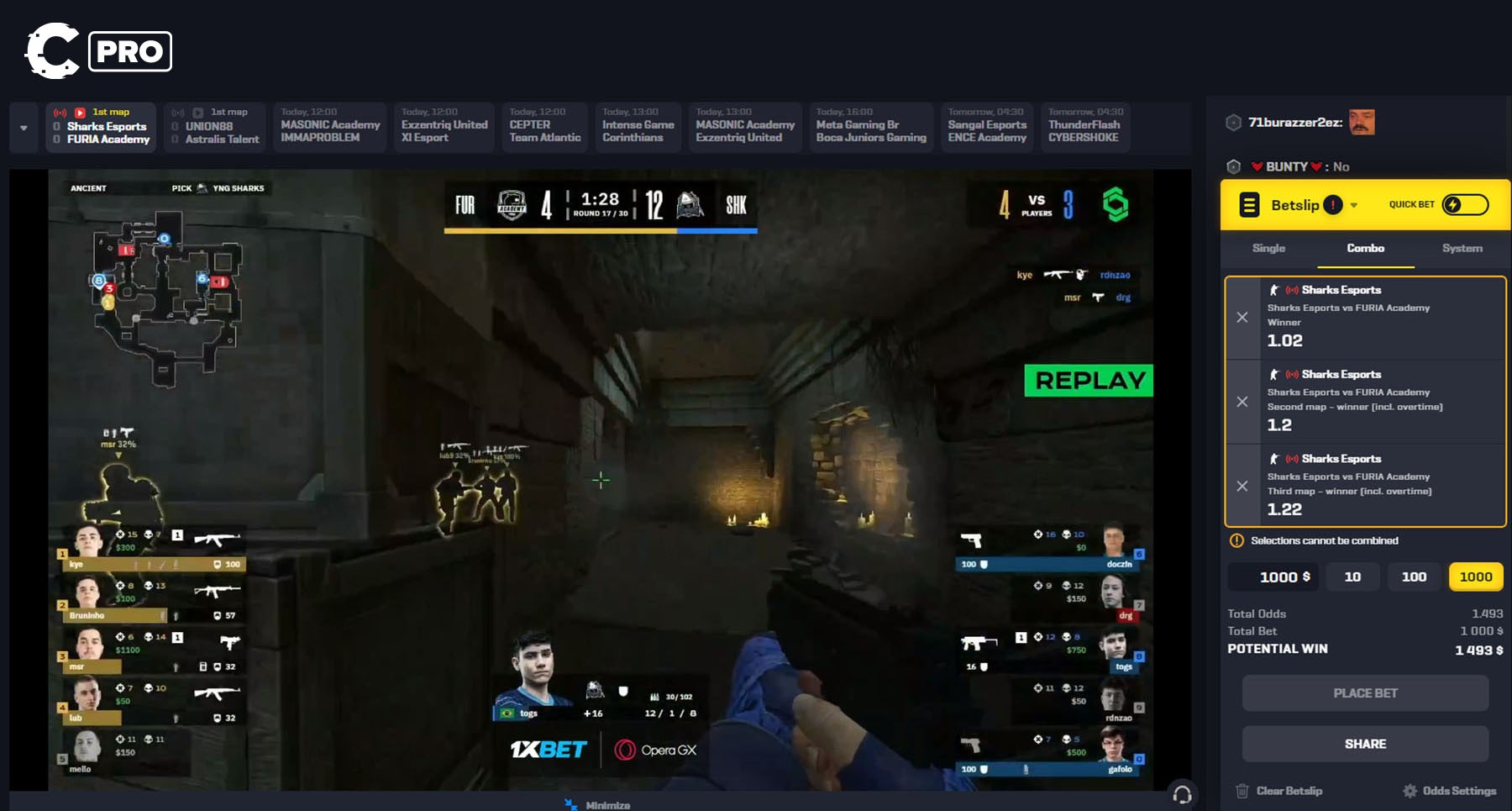

Their sportsbook allows users to bet on the outcome of basically any gaming event you can think of. Favourites include football (soccer), basketball, racing, and eSports like League of Legends and CounterStrike.

Rollbit also pipes in live streams from Twitch for almost all of the eSports matchups, allowing users to watch and bet simultaneously.

Rollbit lets users trade some of their favourite tokens at up to 1000x leverage for their crypto trading platform. Because all of the trading happens within the Rollbit app (and not posted on-chain), Rollbit can also offer an experience similar to a centralised exchange (CEX). This means that users don’t have to confirm all transactions manually, as they would if they were using a decentralised platform like Uniswap.

Tokenomics

Rollbit’s RLB token distribution is quite unique, with nearly all of their tokens being airdropped or distributed to their NFT holders. Since the token is completely distributed, we don’t have to worry about high inflation, where insiders can easily dump tokens on new retail buyers (like us).Now that we understand the “supply” side, let’s dig into the “demand” - why would someone want to hold RLB?

The interesting part about RLB is the buy-back-and-burn architecture that it leverages. When the protocol makes excess revenue, the excess is used to buy and burn RLB from the market. This reduces the supply of circulating RLB and provides a constant source of buying pressure.

Here’s how it works:

- 10% of the revenue generated by Casino games is used to buy back and burn RLB.

- 20% of the revenue generated by the Sportsbook is used to buy back and burn RLB.

- 30% of the revenue generated by Crypto futures trading is used to buy back and burn RLB.

On average, Rollbit is buying back and burning over 1M RLB per day. At this rate, they will burn over 12% of the remaining supply over the year. This equates to an annualised buy pressure of about $60M on the token, which is unheard of in crypto.

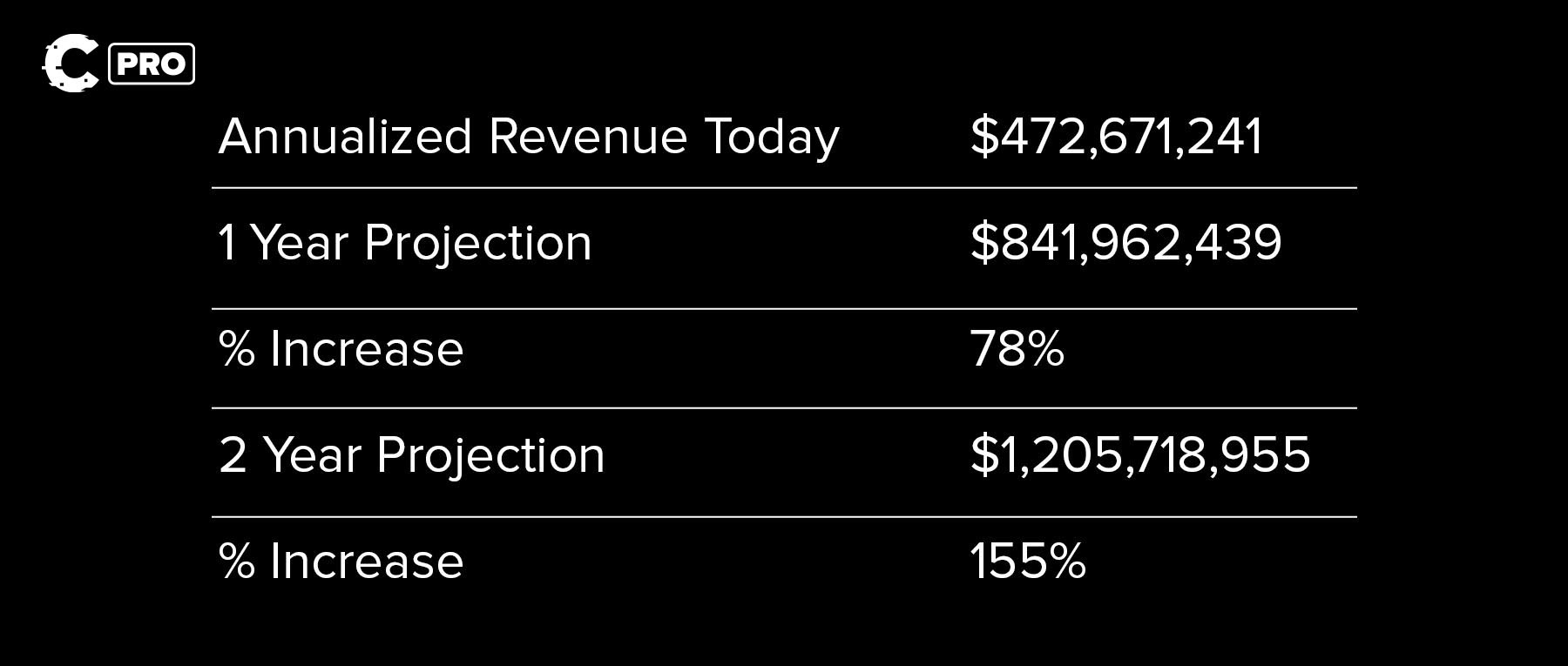

And that’s not all; the buyback and burn campaign is not ending anytime soon because Rollbit is on track to generate ~$470M in annual revenue. This revenue is larger than its current market cap of ~$420M. How is this even possible?

The great repricing

The main reasons for under-valuing the RLB token are the following:- People don’t believe its revenue values are real. Since Rollbit handles many operations “in-house,” there are doubts that it actually generates as much revenue as it announces.

- Investors are worried about risks, which are regulatory and key-man risks since the founders are anonymous.

Until recently, when Rollbit would buy back RLB from “the market,” they would just purchase the tokens from their internal liquidity pools. The burns were on-chain (i.e. you could fact-check that these RLB tokens are eventually destroyed), but the buys were not on-chain. This led doubters to posit that Rollbit was being sneaky and not really producing the level of revenues that they said they were. There’s the possibility that they were taking RLB tokens from their internal liquidity pools without paying fair value for them.

But that’s no longer a concern with a recent update that changed the game. Now, Rollbit is buying back RLB directly from Uniswap, where everyone can check every buyback and every burn.

Of course, this doesn’t automatically erase the perception and the repricing of RLB will be a slow process. Investors will still need to be convinced that the risk of not owning RLB tokens is higher than their preconceived notions about the project. But as Rollbit begins to open the kimono, we expect new investors to reevaluate.

RLB valuation and price targets

We will value Rollbit on a Price-to-Earnings (P/E) basis, similar to how you may value the price of a stock. In particular, we are interested in forecasting future revenues and the future circulating supply of RLB. With these, we can calculate a Market-Cap-to-Revenue (MC/Rev) multiple, a P/E surrogate, to base our valuation.

As a means of comparison, we look to 2021 Binance, as there are many similarities to draw between them and Rollbit:

- Both use a buy-back-and-burn architecture

- Both generate value based on user activity (and specifically trading)

- Both generated healthy doses of retail hype and heavy suspicion

Revenue

We can see that user deposits onto Rollbit have been steadily increasing linearly over the past 12 months. Since conditions have been bearish/neutral for this time period, we see this as a good conservative estimate for our analysis.

With crypto casinos, revenue tends to increase in lockstep with user deposits, assuming a constant take rate. If this is the case, here is what we expect to see over the next couple of years.

Even with our conservative assumptions, we still expect revenues to grow by over 150% in two years.

Even with our conservative assumptions, we still expect revenues to grow by over 150% in two years.

Market capitalisation

Next, we need to estimate how the buy-back-and-burn process will affect the market cap over the next couple of years. This architecture decreases the token supply, which requires an increase in token price to maintain a constant market cap.

We find that about 1.1M RLB are being burnt each day at the current rate. We’ve already discussed how this process works in the sections above, but here are a couple of examples of how this burn rate could potentially decrease over time:

- If revenue were to drop, fewer RLBs would be burnt.

- If RLB's price were to increase, fewer RLB would be burnt since they would cost more to buy back.

This means we expect Rollbit to burn roughly 400,000,000 RLB over the next two years, resulting in a circulating supply of ~2.75B (a decrease of 12.7%).

Price targets

We can solve for a token price using the equations for “Multiple” and “Market Cap” above.Market Cap = RLB Price RLB Supply

Market Cap /Revenue = Multiple

Therefore, RLB Price = (Multiple Revenue) / Supply

This brings us to a price target of $2.27, a roughly 1800% increase from today’s price of approximately $0.126. We set this as our upper price target.

Assuming that the market will continue to undervalue RLB (compared to Binance) due to perceived risks, we can reduce the multiple estimates by 50%. This brings us to our lower price target of $1.13, a rough 900% increase from today.

Invalidation criteria

As mentioned, this project carries non-negligible risks. We will monitor these risks closely as invalidation criteria.- Regulations: Despite being fully registered to host gambling activities via Curacao (same as industry leaders like Stake.com), questions always arise when gambling is present. If Rollbit is facing serious challenges with regulatory bodies, we will likely exit our positions.

- Centralisation: To use Rollbit’s platform, users must deposit funds onto the protocol. At that point, the funds are at the mercy of the Rollbit team. While it’d be confounding that the team would steal funds now that they generate hundreds of millions in revenue annually, we will surely monitor this. The site has been operating for over three years now (longer than most competitors), so this seems to be a low likelihood unless new details arise.

- A decline in users or revenue, perhaps due to competition: Rollbit stands alone (for now) amongst the crypto-native casinos, operating at leagues above the competition. Still, ignoring the key metrics of revenue generation and daily active users (trackable via the links) would be foolish. We must reevaluate our price targets if we see sustained drawdowns in these metrics, we must reevaluate our price targets.

Cryptonary’s take

Conviction Level: 30%

Rollbit has established itself as a powerhouse in the gambling sector, with all others grasping for the leftover scraps. They continue to innovate to serve their customers, all while generating serious revenue daily.Once the market finally convinces itself that Rollbit’s numbers are real, we believe that repricing will occur drastically.

Crypto and gambling, whether we like to admit it or not, have audiences that overlap heavily. Rollbit stands to gain tremendously from the increased adoption of this asset class, and we are excited to watch them become entrenched in their sector.

Action points

We will be buying RLB regularly while the price remains under $0.25, aiming for a 2% portfolio allocation. Assuming our invalidation criteria remain unmet, we will take profits at the following levels, assuming our invalidation criteria remain unmet.- We will be removing 50% of our investment at the lower price target of $1.13

- We will be exiting completely at our upper price target of $2.27

- If one or more of our invalidation criteria is met, we will be either partially reducing our exposure or exiting entirely, depending on the severity